In a moment, we offer the latest sightings of the wake left by Cathy Odgers, including two brief, but searing, personal appearances by the lady herself.

First, though, here are some running repairs to my post of 22nd August, which set out Cathy Odgers’ role in a network of shell companies strongly associated with $multibillion moneylaundering activities in the former Soviet Union, and also, her very unfortunate, very close connection with Jack Flader, the CEO of GCSL, where Odgers was legal counsel. Flader was fingered by an Australian parliamentary enquiry as the ‘mastermind’ of an AUD200Mn superannuation fraud. Flader’s name crops up in connection with a $1Bn US Ponzi, too.

In that August post, I described Cathy Odgers as:

an expatriate New Zealand lawyer specializing in the offshore trust business, for instance in Hong Kong and Samoa.

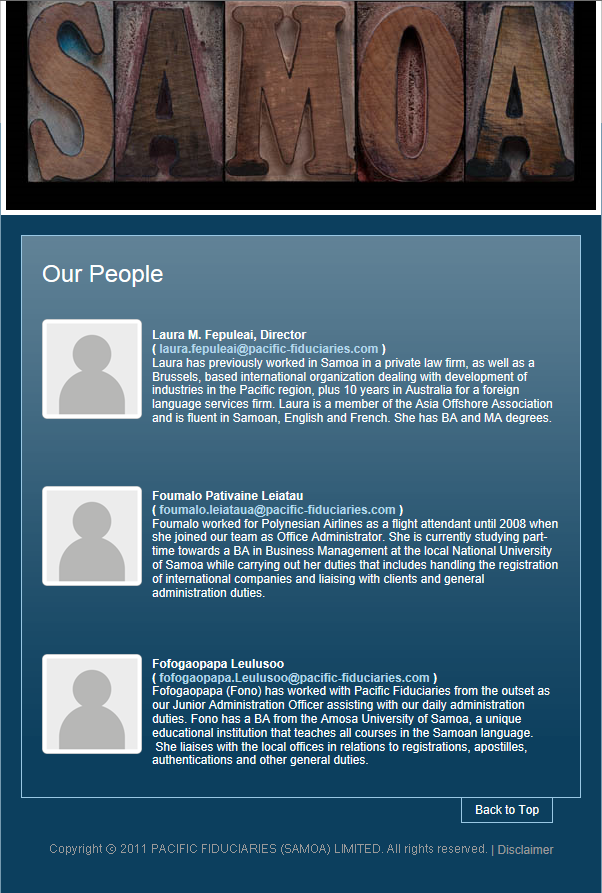

That’s out of date now. Back in August, the “Samoa” link took me to this page, with Cathy Odgers, in her professional rig, resembling nothing so much as a dome-headed alien wearing a precarious toupee of uncertain tint:

Today, the page looks like this:

It appears that the space formerly required for Ms Odgers’ image is now occupied by pictures of lumps of wood, carved into letters. Hurried web page redesign can deliver striking results like that. I quite like the contrast with the rest of the site’s style: bonkers.

Within days of that August blog post, Ms Odgers had turned in her directorship at Jeeves Group of Hong Kong (some time around 25th August) and her New Zealand lawyer’s practicing certificate (early September, as near as I can make out). So, though I can’t be terribly precise, nor accurate, I would guess that her disappearance from Pacific Fiduciaries fits into the same sort of timeframe. By ‘disappearance’ I don’t actually mean ‘resignation’, though. As of 11th October, Odgers was still a director of Pacific Fiduciaries (Samoa), according to the Samoa Companies Registry (look up company number 0530).

While all that resigning and disappearing was going on, another story was breaking: of Odgers’ involvement in two successful paid-for media campaigns to smear the head of the Serious Fraud Office, Adam Feeley, and then the head of the Financial Markets Authority, Sean Hughes. The gentleman paying for the campaign was apparently Mark Hotchin, who was under investigation, first (ahem) by the Serious Fraud Office, and then (ahem) by the Financial Markets Authority, in connection with the $500Mn implosion of his company Hanover Finance, a New Zealand shadow bank. The story broke when Odgers leaked ‘smoking gun’ emails to the Prime Minister’s office, emails in which Justice Minister Collins appeared to be conniving at Feeley’s demise. That leak precipitated the resignation of Judith Collins, who, via her entanglement with the “Dirty Politics” scandal, was already something of an embarrassment to the National party in the late stages of an election campaign. Collins’ resignation pretty much contained the “Dirty Politics” fallout for Key. Thus boosted, Key and party retained power, quite comfortably, in the ensuing election.

After the Collins email leak, and with the sense, one imagines, of a difficult job well done, and with a yen for pastures new, Ms Odgers set off for a spot of globetrotting.

The Quest For Odgers now offers a spot of light relief. While Odgers went walkabout, actress Lucy Lawless speculated briefly, in a mostly serious NZ Herald piece, about portraying Odgers in a film of the Odgers-Collins-Whaleoil political scandal. Lucy Lawless, by the way, is an NZ Green Party activist, when she gets the time, but is better known internationally for her late-90s TV portrayal of teenager-and-gay-icon Xena, Warrior Princess. If you are not a former late-90s teenager, nor gay, nor the right kind of middle-aged lecher to have found her already, you can get some of the idea of Xena from a publicity pose:

In her Herald piece, Lawless concluded that Odgers would not be the juiciest role.

This putdown by the impressive Lawless briefly goaded the less-impressive Odgers out of globetrotting radio silence, which she is anyway constitutionally incapable of maintaining for long. Via the Whaleoil blog, Odgers popped up in a Manhattan Halloween fancy dress shop with a counter-offer: she, Odgers, would portray Xena, Warrior Princess, thus (in another wig, non-professional, this time):

Faced with this apparition, surely the best, honest advice one could offer Ms Odgers would be to stick with the day job; except, of course, that she doesn’t seem to have one, at the moment. But I think Ms Odgers was merely being a little waggish, in that pic, and indulging her fondness for attention, which had gone unsatisfied for a long couple of weeks. I don’t think that she is out of a job, either.

So much for the running repairs, recap and light relief; let’s get serious, and revert to savouring the heady aroma that hits the nostrils whenever one starts to sniff at any of Ms Odgers’ recent professional berths. There’s a new example, the aforementioned Pacific Fiduciaries (Samoa), and the going is about to get a little tougher, so pay attention.

Pacific Fiduciaries (Samoa) was formerly part of dodgy Jack Flader’s GCSL empire. Since it’s in the offshore trust business, it is a low profile sort of an entity, but oddly enough, its name cropped up just a few days ago, in connection with an announcement on the European microcap stock exchange, GXG Markets:

Apia, Samoa October 8 2014 (Globe Newswire) — HCI Hamilton Inc., (the “Company”) a company trading on the GXG Markets under symbol HCI1, is pleased to announce a corporate update. Following the approval of shareholders of the Company at a special meeting held on July 28, 2014, the Company has changed its name from HCI Hamilton Capital Inc to HCI Hamilton Inc and on September 2, 2014 has been re-domiciled to Samoa.

…

The Company intends to diversify into Resort Properties with special emphasis on the pacific islands, and decided that it would be advantageous to be incorporated in an appropriate pacific island jurisdiction. “We continue to seek to add shareholder value by strategic acquisitions.” said Barbara Farr, CEO of the Company.

For further information, please contact the company at info@hcihamilton.com

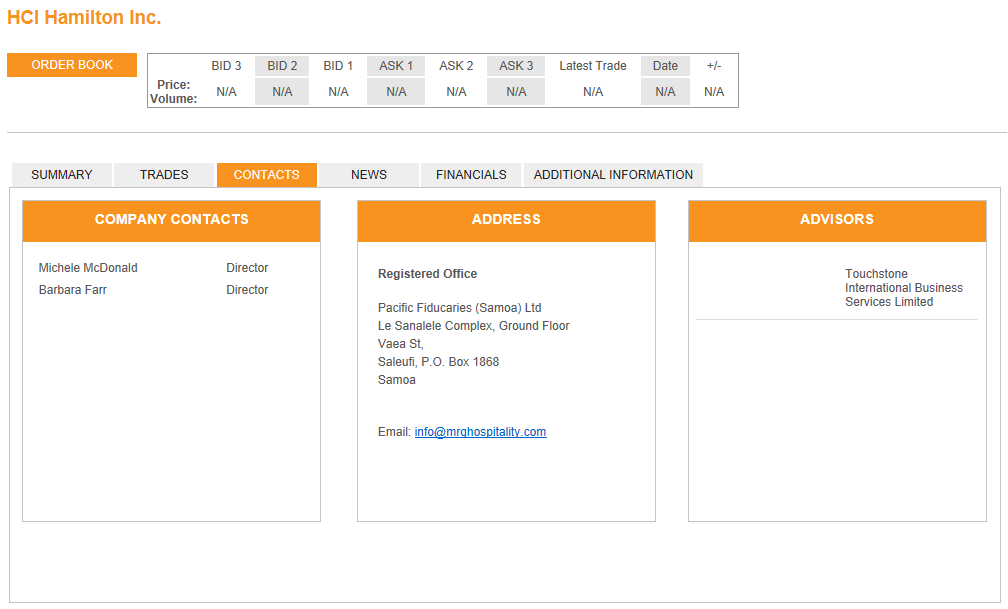

Pacific Fiduciaries (Samoa) duly appears on the contacts page for HCI Hamilton Inc at GXG Markets (click for a huge but legible screen dump, if your viewing device has the resolution):

As if the Odgers connection wasn’t enough, you will see that the contact email address given there for HCI, info@mrghospitality.com, is quite different from the one given in the contemporaneous redomiciling announcement. This might sound like nitpicking, but it’s never a comforting sign when a microcap stock isn’t totally clear about its own corporate identity, and a deeper delve into this one’s public self-description will muddy the picture, much much more.

For instance, despite the claim that HCI is now domiciled in Samoa, by Oct 11th you still won’t actually find anything called HCI on the Samoa Companies Registry, nor Hamilton, nor anything directed by anyone called Farr or McDonald. But still, if Pacific Fiduciaries (Samoa) are providing their contact address for HCI, they must be happy to vouch for HCI. Of course, Pacific Fiduciaries could equally easily deny all knowledge of HCI, if someone asked them about it. One would be none the wiser about Pacific Fiduciaries nor HCI.

It’s all rather confusing, which is a big red flag, all by itself.

Let’s try another route to the bottom of HCI. The first stop is those two elusive HCI directors, Michele McDonald and Barbara Farr. McDonald is a former director of Nevada company The Good One Inc. As for Farr, out there on the Internet there is an unsupported assertion that she was once an officer of Nevada company Kaleidoscope Real Estate, and involved in what looks like an elaborate small-cap fraud in the US.

The author of that assertion does seem to be pretty reliable, though, since a lot of what he says is reaffirmed when Kaleidoscope Real Estate and The Good One Inc. later crop up together in an SEC release from 2012, SEC Charges U.S. Perpetrators in $35 Million International Boiler Room Scheme. The defendants are Nicholas Louis Geranio, and two corporations, Barbara Farr’s possible Kaleidoscope Real Estate and Michele McDonald’s definite The Good One Inc. You can read about the verdict (guilty) in another SEC release, SEC Obtains Final Judgment Against Defendants Charged with Perpetrating $35 Million International Boiler Room Scheme.

Confirmation that we are on the right track comes from the many GXG news releases by HCI that refer to another entity, MRG, also connected to Farr and McDonald; there are examples here and here. MRG’s website, which I have archived, because I don’t necessarily think MRG will be around for terribly long, gives the following details, among others:

- There’s a dubious serviced office “company HQ” address for “MRG Marina Real Estate Group, Ltd”, in Hong Kong, of all places: odd, that, for a British Columbia-registered company.

- Along with Barbara Farr, there’s another director, Josef Obermaier. A person of that name is also the director of Mundus Group, another company mentioned in the SEC judgment where The Good One and Kaleidoscope crop up. That coincidence tends to strengthen the idea that Hamilton, Farr, and Obermaier are up to no good again, in MRG and HCI. Perhaps Nicholas Louis Geranio is in the background too. This fraud case from 2000 suggests he’s not a quitter.

- There’s no sign whatsoever of the Bermuda entity MRG Hospitality Ltd, which first announced a reverse merger with HCI Hamilton Capital Inc, and then didn’t reverse merge after all.

- There’s an MRG address in Vancouver, which turns out to be one of the addresses of HCI Hamilton’s GXG Advisor, Touchstone International Business Services.

- There are the contact details of a Canadian transfer agent, Integral Transfer Agency, based in Toronto.

- Finally, MRG show HCI Hamilton Inc’s GXG stock code, HCI1, and ISIN, as if they were actually MRG’s stock codes, which they aren’t, since, as we know from HCI’s May announcement, HCI and MRG aren’t the same corporate entity at all.

None of this fiesta of dodginess, fraud and further leads seems to have caught the eye of Pacific Fiduciaries’ directors, Cathy Odgers and Laura Fepuleai. So again, either their KYC is quite terrible, or Pacific Fiduciaries have never heard of HCI Hamilton nor MRG, and are oblivious to HCI’s use of Pacific Fiduciaries’ contact details; or Pacific Fiduciaries just don’t care.

This, from December 2013, also appears to have escaped Pacific Fiduciaries’ due diligence, somehow, and gives another clue that there is something terribly wrong with HCI Hamilton. From the Ontario Securities Commission’s PDF:

I. OVERVIEW

1. This proceeding relates to A25 Gold Producers Corp. (“A25”), David Amar, James Stuart Adams (“Adams”) and Avi Amar (collectively, the “Respondents”) selling securities of A25 through fraudulent means, unregistered trading, and illegal distributions.

2. Between March 1, 2007 and December 31, 2012, (the “Relevant Period”), the Respondents raised from Ontario in excess of €1 million from investors in Canada and Europe and, in addition, the Respondent David Amar profited in excess of €770,000 from the sale of A25 shares on the Frankfurt Stock Exchange.

3. By this conduct, the Respondents breached sections 25, 53, 126.1, and 129.2 of the Securities Act, R.S.O. 1990, c. S.5 (the “Act”), and acted in a manner that was contrary to the public interest.

II. THE RESPONDENTS

4. A25 is a corporation incorporated in the province of British Columbia on March 1, 2007. It is operated out of David Amar’s condominium in Toronto, Ontario.

5. David Amar is a resident of Toronto, Ontario. David Amar is the directing mind of and a de facto director of A25. He controls A25. David Amar is the directing mind of and is an officer and a director of Worldwide Graphite Producers Ltd. (“Worldwide Graphite”) and Western Fortune Graphite Ltd. (“Western Fortune”), which are the companies that sold mining claims to A25.

6. Adams is a resident of Toronto, Ontario. He is a director of A25 and carried the title of President of A25 during the Relevant Period. Adams is the sole director of and controls Integral Transfer Agency Inc., which is A25’s share transfer agent.

7. Avi Amar is a resident of Toronto, Ontario. He is the son of David Amar. He is a director of A25 and carried the titles of Secretary and Treasurer of A25 during the Relevant Period. He is also an officer and director of Western Fortune and Worldwide Graphite.

On it goes; peruse at your leisure, dear readers. Upshot: Integral Transfer Agency, MRG’s Transfer Agent, crops up in the Ontario investigation too. This time it is connected with one James Adams, who is one of several subjects of very detailed fraud allegations, made by the Ontario Securities Commission’s own investigators. In what can hardly be a coincidence, the GXG contact details for Touchstone International Business Services also show Jim Adams as the Touchstone contact person. The GXG details are archived here, for, subject to the outcome of the Ontario Securities Commission’s A25 fraud hearing, Touchstone may not last any longer than HCI Hamilton. Maybe that ongoing fraud hearing (now scheduled for 2015, after many delays) also has something to do with why HCI Hamilton has been hopping about so much with name and domicile changes during 2014.

Whatever, off we go to GXG Markets again, on the quest for yet more dirt, and find the following stock offerings advised by Touchstone, in addition to HCI Hamilton:

- Nexacon Energy Inc has director Mr Michael Wexler (who?).

- GMR Global Mineral Resources Corp and Fortune Graphite Inc both have directors Dr Claus Wagner-Bartak (also connected to A25, the subject of the OSC’s allegations), Mr Avi Amar (oops!, see him named in the A25 allegations too), Mr Claude Amar (ooh, another Amar), and Mr Norbert Stocker (who?).

What next with these stocks? GXG, wisely, run a sort of brutally slow filter system for their listed stocks. For instance, UK retail investors can only get their hands on Main Quote or Official List stocks, which are guaranteed to have been through a year or more as First Quote stocks, usually enough time for thorough bedding in, or behind the scenes investigation, or for a dodgy promoter to get bored with the whole thing and pack it in. The Touchstone stocks are still First Quote, so they have yet to traverse the filter system.

What if they do make it through? Well, it’s been a while since I was a registered professional investment advisor, but here’s a word to the wise: in my strictly amateur opinion, those stocks don’t really look set to be stellar long term performers. Full disclosure: I am, perforce, flat of all of them, but now, given the Odgers connection, I am certainly a keen spectator.

Summing up: we had already found Odgers in close proximity to post-Soviet moneylaundering, US ponzis, Australian superannuation frauds and imploding New Zealand shadow banks. Now the HCI Hamilton US microcap boiler room dodginess, and the GXG ramifications, extend an already sprawling picture. Pull at the string named ‘Odgers’ and all manner of nasty stuff keeps turning up at the other end. That’s business as usual when you dig into scams, and now, evidently, when you dig into Odgers, too.

On top of all that normal scam stuff, there are, by way of exotic intensifiers, Odgers’ direct connections to media manipulation, including, FFS, national-press-level op-ed gigs at the NZ Herald and NBR, and to successful smear jobs on regulators and on enforcers.

And lastly, there are Odgers’ strong connections to government ministers, and to the PM himself, via his Office. Those connections are unique, for someone with Odgers’ burgeoning track record of proximity to major financial crime after major financial crime. More precisely, they are connections that are unique in Western democracies, as far as I know. The whole thing builds up into quite a nice generic case study of what sufficiently uninhibited, or incompetent, but anyway well-connected offshore lawyers can get embroiled in.

Clearly, both politicians and journalists should be wary of being beholden to Odgers in any way, but equally clearly, that’s a warning that is far too late.

Around Odgers herself, there is the usual lingering ambiguity. If HCI Hamilton really is a client of Pacific Fiduciaries , it’s really hard to see why Pacific Fiduciaries ever took them on. At worst, it would imply Pacific Fiduciaries are in on a scam. At best, their due diligence and KYC would rank, for quality and conviction, right down there with Odgers’ cod portrayal of Xena, Warrior Princess.

But is HCI a client of Pacific Fiduciaries at all? It seems to be easily deniable. If there is no client relationship, Odgers has simply been mugged by some scammer, who, one might athletically assume, simply picked Pacific Fiduciaries’ name out of a hat containing the names of all the offshore law firms in the world.

That would be one more coincidence, in a professional history in which such coincidences just keep proliferating. This blogger remains intrigued.

Dear Richard

I have had enough of you interviewing your keyboard and defaming me like this so here are a few points:

1. For the first time since I left University I do not work for any employer so there is no need to attempt once again to have me sacked, I am finding various contracts of self employment far more fulfilling. Thank you for asking I am currently on holiday and having a bloody good time. If I wish to dress up in a Xena costume or wear a ninja suit running down a street in San Fran then I damn well will do so. I suggest you take some time off too it might be beneficial as you sound like a bitter boring keyboard warrior who has never had fun in his life for fear he may actually enjoy it.

2. I have never worked for and have no idea what the “Maharal Network” is until I read the rubbish you wrote on your blog post. This is absolute dreamy nonsense you have been pedalling for a long time including to some media.

3. With respect to ASIC and Trio Capital, I never worked for that area of the business or was employed when the structures were set up. No charges were laid against anyone working in the offshore industry over those matters despite extensive worldwide inquiry.

4. Jeeves were not ordered to pay $157 million each for racketeering. In fact if you actually read the judgment and reflected the substance in your post you will find more than 50 defendants. The Jeeves are no longer part of the action in any instance. Just common sense would tell you that considering they are regulated in offshore jurisdictions and have to pass many tests and checks to do so.

5. I have never met John Key and have absolutely no relationship with him whatsoever. I do not know anyone in the Prime Ministers office and apart from socially on the odd occasion I do not associate with any National MP’s and since leaving ACT, do not have anything to do with them either. There is no need to warn politicians not to be involved with me. I do not wish to be involved with them.

Your writing I am afraid shows a complete lack of understanding as to how offshore fiduciary companies operate. There is a difference between being a registered agent and office and a director or indeed a controller or beneficial owner of a company. Just because a company holds an offshore address does not mean those at the offshore address are running the company. Your links for example with Gannaway Mercer are utterly ridiculous.

Please make these corrections in the suitable places and publish my statement here prominently in a separate post. Your writing is not only defamatory it is completely malicious.

I have no idea who you are however please feel free to correspond further with me by revealing your personal details so I too can google you and write lengthy posts of absolutely defamatory nonsense about your career and personal life.

I can assure you that banks and regulators all around the world run far more stringent tests than your keyboard googling on all these people and if they find anything wrong with them they act accordingly.

In the meantime I suggest strongly that you either entertain the regulators with your ignorance by filing suspicious transaction reports or keep your defamatory comments to yourself.

Regards

Cathy Odgers

Oh, hi Cathy,

Thanks for all that. To your comments:

1. You are right in every respect, but, having acknowledged that, I can’t see what corrections I need to make.

2. On the Maharal network thing I got my info here; which bit’s wrong? You do think you have some reliably nasty Russian clients, as I recall from the “Dirty Politics” emails. But, are they other reliably nasty Russians? There are plenty to choose from in the offshore world, I will admit.

3. We agree on this point, in fact, and it’s mentioned in the relevant post.

4. On Jeeves, here, which bit’s wrong? I couldn’t find any sign that the Jeeves father and son had appealed the default judgment, nor challenged the SMH’s account, and I did look.

5. Uh, thanks for the clarification; I suppose you just know the email address, or it’s a friends of friends type of a thing via non-MP Nat Party types. It’s still contact, though, and quite an influential one, in this particular case.

(no number, not sure if you mean me to correct anything or not) “I can assure you that banks and regulators all around the world run far more stringent tests than your keyboard googling on all these people and if they find anything wrong with them they act accordingly.” I’m not 100% sure you’re right about that, in general. But anyway, do you mean that there’s nothing the least bit dubious about HCI Hamilton, specifically? That’s quite wrong, if that’s what you mean.

I’m sorry to harp on, but do you happen to have the faintest idea whether Pacific Fiduciaries (Samoa) actually has any kind of business relationship with HCI Hamilton? I don’t, and it’s bothering me: that’s kind of the point of the post, in fact, though I did faff about getting to it. I’d love it if you could set me straight on that one point, but you seem to be more interested in a load of other stuff that seems less germane, to me.

Lastly, thanks for the commendably brief refresher on the various services that may be required by offshore companies.

Avast there matey! There be Pyrates about!

I know that Mr. Smith is being duly careful and understated in his assertions. It’s still almost too outré to believe. Mz. Odgers should join a Mary Kay “Cell” and learn a little style though. She was far preferable as the “Blue Flash” of international yachting fame. Mz. Lawless was right in one regard. The ‘character’ of Mz. Odgers is something out of a Fantasy Role Playing game.

More seriously though, the fact that Confidence Tricksters like Odgers can get cosy with elected officials of a sovereign nation is a big red flag for said officials illegitimacy. I’m waiting for the day when we see Mz. Odgers use Premier House as one of her contact addresses.

Thanks again for doing all this digging around in the muck.

As I see above, something stirs.

From “Hamlet”:

Hamlet: One.

Laertes: No.

Hamlet: Judgment?

Osric: A hit, a very palpable hit.

Laertes: Well, again.

wrong thread

Richard

This could go on forever but it won’t. You won’t ever accept my word and I can’t keep answering “have you stopped beating your spouse” kind of nonsense like this.

If there is anything illegal here in your child like google with companies I do not manage or control then report it to a regulator.

There isn’t, so why don’t you try doing something more productive with your time than defaming people. You have googled on a keyboard and drawn all manner of conclusions that simply aren’t correct.

Cathy Odgers

Since HCI Hamilton didn’t actually have a Samoan registration at all when last I looked, it was particularly difficult to tell who controls it.

HCI itself does seem to think that Pacific Fiduciaries (Samoa) has something to do with it, though not in a control capacity, for what that’s worth (possibly not much). But, ICYMI: do Pacific Fiduciaries (Samoa) actually have any kind of business relationship with HCI Hamilton? I’d love it if you could set me straight on that one point.

Thanks for the tip about contacting a regulator. But it’s not my company that has its contact details splattered over this scam stock; it’s yours. It’s entirely up to you how you manage that reputation risk, of course.

Odger cull!

Whoo! It appears blood be drawn!

and things go boom…

Empire, Marriage & Mimicry

The empire offers any number of ways to spend wealth, and you are supposed to compete for one way to make money, with credit consumption. Labor offers many ways to make wealth, but few ways to spend it, with natural production. Whether one or the other is prison or freedom is a matter of perspective.

The capitalists rotate credit in and out of the artificial nation/state borders to foster demographic booms and busts. Labor discounts on boom and inflates on bust. The capitalist bloodlines predominate in the short term, with irregular replacement. The socialists are caught in the middle, having children when nature says not to and vice versa.

The socialists want the benefits of capital and labor, but without the responsibility of either, land to lord over and an entitlement check to pay for it. Dealing directly with the capitalists, from time to time, who lay the path of boom and bust for the socialists, to consume both sides of the artificial business cycle, is far more effective.

The capitalists and the socialists want the benefits of rearing children, the NPV multiplier, but not the responsibility, and come up with all kinds of schemes to the end, civil law, all ending in Family Law, taking yours, with public education if possible, divorce if not, and war if necessary, assuming NPV to multiply the annual take and issuing ever-longer bonds/mortgages on the future to cement the outcome.

The empire can only exist by cutting its populations off from nature and making them dependent upon derivative technologies. In a secular bust, the empire can only become increasingly fascist, with increasing financial repression, because its positive feedback reverses. Its take and NPV fall together, and it can only lose purchasing power.

Civil marriage, temporary possession of land and entitlement income, is given all the advantages. If you want economic mobility, spend no more than 10% of your time socializing in the current event horizon, because the habits in one prevent movement to another. Spend 90% of your time developing timeless habits. You cannot choose your parents or your children, but you can choose your spouse.

Bernanke rebooted from the top down and instituted a weaning process. Volcker applied cold turkey. Neither is as good as not taking the financial drugs in the first place. And you have what you see, inflation and deflation, changing speeds, unable to gain traction, because there is no labor working for the empire, providing a path for the followers to follow.

Labor maintains a base ratio of 4 +/-, regardless of empire finance and economic activity, regardless of spacetime, which is why the critters are so busy building and demolishing houses, along with the associated infrastructure. The majority doesn’t hunt down alpha males, dressing the warmongering passive aggressive empire as a damsel in distress, for bait, by accident, and this is not the first time the rocket scientists have labeled a blip as the Age of Humans.

Ideas are like guns, with far greater capacity to kill. Build your idea holders accordingly. The thieves will shoot each other in the head, every time, if you do not interrupt them. Taking a bullet is not the objective. Don’t let the apes and monkeys fool you with all the make-work. Technology is a double-edge sword, and dc technology is killing both privacy and the global economy.

Get your NSA healthcare today!

when you are living in a commercial building, pointing a finger at the homeless on the street, for the cops to prosecute, isn’t the best solution…

Is it just me or does anyone else find it strange that Odgers decided to personally respond to a blog post sans counsel in the first person.

skippy…. got to love it when people self depose themselves voluntarily.

PS. as always… Cheers Richard….

No skippy, you are not alone in that thought. I was surprised too. At the least, a smart operator will leave such ‘events’ alone on the principle that they’ll go away with time. I’m wondering if Mr. Smiths ‘expose’ is getting in the way of one of the Blue Flashes schemes?

Why?

If I engaged counsel you would all be getting your good old blogging jollies that a lawyer has been engaged to deal with this nonsense.

I know how blogging works. This twit has called me out for months.

Well here I am and he won’t put up or shut up. Nothing illegal. Nothing to report.

Not liking the offshore industry isn’t an excuse to write this filth about it and as for investigative reporting? Pfftt. He’s never contacted me before writing a word about me.

Then why do you react like a string has attached its self, incurring constant hand waving, especially if everything is legit. Especially born out by your response to my anon comment.

I’m sure it’s unusual for a target of investigative journalism to respond in such a direct fashion, but I suspect that there was a purpose and a message there, embodied in the oft-repeated word “defamation”.

A little simple googling will turn up the fact that in New Zealand it is easy for anyone with deep pockets, the right connections, (or for a lawyer) to silence almost anyone who has negative information to impart, by bringing a defamation action.

As this layman understands it, even if all the alleged facts are correct, at least in this jurisdiction, the individual who harms someone else’s reputation had better be prepared for a lengthy court battle about whether he is not only correct, but also had a “duty to inform” others about those facts. Even a successful defense against a defamation action can be so costly that I suspect most Kiwis would go far to avoid becoming the target of this kind of legal attack in the first place.

Fortunately for all of us, journalists do have a higher degree of “duty to inform” than ordinary folks, and foreign journalists who don’t plan on coming to New Zealand have the “out of reach” kind of immunity also. But even if I were so inclined before, I would now be doubly cautious about making public mention in New Zealand of these posts by Richard. So I’d say that a certain purpose has been achieved.

It should be noted that the Herald has carried a couple of articles recently about Nicky Hager’s house being raided and extensively searched by the police, with a warrant, looking for evidence about who might have obtained and leaked the emails that “Dirty Politics” was based on. All the usual things were seized and vanished for who-knows how long: computers, cellphones, etc.

This even brought public complaints from someone else who (as best I can tell from what I read in the news) was involved in a slightly similar set of financial accusations and who has tried fruitlessly for a couple of years already to get the police to act on his complaint about stolen emails that were important in his case. He hints that political connections and favoritism may explain the different levels of urgency with which the stolen email complaints have been pursued. He may well think so, but I couldn’t possibly comment.

Defamation is civil. You can only serve parties in your jurisdiction. This is huffing and puffing.

In the US, there is no slander or libel if the content is accurate. We stand by Richard’s work, which as you might note, he has documented in detail.

All quite true, no disagreement here (with one tiny exception), and I’m enjoying Richard’s work immensely, precisely because I do have great confidence in him and in you. And this ain’t the kind of investigative journalism that is commonly available in New Zealand, which makes it extra important.

My point was that the individual in question may have, or hope that she has, some chance of damping down local discussion in (what I believe is) her native country. Huffing and puffing can have different effects in different cultural and legal milieus. A few years ago, when I got involved in some local politics, I was personally (and quite falsely) defamed by the Deputy Mayor in a letter published in the local paper, who referred to me and a couple of others as having taken public property by stealth. That’s when I learned some practical realities of defamation law, and who is really served by it and how.

No defamation is the reserve of people who actually care about what is written. And it also gives the defamer some credibility that the nonsense they have published actually matters. I have replied here and invited Richard to report anything illegal. He has declined because he hasn’t got a single thing.

I could spend the next 3 years of my life in court suing people from the past weeks or I could keep enjoying it.

I know what I prefer while Richard keeps hugging his google searches.

Huh? I didn’t decline to report anything. I did point out that the public association between HCI Hamilton and Pacific Fiduciaries was primarily a reputation risk for Pacific Fiduciaries, though.

To spell it out a little more, one neat way to handle that risk would be for *you* to report HCI Hamilton. Yet, despite your earlier protestations about defamation, it turns out that you prefer to leave the task of managing your company’s reputation to me.

If you need some help puzzling out what I am saying about HCI Hamilton, just ask. I promise not to mention Google.

I still don’t get why Googling Cathy Odgers is bad.

“I still don’t get why ogling Cathy Odgers is bad.” There, fixed it for you.

“….defamation is the reserve of people who actually care about what is written”

Wow- truly she is as beautiful on the outside.

Some of us will never forget.