Yves here. This post might seem a smidge technical for generalist readers, but have faith. Pilkington uses DSGE models, a widely used type of macroeconomic forecasting model, to demonstrate the prevalence of intellectual bankruptcy in economics.

By Philip Pilkington, a writer and research assistant at Kingston University in London. You can follow him on Twitter @pilkingtonphil. Originally published at Fixing the Economists

Confusion of thought and feeling leads to confusion of speech.

– John Maynard Keynes

Readers will note that I very rarely discuss DSGE modelling on here. Frankly, I’m not enormously interested. The fad is one in which economists — or, we should rather say: mathematicians with some loose economic training — have come to mistake analogy for literal explanation.

What do I mean by that? Simply that they have taken certain contingent theoretical statements made by previous generations of economists as Iron-Clad laws and then used these as building blocks to construct ever more Byzantine towers that tell us nothing about how the economy actually operates. This has given rise to a funny game where theorists no longer really build models to give us new insights. Rather they tend to try to integrate things that have already happened and thus they try to tailor their models to fit the discourse of the day.

For example, after the 2008 financial crisis a whole proliferation of models incorporating aspects of What Happened appeared. Theorists began to pick up on words that started appearing in the newspapers and so forth and then tried to incorporate these into their models. The models became the manner in which the theorists articulated What Happened to themselves. It is a truly bizarre ritual indeed. The theorists gain a fuzzy understanding of what actually happened and then incorporate this fuzzy understanding in an even fuzzier manner into a DSGE model and then convince themselves that they are engaged in scientific activity when really all they are doing is following a fad or news-trend.

One such approach that might be of particular interest to readers of this blog is an attempt by two economists by the names of Bianchi and Melosi to integrate ‘uncertainty’ into a DSGE model. If that smells funny, it should because the entire construction of such models seeks to eliminate uncertainty. But when you read the paper, entitled Modeling the Evolution of Expectations and Uncertainty in General Equilibrium, you quickly see that the authors do not understand the concepts they are dealing with.

When I read the title I thought to myself: “I bet they have mistaken risk for uncertainty” and indeed this is precisely what they have done. They basically turn the agents in the model into Bayesian calculators that tot up the probability of the economy entering various phases or states.

This leads to some truly bizarre statements. As readers will probably know a key component of uncertainty is due to the fact that we exist in a world where people exercise free decision. Thus we do not and cannot know what people are going to do in the future and must form judgements about the world by trying to anticipate what those around us will do. This is absolutely central to Keynes’ concepts of uncertainty and animal spirits and so on. The authors of the paper, on the other hand, write,

In our framework agents have always enough information to infer what the current state of the economy is or what other agents are doing: High or low growth, Hawkish or Dovish monetary policy, etc. Nevertheless, agents face uncertainty about the statistical properties of what they are observing. For example, agents could be uncertain about the persistence and the destination of a particular state. (p4 — My Emphasis)

After completely butchering the meaning of the term ‘uncertainty’ they proceed to violently attack other concepts. Next on the chopping block is ‘animal spirits’.

…the methods developed in this paper lay down a convenient framework for investigating the effects of changes in economic fundamentals or animal spirits on uncertainty and the feedback effects of such swings in uncertainty on the economic dynamics. (p37)

The authors genuinely think that in deploying Bayes’ probability theorem to human decision-making they have constructed an approach for studying ‘animal spirits’. But of course the very paragraph where Keynes, who knew more than a little bit about the philosophy of probability, introduces the term states crystal clearly that ‘animal spirits’ is unrelated to probability estimates.

Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as a result of animal spirits — of a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities. (My Emphasis)

This is a very simple point indeed and one that the authors could easily have picked up from either the source itself or the literature that grew up from it. In Keynesian economics we do not assume (a) that certain aspects of the future are reducible to probability estimates, or (b) that people act in a manner in which they take various events in the future to be calculable in numerical probabilistic terms and then apply this to reality in the form of Bayes’ theorem.

The level of scholarship in contemporary economics is absolutely shocking. Contemporary theorists just pick up on buzzwords that they hear in the media and then assume that they have understood them. Then they scramble to build some arcane model or other in which they assure others that they have captured the meaning of the buzzword in question. The mathematics then becomes a cloak hiding the fact that they have never bothered to actually think through the concepts they are using. Poor scholarship and lack of real understanding is perpetuated behind a wall of mathematics. The trick is that anyone who understands the mathematics is very likely not to understand the ideas in question. And so the whole circus can go on indefinitely.

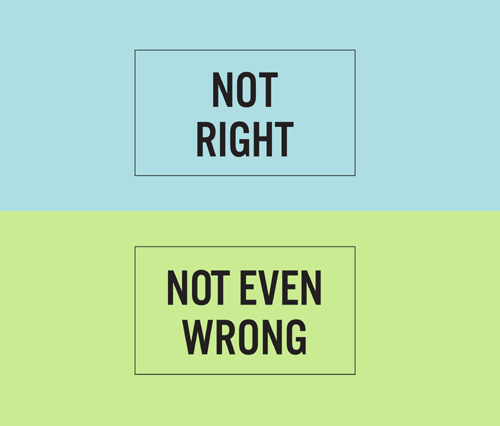

Economists today no longer debate economics at all. They no longer want to talk about, for example, what the meaning of the idea of animal spirits has for economic theorising. Rather they want to busy themselves as fast as possible with applying whatever new trick they have learned in maths class. And then they think that they are saying something about the real economy! DSGE modelling and those that practice it are truly in the territory of not only not being right but not even being wrong.

Reading papers such as this one might well conclude that economics as an academic discipline is largely dead. Ideas are no longer actually debated. Words lose any clear meaning and become allusions to some mysterious and ever-changing x (did someone say ‘liquidity trap’!?). Mathematical consistency becomes confused with truth. The field becomes so garbled that anyone who wants to learn anything about economics has to tear themselves firmly away from it.

The DSGE models were widely used but as they don’t take into account credit flows from the FIRE sector they don”t deal well with debt.

Sectoral balance theory is more simplistic in some ways but deals well with flows of funds such as Federal deficits lead to private surpluses and vice versa. In the crisis we saw unsustainable levels of private debt.

Marx understood this importance of credit as an early classical (now would be considered part of the heterodox school) thinker as opposed to the neoclassical DSGE. This classical thinking was further refined by Hudson, Kalecki, Wray, Keen, Minsky and Godley.

This neglect of the financial sector by mainstream economics allows excess wealth to accumulate in financial assets (credit bubbles) rather than being deployed into the real economy which includes wages.

http://www.ru.nl/publish/pages/611886/bezemer-economicparadigmsandcrisisanticipation.pdf

Actually, they don’t distinguish between credit and money.

Or treat credit as borrowing someones shovel, aka commodity money.

Meaning that they are indirectly goldbugs.

“Mathematical consistency becomes confused with truth” — totally.

I taught philosophy of economics for the first time last year, and found this point kept coming up. Coming from a philosophy of math background, it seemed obvious to me that there being sophisticated mathematics in a proof means nothing in terms of knowing whether you’re deriving actual results about the real world. Math is compatible with total real world falsity. But it turned out that to some, this was an idea that needed explication and justification — I found myself having to say quite a bit about the idea of math as a system in which you can make whatever assumptions you want.

I wonder if subconscious mathematical platonism leads to the mistaken feeling that if the math is there, there’s something “true” about the results.

Do they mistake consistency for accuracy?

I think it’s more that seeing the math intermixed with other forms of reasoning in a proof, the math seems like it’s not mere consistency but rather like it’s really saying something — or somehow adding to the rigor of the analysis — in ways that make the result trustworthy. When it doesn’t, really.

To repeat. I have yet to observe anyone dealing with these issues admit that the fluctuations in economic data represent a non-stationary random process, not presently modeled by any deterministic mathematics. Assuming a stationary random process makes risk analysis possible, which on the average, is correct. To make bets on this basis is risky because much of the non-stationary nature is caused by market manipulation and extreme and unpredictable events.

The psychopathic or sociopathic attraction to power develops every intellectual trope it encounters through the hierarchy heuristic we all come equipped with. Either without empathy to begin with, or having disabled it through agnotological socialization, the power obsessed will be quite content jousting with one another for the loot of their asocial and anti social policies until the rest of us pry the levers of real world power from their malignant grip. DSGE was the Peid Piper’s flute that drew all the rats in economics into Power’s agnotological utopia: a utopia for sociopaths, a purgatory for the rest of us.

Don’t worry. When you try peeling away the layers in actual physics, inflation, dark energy, dark matter, strings, membranes, they are all largely fudges between what is theorized and what is observed.

The problem with math is that it is reductionistic and a lot of important stuff gets lost, then the mathematicians have convinced themselves that their models more accurately reflect reality, than reality does and you end up with multiverses and enormous debt bubbles, far larger than the economy supporting them.

Trying to reason with them is futile, since they make their living pedaling it and others think they know what they are talking about.

Most financial people have through mathematics made themselves incapable of understanding risk. Math is a sort of inverse language. Where language can be used to say anything, and that is its’ utility, Mathematics only has one thing to say and that is truth. But like language, math is a man made fabrication and its truths are only representations we make for ourselves. As our representations increase in subtlety their truthfulness becomes beguiling, they whisper back to us our own perfect certainties. In the last decades time and again finance has been brought to grief by risk that hovers just outside our mathematical models in the world we can represent with math, but have not yet. However good our models, that world will always remain, each new model however prefect simply pushes out the frontier of risk. Math will never fully capture risk, it can only chart its’ know habitat.

I’d like to agree that our “mathematical models in the world we can represent with math” might be possible, but “bounded rationality” (Herbert Simon) actually makes modeling really complex problems impossible. Examples: Many believe chaos theory has possibilities for modeling chaotic phenomena. Not true. Chaos theory is based on variations in initial values, and is used in the “butterfly effect” which requires sound (pressure waves) traveling at the speed of light and no friction. This is nonsense. Real world complexities can only be modeled as a time dependent boundary value problem, which has never been solved by anyone as far as I know.

It should be kept in mind that epicycles were mathematically accurate, for the very simple reason that we are at the center of our perception of the universe. That didn’t mean the heavens were mounted on giant cosmic gearwheels. Similarly I suspect ‘the fabric of spacetime’ is just such an extrapolation. The problem with time is the present ‘moving’ from past to future is the narrative effect of change turning future into past. Tomorrow becomes yesterday because the world turns, not the world traveling some meta-dimension from yesterday to tomorrow. Time is more like temperature than space. Time is to temperature, what frequency is to amplitude.

It’s just that the sequence of time is the basis of the rational thought process, while thermodynamics is just the basis of pretty much everything else, so the intellectuals have trouble putting it in context.

A faster clock actually ‘burns’ quicker, so it falls into the past faster. The tortoise is still plodding along, long after the hare has died.

So don’t get too bent out of shape that economists are making it up as they go. It’s a long and storied tradition. A monetary system based on private assets and public debts needs lots of b.s. to keep the details concealed.

maybe you’d know this. I heard some dude on the radio say time travel is impossible because of quantum entanglement, if you went back in time, the whole universe would have to go with you. that’s a lot of suitcases to pack! there’s not enough time for all that or enough suitcases.

And the universe would have to be in two places at once, so if it went back it would still be here. that sounds to me like borrowing money from the future, if you borrow money from the future, you have to have it here now to borrow it, so it’s here and in the future at the same time. that makes no sense. none of this makes any sense. very little really makes sense, except on paper

somebody can say the DSGE makes no sense. Then somebody else, probably a DSGE specialist, would say, well it’s better than nothing. Not really. Nothing is better, literally. Nothing is better now and it will be better in the future too. How can somebody know that without a model to help them know? That’s when you just have to be decisive! haha

I must stand up for mathematics. Calling DSGE economists “mathematicians with some loose eonomic training” is a bit of an insult.

Mathematics is a – mostly – internally consistent language to describe phenomena. When you use it in the real world, e.g. in physics, you use it as to formulate a theory and then you backtest your predictions with real data.

Economics only rarely carries out this reality check. It is admittedly more difficult in economics, but that is no reason not to try!

I certainly remember being shocked coming from physics and seeing what passes for “mathematical rigour” in economics and the reliance on a very limited part of the tools maths has on offer. Nor have I found DSGE insights particularly compelling as a policy maker as their insights are often limited to special cases that the real world rarely offers up.

Encouragingly, some of the initiatives to rewrite economics curricula at universities are now putting an emphasis on data collection and testing and I remain convinced that forays into complexity/chaos theory could be helpful in improving models although by no means the sole answer. In a discipline that deals with humans, human judgment will remain of utmost importance.

it kind of makes me sad because one of the best Star Trek’s was the one when the Enterprise went back in time to the 20th century in the sky above America. It actually showed on radar! and the Air Force scrambled a jet to check it out, to see what the hell it was. Somehow the jet got put into a tractor beam, since I think the Enterprise got its time coordinates a bit off and ended up to low in the sky, and they had to beam the pilot aboard. Boy he was freaked out! Can you imagine?? They put him back somehow. I can’t remember how. I think they may have even put him back in time BEFORE he got beamed up. So he may not even remember. Just in case, sometimes I check the sky out my office window. Maybe in the future they’ll figure this stuff out with new math. Math from the future. It’s there now. You never know!

Irrational,

If I may be so presumptuous, I would like to describe reality as the dichotomy of energy and information. Energy manifests information, while information defines energy. The tension is that energy is inherently dynamic, while information is necessarily static. So as energy moves, it is both creating and dissolving information, thus the effect of time.

Not even a moving car has an exact location, or it wouldn’t be moving. As for those quantum particles, they are only particles when we test for particles and seem rather holographic otherwise. Which goes back to the dichotomy of energy and information and why they are not the same thing.

Now this does go against many of the current theories in physics, such as spacetime being physically real, rather than just a mathematical model, correlating relative measures of duration and distance.

I would point out that biological organisms have been evolving for billions of years and we have very distinct information processing functions, in the central nervous system and energy processing functions, in the digestive, respiratory and circulatory systems. While the ‘fabric of spacetime’ is a theory that has only been around for a hundred years and has led to quite a few fantastical assertions, most recently with multiverses.

As craazyman points out above, the idea of blocktime does contradict the very reasonable physical principle of conservation of energy.

When we measure time, we really are measuring frequency and when we measure temperature, we really are measuring cumulative amplitude. There is no universal clock, just the cumulative effect of lots of change.

Now this isn’t to say we can devise some very effective math, based on time as a physical vector, given history and narrative are essential logical concepts, but it does make sense as an effect of action, rather than the basis for it.

For one thing, the future isn’t deterministic, nor does the past remain probabilistic, ie. multiworlds, because probability precedes actuality. There are ten potential winners before a race and one actual winner after it. The collapse of probability might yield one outcome, but it isn’t determined because the input into any event only occurs with that event and would have to travel faster than light, otherwise.

Safe to say, this is not a popular point of view in physics discussions, but that has become something of an echo chamber and the feedback is going very strange places.

This provokes thought: “the future isn’t deterministic, nor does the past remain probabilistic, ie. multiworlds, because probability precedes actuality. There are ten potential winners before a race and one actual winner after it. The collapse of probability might yield one outcome, but it isn’t determined because the input into any event only occurs with that event and would have to travel faster than light, otherwise.”

If I understand this correctly, “future” refers to the time when anything may happen (the future is “open” or “fluid”: everything than can be possible is possible; anything can be done), “past” refers to the time when nothing can happen (the past is “closed” or “frozen”: nothing about it can be changed), and “present” (or should we call it “happenstance” ?) refers to the boundary between “future” and “past”–analogous to a phase change like deposition or freezing–where “openness” collapses into “closedness” and the entropy of the universe increases.

If I understand it correctly. But since my understanding is poetry, not physics, I may not understand it. However, it seems to me the statements I am interpreting may be consistent with thermodynamics, but not fully consistent with Einstein’s theories of relativity. Maybe they are poetry, too.

I should have added: the “future” is “indeterminate” and the “past” is “determined”. “Determination” is what takes place in the present, because the present is the only time when anything happens. This leads to the (paradoxical) conclusion that determination = happenstance.

It would all sound crazy to me, if I hadn’t written it myself. But is it crazy enough to be right, I wonder?

Maroon,

Keep in mind that your thought process is a sequence of events, like frames of a film. Yet what what you perceive as the sequence is a process of occurrence. What is more physically real is the projector light shining through the film, ie. what is happening and that is much more about thermodynamics, than sequence. “For every action, there is an equal and opposite reaction,” etc.

We think of one event causing the next, but cause is energy exchange. For instance, one day doesn’t cause the next, the sun shining on a spinning planet causes this perception, from a point of view on the planet, of the events called ‘days.’ The input into any event is arriving from all directions, but our perception only arrives from one direction.

As for the past, our perception of the events is dependent on our point of view and that continues to change, as the event recedes into the past and we both gain and lose information. It is as though time were a tapestry being woven from threads pulled from what had already been woven, as prior events provide the context for future ones and those succeeding events absorb the energy which had been manifesting those prior events.

The notion of time as a dimension really is based on the assumption of narrative, since it simply uses measures of duration as foundational. “Shut up and calculate,” as philosophy.

“They can assemble strings of jargon and generate clots of ventriloquistic syntax. They can meta-metastasize any thematic or ideological notion they happen upon. And they get good grades for doing just that.”

Verlyn Klinenborg, The Decline and Fall of the English Major: http://www.nytimes.com/2013/06/23/opinion/sunday/the-decline-and-fall-of-the-english-major.html?_r=0

“As I have tried to show, modern writing at its worst does not consist in picking out words for the sake of their meaning and inventing images in order to make the meaning clearer. It consists in gumming together long strips of words which have already been set in order by someone else, and making the results presentable by sheer humbug. The attraction of this way of writing is that it is easy.”

Orwell: Politics and the English Lanquage http://www.orwell.ru/library/essays/politics/english/e_polit

correction, author’s name is Verlyn Klinkenborg

Since economics is the relationship between a single producer and a single consumer, and economic systems are brought forth to facilitate wealth transference from individuals, it seems reasonable that an economics profession had to create cover in the form of all kinds of bizarre non-sense. You know when they bring out the math, the bullshit has piled up way over the peak of the barn!

“How can you meaningfully integrate uncertainty into a teleological framework? That would amount to a self-contradiction.” – Amogh Sahu

skippy… Sigh…. ‘Tis the age old problem, of arguing, a *Burning Bush* told me the – Truth – about “human nature” stuff.

I seriously doubt that it is possible to do any analytic model that incorporates uncertainty, and consequently, impossible to create an analytic model, which is a straight-forward analogue of the world we inhabit.

This really shouldn’t be a great surprise. Any reasonable interpretation of conventional, Popperian theory of science would lead to the conclusion that it would be necessary to build operational models of the institutional economy, before being able to describe, measure or interpret “what’s really going on”. That economists shy away from making contact with the economy is the great mystery here. If they are not interested in the economy as a phenomenon, why did they take up economics?