By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

The oil-price plunge hit the industry when it was drunk on its own exuberance and awash in money. At the time, over-indebted junk-rated drillers had no trouble borrowing even more to drill more, efficiently or not. Dreadful IPOs flew off the shelf. Misbegotten spin-offs made Wall Street a ton of money. But in July, everything started to go awry. By October, it was clear that the oil-price plunge wasn’t a blip. By November, oil was in free fall.

Soaring production in the US, reaching 9.2 million barrels per day in January, and lackluster demand have caused US inventories to balloon. The “oil glut” was born.

So the industry adjusted by announcing waves of layoffs, whittling down operating costs, renegotiating prices with suppliers, and slashing capital expenditures. The number of rigs actively drilling for oil – a weekly gauge that indicates what’s going on in the oil field – has plummeted by 553 rigs, or 34%, since the peak in October. Never before has it plummeted this fast this far [The Fracking Bust Hits Home].

The crashing rig count was supposed to curtail production, and lower production would bring supply and demand into balance and allow the price of oil to recover. But the opposite is happening. And Devon Energy Corp. just told us why.

With total operating revenues of nearly $6 billion in the fourth quarter 2014, Devon isn’t the largest oil company out there, but it’s one of the larger players in the US shale revolution.

It reported Q4 results on Tuesday evening. According to its own measure of “core earnings,” it made $343 million. According to GAAP, it lost $408 million, after writing off “asset impairments” of $1.95 billion “related to the recent drop in oil prices.”

Stuff happens when the price of oil plunges.

But production soared – and will continue to soar. CEO John Richels explained the phenomenon in the press release:

We expect to sustain operational momentum in 2015 with the significant improvements we have seen in our completion designs and a capital program focused on development drilling. With strong results from our enhanced completions and a focus on core development areas, we expect growth in oil production to be between 20 and 25 percent in 2015, even with a projected reduction of approximately 20 percent in E&P capital spending compared to 2014.

So, despite slashing the capital expenditure budget by 20%, the company’s oil production in 2015 would grow 20% to 25%.

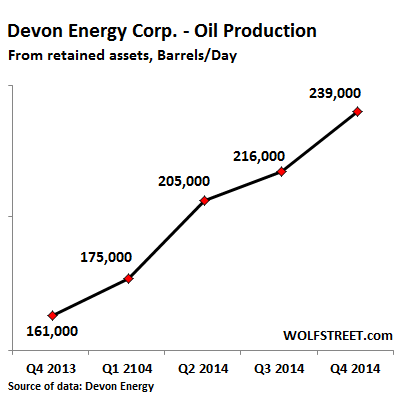

And in Q4 2014, production of oil, gas, and natural gas liquids from Devon’s “retained assets” had soared to an average of 664,000 oil-equivalent barrels (Boe) per day. This included record oil production of 239,000 barrels per day, up 48% year over year. While bitumen production in Canada grew more slowly, oil production from fracking in the US soared 82%!

This chart shows Devon Energy’s oil production for the last five quarters:

Oil production is projected to grow another 20% to 25% in 2015. This is how Devon explained the phenomenon:

The strong growth in U.S. oil production during the quarter was largely attributable to prolific well results from the company’s world-class Eagle Ford assets. Net production in the Eagle Ford averaged 98,000 Boe per day in the fourth quarter, a 100 percent increase compared to Devon’s first month of ownership in March 2014.

And in 2015, it expects a 50% increase in production from the Eagle Ford shale.

Devon liberally praised its “significant scale in core plays,” “a consistent focus on efficient operations,” and “significant improvements in completion design.” In other words, it would spend less, it would use fewer rigs, but it would spend more efficiently – and produce more oil.

Oil – not natural gas. The price of natural gas has been a fiasco for years, and Devon has been moving away from it by selling assets and focusing its resources on oil-rich plays. Hence, natural gas production has actually edged down over the last three quarters even on a retained assets basis.

Devon will drill $1.1 billion in capital expenditures into the ground to achieve its oil production goals. It will use fewer rigs but accomplish more with them: its drill times, thanks to innovation, have improved by 47% over the last three years. And these rigs will be focused “almost exclusively” in DeWitt County, its most productive play in the Eagle Ford shale.

Other drillers are doing the same. Innovation, design improvements, efficiencies, and a relentless focus on the most productive plays will see to it that production continues to rise, despite the plunging rig count, despite the evaporating capital expenditures, despite the layoffs.

They will lose money. They have a lot of debt because the fracking boom was funded by debt. To stay alive, they must meet their interest costs. But if they slow down drilling, and production tapers off in line with the steep decline rates of fracked wells, their interest costs might eat up 50% or more of their shrinking operating profits, and the risk of default would soar – turning off the money-spigot entirely. Default might be next.

This is the brutal irony: drillers are hoping that rising production achieved with greater efficiencies allows them to meet their interest costs; but rising production pressures the price of oil to a level that may not be survivable long-term for many of them. They can lose money, burn through cash, and keep themselves above water through asset sales for only so long. And this is the terrible fracking treadmill they’ve all gotten on and now can’t get off.

In Canada, the floodgates opened in December. Perhaps it had something to do with oil, Canada’s number one export product, whose price plunge has triggered extensive bloodletting in the Canadian oil patch. Or perhaps foreign investors got spooked by something else. Read… Money Is Bailing Out of Canada

There was an interesting economic article, down the memory hole now, from the Franco-Prussian War, how Germany forced France to pay war reparations, which France was quickly able to do by two rounds of (fiat) bond financing. Thus Germany received insane amounts of liquidity insanely fast, which shattered the imperial economy and led ultimately to the German Revolution of 1918, at the end of WW1.

Germany was later forced to pay reparations of its own for WW1, which caused unimaginable austerity that we can scarcely imagine now. Listen to Hitler translated to English sometime. Instead of a raging maniac howling in some Gothic nightmare, his words in English almost exactly parallel FDRs, how Germans have to pull together as a people, how everyone has to share the burden and lift up their fellow citizen, how your money Jim is in Frank’s house, and your money Tim is in Steve’s business, and how all the tribes have to unit as one Republic to throw off the yoke of economic ‘Marxism’, (what that word meant to the German people at that moment in time was probably Stalin’s purges, not Trotsky’s permanent revolution).

Now we have the US$ running rampant on a field of $18T in illegal onerous debt, the economic equivalent of fracking, that’s bringing a surging influx of foreign investment capital no different from the fracking fields. But the valuations are all gone. Everyone knows it. We will see horrific plays on the American economy to keep that inflow of foreign capital coming in, while terrible GAAP realities are hidden by balmy words and ruthless public austerity programs, that we can only imagine now, even with 100,000,000 jobless/homeless already.

But then despite Hitler’s efforts to unite the German tribes and bring them out of the post-WW1 Depression ‘by their own bootstraps’, the world launched into WW2 anyway, over ‘lebensraum’, a German word for ‘blue chip assets inflation’, and as evidenced now by average rents in the inflated US R/E market soaring above Social Security fixed incomes, creating a tsunami of seniors about to be pushed out to the curb, at the same moment as the State is cutting health and human services by, if Congress gets its way, -8% in FY2015.

It won’t be long before seniors are auctioned off to the lowest bidder, shuffled from one fly-blown flea-invested flop house to the next, their final days on earth as involuntary biopharmaceutical drug interaction experiments by the Chosen, and as their children wander, Strangers in a strange land entirely owned by the Rentier Class, staffed by unlimited hordes of H-1B techies and savants, and served by a 40,000,000 ‘Blue Visa’ underclass. This is all happening in plain view, right now, today.

The elderly US quintile is the only group which still holds wealth. Congress has just given the key to that wealth, and to all American passbook savings, to the Chosen, who will speculate along with the EuroTrash and the Saudi Royals, in driving up US real property to unsustainable and unreachable levels for Americans. And when that wealth is gone, and all the jobs are gone to the H-1Bs and the Blue Visas, can you imagine?

Can you imagine the Second Wave, after the seniors are liquidated?!

Of course we have to be chipper, and ‘remain calm’ like poor Poroshenko, turning a blind and bland public face to the audience, while his -$50B in the red State Matrix collapses behind the facade of triumphal exceptionalism. Pay no attention to those men behind the curtains!! Live! Work! Die! Arbeit Macht Frei!

Retrieved from the hole, the article referencing the Franco-Prussian war is by Pettis . Required reading.

“http://www.nakedcapitalism.com/2015/02/michael-pettis-syriza-french-indemnity-1871-73.html”>

the latest (feb 6) production and inventory figures are graphed here: rig count still falling, oil production and oil glut still rising…

but new data is out today…use these links this afternoon:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRFPUS2&f=W

http://www.eia.gov/petroleum/supply/weekly/pdf/wpsrall.pdf

… and the eia’s Wayback Machine takes us all the way back to 1973, coincidentally the year of the OPEC oil embargo, for comparable U.S. production levels. Funny, that… message in a barrel?

Thanks for the links, rjs.

i assume you are suggesting this example is systemic. In which case, what we have been expecting to see? A short term over shoot but an equilibrium supply in the coming. Leading to my next question, how much time can really be bought using cash reserves?

Yes Karl, good basic question. Mr. Richter offers a lot of negative hyperbole but no clear metrics on the key points. How much cash do these operators have, and how long can they last at today’s and potentially incrementally lower prices, and Second, why, really, have prices not plunged lower??? Truly valuable analysis.

It is curious, that in the face of the wide exposure of the specific (widely available) numbers on the “Glut”, prices seem to be in a range. Even though the growing glut narrative is EVERYWHERE. Why is that? The price seems to be defying the basic law…..supply/demand…..why is that?

Its not because everything is going into storage, that story has been out there for 3 months now. The talking heads drone on and on “..80 year high..”. Has there EVER been such an example of S/D dysfunction as this? Hell, futures indicate higher prices. Why EXACTLY is that if we are in the middle of an EPIC GLUT.

It is also interesting, foreign oil imports into the US continue decreasing, materially. Does it seem….accidental…..manipulated…..strategic…..?

Contributors here, who wail and moan about nefarious insider dealings, and “the chosen”, illegal QE, manipulation,….do not seem to understand…….every economic system organized by human beings is a house of cards…..its ALL BUILT ON CONFIDENCE. Every one of us depends on it – EXTREMELY DEPENDS. Can you imagine what would happen if there was a complete rout of confidence in our systems? None would be happy. Wailing only goes so far, it becomes static, or it compromises confidence, incrementally. Lets help each other with the facts. At least we can trade that, or possibly organize our lives around the potential outcomes, if we choose.

The ubiquitous ever present ability to grind the negative narrative (which sells) is affecting confidence. Kneecap confidence in our system at all of our peril.

Ask the immigrants who do the grunt work in America what they think of this Country. I do, constantly. I’ve never heard anything but extreme devotion and love.

Get up and make something positive happen tomorrow. We need more of that. These droning complaints and chicken little assertions of impending doom……..THEY DO NO GOOD.

Unless you can trade them, but for that, we need all the facts. Not, dramatic, negatively biased hyperbole.

First, there are other producers who are behaving in the same way as Devon. To call them unrepresentative as an example is bollocks. Every OPEC producer is continuing to pump, and every indebted oil and shale gas producer has strong incentives not to cut production. But they ALL have incentives to cut costs and to try to talk the market back up. You are trying to dismiss obvious, industry-wide incentives and conduct as “negative hyperbole” Good luck with that. Even BP says they expect oil prices to remain low for the next three years.

Second, there is no good data and if you know anything about oil and gas, you should know that. To demand of Wolf something that no one has is utterly disingenuous.

See here:

http://www.slate.com/articles/business/moneybox/2008/06/barrel_fever.html

And a more recent example:

http://www.nakedcapitalism.com/2014/10/drilling-deeper-new-report-casts-doubt-fracking-production-numbers.html

Also the tone of your comment strongly suggests you have a vested interest.

“These droning complaints and chicken little assertions of impending doom.THEY DO NO GOOD.”

Complaints and assertions are the reason NASA has three or five redundant computers, so we don’t have another Challenger disaster, because they forgot to re-check their altitude:density calculations for the ‘go to full power’ countdown that fateful day. The harsh social causality of unregulated market transactions and opaque deep state interventions demands it.

“Banksters, go to full investment!” Oops! Kablooey! Fire in the sky. Black rain… Black rain….

Traders, keep on trading. They will trade right until the very end, rolling bones over Christ’s robes. The facts remain, the -$18T US illegal onerous debt is exactly that. Fraudulent, uninsured synthetic debt ‘obligations’ that were illegally transferred to the Public Treasury, just as the illegal unfunded IQ/AF war crimes were, just as the QEn was: State:Corporation Chosen intervention in the financial ‘market’ to their exclusive benefit. Illegal, onerous, yet we will pay interest-only debt on it forever, a permanently dysfunctional market black hole sink, like the soon $T National Security State bleed, [3/4ths of all Federal contracts are for ‘Defense’ (sic), ID, IQ and if Congress has its way, NO BID. ]

BIg Picture is our fifth quintile is being liquidated against their will. Their children inherit the wind.

It’s risk-analysis, not ‘whining’. Look-ahead loss-prevention, not ‘droning’. You can’t trade on it, you can only avoid deep permanent losses. Or, if you have chrome balls, you can still try to short it, but, like currency speculation, that’s the shortest distance between your ‘stack’ and the poor house.

Oh, look! A whole bunch of squirrels!! Buy nuts!! BUY NUTS!!

Here is my question: how much oil can we SuCK from the planet before it does

Irreverable damage??? No one ever discusses THAT. I’m sure the oil beneath the ground(where it should stay) has a purpose………………besides profits !!!

example

“More than 27,000 abandoned oil and gas wells lurk in the hard rock beneath the Gulf of Mexico, an environmental minefield that has been ignored for decades. No one — not industry, not government — is checking to see if they are leaking, an Associated Press investigation shows.”

http://www.nola.com/news/gulf-oil-spill/index.ssf/2010/07/27000_abandoned_oil_and_gas_we.html

The situation is truly grim, and it’s even worse in Nigeria and Ecuador. Example articles:

And these are just the tip of the oil berg.

There is another way to look at Devon.

In 2014 they grew quarterly oil production strongly from 175 million b/d in Q1 to 239 mb/d in Q4. That is growth of 37%. Although Q4 production was 239, the annual average production number is closer to 210.

For Q1 2015 production will be between 250-260 mb/d, an increase of between 5% and 9% over Q4. Their full year production forecast for 2015 is the same as their Q1 forecast.

Devon also have plenty of hedges in place.

So, another way of looking at this is to say that a hedged producer will grow 2015 production by 5%, as compared to Q4, 2014, and they will have no growth from Q1 2015 to Q4 2015.

The 20% growth number on an annual basis is correct but it masks a slowdown in production that is evident from a quarterly view.

Long term hedges are pricey and thus generally not worth the cost. The word I hear from bankers is most of the hedges bought when prices were higher expire in March.

Great comment Noreply!

Wrt to the post this is a prime example of how most financial discussion gets mired in the details and misses the big picture. Break-even is only interesting to the Company operations. The economy requires 5 to 10 times break-even in order to function. Especially now when such a large part of the economy is based not on production but from extracting revenue from ongoing productive efforts, money making money. This means production needs to have enough surplus to support itself as well as the extractive process and for that to happen you need cheap almost free energy.

Unless you believe we can all get rich loaning each other money then bundling those loans and selling them to each other and taking out insurance on all that then bundling those polices and selling those to each other then borrowing more money to pay the payments on the loans and policies and on and on in one big circle jerk.

Comer Magazine

Excellent article about the impact of fiat money and fractional reserve banking on real estate inflation in Canada, an inflation that can only be met with higher rents (our town is seeing +10% YOY increases), even as seniors on fixed income see 0.25% savings return and 0% COLA on SS. Their children are finding nothing but minimum wage jobs, especially with H-1B foreign immigrants taking an astounding 99% of all new high-tech jobs, according to new research, and a Congress preparing five new riders to the Gang of Eight’s plan to immigrate a 40,000,000 sub-minimum wage, no benefits ‘Blue Visa’ service subclass.

Just look at the explosive curve of fiat money washing across the R/E landscape. Seniors will not be able to retire, nor survive when they do. They will be forced from their homes by higher utilities and property taxes. Retail will (is) necessarily collapse. Their children will inherent the wind within a Rentier regime of absentee landlords and local strawboss managers. We will see reappearance of ‘flop houses’ and tenement housing, of work camps and millions and millions unemployed living in their vehicles or in hobo jungle tent camps.

Mil.Gov could clearly care less. Laissez les bon temps roulez! They are joined at the hip with Corporate Chosen. Congress is proposing UNLIMITED fiat funding and NO BID Federal contracts for both DoD and DHS! Congress has just given the Banksters access to every Americans’ passbook savings!! Their Mil.Gov pensions for life are COLA’d every year, and their salaries for life are increased as much, or more, as each new tax increase. They are America’s Nuevo Riche, and the US$ is their Emperor.

Your choice for 2016 will be the Clinton Regime II or the Bush Regime III.

Oh, look!! A scrum of squid! Buy hooks! BUY HOOKS!!

Through Mr. Richter’s blog site I’ve been given news of a law suite in Canada, fought by Canadian citizens and a remarkable lawyer, in which the original and constitutional purpose of the Bank of Canada has been ‘restored’ legally – provided, of course . . . .

http://investmentwatchblog.com/canadians-win-in-court-against-bank-of-canada-enormous-implications/

News of the decision, declared in January of this year, has not _not_ been shared by Canada’s msm: too busy courting the usual stuff and nonsense.

Thanks for your efforts!

McKillop,

I left a long response last night but it disappeared into cyberspace. Thus I’ll leave a link to the decision in April, the latest published (and I’m assuming no decisions have been made since April until January, and COMER site doesn’t claim any), along with the judge’s conclusions for you to read yourself. The judge in April overturned the prior ruling to strike their entire case, without leave to amend. The plaintiffs thus could proceed with some of their claims if they were properly amended, refiled, and plead. The pleadings needed to be specific as to who was harmed (filed as class action on behalf of all Canadian citizens), how they were harmed, and who caused the harm. Nor does COMER on its site make any such claims of having been victorious. In large part, the plaintiff appears to be hinging their case on the word “may” implying the legislature and Bank of Canada and government has obligatory versus discretionary powers to, for example, request and make interest-free loans to Canadian government entities to ensure equal access to health, education, and other public services. Unlike the Prothonotary (has limited powers e.g. deciding if suit can proceed to trial) who struck the case in entirety without leave to amend, on appeal, the Federal judge ruled that while “may” was ordinarily discretionary, its proper interpretation could only be definitively determined at trial. COMER alleges Bank of Canada, a public-owned central bank whose board meetings’ minutes and audits are published in real time, sets its policies in meetings with the BIS and IMF conducted in secret. The next steps would be related to filing the amended claims and a determination if the amended complaints could survive motions to strike and thus proceed. Success in getting a case heard doesn’t indicate future success of prevailing at trial.

COMER v. Bank of Canada April 2014

In other words, the hearing in January was COMER’s opportunity for another try. They haven’t yet reached the stage of discovery and trial. If anybody reads this differently, I’d be happy to be proven wrong.

Update, per Google search:

The defendants appealed the decision quoted above, published in April. The ruling was upheld on January 26 before a panel of three judges. The defendants have 60 days to appeal this latest decision for a final ruling from the Canadian Supreme Court, if they intend to do so.

Attorney for Plaintiff on January 26, 2015 Decision

Thank you for your efforts to explain to me. Like many people I have great difficulty in understanding a court case with its terminologies and procedures. I confess my heart did flip when I read the bit of news made available to me, and jumped the gun, but having read your comment, I am less excited although a tad more educated!

Still, Rocco Galati in the Supreme Court (Nadon) app’t case chased Harper away with Harper’s tail between his legs and the success of that case gives me hope. Oft he lawyers I know about few I consider ‘heroic’

It seems clear to me that Greece will either win, or the new government will fall. But Syriza is not going to capitulate. The most they would do is fib on the terms of the extension and then default later.

What would Syriza gain by agreeing to Germany’s terms? Their entire justification for existence would be repudiated. They would lose all credibility.