The Wall Street Journal reports that banks have become much less active participants in the repo market, which is a critical source of short-term liquidity for big investors.

Repo was a major focus of concern during the crisis. The Fed halted a run on the repo market when it provided guarantees to money market funds in September 2008 after the Reserve Fund “broke the buck,” leading customers to pull funds out of other money market funds.

For newbies, large investors use repo rather than park funds with banks. Deposits are guaranteed only up to $250,000 per account, and even though there are services that will break up deposits and distribute them among small banks, those can handle wealthy individuals, not major institutional players.

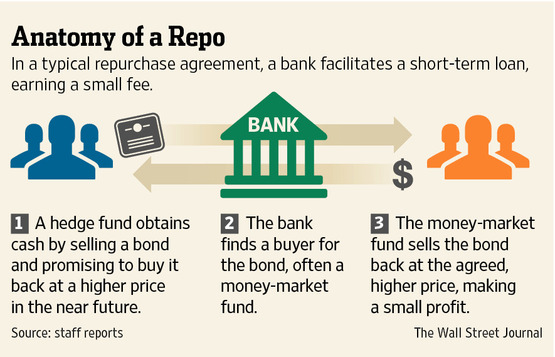

With “repo,” which is short for “sale with agreement to repurchase,” an investor with securities can turn them into cash on a short-term basis by selling them (say overnight or for a week) with the said agreement to buy them back at a higher price, which amounts to getting a short-term loan, with the bonds pledged as collateral. The reason this arrangements appeals to lenders like money market funds is that they see the loan with collateral (a high quality bond, ideally Treasuries) as more secure than an deposit at a bank in excess of the guaranteed level. The graphic from the Wall Street Journal gives a simplified idea of how this arrangement normally works:

Even before the Reserve Fund blowup, the repo market was under great stress during the crisis. There was so much concern about counterparty risk that tenors collapsed to overnight. And during the very worst periods, as Wall Street denizen put it, the sixth seal had been opened, and you couldn’t even repo Treasuries.

However, despite the troubling historical significance of lower liquidity in the repo market, the Wall Street Journal story presents evidence that shows that this outcome was a predictable outcome of moves taken by the Fed. And it also serves to illustrate one of the key warnings of Richard Bookstaber, a former Wall Street risk manager and author of the book The Demon of Our Own Design: that in tightly coupled (as in overly interconnected) systems, the most important risk reduction measure is to reduce the interconnectedness first. Taking steps to reduce specific exposures without reducing the tight coupling first is almost certain to make matters worse.

Here, the Fed has been “experimenting” with intervening directly in the repo market directly, as both a way to drain liquidity from the market and to allow it to step in and stabilize the market as needed in a crisis.

The wee problem is that even in good times, there is counterparty risk in the repo market. The Fed is the best counterparty imaginable. So given the choice between doing a repo with a bank versus doing a repo with the Fed on the same terms, anyone with an operating brain cell will go to the central bank. And the Fed was willing to experiment in size, so it’s now become a big part of the repo market. This comes from the end of the Journal article (emphasis ours):

The Fed has expanded its role in the repo market as it tests out a new monetary-policy tool aimed at controlling short-term interest rates.

The central bank is sitting on more than $4 trillion in bonds as part of a program to stimulate the economy and has been testing borrowing against some of those bonds in return for cash to drain money from the economy.

The New York Fed’s repo-trading desk accepted a daily average of $121.3 billion of repurchase agreements in July, up from $73 billion in January. Money-market mutual funds have been especially big players in this “reverse repo” pilot program, giving funds a safe place to park cash.

Large market participants like money-market funds are increasingly trading from the Fed, rather than with banks—a move Fitch Ratings attributes to comfort with the central bank, better terms and regulatory changes that are altering how financial firms participate in the market.

There are signs the Fed is growing uncomfortable with its repo market presence.

At a Senate hearing last month, Fed Chairwoman Janet Yellen voiced concerns that the Fed could “become too large or play too prominent a role” and could provide “a safe haven that could cause flight from lending to other participants in the money markets.”

Now keep in mind that the article prior to this section was presenting the bank pullback from the repo market as Seriously Not Good as well as a possible result of Evil New Regulations. There admittedly was some concern about repo market failures, which also was not an uncommon occurrence in the runup to the crisis:

Goldman Sachs Group Inc. reduced its repo activity by about $42 billion in the first six months of this year, citing capital requirements. Barclays cut back lending through repos and similar agreements by roughly $25 billion, to $289 billion in the first half of the year.

Bank of America Corp. and Citigroup Inc. made first-half reductions in repo lending of about $11.4 billion and about $8 billion, respectively. J.P. Morgan Chase & Co.’s repo lending stayed roughly flat….

Banks said privately they don’t intend to abandon clients in repo markets. But there are signs their reluctance to facilitate huge amounts of repo activity is contributing to increased volatility.

In June, a relatively high number of repo transactions tied to U.S. Treasurys “failed,” or didn’t close because one of the parties didn’t provide the bond, according to research firm Wrightson ICAP.

Cynically, your humble blogger wonders whether the Fed’s presence in the market is allowing banks to pull back from a product that was not a big money-maker for them. Indeed, the Fed offering better terms is a sign that crowding out the bank was a feature, not a bug:

Regulators say the changes are positive. Before the crisis, many Wall Street firms relied heavily on repos for cash. But they lost access to those funds when investors panicked about the value of mortgage bonds and the solvency of firms like Lehman Brothers Holdings Inc. that relied on repos for cash.

New rules are “a constraint, but one that facilitates financial stability in the long run,” said Federal Deposit Insurance Corp. Vice Chairman Thomas Hoenig.

The Wall Street Journal also points out that some investors have been scrambling to find enough “good collateral”. We’ve always been bothered by this construction, since the big use of collateral is to secure derivatives positions. Derivative experts like Satyajit Das attest that the main uses of derivatives aren’t for socially productive hedging (and related trading to make enough in the way of markets) but speculation, and accounting, tax, and regulatory arbitrage. It would be preferable for the authorities to have addressed the issue of derivatives directly. But making collateral less available (or more costly) is another way to crimp derivatives activity. So the inability to find enough collateral, assuming the squeeze is gradual rather than sudden, could also have salutary effects. From the Journal:

Bank pullbacks have shrunk the pool of securities available for repo trades with U.S. Treasurys as collateral, leading to smaller transactions. “There is a shortage of collateral,” said Joe Lynagh, who oversees $18 billion in money-market funds at T. Rowe Price. “Because that trend is continuing, you could see more funds rely more on the Fed” for investing their cash.

Investors said there is such high demand for certain types of bonds that some firms are accepting negative interest rates on the cash they are lending in exchange for the in-demand collateral. As of Tuesday, the rate to borrow five-year Treasury notes maturing in 2019 in the repo market was minus 0.25 percentage points—in other words, financial firms were willing to pay bondholders for the privilege of lending them cash.

In other words, the central bank appears, whether by accident or design, to have shoved the banks to the side in the repo market, and have also contributed to the scarcity of collateral. They’d pretend this was intentional whether or not they’d goofed. So I’d be curious to get insider readings as to whether the Fed is being clever or has outsmarted itself.

Lehman used repo 105 as a method of boosting its numbers while MF Global (so far as I can tell) was annihilated by internal repo, using client funds to buy junk securities with a high yield. It might be the Fed sees muscling banks out of the business as a systemic risk reduction. The thing is I’ve heard very little about this from the big banks, so it’s not like they’re bitching about it. Possibly they’re fine with this, as Yves suggested.

Could some one explain how there could be a shortage of collateral for derivatives if the fed is moving treasuries/mbs’, etc off there balance sheets and into the market? It seems like this would increase available collateral.

Or is it that the collateral the fed is increasing just not going to the banks? What am I missing here?

The Fed essentially cornered the market with QE, creating a shortage of collateral for everyone else. That could only go on so long. Now they’re trying to “reverse repo” their way out of it offering their garbage for cash to try to absorb all of the excess dollars on the market. Good luck to them. Looks to me like they are preparing for a massive sell off in the USD which they have no foreign currency to absorb.

It’ll all be fine. Now that the banks and the Fed have blown through every last penny of collateral in housing by fraudulent securitizations and foreclosures, they still have a little more pillage they can indulge in. It would be a very shrewd market solution for the Fed to actually invest in pawn shops across america. In fact, just buy them out like any good vulture capitalist. The shelves in pawn shops are actually full of goods with value, lots of gold and jewelry, fine art, some historic artifacts, collectors items, etc. All this stuff could be managed by the Fed by some wizard app. so that redemptions are more difficult or impossible and the collateral can simply be confiscated by the Fed. And auctioned regularly. Sound familiar? So this could keep the Fed competing with the banksters for some time to come. After all, it may be a closed, private financial system which socializes risk and claims all the gain, but both the Fed and the banks have to compete with each other to stay alive. Else the Fed will be folded into the Treasury and we will finally have socialized banking.

It’s more like they are draining collateral from the system anyway.

Thanks for the responses Susan and Mossman,

I get the QE part on how that drains collateral; the article states following, suggesting a new phenonema:

Bank pullbacks have shrunk the pool of securities available for repo trades with U.S. Treasurys as collateral, leading to smaller transactions.

Hence my question about how the fed’s recent reverse repo activities are creating a shortage of collateral…

Thoughts?

As Clive has mentioned I think the stronger regulatory requirements on clearing banks forcing them to recognize the risks they are taking by taking on the intraday broker/dealer/hedge fund risk is drying up that market. If one of these funds defaults on a risky security or derivative it is the clearing bank that ends up holding the bag and it will extract what it can from the money market funds.

Thanks financial matters..

So it sounds like all the article’s hand waving is just another way to say that there is a shortage collateral at the current “market” price, at least for the banks.

There is a new regulatory/risk environment but the market price has not adjusted to compensate. Or more accurately, the fed doesn’t want to lower the price which would increase short term rates. Hence the bank “pull back” and an increase in fed dealing directly with money market funds:

“The New York Fed’s repo-trading desk accepted a daily average of $121.3 billion of repurchase agreements in July, up from $73 billion in January”

Again, the immediate above suggests that there is an increase in collateral in the market as a whole. But the banks are not participating because the price is not low enough to make money. No?

This article is sounding more like a smoke screen of a negotiation between the fed and the banks; The fed does not want to lower price because this would increase short interests rates and the banks respond by not participating.

I’m not sure I’m understanding the price as a factor. If a dealer such as a Goldman subsidiary wants to borrow money secured by a security it sells that security to a money market fund via a repo. A clearing bank such as JP Morgan facilitates the deal by holding the security and the cash. The purpose of the regulations is for JP Morgan to consider the risk of holding that security and the risk to the stability of the money market funds since JP Morgan is able to retain that cash.

If they don’t have to consider the risk because the Fed will come in and bail out the money market funds then they can provide these loans on a cheap basis. If they have to shoulder the risk themselves the loans become more expensive.

Thanks financial matters..

I think we are talking about similar things…I am try to stay focused on the fed though. and specifically the revers repo

Here are my assumptions and nderstanding:

1) The Fed is performing revers repos to take out liquidity in the markets and

2) it does this by borrowing money. In consequence, it sells a security for ‘X’ amount of dollars (read price) with a promise to buy the same security back for those ‘X’ dollars plus some delta (read profit/return/interest rate).

Is this not the mechanism by which a reverse repo goes down?

So, my take on the so called “bank pull back” is that the price the fed wants to “sell” at is too high. The fed can not lower the price too much less it will raise short term interest rates.

Thus, the rise in non bank facilitated reverse repos. However, it appears the fed needs the banks to handle to volumes necessary. But the bnks won’t play unless the fed lowers the price.

Hence their negotiations are going public and the first swing is that it is the banks fault for screqing up the market; i.e pulling back.

It’s sort of a none problem. They like using very short term T-bills for collateral because the market price is stable.

I did see a banker trader expert guy questioned about that a few years ago. He just shrugged his shoulders and said if they run out of short term treasuries, they will just discount long term treasuries instead.

Like you can only borrow 90 cents on the dollar. That way your collateral is protected from price swings. Plus it only matters if your counterparty goes bankrupt in the week or whatever the repo is good for.

And wish they would worry more about the derivatives market getting too big for the national debt.

May have misunderstood your question. I explained how repo normally works.

Fed reverse repo means the 4 trillion in bonds go out of inventory and cash goes into the Fed.

So what you asking doesn’t happen, unless there is some 2nd order effect that escapes, at least at moment.

I should probably give up on this before I say something stupid, but maybe everyone mal invested all the liquidity and the Fed can’t get it back, because illiquid, so no one has any cash to lend to the Fed for week whilst holding a treasury?

That’s silly. There has to be some reason for doing all this.

I’m gonna put a slice of pizza in the oven and maybe the answer will come to me. Sometimes that works. But it might take a day or two sometimes.

I’m having reading comprehension fail. This post makes no sense. Repos are introduced as ways of by-passing banks to avoid concentrated credit risk. Then the idea is introduced that Federal Reserve borrowing using reverse repos to drain cash from the system is elbowing out banks, which contradicts the opening premise that repos by definition by-pass banks. Then when banks are introduced as pulling back from the repo market, they’re introduced in the context of lenders not borrowers, this is the opposite of the Fed, which the post says is using repos to borrow, not lend. Then at the end it says banks have been “shoved to the side” of something they started out not being a part of anyway. Even the picture show them in the middle. Mayday! Mayday! My confusion boat is sinking. It’s too early in the a.m. for this kind of mind pain.

Sounds craazy man, doesn’t it.

C’mon craazy. Wasn’t that hard and I’m still on my first cup of coffee here.

Although I’m sure there are more variations on the theme than outlined here.

Like is Lehman a bank, or not.

My Oy,veyness meter spiked when I saw the WSJ pic indicating there is a bank between a hedge fund and a money market mutual fund to facilitate the transaction. Wtf? Doesn’t anyone besides a bank know how to handle money? hahaha

But at least the author suspected that the banks don’t make a boatload of money at it. That was a little comforting.

Wait a minute . . . . Isn’t there a penalty for early withdrawal?

None of this make any sense at all. :-)

I think you just described modern day finance.

What are you sinking about?

I told the doctor I’m always sinking about wigwams and tee-pees.

he told me, “I sink you are two tents. You should take 1 mg Xanax and spend more time on youtube.”

No, the point of repo is to avoid making a deposit over the FDIC limits, which is an UNSECURED loan. A repo is secured by very high quality collateral, typically Treasuries or something the lender accepts as almost as good. So that makes it much better than a deposit. We did explain the secured v. unsecured issue.

And in the old days, when investment banks and banks were different beasts, investment banks were big repo players.

I’m sorry but this was a dreadful post.

The author is clearly suffering from ED: “Editorial Dysfunction”. Symptoms of ED include flaccid phrasings, wandering words and limp logic that leaves the reader — who wishes to be filled with the powerful thrust of the author’s argument — confused and unfulfilled.

While ED can be embarrasing, there’s no need to suffer or resort to medications that only mask symptoms. ED can be cured! Usually in a few private sessions with a Certified Cunning Linguist. Through a hands-on demonstration of easy to follow techniques, the patient — particularly patients who are hot women — can learn to harden their prose with solid syntax, clarity of thought and a potent persuasion that leaves the reader satiated with pleasure in a state of enlightened ecstasy.

Taking the first step toward a cure can be frought with anxiety. This is why xanax and red wine are often used during the first lesson. The lesson plan can be customized to address the specific challenges faced by the patient, but here’s a video of how sessions typically proceed with an expert instructor:

https://www.youtube.com/watch?v=ZQiRtJ6uumk

In the center of the diagram there are only 2 clearing banks, JPMorgan Chase and Bank of New York Mellon.

So it appears to be taking over their function and also making the hedge funds/broker dealers look for other ways to find liquidity than the money market funds. They should find other ways to fund their activities that don’t involve Fed bailouts. Money market funds are better off dealing with the Fed which can provide them a stable interest rate.

If Thomas Hoenig likes it it’s probably good.

http://neweconomicperspectives.org/2014/08/official-big-fail-alive-well.html

“”Thank heaven for Tom Hoenig, the only proven-honest central banker we’ve got. Yes, I know he’s moved on from the KC Fed to serve as Vice Chairman of the FDIC. He actually might do a lot more good over there, anyway.””

Good article on tri-party repo

https://www.stern.nyu.edu/sites/default/files/assets/documents/con_040111.pdf

Only two banks are major clearing banks but all the major banks engage in repo. Just pull a balance sheet off Edgar. You’ll see the repo and reverse repo totals.

Have any of them thought about the question of whether these “overnight loans” have any actual collateral?

We know that the mortgage titles were completely bogus, with the same mortgages being claimed to be in multiple trusts at once. Is there any reason to believe that the collateral tracking in repo is accurate?

If it isn’t, then it isn’t collateral, it’s just unsecured loans….

Yves:

In answer to your closing question, and I’m certainly not an insider, doesn’t it illustrate the old tension about interventions into the market? The repo market was always one of the least understood private markets, but crucial for speculation, I had to teach myself to understand the crisis and most of even the financially literate public don’t have a grasp of it. It was inherently unstable, so then comes along a quasi public institution with higher “neutrality” ratings and higher ethical standards, and it is displacing the darker pools…but it is uncomfortable in the role because as you point out it threatens to displace private market power and prerogatives…this sounds like the “double movement” inherent in market “reforms” that Polanyi so skillfully portrayed in “The Great Transformation.”

interesting.

Isn’t this situation very similar to how Fannie Mae/Freddie Mac took over the mortgage market?

Where I am, they want out this business. I’m not directly involved, not my area of ah-hem, (so called) expertise) but from what that department say, it’s a dead end. Part of it is regulatory. Here, the regulators want simple financial institutions. They (the regulators) have recognised that, if they try to regulator complex entities, they become the risk, not the institutions. Having seen how failed banks blame everyone but themselves, they’ve wised up so next time, the regulators are not setting themselves up for being the fall guys through failing to regulate properly. Regulators are, first and foremost, political creatures. Anything that turns out to be a beneficial outcome of their regulatory enforcement is happy accident.

But the other part is, as Yves alluded to in the feature, this is a crappy business (low margins) and it’s about to get crappier. With apologies to craazyman and his poor, enfeebled brain, I’ll have to get a bit technical here.

Firstly, there’s the Basel III Leverage Ratio. Repo is low margin an capital intensive. The treatment of counterparty risk isn’t more onerous in two way flows where the central bank is one of the counterparties (the central bank is deemed fail-proof. Yes, I know. Still. But I digress. The netting of positions isn’t hugely detrimental in Basel III for Leverage Ratios in these transactions). But it is tougher in Basel III where you have a single way flow with a specific client (as “lender” of the bond as liquidity being repo’ed). You need to check how good that client is in terms of credit risk and allocate capital accordingly. Vanishingly small margins thus just got smaller. I will need to check my figures here, but I think in the US rather than us here in Europe, so called systemically significant bank holding companies have to apply a Supplementary Leverage Ratio of 5% for the bank holding company accepting collateral for repo and 6% for any of their subsidiaries. For Europe, from 2018, it’s 3% tier 1. US banks will therefore find this business even less attractive than those in Europe.

Secondly, stay with me people if you can, this is where you brain starts to hurt, where you have a match funded repo trade between a bank and another bank, that is deemed not in scope of Basel III’s Net Stable Funding Ratio calculation. Don’t ask me why. Was probably a bank “gimmie” when they watered down Basel III way back when. But match funded securities financing trades between a bank and a non-bank *are* included in the Net Stable Funding Ratio. This will pretty much kill cash balances (of the type which is described in the article) from non-bank counterparties.

So it’s a Basel III induced double-whammy. Leverage Ratio and Net Stable Funding Ratio get whacked (depending on the counterparty).

Therefore, the banks don’t want to play anymore (being now I think pathologically incapable of operating any sort of business model not dependent on high-margin rent seeking or outright fraud, their version of an existential crisis as the easy money tap is, if not turned off, at least reduced in flow) and the regulators don’t want the hassle of trying to regulate this stuff. Repo is too useful to be allowed to die, so apart from the Fed. who else is there ? My take, then, is that the Fed has been forced to pick up the ball. A text book case of Market Failure. There is a market, there is some (small amount) of money to be made, but if your diet consists only of gravy, it’s kind-a hard to sit at a plate of broccoli, carrots and potatoes.

Sounds a lot like the card game Big League TEGWAR introduced in the movie Bang the Drum Slowly. TEGWAR, of course stands for The Exciting Game Without Any Rules.

My first reading on this was “is this bad?” Frankly, I think they should keep it that way. In fact, go further and make the central bank our public banking utility…

But hasn’t the Fed already been buying up much of the “good collateral” through it’s QE programs? And guess what? If and when the Fed wants to unwind its QE purchases, draining all those idle excess reserves to avoid spiking inflation, and raise interest rates, it will wind up with a net capital loss on its bond purchases, which will have to come out of the Treasury, if only disguised as reduced payments to it, which is to say, replaced by increased deficits. IOW QE has always really been a hidden form of fiscal policy, if a largely ineffective and dysfunctional one at that. But the Fed wants to keep that fact hidden, so it will hold on to its purchased bonds until their terms expire, while draining the excess reserves through reverse repo transactions. That seems to me to be what the Fed is “testing” out now.

Yes, it’s FUBAR.

Ya, Bingo! Or more precisely, Bingo and the pot gets settled up 10 years from now. The only reason for this I can put my finger on is it’s just balance sheet engineering so no losses show up when they do the “drain liquidity” thing.

Almost seems normal in the financial world too, borrow short term to be around when profits return someday, so I guess it’s hard to say this is “‘evil”. Except the part about being in QE for 5 years and, if we ever do get another recesson, ZIRP forevaah. So we’ve institutionalized stealing purchasing power from savers forever. But we all make the big bucks…so no big problem there!

An overlooked aspect of the Fed’s Repo facility has been the day to day volatility in the total balance in this account at the Fed. For example, over the June 30, 2014 second quarter end when the Fed’s counter-parties might have wanted to show higher “Cash Equivalents” liquidity on their balance sheets, the Fed was carrying a total Repo balance of $339.5 bil. Yesterday (August 12, 2014) the balance in the Repo account at the FRBNY was $130.7 bil. This balance was zero on January 2nd, the day before this program was initiated

http://www.ny.frb.org/markets/omo/dmm/historical/tomo/temp.cfm

My own opinion is that this mechanism is also a way for the Fed to pretend it is unwinding QE, when in fact it is not doing so or is doing so at a much more leisurely pace and on a much more flexible basis than is being publicly portrayed. After all, the Fed’s Repo facility was only made available beginning on January 3, 2014. Rather, the Fed is simply rolling over these securities daily rather than purchasing and holding the securities to maturity. To the best of my knowledge, no bid has ever been declined under this facility, and the rate has been 3bp- 5bp throughout this period, so it also acts as a vehicle to suppress interest rates.

My question: Are there any limits on the type of securities that the Fed can accept as collateral under this facility?

As I think you’re suggesting it makes a big difference which party the Fed is backing. If they are offering up Treasuries to give money market funds (which most people consider safe anyway and are generally used to park money) a safe rate of return for their cash that’s one thing. If they are accepting who knows what from hedge funds/broker dealers on the public dime that’s a whole different issue and allows these firms to continue to speculate with socially shared losses.

I think we want to avoid these going forward..

6. The TSLF was announced on March 11, 2008, during the week leading up to the collapse of Bear Stearns. The program allows primary dealers to receive Treasury collateral from the Fed in exchange for less liquid collateral. The dealers could then post these Treasuries to another private counterparty as collateral against cash loans.

7. The PDCF was announced on March 16, 2008, at the same time as the announcement of JPMorgan Chase’s takeover of Bear Stearns. The PDCF allowed primary dealers to borrow, on a secured basis, directly from the Fed.

https://www.stern.nyu.edu/sites/default/files/assets/documents/con_040111.pdf

I think it’s rather a case of “banks” as opposed to money market funds being the preferred counterparty by the Fed. Which has made me have a thought. To support this counterparty preference by the Fed, it is implicit that the Fed is still viewing the banks as Too Big To Fail. And that that status will be perpetuated. Otherwise, what makes banks such desireable counterparties ?

IIRC, and this goes back maybe 3 years or so because that was when the Fed was trying to convince everyone they had a credible exit strategy from QE, was the Fed proposed this “reverse repo” idea and they thought it was a good idea to do it thru the “repo market”.

I didn’t see any explanation why they thought so, and it was back then and still now, up to us to determine the difference between “bank” and repo market. Far as I can tell anyone with a big enough pile of other people’s money and not owned by a TBTF bank counts as a non-bank player. Otherwise banks are doing it.

What this means to us, we don’t know yet. But it does eliminate the much feared “interest rate spike” scenario of the Fed just dumping their inventory of long term bonds. So ZIRP forevahh and we can all go out and get our incredibly cheap loans and buy more stuff.

Hooray!

Hi spoofs, thanks.

It seems the main purpose of the reverse repo is to try and control short term interest rates. They appear to be offering money market funds a similar deal to what they offer depository institutions with interest on excess reserves.

The Fed has the power to set this interest rate so it can out compete the dealer banks for these money market funds.

I think this also provides stability to the system by giving money market funds a safer vehicle for investment and making dealer banks look elsewhere for their cash.

http://www.newyorkfed.org/markets/rrp_faq.html