By Lambert Strether of Corrente.

Let’s start by recalling that ObamaCare does not treat health care as a right, and is not structured to provide universal coverage. As we wrote:

ObamaCare conceives of health insurance as a “shared responsibility” — the fines for mandate breakers are called “shared responsibility payments” — between the federal government, state governments, insurers, employers, and individuals, except not employers.)

Another way of looking at this Orwellian language is that “shared responsibility” guarantees a role in the system for a type of business entity that has no reason to exist: The private health insurance company. That is ObamaCare’s basic requirement, and it drove ObamaCare’s system architecture (“the marketplace”) and its design. Again:

With a single payer system, “shared responsibility” would not involve handling a chunk of rent to the health insurance companies, since the tax system would handle this duty of citizenship.

All of the insane complexity I am about to describe — and which you are about to experience, on Tax Day — comes from ObamaCare’s central requirement. It’s not a bug. It’s a feature.

The ObamaCare Income Tax Logic Tree

Here’s a map of ObamaCare’s useless complexity at tax time; the numbered subheads below come from healthcare.gov). ObamaCare’s logic tree throws citizens consumers into three buckets, depending on how they consumed, or did not consume, their insurance coverage.

1. If you had 2014 health coverage through the Health Insurance Marketplace

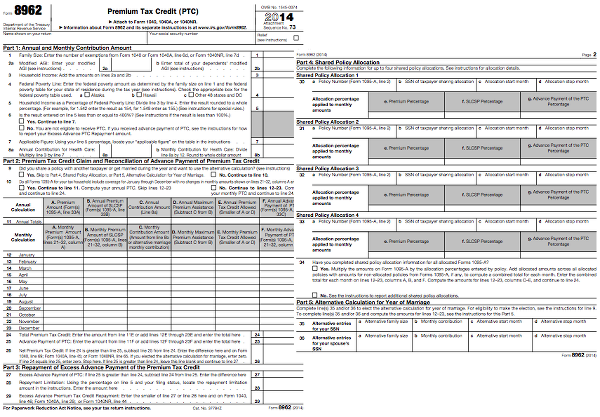

If you had 2014 health coverage through the Health Insurance Marketplace, you should receive Form 1095-A in the mail in early February. Form 1095-A, the “Health Insurance Marketplace Statement,” lists who in your household had ObamaCare policies, and their subsidies, if any. (Note that Form 1095-A comes from your insurer, not the IRS, so the IRS can’t answer any questions about it.) However, those subsidies were based on the income you projected, back when you purchased the policy. Now it’s time to reconcile your subsidies with your actual income, now that you finally know it. (If you’ve been accustomed to using Form 1040EZ, you can’t do that, because there’s no place to perform this calculation). You perform this reconciliation using Form 8962, which looks like this:

H&R Block has been gaming out this process with fictional couples, and here’s one possible outcome:

[“Dan and Lucy”] did sign up for health insurance last year. They even got a subsidy to help them pay their premiums.

“They were entitled to a $1,500 subsidy,” Smith says.

But then Lucy got a part-time job [as part of that great recovery we keep hearing so much about], raising the family’s income and reducing the amount of subsidy for which they were eligible. That means they’ll have to pay the subsidy back.

“So that would come out of any potential refund,” [H&R Block’s Sue Ellen] Smith says. Or increase the amount of tax they pay, if they are not getting a refund.

So how many Dan and Lucy’s are there going to be? Lots. The Los Angeles Times:

About 85% of the roughly 7 million Americans who signed up last year through government-run exchanges paid discounted premiums thanks to subsidies.

Experts project that 40% to 50% of families that qualified for financial assistance might have to repay some portion because their actual household income for 2014 was higher than what they estimated during enrollment.

Those repayments could range from a relatively small amount to thousands of dollars in some cases.

As part of his research at Vanderbilt, Graves analyzed household income data and estimated that the average subsidy is $208 too high.

Even better, Dan and Lucy probably didn’t understand how the flying bits of the exploding Rube Goldberg device that is ObamaCare were going to hit them:

Public awareness of the penalties is very low. A survey published last month by the Kaiser Family Foundation found that 72% of people didn’t know what the fines are in the health law.

So you can see why H&R Block would want its preparers briefed on how to break the glad news to clients, eh?

Let me pause here to reflect on the insanity of mandating that people with unpredictable incomes predict their incomes. Health Affairs (quoted by CNBC):

The authors said that more than 73 percent of people predicted to receive subsidies were in families that had income changes of more than 10 percent between the two years looked at, with a nearly even split between the number that had large income increases and the number that had large income decreases.

And “30 percent of the recipients were in families whose incomes increased more than 20 percent,” and nearly 19 percent of the recipients had income increases of more than 40 percent, the study found.

To be fair, if people whose income had increased had reported the change promptly to ObamaCare, their subsidies would have been cut immediately, and they would have avoided the April 15 clawback. Try reading this story on the precariat if you want to see how only a Harvard professor could have dreamed up an compliance regime like that:

It has been hard. Over the past year, they have spent down the meager savings they once had. Luis, Josefa, Iris, and Sol — all four are fast-food workers. But on low, low wages and unreliable hours, they have to come up with $550 a month in rent for the studio. Then there are the utilities, the gas, the groceries, the schoolbooks, and the clothes.

Yep, reporting a temporary upward income blip to healthcare.gov is going to be totally the first thing Luis, Josefa, Iris, and Sol think about, even assuming they have access to the web site.

2. If you had 2014 health coverage from another source

If you had health coverage from another source, like a job, Medicare, Medicaid, or a plan you bought outside the Marketplace, life gets a lot easier: You just check a box, Box 61 on Form 1040, saying you’re covered; no proof is required, though of course you’re could be subject to an audit. Just for grins, I’ll quote Jack Lew:

“For the vast majority of Americans, tax filing under the Affordable Care Act will be as simple as checking a box to show they had health coverage all year.”

Yeah, the part of the sytem you didn’t change is still sane!

3. If you didn’t have 2014 health coverage

Here, there are two alternatives. First, you can pay a fine. The kicker here is that the fine will be larger than most people expect. The meme that the fine is $95 seems to have “stuck”:

For those who were uninsured in all or part of 2014, much attention has been given to the $95 penalty. Few realize that the penalty may be as much as 1% of their modified gross adjusted income and rises to 2% in 2016 and 2.5% in 2017. While the government has been clear that it will apply the higher of the two penalties, this myth still persists.

This is a second scenario H&R Block has gamed out. Here “Ray and Vicky” attain enlightenment:

[“Ray and Vicky”] they earn $65,000 a year. Neither has health insurance.

“The biggest misconception I hear people say is, ‘Oh, the penalty’s only $95, that’s easy,’” Smith says.

But a lot of people like Ray and Vicky could be in for a surprise this year, Smith says. For the fictional couple, their fine will be much more than $95. “In this situation, it’s almost $450.”

That’s because the penalty for being uninsured is $95 or 1 percent of income, whichever is greater.

To be fair, even though $450 is quite a hit, the clawback is capped:

To help ease the pain, the amount you have to pay back is capped based on your filing status and income as a percentage of the federal poverty line; for example, in 2014, a single taxpayer with income of between 200% and 300% of the federal poverty line cannot be required to pay back more than $750 of advance credit. But it’s still going to hurt, particularly if you didn’t know it was coming, and had budgeted on receiving extra cash, not paying an additional liability over to the IRS.

The good news is that you can file for an exemption from the fines. The bad news is that the process is — hold onto your hats, here, folks — butchered. healthcare.gov does not inspire confidence:

You can apply for some exemptions by filling out an exemption application. Others you can claim when you fill out your federal income tax form. Some you can apply for either way.

Encouraging! Here’s a description of what you have to go through just to find out whether the exemptions apply in your case:

This tax-filing season brings the first enforcement of the Affordable Care Act’s individual mandate–the complexity of which could become a boon for tax-preparation firms. The instructions for completing the mandate exemption form run 12 pages, list 19 types of exemptions (with multiple codes), and include worksheets that may require individuals to go to their state exchange’s Web site to find the monthly premiums that will determine whether they had access to “affordable” coverage.

Anyhow, here’s a list of the 19 types of exemptions.[1]

Oh, and don’t expect any help from the IRS on any of this:

The Internal Revenue Service (IRS), which will play a starring role in the implementation of the ACA this year, has already forecast that they will receive upwards of six million additional calls from taxpayers seeking help, largely because of ACA tax code changes. They also estimate they will only be able to answer about half of these calls, with wait times of more than half an hour.

Enjoy your tax season!

The ObamaCare Income Tax Logic Tree Is in Itself a Tax Burden

First, ObamaCare’s useless complexity is a tax on time, and for those who can’t afford to have their accountants handle such things. Even Megan McArdle gets this:

There’s been a lot of talk about the “hidden taxes” in the Affordable Care Act, but here’s one I hadn’t thought of before or seen mentioned anywhere: the sudden need for folks with simple tax returns to avail themselves of the services of a paid professional. If you have no income outside a modest salary, and not much in the way of potential deductions such as huge mortgage interest or state tax bills, then there was really no reason to use a tax preparer. Even the mathematically challenged should, with the aid of a calculator, be able to fill out their 1040EZ forms just fine. But Obamacare has introduced a significant level of complexity into the taxes of lower-middle-class wage earners. More of them are going to need an accountant to negotiate the process — or risk owing the government hundreds of dollars because they didn’t fill out the forms correctly.

The money doesn’t go to the government, of course, but in many ways this looks like a tax: Suddenly, people with simple incomes are going to need to pay a significant sum to keep themselves out of trouble with the IRS. This tax will be extremely regressive, because the people most likely to be hit by it are people whose incomes are (or have been) low enough to qualify for subsidies.

Second, ObamaCare’s useless complexity will increase fees at tax preparation services:

On Wednesday, the CEO of the tax preparation firm H&R Block told the Reuters news service that the company expects about one in every four of its tax return customers to file either a form calculating their penalty for failing to have insurance or the form detailing the subsidies they received for their plans.

CEO Bill Cobb would not estimate the boost to H&R Block revenue this year from charging for the forms, but he did say that an outside analyst was correct in estimating that the charges could be between $5 and $30 per form.

And that totals up to a nice chunk of “change” for H&R Block:

[Wedbush Securities analyst Gil Luria] estimates about 13.9 million clients will visit H&R Block’s retail locations. If 25 percent of them pay $30 to file one of the new forms, that would yield as much as $104.25 million in additional revenue for the company this year.

Cobb said he expected the new healthcare requirements to attract more new clients as well.

“Generally tax complexity is a good thing for H&R Block,” Cobb said.

Third, ObamaCare’s useless complexity decreases the value provided by tax preparation services. USA Today:

For many of these people, the tax refund is one of the biggest financial moments of their year, making it even more imperative that they understand the tax implications of the ACA.

The “Shared Responsibility Payment” ruins this “big financial moment” in two ways: First, the refund just may not be as big. Second, speaking from my own experience, the real value that H&R Block brings is peace of mind; the forms are filled out professionally, and I rest easy the job is done right. However, H&R Block isn’t in the “peace of mind” business any more: That’s why they’re gaming out scenarios for how to deliver bad news to clients.

Conclusion

I put on my yellow waders, and I work through this crap, this steaming pile of crap that should not exist in the first place, a system that insults every citizen consumer forced to participate in it, and I think of France under the Bourbons, the ancien regime. People knew the ancien regime was broken for decades before 1789, and earnestly tried to fix it, but no fix was possible. Perhaps we will do better.

NOTES

[1] Haygood is right; those shut-off notices are “little tax shelters”; see exemption #3. (In fact, in Maine, which is cold and poor, shut off notices are routine during the heating season, which is why there are plans in place to stretch payments out.) Of course, having the notice and turning it into an exemption by filing the proper form are two different things.

NOTE

This post doesn’t cover the “Cadillac Tax” on “lavish” health insurance plans, such as those available to Harvard professors. I must confess to a smidgeon of schadenfreude:

The [Cadillac] tax “is having the effect that was intended, which is the cost of these plans are being reduced,” Christopher Condeluci, a former Senate Republican aide who helped design it, said in a phone interview. “Sadly, the way in which they’re being reduced is they’re shifting more costs onto the employees.”

“Sadly” is rich, isn’t it?

I would think the whole IRS angle of Obamacare is unenforceable, prima facie. If that aspect were taken to the Dancing Supremes, perhaps this entire abortion could be purged from the public’s life.

The minute the plan called for IRS “intervention”, “participation”, “oversight”, alarms and red flags went up in my head. I would rather die of a treatable disease than put myself through that kind of torture by paperwork.

The Dancing-To-Roberts’s-Tune Supremes would find a way to “make” it “work”. After all the work Roberts did to uphold the Forced Mandate to begin with, do you think he would permit anything to stop its enforcement now?

All of those videos they have of Roberts blowing a poodle, more like it. Courtesy of the NSA of course.

No, Roberts never had to be blackmailed into his decision.

He’s a complete corporatist (that’s why he was put there in the first place) and was ALWAYS going to make sure the extortion racket of the private for-profit health insurance companies continued. And he did. And he also took the opportunity to make sure Medicaid wouldn’t be expanded.

correct. roberts was one of the strongest and profitable corporate lawyers of the land!

AMEN

Lambert said…”All of the insane complexity I am about to describe — and which you are about to experience, on Tax Day — comes from ObamaCare’s central requirement. It’s not a bug. It’s a feature.”

As Thomas Frank writes today, “… the key to all kinds of Democratic betrayals and failures over the years, from the embrace of NAFTA to the abandonment of the Employee Free Choice Act. Maybe these episodes weren’t failures at all. Maybe it’s time we confronted the possibility that these disasters unfolded the way they did because Democratic leaders wanted them to work out that way.”

“The most consequential issue facing Americans these days is the gradual reversion of their economy to a 19th-century pattern … Yet the current leadership of the Democratic Party has been unable either to reverse the trend or to make political capital out of it.”

http://www.salon.com/2015/01/11/its_not_just_fox_news_how_liberal_apologists_torpedoed_change_helped_make_the_democrats_safe_for_wall_street/

Good link. Thanks. As Tommy Douglas said, “Every four years the mice go to the polls and elect another cat.”

With all that, Thomas Frank supported voting for Obama in 2012 – and still hasn’t abandoned the Democrats. He’s a fraud who doesn’t read his own work.

I work as a Tax Advice Specialist for TurboTax and the following comments are my solely own and do not reflect the positions of my employer, Intuit.

First, let me refer you to the TurboTax AnswerExchange which is a community if users providing answers to tax questions. Many of the answers are provided by TurboTax employees and those are the ones you should pay the most attention to, although some of the super users are quite good and accurate. Of course, I also recommend our TurboTax website and software as an alternative to the green square place. An enormous amount of effort has gone into making it as smooth as possible to navigate the process.

Everything Lambert says about the burdens and issues is spot on and is creating enormous anxiety among taxpayers; another “hidden tax”, this one on your psyche.

On a positive note, the exchanges are getting out exemption certificates for those who qualify for the some of the ones that can be claimed through the exchanges.

Two points I would like to emphasize: One, the penalties are going to be the biggest surprise for those who thought they would opt-out, especially the ones with higher middle class incomes.

Second, the IRS will be of very little help when you finally do get through to a person. They stopped giving actual tax advice at the beginning of last year, so what they even have on offer is quite limited. Last January the annual report of the Tax Advocate’s Office predicted that the IRS would only be able to answer about 60% of the incoming calls, IIRC, the others would just be dropped. This year’s report will probably be worse since Congress cut their budget by $300 million and they are having to layoff 13,000 employees.

Why not clog up Tax Court in order to litigate assessments? I understand Tax Court jurisdiction depends on the nature of the assessment–and I don’t know if these Obamacare penalties would qualify–but perhaps there are angles here that could be played? But, regardless, I would imagine that Tax Court at least has jurisdiction to determine its own jurisdiction, so . . . . . . . file away.

Clog up Tax Court and the tax system becomes more and more dysfunctional.

In any event, I think all of this penalty/clawback business will become big news as tax time approaches. It will be interesting how it plays out politically.

And if at the end of it all you are found by the Tax Court to owe “this much” . . . what is the smallest amount of money by law that you are permitted to write a check for? A dollar? So if you owe a thousand dollars, why not write a thousand one-dollar checks?

Your employer is the reason that everyone still has to file in the first place. In civilized countries the government just sends you a bill.

I had health insurance for the first of half of last year. To my understanding, the penalty can only be taken from an income tax refund. Tax strategy: no refund.

Luke, iirc some day within the last month, Yves had an article clarifying that someone in your situation, will have to purposefully not have a refund not only for the 2014 return, but for the NEXT 10 years through 2023. Otherwise, say on your 2023 return, they will steal your refund by deducting the ancient 2014 Individual Mandate Fee, adding 3% + short term rate interest. iirc currently this rate is 0.34%, so the composite rate is 3.34%.

I recall 0bot hack Lawrence O’Donnell make the claim you made, but apparently it is not the case. Has even 1 0bot apologized for this lie? Has even 1 R Team or Tea Bagger made an issue of this lie, as opposed to their neverending series of Fake Scandal Du Jour like Benghazi?

Thanks to Yves/Lambert for keeping up with all of these random ACA Gotchas TM that keep occurring every few months. I feel bad for the vast majority of USians, many (most?) of whom will be getting rudely surprised by these ACA Gotchas (Individual Mandate clawback in future year, owing $ to the IRS due not being able to correctly Nostradamus their calendar year income a year ahead of time, Narrow Network victim, High Deductible victim, etc)

It’s really a no-brainer then if you don’t necessarily need insurance and don’t want the extra cost. Just set your I-9 tax allowances high, say 5 or 6, so that you keep most of your payroll money throughout the year and end up with a big tax bill on April 15.

No but you are missing the point.

The penalty does not go away. It accumulates, WITH INTEREST, until the IRS finds a refund and can take deduct it from that.

And who is to say the regs won’t be changed later and any long-overdue penalties won’t be treated like regular penalties, as due and payable?

You are referring to the W-4, not the I-9, which is a form to certify your citizenship or right to work in the US. Otherwise, you are correct, that is a strategy that would work for now. However, Yves is also right and the regulations might change so that penalties are added and other collection methods are allowed. Of course you also need to have the money to pay the taxes due on April 15th, which is difficult for most people who live paycheck to paycheck or nearly so.

Also, even at the relatively low rate of 3% per year, the interest adds up pretty quickly, and this rate will rise whenever the Fed starts to raise rates.

The arbitrary nature of the random changes of the ACA has been frustrating. Until now in Jan 2015, it seemingly has been unclear what the tax preparation would be like. I randomly happened to speak with an actually competent manager & helpful of a state ACA exchange in Oct 2014; he noted that he also did not know how one will “prove having had insurance during 2014” & that it is likely unknowable until Jan 2015 when the tax forms/prep software become available.

Thanks Lambert for this informative article; it finally informed me somewhat of the impact on ACA compliance on personal self tax preparation. Another arbitrary aspect: those without insurance & those using the ACA subsidized private oligopoly “insurance” have extra paperwork than the fortunate others. Perhaps another example of the arbitrary victims vs. “winners” that Lambert has spoken of when describing the ACA.

Oligarchs & their paid hacks like 0bama complain about the Uncertainty Genie. Meanwhile they inflict all this Uncertainty on us the 99%, this ACA & tax-prep Uncertainty being just another eample.

—

PS – since religion is apparently a possible exception to the Individual Mandate Tax, perhaps we can start a new religion, Douglasian, named after the Holy Prophet Tommy Douglas, who brought Medicare For All to our Holy Land of Canada. Among the 10 Commandments all Douglasians follow is that it is a mortal sin to be coerced into paying for private oligopolistic crappy health-“insurance” riddled with narrow physician & pharma networks, 20%+ extortionist admin cost, & high deductibles that render the insurance unusable for most customers; that such a Mandate is only allowable if “Kosher” versions of Health Insurance are available, a chance to buy-in to Medicare or VA, at no more than 130% of the Actuarial Cost of these programs.

—

PS2 – it appears that the effect of 0bama’s policies, “The Legacy”, of the 0bama Admin, may be even Worse than the prior nominated Worst Ever GW Bush 43/Cheney Admin. What do yall think?

Tommy Douglas! Here’s his “Mouseland” speech. Youtube. 6:30m.

https://www.youtube.com/watch?v=gqpFm7zAK90&feature=youtu.be

Thanks. Great video. A bit strange to see Kiefer Sutherland lauding his socialist grandfather in the accompanying remarks.

Comparing Obama and GW Bush is like comparing Presidents Buchanan and Pierce. Really, why bother? The important thing is that they both sucked in very, very similar ways.

Great post. Thanks.

Good article, Lambert. You’ve done a good job covering the O-care mess, other than your fixation on socialized insurance as the answer rather than socialized healthcare.

FYI, when I tried to share this article on FB, FB could not “see” the link. So then I headed over to Correntewire to try the link from that site, but the article does not seem to be posted at Correntewire. So I gave up. :'(

You misrepresent Lambert’s clear and often stated position. He favors single payer, period. He has been consistently stated that health insurance is a grossly inferior substitute for healthcare, and regularly shreds Administration-defencers for trying to conflate the two.

That wasn’t a misrepresentation. “Socialized insurance” means single-payer. “Socialized healthcare” means an NHS like Clement Attlee created in the UK. Lambert has not been an NHS backer.

I’m actually pretty conservative. Single payer has had immense success in a society very similar to ours: Canada. (It’s the biggest controlled experiment in the history of the world, US vs. Canada.) I don’t see radically better outcomes in doing more than Canada does.

Dan – I don’t use FB, but I have heard of problems like yours before. It has something to do with FB dropping the http:// or trying to add an extra http:// when setting up the link.

No, you just have to delete the “s” in https://

Last year my friend’s ACA plan was $65.00 a month, this year same income and the plan is $265.00 per month. Unaffordable for my friend, thus she will not have insurance this year. BTW, this year’s plan has a $7,000.00 deductible. My friend states that she called the exchange for a consult and the employee was rude and said that this was the cheapest plan. WOOPEE!

My understanding is that the subsidies for Obamacare only cover premiums not the minimum $2,000-$3,000 deductibles. The poorest uninsured would have to rob a bank to come up with that, Now, instead of just sitting out Obamacare on the sidelines, new penalties may charge these same poorest theoretically eligible left-outs for not playing!

That’s my admittedly incomplete — if overanxious — understanding. I am getting up to speed quickly, reading Steven Brill’s America’s Bitter Pill . I ordered it from Amazon after I realized there were 35 people on line ahead of me for 3 books at the Chicago Public Library. Haven’t seen that before.

http://www.amazon.com/Americas-Bitter-Pill-Back-Room-Healthcare/dp/081299695X/ref=sr_1_1?ie=UTF8&qid=1420989997&sr=8-1&keywords=A+Bitter+PIll

I have heard that the book is quite good and to give Brill added credibility, apparently he had to have open heart surgery before completing the book and included the experience.

I have one of those $2500 high deductible plans. The net effect is that it only amounts to a catastrophic coverage plan. Until I reach the deductible, I pay 100% of doctor fees and lab tests. After deductible is reached, I pay 30%. The plan costs $7200 per year (employer retiree plan).

Still trying to figure out where the word “Affordable” comes from in ACA.

Welcome to the New Normal, previously known as “Eugenics for the Masses.”

Our oldest daughter and her family are self employed and had to settle for a plan in Colorado with a $5500 deductible. Not being able to predict their income with any degree of certainty, they settled for a minimal Support level and hope to make up for it at tax time. Anecdotal evidence from family members in four states suggest that the ACA may well be the death knell for the legacy Democratic Party. Just as the American political parties split up, rearranged and mutated before the American War Between the States, so too will we see a similar process spurred on by this newest attempt to enslave Americans. (If debt peonage resulting from ones’ inability to pay mandated major expenses isn’t a form of indentured servitude, I’ll help you tear up the Fourteenth Amendment.)

I ran through the different plans working out the worst-case out of pocket and concluded that one of the platinum plans had the lowest worst-case scenario, and was therefore the best catastrophic plan! Really! The others were scams.

The word “affordable”? Well, my new plan only costs $660 per month. In New York the year before the ACA plans started, the only available individual insurance cost $1200 per month. I suppose that’s an improvement in affordability?

At every twist and turn of complexity, bandits wait to shake you down. Oh snap, you didn’t see their hiding places? Caveat emptor, sucker. And happy shopping! Life’s just one big market.

Lambert,

Thanks for doing the dirty work of detailing this mess. The punitive part of not buying into coercive and expensive insurance is the worst part of the full catrastrophe, and galls me the most.

It’s what happens when psychopathic entities called corporations are allowed to run the federal government after buying their way in through the back door as well as the front door.

For all insurance contracts, complexity is always a feature, never a bug. I will never buy unaffordable insurance with a ridiculous deductible from these crazies. Bring on my punishment!

In a gallows humor sort of way, part of me feels insufferably smug about this Ocare tax situation. I read that LATimes article and sat there saying, “I knew that. I knew that, too. And that. I read it on correntewire over a year ago.” Dromaius as well as Lambert did excellent work letting us know what was coming down the pike.

Of course, now that the honey wagon is, in fact, here, that smugness is only a small carnation in the buttonhole of a full suit of total disgust.

One note: In addition to the hardship exemptions, there’s the “cliff” exemption, which is particularly important for older people who make above 400% of poverty in wages. If the cheapest bronze plan in your community requires premiums above 8% of your income, you can claim exemption. I computed this for my community and discovered that the cheapest bronze plan would cost nearly 30% of income for those just above the cliff and to get to less than 8% of income would require an income much above $100K a year.

Thank you for bringing this up and providing the great links. I’m volunteering next month to help low income families do their taxes and the ACA section is going to cause huge headaches. I’ve printed out the list of exemptions and being in the Midwest, #3 is priceless.

The people who are getting hurt the most by ObamaCare are the ones who don’t have employer-based insurance and who make just a little too much to qualify for a federal subsidy. It don’t seem fair at all that these people don’t get any tax breaks or federal subsidies to help pay for their insurance premiums. On top of having unaffordable premiums, they are also stuck with deductibles that are even more unaffordable. If you are poor enough to qualify for a federal subsidy, your deductibles are equally unaffordable, but at least your premiums are made to be somewhat affordable.

So far, the only people who have gained from ObamaCare are the one who are poor enough to qualify for Medicaid. They pay absolute nothing in terms of premiums or deductibles. People who are fortunate enough to have a Cadillac plan still have it pretty good, too. There is so much pushback from employers, private well as public, that I don’t foresee Cadillac plans going away anytime soon, if ever. They don’t face the axe until 2018. By then, Obama will be out of office, making it fairly easy for the Cadillac tax to be repealed.

You are wrong about Medicaid premiums being free if the recipient is over 55 yoa. Look into the “clawback” legislation passed by the Democratic Party on a partisan vote back when Al Gore could break a tie. All costs are recoverable to the extent of assets to claw back. That is not free. In addition, if one does not qualify for a subsidy for private exchange insurance there is not much alternative to Medicaid. Search for your State version of the clawback, ymmv, but it’s not free if you are over 55.

I’ve read that if you’re on Medicaid and you die the .gov can recover any benefits paid to you from your estate if there is one. Sorry I have no link.

Try this Daily Kos link:

http://www.dailykos.com/story/2013/10/21/1249471/-Estate-Recovery-It-s-Worse-Than-You-Thought

It’s the same for Medicare. Medicare (w/o supplemental plan) only covers 75% of expenses (minus relatively small deductibles). Long term stays in a hospital can add up to Big $. This is a good reason to put the family house in a Trust. See your attorney for details.

That clawback is for benefits paid after you reach age 55, which is when most people have the most expenses.

Bruno – I don’t think the clawback applies to Medicare.

I’m rather surprised no one has yet noted that the timing of the public effects, as Lambert lays them out, of this insurance company boondoggle, will be a political boon for the Republicans. By April 15, the Rs will likely be fighting desperately to maintain their momentum in Congress against widespread public revulsion against their pet projects such as cutting Social Security disability. That revulsion will be rapidly replaced by public dismay and anger at the dramatic changes wrought by Obamacare to what they were expecting at tax time. I’m left to wonder what other social programs will be swept away by the flood of reaction under Republican control. As Rahm Emanuel said, never let a good crisis go to waste. I’m sure the Rs are working on their plans to expand the flood plain of devastation even now.

Hard to say what strategy the repubs will take regarding Obamacare and tax consequences.

I could see them blaming those who got higher than warranted subsidies as typical deadbeats who are cheating the nation into insolvency, or I can see them blaming the baked in complexity of it all. Either case will do of course as a rationale against any government social welfare spending, as you say.

Ocare was designed as a rolling bailout for Big Insura. A para-TARP for those people, if you will.

The Rs will not let anything . . . ANYthing . . . happen to the Forced Mandate. They will strain their hernias to preserve the subsidies too, because those subsidies go to Big Insura. Whatever pretzel shapes they assume will be to preserve the Forced Mandate and the Subsidies in some form.

IMO, corporatist/conservative Dems and Repubs are mostly in agreement regarding nixing the “employer mandate.” Actually, it wouldn’t surprise me if this was their intention all along.

IOW, in order to get the support of progressives [prior to passing the ACA], Democrats gave lip service to the employer mandate.

And I doubt that Democrats would EVER concede to removing the “individual mandate.” The entire purpose of this toxic exercise was to shift the cost and responsibility to “consumers.” It never had anything to do with providing health care to anyone.

And, I’m not certain that Repubs will have to worry too much when it comes to dealing with getting blamed for dismantling “entitlements.”

After more than six years of a Dem Administration pushing for a ‘Grand Bargain,’ I believe that it’s clear who will own any cuts to entitlements. (And, of course, it will be a Dem President who signs any bill.)

Remember, it was a bevy of Southern [conservative fiscal hawks] Democrats–Jake Pickle, Claude Pepper, not to mention then Chairman of Ways and Means, Dan Rostenkowski (IL), who mostly led the push to raise the FRA (Full Retirement Age) by two years in the 1980s (from 65 to 67). Of course, since Reagan signed the bill, many people blamed him. And the same will happen, in this instance.

And once the 150 million group health plan beneficiaries realize how badly they will be scr**ed upon the full implementation of the ACA, I anticipate that ‘all heck will break loose.’

It will be absolutely fascinating to observe the change in public mood as more and more Americans are shifted from so-called “Cadillac Plans” into CDHPs. (one of the most draconian–as in OOP costs, etc.–of the catastrophic health plans)

Hey, we may yet see a few million citizens marching on Washington!

;-D

Also, I’ll be very interested in seeing some of the related news accounts [after this tax filing season], ’cause as someone already mentioned, I expect that most Americans have no idea of the actual cost of the tax penalty, since so many ACA shills intentionally mislead the public on this matter.

All things considered, I can hardly wait for the 2016 election cycle to get into full swing!

Oh, and one last thing–I hope that anyone who attempts to “use an exemption,” will at least consider sharing their experience.

From what I recall from [reading about] Massachusetts, getting an exemption from the tax penalty was not an easy chore. Even homelessness did not exempt a beneficiary from owing an insurer for any “back” health care premiums, racked up before the beneficiary withdrew from the plan.

I’m pretty certain that the backup paperwork was relatively onerous. And if you missed your utility payment, for instance, but your checking or savings statement (and they will ask for documentation) shows several thousand dollars in your account–you don’t automatically get a “get out of jail free pass.”

Well, the “liberals” in the Democratic Party will have you know that if you think about a third party, Nader Nader Nader. They will attack you even more than they do the rubes that support the Republican Party because if you are on the left you for some reason owe their party your vote.

I thought that the Medicaid expansion was a good part of the ACA but it appears to be a backdoor privatization of Medicaid. Many states are now using public money to pay parasitic private insurance companies. Yet, I am told time and time again that single pay will never happen. Are we this collectively stupid?

In a word, “Yes.”

;-)

If 308,000 Florida Democrats had voted for Gore in 2000 instead of Bush, Gore would have been President, despite Jebbie’s election fraud shenanigains and Nader Nader Nader.

The Democrats have nobody to blame but themselves for Gore’s loss, and their inability to look in the mirror, and their constant shifting of responsibility and fingerpointing at demon figures has been a distinguishing feature of the party from that day to this. This behavior pattern is one of the many reasons Democrats suck.

Health insurers provide the cost control function, and they are the only entity in the system that does. I know it’s fashionable to claim otherwise; that health insurers have no function except as rent extractors, but that’s a crock, and suggests the person making the claim really doesn’t understand how the system is put together.

Two points:

1) Canadians don’t need to have health insurance in order to receive medical care at no personal cost, yet the system somehow manages to get by without the cost control benefit provided by private insurance.

2) As a disabled veteran living in the US with access to the VA, I don’t need to have medical insurance in order to receive medical care at no personal cost, yet .even so the system somehow manages to get by without the cost control benefit provided by private insurance. Also when I have a medical problem, I have absolutely no paperwork to fill out or hassle about payments. I literally just see my doctor, get it taken care of, and then leave.

It’s a fundamental rule of logic that if there is even one case where a given statement is false, that statement is entirely false. I have given two. Therefore I call crock on your call of crock.

They do not provide a cost control function. Look at drug prices.

The result is simply that all participants in the game further inflate their prices to serve as a higher base for discounts. The rack rate for my annual eye exam is $950. Technician does 5 or 6 tests and the doctor spends max 10 minutes reading them and talking to me. Even in NYC, that is max $400 of actual service.

And of course it kills the people who don’t have insurance or mistakenly wound up at a service provider they thought was in their plan.

This is what makes me doubt the basic health of democracies. Kenneth Arrow’s classic “Uncertainty and the Welfare Economics of Health Care” was published in December 1963, and we still have to deal with the argument that health care costs can be better managed and health care resources better allocated by market mechanisms.

Ok, ok, probably most people don’t know about or remember Arrow’s paper, let alone have read it. We have plenty of experience now with allowing market mechanisms to direct health care decisions. As Dr. Bernard Lown, the cardiologist who invented defibrillation, pointed out in 2007, Health Maintenance Organizations (HMOs) increased from 12% of those, to 80% of the 200 million covered in 1999. “The proffered rationale for the sweeping corporatization was the need to contain health care costs, founded on the belief is that only competitive, investor-owned organizations have the financial discipline to stem the inflation of health care expenditures.” Did it work? No. If you disagree, point to which of the past 15 to 20 years in which health care costs rose less than general inflation.

This is such typical ideological blindness to actual policy results. How many more years do we have to try the experiment before you accept that, no, market forces do NOT work when applied to health care. And there are reasons why: Dr. Lown restates what Dr. Arrow explained 54 years ago: “…the serious flaws in the theory and the practice of market-driven managed health care are neon lighted. Key assumptions in market theory are that the consumer knows what he needs, appreciates differences in quality, is offered these at different price levels, has bargaining power and can exercise free choice to buy or not to buy. None of these is true in health care. Patients usually do not know what is wrong; they do not comprehend the diagnostic possibilities; they are not familiar with the therapeutic options, they cannot assess the quality of care needed, and they do not appreciate the numerous potential outcomes.”

At some point, we are going to have to put aside civility and manners, and start labeling the ideologues who insist on these disastrous experiments as the ghouls and murderers they are.

So, the inefficient entities who are primarily responsible for our overpriced health care system are the ones that provide the cost control function? I thought that massively high administrative costs, the profits, the executive pay, the marketing costs, the denial of services as a result of the profit motive, was waste. Money spent that didn’t go to cure a person’s medical problems. What an absurd argument.

Lambert – thank you, I appreciate this very useful information! None of the exemptions on the provided link apply to me, but 1% of my below poverty income is still better than paying the insurance companies. I’d rather eat healthy and exercise, f***k the insurance company predators, their CEO skimmers, and the traitor democrats. If I get cancer or any other life-threatening illness, I’ll let it run it’s course and die as the god I don’t believe in intended.

MK

That’s my plan also. It worked for my mother, stepfather, aunt and my sister as well. We just don’t like being practiced upon.

If you do get a life-threatening illness, head for Canada or Mexico (or, frankly, just about any other country in the entire world). Medical tourism is the way to go now. The US has the worst and most expensive health care “system” among countries which aren’t enmeshed in civil war, so pretty much anywhere you go will be an improvement (as long as you don’t head for a civil war).

Longtime reader, first post. I am so grateful to Lambert for his analysis and research over the past 2 years or so. I’m one of the ones who has a variable weekly paycheck. I decided to opt out of Obamacare, and pay the penalty, rather than underestimate my 2014 earnings (even though I am a cancer survivor). That was the right move. I haven’t needed any healthcare all year long (I postponed some recommended wellness testing until 2015). My shared responsibility fee should be in the range of $150, which is $3 a week or so – a fantastic bargain since it gave me the freedom to work as much as I wanted in 2014. I don’t know what I am going to do about 2015; I still have a few weeks to sign up. 1% was pretty affordable; 2% asks for a deeper look at my projected finances. Thank you, Lambert.

The IRS can’t come out and say it, but they would be happy if everyone just checked Box 61 on Form 1040, claiming to have coverage. There is no reporting or computer matching program to verify the claim, so it saves them a lot work not processing Form 8962. Check a box, save $150 … or withhold payment on the cable bill until you get a shut-off notice, which qualifies you for exemption #3. This is a true win-win, sticking it to the cable company and saving on taxes too!

I live in the U.K.

Nyah, nyah, nyah-ha!

You’re next, you know.

this whole article is TOTAL NONSENSE

Mr Strether, have you heard of these things called computers ? That come with easy to use step by step guides called programs, for filling out tax forms ? Programs that are often free ?

As to the structure of Ocare, what, exactly were Obama et al supposed to do to get a bill passed in the real world ?

wave their magic wands and convince blue dogs and gop members to pass single payer over the objection of big pharma ?

If you believe that, I have bridge in brooklyn I can sell you cheap (you are suffering from what I think is called “green lantern syndrome” (as is S Brill in his interveiw last week on NPRs Fresh Air; Brill is an obnoxious know it all who, apparently, seems to think like you: if Obama had just tried a little harder, he could have passed a bill over the objections of Big Pharma, and hte insurers, and the MDs…)

I see you were asleep when the Democrats had the majority in the House and Senate. Obama was perfectly capable of getting single payer passed. The country was desperate for leadership when he took office, when the financial crisis was still in motion. He could have implemented a Rooseveltian 100 days menu of new measures. But he’s a neoliberal through and through. Obama didn’t implement single payer because he didn’t want to.

Lambert discussed the tax issues in detail. If you think there is a tax program that will magically navigate you through the various exemptions any more easily than grappling with the forms themselves, you are smoking something very strong. And your trying to wave a technology wand does not address any of the issues Lambert raised.

Better trolls, please.

With all due respect, Yves, TurboTax software, is available on CD’s at many retailers, as downloads on the website or you can use it online to complete and file your return. It has been written to ask the right questions via a step-by-step interview format to help the taxpayer to claim the exemption to which he/she is entitled.

It’s not magic, but it is much better and easier than grappling with the forms themselves, (which is not to deny their complexity and difficulty). However, saying that there is no technology that can make the process easier than working directly with the forms is simply incorrect. And I am not smoking anything stronger than a tobacco cigarette. :-)

(FD: I work as a Tax Advice Specialist for TurboTax. These comments are solely my own and do not reflect the positions of my employer, Intuit.)

TurboTax has repeatedly given incorrect computations for new or unusual issues. I reverted to doing taxes by hand on paper over 20 years ago and have not regretted it. The forms are NOT that complicated, really.

(The tax law is ridiculously complicated. But the forms and instructions are about as clear and straightforward as you can get given the mess which the tax law is.)

It seems my last reply was unacceptable to the moderators. Ok, I can think of reasons why, so I’d like to try again.

Lambert has done a most incredible job of analyzing, criticizing and helping us understand the “gotchas” and the rank unfairness of Obamacare over the past couple of years. I was unaware of some of the issues with “bucketing” and cliffs until Lambert pointed them out and this is part of my vocation.

However, although I think e abrams is way off base, there are software packages available that can make it somewhat easier for taxpayers to navigate the forms, exemptions, penalties, etc. They do not, of course, address all the issues that Lambert has raised, but they are better than trying to deal with the forms directly.

Akismet is what it is.

I grant that software can take the edge of an onerous process — “somewhat easier,” as you put it — that shouldn’t exist in the first place. There’s still the record-gathering and keeping, the tax on time, the “psychic tax” (as one commenter put it), ameliorated or no. For exemptions in particular, the healthcare.gov wording is just a huge red flag, because of the multiplicity of sources for the data. For example — and I’m just making this up! — if #3 boils down to “Supply a scan of a notarized copy of your utility shutoff notice” then the software isn’t going to take a lot of the pain out of the process. And even scanning, which most software demands, isn’t so easy.

You are absolutely correct. It is an unholy mess.

“It is an unholy mess.”

That’s true of the entire income tax code, which serves only to grow more useless government jobs and reward tax-prep professionals whose only skill is sorting out oriental complexity of tax laws — which benefit only those who can buy “advice” about tax-avoidance provisions useful only to high-income persons.

after going online and reviewing the software options available for filing as self-employed, i reluctantly concluded, after reading through all the customer complaints about specific, unresolved problems encountered in using these softwares (turbotax, by the way, for filing self-employed, comes at a significant price), that i would prefer to pay an accountant (as i have done for many years) to complete my return.

doing so costs about 2 1/2 x the software price, which is a lot (relative to my income), but at least i do not have to spend hours of good income-earning time struggling with software that is not designed to work well beyond a certain level of simplicity or struggling directly with IRS forms.

i may be experiencing an irrational “fear of software”, but until that changes–i’d have to try it out, invest hours of learning time, wrestle through it, and conclude it was ultimately cheaper in terms of both time and money, an exercise i’m not eager to undertake–i’ll be keeping my accountant in the lifestyle to which she has become accustomed. i’m also under the impression that an accountant’s signature on the return lowers likelihood of IRS audit to some extent, though i don’t know if that is still true–it’s something i read about decades ago.

Yep. I’d rather have a human. Sorry, but there it is.

that too. they can actually answer questions! what a thrill

First time poster? The exit to Kos is that way.

I’m 28, part of the “lost generation”, have never made enough money in a year to need to file with the IRS. Always claim exemption from withholding when I do get work.

It sucks for the most part, but not having to deal with this clusterfuck is the silver lining.

Well, you are one reason I want single payer. “Everybody in, nobody out.”

This good presentation reminds me about the latest trend in economics (I think its termed “behavioral economics”) where “nudging” is the preferred way to manipulate people into doing what those in charge think is right. Well, after having created such a mess with their previous dogmas, economists will certainly find new applications for their skill set to serve those in power.

I guess the elite strategy is that the beatings will continue, haven’t heard a word of complaint.

this is a great piece, among many others equally great in this series. lambert deserves a pulitzer for his lone, dogged, detailed, trenchant reporting and analysis on obamacare, covering every small working part and demonstrating with rare clarity how it has been carefully designed to screw us.

mark my words, this series will be consulted going forward as a record and a source of priceless information on what has gone down.

the new york times can’t hold a candle to it.

Thanks. I’m not really doing reporting, in the sense that I’m not cultivating original sources. I’m a blogger! That said, one thing that blogging really does is build the record in near real time, and in a way that most news organizations tend not to do, since they’ll put their content behind a paywall, or change all their URLs and not redirect, or simply take stuff offline. At Corrente, I’ve got a ton of stuff from the 2008 campaign and earlier that just doesn’t exist anywhere else, and I’m sure NC does exactly the same thing with the 2007 – 2008 crash.

duly noted.

OK, you’re practicing a new genre of journalism. so even more so, pulitzer-worthy.

The cheapest plan I could find for my family of four cost 18,000 with a 3300 deductible per person and until we reach the deductible, we would pay 100% of doctor fees and lab tests and drugs are not covered. After deductible is reached, we would pay 30%. So I would have to pay more than 30,000 – 40% of my take home pay – before anything is covered. They already steal 40% of my pretax, now they want 40% of my after tax – they will not rest until we are all destitute…Funny that the “shrugging: envisioned by Liberatarians was never going to be by the working class…but that is exactly what is happening…I am beginning to question the value of work at all…I make twice what my 20-something son makes yet my take home pay if not that much more and he has free insurance. Why am I working again?

Hey lets make this real easy. Lets use non-violent civil disobedience. Just don’t file at all.

Honestly, I thought conservatives were the anti-tax/tax resistance crowd. ObamaCare is written so the IRS can’t put a lien on you if you don’t pay the fine (not a tax expert, so please don’t make life decisions based on my possibly faulty understanding of “lien”). Seems tailor-made for resistance. But not a peep from them. Wierd. (It’s a lot like their frothing and stamping about guns vs. tyranny, and then when confronted with actual tyranny, they do squat.)