Those who were hoping that Syriza would be cowed by the ECB’s aggressive moves to shut Greece out of bond markets and Eurozone finance ministers’ unified resistance to the new government’s proposals are no doubt frustrated by its refusal to capitulate. On Sunday, Greek prime minister Alexis Tsipras gave a rousing speech reaffirming Syriza’s plans. Ekathimerini’s summary:

Prime Minister Alexis Tsipras on Sunday presented his government’s policy program in Parliament, pledging to implement pre-election promises to revoke austerity measures, though not all at once…

The premier said the government would not seek an extension to Greece’s bailout, noting that it would be an “extension of mistakes and disaster,” and reiterated Greek demands for a “bridge” deal to be put in place until a “mutually acceptable agreement” is reached with creditors. “We do not intend to threaten stability in Europe,” he said, adding, however, that he would not “negotiate” the country’s sovereignty.

Tsipras said his government needs “fiscal space” for a discussion on restructuring Greece’s debt and a new deal, adding that increasing austerity would only exacerbate the problem.

He pledged to replace a unified property tax (ENFIA) with a new tax on large property and to increase the tax-free income threshold to 12,000 euros from 5,000 euros. He also vowed to introduce a fair tax system and crack down on tax evasion and corruption. Collective wage bargaining will be restored, Tsipras said, adding that the minimum wage will return to 751 euros a month from 586 euros, though gradually from now until 2016.

Greek authorities would also reinstate at the end of the year the so-called 13th pension for retirees earning less than 700 euros a month, Tsipras said.

A chief priority remains tackling the “humanitarian crisis,” he said, pledging free electricity and food to households that have fallen victim to the “barbarous measures” of recent years. In the civil service, immediate rehirings will include dismissed Finance Ministry cleaners, school guards and university administrative staff, he said, noting that this would not burden the budget and will come from planned hirings for 2015.

In parallel, a number of observers, including Alan Greenspan, argue that Greece either has to, or by virtue of not being willing to bend to the Troika, will wind up leaving the Eurozone. And at the moment, the Greek government does appear to have set up some incompatible boundary conditions: not defaulting, not “threatening the stability of the Eurozone,” which presumably means a Grexit, but also not accepting demands that the Troika is treating as non-negotiable.

As we’ve stressed before, while a deal on restructuring Greece’s debt could probably get done, it seems highly unlikely that a compromise can be found between the bailout brigade’s idées fixes around structural reforms, which amount to squeezing labor, which stands in stark contrast with Tsipras’ plans to boost wage levels and labor bargaining rights. Greece also wants to reduce the primary surplus it is required to achieve from 4.5% to 1% to 1.5%. While some respected commentators like Martin Wolf at the Financial Times regard that as a reasonable ask, the belligerent mood among Greece’s creditors means that this request is also likely to be rejected.

Here are some of the grim verdicts from the press. First, from Wolfgang Munchau in the Financial Times, in an article titled, All Grexit needs is a few more disastrous weeks like this:

The first two weeks after Syriza’s victory in the Greek elections had the effect I feared. A sceptical northern European public was converted into a hostile one…

Politically, the situation is now as bad as it was in 2010 when the Greek debt crisis began. It was an utterly disastrous week of economic diplomacy.

And Greece watcher Hugo Dixon at Reuters:

But here is the disconnect: Syriza is right. Austerity is a failure. Even the IMF effectively admitted that, although the policy side seems to ignore what its own research says.

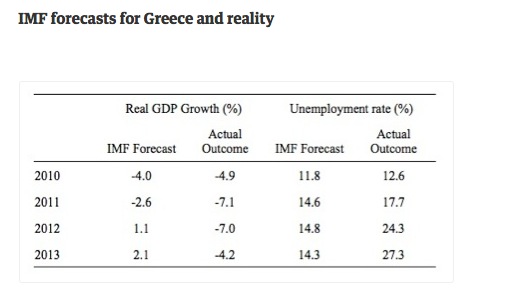

Curiously, it was Bill Mitchell, and not the IMF, who put together this table that shows how the IMF forecasts for Greece under austerity compared to what actually happened:

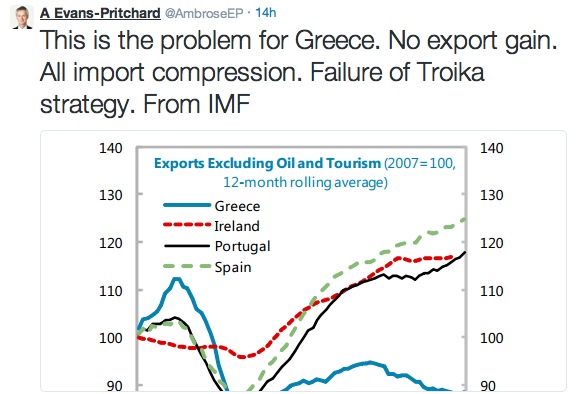

And Ambrose Evans-Pritchard highlights another axis of failure:

And Finance Minister Yanis Varoufakis continues to make waves by telling unpopular truths about austerity and the fragility of the Eurozone. From Reuters (hat tip furzy mouse):

In an interview with Italian state television network RAI, Varoufakis said Greece’s debt problems must be solved as part of a rejection of austerity policies for the euro zone as a whole….

The euro zone faces a risk of fragmentation and “de-construction” unless it faces up to the fact that Greece, and not only Greece, is unable to pay back its debt under the current terms, Varoufakis said.

“I would warn anyone who is considering strategically amputating Greece from Europe because this is very dangerous,” he said. “Who will be next after us? Portugal? What will happen when Italy discovers it is impossible to remain inside the straitjacket of austerity?”

Varoufakis and his Prime Minister Alexis Tsipras received friendly words but no support for debt re-negotiation from their Italian counterparts when they visited Rome last week. But Varoufakis said things were different behind the scenes.

“Italian officials, I can’t tell you from which big institution, approached me to tell me they backed us but they can’t tell the truth because Italy also risks bankruptcy and they are afraid of the reaction from Germany,” he said.

“Let’s face it, Italy’s debt situation is unsustainable,” he added, a comment that drew a sharp response from Italian Economy Minister Pier Carlo Padoan, who said in a tweet that Italy’s debt was “solid and sustainable.”

Most observers believe Greece has to knuckle under, and along conventional reasoning like that of Wolfgang Munchau, taking a tough position when you have a weak hand only leads to worse outcomes. The basis for the thinking that Greece must give in is its near-term funding needs:

And Greece is cheeky enough to be asking for a short-term lifeline even as it is otherwise defying its financial overlords. From Reuters:

Instead of the next tranche of bailout funds – 7.2 billion euros due, pending a suspended review – Greece’s new government wants the right to issue more short-term debt beyond a current 15 billion euro threshold. It also wants 1.9 billion euros in profits from Greek bonds held by the European Central Bank and other euro zone authorities.

With that as a bridge, Greek officials would then try to renegotiate payment of Greek sovereign bond debt, perhaps by extending payments, only paying interest and getting some respite on the budget surplus it is expected to run.

However, as much as Greece would like to get some relief while it is in negotiations, over the weekend government official indicated they can go it alone, at least for a few months. From another Reuters account:

Greece faces interest rate payments of around 2 billion euros over February and should repay a 1.5 billion euro loan to the IMF in March.

That has raised concerns the country may suffer a cash crunch, but this was dismissed on Saturday by the Greek official in charge of the government’s accounts.

“During the time span of the negotiations there is no problem (of liquidity). This does not mean that there will be a problem afterwards,” Deputy Finance Minister Dimitris Mardas said on Mega TV.

Asked whether the state may suffer a cash crunch if talks drag on until May, the minister said he did not expect the negotiations over a new deal to last that long.

“Even if they did, we can find money,” he said.

Now in fact we won’t know the full details of Greece’s proposal until it tables it Wednesday, February 11 (although it is likely to go to a working group on Tuesday so we may get leaks then). However, the Greek government has been very consistent in its position, save Varoufakis’ initial wobble on asking for debt writedowns, then changing that to suggesting financial structures that align incentives better and would also have the economic impact of a haircut. So if Greece makes no changes in its position, given that it is predictable that its request for financial break will be rejected, that would indicate that the upstart government is confident that it can pay its bills at least through the end of March.

That alone would represent a tactical defeat for the Troika. The whole point of the ECB mugging Greece last week was to force to the negotiating table by the end of the month, to take the bailout funds and all the existing “structural reform” strings attached. We discussed at some length why a short negotiating time frame was to the creditors’ advantage.

And here is why the provocative move of Varoufakis’ rejecting the Troika bailout monitors may actually have been inspired: with no Troika spies in Greece, Syriza knows where its finances stand, but the parties across the table are in the dark. Syriza is in a much better negotiating position keeping that critical information to itself.

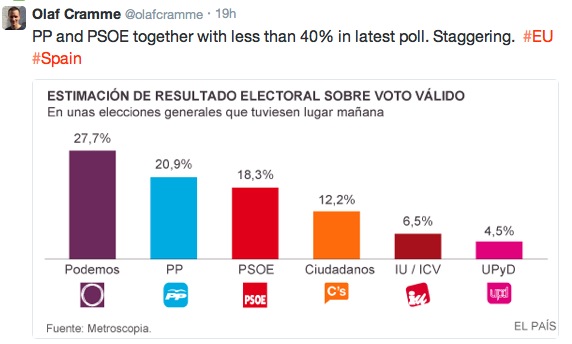

Even though the odds of Syriza prevailing are still remote, the longer it can keep the negotiations going, the more press it gets, and the more it dents the perception that the Troika is all-powerful. Moreover, some of the governments that are most opposed to Greece getting a break are the governments of periphery countries that sold out their populations to the banking classes, namely Spain and Portugal. But there are two rounds of elections in Spain, in March and April. If anti-austerity party Podemos continues to gain in the polls, the government may feel pressured to moderate its stance in order to save its hide:

As we’ve also said, an even bigger potential political threat is France’s extreme right wing, anti-Eurozone party Front National. Its leader Marine Le Pen has already promised to leave the Eurozone. Front National could well gain 5% to 10% in the polls if the party plays up the harsh treatment of Greece is being treated as showing how hostile unelected EU bureaucrats are to nation-states. The open question is whether it chooses to play that card before regional elections in France at the end of March.

Although they are less likely to be of immediate help, financial commentators are also showing some sympathy with much, and in some cases, most of Syriza’s critique of extend and pretend. Even qualified media validation of Syriza’s upstart effort chips away at the veneer of the Troika’s legitimacy. And as we discuss in an accompanying post, Bernie Sanders has noticed (as we have) the Fed’s dereliction of duty in not trying to curb the ECB in pursuing a course of action that puts the Eurozone, and hence US incomes and jobs, at risk. So again, while success is still a remote possibility, more external pressure may be brought to bear on the ECB and some of the Eurozone states, particularly if the negotiations drag on, the odds of a Grexit or default rise, and a Greek unraveling looks more and more likely to create political contagion.

Again, I must stress to readers that the odds are still very much against the Greek government. But despite the German paper Frankfurter Allgemeine Sonntagszeitung (FAZ) depicting pro-government rallies in Athens as part of a Syriza permanent campaign, the English version of Die Welt reports that the Greek public is firmly behind the new government’s concerted efforts to get a better deal from its paymasters and to give its citizens a say in their own destiny. So the fight is still very much on.

Not Quite an Update 6:30 AM. This post has not yet launched yet, but Syriza looks to be knocking a big hole in one of the Troika’s, and even more Germany’s, pet assumptions: that there was no contagion, meaning financial contagion risk, in the event of a Grexit. Mr. Market is already not happy with mere brinksmanship. From the Financial Times:

Monday 10:40GMT. Europe’s main equities markets are falling fast in early trade, as investors’ attention turns back to the relations between Greece and its creditors.

Germany’s Xetra Dax is under the most pressure among the region’s main indices, its losses extending as the session progresses. The Frankfurt index is now down 1.8 per cent, having started the day down 0.8 per cent. The FTSE 100 in London is down 1 per cent while the CAC 40 is off 0.8 per cent in Paris.

On the eurozone periphery, Spain’s Ibex 35 is 1.5 per cent lower while Portugal’s PSI 20 is down 0.7 per cent. Greece’s main index, the Athens General, is 5.2 per cent lower with banks once again taking heavy losses — the sub index tracking the Greek banking sector is down 10 per cent. The region-wide FTSE Eurofirst 300 is 1.3 per cent weaker.

The losses come after a defiant speech on Sunday from new Greek prime minister Alexis Tsipras, in which he said the country would not seek an extension to the country’s current bailout, putting his leftwing government on a collision course with its creditors in the run-up to this week’s EU summit.

Greece’s sovereign borrowing costs are higher, with the yield on its 2-year debt up 70 basis points at 21.33 per cent and the yield on 10-year debt up 59 basis points at 11.04 per cent.

Now having said that, the Eurozone authorities are (unlike their American counterparts) presumably more worried about bond yields than equity markets. The Euro has traded up a smidge this AM, so the worries that have led equity investors to reduce risk exposures have not translated into further weakening of the Euro.

I’m quite happy to hear that Syriza, and Varaoufakis in particular, are thumbing their noses at the Troika in such a productive manner. The Germans are obviously not going to bend easily, but if enough countries start following Greece’s lead (and we saw the link with Irish leaders saying they want a better deal if Greece gets one) then there will be real pressure for major reform. I remain very hopeful that the next few months will see some major success on these fronts.

Nice to see Bill Black at work in Ireland.

http://neweconomicperspectives.org/2015/02/oral-testimony-william-k-black.html

Initially, I was confused by what seemed to be two parties talking past each other. But Syriza’s firm stance in defiance of troika hand waving now makes perfect sense.

I thought about when my daughter grew into toddlerhood. Struggling back against a temper tantrum is counterproductive and often simply exacerbates it. The most effective strategy is to wait it out with blissful indifference, and once the child is exhausted from screaming and rolling about, you can begin to address what everyone was upset about. The ECB in particular seems to be throwing a tantrum, so it makes sense that the only logical step is to wait it out until the powers that be exhaust themselves with hand waving and forecasts of imminent doom. “The sky is not falling. Use your words.”

Outside the realm of analogy, the Greek govt might realize that there is no liquidity problem outside the one the ECB has chosen to create by refusing, or insinuating a refusal, to backstop Greek banks. Perhaps the most effective solution is to wait out the tantrum that is causing the Euro bankers to behave this way, so that the means to deal with the situation that already exist can be used without egos getting in the way.

My 2p.

Define success? Most readers at NC would consider a Grexit a successful conclusion. Personally it’s about Greek independence. All the Troika can do is buy influence and that won’t work this time. Therefore Syriza has complete control of its own destiny. It will decide whether it gives in or not. They won’t sell out and they cannot be forced to give in. Plus it has positioned itself so that no matter how badly things go in Greece the blame will be on the EU and Germany. I don’t think Syriza has to give in at all. I also suspect Grexit has always been its unstated goal and the current process we’re in is preparing the Greek population for such an inevitable conclusion.

Varoufakis has written for years that a Grexit would be a disaster for Greece. It’s not just the year to eighteen months of painful adjustment, which would deepen Greece’s humanitarian crisis. It is that a Grexit would lead to the eventual dissolution of the Eurozone. Remember, there is no exit mechanism now. The Eurocrats would have to figure that out in order to expel Greece (the Maastrict Treaty is clear that a country cannot withdraw on its own). Doing that will create a road map and procedures for other countries to leave. Italy is the most logical candidate, as Ambrose Evans-Pritchard has discussed, but it is not inconceivable that a France under Marine Le Pen would depart sooner.

The breakup of the Eurozone would create a new Great Depression in Europe. Greece would be dragged down in it, so its economic disaster would be greatly intensified and could easily last a decade. And the benefit of a cheaper currency would be close to non-existant since all the former periphery countries would also have cheaper currencies, and none of their logical export markets would be in a position to buy much.

It’s easy to prescribe dramatic, simple-sounding solutions when you don’t have to live with the consequences.

Thanks for reminding us of Yanis’s long-standing concerns. Dealt a bad hand, you get the most out of it you can. This isn’t a situation where you can just throw the cards in and wait for a better hand. Standing tall and fighting the righteous fight is the only virtuous option.

By the way, doesn’t a Great Depression in Europe trigger at least some mild dyspepsia on Wall Street … there are some worrying linkages ;-)

Greenspan is talking his book. He would rather see a Grexit and the dissolution of the EU than a universal solution to all this financial insanity. Why doesn’t this surprise me? On the face of it, it looks like German sovereignty v. Greek sovereignty because the German taxpayers are on the hook if Greece gets a write down, etc. Well – isn’t this a red herring? Bec. the proposal by Varoufakis could work for German sovereignty as well. Besides, the Germans owe most of the debt to themselves, some of it to China, and some big odious chunk of money to US and UK banksters. The amounts owed to US banksters would be a good place for the US Treasury and it’s loyal “agent” the Fed to step in and do a similar time extension here so those write downs don’t sink US pension funds. With all the QE that has been thrown down the rat hole, this really shouldn’t be a problem, should it?

I don’t have to live with it…yet. What is Greece today will be Canada tomorrow. I’ve been consistent in all my posts that if you let criminals run things you can’t really hope for things to ever get better. Granted that is simplistic, however it’s not necessarily wrong. Maybe the end result doesn’t have to be so dire. You are the Economic Maestro, not I, so it’d be wonderful if you are right and I’m wrong. But I’m not being cold hearted. Just wanting to get to the bottom so we can begin to rise again.

Regarding Grexit, I assume there are already sections of the population living in a great depression state. Obviously many aren’t and they didn’t vote for Syriza. For these people a less dramatic solution suits them because even if that means more of the status quo they are still keeping their heads above water. They can live with the status quo until things get worse.

Ultimately I believe Varoufakis will realize the EU blueprint makes a Greek great depression inevitable. Thus the choice becomes: to suffer such a fate and still be ruled by foreign technocrats or to face such a fate with a Greek government in charge actually working to make things better?

Many of the great tragedies in history happened even when the players involved knew what was at stake, what was to be done and what to avoid.

And yet they happened anyway.

Seems to me that Greece is playing a high stakes game of chicken: it doesn’t want to exit the Eurozone but ultimately it doesn’t have much left to lose compared to Germany and others in the EZ. I don’t think they will swerve first, like you said there is a disconnect: Syriza is right and the austerity peddlers are wrong. Moreover the sheer size of the numbers mean that Greece owns the Troika rather than the other way round, with the EZ as a hostage. I suspect the Troika knows it too, and this is a last ditch effort to try and force Syriza into backing down. I don’t think that they are any more suicidal than Syriza is, they are just dealing with the realization that a Syriza win will be the beginning of the end of austerity everywhere in Europe. Speaking of which, as much as Syriza employs the arguments of sovereignty, it is still possible that it views its mission as at least partly ideological on a continental scale. Or that might be the irrational dreamer in me; in any case a Syriza win is a win for all of Europe.

I’m sure Greece wants to remain in the Eurozone. To do that, the Troika has to end austerity. Syriza hopes by dragging this out, they’ll get the banks and the bond holders to relent on austerity. Maybe the FED or the USG will lean on Germany to cut a deal with Greece. For the Greeks this is an existential matter. Minister Varoufakis the economist knows the disruption a Grexit would cause, but thi is not his decision. The Greeks themselves have to make the call. For them, the choice is simple: either submit to the Troikas demands and be slowly and inexorably ground into dust, or leave the Eurozone and have a shot at reclaiming their sovereignty.

Why will there be a great depression if the EU breaks up? Is that assuming that trade between countries drops sharply?

Like “Shock & Awe”?

I can agree with EoinW. At some point a new paradigm will be created. It seems Russia’s Lavrov has got it about right; the West is in steep decline and needs to divert attention away from the train wreck; ergo, pick a fight in the Ukraine.

Look. There is no way we get to a better condition without pain and consequences. For certain, the large US population is comatose to world events. Cheer on the Greeks!

‘It seems highly unlikely that a compromise can be found between the bailout brigade’s idées fixes around structural reforms … in stark contrast with Tsipras’ plans to boost wage levels and labor bargaining rights.

‘Instead of the next tranche of bailout funds – 7.2 billion euros due, pending a suspended review – Greece’s new government wants the right to issue more short-term debt beyond a current 15 billion euro threshold.’ — YS

Varoufakis’s logic seems to be that if fresh funds are raised with T-bills, instead of being explicitly transferred from the Troika, then this will meet with less resistance. The current €15 billion limit (which Minister V wants to raise to €25 billion) was agreed with the EU and IMF as part of the previous bailout, which Greece already has declared defunct.

Meanwhile the Troika cut off discounting of Greek debt with the ECB starting Wednesday, leaving ELA (with bi-weekly-reviewed limits) as the only lifeline. This amounts to a siege by the Troika, in which Greece can raise no fresh funds except through the ECB’s mechanisms and limits.

If Greece defiantly issues T-bills anyway, what then? Would enough external funds be raised to produce a capital account inflow? Would the ECB block such transfers?

This is the year of living dangerously: high finance, scribbled on the back of an envelope, whilst sitting in an aircraft seat. The captain has turned on the seat belt sign …

“Greece either has to find a way to get bridge financing, or, if they want to do it with us, they need a program,” German Finance Minister Wolfgang Schaeuble tells reporters at G-20 meeting in Istanbul. — Bloomberg TV interview, quoted on ZH [no link provided]

Extremely hard to imagine that any other source, such as Russia or (even more remotely) China, would get involved in Greece’s plight. It’s serious money; it’s not Russia’s sphere of influence; there’s not that much upside for them; and worst of all, the West likely would clamp on new sanctions to block repayments.

In all human history, ‘new loans’ and ‘programs’ are inextricably linked. Lenders don’t just hand out funds unconditionally to troubled borrowers. The conditions may be misguided or destructive, but conditionality is the secular religion of the IMF, never to be questioned except on pain of excommunication.

Grexit … or program? If the Troika can fudge this dilemma with some kind of ‘third way’ solution that saves face for all concerned, then I will eat my hat (after tipping to it to them).

Print link for Schaeuble’s remarks:

http://news.asiaone.com/news/world/greece-must-agree-plan-creditors-get-help-schaeuble

Lending (or even permitting more Greek domestic borrowing) without conditionality is inconceivable to him.

I have to believe give what Greek officials stated over the weekend that Greece can squeak by for at least 6 weeks on tax receipts alone and deferring some payments, perhaps doing what California did and issuing tax anticipation notes as a sort of scrip for internal payments. They can also sell assets (the government car fleet, which it turns out was large and plush, and a presidential jet are being sold). One colleague suggested that the central bank probably has some hidden assets (another reason not to let the Troika monitors in).

So if the Greeks can get by for a while, as they said, the ploy of asking for money they know they won’t get is to make the Troika look abusive/unreasonable to Greek voters and sympathetic onlookers in other countries. They want to make the ploy of trying to force the Greeks to the negotiating table obvious.

As I said, we’ll see if this theory is right when their plans are announced Wednesday. If they have not backed down on any of their demands, they aren’t knuckling under to the Troika, that would seem to confirm that they believe they can go it alone for a while. Varoufakis is too smart not to hear all the noise coming back at him and the government and know that means “no way” in terms of getting some short-term relief from the Troika.

It may also be that the refusal triggers some legalistic basis for arguing they can ignore the funding ceilings.

If the ECB tries not rolling the ELA, Greece should impose capital controls immediately. Not sure they are set up to close that window fast enough, although they could announce a one or two day bank holiday while they sort that out. And with the ECB having extended all that support to the Greek central bank, query how it gets all those losses back if Greece refuses to pay. The strategy for Greece might be to suck as much out of the ELA as possible, then impose capital controls.

Using the ELA to try to bring Greece to heel would backfire on the ECB longer term. It is almost certain to play into Podemos and Front National’s hands, and would give the US legitimate grounds for being unhappy with the ECB. Pretty much every expert sees that as an unjustifiable move, given that the ECB is supposed to promote fiscal stability and has nothing in its charter that allows it to act as an enforcer re Maastrict rules (like a country’s fiscal position). It would also almost certainly put it in violation of a Constitutional Court decision that ordered it out of the Troika because it has a conflict of interest. That is one reason the ECB said (but hardly any news outlets picked it up) that it was going to have to remove its bailout monitors anyhow from Greece.

This quote from John Whittaker´s seminal paper on the eurozone payments system may help clarify the issue of the likelihood of Greece being “expelled” from the eurozone:

Taking into account that the Maastricht and subsequent European treaties do not allow for expulsions from the eurozone we may perhaps conclude that the ECB´s threats of cutting off Greece from the ELA are just that: threats that they will think twice or thrice before carrying out.

It´s highly unlikely that unelected bureaucrats at the ECB would be ready to assume responsibility for an illegal and unconstitucional expulsion of a member state from the currency union. And even if the central bankers got the formal backing of EU heads of state and government that would still not absolve both the bureaucrats and the politicians from full legal responsibility (civil and criminal) for a true rogue move.

(And, btw, a decision by the heads of state and government on such a matter would have to be unanimous – and Greece would certainly not vote for her own expulsion).

So Greece´s hand is much stronger than it may appear at first sight.

‘The strategy for Greece might be to suck as much out of the ELA as possible, then impose capital controls.’

Probably so. But Greek banks’ rising ELA liabilities likely are the passive result of covering external remittances initiated by account holders, rather than an active pre-bankruptcy ‘max out the credit cards’ move by the Greek government.

Presumably, the higher Greece’s total ELA balance rises, the sooner the ECB clamps a limit on further increases. And one has to think those balances are accelerating exponentially in response to today’s alarming news backdrop.

What happens when the irresistible force of Greek austerity resistance crashes into the immovable object of Troika conditionality? One shudders to think, but evidently push is coming to shove as soon as Wednesday morning.

I think crashing European bourses Tuesday will play to team Austerity Resistance’s advantage.

I think.

One trick which I hope that it might be possible for Syriza to pull off is, now that it has the Greek Civil Service at its disposal it can do a bit of Easter Egging to see what dirt it can dig up. And I simply cannot believe there isn’t, after knocking on for the best part of 7 years, dirt to be dug. Greece must have been able to access certain privileged information in the ECB and of course will have its own documentation at the Bank of Greece.

The previous governments had an absolute need to conceal the pre-crisis book-cooking and, more especially, what it learnt about who really “owns the notes” i.e. on who’s balance sheets is the Greek sovereign debt sitting, does that number tally with what it knows is outstanding, what has been hypothecated and re-hypothecated.

Conversely, Syriza has a lot to gain by threatening to not recognise non-state registered claims if for no other reason than it can perfectly justifiably point out what happened with Argentina once a vulture fund came across Judge Griesa and found it had a complete ignoramus / useful tool who made a nicely negotiated creditor cramdown completely worthless (or tried their best to do so). At least as far as the U.S. courts (which of course equals the U.S. dollar clearing banks) goes. For Greece’s creditors, If they bought something, they really should have a means of identifying that the person selling it to them actually has title to it and that there is actually an underlying asset there not just Trading Sardines. I have a bit of a hunch that is not entirely the case and the Bank of Greece can at the very least provide information that, if not telling precisely where the bodies are buried, as a minimum say which banks / hedge funds smell the most.

Oh, and it can enmesh Goldman in a mire of lawsuits if it has the slightest grounds for believing that it colluded illegally with previous administrations in financial engineering that crossed red lines.

Greece can also explicitly invalidate any private contracts through which it ends up being a counter party to but which it doesn’t know about.

In short, plenty of French and German banks have been skinny dipping where Greek sovereign debt is concerned. Greece can pull the plug in the pool. Or it can threaten to. I’d certainly buy tickets to see that spectacle.

Sorta in this vein, the Guardian/Le Monde HSBC story which broke just yesterday refers to 30,000 hidden accounts HSBC set up to allow clients to hide, at least at one point, 78 billion euros. Likely some of it was from the Greek oligarchy and should provide additional fuel for Syriza.

“http://www.theguardian.com/news/2015/feb/09/hsbc-senate-democrat-us-government-biggest-leak”>

I suspected as much.

I am no defender of Goldman but read this article and put it into perspective: http://www.risk.net/risk-magazine/feature/1498135/revealed-goldman-sachs-mega-deal-greece

Note that Greece was under the thresholds for admission prior to the deal. Also note that Eurostat wanted the swaps counted as debt. But the Euro FMs insisted the swaps be kept off the books. And, lastly, many Euro countries completed the same swaps, including Germany.

All of this leads me to ask, why was the Greece-Goldman deal such a big story? I think I know. Misdirection and distraction. If the banks can say, we didn’t know about Greece’s debt, the argument is made that taxpayers should make the banks whole. But they did know. Everyone knew.

Like Watergate, the crime, then, is in the cover up (‘We didn’t know’).

As I mentioned before, treat it as a crime.

Go after the bankers and the oligarchs.

“We defeated the Xerxes-following Persians before. We will beat the Xetra-worshiping Teutons now. Remember Thermopylae!!!”

This sounds very interesting. And it makes Varoufakis’ plan look like an olive branch.

I read this, one explanation of Greece’s end game.

“Greece is now betting everything that Europe will not allow it to exit, hoping that “this time is not different”, and the existential terror that would be heaped on the Eurozone… will still take place, and Europe will concede that spending a few more billion on Greece’s bridge program is worth it, to avoid what could potentially spiral into an out of control collapse.”

Since Yves continues to state that Syriza has no intention of Grexit, then this theory makes some sense.

There are no legal provisions for any sort of exit of the Eurozone: nobody is supposed to leave and no institution can force an exit. Therefore the only possible exit is voluntary: if Greece wants to stay in the Eurozone, it will stay.

Exiting the Eurozone would require a much more radical socialist program than Syriza is willing to implement at the moment: Greece would have to become the Cuba of Europe in order to survive the “Grexit”. So far they only seem to try to be something like Venezuela or Ecuador.

The end game for Greece is to gain enough time to implement their program, increasing income (taxes, profit from unsold/recovered state companies) and reducing costs (largely by not paying the debt, half of which is already being written off for the never-paid German debt of war, but also by reducing military spending and other “luxuries”). I presume that they will also withhold the debt to Britain until the Parthenon marbles are returned, etc. In essence: a debt moratorium is already ongoing and the ball is on Brussel’s court, where the various agents are mostly powerless, more so as several independent powers (Russia, Venezuela) have already hinted their backing to Athens’ defiance.

The main chance the Troika/Germany has is to incite a military coup but that is actually much harder than it sounds because the Greek Army is a conscription army and it is likely that the soldiers (and even many officers) will behave loyally with such a patriotic and popularly-backed government – never mind popular resistance on the streets. Another option could be to provoke a border conflict with Turkey but this kind of development could well backfire inside the Eurasian state, which is clearly very unstable these days. Finally they could try to destabilize the government using fascist terrorism of some sort (again not with any guarantee of success).

As long as they deliver on their promises, and they will within reason, the Syriza government is bound to gain support and stability before it feels the erosion of management. The crisis is not anymore in Greece: the crisis is now in Brussels.

I wouldn’t put it entirely past SYRIZA to make Greece into the Cuba of Europe. That’s not that I think it’s likely to happen — I just wouldn’t put it out of the realm of possibility. You did read this?

https://www.jacobinmag.com/2015/01/phase-one/

Since the Greek army is a conscript army, with the conscripts voting as part of the civilian population, only the officers count in terms of a coup – and they are very pro-sovereign with no love for the Eurozone, not least because their already small salaries were cut 50%. ANEL firstly and SYRIZA second (not as a “far Left” party as EU chooses to describe it, but in terms of patriotic resistance) would best describe their voting preference at this time.

As for a Greek army colluding with any form of pressure emanating from Germany? Impossible to laughable.

Regarding Yves’ comments on France.

If le Front National (FN) wins in 2017 (presidential and parliament), it would mean the instant and brutal end of the EU and, of course of the euro. Some of you may think that that would be a great idea, but be careful what you wish for if you have FN in power in Europe’s No. 2 state.

One has to know a couple of things about France. Elections are done in two phases, with one week intervals (unless a candidate gets +50% in the first round). In the second round, only the two highest scoring candiates are eligible. Marine le Pen currently leads in most opinion polls (+30%), meaning that she would easily get to the second round. Against her would then be either the traditional right or the traditional left. However, the big question is how no. 3 in the first round wuold act; tell his/hers voters to vote as they wish in the second round or “vote against FN, even if it means voting for a candidate with convictions and a programme opposite to yours”. This is what happened in 2002 when the socialists (Jospin) after having lost in the first round asked their voters to vote for the right (Chirac) in order to defeat Le Pen (father) who had managed to come second in the first round.

Fast Forward to 2015, when the traditional right under Sarkozy is clearly internally divided as to how to behave as regards telling their voters how to vote (as they wish or against FN – “le front républicain”). By not having a pact between the socialists and the traditional right, FN’s chances are increasing exponentially.

This is what happened yesterday: http://www.theguardian.com/world/2015/feb/08/france-socialists-doubs-byelection-front-national

Unless the traditional right changes its stance (again), FN has quite good chances of winning in 2017.

FN does not need +50% of the votes, really, unless the traditional parties do not agree to block FN.

Unfortunately the French electorate is totally fed up with the traditional parties. Unlike Greece or Spain, where people chose new parties with fresh programs, the French are moving towards the extreme right.

Merkel should understand that it is in her best interest to kick-start the European economy in order to deflect voters from FN. But I have passed the point of any hope in this regard a long time ago.

If Greece defaults, Syriza govt. falls and is replaced by Golden Dawn. Who then exit the euro. First domino.

Not a chance. GD is an isolated and self-isolating party whose previous power lay in being the secret right arm of extreme right wing Antonis Samaras. When the US government put its foot down in Oct. 2012, its leadership was swept up on rather shaky charges.

Its core members (10%) are neo-nazi, its general membership are the poor & disaffected who have found mutual support and self-respect through its various neighbourhood associations – particularly among youth. This latter has been the secret of its ‘success’ such as it is. Taken together, core + gen. membership, we are still only looking at 7% of the Greek voting public.

Should SYRIZA’s program come into being, the general membership of the party will melt away. To prevent this, GD will have to greatly modify its program / ideology.

Sorry – make that Oct. 2013.

The French voted on Hollande that promised end of austerity, they got disappointed. Hollande promised what was impossible to deliver in the present EU/Euro frame work. Neither Merkel have some magical wand that can instantly reform the EU/Euro system even if she wanted. They have locked them self into a system that they are incapable and maybe even intellectually unfit to reform.

Someone have to break the negative spiral, Marine Le Pen is probably the one. As they said in Germany about Hitler when Heinrich Brünning wrecked Germanys economy with extreme austerity and created unprecedented unemployment, “our last hope”.

Oh gods, the lesser-of-two-evils brain damage has infected Europe because Bonnier and the rest of the MSM don’t make free money if Le Pen wins.

A cratered economy can’t do anything with reforms anyway, so much of the discussion is ideological. Take labor market reforms. In Greece, you have 27% unemployment, a lot of desperate workers. People scrapping for jobs will work for awhile for no pay. Many full and over-timers will agree to part-time wages. There is no regulatory force in the gov’t to insure that worker rights are followed. Effectively, the labor market is already in its wild west stage. In that sense, Greece could cynically free up the labor market and please the EU, but that would accomplish next to nothing. There is really no real mechanism to get this economy out of the deathtrap other than new projects. The only thing Syriza can really do is clean up gov’t. And stop buying military weaponry. That should be JOB 1 and JOB 2 of any Greek gov’t. Not economic reforms.

Ah-hah. I think you’ve got it. To me this post reads like you’ve had an epiphany. Well ok. I’ve just begun to appreciate is this “game theory” stuff myself. In that speech to parliament (Ekathimerini article) Tsipras burned his ships. Which is to say, “you want your euro, we’ll have a new consensus”. There are a lot of people who aren’t going to buy that. But there are a lot more, even though they’ll be careful how they speak in public, that support it. The real question is how that balance weighs on the boards of the EC instutions. I believe it favors the fossils. Portugal & Spain are in the old camp. France & Italy could go either way.

This is the EC’s Lehmans moment. I’m optimistic, but I’m not buying euros. The downside risks are massive.

(Hugo Dixon should not be taken very seriously.)

What changes the picture is if Greece really can get by with no bailout money through at least then end of March. Most observers assume that is not true, and the Troika certainly believes not, but they are biased onlookers. But the lack of a change in the Greek position, now that they’ve gotten firm negative reactions from all their negotiating “partners” makes no sense unless they can go it alone for a while.

As I said, we’ll see where things stand. If they back down at all on Wednesday, beyond cosmetics, it will show they were just bluffing.

Syriza isn’t going back. It only remains to see what the rest of the EZ does. I think Syriza finds enough support to parry this thrust. However, that isn’t a sure thing.

If they run short of cash, I’d think they could give some form of rationing a try. Greece has enough resources, I would think, to feed, clothe and shelter its citizens. And I feel sure they could find a way to get some help with energy supplies from Russia and possibly Venezuela. And of course, they could, and should, nationalize the banks and, above all, the extremely lucrative shipping industry. After tossing all the oligarchs who cheated on their taxes into jail, natch.

This is supposed to be a leftist government, right? So how about taking some cues from leftist governments of the past? So far I don’t see much in the way of revolutionary spirit in Greece. Refusing to accept a poisoned loan deal isn’t nearly enough. Show them your teeth, guys!

Greek shipowners as a general group are not to be confused with the Greek oligarchs, with the major exception of Latsis.

There is no possibility of nationalising shipowners since the majority are not Greek businesses. There is also no sense in it since these businesses are no.1 in the world for a reason: they are run brilliantly.

Meanwhile they contribute in their own way and are extremely patriotic.

Re: liquidity until March, my guess is that Varoufakis is betting that either the austerians will cave in and keep ELA running while an agreement is negotiated or, when Greece runs out of liquidity and ELA gets cut, Greece will set capital controls and issue the IOU (as in fourth option here), which should escalate the situation for the whole of the Eurozone and start highlighting how nude, for instance, Rajoy is with unemployment at 24%, primary deficit of more than 3%, a deflation of a yearly 2% and debt of 100% GDP and growing, if the troika would just apply him the same rules they are applying to Greece.

So, Varoufakis does not want to get out of the Eurozone, but he also won’t look back or cede in the fundamental: no troika humiliation, equal rules for every country, no imposed wage cuts, reasonable growth policies for the EZ as a whole. If needed, he’ll be ready to turn this IOU into a new currency and leave the Euro. I think a referendum for the minimal acceptable plan is a good idea, after the negotiation is closed, be it closed with agreement or not.

The worst possible outcome is a Grexit without any change in policies, which will leave Greece suffering, Europe stagnated and Spain and Portugal suffering for two additional years until the degradation of competitivity plus deflation makes the Euro implosion a fact.

Recognizing insolvency and the terrible effects imposed austerity have had on the people of Greece, an aspect of this where I do perceive possible commonality in views between Schaeuble and Varoufakis is in addressing the level of corruption and tax avoidance in Greece, particularly among the Greek 1 percent.

If auditing issues can be addressed without compromising Greek sovereignty (admittedly a Big “If”), that is an area of governance where the new Greek government might benefit from meaningful and cooperative German assistance. I would encourage Tsipras to consider taking Schaeuble up on his offer of assistance in this area. I believe the Greek government needs all the help it can get in reducing corruption and tax avoidance, and the Germans would be largely independent of the type of internal pressures that might inhibit their Greek counterparts. Just a thought, and I do recognize the possibility of capital flight. But hasn’t that box already been opened?

Keep in mind that the largest scale corruption in Greece has come from German companies, that Germany is sheltering Christofakis (the go-between for Siemens) and not extraditing him, nor releasing information and that Scheuble himself was caught red-handed with bribes in the past (but not prosecuted because, interestingly, corruption was not a crime in Germany)….this angle needs to be handled carefully and the ‘gift’ of help taken with a pinch of salt.

In fact Varoufakis in his press conference with Scheuble made a plea for REAL help in this area not only to Germany but all the EU countries.

Europoly – The Game of Europe

http://europoly.tagesspiegel.de/english/

Time for unions and working people across to:

1. Point out that EU bureaucrats and national politicians driving to drive Greece over the edge do not speak for them

2. Call for a true European political solution that represents the interests of the true majority of Europeans – working people

– short term: a reasonable solution to the Greek “problem” that keeps Greece inside the Euro and ends the strategy of further impoverishing the Greek people

– medium term: the creation of a truly democratic European political entity that can represent the interests of a democratic Europe.

I don’t see how Grexit solves anything.What level of devaluation are we looking at? What are the ramifications of that?

“across Europe,” though not opposed to solidarity actions elsewhere.

I am wondering what would be the perception of european citizens in different countries if the Troika kneels Greece, there is no debt re-negotiation and Siryza is forced to go on with austerity programs. Eurocrats seem to believe that this should be fearful enough to prevent any move in any other country. (note that I avoid the use of “germans” or Germany). I think that french voters would turn to FN with enthusiasm. In Spain, this would somehow stop Podemos in polls, or turn Podemos more nationalistic “FN-style”. The outcome would be a rise of nationalistic parties in Catalonia or Basque Country. I don’t know what could happen in Italy.

Those troika guys are playing with fire.

I think you;’re coming around Yves ;), but …

“And at the moment, the Greek government does appear to have set up some incompatible boundary conditions:”

No, actually not (or at least not necessarily so), because the Europeans will cave. They will be begging them to take the extension by the end of the month – actually the begging has already begun. As you point out, knowing their own fiscal position gives them another advantage. They can announce – maybe even truthfully – that they have enough cash, but the market will never completely believe them. So the financial squeeze on the Eurozone and especially the periphery will start even before Greece is really on the precipice of default.

Its going to be a pleasure to see the thumb screws tighten …

Game theory or poker playing, you have got to be good at bluffing.

Sweet, good to see the notion that Greece also holds some negotiating leverage gaining traction. Basic negotiation and strategy is that if you are unwilling to walk away at any cost, then other players will ask you to pay an absurdly high cost. It’s nothing personal. Just logic.

It has reminded me a lot of that entertaining debate in the US about whether the Democrats are spineless wimps or active collaborators. Collaborators often use weakness as cover so they can claim they weren’t really collaborating.

What’s fascinating about Tsipras is that he’s not playing the weak card. He has been saying directly and plainly for some time now how he views things.

Gramsci used to say that “Truth is always a revolutionary weapon”, and the Eurostuff seems to be a clear case of Emperor clothes badly designed :)

This is somehow off topic, but I am also starting to wonder about US’s position not just on greek debt negotiation but on the more general problem where the root lies: current account surpluses. The US has to cope now with large surpluses of China and the eurozone combined and I guess that sooner or later this will induce a change in policy and the course of globalization. Forget about TPPs and TAPs, here is the real playground.

Wouldn’t this be a good time to discuss systemic restructuring of the EU economy? Rather than making it Greece versus Troika. This is why I can’t get past this being purely insidious on the part of the Troika. They have to reset their system. Grexit or no, there is no other way out of this. Italy, Spain, Portugal, and Ireland are on deck for a thrashing because of their debt. Having an open discussion regarding the faults of the system could be miraculous. Look a Iceland. Most of the momentum created to solve their problems came from an openness to the “impossible”. They prosecuted financiers, they regulated their finance economy, they stopped being a country that followed the herd and instead measured their approach based on what they needed. Europe can either have 5 years or less of misery with a total restructuring or indefinite misery (on very unfair terms I may add).

That they are able to deal with Greece, Spain, Portugal, Ireland, one at a time is a major strategic advantage.

I would look to weaken that.

This is what Varoufakis does when he declares that a Grexit would bring the destruction of the Euro, something that is clearly true with deflation and depression or low growth. While Germany keeps reducing their wages, the Souths unemployment, deficits and GDP will go wrong. Spain has an increasing public debt, now at almost 100% of the GDP, and unemployment very similar to Greece, and is in a 2% yearly deflation, plus pending three elections in 2015. Our position in Euro is clearly unsustainable in the medium term. They are hiding behind the rug that we have the biggest primary deficit in the whole Eurozone, that the “growth” they boost is only due to deflation and that we are not complying with the Stability Pact…

If Greenspan sees Grexit probable, he should also see Spain out in around 2 years, ditto for Italy in 5 years,…

In logical terms, the dilemme is: either the European institutions are changed so that Greece can stay, and then surely, if done properly, Portugal, Spain, Ireland and Italy will be sustainable and the euro will survive, or not, and then the euro will collapse in around two years. Thinking that having Greece out will save the euro is clearly wishful thinking.

This is what Varoufakis has pushed for for years. His ideas have gotten no welcome. And the Germans are unwilling to cede power to the sort of more integrated Eurozone that would be a necessary result.

Introducing a parallel currency in a cash-based economy is complicated, introducing a parallel currency in an economy where most transactions are electronic (credit-card, debit-card etc) is still difficult but a lot easier.

Greece is a cash-based economy. Credit sales are risky as even tax-collectors have difficulty collecting debts.

Maybe Greece can introduce a parallel currency similar to US food-stamps. But to do so then the underground untaxed economy would come to light and that may or may not be popular.

And at the moment, the Greek government does appear to have set up some incompatible boundary conditions: not defaulting, not “threatening the stability of the Eurozone,” which presumably means a Grexit, but also not accepting demands that the Troika is treating as non-negotiable.

This strikes me as a positioning statement. From Syriza’s point of view, they have laid out a plan which they think is reasonable and offers a path forward. If the Troika continues to take a hard line and refuses to negotiate, I imagine that Syriza intends to frame that as the Troika threatening the stability of the Eurozone by choosing not to accept the possible resolution on offer.

In any case, it’s refreshing to see Syriza mentioning some of the Things That Must Never Be Stated Out Loud Even Though They Are Manifestly True. This forces Eurozone officials to respond with the Things That Must Always Be Stated Out Loud Even Though They Are Manifestly False, which makes them look more than a little ridiculous, and lends credibility to Syriza in the court of public opinion. It’s also refreshing to see official acknowledgement of both the humanitarian crisis in Greece and the role of austerity in creating it. The Greek people finally have their own government on their side, even if the rest of the Eurozone remains against them. It’s a first step.

History is written by the victors.

The Troika will exact blood from Greece, and history will be written or they will re-write history to blame it on Greece no matter how the current Greek government is framing the problem.

Sadly, that’s realpolitik and realekonomik.

Realpolitick and realekonomik are German notions. Taking the history of the German nation as a whole, including now – ie the ‘success’ [not!] of the German-dictated EZ economy – just how successful, more to the point: victorious, have these German ideas been?

Here’s what I had to say back in 2012, just before the last Greek election:

“. . . thanks to the “unrestricted free market” in human exploitation worldwide, European workers (along with American workers, of course) are in effect being told, in no uncertain terms, to literally enslave themselves. Otherwise, how can they compete with all the billions of submissive wage slaves of the “developing” world? And if they refuse, as the Greeks may well do this Sunday, why then they will be responsible for the collapse of the European economy if not the world economy, an apparently “disastrous” outcome, leading to the dread EOTWAWKI (End of the World As We Know it).

From this perspective, the whole dog and pony show of recapitalization, austerity, growth, default, EFSF, ESB, TARGET 1, TARGET 2, etc., etc. is nothing but a huge misdirection, intended to confuse the workers of the world as to the true nature of what is taking place. Amidst all this turmoil, the tiny minority of plutocrats and oligarchs is doing just fine, raking in millions if not billions in profits earned on the backs of hapless human beings the world over, conned into believing they have no choice but to sacrifice their very lives to feed the enormous profit machine. What is at risk if they refuse to comply, is NOT their own well being, which will in fact be liberated, but the vast wealth of the super wealthy, whose power very literally depends on the willingness of ordinary people to buy into the swindle.

When the huge monstrosity that “free market” capitalism has become finally collapses under its own weight, the spell will be broken and we can all return to our lives as autonomous human beings rather than pawns in someone else’s game.” (http://amoleintheground.blogspot.com/2012/06/immigration-and-global-economy-part-3.html)

It took well over two years, but the Greeks finally did what I hoped they’d do first time round: respond to the “crisis” with a big fat NO! But that “no” has to have more than just air behind it. It has to have teeth. Being right won’t cut it. The key phrase in my little screed is: “workers of the world.” Which absolutely MUST, you guessed it: UNITE! Whether or not Tzipris and Varoufakis and their cohorts have the guts for it, Greece must go beyond simply warning the troika (i.e., the plutogarchs) that a disaster for Greece just might be a disaster for them. They need to declare independence from the venal manipulators whose only interest is exploitation. Meaning: they need to embrace revolution — if not on a worldwide scale (preferable) on a Euro-wide scale.

Not only labor as you’ve very aptly described but also land (climate change, respecting our resources) and money/credit which is also not a commodity (the euro has echos of a gold standard) but a unit of purchasing power guaranteed by the state and meant to be used for the welfare and prosperity of that state.

“The case of money showed a very real analogy to that of labor and land. The application of the commodity fiction to each of them led to its effective inclusion into the market system, while at the same time grave dangers to society developed.” (Polanyi)

“What is at risk if they refuse to comply, is NOT their own well being, which will in fact be liberated, but the vast wealth of the super wealthy, whose power very literally depends on the willingness of ordinary people to buy into the swindle.”

Very well said! With even a little solidarity, a much better world for those of us not sharing in the kleptocrats’ plunder is very possible. We outnumber the kleptocrats, and their lackeys, about 7 billion to one on this little planet of ours. If we only wake up about 5% of the anti-austerity billions we have won the struggle!

““We do not intend to threaten stability in Europe,” he said, adding, however, that he would not “negotiate” the country’s sovereignty.”

“Intend” is a weasel word, and a very important one. It acknowledges that destabilizing Europe may well be a consequence of Greece’s position, and denies responsibility for that result. By implication, he puts responsibility on the EU authorities, WHERE IT BELONGS.

Of course, it’s subject to another interpretation, that they won’t do anything that would “threaten stability.” And it’s translated, so we can’t be sure of the original unless we read Greek. But I think the dual meaning is butt-covering. They cannot meet their campaign pledges without “destabilizing Europe” as presently constituted. That was precisely the intention.

““Even if they did, we can find money,” he said.”

Russia? China? Stick it to the oligarchs? It’s very pointedly cryptic – and there may be a threat buried in the opacity.

They can sell all the tanks they were made to buy. Greece had the highest % of military spending to GDP of the Eurozone even when it was under the Troika’s tender care. Tell me how THAT was justified.

I just heard the opening Parliamentary statement by the new Minister of Defense. He noted inter alia that he would not be signing the chit for a 71 million euro “maintenance fee” for 20 helicopters ordered for delivery in 2013. Of those that have arrived (9), only two (2) have been deemed service-ready, and one of the two is already out-of-service and stuck on Crete. He’s not going to play ball with the war materiel provenders, and unlike Varoufakis and Tsipras, he’s not a really personable kind of guy.

The more programmatic statements I hear by new ministers and MPs, the more I sense that what Greece’s new government actually hopes to do is construct a state modeled along the original vision of the EU’s post-WWII architects. I leave it to other more learned commentators to contemplate how pleased the EU will be with such a model/state.

LOL!! In fact he looks like a stone cold badass and sounds even meaner…

Sounds like an excellent choice – especially to fend off Golden Dawn: “badass” is one of their chief selling points.

Turkey is an existential threat to Greece. They should be buying more tanks, not selling the few they have. Greece is the only thing that stands between the Islamic Middle East and Christian Europe. You would think the eurocrats in Brussels would ponder that carefully before destroying Greece. But what do you know, greed and short-sightedness win again.

“Greece is the only thing that stands between the Islamic Middle East and Christian Europe.” Tell that to Bulgaria.

Unfortunately for Greece it would pay a price from Turkey as it has in the past for having a weak military.

It would have no sort of deterrence to the constant incursion of Turkey in to Greek territory. And it would undoubtedly lose territory and life again.

Buying new unwanted and unnecessary French and German military equipment has been a CONDITION of the Troika memoranda to Greece. Against the will or needs of the Greek military.

“Even though the odds of Syriza prevailing are still remote” –

unless their real intent is to get themselves kicked out of the Euro.

As I keep saying, Yanis Varoufakis sincerely believes this would be a disaster for Greece, and Greece is already in the midst of a humanitarian crisis. Americans keep projecting their beliefs on the situation without understanding how desperately bad conditions are there. Any worsening of conditions for any length of time only strengthens Golden Dawn, which is providing services, like feeding people, but only ethnic Greeks.

I think that I’ve already posted this, but Yanis Varoufakis has publicly provided his rationale before:

I agree they are much better off united with Spain, Portugal, Italy, etc.

Are they making any progress on that front, perhaps in secrecy at the present moment, as we speak?

Or else, its’ divide and conquer.

Your extract only covers what Varoufakis has said about IMMEDIATE effects. He thinks the long-term effects are worse:

Secondly, An exit from the Eurozone would have devastating effects that the current primary surplus, even if it were real, would not be able to cover for. The exodus of capital would necessitate an effective withdrawal from the EU.

http://yanisvaroufakis.eu/2013/07/24/can-greece-get-out-of-the-eurozone-now-should-it-comments-on-munchau-and-sinn/

It would be a disaster if Greece were to be forced out of the euro. For Greece and for the euro, and Europe at large. There is no need for that. If the Eurozone cannot survive intact the democratic election of a government that seeks to put an end to its people’s suffering, it is doubtful whether a United Europe is still possible.

http://yanisvaroufakis.eu/2014/12/11/ten-questions-on-greece-syriza-with-ten-answers-qa-with-jorge-n-rodrigues/

Pretty much everyone agrees that for a EU county to leave the EU is a terrible idea. It would put them at a big disadvantage in terms of trade and tourism.

More Varoufakis (emphasis his):

In the case of Greece it simply cannot. And this makes a world of a difference. Why? Because of two important reasons. First, because of the crushing delay in introducing a new currency. Secondly, because of what I call the bifurcation between the stock of savings and the flow of incomes. But let me take these one at a time.

Delay: Bank of Greece colleagues tell me that it will take months before ATMs are stocked with new drachmas once they get the go ahead to print them. Even if it takes weeks, an economy cannot remain un-monetised for so long, especially when already on the canvass of a deep crisis, without major civil unrest and an almost terminal effect on economic activity.

Bifurcation: Even ignoring the crippling effects of the delay, we must not forget that the ongoing crises has led Greek savers to withdraw oodles of their savings from Greek banks and either shift them offshore (London, Geneva, Frankfurt) or stuff them in their mattresses, or hide them in their freezers (in ‘bricks’ of 500 notes). This means that, by the time we come to an exit from the euro, the stock of savings will be in euros and the flow of incomes and pensions (once the banks re-open) will be in drachmas. So, unlike in Argentina, a Greek euro-exit will drive a wedge between stocks and flows, savings and incomes; with the former revaluing massively relative to the latter. Moreover, the very availability of such large quantities of ‘hard’ currency savings, in the hands of the average Dimitri and Kiki on the street, will ensure that the decline in the value of the new drachma will be precipitous (something that did not happen in Argentina since most savings were in pesos also).

In short, even if we neglect the devastation caused by the delay in the introduction of the new currency (something Argentina did not have to worry about), the new currency will be debased ever so quickly due to this bifurcation, leading to hyperinflation and the loss of most of the competitive gains we might have hoped for from the devaluation.

When Argentina defaulted and broke the peg, the ill effects on its trading partners (China, Brazil etc.), as well as on the broader macro-economy in which it was functioning, were negligible. If Greece leaves the euro, however, the results will most certainly prove catastrophic for our ‘economic ecology’, and in a never-ending circle of negative feedback, will bite our struggling nation back.

3rd difference: Greece is perfectly capable of poisoning the water it is swimming in (Europe)

To begin with, Greece must exit not only the Eurozone but also the European Union. This is non-negotiable and unavoidable. For if the Greek state is effectively to confiscate the few euros a citizen has in her bank account and turn them into drachmas of diminishing value, she will be able to take the Greek government to the European Courts and win outright. Additionally, the Greek state will have to introduce border and capital controls to prevent the export of its citizens euro-savings. Thus, Greece will have to get out of the European Union.

Setting aside the domestic ramifications over loss of agricultural subsidies, structural funds and possibly trade (following the possible introduction of trade barriers between Greece and the EU), the effects on the rest of the Eurozone will also be cataclysmic. Spain, already in a black hole, will see its GDP shrink by more than Greece’s current deflationary record rate, interest rate spreads will tend to 20% in Ireland and in Italy and, before long, Germany will decide to call it a day, bailing itself out (in unison with other surplus countries). This chain of events will cause a bitter recession in the surplus countries clustered around Germany, whose currency will appreciate through the roof, while the rest of Europe will sink into the mire of stagflation.

How good will this environment be for Greece? I submit it to you, dear reader, that the answer is: Not good at all!

http://yanisvaroufakis.eu/2012/05/16/weisbrot-and-krugman-are-wrong-greece-cannot-pull-off-an-argentina/

Pretty much everyone agrees that for a EU county to leave the EU is a terrible idea. It would put them at a big disadvantage in terms of trade and tourism.

I don’t understand this I have heard that joining the E.U caused a lot of de-industrialization in Greece. If you have a chance can you expand on why it would put them at a big disadvantage in terms of trade and tourism? Wouldn’t there be any positives?

Setting aside the domestic ramifications over loss of agricultural subsidies, structural funds and possibly trade (following the possible introduction of trade barriers between Greece and the EU)

Why would it need these funds from the E.U which were already less than the money flowing out of the country to the E.U in trade.

Would not trade barriers help in this sense by been able to hold that money in the country and spend it there instead of flowing outwards? And also to give new industries to start up in Greece and current ones a chance?

Ms. Smith,

Thanks for the links/excerpts. Suffice it to say, Yanis Varoufakis’ intellectual depth is quite impressive. It’s clear that he derives his thoughtful recommendations/conclusions from a careful analysis of the underlying issues. I wish more high-ranking government officials around the world would follow suit.

In light of the opinions expressed by Varoufakis in your comment, it’s also interesting to review his November 2014 interview with Doug Henwood:

“You have to be prepared to blow the whole thing up”

In the end they have to chose the lesser of two evils.

It’s a bit strange how EU is portrayed in this crisis, Greece and the Mediterranean vs west northern EU, as if the huge chunk of the enlarged eastern EU dosent exist as pawns in the game. Romania is hardly better of now in purchasing power GDP per capita than they where during Ceaușescu austerity repaying foreign debt in the aftermath the debt crisis due to Volker ballooning interest rates. One Greek/Swedish journalist expressed horrors that many Greeks now was almost as poor as Bulgarians. Noone really cares what’s going on in the EU eastern block on poverty and unemployment etc, the exeption is Orban, horror, horror an anti EU nationalist, fascism and Nazism is on the rise then.

I agree with the technical points regarding an exit from the Euro and its consequences, but we have to acknowledge that this is a much, much bigger problem than current and 10-years-future balance sheets. This is about destroying toxic economic culture and moving on. What discussions are being had with respect to the Euro’s relationship to the United States/English cancerous financial systems? Why would they want to be part of a doomed economic calculus? If Greece can form an alliance of the indebted to fight the EU elite with negotiations, so be it, but it will be a catastrophe one way or another.

The indebted countries are even more opposed to Greece than Germany is. They are run by right or center-right governments that capitulated to the Troika. They see allowing Syriza to prevail as tantamount to signing their political death warrants.

While it is still way too early to predict an outcome, a thought occurred to me concerning Tzipris/Varoufakis somewhat parallel to that expressed by Abraham Lincoln concerning Ulysses Grant:

“I can’t spare this man; he fights.”

And it reminds me of Fabius Maximus, the Roman Cunctator (that’s not a bad word), who refused to meet Hannibal on the battlefield.

He fought a different fight by his delaying.

george washington also became a master of delay.

and he learned to listen to commoners, the leaders of the rabble of boston–with great reluctance.

and let us hope that our talk of generals remains in the realm of analogies.

For those handy for London:

Defend Greece – protests

Wed 11 Feb and Sun 15 Feb

Emergency protests against the actions of the ECB

Wed 6.30pm. Let Greece Breathe – banner drop, Big Ben

Sun 1pm: Solidarity demo. National Gallery, Trafalgar Square

Organised by the GSC and Syriza London.

See Facebook for details.

Interesting little snippet in an otherwise fairly bland profile of Yannis Varoufakis in this weekends Financial Times. It quotes the prof who hired YV back to Athens University:

“… He made an important contribution, among other things, to our expertise on game theory”.

Note that this prof is now the governor of Greece’s central bank.

the population of greece is just a a bit smaller than the population of ohio.

within europe, it is closest in size to belgium, the czech republic, and portugal.

germany, uk, france, italy, and spain all have more than 4x the population of greece. germany is 7x.

all the scandinavian countries are smaller, and ireland is smaller yet, than greece.

perhaps being smallish does make it a bit easier to maneuver, in various ways.

in a polity of 11.3 million, all the networks in the capital city are likely to be small enough that you know everyone else in your field of operation.

no doubt the identities of the oligarchs are well known to many people.

In defense of germany…

no the rapture is not nigh…

Germany has always stretched…she had no choice…unlike Spain, the UK, France and somewhat with Italy, she has no colonies to strip mine and never did…even though JFK and Ike forced the North Atlantic Treaty to be upheld with the release of direct control over former colonies…the SUFI euro economies never gave up economic control of their former colonies…

in respect to if PIIGS CAN FLY, only the greek bailout kept funds in Europe. Irelands banking system had loans in the US and other parts of the world, Portugals banks are deep in Brazil and parts of Africa, Spains banking system is all over Central and South America, the UK banking system supports all the Commonwealth Nations and there is still a CFA (Communauté Financière d’Afrique) for 145 million people in 14 countries of Africa that were former French Colonies. Italy, although no longer knee deep in Libya, still has multinationals who have Italian Banks funding their exports across the globe…So if the SUFI+I Euro economies were honest, Greece might have a clean chance at a deal, but they will try to piigy back on any deal Greece might get, even if that would realistically be inequitable…

Greece invented democracy. Let’s see if she can resurrect it again

from the importunities of the capitalists. Whatever it takes Greece.

So, I thought this was pretty relevant to the situation. The archaic use of idiot (ἰδιώτης) would be a nice description for the EU technocrats. Very appropriate when used in its original application, meaning one who is, as a citizen, private (reasons as an individual) as compared to one who interacts with the οἱ πολλοί to establish “truth” or “reason”. It is difficult to be a citizen of the EU when actuarial tendencies obscure the realities of day-to-day existence. The original usage of the term would best be applied liberally to nearly all in charge of global affairs. They all appear to be outdoing each other.

To enlarge on that, the ‘idiot’ in Greek terms is the person who refuses to take up his responsibility in terms of participation in democratic decision making, one who refuses his public role / duty / responsibility, ie remains unengaged, ‘private’.

No way to tell what Yanis thinks, either when he made earlier statements or now, while he works with other bright people in a situation that likely concentrates minds.

However…

It is clearly not correct that Greece would face a delay printing Drachmas… they can and do print Euros now, so just add a D to the serial number, distinguishing from old euros printed in Greece (already market with a Y)… all ‘D’ notes are now Drachmas. Plus, all Y serial numbers above a certain previously issued number is a drachma. Consider too that printing existing notes with slightly different designations mean they of course work in Greek ATM’s. Regarding problems for other countries, banks would of course be on the lookout for ‘D’ marked notes…

Imagine, then, having printed and loaded ATM’s with new drachmas over a short banking holiday, that

a) greece declares one drachma = one euro.

b) greece states it will not accept euros for tax payments, only drachmas, as is typical for all sovereign governments with their own currency.

c) greece enforces tax laws and hits the oligarchs with major tax bills, hits the profitable Greek shipping fleet, etc. (Yes, it may be necessary to sack most or all existing corrupted tax collectors.)

So, if greece does not spend much more than tax collections (remember they are now running a primary surplus), the demand for drachmas might easily exceed the supply, i.e. drachmas rise against the euro (yes, that is not desirable, so they must deficit spend at a higher rate and hire more people for needed infrastructure, i.e. a feature, not a bug.)

But what about critically needed imports, particularly fuel and medicines?

a) IMO it will not be that long before foreigners accept drachmas because their value in greece will not fall much vs. euros. And, in the short term, Russia would likely loan them some oil… indeed, they might even give them some to push back against western sanctions.

b) regarding other critical imports e.g. medicines, consider first that they don’t have any now… but again, IMO pretty soon the drachma will be accepted for trade.