Lambert here: If the policymakers have turned the US into Japan, we’re looking at 20 years of a flatlined economy, punctuated (this being the US) by explosions. Could that be the why 5- and 10-year yields have diverged?

By Jérémie Cohen-Setton, PhD candidate in Economics at U.C. Berkeley and a summer associate intern at Goldman Sachs Global Economic Research. Originally published at Bruegel.

What’s at stake: Fed tapering was widely expected to push up US yields. Instead, US yields have fallen since the beginning of the year, raising the question of whether we’re seeing a new version of the Greenspan 2005 conundrum. Interestingly, a successful explanation of this new conundrum cannot just rely on a flight to safety explanation as it also needs to rationalize why 5-year yield and 10-year yield have diverged over the same period.

Tapering and Interest Rates

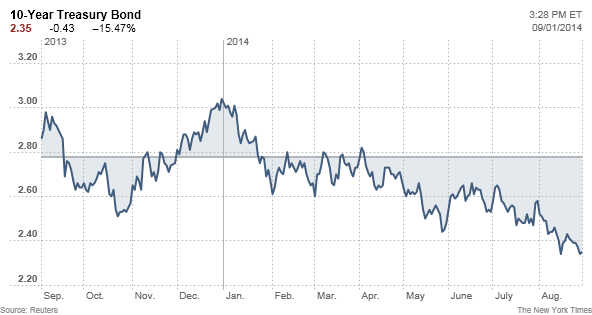

Jeff Sommer writes that yields have been falling with embarrassing consistency in 2014 despite forecasts to the contrary from most Wall Street analysts at the beginning of the year. David Beckworth writes that the Fed has been tightening monetary policy with its tapering of QE3 and yet the benchmark 10-year treasury interest rate has been falling since the beginning of 2014. Marc to Market writes that moreover, the US market rally has taken place amid a tick up in both core and headline measure of consumer prices.

Source: Dealbook

James Hamilton writes that as the U.S. economy returns to healthier growth, many of us expected long-term interest rates to return to more normal historical levels. But the general trend has been down since the end of the Great Recession. The 10-year rate did jump back up in the spring of 2013. But during most of this year it has been falling again.

In his famous 2005 testimony before Congress, Alan Greenspan noted that long-term interest rates [had] trended lower in recent months even as the Federal Reserve [had] raised the level of the target federal funds rate by 150 basis points. This development contrasts with most experience, which suggests that, other things being equal, increasing short-term interest rates are normally accompanied by a rise in longer-term yields. Calculated Risk writes that Mr. Greenspan is referring to the expectations theory of interest rates were long rates are the geometric average of expected future short rates plus a risk premium that would usually increase with duration of the instrument. This theory assumes that arbitrage between instruments of different durations will set the price.

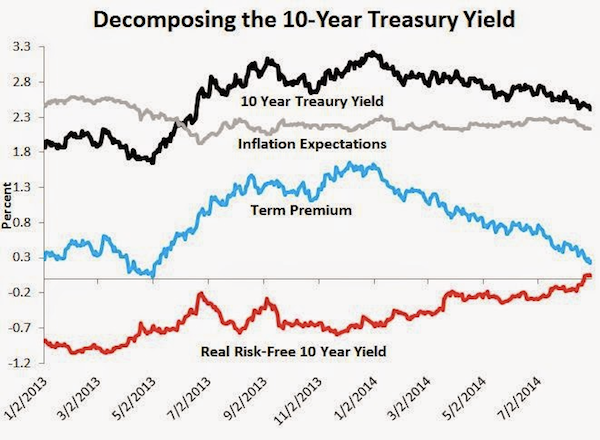

David Beckworth uses a decomposition of the long term interest rate into an average expected real short-term interest rate, average expected inflation and a term premium to argue that it’s the term premium has been steadily falling.

The Divergence of 5-Year and 10-Year Yields

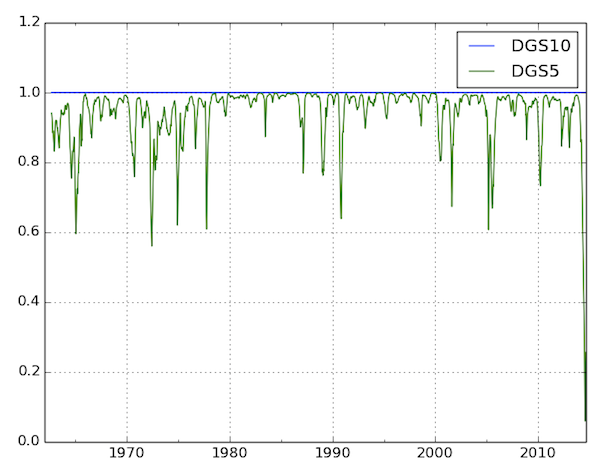

James Hamilton writes that interestingly while the return on a 10-year Treasury has been falling for most of this year, the 5-year yield has held fairly steady. If investors are risk neutral, the drop in the forward rate during 2014 indicates that something happened this year to persuade people that rates in the future (for 5 to 10 years from now) were going to be lower than they had been expecting.

Robin Harding and Michael Mackenzie write that this is unprecedented: no other global shock going back to the 1960s has ever caused US 5 and 10-year yields to diverge like this.

Note: US 5y10y yield correlation; Source: @RobinBHarding

James Hamilton writes that it’s hard to attribute it to changing perceptions about the Fed, which should surely matter more for the next 5 years than they would for 5 to 10 years from now. More confidence that the U.S. government will be able to keep debt from growing relative to GDP over the next decade may have played a role. Another possibility is that more people are starting to take seriously the suggestion that we’re on a path now of secular stagnation with weak economic growth and poor investment opportunities over the next decade. But that’s hard to reconcile with the stock market, which climbed impressively this year.

Bit hard to be optimistic when there’s so much saber rattling going on every where.

When the Fed starts backing out of its asset purchases, dumping bonds onto the open market, then we get price collapse and yields climbing.

“Another possibility is that more people are starting to take seriously the suggestion that we’re on a path now of secular stagnation with weak economic growth and poor investment opportunities over the next decade. But that’s hard to reconcile with the stock market, which climbed impressively this year.”

I think there is no need to reconcile that suggestion with the behaviour of the Great Casino.

Good point. And also has Japan really done that badly over the last 20 years?

“Behind the facade of the ‘lost decade”, Japan has evidently managed to amass extraordinary wealth; and this wealth is distributed in an egalitarian way. Fingleton calls Japan one of the most egalitarian societies on earth. The top fifth of the population have incomes that are only 2.9 times those of the bottom fifth, compared to a spread of 9 to 1 in the United States.

The keiretsu (cooperative corporate groupings under state-guided capitalism) can take the long view because their funding comes from their own banks rather than shareholders whose chief interest is quarterly profit.” (‘Beyond Capitalism and Socialism’, “Public Banking”, Ellen Brown)

The Public Bank Solution: From Austerity to Prosperity

http://www.amazon.com/Public-Bank-Solution-Austerity-Prosperity/dp/0983330867/ref=sr_1_2?s=books&ie=UTF8&qid=1409845593&sr=1-2&keywords=web+of+debt

What I have been seeing:

1. Pension plans reducing their fixed income exposure and increasing their weight in alternatives

2. Then immunizing what is left of their bond portfolio. Therefore increasing duration.

It will be interesting to see how committed their are to this strategy now that Calpers has announced that it will be cutting their exposure to alternatives.

Maybe one day more people will believe me when I say that our pension plan system is contributing to the destructing of the middle class.

We need more pay-as-you-go. Trying to fund retirements with overvalued securities is at the root of financial engineering.

Short rates at all-time lows…. so companies issue debt to top up underfunded pension plans. With new money, pension plans buy up more securities, including FXED INCOME, putting further downward pressure on yields and pushing up equity valuations.

Let’s not forget that all this happened without any productivity whatsoever. Who cares about production when you can just print yourself to prosperity. LOL!

Moneta, where do you see companies issuing debt to fund underfunded pension plans? Where do you even see pensions in the private sector capable of being underfunded? The norm is defined contribution plans to which the concept of underfunding does not apply. Also, the net outcome in the scenario you describe would be upward pressure on rates since more money is borrowed than is used to purchase bonds.

Our problems will not get better until the general population finally understands that our current pension system is strangling us.

——————–

http://thetimes-tribune.com/news/experts-mixed-on-borrowing-to-shore-up-pension-funds-1.1562504

1.Pension Plan De-Risking on the Rise: http://www.shrm.org/hrdisciplines/benefits/articles/pages/pension-de-risking.aspx

“De-Risking Study There has been a long-term fundamental change in perception about the importance of pension risk, concurs the 2013 MetLife U.S. Pension Risk Behavior Index (U.S. PRBI), a study of 126 corporate plan sponsors from some of the largest U.S. DB pension plans. During the five-year period, plan sponsors have shifted away from an asset- and returns-centric approach to a more balanced strategy that takes into account both the asset and liability sides of the pension risk management equation, according to the report. “At a time when benefit obligations are climbing due, likely in large part to the persistently low interest rate environment, and many plan sponsors may be grappling with how best to maintain minimum funding levels, the recent de-risking moves by several major U.S. corporations may be paving the way for additional companies to consider a similar approach for their DB pension plans,” MetLife found. Among the study’s key findings: 38 percent of plan sponsors report that they have already taken, or are planning to take, action to de-risk their plans, either through a partial risk transfer, pension buyout or some other risk-mitigation strategy. A discussion of these solutions is included in the study.”

2. To be able to de-risk plans usually have to be funded… many companies are doing whatever they need to do to get these plans off their books… which can entail tapping the bond market.

3.http://latam.pimco.com/EN/Insights/Pages/The-Upside-of-Low-Interest-Rates-for-Pension-Plans-Issuing-Debt-to-Fund-Pension-Liabilities.aspx

You make it sound as if a pension is a bad thing, some unnecessary obligation to undeserving employees when in fact pensions are a promise from an employer in lieu of higher wages. Employees should take the lead of upper management and take theirs now. At minimum, you’re probably looking at a 5-10,000 annual increase in salary per employee.

Why does everyone assume that I think a pension is bad thing? I think there should be pay-as-you-go pensions.

I believe that fully funding pensions is a loser’s game. Too hard to keep cheats away from big pools of money. Stimulates financial engineering.

As long as people cling to our current system, more and more people will lose their entitlements. Malinvestment is leading to systemic failure of the pension system.

Eliminate pensions, share quarterly profits with employees, increase the IRA cap, and increase salaries. That’s the ultimate pay as you go. (I’m not a fan of 401ks)

Last I checked, nobody was doing financial engineering on Social Security, though they sure are trying. So let’s do more of that.

The whole bond market is financially-engineered with bailouts, QE… that surely has an impact of the market value of securities in that fund.

Interesting that you cite a report from MetLife, a few weeks ago the NY Fed put them on the “Systemic Risk” list. Not surprising considering they have a 30-year term structure, good fun when rates are zero. Give your money to the German government for 10 years and they will give you 0.88% for your trouble. That’s the only fact that matters these days: what are the CB priests doing, what incantations are they making. Their permanent answer seems to be that the right price for money is zero, and they are utterly blind to how destructive that is. Insolvency has been outlawed, prosperity can be printed at will. Whee! This finance stuff is easy!

I wrote companies because I deal with the private side. But the phenomenon is even bigger on the public side.

Also, the net outcome in the scenario you describe would be upward pressure on rates since more money is borrowed than is used to purchase bonds.

——–

Not necessarily. There could be a lack of longer term bonds supplied vs. the demand generated by the immunization strategies which are increasing duration. In these de-risking strategies, plan sponsors are not basing their decisions on long-term rates staying low. They could not care less about the future of rates. They are just trying to cope with the current dire situation or looking for ways to get rid of the plan.

This is a very interesting and thought-provoking post. As noteworthy as the difference between 5 year and 10 year yields,however, it pales before the difference in 10 year treasuries vs. the stock market. There is a divergence between long bonds and stocks that hasn’t happened in nearly 20 years.

Since 1998, stocks and bond yields have typically moved in the same direction. One exception was 2004-06, where long bonds went sideways and stocks increased. Another was in 2007 as bonds yields declined and stocks continued to rise. The last 6 months have seen a big move higher by stocks, which think that Happy Days are Here Again, vs. the 10 year bond, which is moving as if it expects lower inflation (either due to a fall in commodity prices, or because of economic weakness ahead, or both).

This post helps clarify that the anomaly is probably in the 10 year bond, which is behaving as if it overreacted to Fed taper talk in spring 2013 (and it almost certainly did). The 5 year, by contrast, is behaving as if it got it right. Aside from that, what I see are normalizing interest rates, measured by the 10 year yield minus 5 year yield, which had been extraordinarily high, but is now closer to its usual spread.

I already had the stocks vs. bonds graphs done, but I”ll add to it and link back to this article when I publish next week, so you can see what I am talking about.

‘This post helps clarify that the anomaly is probably in the 10 year bond, which is behaving as if it overreacted to Fed taper talk in spring 2013 (and it almost certainly did).’

Probably so. This year, the yield curve has flattened at the long end (10s and 30s), while the 5s served as the pivot point (thus the low correlation with the 10s).

Let us not forget that this is a managed market, with Federal Reserve buying having been concentrated in the middle of the curve, and various levels of relative scarcity having resulted. So any crazy sh*t can happen.

ECB just announced 500 billion euro aid program for struggling banks and billionaires.

No word yet on the upto 45% unemployed (in some areas).

It may be discounting The Rapture. Turbulence will increase over the near to intermediate term, giving the 5-year yield a volatility premium, while the 10-year is slowly anticipating catastrophic exstinguishment of all reality and the judgement day, which most folks won’t enjoy, probably.

Well this is a first. My oh my. A Vampire Squid employee posting at NC. This has to be a sign. A sign of the approaching Rapture, confirming the thesis detailed above Well, he’s just an intern so we won’t throw him directly into jail, but if he takes a full-time job there he better get a tailored Striped Suit and not something from Saville Row bhwoahahhahahahhahahahahahah. .

Maybe this guy can help us make money. What’s the best 10-bagger right now at the Squid, other than muppet fees? hahahahahahahah. If we can actually make some money from reading this stuff, all will be forgiven.

Most people do not understand interest rate term structure. This article is clear evidence of that.

“Long-term interest rates” represent nothing more than the weighted average of short-term interest rates during that time frame. The fact that “long-term” (10 Yr UST) yields have dropped this year reflects the fact that market participants now realize that “short-term” rates (Fed Funds, 90 Day UST-bills) will not average more than 2.40% over the next 10 years. More than 5 years into the current economic expansion (with short-term rates still pinned at 0.25%), this is an extremely reasonable assumption, given that there will certainly be at least one, probably two recessions in the next ten years. Personally, I would be very surprised if the Fed Funds rate ever gets as high as 2.40% in the next ten years- much less averages 2.40% over that time period.

There’s simply too much money chasing too few assets.

Stocks are at a high and most people I speak with think they’re due for a correction. Real estate prices have recovered. PE is played out. Commodities too. I guess you can always buy bonds farther out on yield curve…

As noted by Jim H. above, the Fed’s interventions have been so large (to the point where there has several times been a shortage of good collateral for repo operations) their targeting of portions of the curve is apt to be a big factor in this apparent ‘divergence’ of collective betting behaviour – that would still leave ‘flight to safety’ as the primary driver for the drop in the 10yr yield (a ton of foreign capital has entered the US).

How long can it be before this influx of foreign capital, seemingly improving official US macro data and the clear relative weakness of most of the rest of the world ignites warm and fuzzy memories in old-school politicos, pundits, institutional technocrats of the old formula for global growth – US ‘leadership’ in the form of the US middle class consumer? Like the good old days:

http://adage.com/images/random/consumerchart011607.pdf