Yves here. Richard Smith is on the trail of what looks to be his biggest international scam find ever, orders of magnitude larger than the usual below the radar single to low double digit million dollar/pound/euro operation that he has ferreted out in the past. And mind you, even though he focuses on the dubious looking inter-corporate relationships and the often evident lack of normal investors protections and business substance, these companies sell hope and glamour to typically credulous retail investors who lose their money and have no recourse.

By Richard Smith

Man, this post is going to be tough going for some sports journos. Well, tough tits; pay attention.

On the information at hand, Power 8 is a Costa Rica-registered entity with an office in Spain, a hard-to-trace board, and no named auditor. It appears to sell its shares by pyramid methods, to poorly-protected investors in India, Hong Kong, Taiwan (and possibly other Chinese-speaking locations such as Singapore or mainland China). Despite an abundance of unsupported claims, Power 8’s only confirmable business relationships are sponsorship deals with three reasonably high-profile European football clubs.

Now, I’m definitely not saying that Power 8 is a Ponzi (I absolutely wouldn’t ever do that). But I certainly am saying that right now Power 8 looks to me, on the balance of the available information, exactly the way a fairly ambitious Ponzi would look.

Back in October, over at Moneymakergroup, which Rat Smell addicts visit periodically, for a good heady fix, a Pyramid promoter did what Pyramid promoters do. Here’s his posting:

Quick summary: Power8.com is a registered company. It offers company share subscription and share holders get a weekly Dividend and Revenue Sharing. (Currently averaging about +/- 2%.) Power8.com also offers uni-level incentive scheme that rewards shareholders up to 20 levels of their referrals’ weekly dividend. Currently still at soft launch stage. Major official launching next Mar 2015.

About Power8.com Power8.com is a leading full service technology provider to the international online gaming and sports betting industry with a range of premium product solutions and an unrivalled service reputation. Power8.com does not rule out offering financial support to stable and well managed gaming companies with tremendous growth potential. Power Eight Resources S.A. is registered in Costa Rica (CR number 3-101-676220). Power8 maintained a corporate office in Barcelona, Spain to develop and operate comprehensive online and mobile gaming solutions and international network system products to keep clients and affiliates ahead of the game.

LEGACY BRAND 1st January 2014 it became an official sponsor of Fulham FC which is playing its 13th consecutive season in the Barclays’ English Premier League. In May 2014, Power8 entered into a commercial partnership agreement with Everton FC. This partnership designates Power8 as the Exclusive Official IT Solutions Partner and one of the Official Club Partners of Everton Football Club. Power8 is very proud to be the new PRINCIPAL SPONSOR OF RCD ESPANYOL and THE OFFICIAL SPONSOR OF RCD ESPANYOL STADIUM. This Sponsorship Agreement is for a period of 7 Sporting Seasons (7 years), from mid 2014 until mid of 2021. As the Official Sponsor of RCD Espanyol Stadium, the stadium will be renamed as Power8 Stadium during the 7 years from 2014/15 until 2020/2021.

Power8.com Shareholders Power8.com shareholders are entitled to weekly Dividend and Revenue Sharing. Currently average about 2% per week. Paid out every Monday of the week. From the back office (Most recent): Shareholder Dividend Week 39 (29th – 05th October) 1.82% Shareholder Dividend Week 38 (22nd – 28th September) 2.04% Shareholder Dividend Week 37 (15th – 21st September) 2.02% Power8.com allows unsubscribing of shares anytime.

Revenue Sharing * Elite Shareholders (Personally subscribe 50,000 and above of Power8.com Shares): Amount of Shares Subscribed by Direct Referral(s) ][ Revenue Sharing Entitlement 10,000 ][ 5 Levels 50,000 ][ 10 Levels 100,000 ][ 20 Levels * Secondary Shareholders (Personally subscribe between 25,000 – 49,900 Power8.com Shares): Amount of Shares Subscribed by Direct Referral(s) ][ Revenue Sharing Entitlement 10,000 ][ 5 Levels 50,000 ][ 10 Levels 200,000 ][ 20 Levels * Regular Shareholders (Personally subscribe between 5,000 – 24,900 Power8.com Shares): Amount of Shares Subscribed by Direct Referral(s) ][ Revenue Sharing Entitlement 10,000 ][ 5 Levels 50,000 ][ 10 Levels 300,000 ][ 20 Levels Note: Direct Referral Volume will be calculated every Monday at 00:00 hours.

Free Sign Up:

Goto main website www.Power8.com.

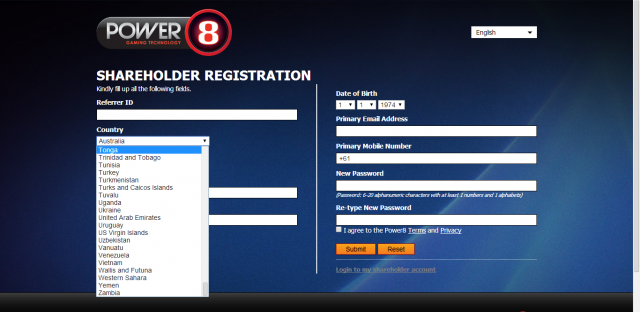

On top right hand corner, there is a Sign Up button. Or on mobile device, click on menu and look for Sign Up page.

You have to use a referral ID to sign up.

Referral ID: CB105796

That’ll be *his* referral ID, of course. Then Pyramid Guy suddenly found a flaw in his pitch: a certain geographical sensitivity in the web site.

Oh, I was just informed that some countries may not be able to see the sign up button and thus [c]an’t find the sign up page. Here’s the link:

https://sa.power8.com/Register.aspx

But whatever…2% a week is far too good to be true: Rat Smell!

Accordingly, Pyramid Guy ran into a buzzsaw wielded by one Ken Roklin, posting on the side of the angels. A lengthy exchange ensued, so I will distil Ken’s cumulative points to Pyramid Guy, and others who rocked up, as succinctly as I can, and walk through them, commenting.

Ken: Power8 has high profile deals with major European football clubs…

RS: Ken is absolutely correct. In 2014, Power8 struck sponsorship deals with:

Everton FC, a very well known English Premier League club, usually slightly overshadowed by its local rivals, Liverpool FC: “Utilising Everton’s global reach, Power8 will be entitled to advertising space around Goodison Park and on evertonfc.com to increase brand awareness.”

Fulham FC, a smaller, but still prominent, London club, (UPDATE: relegated from the Premier League last season; I admit I am not a close follower). On the deal, we read: ”The relationship includes significant presence of the Power8 branding on LED perimeter advertising, ultimately reaching TV and online audiences in 212 worldwide markets.”

RCD Espanyol, which is a well-known ancient Spanish side, albeit decidedly the second best big football side in Barcelona. Via Bing’s surprisingly not-bad online translator, we discover than this deal’s a biggie: “RCD Espanol announced on its website on Friday that the company technology for sports betting and gaming sector ‘Power8’ has become in the new main sponsor of the club and, in particular, has been made with the rights to name the stadium in Cornellà-El Prat for the next seven years, which will become the Power8 Stadium.”

Ken:…Power8 is therefore entirely trustworthy and reputable.

RS: Ahem, well, outsourcing your due diligence to anyone else is a bad idea, and in fact I would like to suggest that outsourcing your due diligence to sports team managers scrabbling around for sponsorship can be a spectacularly bad idea. I offer two examples.

First, there is the Lotus Formula One Team, whose ignominious entanglement with, then retreat from, Advanced Global Technologies, a Gulf-based carbon credits boiler room scam, got some coverage at this blog.

More resonantly, for many non-North-American Anglophones, at least, there is this queasy-making image, via ESPNcricinfo.

That, I’m sad to say, is two titans of the game of cricket, Sir Vivian Richards (shaven head, aquiline, left) and Sir Garfield Sobers (grey haired, shades, middle), hovering around one titan of the game of fraud, (grinning, signing for the eager kids, right): the grotesque Texan psychopath Sir Allen Stanford, whose $7Bn pseudobank Ponzi was shortly to make a mess not only of thousands of investors’ savings and West Indian cricket funding, but of the economy of Antigua too:

He was the island’s largest private employer, but when he was charged his empire crumbled.

He paid first-world wages, and when his staff lost their jobs it had a knock-on effect. They in turn fired their helpers, gardeners, nannies; thousands of people were left out of work in a population of just 85,000.

“It’s been difficult for many of us. We were getting good money so we spent a bit more on a better house, a new car, and before you know it you’re struggling to pay the mortgage, to repay the car loan,” says Tim Payne looking through the latest edition of his paper, the Antigua & Barbuda News Pages.

He was the managing editor of the Stanford-owned Sun Newspaper, but started his own publication after the company folded.

“It’s amazing that nobody has gone off the deep end,” he says.

So, overall, you couldn’t call me a big buyer of the idea that merely having a deal with some big name sports outfits makes you trustworthy. I don’t think Ken’s got that bit right.

Ken’s next objection is more geeky. The site of the “real” Power8 company, that Ken can see, does not have a “Sign Up” link”, and Pyramid Guy’s “Sign Up” page has a different web address. You have the apparent fake https://sa.power8.com/Register.aspx versus the apparently genuine www.power8.com. Several different browsers deliver the same result – no sign up link for Ken. He concludes that the site pushed by Pyramid Guy is therefore a PHISHING site which is trying to get people to join a scam.

RS: Ken’s ignoring IP location: his sparring partners are from Taiwan and India. Someone else cuts in with the obvious explanation:

I’m not a member but I do see the links for login and signup on the upper right hand corner of the website. I guess there’s a country restriction as to why some are able to see the signup option and others can’t.

…and later, he gives a screen dump; on the far right, there is indeed a “sign up” button:

Someone else cuts in saying the same thing, and provides another screen dump, of the alleged signup page itself, which is in quite a different livery, matching the “genuine” Power8 site rather well:

Well, anyone can fake a web page, but if this is a phishing scam, it is a very polished one. They are slowly “improving”, to be sure, but mostly, phishing scams are knocked up in a few minutes by semi-literate fly-by-nights who speak English as a (distant) second language.

Let’s see if we can confirm, three months later, what Ken’s antagonists are saying.

I can’t find a link, on Power8’s site, to the dodgy sign up page, but I can certainly still reproduce the sensitivity of the official site’s pages to the viewer’s IP location, which is alleged by Ken’s antagonists, but ignored by Ken. Here, for instance, is the page you get automatically when you pretend to be located in Singapore:

Ken’s antagonists have half a point, at least: the site is location-sensitive. The dodgy signup page could still be a subdomain hijack, I suppose,

An attacker could exploit such a situation by… setting up a phishing page that mimics the company’s main website.

…but that brings me on to Ken’s next claim.

Ken has forwarded Pyramid Guy’s post to the real company as well as the authorities who investigate online frauds.

RS: If the dubious signup page is a hijacked subdomain, or a phishing scam, why is it still there (here’s the archive I took of it, just now), three months later? The domain https://sa.power8.com/Register.aspx still looks exactly like a genuine subdomain of www.power8.com. Surely Power8, with its wonderful location-sensitive website, has both the nous and the motivation to be more careful of its online reputation than that? Perhaps Ken didn’t tell anyone about it after all, but he does sound like a straight shooter.

It’s a wee bit inconclusive, all this, but so far it does look as if both the pyramid enthusiasts and Ken have both got hold of a bit of the truth. The site does have a potential Jekyll and Hyde character, depending on where your IP number says you live; though if (if) that duality was very evident in October (before Ken’s possible tipoff, say), it’s been muted now.

Here’s the final bit of dialogue with Ken.

Ken: Why would a company like Power8 resort to the affiliate marketing type of business plan implied by Pyramid Guy’s posts, when they have Power8 shareholders that have invested millions? Low-level marketing affiliates would not make money for Power8 as they have no product for affiliates to sell, so why would Power8 even bother with the expense of recruiting affiliates? Real companies don’t do that.

RS: One way an affiliate marketing plan might pan out quite wonderfully is if the Power8 at the official www.power8.com really is a relatively well-disguised Ponzi, after all.

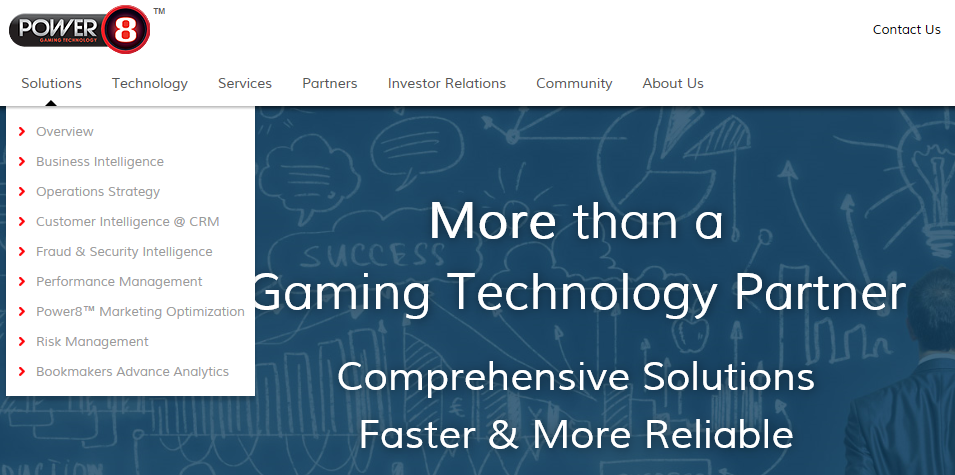

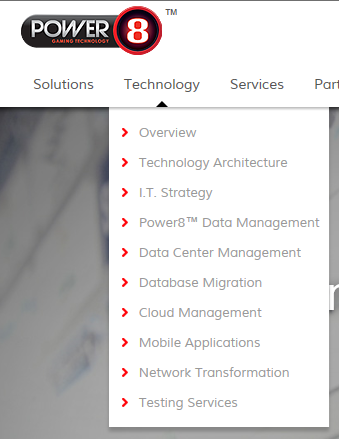

But before we consider going anywhere near that apocalyptic and potentially defamatory conclusion, let us abandon our dialogue with Ken and take a closer look at that official web site. I have to say, there is some interesting stuff on it.

First, Power8’s solution offering is either vapourware, or must be producing some serious cash burn:

That’s a lot of solutions. I wonder how much the staff that deliver them are costing, and where they are based. The same goes for the “technologies”:

…and the services

Strikingly, none of the 26 business lines mentioned in these three screen dumps is, so far, producing any site-announced, corroborated business flow.

Incidentally, with or without Ken’s tipoff, the “Fraud Protection” team at Power 8 don’t seem to have noticed the dodgy-looking signup site, either. That’s not a great ad for that element of Power 8’s profusion of offerings.

Then there’s something arresting under “investor relations”:

In many jurisdictions, a company saying things like that to retail investors about their own unquoted stock is really being quite adventurous, from a regulatory point of view. Finance professionals will notice various other slight oddities. Most striking: Power 8 say loudly that they’ve got an auditor, but they don’t say who it is, anywhere on the site.

One also notes that none of the company newsflow, archived here in case it suddenly goes for a walk, supports, in any way, the claim that the Affiliates Partnership Program, whatever that is (Power 8 don’t say), is performing well. In fact all I can see, and corroborate, of Power 8’s business, is the three football sponsorship deals.

The management team descriptions are striking too. Here’s the CEO bio and job description, in full:

Matthew Elliot has been the Chief Executive Officer of Power8™ since 2013. Matthew is also a member of the Power8™ Board of Directors. He runs the day to day management of the company and reports directly to the Board of Directors and its Chairman.

Well, blow me down: is that what he does? What was he doing before? Here’s the CFO:

Stuart McDonald became Chief Financial Officer of Power8™ in 2014. He is responsible for all finance functions and corporate investment partnerships. His team drafts all the financial details of partnership agreements with our Affiliates. Stuart is a member of the company’s Executive Management Team.

Do these people even exist? Good luck tracking down their past experience based on those scanty details.

It’s not really written with in-depth investor due diligence in mind, this Power8 copy, is it?

One exec who definitely does exist is Arman Ghen:

Arman Ghen is the Chief Investor Relations Officer of Power8™ and is a member of the company’s Executive Management Team. Arman handles enquiries from shareholders and is also Chairman of our Corporate Social Responsibility & Charity Committee.

The reason I’m so confident that he exists is that there’s a video of him on the Power 8 site (bottom left; I’ll have to repair this post if the video disappears). In the remaining videos it becomes abundantly obvious that some of the investors in Power 8 are not millionaires nor expert investors, but bog-standard Chinese-speaking retail types, some based in Hong Kong, who like a bit of razzmatazz. That’s entirely consistent with the claim that Power 8 is using pyramid sales methods to distribute its shares.

Perhaps Power 8 just needs a bit of an image brushup, though, and a more communicative web site. That hopeful thought might make the management of Everton FC, Fulham FC, and particularly RCD Espanol (and their bankers), feel a little more cheerful, at least for a while. For Ponzis always blow up, eventually, and afterwards, there is plenty of woe, both for the folk who fell for the swindle, and for completely innocent bystanders. One sign of a Ponzi blow up, of course, would be the disappearance, quiet or not, of Power 8’s branding from the Everton and Fulham home grounds.

By contrast, it’s really hard to see how Power 8 could disappear at all quietly from RCD Espanyol’s stadium, currently called the Power8 Stadium. That would be a noisy vanishing trick indeed, and a trigger for scrutiny of the latest state of the Everton and Fulham sponsor lists, too.

Let us watch for developments, then, at Everton, Fulham, and most particularly, RCD Espanyol…

Footnote, mostly for sports journalists, football club officials, financial regulators and random New Zealanders.

I have one more minor observation that will explain why this post has a “New Zealand” tag.

While looking for independent evidence that Power 8 CEO Matthew Elliot wasn’t a figment of some crook’s imagination, I found that last year, local Spanish press had provided a picture of Espanyol and Power 8 inking the deal:

The guy on the left is Joan Collet, President of RCD Espanyol. The other guy, purportedly from Power 8, isn’t a Power 8 board member. He is Philippe Capelle, described as a ‘manager’ at Power 8. It seems rather disdainful of Power 8 to send out someone who isn’t even a Power 8 board member to sign by far their biggest-ever deal, but hey, maybe they aren’t that status-conscious, in Spain.

Now for a little pull at some threads. Capelle is a former director of London Capital Associates, directed now by Bryan Cook and Thomas Ungchun Yi.

London Capital Associates is a sister company of a GXG Broker, London Capital (NZ), aka LCNZ, aka Asia Finance Corporation, a registered New Zealand Financial Services Provider, which, until recently, was also directed by Bryan Cook, an Australian resident of Switzerland who has attracted Naked Capitalism’s attention before. Cook can still exercise control of Asia Finance Corporation (registered in New Zealand) via his 100% shareholding.

Capelle, meanwhile, is also currently a director of a GXG-listed stock, APGMI, whose shareholders, another London Capital-branded firm, registered in Hong Kong, are trying to depose the entire board, including Capelle and some reasonably worthy-looking Brits.

So it looks as if Capelle and co-directors are getting comprehensively dumped on, all of a sudden, by “London Capital”. I wonder why. Oh, maybe this very recent GXG Press release by APGMI’s board has something to do with it:

…the directors of APGMI have expressed their concerns to LCNZ following the arrest of LCNZ’s Chairman, Bryan Cook, by the German authorities in 1H2014. Mr. Cook continues to be detained, pending an investigation. APGMI has sought clarification as to whether this arrest is linked to the withdrawal of funding of APGMI by London Seychelles Ltd., under the direction of his sister Julie Cook, late in 2014, or to matters linked to share trading for various companies that resulted in large market capitalisations including possibly APGMI. To date, Thomas Yi and Julie Cook have refused to provide details or answers on this matter.

In a further tie-up with prior work here at Naked Capitalism, GXG-listed APGMI’s transfer agent is the very same dubious Integral Transfer Agency that appeared in connection with the story of fraud stock HCI Hamilton and New Zealand gargoyle Cathy Odgers. My profuse thanks to Cathy Odgers, then, for giving me a chance to name-check her yet again.

Ouch! You have hit close to home! I was born at Fulham General Hospital, on Old Brompton Road. Since I was born a lot later than the ’30s, I can only say that Mum always refers to it as Fulham General, not Princess Beatrice Hospital. Who knows, perhaps I was born in clinic or at home. That wasn’t uncommon back then. I do know that I was told often about my tendency to wander off up Putney High Street with the little girl who lived across the road. Evidently we were once found at the Local doing a song and dance act for change, which I’m told we promptly took round to the Sweets Shop. Cheeky little devils.

I can understand the mob from Fulham falling for the old King and Country con, but Power8? What a bunch of Yobs.

Sounds awful, but why highlight the soccer clubs? In your take downs of AIG did you ever title a post “AIG, sponsor of Manchester United …”? Is this an attempt, with the Super Bowl approaching, to divert attention from the NFL?

Soccer clubs may be culpable if they agreed to promote a criminal venture in exchange for printing the venture’s logo on their uniforms, or if club executives discount the cost of sponsorship in exchange for a piece of the criminal action. The article does not present evidence that the named clubs exhibited behavior that would indicate their involvment in such crimes. The clubs apparently took money at the going price from a shady player in exchange for printing the player’s logo on their uniforms. In doing so they tacitly lend support to the sponsor’s activities. There is however no formal endorsement. ManU didn’t suffer from AIG’s troubles. Fulham probably suffered more for hiring Magath than they will suffer should SUper8 collapse.

You are missing that the very soccer club deals that Richard highlights are

1. The only business activity (aside from taking money from investors, setting up corporate entities, and creating selling and legal-looking documentation) that the promoters appear to have undertaken

2. Important, if not key, to whatever legitimacy they have

And I have to tell you as someone who has worked with companies like American Express in their marketing area (and Amex’s premium pricing has long depended solely on its heavy investment in its brand image) that no business of any competence should engage in license deals casually. You get tarred if you license to people who degrade your reputation.

Quoting Gilda, never mind.

Er, well, for exactly the reason that the Ponzi promoters (if that’s what they are) highlight them. To try and get a bit of profile. That’s also how the AGT/Lotus tie up worked, and the Stanford/cricket tie up.

“The clubs apparently took money at the going price from a shady player in exchange for printing the player’s logo on their uniforms.”

Stadium and/or official club sponsors, but not kit sponsors that I can tell for Fulham or Everton. Everton has had their shirt sponsored by Chang beer for a decade now. Fulham’s kit is sponsored by a sports betting website, which is always a surprising thing to see–at least for this American. It’s also a bit unclear to me as to when the above was written. That said, Fulham was relegated from the Premier League and aren’t doing so well in England’s 2nd tier this year. A disastrous second relegation again remains a looming threat.

The world of finance and football is a hard one to understand, full of murkiness and shady dealings, from third-party ownership of players to questions over the ownership of shares. I recently watched one documentary on Glasgow’s Rangers FC, one of the two Scottish giants who have been embroiled in an ownership mess for a number of years now. I also have another TV doc on Rangers saved on my youtube list.

Have a look at the ‘Corporate Legitimacy’ section under Investor Relations on their site (I love that heading – how many companies put that on their site?) Other than a relationship with thirty unnamed ‘affiliates,’ their claim to legitimacy rests entirely on their sponsorship deals with the football clubs. If this actually is a scam, then it’s the clubs who make it possible.

interesting. but the mother of all ponzi schemes is brewing in china and it’s 16% owned by HSBC (i.e. will take down the entire financial system when it blows up). it requires new entrants to pay for the lavish guarantees it promises on their life products (10%) and anyone who opens an account with their bank above a certain threshold (they’ll throw in a free mercedes)

Sounds awesome. Will look into it.

i look forward to it.

Ping An? You are out of date if so – HSBC ditched the last piece of their stake in 2013

really? i didn’t see that. when i looked on the wikipedia page a month or so ago HSBC’s name was still on it. guess they smelled a rat.

HSBC are a funny lot: hair-raising in some ways (moneylaundering controls at overseas subs have been a farce). Commendably alert in others, e.g. first by mile to clean up their US mortgage book (early 07), and prudent in their funding (no great reliance on repo). Still, China is wild, and they are big in China, so you are right, always worth watching.

ponzi in the title should be changed to pyramid, btw

Nope.

What is the difference? I’ve heard Herbalife/Amway are a pyramid, yet others call them multi-level marketing, and still others call them a Ponzi.

Actually, a) there is a difference, and b) vidimi is right. But the term is close enough, and more familiar

Rangers, Wonga, Mike Ashley, Shinawatra, Venky’s, and the Russian oligarchs. British football really is a trough.

The signup page operates under the power8.com domain and uses the correct certificate. So from a Web security point of view, it’s genuine. It’s either a real signup page or (if a MOM attack) the work of an attacker who has compromised their security and is able to operate under the site certificate. It could be a subdomain hijack, but that could be easily fixed by revoking the star certificate and providing separate ones for each subdomain. I suspect that it is indeed provided by Power8 themselves (I was going to say ‘legitimate’ but I guess that’s the point in question). It’s unfortunate that Mr. Roklin has chosen this line of attack as it means the other guy is probably in the right regarding the security issue, which lends some undeserved credibility to his other statements.

Overall the company looks pretty questionable to me. As Richard points out, they have a heck of a lot of service lines. Delivering on all of those must take a pretty large team for the IT and support alone. Where are they based? Why is there no address for them on the site? Are they hiring? Where is the careers page? Any listings on LinkedIn or online job boards? (I can’t find any via Google).

What about customers? Where are the case studies, examples, testimonials? As for solutions, what technology platforms do they support? Any technology company partnerships? Any evidence of any kind to demonstrate that this is a real company that can build (and has built) actual paid solutions for customers, and not just a Web site written by somebody with access to Gartner reports and a good grasp of buzzwords?

Overall it’s pretty standard stuff and nothing we haven’t seen before (if a little higher quality than usual) with one exception, and that’s the football club deals. I agree those are pretty remarkable. What were they thinking? Did they not do any due diligence at all? Anybody with a rudimentary grasp of business and IT, access to Google, and half an hour to spare could have told them that something was fishy. Are they just happy to whore out their brand with no questions asked to anybody who pays them enough money?

As a side issue, I was going to point out this bit from the Privacy Policy as further evidence of dodginess:

Note: In case of discrepancies between the English and Chinese versions, the English version shall apply and prevail.

However a bit of Googling reveals that this kind of language isn’t all that uncommon for businesses like banks serving the Asian market. I wonder how many Chinese language customers are aware of this, and whether they have access to English-language legal advice.

You should probably take a look at Manchester City‘s sponsor QNET.

I will.

We are a group of Power8 investors in Malaysia. Promised returns were stopped. There was no payments for the last few months. Is this a scam?!

If the payments have suddenly stopped, that’s another sign that it’s a scam. Contact the police.

Why take down our post ? Avoiding ? Then we will go to the authority … If we can afford to invest … We can also afford to advertise in the paper .

You’ll have to explain more. What post of yours was taken down?

In your quick list of sports/financial scam links I reckon you’ve missed perhaps the best of them (with both Australian and NZ links) – the intersection between the Western Force rugby team in Perth and Firepower International.

Dammit, Firepower! I am very fond of them.

http://www.nakedcapitalism.com/2011/10/new-zealands-miracle-cure-peddler-and-the-most-spectacular-fraud-in-australian-history.html

Richard Smith, it is great to see your article, I am an investor of power8 from China, please send me an email, I will tell you more details of the tricks power8 used to get our money away!

Someone will be in touch with you soon.

Hi Richard Smith, I am an investor of power8 from China as well. I have noticed that there is someone from China also left a message here. I am not sure what information he provided with you, but I might get more detail and important information regarding the responses from power8 Spain. We need your help. Could you please ask someone to contact me?

I will do!

Thanks! Looking forward to your email.

Hi, Richard Smith. I have been waiting for a whole week but didn’t receive your email. Could you please ask someone to send me an email as soon as possible? Because I have lots of important information and need your help to analyse because we believe in your strong analytical skills. By the way, these private informations also related to KPMG and London Capital.

Sorry, it should be APGMI . I made a typo in previous message. Thanks in advance for your kind reply.

Hi, Richard Smith. I have been waiting for a whole week but didn’t receive your email. Could you please ask someone to send me an email as soon as possible? Because I have important information related to APGMI and London Capital, which I think could help you find out more secrets regarding the fraud. Thanks in advance for your kind reply!