By Zsolt Darvas, Senior Fellow at Breugel and Pia Hüttl, Research Assistant at Breugel. Originally published at Breugel.

A few days ago the influential IFO Institute published a short paper suggesting that a Greek default inside the euro-area would cost Germany €77.1 billion, while a default combined with an exit from the euro would cost €75.8 billion. The two numbers are about the same, yet unsurprisingly, media reports emphasised that a Grexit would be cheaper for Germany by €1.3 billion (see e.g. a Focus report here).

We think that the publication of such numbers falsely suggests that direct losses can be calculated precisely. Even more importantly, we noticed that the calculation did not consider three major factors:

- the different haircuts likely under the two scenarios,

- private claims,

- other second round losses.

All three factors suggest that direct losses for Germany would be much larger if Greece was to exit the euro.

Before assessing the details of the calculations, let us make our view clear: we think that a Greek default and exit are neither likely nor necessary. It is definitely in the interests of both Greece and its euro-area partners to find a comprehensive agreement that would avoid default and exit, which would make everyone much worse-off. Greece would enter another deep recession, which would push unemployment up further and reduce budget revenues, necessitating another round of harsh fiscal consolidation. Euro-area creditors would lose a lot on their Greek claims and private claims on Greece would also suffer. The new depreciating Greek drachma may not revive the Greek economy that much (see on this Guntram Wolff’s recent post here and our 2011 post here). Furthermore, a Grexit would have many broader implications beyond economic issues. What are the prospects for a comprehensive agreement?

- Concerning Greek debt sustainability, there are relatively painless options, as we recently argued.

- Agreement on fiscal policy may not be that difficult either. Greece has suffered a lot in the past few years and has implemented major fiscal adjustments. Although the outlook is not too bright, by now the trough in economic activity has perhaps been reached and some economic growth is expected. This should help fiscal accounts and it is likely that no more fiscal adjustment will be necessary. In fact, the EU Commission expects that the cyclical adjusted primary budget surplus of Greece will decline from 8% of GDP in 2014 by about 1 percentage point in both 2015-16, suggesting a fiscal easing: exactly what Greek opposition parties demand. In other words, the new Greek government will be able to reap the benefits of the adjustments made in the past few years.

- The most difficult step may be to secure an agreement on structural policies, because many of the current plans of the Greek opposition parties are in diametrical opposition to reforms agreed under the financial assistance programme. But a compromise has to be found: both sides have strong incentives to agree and structural reforms have to be part of the comprehensive agreement.

While there are very strong incentives to cooperate and therefore a Grexit is not very likely, for the sake of intellectual exchange, we thought it useful to comment on the IFO calculations assessing the impact of default.

The IFO Institute’s calculations considered the German share of the official assistance to Greece (bilateral German loans, Germany’s share in the EFSF and IMF loans) and various European Central Bank claims. They summed-up all of these claims, assuming that all will be written off in the case of a default. While we have some questions considering central bank related claims (which explains the €1.3 billion difference in IFO’s results), there are three more important issues.

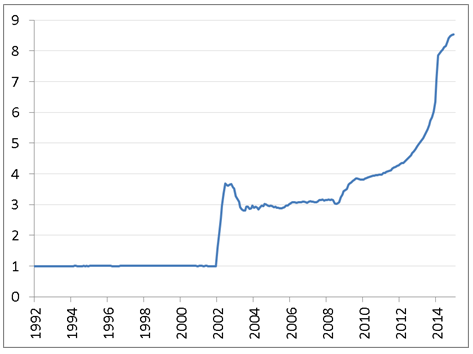

The first major problem with these calculations is that they consider the complete write-off of official claims on Greece in both cases. We doubt that this will be the case: there have been many debt restructurings in recent decades, but claims have never been written off completely. See for example, Juan Cruces and Christoph Trebesch’s dataset –, which summarises 187 distressed sovereign debt restructurings from 1970-2013. The average haircut was 38 percent. Moreover, among the two scenarios (default inside versus exit), the haircut would most likely be much higher if Greece was to exit the euro area, since the new Greek drachma would likely depreciate substantially and Greek GDP would contract substantially, thereby reducing Greece’s ability to honour debts, especially those that are denominated in foreign currencies (in this case, the euro would be a foreign currency). The depreciation of the exchange rate of the Argentine peso in 2002 may be indicative of a hypothetical nominal currency depreciation of the new Greek drachma in the case of a Grexit (Figure 1).

Figure 1: The exchange rate of the Argentine peso against the US dollar, January 1992 – January 2015

Source: datastream

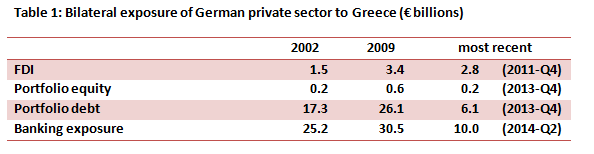

Second, the the IFO Institute’s calculations do not consider claims by the private sector (though the IFO paper acknowledges this omission). Again, a Grexit would likely lead to much larger losses for the German private sector than a Greek default inside the euro area, since more Greek banks and non-banks would default on the back of a likely massive depreciation of the new currency and contraction of Greek GDP. The table below shows that while German private sector claims on Greece have been reduced substantially since 2009, they still amount to about €16 billion of debt-type claims (the sum of portfolio debt and banking exposure) and about €3 billion of equity-type claims (the sum of FDI ad portfolio equity).

Source: OECD International direct investment database, IMF Coordinated Portfolio investment Survey, BIS consolidated data (ultimate risk basis), and Eurostat (exchange rate data to convert US dollar figures to euros).

Third, further second round effects should be expected, such as a reduction of German exports to Greece. Moreover, other euro area countries would suffer losses too, which could negatively impact Germany as well.

Overall, we conclude that while calculating the losses in the event of a Greek default is difficult and depends on many assumptions, in all likelihood, the financial losses of Germany and other euro-area countries would be much higher if Greece exits the euro than if Greece remains.

I think that a very important development is the SNB “Swexit” : With the peg, Switzerland was de facto in the eurozone and just got out. If Switzerland manages to absorb the shock smoothly, that could give more arguments to proponents of “Gerexit”, whereas Germany exits from the Euro and reintroduce the DEM on a clean basis (I.e. current german based euro liabilities stay in euro). A good opportunity of “Gerexit” is a BUBA who refuses to carry the OMT before the constitutional court authorises it. It is also worth remembering that the ECB is headquartered in Frankfurt, which could introduce spammers in the works.

‘Spammers in the works’ — good one!

Maybe better than the original ‘spanner in the works.’

The Germans, Dutch, Austrians and Finns must do what the Swiss have realized is necessary for the long-term health of their citizens … bail on the Keynesian lunacy of unlimited money-printing and “ponies for all”, and leave the euro. Yes, it will require the governments capitalizing brand new banks to absorb both the bank liabilities you wish to protect (e.g. bank deposits of the citizens and businesses) and the “good assets” held by the banks (those that have any prayer of being repaid in real terms). But if done right, the new banks can be privatized in short order. Let the shareholders and debtholders of the failed banks, which have brought the middle classes to their knees, rapidly descend into the abyss of insolvency. And let the nations which believe they can bring prosperity through QE, MMT, or magic beans, continue to destroy their currencies, sinking their citizens into poverty. Remaining in the print-till-you-drop fold only ensures your own demise.

“the Keynesian lunacy of unlimited money-printing and ‘ponies for all'” A match for that straw?

You choose to misrepresent the Keynesian position. There is a difference between ‘money printing’ and fiscal policy. And you can’t increase the money supply by pumping reserves into the banking system because reserves do not circulate in the economy (yes, the money multiplier is a lie).

So it appears that you’ve never read Keynes, or that you think that the Hicks’s bastardization of Keynes is representative of what Keynes wrote.

Huh? I’m quoting the comment above. Direct your attention there.

I am not aware that Keynes ever advocated unlimited money-printing. I thought Keynes’s own advice had a cyclical alternation between smiley-face deficit-running and frowney-face deficit-incurred debt-paydowning . . . to allow the government renewed freedom to incur deficits through borrowing and monetizing the lent-credit through spending it into the economy when the NEXT private-activity downturn occurred.

It is not Keynes’s fault that political operators kept the government stuck on Smiley Face Keynesian deficitism in a deliberate attempt to force government into percieved utter bankruptcy as an excuse to abolish programs such as Social Security.

Thanks for sharing this illuminating post, Lambert! It seems to me that the Greeks themselves must be very conflicted on how best to proceed. Clearly the status quo is not good for all but a tiny handful of elite Greeks. Yet there are major risks in changing the status quo through leaving the Eurozone. The temptation that even Syriza seems to be falling into is to kick the can down the road, hoping for “better times.” Where those “better times” might come from is hard to imagine!

So if all of the weak economies leave the euro, and it drives up the value of the euro, then what does that do to the German economy? How much will their BMWs, Mercedes, and even VWs cost in dollars?

EZ QE will be done to save the banks. So Deutsche Bank will benefit as much with QE as it would by some greater austerity. But Greek bonds will not be purchased and are not authorized for purchase by the ECB because they are considered trash. Which is amusing. Because Deutsche Bank depends on those loan payments to keep Deutsche from becoming trash. Technically if Greek bonds are trash, Deutsche Bank is also trash. So if the Greeks are not helped, and even punished, by the ECB’s QE, what difference does it make (for Greece) if Greece exits the EZ? They are screwed either way because they are in so deep now they’ll never get out. Is it also not the case that haircuts have been rejected because they will trigger CDS payouts which Goldman Sachs still cannot afford to make? When it comes to resource speculation and cowboy capitalism there are no rules against looting. But when it comes to financial “instruments” the whole world is extorted. We need a flexible financial world. Otherwise cooperation will quickly become a thing of the past. Greek debt needs to be forgiven and credit default swaps that hold the world for ransom need to be nullified. Those insurance policies were written without the financial resources to pay them. It is pure fraud.

This analysis is ridiculous, Germany would probably make a profit on a Greek exit.

if they had 100 euros in debt and the exchange started at 1 to 1, that would be 100 drachmas

Then if the exchange rate over a few weeks went to 1 euro for 10 drachmas, they’d have 1000 drachmas.

That’s a ten bagger! I wouldn’t call that a loss.

You are too funny, craazyman!

You don’t seem to comprehend the fact that they will have to reinstitute the “new” drachma BECAUSE THEY AREN’T PAYING THE DEBT BACK … in euros, “new” drachmas, or the magic beans you and the rest of the MMTers think bring “ponies” for all. In addition, nobody else will likely accept the “new” drachmas for at least a period of time, as the Greeks will have just STIFFED THEIR PAST CREDITORS … funny how that works in the real world (of course not in MMT la-la land). And finally, if they operate their national finances as they have in the past, if the “new” drachma starts out an exchange rate of 1 euro per thousand drachmas, it will quickly descend to 1 euro per five thousand drachmas … funny how that works in the real world too!

If the Swiss National Bank move on Thursday doesn’t fire up some dormant brain cells in the few MMters who have hope of coming back from the dark (Yves?) nothing ever will. The Greeks SHOULD DEFAULT, as they have no hope of ever paying back their obligations (and should have never been extended more debt in the last “bailouts”). But the idea that the Greeks are not going to suffer even more as a result, or that “new” drachmas for all will change that, is utter delusion.

Your logic is falling apart piece by piece !

If youre a German who’s owed 100 euros a month by a Greek. Then you’re owed 100 drachmas on Day 1 if Greece goes back to the Drachma.

But by Day 30, say, if the drachma goes to 10 to 1, the Greek owes you 1000 drachmas to cover their 100 euro payment. Of course they can pay since they can print.

It’s not my opiniion, this is math. And it’s a 10 bagger. If sombody can’t figure out how where to spend their 9 new bags, well, thatt’s a problem of creativity. Maybe they can go on vacation to one of the islands!

Hard to tell the Trojan Horse from the Sparkling Pony. Remind me of the old Gordon Lightfoot song from way back in the day, it was on the radio, “Sometimes I think it’s a sin when I feel like I”m winniin and I’m losin again”

This is called Multidimensional Economic Analysis — MEA for short. OK, I know hwat your thinking. What if the 10 bagger goes to 1000 bags, or 10000000 bags. Where would keep all those drachmas? Eventually you’d have so many you’d have to pay somebody to keep them for you. It might be like going long a commodty contract and having some truck dump 1000 hog bellies on your front lawn. There’s only so much bacon a man can keep in the fridge.

Is it always going to be written by someone that tells part of the story and leaves the other half out. Default means not paying the bills, euro or drachma. Greeced has been “relieved” of their assets that can be transferred by Pasok/New Democracy et al, who got paid well for transferring them to any greater fool that purchased them from Goldman. (simplistic, certainly)

I am sure the Grecians would argue that 100 euros owed does not turn in to 100 drachma owed. It seems remote that they would reward the thieves again.

But we could all be pontificating yet again, and I expect I am.