By Jérémie Cohen-Setton, PhD candidate in Economics at U.C. Berkeley and a summer associate intern at Goldman Sachs Global Economic Research. Originally published at Bruegel.

What’s at stake: Speaking at the Federal Reserve Bank of Kansas City’s annual conference Jackson Hole, Wyo., ECB President Mario Draghi made an important speech recognizing that the recovery in the euro area remains uniformly weak and that the euro area fiscal stance was not helping the ECB do its job. Interestingly, French leaders also reintroduced over the weekend the notion of aggregate demand, a concept they had noticeably moved away from with the “Pacte de responsabilite”.

The qualification of the European economic outlook

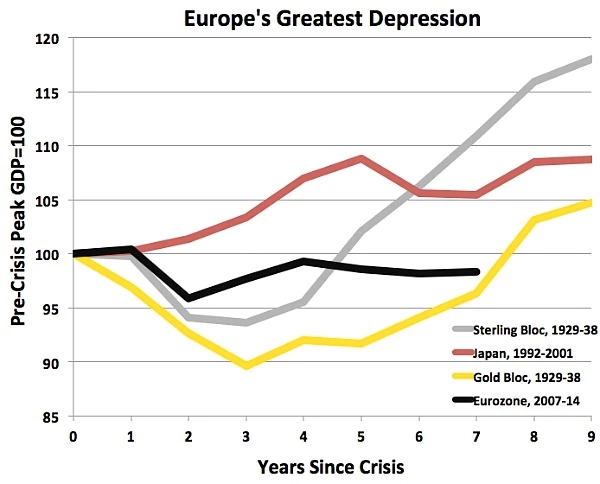

Joe Weisenthal writes that Draghi’s speech is significant because it acknowledges that the eurozone is in a massive ongoing crisis. Only two weeks ago, ECB President Draghi still considered that “the available information remain[ed] consistent with our assessment of a continued moderate and uneven recovery of the euro area economy”. This time, Draghi described that the “the most recent GDP data confirm[ed] that the recovery in the euro area remains uniformly weak, with subdued wage growth even in non-stressed countries suggesting lackluster demand.”

Greg Ip writes that Mario Draghi sounded strangely dismissive of price development concerns after his last press conference. He noted that excluding food and energy inflation was 0.8%, and argued that the decline in inflation expectations was all in the short term, whereas “long-term expectations remain anchored at 2%.” At his speech on Friday in Jackson Hole, his tone was much less sanguine. Inflation, he noted, has been on a downward path from around 2.5% in the summer of 2012 to 0.4% most recently. Departing from his prepared text, he said, if “low inflation were to last a long period of time, risks to price stability would increase.” He said inflation expectations had experienced a “significant decline at the long horizon,” by 15 basis points (five-year inflation starting in five years’ time). “If we go to shorter and medium term horizons,” the declines “are even more significant.

Source: Wonkblog

Joe Weisenthal reports that Citi’s top economist, Willem Buiter, expects monetary policies to widely diverge as both the Bank of Japan and the European Central Bank would engage in “major” quantitative easing programs later this year or early next year. This is because their economies are flagging, particularly in Europe, where inflation expectations are collapsing. On the flipside, the Fed and the Bank of England are both expected to begin the normalization process (rate hikes) fairly soon (sometime next year). In its daily email, Sober Look writes that the euro’s decline accelerated on Sunday evening, as Jackson Hole discussions solidified the expectations of diverging monetary policies between the US and the Eurozone.

The departure from previous fiscal policies

Brian Blackstone writes that ECB President Mario Draghi on Friday signaled a departure from the austerity-focused mind-set that has dominated economic policy-making in the euro zone since the onset of the region’s debt crisis nearly five years ago. Mario Draghi writes that “since 2010 the euro area has suffered from fiscal policy being less available and effective, especially compared with other large advanced economies […] it would be helpful for the overall stance of policy if fiscal policy could play a greater role alongside monetary policy, and I believe there is scope for this, while taking into account our specific initial conditions and legal constraints.“

Simon Wren-Lewis writes that to understand the significance of Draghi’s speech, it is crucial to know the background. The ECB has appeared to be in the past a center of what Paul De Grauwe calls balanced-budget fundamentalism. Traditionally ECB briefings would not be complete without a ritual call for governments to undertake structural reforms and to continue with fiscal consolidation. The big news is that Draghi does not (at least now) believe in balanced-budget fundamentalism. Instead this speech follows the line taken by Ben Bernanke, who made public his view that fiscal consolidation in the US was not helping the Fed do its job.

Simon Wren-Lewis writes that we should celebrate the fact that Draghi is now changing the ECB’s tune, and calling for fiscal expansion because it may begin to break the hold of balanced-budget fundamentalism on the rest of the policy making elite in the Eurozone. But Draghi is only talking about flexibility within the Stability and Growth Pact rules, and these rules are the big problem. Paul Krugman writes that even if Draghi gets the situation, the combination of the euro’s structure and the intransigence of the austerians means that the situation remains very grim.

Richard Portes and Philippe Weil write European citizens must hope that their policy makers will recognize that the acute, pressing problem is aggregate demand. Repairing the credit system, implementing serious reforms of state expenditure and taxation, creating more flexible labor markets, finally opening the services market to cross-border competition – all are indeed very important. But they will not liberate the eurozone from stagnation.

France and Jean-Baptiste Say

There has also been a striking change in the language used by French President Francois Hollande over the weekend. A few months ago, Francois was re-named Jean-Baptiste Hollande in the blogosphere for reviving the “supply creates demand” fairy as he embraced the view of his compatriot Jean-Baptiste Say that to boost growth one needs only to care about creating optimal condition for production and supply, and that demand will follow.

In his recent interview with Le Monde, Francois Hollande appeared to rebalance his approach saying that Europe faced a clear lack of demand (“le diagnostic est implacable: il y a un problème de demande dans toute l’Europe”). He suggested that Europe should support overall demand while national policy should mostly remained focus on supply side policies. Meanwhile, Arnaud Montebourg, the economy minister, shortly joined by Benoit Hamon, the Education minister went further and called for a new policy direction, also at the national level, arguing that the fiscal consolidation path needed to be adjusted substantially and that France shouldn’t accept the economic choices and ideological preferences of the German CDU.

With right-wing national governments in place all over Europe, tight economic policy is the order of day. Draghi can come up with Lincoln’s Gettysburg Address all day long, in far away places like in Wyoming…. nothing is going to change the entrenched economic policies at the national governments — after all these years into our politically induced Great Recession.

An analogy to misbegotten stimulus efforts:

https://www.youtube.com/watch?v=3RNwJfLGzlQ

If the expected reaction doesn’t happen, just keep adding more . . .

A central banker becomes a political leader when he talks of such things.

The question of course is what abyss is he leading us towards ? (And who the F$£k gave him this power)

Whe can clearly see a trajectory here.

Destroy european nation states – rebuild them into your own image.

And Hollande

“He suggested that Europe (see the ECB) should support overall demand while national policy should mostly remained focus on supply side policies.”

Wow.

Lets all go down to our local church – remove that Jesus nailed to wood bloke and replace him with the evil eye and we will all live happily ever after.

Looks like a nightmare corporate state from where I am sitting.

Unfortunately, the analysis on France is dead wrong – Montebourg and Hamon were promptly sacked as Hollande restated his commitment to orthodox economic policies.

RE: …”Montebourg and Hamon were promptly sacked as Hollande restated his commitment to orthodox economic policies.”

One might have wondered–as I did at the time: What are these men doing joining Hollande’s government in the first place? Even before he was elected, I figured Hollande for a dopey French version of the soporific Barack Obama, the conventionally-thinking Organization Man par excellence. Just as when a supposedly differentiable John Kerry or a Hilary Clinton join the Obama administration as cabinet members, what we find is that such people who’ve tried so hard (who’ve strained, really) to assert their individuality and their distinctiveness, turn out to join the administrations of the very people they’ve opposed in seeking elective public office. So what if the ice cream parlour sign reads “33 flavors” when, on going in, one finds that they’re all mixed together into one enormous mish-mash?

Absolutely correct, Jose. France just purged those Socialists who wanted a turn from austerity. Given Junker’s recent election as head of the EU commission, will will see many years of further austerity. I can see a push for QE, because those billions will go to the holders of assets. I see both QE and austerity go hand in hand. With the ECB running QE, they can say, ‘Wait till next years!’ for many years.

So how’s that NATO saber-rattling in eastern Europe workin’ out for eurozone consumer confidence?

Produce, European comrades! We need to stock up on matériel before the shells start exploding.

Central banks don’t declare wars. But they finance them. And war is quickest remedy to boost demand …

Simon Wren Lewis “we should celebrate the fact that Draghi is now changing the ECB’s tune”

From Bm to Am? It is all discord in a minor key as far as I can see.

What does “fiscal consolidation” mean in plainspeak? What, precisely, is it referring to? Thx.

Tammany Hall, Community Organizers in-Chief, & Membranes

Get a government check, get into public housing, and buy a government car (or Harley). Welfare is all there is at the end of an empire cycle, whether you work for Boeing, School, Hospital or Fed. That’s just the way it is. And the printing cycle has come full circle, again, back to Germany, which is playing last-to-lose better than others, again.

Dog’ll have the Beagles tree the bear, and ISIS is a derivative, new sh-show same as the old sh-show. Whether authority or stupidity came first is irrelevant. Bank prints for the ‘elite’ and legislature forms the credit gradient in the sewer line. The process goes round and round, until no one with experience remains, when rent to busy-work income peaks.

So, the pot growers have commoditized themselves and are trying to make their mortgage on the backs of renters, and the proffered solution is to print more money for the consumers, surprise.

Regardless of job, it’s always the same. The critters want privilege without responsibility, so the authority generated takes the privilege and sends the responsibility downhill, with objective-based management implementing best business practice, printing until all the resources are gone and the demographic boom busts.

Normally, there is an informal authority, with experience, which the majority turns to when the expected emergency arises, and then crucifies upon recovery. Turn your phone off, and you won’t have to worry about a call in the middle of the night, telling you what you already know, that the critters are at war, again.

You are much better off paying the critters to go play golf, where they can be politically correct together. You warn them, you show them, and then you let them learn for themselves. The ‘market’ measures pressure in the sewer line.

Don’t expect Jesus.

Regardless of what you let the critters steal, they are going to turn it into a weapon, to increase the toll at the booth.

Yes, membranes exist for a reason, transport.

Does Mario Draghi’s recent speech signal a police shift over his ongoing policy of screwing the average person to boost the fortunes of the super-rich?

No.