Yves here. Wolf has been keeping a sharp eye out on how shale gas players were junk bond junkies, and how that is going to lead to a painful withdrawal. Here, he focuses on one of the big drivers of the heavy borrowings: the deep involvement of private equity firms, who make money whether or not the companies they invest in do well, by virtue of all the fees they extract. The precipitous drop in natural gas prices is exposing how bad the downside of a dubious can be, at least for the chump fund investors.

It’s hard to imagine an industry that is a worse candidate for private equity than oil and gas exploration and production. The prototypical private equity purchase is a mature company with steady cash flow. Oil and gas development is capital intensive and the cash flows are unpredictable and volatile, because the commodity prices are unpredictable and volatile.

A less obvious issue is that it actually takes a lot of expertise to run these businesses. This is not like buying a retailer or a metal-bender. Now private equity kingpins flatter themselves into believing that experts are just people they hire, but here, the level of expertise required, and the fact that the majors are way bigger than private equity firms means that the private equity buyers don’t know enough to vet whether the guy they hire is really as good as he says he is. Like all outsiders, they are way too likely to be swayed by the sales pitch and personality rather than competence.* And even with all the money that private equity has thrown at energy plays, it’s not clear that New York commands much respect in Houston.

As one private equity insider wrote in June, ironically just before oil priced peaked:

I have been digging underneath the surface (pun was not originally intended) of these let us call them fracking E&P companies and I was pretty surprised. Many of the bigger ones have not made money the last few years. Sitting in a bar over dinner I got to talking to a petroleum landman and he basically told me they have to keep drilling or if they stop they will not get started again (Red Queen effect). The reason is these wells deplete so quickly that the economics have been hidden by artificially high reserve reports. This whole process got started by someone telling me they had reserves worth $600 million but after long discussions I saw there financials and they were losing there ass even with full cost accounting which is the most aggressive.

One minor quibble: I agree that the sudden fall in oil and now natural gas prices has the potential to have very nasty blowback to the financial system. But I don’t see shale gas plays alone as having the potential to do as much damage as the housing bust did. The big reason that what were ultimately 40% losses in a $1.3 trillion subprime market did so much damage is that credit default swaps created exposures on the worst subprime bonds, and on the weakest rated tranches, that were 4-6 times the real economy exposures, and too many of those toxic bets wound up on the balance sheets of over-levered, systemically important financial institutions. We don’t have that kind of leverage and concentration in shale-related debt. However, the sudden fall in energy prices creates additional dislocations, such as among financial speculators who sold price protection, investors in emerging market equity and debt. So the cumulative impact of the oil price reset could well be greater than you’d think based on the sum of its parts.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

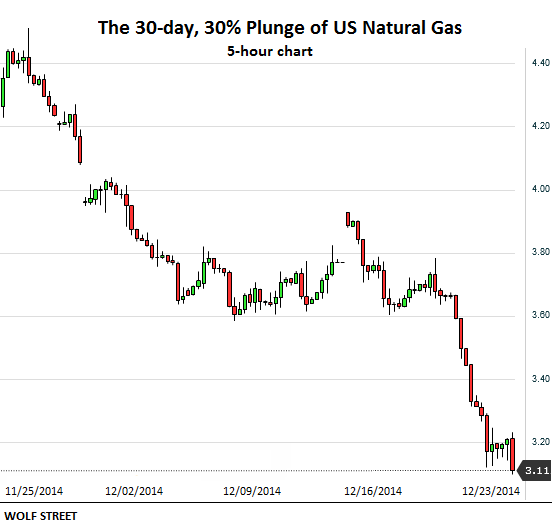

Friday, natural gas futures plunged 6%. Monday morning, when folks were thinking about the beautiful Santa Rally, NG futures plunged nearly 10% to $3.12 per million Btu, the lowest since January 10, 2013. But the crazy day had just begun. NG bounced off and jumped nearly 4%, only to give up much of it later. Tuesday morning, as I’m finishing this up, NG continues to decline, now at $3.11/mmBtu. Down 30% from a month ago.

NG demand peaks when the heating season starts. It’s a bet on the weather. Our gurus forecast warmer than normal temperatures across the country, so prices plunged. Or shorts piled into the pre-holiday session with exaggerated effect to make a quick buck.

Here is what this 30-day, 30% plunge looks like (each bar = 5 hours):

Whatever the cause, NG has traded below the cost of production of many wells for years. That lofty $4.40/mmBtu on the left side in the chart above is still below the cost of production for many wells. The price simply fell from bad to terrible.

To make the equation work, drillers have shifted from shale formations that produce mostly “dry” natural gas to formations that also produce a lot of liquids, such as oil, natural gasoline, propane, butane, or ethane that were fetching a much higher price. Thus, they’d be immune to the low price of NG. They pitched this strategy to investors to attract ever more money and keep the fracking treadmill going.

Much of this new money was in form of junk debt. Now energy companies account for over 15% of the Barclays U.S. Corporate High-Yield Bond Index – up from less than 5% in 2005.

But there is no respite for the American oil patch. The price of oil has plunged 50% since June, the price of propane is down 50% since its recent high in mid-September, and natural gasoline is down 32% since recent high in mid-November. None of the fancy charts natural gas drillers have shown to investors work at these prices.

It’s showing up everywhere. Take Samson Resources. As is typical in that space, there is a Wall Street angle to it. One of the largest closely-held exploration and production companies, Samson was acquired for $7.2 billion in 2011 by private-equity firms KKR, Itochu Corp., Crestview Partners, and NGP Energy Capital Management. They ponied up $4.1 billion. For the rest of the acquisition costs, they loaded up the company with $3.6 billion in new debt. In addition to the interest expense on this debt, Samson is paying “management fees” to these PE firms, starting at $20 million per year and increasing by 5% every year.

KKR is famous for leading the largest LBO in history in 2007 at the cusp of the Financial Crisis. The buyout of a Texas utility, now called Energy Future Holdings Corp., was a bet that NG prices would rise forevermore, thus giving the coal-focused utility a leg up. But NG prices soon collapsed. And in April 2014, the company filed for bankruptcy.

Now KKR is stuck with Samson. Being focused on NG, the company is another bet that NG prices would rise forevermore. But in 2011, they went on to collapse further. In 2014 through September, the company lost $471 million, the Wall Street Journal reported, bringing the total loss since acquisition to over $3 billion. This is what happens when the cost of production exceeds the price of NG for years.

Samson has used up almost all of its available credit. In order to stay afloat a while longer, it is selling off a good part of its oil-and-gas fields in Oklahoma, North Dakota, Wyoming, and Colorado. It’s shedding workers. Production will decline with the asset sales – the reverse of what investors in its bonds had been promised.

Samson’s junk bonds have been eviscerated. In early August, the $2.25 billion of 9.75% bonds due in 2020 still traded at 103.5 cents on the dollar. By December 1, they were down to 56 cents on the dollar. Now they trade for 43.5 cents on the dollar. They’d plunged 58% in four months.

The collapse of oil and gas prices hasn’t rubbed off on the enthusiasm that PE firms portray in order to attract new money from pension funds and the like. “We see this as a real opportunity,” explained KKR co-founder Henry Kravis at a conference in November.

KKR, Apollo Global Management, Carlyle, Warburg Pincus, Blackstone and many other PE firms traipsed all over the oil patch, buying or investing in E&P companies, stripping out whatever equity was in them, and loading them up with piles of what was not long ago very cheap junk bonds and even more toxic leveraged loans.This is how Wall Street fired up the fracking boom.

PE firms gathered over $100 billion in their energy funds since 2011. The nine publicly traded E&P companies that represent the largest holdings have cost PE firms at least $12.7 billion, the Wall Street Journal figured. This doesn’t include their losses on the smaller holdings. Nor does it include losses from companies like Samson that are not publicly traded. And it doesn’t include losses pocketed by bondholders and leveraged loan holders or all the millions of stockholders out there.

Undeterred, Blackstone is raising its second energy-focused fund; it has a $4.5 billion target, Bloomberg reported. The plunge in oil and gas prices “has not created a lot of difficulties for us,” CEO Schwarzman explained at a conference on December 10. KKR’s Kravis said at the same conference that he welcomed the collapse as an opportunity. Carlyle co-CEO Rubenstein expected the next 5 to 10 years to be “one of the greatest times” to invest in the oil patch.

The problem?

“If you have an asset you already own, it’s probably going to go down in value,” Rubenstein admitted. But if you’ve got money to invest, in Carlyle’s case about $7 billion, “it’s a great time to buy.” They all agree: opportunities will be bountiful for those folks who refused to believe the hype about fracking over the past few years and who haven’t sunk their money into energy companies. Or those who got out in time.

Timing?

Not for a while, says Oaktree Capital, the world’s biggest distressed-debt investor. Co-chairman Howard Marks told clients in a December 18 letter, obtained by Bloomberg, that the plunge in oil and gas prices could trigger a new debt crisis.

“We knew great buying opportunities wouldn’t arrive until a negative ‘igniter’ caused the tide to go out, exposing the debt’s weaknesses,” he wrote. “The current oil crisis is an example of something with the potential to grow into that role.”

Last time that “negative igniter,” as Marks calls it, was housing. Once the effects began cascading to other sectors, it blew up the financial system. This time, the “negative igniter” could be the outgrowth of the shale revolution. And as was the case before the housing collapse, financial firms are already lining up to profit from it.

The Fed giveth, the Fed taketh away. What’s going to crash next? Read… Oil Price Crash Triggered by the Fed? Amazing Chart

___

* You may not believe that this happens, but I have seen this occur so often that is it almost predictable, from when Americans hire Japanese, corporate types try finding heavyweight IT specialists, to the US intelligence community believing Ahmed Cahalabi had enough legitimacy in Iraq for him to serve as our puppet, or even supposedly savvy people assessing their doctor. That does not mean it is inevitable, but it is far more common than you’d expect

While the short term is certainly gloomy, I would tend to agree with KKRs assessment that now is a great time to buy up energy assets. While oil and NG are low, they can only go up. Over what time frame I don’t know, but they’ll go up. Perhaps KKR can hold out that long.

Yeah, doubling down is a great idea.

I’d say now is a great time to invest in solar, wind, and other alternative energy sources – especially small-scale systems for homeowners and commercial building owners. Sooner or later, the price of fossil fuels will go back up – and folks invested in alternative energy systems will be ready to capitalize on this. Buying fossil fuel assets is risky – you may be buying a dry hole.

Cry me a river. The public can only gain from all this, those that aren’t invested in the business for their livelihoods, and, well, Texans. It’s a huge tax break for the rest of us. The housing bust destroyed trillions in equity that the average American thought they owned, but this will put billions into our pockets. It’s not as though difficulties in the financial world that has been lending so freely (except for cars) over the last five years will be of any concern to most of us. And, if one is somewhat invested in equities, the great bull market that started in ’09 should be rosy again in ’15.

“It’s not as though difficulties in the financial world that has been lending so freely (except for cars) over the last five years will be of any concern to most of us.”

Why do you believe it won’t be “any concern to most of us”?

Recent (very recent) history shows us that turmoil in the financial sector can spread to other sectors of the economy.

Dream on we will be importing deflation from Europe and Asia.

The ECB created and pumped over 100 billion euros (about USD $122 billion) into “euro area banks” last week, while the BoJ created and pumped the equivalent of about $46 billion into their primary dealers, many of whom are the same mega-bank financial intermediaries that are the Fed’s primary dealers.

So, where did that money go?…

It would appear that it did not go to the people of the EU or Japan. Maybe it went into the global carry trade where it is kept locked up in the financial system?… derivatives losses stemming from the sharp declines in fossil energy prices?… propping junk bonds… who knows?…

It’s an unpopular fact that “Limits to Growth” remains right on track, with (redefined) “oil” peak around 2015, following “the-artist-previously-known-as-oil” peaking in 2005.

No other than T.Boone Pickins tries to lay it out here to a CNBC host of idiots shouting “No, peak oil was refuted; that’s stupid!”

He’s rather patient with them, but has to state that “he is the expert” after being shouted down for awhile.

Loss of DEMAND is what he calls as the reason for price drops, and this is gonna’ take awhile.

http://www.zerohedge.com/news/2014-12-23/t-boone-pickens-rages-cnbc-i-am-expert-not-you-says-oil-down-due-weak-demand

Oh the pleasure of being able to say that on major audience TV. It must make all the pain and pressure of having gotten that rich to begin with feel worthwhile.

Lower price? Less pressure to conserve, more burning, more carbon skydumping.

Now more than ever, contrarian investors should buy up all the sea-side oceanfront property they can possibly afford.

Happy Holidays to Yves and all at NC.