By Philip Pilkington, a London-based economist and member of the Political Economy Research Group at Kingston University. Originally published at his website, Fixing the Economists

Although less prevalently talked about today many economists assume that while the central bank has control over the short-term rate of interest, the long-term rate of interest is set by the market. When Post-Keynesians make the case that when a country issues its own sovereign currency the rate of interest is controlled by the central bank and that the government never faces a financing constraint some economists deny this and point to the long-term rate of interest which they claim is under the control of the market. They say that if market participants decide to put the squeeze on the government they can raise the long-term rate of interest.

Keynes himself was wholly convinced that the central bank had full control over the long-term rate of interest. In a 1933 open letter to US President Franklin Roosevelt Keynes wrote:

The turn of the tide in great Britain is largely attributable to the reduction in the long-term rate of interest which ensued on the success of the conversion of the War Loan. This was deliberately engineered by means of the open-market policy of the Bank of England. I see no reason why you should not reduce the rate of interest on your long-term Government Bonds to 2½ per cent or less with favourable repercussions on the whole bond market, if only the Federal Reserve System would replace its present holdings of short-dated Treasury issues by purchasing long-dated issues in exchange. Such a policy might become effective in the course of a few months, and I attach great importance to it.

What Keynes was advocating was what has since been referred to as Operation Twist. This was a policy that was first initiated in the US during the Keynesian heyday under President John F. Kennedy. The Wikipedia page provides a nice overview of how it worked — note how it is identical to Keynes’ suggestion in his 1933 letter:

The Fed utilized open market operations to shorten the maturity of public debt in the open market. It performs the ‘twist’ by selling some of the short term debt (with three years or less to maturity) it purchased as part of the quantitative easing policy back into the market and using the money received from this to buy longer term government debt.

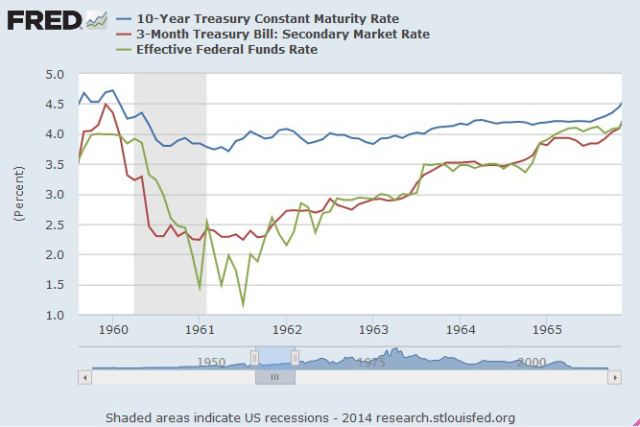

The policy basically did nothing. Below are the interest rates of the era.

As we can see the long-term treasury yield responded to the lowering of the Fed funds rate in 1960 but we can detect no change between the spread of the short-term and the long-term yield in 1961. The spread begins to close in 1962 but this is as a result of the increases in the Fed funds rate.

Recently the Federal Reserve Bank of San Francisco released a study claiming that the program had actually worked. I won’t get into the methodology of the study but I think its basically rubbish. The fact is that the stated aim of the program did not come to pass in any meaningful way. But the reason that the Fed probably commissioned the study was because they tried Operation Twist again once more in 2011. The Fed described the program thus after it had been completed:

Under the maturity extension program, the Federal Reserve sold or redeemed a total of $667 billion of shorter-term Treasury securities and used the proceeds to buy longer-term Treasury securities, thereby extending the average maturity of the securities in the Federal Reserve’s portfolio. By putting downward pressure on longer-term interest rates, the maturity extension program was intended to contribute to a broad easing in financial market conditions and provide support for the economic recovery.

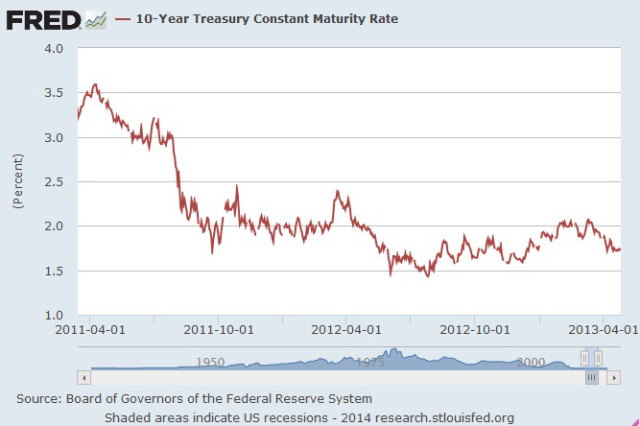

So, did it work? Not unless the Fed were lying about when they started the program. The press release at the time dates the program to September 21st 2011. Keeping that in mind let’s look at the long-term interest rates in that period. (We do not bother showing the short-term interest rates here because, as everyone knows, they are basically zero throughout the period).

Do you see that significant drop in long-term interest rates of about 1%? Well, that occurs in July 2011 and reaches its bottom in September 2011. This opens the possibility that the Fed actually undertook the program two months before they announced it. Unfortunately, there is no hard evidence of this and unless such evidence emerges we must assume that the second attempt at Operation Twist was indeed a failure.

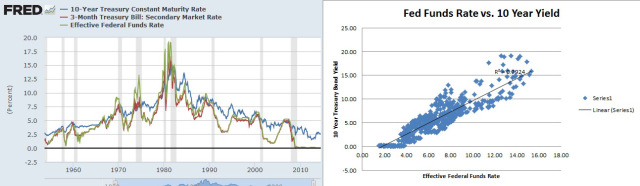

Does this mean that Keynes was wrong and that the central bank does not control the long-term rate of interest? No. Keynes was actually confusing two distinct things in his letter to Roosevelt; namely, whether the central bank controlled the long-term rate of interest and whether it controlled the spread between the short-term and the long-term rate of interest. There is no evidence that the central bank has any meaningful control over the latter — although I am open to being proved wrong on this front should it ever turn out that Operation Twist II was actually initiated in the summer of 2011. But if we zoom out it is quite clear that the central bank has full control over the long-term rate of interest. (Click for a larger picture)

On the left I have graphed all the interest rates together. The pattern should be clear to the reader. But in order to be concrete I have also included a regression of the the Fed funds rate on the ten-year bond yield. As we see the relationship is positive and quite statistically significant. It is quite clear that the central bank controls the long-term rate of interest through its short-term interest rate policy. Indeed, the fact that the regression does not produce a perfect fit is mainly due to the fact that the spread between the long-term rate and the short-term rate widens whenever the Fed drops the short-term rate significantly — this can be seen quite clearly in the graph on the left.

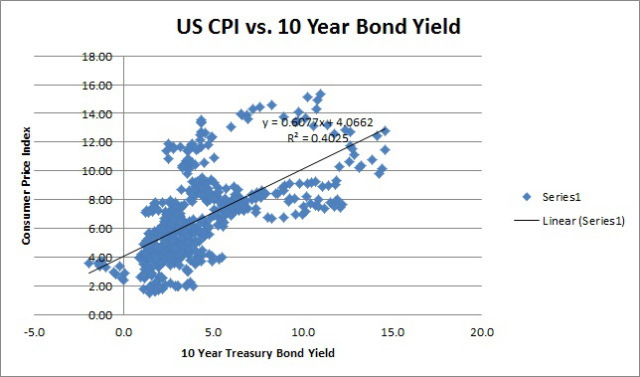

Some will claim that the long-term interest rate is actually tracking inflation. That is, when inflation rises the long-term interest rate would rise. Then the central bank merely reacts to this inflation by raising the short-term rate thus giving the statistical illusion of control. But this is not the case. If you look at the data carefully it is clear that it is the short-term rate driving the long-term rate and not inflation. There are many ways to illustrate this but perhaps the easiest is to run a regression of the long-term interest rate against the CPI which I have done below.

As we can see the fit is far less statistically significant than when we ran the regression of the short-term interest rate against the long-term interest rate. This shows quite clearly that, although the short-term rate may be raised by the central bank in response to inflation, it is clearly the short-term rate that is driving the long-term rate and not the rate of inflation.

So, does the central bank control the long-term interest rate? Yes. Does it control the spread between the long-term rate and the short-term rate? There is no evidence to confirm this and the evidence that we do have — taking the Fed at its word — suggests that they do not. But regardless, next time some economists tells you that the markets control the long-term rate of interest you can safely tell them that they have absolutely no idea what they are talking about.

I would think the CB could narrow the spread by simply making an open bid for 10-year bonds at a lower yield; buyers would have to raise their prices or be shoved aside as the Fed took the action, yet to my knowledge they’ve never done this.

I agree, Ben. But it was never done in this period.

Ben- it has been done, just read about the 1951 Fed-TSY accord

Correct. It was done from 1942 to 1951, as the Fed did precisely what Maynard Keynes advocated in the quoted letter, pegging T-bond yields at 2.5% to finance WW II at E-Z rates.

One can see the result of this policy in an appalling graphic from Greshamslaw. The Fed’s pristine prewar balance sheet, consisting almost exclusively of gold reserves, degenerated by 1945 to less than half gold owing to the headlong monetization of government debt.

http://greshams-law.com/wp-content/uploads/2012/02/Screen-shot-2012-02-12-at-21.23.00.png

Today gold (as valued at an anachronistic, absurd $42.22/oz) doesn’t even amount to one percent of the Yellen hedge fund’s paper-laden balance sheet:

http://www.federalreserve.gov/releases/h41/Current/

If you wonder why the mighty US empire is in accelerating decline, look no further than the delusions of those who believe their ‘control’ adds value rather than destroying it, as the evidence so conclusively demonstrates. Smash the counterfeiters!

Your comment is so silly, why should the Govt care about how much gold it has? Do you care how many Euro’s the Fed has? Why should the Govt acquire commodities not necessary for national security aka oil? Do you really think the Govt should develop a strategic wheat reserve?

Debt monetization is a meaningless phrase, only used by people you don’t understand monetary operations. All money is fiat, dollars do not exist in nature, so who is counterfeiting dollars?

A growing economy needs a growing money supply. Population and productivity growth require a growing money supply in order to fend off deflation.

Its hard to imagine how someone can be so wrong about so many economic concepts in such a short comment.

‘Population and productivity growth require a growing money supply in order to fend off deflation.’

Indeed. Regretably, though, once the lads got the bit between their teeth, they found it impossible to stop. Rather than merely ‘fending off deflation,’ they managed to explode the Consumer Price Index by a factor of 15.38 times since Dec. 1941, making the 20th century the most inflationary in history.

Oops! Whereas if they’d stuck with their pre-1941 solid gold balance sheet, intentions wouldn’t have mattered. The war on fascism turned out to be a war on stable currency. And we won!

“they managed to explode the Consumer Price Index by a factor of 15.38 times since Dec. 1941, making the 20th century the most inflationary in history.”

Like I said before, your understanding of economics is very bad.

the nominal CPI index is irrelevant to anything, inflation is the year over year changes, and since 1971 (the pure fiat era) we’ve had very low and stable inflation, the most stable in history in fact.

Youre wrong on every account.

Apart from all of the bogus CPI hedonic adjustments, I wonder how you’d explain this chart. Looks like something went very haywire after 1971:

http://i.imgur.com/eCJbK4M.jpg

I think Jim Grant makes an excellent point. He says the classical definition of inflation goes too far: it shouldn’t be “too much money chasing too few goods & services”, it should just be “too much money”. Inflation can pop out in different places…this time it’s in financial assets. Why is wanting to own a company (buying stock), and wanting my currency to store purchasing power until I buy, any different from wanting to buy a house or a car or a vegetable (or health care, or insurance, or tuition etc etc)? Oops my currency buys half of the company (stock) that it did five years ago.

The only people I see asserting there is low/no inflation tend to be those, like George Bush with the grocery scanner, don’t tend to be out in the trenches paying bills and buying things. Everyone who does can tell you as a certainty that the CPI figures are pure fantasy.

You got it.

It is mainly the idea that a few PhDs have the wisdom and foresight to manipulate the economy by debauching the currency in such a way that it produces the best outcome. Well, the good outcomes have been harvested and the negative longterm effects are looming ever greater on the horizon.

A good economist will apply policies that hurt in the immediate future with longterm positive results to be expected and not the other way around.

Its always a gas to see inflationistas’ groaning on about devaluation when the “Taxes are Theft” mob went after wages instead, then via their brilliant idea of lowering underwriting standards [to the point of absurdity], letting the barn door open to every criminal on the orb from pizza delivery boys to suits.

When standards are so low that gray becomes black, the only thing left is the self regulating void.

Skippy… pro tip – criminal acts do more damage than a wee bit of inflation….

That is exactly the point, inflation does promote corruption and criminal acts by making it profitable to lower standards via the use of lobbying efforts as any negative consequences are taken care of by the intensification of inflationary policies.

Wellie it seems the money came from out side of government, to ram policy through, via think tanks, economic schools [ideological sociopolitical cortex injection syringe], paper bags or lifestyle up grades down the road.

Skippy… inflation promotes good sorts to commit crimes… shezzz… please provide any psychiatric white papers which bare out this looney premiss.

The difference between inflation and deflation is that the latter lowers the living standards of working people, while the former hurts everyone.

Both inflation and deflation can lower standards of living by kicking workers out of the system.

Moneta,

What is the precept for shedding workers?

Skippy… to the Divine everything is Mine… methinks…

You’re getting causality backward: an endogenous money supply expands to meet demand, so prices rise first and then supply increases to satisfy transactional desires.

Maybe Beppe Grillo had the right idea… Why don’t we just move all the banks on top of the gold mines?

@ Lambert & Auburn

Nice going! But you both do not recognize your own misconception, namely the fact that it is exactly the idea to free the concerned decision makers from the restrictions of a commodity backed currency that brought us to today’s junction. The bogey man “deflation” is always a great way to avoid the repercussions of increased power concentration.

The principle and by the sheeple un-recognized infantilisation of society at the hands of some PhDs’ in the form of increased regulation (not to be mixed up with the deregulation where it served the power elite), control and monitoring of populations is well accompanied by a form of monetary manipulation serving the same purpose. I may agree that those PhDs may act with good intentions but the way to destruction is mostly plastered with good intentions. I draw the line at the degree at which governmental organizations infer in the lives of the population and less at the immediate results which often ignore (as unrecognized) the longterm negative effects. The real solution lays in the recognition that power has to be decentralized and that decision making has to be brought down on a lower hierarchical level with increased transparency and a clear assignment of accountability.

I agree but they probably don’t see it that way. Since they promote MMT, they probably believe in even greater centralization.

Centralization????

Please… in a highly deregulated market where even the remnants of oversight are compromised, you have that audacity to trot out the monopoly meme.

Skippy…. This gets even more ludicrous if followed by the Chicago Plan devotees….

We’re talking about narrowing the interest differentials between bonds of varying maturities, not fixing a rate.

The 1951 accord nominally separated monetary policy from directly supporting fiscal policy. Do you have a source for narrowing the spread at this time using the above-discussed method?

The mere fact that the Fed can set the rates on any term T-security wherever it chooses is the source.

If the Fed thought that the spread between 10 yr T-bonds and the FFR was too high, they could announce they are buying and selling all T-bonds at 1% (just like they did between 1942 and 1951) and presto, the spread would become 1% between the FFr and 10yr T-bond. And that example would obviously work for any term T-security.

Between 1942 and 1951, the Fed did exactly what you described, the Fed-TSY accord of 1951 ended the practice.

So the correct reply to your original comment…

“I would think the CB could narrow the spread by simply making an open bid for 10-year bonds at a lower yield; buyers would have to raise their prices or be shoved aside as the Fed took the action, yet to my knowledge they’ve never done this.”

Is “Yes, the have done this”.

Obviously I was unclear: “at this time” means the period to which Phillip discusses in his post.

These charts do not capt the alternate world scenario…for example, it looks like the rates did nothing in late 2011 but maybe without intervention they would have gone up.

It’s not possible to make any type of scientific deductions, or even any simply rational ones, from the study of counter-factual scenarios. The analysis suffers not at all for failing to consider what might have happened if things had turned out differently. We are, afterall, interested in what has actually happened, not speculations on what might have been.

That’s why economic policies fail time and time again…. for many, what you can not see, does not exist.

Opportunity costs are real.

George II suspended issuance of the long bond for five years from 2001 to 2006. I assume– although please correct me if I am wrong– that this was done in an attempt to lower long term interest rates (in addition, of course, to Mr. Greenspan’s considerable efforts on the short end of the curve). I would think that going for five years with no new long bond issuance must have been motivated by thinking very similar to the rational for Operation Twist. Are there any studies of whether or not this five year policy actually affected the level of long term interest rates, and if so, how?

Ben-

The Fed used to do this very thing, and could do so again anytime they wanted. They stopped explicitly setting the long term rates after the TSY-Fed Accord of 1951, ostensibly to maintain Fed “independence”, whatever that means.

https://www.richmondfed.org/publications/research/special_reports/treasury_fed_accord/background/

I liked this comment from earlier. Treasuries have their uses but it’s not to fund govt spending. The govt prints USD which includes the interest on Treasuries. And the Fed and Treasury essentially act as one body.

Joe Firestone (LetsGetitDone)

July 3, 2014 at 11:49 pm

Your reference to other interest rates is beside the point, since the claim being addressed is that the market can drive up the interest rates on Treasury securities. Again, the Treasury and the Fed set those rates. The Fed leads with its FFR, then The Treasury prices the bonds a bit above that to offer a better deal to banks and foreign nations holding dollar reserves. Of course, other instruments might offer very high interest to investors; but there’s always a need for risk-free vehicles to park reserves while deciding on investments, so there will always be buyers for Treasury securities at the rates offered.

In addition, even if the market didn’t want to buy the Treasuries, there are some 20 private certified dealers, whose deal with the Fed is that they will purchase securities on offer and then resell them to others. These dealers, in return for their commitment to buy all the securities on offer get to charge fees when they sell. In addition, the Fed advances the money to them to buy the securities. So, the risk to the dealers is removed and the sale of the securities at auction is guaranteed.

Finally, your comment, ignores the point I made about ceasing to issue debt and funding repayment of debt instruments and deficit spending with platinum coins. In that scenario, the market loses all power to drive up interest costs because the only ones are interest costs on securities sold in the past and still not redeemed. There are no new interest costs at higher rates. In that scenario, interest costs would fall every year until the public debt subject to the limit would be entirely liquidated.

The whole idea of investors taking over the task of setting long term rates depends on the mythical Bond Vigilantes doing it. These people either do not exist, or they have gone into hiding – same as the Templars.

But that is only one part of the puzzle.

The other is the market seems to accept our BS inflation numbers when pricing real return. They also have low future inflation expectations over a 10-30 year period. All other guesses about the future are more cloudy, of course.

Then, modern market participants generally are not taking delivery on 10-30 year treasuries and sticking them in the safe deposit box for the chilluns edjacation. They are traders, do the carry trade where they borrow short term money continuously on a daily or weekly basis to leverage up 30:1 on long term bonds. This is not the buy and hold type guy, and they think they can trade out anytime they want. So they are ignoring term risk and just looking at that juicy 2-3% nominal yield.

Then there are institutional investors that have charters saying they must be a large percentage in USG bonds.

Then the whole world is doing ZIRP and QE, so there is no where to go if you want at least low default risk.

The Bond Vigilantes may be dead.

Of course, no one in the USG or Fed realizes it works this way. hahaha.

“They say that if market participants decide to put the squeeze on the government they can raise the long-term rate of interest.”

How does raising the long term rate of interest “put a squeeze” on a Monetarily Sovereign government — a government having the unlimited ability to create its sovereign currency and pay any bill denominated in its sovereign currency?

The massive drop in 10 yr bond rates – from over 3% to under 2%, two months before the Fed’s program kicks in – suggests that there was major front running taking place by knowledgeable participants. Therefore, it appears that Operation Twist was a success in lowering long-term rates. And chalk one up for the front-runners too.

Agreed, should we really believe that those major banks did not have the insights to act accordingly? Even my toes are laughing at the thought. Corruption at its finest.

This confused me. I interpreted Greenspan’s comment that interest rates “don’t work” as meaning that the Fed has no control over the market because raising interest rates does not correct the market; raising interest rates does nothing to curb irrational exuberance and all the imbalances going critical mass. And Yellen’s comment that “it is not the Fed’s job to pop bubbles” as meaning the same thing. Our recent imbalances (last 20 years) were allowed to happen because there was an irrational exuberance that a free market solved all problems. So that left the Fed with only one tool which was to go ZIRP.

It seems like when, in the transition between Bernanke and Greenspan, the decision to raise interest rates (2006?) sent the economy into such a wobble that it couldn’t recover – it had no stability because there were no other ways to correct it. And the vigilantes shut down the credit market. Or maybe the vigilantes did the whole thing.

It wasn’t “vigilantes” – them is pardners in the wild – pretty much everyone who has studied it calls it a “wholesale run on banks” – which was when a bank and its banking counterparties decided to stop dealing with each other. Lehman was thought to be the trigger. Since it appeared the Fed would allow a bank in the tangled counterparty mess to fail – that really spooked all the banks when they realized their crappy trades and deals(subprime) may not get backstopped by the Fed after all. They also realized the system was highly leveraged and “frail”, so the domino effect would be happening too. They have explained to the Fed and Congress that this is called Armageddon – so don’t mess with a TBTF.

Was just thinking about Hank Paulson jetting off to talk to Lagarde and Sarkozy in early 2007. And how clever his namesake John was, at their mutual alma mater – GS, for doing a massive short on MBS Securitizations. And then a big snafu about how to spend TARP – for people or for banksters. And isn’t George Soros the biggest vigilante of them all? Tis a mess.

Soros said we shoulda hung the banks when we had the opportunity….that’s more like a judge but no rope.

PIMCO may rate as the biggest potential vigilante, but I read a Bill Gross missive a long time ago where he said PIMCO is too small to be one, and that’s why he was too scared to try it all on his own.

Plus bank regulation and consumer loan standards protection, but that wouldn’t be free market.

hahaha. Can’t say anything about ’em without making ’em all sound like bubble brains.

@ Susan

Well, you can condition market participants to believe that no matter how bad the repercussions of popped bubbles will be, the FED will always and under any circumstances use the currency to ameliorate the consequences as it is freed from any restrictions since the fall of the gold standard. That is not a free market but a market subjected to centralized planning by central banks.

Exactly what I have been thinking for quite some time;;;;;;;; better explication of my thinking by both the blog and commentary. Thanks.

Something isn’t clear to me. If the government can control the short and long term rates, how does it not control the spread?

If the government can’t control the spread, but can control the long term rate, then either it cannot control the short term rate, or cannot control both short and long term simultaneously.

Of course, just because it can, does not mean it does, or chooses not do so consistently, which makes correlations difficult to interpret.

I’ll try and straighten that out fer ya.

Firstly, the Fed only usually tries to control short rates. Without going into details – which I read about a long time ago and am fuzzy on anyway at this point – it is generally agreed that the Fed can control short rates.

The Fed usually doesn’t try and overtly control long rates thru FOMC transactions because they always did think they would spook the world if they went out and just bought most of the USG debt. In fact they were happily surprised the market accepted QE1 – but they did wait for Britain to go first.

So the specific case in the post here is when they did the “Twist”. (And they did try this along time ago too) The idea is they sell short term debt and buy long term debt. This is supposed to be comforting to the market because it is neutral from a quantity of money standpoint, and the Fed likes our current psyche factor that they call “low inflation expectations”. They don’t want the market to price in higher long term inflation expectations – which would undermine their whole effort.

So it didn’t appear to do anything, again. Now partly that could be they didn’t buy enough to move the market – it is big – but then we are getting closer to what they don’t want to do which is buy all the USG debt.

Then I’d add a new term – which I’m copyrighting right here and now – “The Fed Is Pushing On A Spring”.

In my comment above I outline my observations of the Treasury market structure. I would say the market structure has already compressed longer term rates so far that the Fed is pushing on a spring trying to make them go even lower.

If this term really catches on as well as Marriner Eccles’ “pushing on a string”, I’m hoping I’ll get a Fed building restroom named after me. A “craazyboy” plaque on the door would really be cool!

spring theory

as the legal money system is a legal fiction, the govt can essentially do whatever it wants with it (as proven by the somewhat shadily legal gift of 4.5 trillion by the Fed to the asset owners). if if cannot then it can make a law allowing it to, in the nominal realm. the technicalities of money are important, especially to the coneheads, but the political economy is who gets the blessing of the people who hold the key to the fiction and why.

the interesting question is why does it not (control the long rates), and “what happens if”.

First you have the axes wrong.

Second the causality flows mostly opposite to what you have stated, usually the long bond moves first.

Cheers.

The Fed was trying to reduce the spread between long and short bonds well prior to September 21st. From the June 20th release:

Plus, Operation Twist II was highly anticipated and not at all a surprise when officially announced. So you’d expect most of the effects of the policy to have taken effect prior to September 21st. And the gap between short and long-term rates did indeed drop 1 and a half points over the period the Fed was talking about Operation Twist II, and another half point over the next few months, so it does look like the Fed did successfully influence the spreads.

@ Rodger,

1. Even monetarily sovereign entities often still need to buy something with a price not denominated in their own currency. Just because you’re monetarily sovereign doesn’t mean you necessarily have a reserve currency that others feel pressured to accept as the unit of mutual trade.

2. As for how far a monetary sovereign with a reserve currency can abuse that role, I don’t know. That is something that is now being tested in our own interesting times.

If you had told me back, say, in the mid-1990’s that the Chinese would fully subscribe the costs of the Americans invading and occupying a Middle-Eastern country–and all at a negative real interest rate–I would have met such a claim with considerable scepticism. But that is indeed the way it happened, much to the delight of Dick Cheney, the 1%, and every MMT’er. Mammon and his most pious Empire chastise those of little faith.

2. Also it is possible, in an extreme case, that even within its own moneyzone, goods and services might become unavailable for purchase in units of the monetary sovereign’s money. The sovereign can have the money, but the loyal and long-suffering subjects might prefer to not offer goods and services in exchange for those units. The sovereign’s command measures will then probably become more direct in their nature. Times then go from being merely interesting to rather morbidly fascinating, unless you actually live there, in which case you may suffer from the surplus mortality often associated with such events.

No one seems to have pointed out that the “bond vigilantes” are vigilant only in the defense of upper class interests. since the central bank authorities have been earnestly exercising themselves in the furtherance of upper-class interests, why would the vigilantes object?

Just wait until a central bank attempted to use its monetary authority contrary to upper class interests? You’ll see more vigilante action than in all Hollywood movies put together. Every bond trader in the world would turn into Dirty Harry overnight. You feel lucky, punk?

Pffft. The bond vigilantes are a joke. As long as the US is borrowing in its own currency, they can’t actually exist. They can screw around politically, but no other way.

In the old days, the King would simply order people to lend to him. They were required to obey. The US government retains essentially the same powers. The only time you can’t do this is if you want to borrow from *foreigners*.

The short term / long-term spread is related to risk assessment. I dont’ thin kthat can be changed.