Yves here. The odds are high that if super low interest rates continue (virtually certain), P2P lending will continue to rise rapidly as yield-desperate investors seek better returns. As more money flows through these channels, it virtually assures less careful selection. The question is how bad the downside will be when lenders get bruised and how the market evolves after its inevitable first large-scale setback (the first venture in this market ended in tears, but it was sufficiently small so as not to have burned enough people so as to sour the image of this concept).

By Jérémie Cohen-Setton, a PhD candidate in Economics at U.C. Berkeley. Originally published at Bruegel

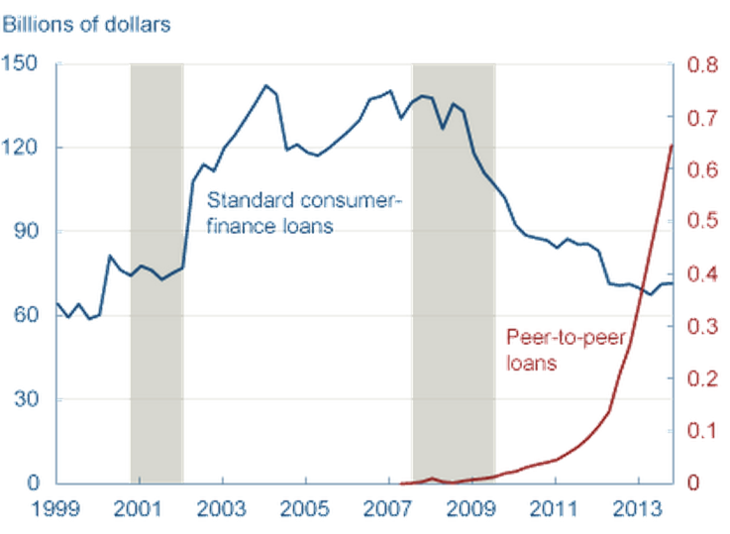

What’s at stake: Lending Club has captured the attention this week as it became listed on Thursday on the NY Stock Exchange and its share spiked nearly 70% in trading debut. While the growth of marketplace lenders has been exponential over the past few years, questions remain as to whether P2P lenders will manage to move beyond the niche of middle-class credit card borrowers and will be able shoulder the next recession.

Tracy Alloway and Eric Platt write that Lending Club, the San Francisco start-up that set out to bypass traditional banking, captured the attention of Wall Street on Thursday as it listed on the New York Stock Exchange and shot to a valuation of $8.5bn. The listing is widely viewed as a coming of age moment for the entire peer-to-peer, or marketplace lending, industry. Already two other alternative lenders — OnDeck and SoFi — are waiting in the wings for their own IPOs.

The Basics of P2P Lending

Ian Galloway writes that P2P lending sites match individual borrowers with individual lenders. Borrowers share information about themselves—both personal and financial—and lenders decide whether or not to contribute to their loan request.

The Economist writes that the growth of marketplace lenders has been exponential. Doing banking without the expensive bits of the industry—branches, creaking IT systems and so on—means that peer-to-peer loans offer lower rates, reflecting their reduced costs (see chart). Most borrowers are refinancing their credit-card debt, swapping a loan on which they paid 16-18% for 12% or so at Lending Club. The company’s focus has been on smaller loans (up to $35,000) to individuals with decent credit ratings, although it is also catering to businesses now.

In its registration statement to the Securities and Exchange Commission, Lending Club writes that a technology-powered online marketplace is a more efficient mechanism to allocate capital between borrowers and investors than the traditional banking system. Consumers and small business owners borrow through Lending Club to lower the cost of their credit and enjoy a better experience than traditional bank lending. Investors use Lending Club to earn attractive risk-adjusted returns from an asset class that has historically been closed to individual investors and only available on a limited basis to institutional investors.

Jonathan Ford writes that peer-to-peer lending is often described in the same breath as disruptive new web technologies such as Uber. But the way mainstream banks have responded to the P2P challenge is much more laid back than the response of taxis. What the bankers seem ultimately to be betting is that P2P will struggle to scale its business. It may be easy to arbitrage a few old credit card loans. But when it comes to riskier advances, whatever whizzy algorithm-based underwriting systems P2P lenders have concocted will prove no match for their own — which are based on a deep knowledge of a full range of a customer’s financial transactions.

The Risk/Return Ttradeoff

Felix Salmon writes that Lending Club’s most valuable innovation, it turns out, wasn’t its mechanism for matching borrowers with lenders; instead, it was its uncanny ability to use proprietary algorithms to identify which prospective borrowers were most likely to repay their loans. Lending Club wasn’t the first peer-to-peer lender—that honor goes to its main competitor, Prosper, which was launched by entrepreneur Chris Larsen in 2005. Prosper was, however, soon overrun by people who would take out loans and never pay them back. It also had to close down for six months after it ran into trouble with the SEC. Into the breach stepped its biggest competitor.

The Economist writes that P2P lenders use credit scores as a starting-point to establish a borrower’s creditworthiness in the same way as banks and credit-card companies do. But they say their snazzy credit-scoring algorithms will enable them to weed out probable defaulters better than conventional financial firms do, leading to smaller losses. That is plausible but unproven. Doling out cash in good times is far easier than getting it back in a recession, as seasoned bankers know. Elaine Moore and Tracy Alloway write that unlike banks rates are largely determined by the people who lend the money.

Jonathan Ford writes that publicly available credit data has allowed Lending Club to cherry pick middle-class credit card borrowers. Its lack of expensive branches and legacy IT systems then allowed it to refinance their debts at lower cost, while still generating juicy returns for lenders. But as the P2P business expands, operators will need to find riskier borrowers to lend to. The industry is already doing so, moving into areas such as small business lending where there is an appreciable need.

Calculated Risk looks at the average Lending Club loan (that they call “quality”): it’s an unsecured personal loan to an individual so they can pay off $14,000 in credit card debt with interest rate at 17%. The person has a 15-year credit history, a FICO score of 699, an annual income of $73,000 and a DTI of 17% (excluding mortgage debt). Maybe I’d consider helping for a close friend or family member if I knew all the circumstances. However, for everyone else, my answer isn’t no, it is Hell No!

Patrick Jenkins writes that the interest rates on offer to investors in this lightly regulated industry probably look too good to be true because they are. A 15 per cent interest rate can only mean you are in grave danger of losing your money altogether. Historic P2P loan default rates look flattering because they only go back a few years.

Lending Club writes that they make payments ratably on an investor’s investment only if they receive the borrower’s payments on the corresponding loan. If they do not receive payments on the corresponding loan related to an investment, the investor will not be entitled to any payments under the terms of the investment. Further, investors may have to pay them an additional servicing fee of up to 35% of any amount recovered by their third-party collection agencies assigned to collect on the loan.

The Economist writes that funds placed with P2P lenders are not covered by the state-backed guarantees that protect retail deposits in banks. Some platforms offer something of a substitute. Zopa and most other British companies have started “provision funds”, which aim (but do not promise) to make good on loans that sour.

‘Maybe I’d consider helping for a close friend or family member if I knew all the circumstances. However, for everyone else, my answer isn’t no, it is Hell No!’ — Calculated Risk

Lending a substantial sum to an individual without collateral is quite risky. LendingClub therefore offers diversification:

Of course, this scheme existed already: it’s called ABS (Asset Backed Securities). But ABS is mostly an institutional market, accessible to smaller individual investors only through mutual funds, which add their own layer of fees.

The question is how returns from a disintermediator such as LendingClub compare to ABS. Given the awe-inspiring stupidity and greed of banks, one might suspect that new entrants such as LendingClub could provide higher returns to investors, while grabbing some of banks’ market share on the lending side. But it’s too early to say.

Here’s why diversification doesn’t work in the P2P context. Without good underwriting, your credit quality goes to shit in a minute. If you want to spend the time to properly vet each and every share you buy, you can probably end up with passable quality and OK returns, but there’s just not enough time to do this on an investment large enough to be worthy of the name. I mean, even at the fairly quick underwriting rate of ten minutes per share, you’re looking at almost seven hours of underwriting per $1000 of investment.

I fucked around with Prosper way back before their class action suit and soon tired of sifting through all of the garbage applications that looked primed to default. Once I set their vaunted algorithm loose on the rest of my money, my portfolio was soon filled with shares of loans to dumbshits attempting to make money off their good credit (I chose only to lend to A+ borrowers) reinvesting in Prosper loans. Needless to say, my little experiment went sour, and I wrote off P2P as a quite literally a waste of time. You should too.

I’m optimistic that the smart-n-savvy people will be screwing the marks big-time on this one.

The economics of P2P lending?

Isn’t this “loanable funds” for the little people? One person loans money to another, with a 100% backing and no new money is created like there would be with a bank loan.

Ultimately, deflationary.

Very good point!

That is an extremely interesting point. Though what is the size of this overall marketplace? And if we assume that most people are using this to tackle higher interest loans (credit card debt) then can it strictly be inflationary if the credit was already expanded? Will it potentially decrease defaults and thus let credit card originators to ultimately offer up more credit?

Who still needs a credit card if p2p lending takes a boom? cnchal is right that it’s ultimately deflationary; less money that can be created through fractional reserve. Same goes for the increasing amount of holdings at e-payment providers, effectively reducing the levels of deposits at traditional banks. It’s going to be interesting to see how banks will defend themselves against the IMO huge risk of p2p lending.

From what I’ve read, P2P lending is simply trading in debt from point A to point B with the hopes of obtaining lower rates.

The trend of increasing P2P, in the context of a slowing economy, doesn’t really illustrate much of anything. Im sure the phones of local loansharks must be off the hook nowadays. One only needs to look at the subprime auto loan boom to ascertain how many individuals must be scrambling to refinance/get lower interest rates. Lending Club really just perhaps provides a more transparent interaction?

Im failing to see how this will really affect the economy as a whole…not useful for anything but obtaining cash for a car or restructuring debt since most people will use their credit card for anything under $2000 just for the convenience and the ability to pay it off before interest accrues. Houses are just too expensive. Businesses getting loans from Lending Club are probably private and thus not transparent enough for the smart investor to ascertain risk involved.

Also, what happens if the borrower defaults? Does it affect their credit score? Are they blacklisted? I guess the point I’m making is what assures that the borrower won’t simply take it out as cash and vanish into thin air?

It’s great that it’s deflationary, blah blah, fact of the matter is that most peoples cash comes from capital gains and payroll, which are inextricably tied to large banks, so you can’t just break out of the cycle through P2P lending. Same argument I have with Bitcoin aficionados everytime. Until their is a systemic change, Lending Club sounds like a more fancy debt refinance company.

credit card originators

Do you mean the credit card companies or the banks that lend the money to the credit card companies?

If the former, they don’t want you to pay off your credit card by borrowing somewhere else cheaper. Much better for them if you are caught in a financial leg hold trap.

The banks are sitting back because they know people will borrow from them through home equity to “invest” in P2P lending.

OK, here’s a radical idea. How about a lending club for those who believe usury is wrong?

I wonder where the Supremes would come down. Would they side with religion? Or the financial folks?

They’d side with both. You don’t get to level of the Supremes if you can’t create world-class duplicity.

Society is held together with high quality duplicity.

Actually, for an interesting take on that idea, you should check out how Islamic finance works if you aren’t already familiar with it.

I would argue that, unfortunately, P2P borrowers are inevitably going to present poorer credit quality as they would have presumably been declined already by the TBTFs (hence them considering borrowing from a P2P). Poorer asset quality is of course (or at least it should be) reflected in the rate of return on the capital which “investors” put up. But all things being equal, if you want to have exposure to the sort of risk profile that P2P investment offers, you can do that in loads of other asset classes, most of them with better liquidity.

And there’s no magic in credit scoring, no real “secret sauce” that the P2Ps might have developed or have access to in order to determine who presents what sort of default risk and so what the applicable interest rate should be. I really can’t figure out what is so special about the business model which makes P2P better for either those who provide capital or those who want to borrow from them.

If the affiliated collection agencies are publicly traded they look like a better investment. First placement accounts are usually at a 25% commission rate, so either lending club is getting some nice skim off the recoveries or these are sweetheart deals.

I’m cautiously optimistic that this will find a niche. While I agree that there’s nothing special with P2P underwriting methods, the fact is that the banks have crapified their underwriting methods so much in the name of cutting costs, that this is the ultimate end-result. If everyone makes underwriting merely some algorithm that’s run on a huge data store, then it makes no difference if that algorithm is run on Bank of America’s mainframe or an Lending Club’s outsourced Amazon cloud platform.

The main advantage TBTF banks have isn’t the quality of underwriting, it’s access to low cost funds direct from the Fed, and the ability to securitize the debt and thereby offload the risks while skimming fees. Lending Club brings the same advantages to individual lenders. Thanks to ZIRP, the opportunity cost of funds for individuals is lower than for TBTF banks. And lending small amounts to a bunch of borrowers is a way of creating a personalized ABS that in some respects is better than what banks offer (since you can choose exactly which loans to make in your bundle).

IMHO, Lending Club (and its individual lenders) deserves to succeed simply so they can hoist banks on their own petard. Banks pissed away their one competitive advantage in making loans, namely deep knowledge of their borrowers, in the name of cost-cutting. And by unilaterally destroying that high barrier to entry for a short-term increase in profits, they now face a swarm of even cheaper competitors.

P2P discounting, is what labor is all about…

The critters have been trying to build a one-way road to city, and failing, for thousands of years, but they don’t care, because they are consumed by what happened yesterday. Economics is not a closed-system, zero-sum game, which is what the economic priests have always tried to prove, in their own self interest. The Euro was an oxymoron, problemsolution from the get-go, and Silicon Valley is just the latest in a very long line of Edisons, with the intent of increasing the efficiency of extortion as its foundation.

The State has been holding me up for $10k for 20 years, losing millions in taxes, on the assumption that labor is replaceable, printing inflation to get its tax base. The critters choose to believe that they are replaceable and therefore everyone else is. If you don’t show up to work, the economy not only loses your productivity, but, more importantly, your multiplier effect on others, which, as you can see, Big G is desperately trying to ignite, and failing.

I prefer to work union, but when I don’t I charge two to three times the union rate, and I short the short, eliminating future make-work. That is what the Fed is fighting, and it’s going to lose, like it always does, in the long run. It didn’t abandon the gold standard by choice. China is welcome to hoard gold, along with all the other critters chasing shiny objects, squatting on farmland, starving their own people.

Putin doesn’t care what the price of oil is; he wins either way. Labor doesn’t get up in the morning because the Fed prints paper, and the corporations are not buying back stock and increasing dividends, with middle class purchasing power, by accident. How many critters do you suppose found themselves on the wrong side of the oil bet, most not even knowing that they made the bet?

The world is always getting smaller, for those who choose to live in a bubble. If you bet, the empire always wins, surprise, so bet on yourself. The union elevator mechanics have a job because many, many more union elevator operators went on strike, and ta-da, where replaced, magic. Fewer people making relatively more paper is a problemsolution.

What they say about assumptions is true. If you want to get on a Boeing piloted by computers and kids with a joy stick who think that life is a game, you are welcome to do so. Germany is going to lose, again, and do something stupid, again. Don’t get involved in other people’s feudal marriages expecting a happy outcome. Containment is a stupid game, McNamara was a moron, and so are the captains of the US Navy, who bet on pensions like the rest of the herd.

Answer the questions, get out of the way, and pay the bill, because I have much better things to do than fix poor German technology so Italian bankers have a reason to exist. Italy doesn’t have all those elevators by accident.

Who puts money in the bank to give Trump the arbitrage he needs to exist, in a long line of masters and slaves, controlled by assumptions in a computer? How many times a day do you suppose Trump gets into an elevator?

You might want to learn something about unions, before you start talking about labor. Eat all the paper, break all the windows, and dig all the ditches you like. The global cities are sitting on centuries old infrastructure, which is a sunk cost, financed as economic activity, critters chasing their own tail, wondering why they are getting poorer.

I invested a few thousand dollars in Lending Club several years ago, and my rate of return has been a steady 9-10% after dropping from the initial 17% (in the first few months, no one defaults and you look like a genius).

I stopped investing a 1-2 years ago and have been withdrawing cash as it becomes available. One trouble was you used to be able to ask borrowers anything you wanted – there was basically an open forum for each loan. The borrower’s didn’t indicate if they had a working spouse, if they had kids, or some other crucial details about the need for the loan. Likewise, I could ask if they’d learned any lessons from being over-indebted. I had a copy-paste document ready with questions for refinancing debtors like, “What did you learn from going into debt? How’re you going to avoid debt in the future? Show me your budget demonstrating how you’ll increase savings with this loan.” – it was very personal, and the tone of the response indicated as much as its content whether the person would be a good bet.

I never invested enough and tracked results enough to learn whether my hunches/questions were significantly better than just using Lending Club’s risk categories, but it was interesting for awhile. Then LC ended the open forum, and I had to pick from a pre-set list of questions which rarely got answered anyway. Without being able to ask any follow-up questions or any non-default questions, it got less fun and felt much less safe, especially since borrowers commonly closed on loans without responding to any questions at all. I also realized all those loans would start to hurt in the next crash, so I stopped investing and hoped to withdraw the money before the next crash. So far so good.

Just my 2c and another perspective on p2p lending.

Will

ZIRP is irrelevant. Lending changes because of conditions market to market. Considering real us currency creation is at post-WWII historical lows, your getting a lack of money into the system while the shadow banking system and its global credit currency control real capital flows.

You make the same mistake so many make: you still think we have a currency.

I ain’t loaning no money ‘less’n I have Guido or Bubba workin’ for me! Crap! I’d rather invest in a too-big-to-fail. At least they have the federal government to make good the bad loans. What a dumb business to just go get into without REALLY knowing what you’re doing. I don’t care if they make it seem like you’re part of a larger organization or not. Got Ponzi all over it.

Got Ponzi all over it.

Yeah. How soon before tales of woe are heard from those that used home equity to “invest” in P2P lending to credit card debtors?

I would wager a large sum of money that P2P lending will never be significant in our present system of political economy.

I have been very interested for several years in ways for people to lend directly to each other. And the problem is, none of them actually work, for an extended period of time, at scale. It takes more time to do due diligence beforehand and enforce agreements afterward than there is money to be made.

Or to say it differently, underwriting, recordkeeping, and collections are expensive. Especially among strangers.

I don’t doubt the PR ability of IPOs, though. I’m staring at a Lending Club ad as I write this!