Yves here. The Fed’s eagerness to start increasing interest rates was given new impetus by last week’s strong job reports…which seem to have gotten perilous little in the way of critical scrutiny. Reader Scott is an exception:

No, the jobs report was very weak; sorry. Start first with the 18K downward revision to January. Then think about flat hours, below 35 a week, so they’re hiring to keep under that number because of the ACA. Earnings MoM up 0.1%, below expectations for 0.2%. Earnings YoY up 2%, below last month’s 2.2% increase, and below expectations for another 2.2% increase. Household survey came in at 96K versus last month’s 759K, and below expectations of 250K. Labor force participation rate fell from 62.9%, where it was expected to remain, to 62.8%.

So you know based on the earnings and the hours that the jobs that were added were lousy, that confirmed by 23% of them being Leisure and Hospitality, 66,000 jobs, of which 58,700 were restaurants and bars. Somebody said that the bottom 80% of earners saw flat wages, but I haven’t been able to figure out how they got to that number; I’m trying to do so.

The analysis below explains the longer-term data does not justify a rate increase either. So why is the central bank touting the idea? Is it simply to talk froth out of the market? Is it because they don’t like being in the ZIPR corner they’ve painted themselves into and feel no time is a good time, so they might as well start inching out?

By New Deal democrat. Cross posted from Angry Bear

Dear Federal Reserve: *Now* is the time to raise interest rates? RLY?? SRSLY?!?

I am at a complete loss as to why the Federal Reserve might think that now is the moment to begin raising interest rates. I cannot see a scintilla of hard evidence in support, and potent evidence against.

The theory is that the Federal Reserve must start to “normalize” interest rates in order to stave off inflationary pressures, particularly inflationary pressures from wages.

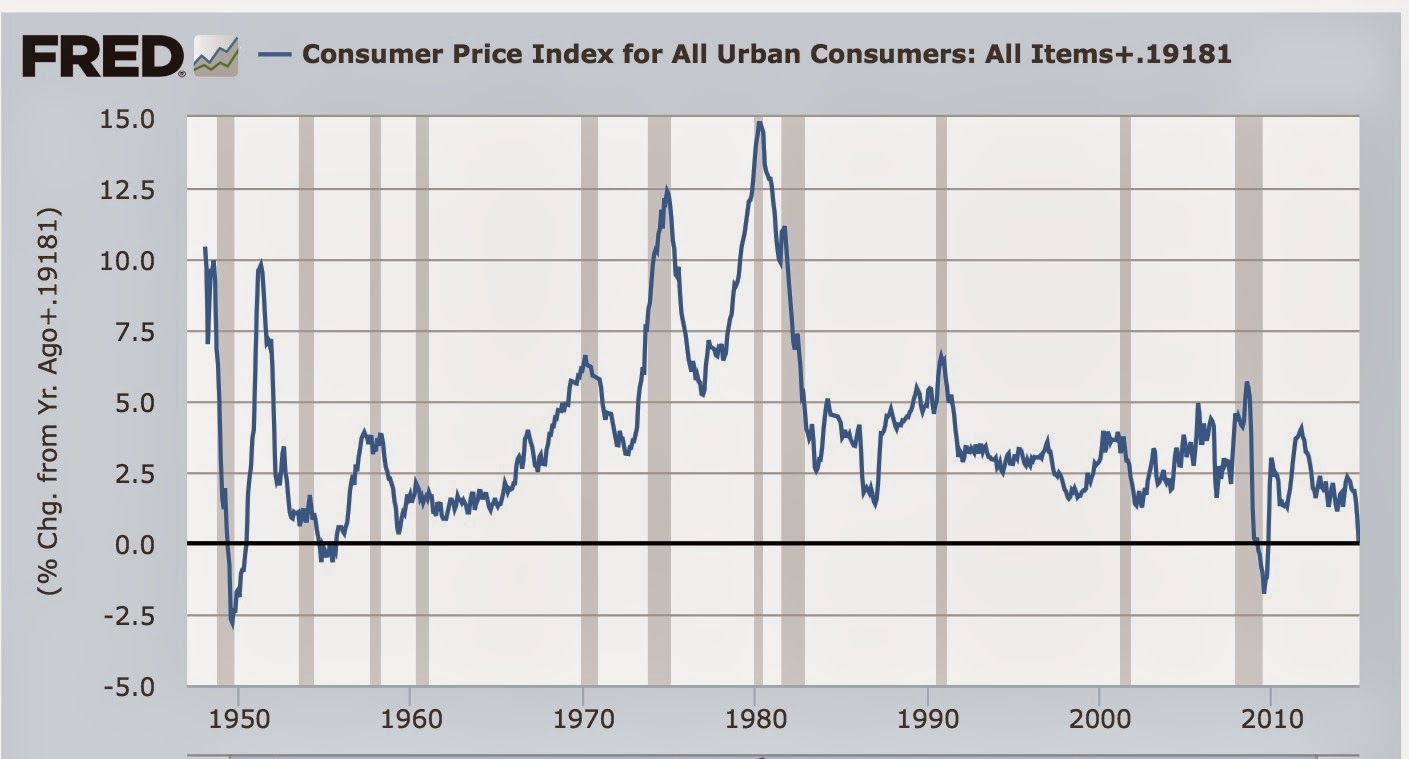

Here is the last 65 years of consumer inflation YoY:

In that entire time, the only occasions on which there was less inflationary pressure than there is now is immediately after the 1950, 1952, and Great Recessions.

The situation is even more compelling when we look at the rolling 3 month average of consumer prices:

(h/t Doug Short for preparing this graph)

In the last half a century, there have only been 2 three-month periods, from November 2011 through February 2012, when there was less inflation than there is now.

In other words, of the last 600 measurements, only 2 of them have been less than now. That’s 1 in 300. In other words, we are in the bottom 0.05% of all measurements. 99.5% of the measurements have shown more inflationary pressure than now.

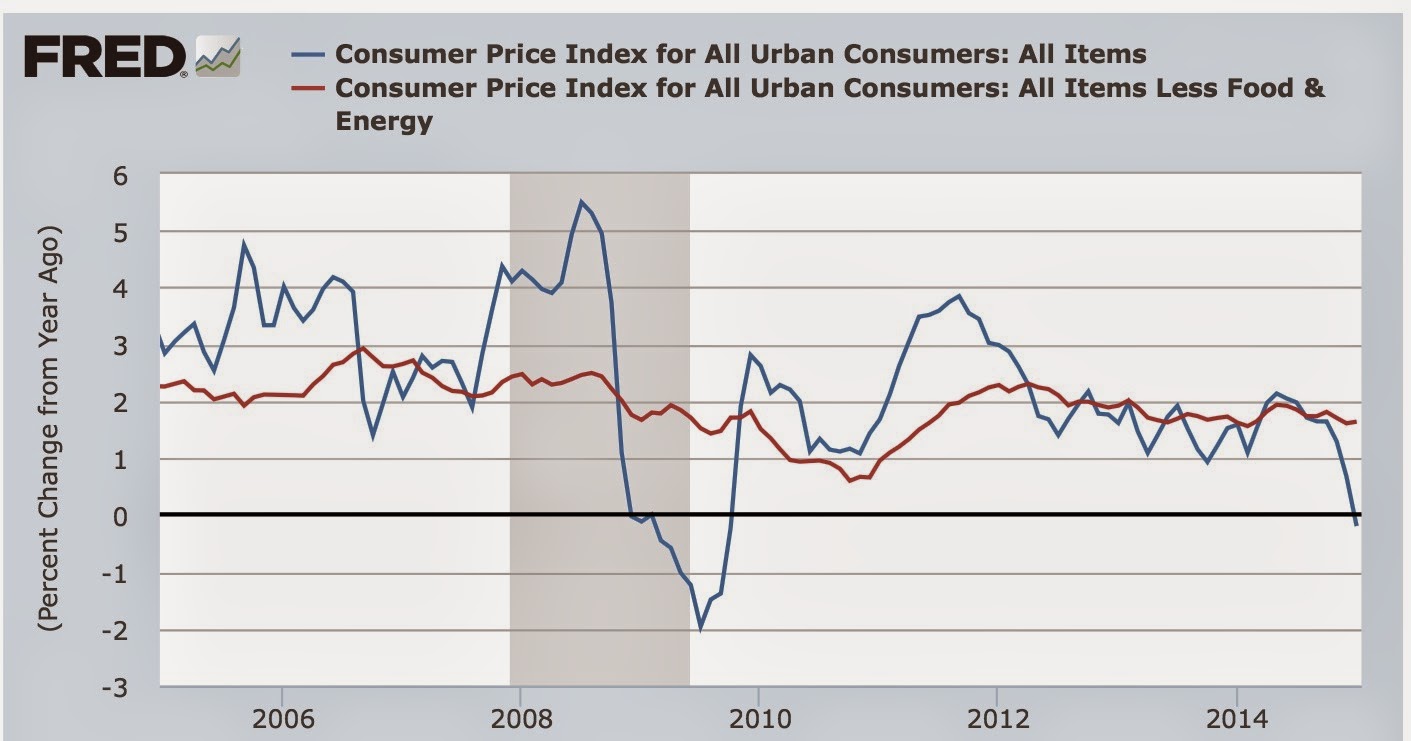

And it’s not likely, based on your own core measure, that we will see much inflationary pressure in the next 12 months. Because as you well know, just as core inflation tends to predict the direction of all prices in the next 24 to 36 months, so it takes 12 months or so for current gas prices to feed through into the rest of the economy:

In other words, it is likely that the core inflation reading is going to move lower for the rest of 2015.

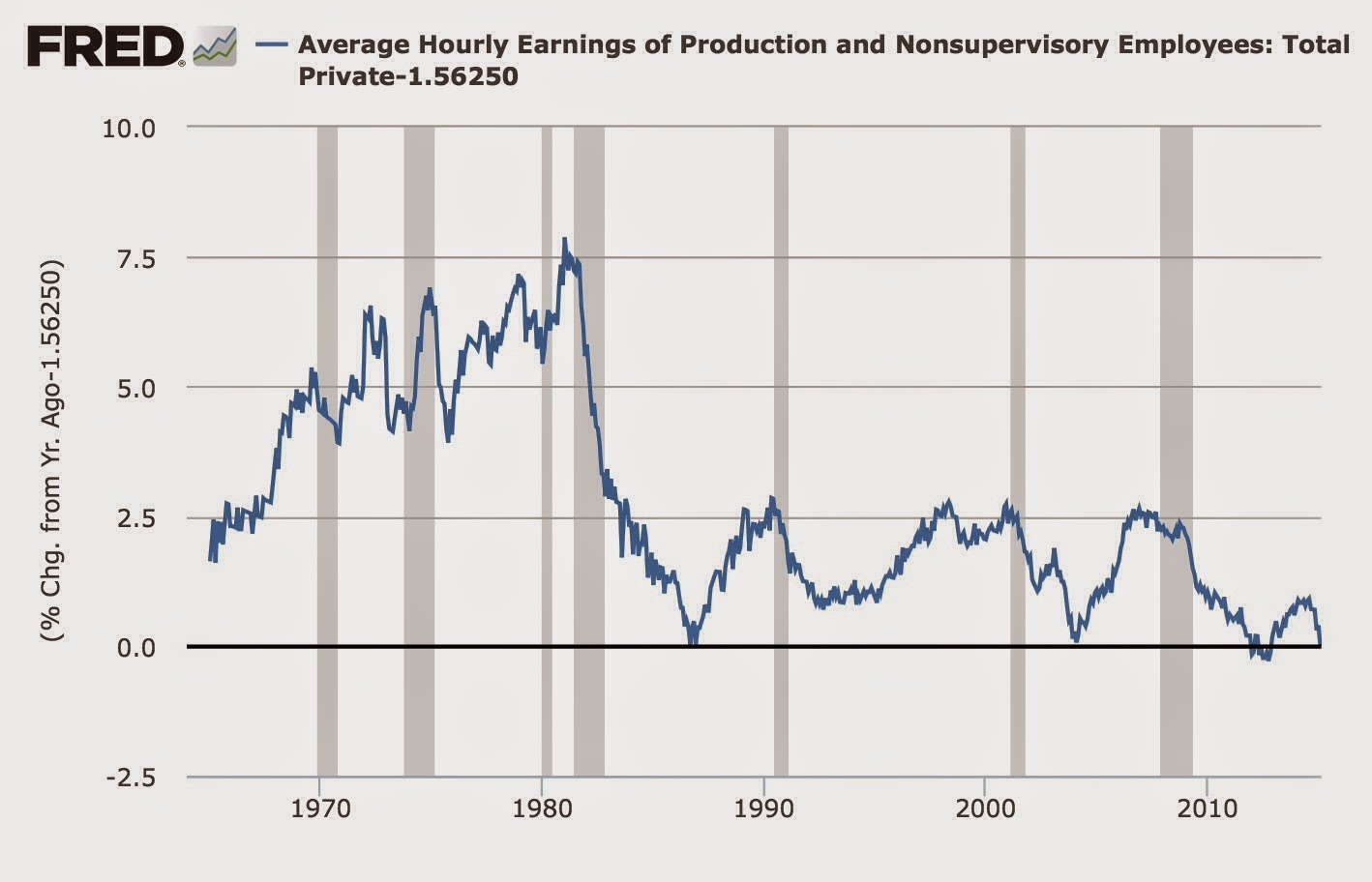

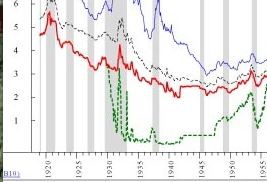

Now let’s look at wage “growth.” Here is nominal YoY wage growth for the last 50 years:

Wages now are putting less pressure on prices than at any time in the last 50 years with the exception of 8 months in 2012. This is wage pressure??? Again, of the last 600 measurement periods, only 9 of them have shown less pressure than at present. That puts us in the bottom 1.5% of all time periods in the last 50 years for wage pressure.

I realize that the unemployment rate just fell to 5.5%, and you think that inflationary pressures might start to build as unemployment falls to 5%.

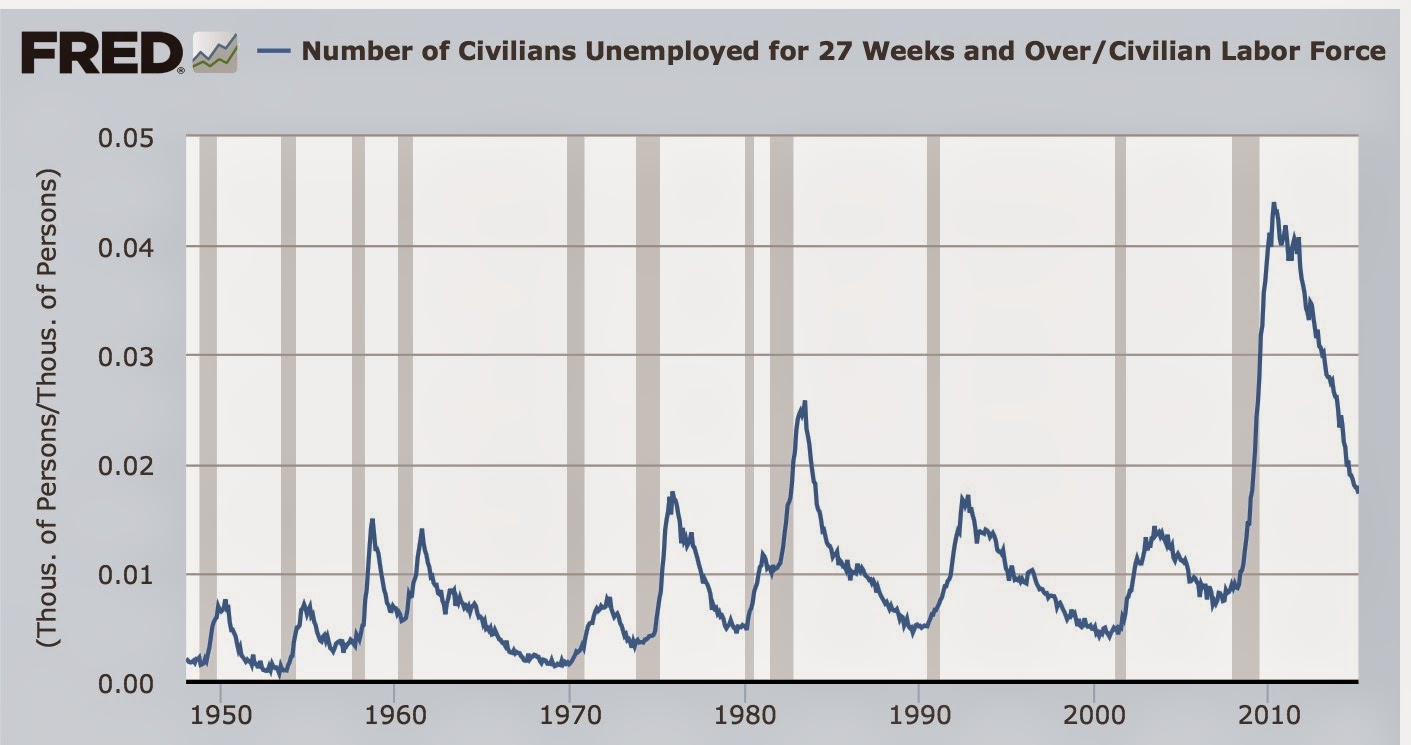

But your own staff has just published a paper indicating that the percentage of long-term unemployed (i.e., people unemployed 27 months or more) is an independent factor in calculating when wage pressure might begin to build. And here’s what that looks like now:

Higher than at any point in the last half century with the exception of the last few years, and coming out of the 1981-82 recession.

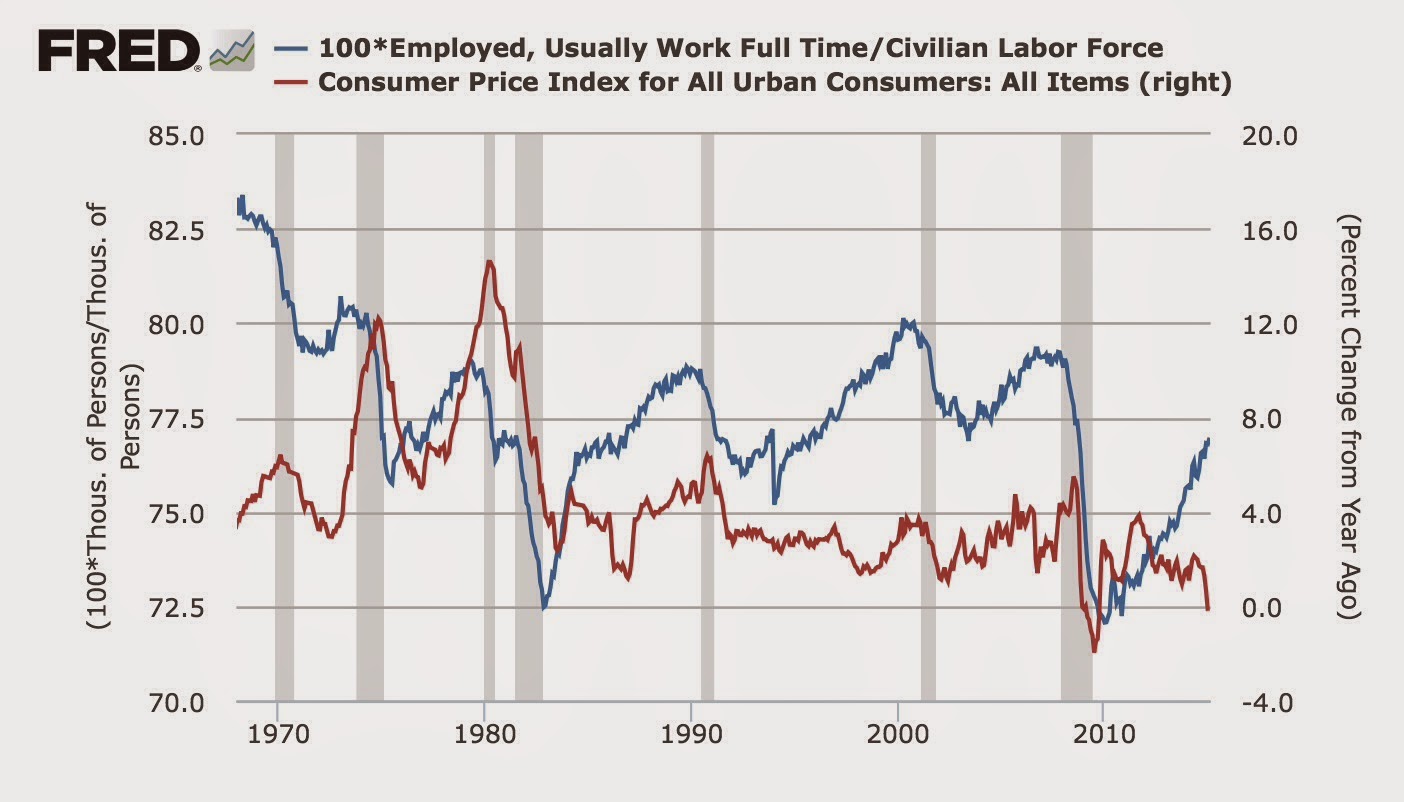

And 5.5% unemployment now is not the same as 5.5% unemployment 10 or 20 years ago. Here is the percentage of the labor force consisting of full-time employees (blue) compared with inflation (red):

In 1998 and 2002 when inflation started to increase off the bottom, the full time employees were 78.3% and 77.6% of the labor force. Now they are only 77.0% of the labor force.

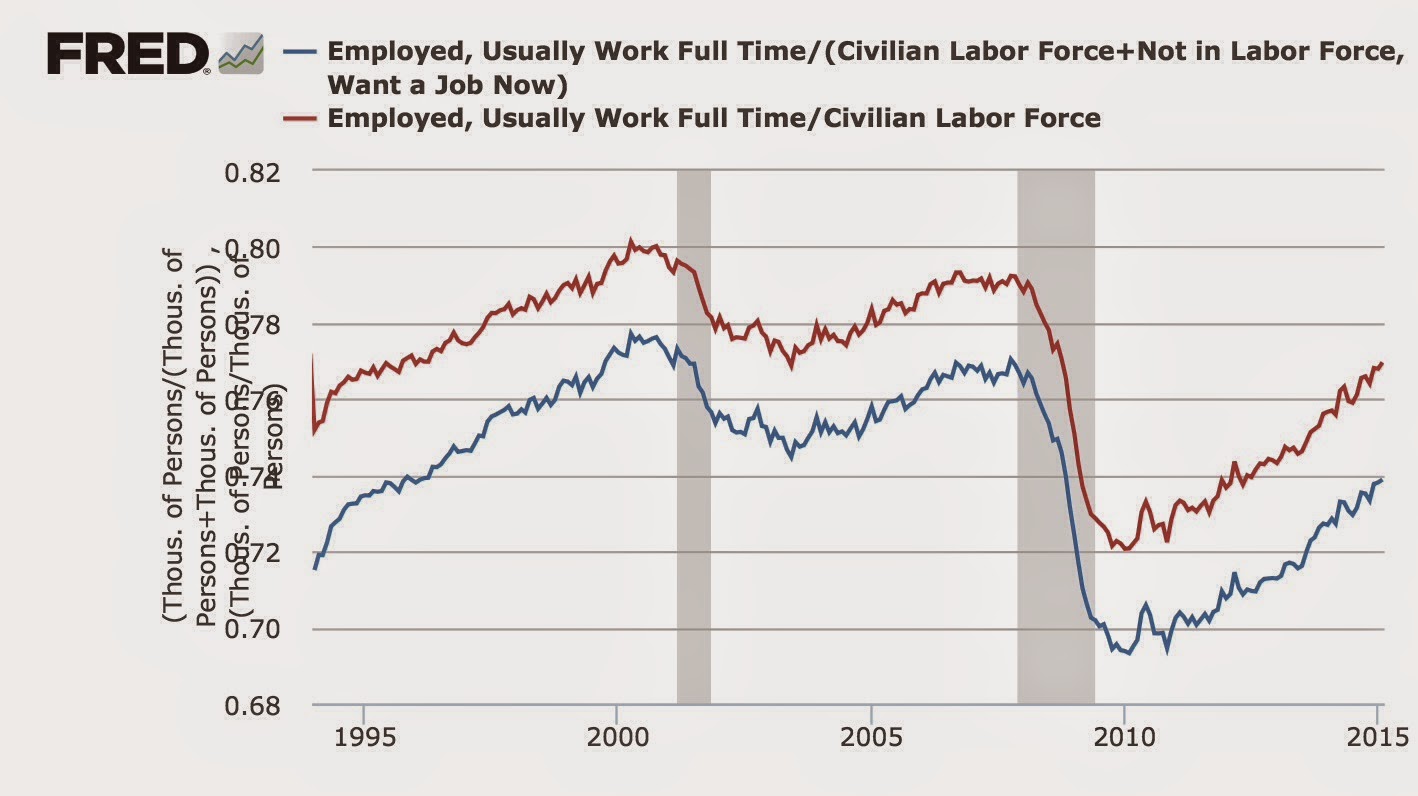

And that’s not all. Here is that same information (red) compared with full time employees as a percentage of the labor force plus those who want a job now, but are so discouraged they have dropped out of the labor force (blue):

In 1998 and 2002 respectively, those not in the labor force who wanted a job were 2.7% and 2.5% of the total. Right now they are 3.1% of the total.

So, to summarize, inflation is in the lowest 1% of all times in the last half century, wage growth is in the lowest 1.5% of the last half century, we still have extraordinarily high long-term unemployment, and a unusually high percentage of part-time employees and discouraged workers even taking into account the current unemployment rate.

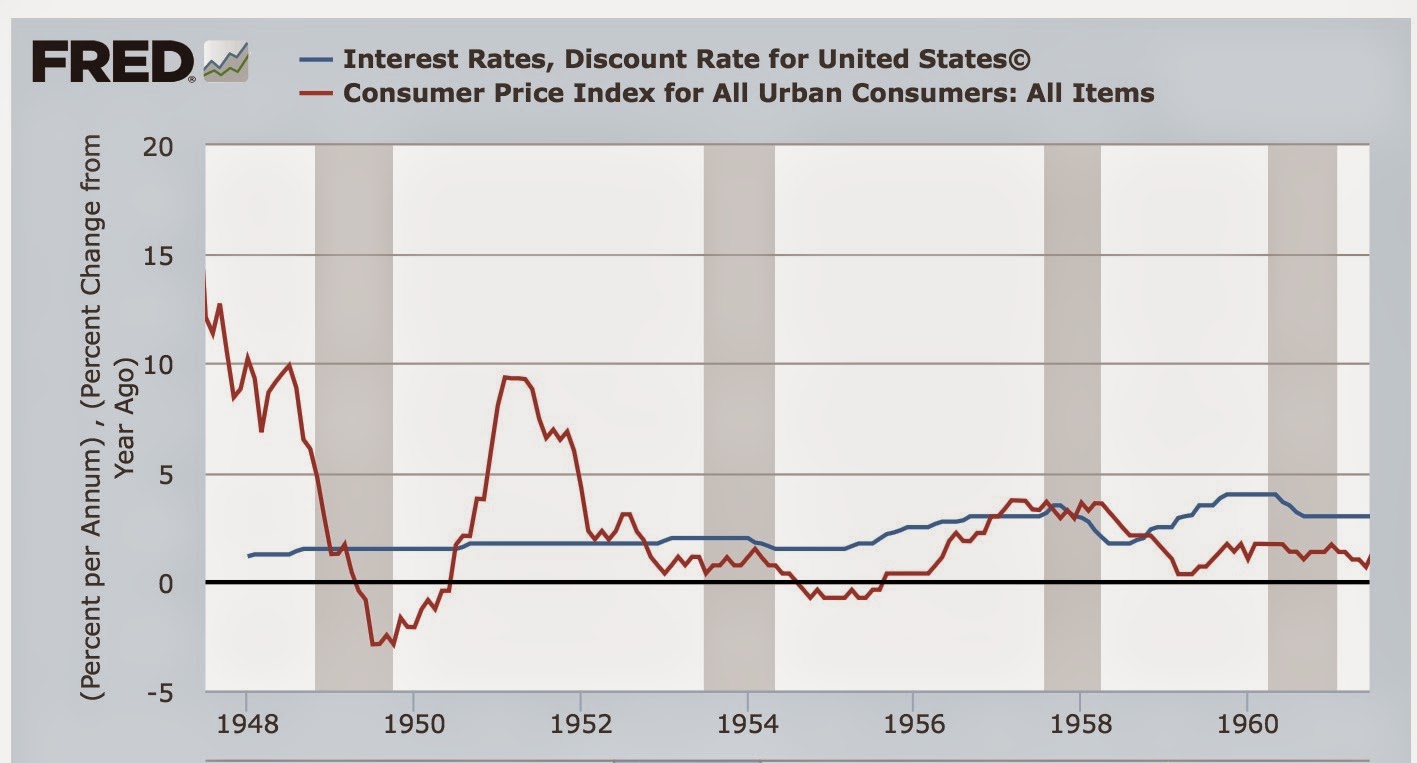

Finally, just consider the historical record, limited as it is, of when the Federal Reserve has raised interest rates in the present of out-and-out deflation.

This has happened only once since World War 2:

and three times before – in 1928, 1930, and 1937:

Correlation is not causation and all that, but that’s 3 out of 4 times with disastrous results. Do you like those odds?

In short, you know that raising rates will put additional pressure on wages and employment. So you think NOW of all times is the appropriate time to raise interest rates. Really?? Seriously?!?

Is NOW is the time to raise interest rates, you ask? Well, why not?

We’ve had 5+ years of “near-zero” interest rate policy from the Fed, and the job creation rate has been no better than it was during the Bush II years after the dot-bomb recession. Meanwhile, ordinary savers get hammered on their interest earnings while Wall Street tycoons use the ultra-cheap money to speculate in stock, bond, and commodities markets.

The reason there’s been no consumer inflation is that none of the Fed’s money is ending up in consumers’ hands. Why keep making it ultra-cheap for Wall Street when none of it is landing in our pockets anyway?

What he said.

Agreed. Now is a great time because it will kill the housing market which means it will be worth getting out of bed if you are young.

And yes some people will be caught in negative equity. The longer you leave it to hike rates the more people fall into this trap.

I’m wondering how the hike in interest rates will affect the upcoming 10/1 ARM resets?

Double what he said.

triple it!

Have we entered the Twilight Zone? It isn’t just that Mike is right, the entire concept of using easy monetary policy to stoke the economy is, shall we say, not borne out by the evidence. If .gov wants to goose the economy it needs to spend money, not just make it cheap to borrow. I am a tad surprised to find this piece here – it smells of Krugman.

It also has a Baker stink to it. :)

It’s part of the modern lie behind the US economy. It seems that it is implicitly (and explicitly) assumed that the stock market = the economy. If the market is booming, then so must be the economy. It goes hand-in-hand with the over-financialization of the economy, Big finance has been allowed (enthusiastically since the 90s at least) to become far FAR too big. They don’t actually make anything. Their entire operation is trading slips of paper back and forth. Not a single widget is made, not a single shelter, not a single road repaired, etc. Just paper shuffling. When the paper shufflers do well then it must mean the economy is doing well because they are the economy.

Of course, it IS a fat-assed lie.

+1

Yes.

i’ll hasten to add that the wall street tycoons get rich by taking the credit they obtain at 0% and investing it in developing economies, causing rampant inflation there. thanks to “free trade” deals, they can move their looted money across borders without any barriers. increasing interest rates will make borrowing money to invest it in china, especially with all the low-hanging fruit over there already picked, less lucrative and actually increases the chance that it is reinvested at home as higher rates promise higher returns. there’s a reason why the velocity of money is inversely proportional to interest rates.

the view that low interest rates stimulate inflation and that high interest rates stymie it is obsolete and should be abandoned.

What is the point of the rich having the global reserve currency if they can’t open up every nation’s financial sector – which has been the aim of every free trade in the past?

“You say my money is good everywhere. So, let my money in, and when the time comes, out.”

If you can only print, say, for example, the North Korean Won, you don’t worry about that.

Mike: Your comment totally ignores fiscal policy as an economic stimulus. Although this may be realistic under the current austerity (for the 99.9%) ideology, there have been countless discussions on Progressive blogs about the need to spend money into existence rather than total reliance on banks ( MMT and others), debt relief for the 99.9% (Keen and others), and infrastructure projects to create employment and useful projects (Krugman and many others). The Billionaires (Peterson and others) reject these alternatives of course as do those in their employ (most of Congress) but alternatives exist with the political will or sufficiently large pitchforks.

Jim

We can stimulate the economy and create jobs politically, without more government spending.

For example, we can cut down military spending and use it to lower the retirement ages for social security and Medicare. If not enough, Social Security can borrow from future military spending.

With higher interest rates and a less insecure pension, more people will retire, opening up jobs for the younger generation and the young employed will 1. stimulate the economy 2. fortify the trust funds of SS and Medicare.

Hah! I was originally downsized out of the military in the mid-90s after the fall of the Soviet Union meant a “peace dividend”. It didn’t last long. The big defense corporations and the politicians in their pockets handily reversed the downsizing very quickly and totally eliminated any “peace dividend” to be had. The Pentagon and defense contractor have also been VERY astute by placing military bases and defense industry outposts in communities all over the country. Whole cities and even sizable portions of states have built up economies that are dependent upon the military bases AND the localized defense industry outposts. That’s why communities scream bloody murder when base closure talk comes along. Close a base and destroy an entire community’s economy.

Almost as soon as I was RIF’d out of the military in the 90s they wanted me and a bunch of others to come back (they’d oopsed and cut too many). I joined the reserves instead and business has boomed ever since. With the end of the peace dividend the industry had to justify the re-spending so various threats had to be found and blown up out of proportion so people could be all a-feared into accepting, nay DEMANDING, more military spending. Plus it saved or improved multitudes of local economies. No, while it is technically true that defense cuts could well be tolerated and those cuts could be used for truly productive domestic purposes, it wont happen because the defense industry has DC by the short and curlies. Revolving door lobbyist jobs for politicos, outright bribes, or even threats, all piled on top of the universal gullibility of the dumb US populace makes defense cuts and redistributing the spending impossible in practical terms.

Masonboro (Jim): My comment ignores fiscal policy because it’s *off-topic*. So are the subjects of tax policy, military spending policy, regulatory reform, Medicare/Medicaid policy, entitlement reform, drug legalization policy, tort reform, and a whole bunch of other things that might be relevant to the health of the nation’s economy. The blog article is on a single subject: Should or should not the Federal Reserve raise *interest rates*?

And given that there is *zero* evidence that QE and ZIRP have helped create jobs but *substantial* evidence that they’ve *accelerated* America’s already severe income inequality problem, the answer is very clearly YES.

Ah, but QE HAS created jobs. In the financial sector (to some extent) – while the vast bulk of the QE dollars have gone into the usual suspect’s pockets rather than into even more financial sector jobs, however.

Upside down and backwards, the article focuses on wages and employment, but ZIRP is the reason we have stagnant wages and employment. Think about it: if money were priced to reflect risk, company managers would not be falling over themselves to take on more debt and monetize it right back to shareholders through dividends and buybacks, they would be forced instead to innovate and build new products and hire people. Since the crisis began in 2009 the SP 500 companies have earned just shy of $4 trillion; and $3.8 trillion has been returned to shareholders in the form of dividends and buybacks, causing the stock “market” and CEO pay packages to zoom. With bond interest at zero, the stock market morphs into a kind of surrogate bond market.

For wage growth, productivity growth, and employment let money and risk find their own price without the butcher’s thumb (or should I say fist) of the FED, if you must stimulate, do it on the fiscal side, not the monetary side.

Amen. Bass-ackwards, downside-up, and outside-in. After six years of supply-side monetary meth, we need more free money for casino capitalists? Six years of neo-Keynesian compound debt has failed to lift wages, mitigate inequality, or reduce aggregate debt levels,; all are growing worse, so how will more of the same insanity produce different results? Maybe NIRP (negative rates) will do it, and maybe New Deal Dem is run by supply-side neolibs. It’s time to try demand-side fiscal stimulus; that’s the New Deal thinking we need.

and meanwhile old retired people nowhere near the upper class, put their measly money in the stock market to get a return (my own family members), as does any middle class person with some money to save, as it’s the only game in town with almost nothing paying any interest. Only everyone also knows it’s corrupt, but sees no choice but to throw their money in the casino as well. And only the 1% seem to get richer and richer as they buy up all the real assets with funny money. Monetary policy has failed to create a viable economic system.

Although this counterpunch article makes me wonder if U.S. monetary policy is even about the U.S. in any sense whatsoever (not just in the sense of helping the common man, which it obviously isn’t about, but EVEN in the sense of deliberately keeping u.s. wages DOWN although of course the ruling class wants that). Maybe it’s really all about foreign policy. If the U.S. can manipulate gas prices to foreign policy ends as some speculate, why not interest rates?

http://www.counterpunch.org/2015/03/06/dollar-imperialism-2015-edition/

The Senators are too stupid* to think like that. The Fed is viewed as a mysterious bureaucracy with answers with little costs. Stimulus without new spending explains the behavior. Stocks are high.

The smart people worried about interest rate hikes know it would be an immediate short term disaster for the 45+ crowd near the 60 to 80k mark. Many current consumers, donors, and so forth would find themselves in hock.

*Warren isn’t a Rockstar because she is a visionary. Not being a blithering idiot let’s an elected be hailed as a super idiot.

The point of the post is logical inconsistency among the monetarist crowd which claims a low short-term rate is stimulatory, not that a low rate works well.

I agree. Regular people, not financial titans or wizards or obsessed investment hobbyists, are slowly sinking in this morass of ZIRP. . My retired in laws ( a trauma nurse (for her entire career) and a plumber) are slowly sinking into poverty because they are the wrong age at the wrong time with the wrong situation. They cared for their virtually destitute and ill parents( both sets) and now they are now themselves unable to work, even if they wanted to, at their ages due to serious physical infirmities. Caring for their parents took a great deal of their savingsas well as a huge toll on their physical health ( they were never big spenders either) and now with the continuing ZIRP their money is disappearing awfully fast. Or should I better say, is nearly gone. They were/ are afraid of too much in the volatile stock market as is/was conventional financial advice and don’t want the little they have to be gone overnight… They moved to a small cheap manufactured home, sold most of what every they had worth anything, never traveled then or now and are facing real poverty. Obviously we, their family would never let them starve but none of us can take them in- our homes do not have a downstairs room with bathing facility which they require. They cannot afford any kind of retirement community, even the cheapest type of place. If the corporate and banking sectors had not ruined the economy for the average person my inlaws would not be in this situation yet the corps/banker classes get free unlimited money for years on end….which they are socking away for their own personal golden hoard… How can raising the interest rates they must pay to borrow money to put in their hoard POSSIBLY do ANY more harm to the little people than is already being done???

The financial class want them to inject more credit into the system by borrowing big to buy into real-estate which they then use to farm the young. Of course the distasteful side-effect is that wall street get a cut but they do so reluctantly…

Multiply your tragic story by millions, tens of millions. ZIRP (and soon NIRP) has only benefitted Wall Street banksters as designed, and perhaps the next 10% down, in making the stock market the only magnetized roulette game in town. It’s s naked pump and dump poker game by primary dealers and insiders who get free money for stock buy-backs, tripling the S&P in six years to blow “the grandaddy of all bubbles (Doug Noland). It hasn’t done anything to reduce credit card, student loan, or payday loan rates for “little people”, or anything for prudent savers who don’t trust the serial bubble machine. Imagine what’ll happen if they get their bloody claws on Social Security (we wants our preciousss!). No, we need public FISCAL stimulus, MMT for Main Street, not more monetary heroin for Wall Street.

http://creditbubblebulletin.blogspot.com/2015/03/my-weekly-commentary-king-dollar.html?m=1

+++++++. . .

. . . only benefitted Wall Street banksters as designed, and perhaps the next 10% down, in making the stock market the only magnetized roulette game in town. It’s s naked pump and dump poker game by primary dealers and insiders who get free money for stock buy-backs . . . ,

Exactly right.

85% of stock market gains go to just 5% of people. So there you have it.

Very monetarist, Krugmanite, Chicago-school thinking to assert wages and employment depend on the interbank interest-rate setting. How supply oriented.

No, companies acting as net savers has NOTHING TO DO with the level of interests rates. Nada.

As we wrote in 2005, when interest rates were set at a real positive yield, companies were net saving, which means they were not borrowing and investing (which would lead them to be net borrowers):

http://www.auroraadvisors.com/articles/Shrinking.pdf

The reason was short-termism and stock-linked executive pay, which made them unwilling to do ANYTHING that would have a negative impact on quarterly earnings. No matter how you go about it, any investment will have an expense component (marketing/ad planning, hiring people for the rollout before the product is launched, etc). They aren’t willing to incur those expenses, hence no investment.

Similarly, Rob Parenteau pointed to a chart that showed that there was not much correlation between interest rates and GDP growth except at extreme levels:

http://www.nakedcapitalism.com/2015/03/robert-parenteau-the-large-fly-in-krugmans-new-keynesian-soup.html

You can eyeball and see that while there is an inverse relationship, it’s so slight as to not be very meaningful.

And the “corporations not investing” ex China has become widespread overseas. As Partenteau and I wrote in 2010:

Unbeknownst to most commentators, corporations in the US and many advanced economies have been underinvesting for some time.

The normal state of affairs is for households to save for large purchases, retirement and emergencies, and for businesses to tap those savings via borrowings or equity investments to help fund the expansion of their businesses.

But many economies have abandoned that pattern. For instance, IMF and World Bank studies found a reduced reinvestment rate of profits in many Asian nations following the 1998 crisis. Similarly, a 2005 JPMorgan report noted with concern that since 2002, US corporations on average ran a net financial surplus of 1.7 percent of GDP, which contrasted with an average deficit of 1.2 percent of GDP for the preceding forty years. Companies as a whole historically ran fiscal surpluses, meaning in aggregate they saved rather than expanded, in economic downturns, not expansion phases.

http://www.nakedcapitalism.com/2010/07/our-new-york-times-op-ed-on-the-corporate-savings-glut.html

Now it has become clear that ZIRP is unproductive. However, interest rate policy has this nasty way of being asymmetrical. Tightening has tended to affect growth in the US more through the housing market than any other channel. Housing has been the flywheel in the US since WWII. That has been dampened with the shift in policy toward encouraging more rentals:

https://www.questia.com/library/journal/1G1-301181026/the-housing-crash-and-the-end-of-american-citizenship

And it is also true that super low interest rates are depriving retirees and savers of interest income.

However, as they say in Maine, you can’t get there from here. Raising rates will result in principal losses on bonds, particularly at super low rates (the effect of interest rate moves on market values is amplified at very low interest rates) and will lead to lower home prices, putting people who had gotten back into positive equity into negative equity, and making new home purchases less “affordable,” thus hurting the housing industrial complex.

In other words, when the Fed raises rates, given how low they are and who this recovery appears to have been driven by the wealth effect more than anything else (the Fed was explicit about that and that does appear to be what is has created, given the gains at the top of the food chain and not much benefit to the lower income cohorts), it is going to produce dislocations and dampen activity. And as the post demonstrates, it’s not as if there is any justification, in terms of the state of the economy, for doing so. The Fed’s hawks are explicit that their big worry is wage rates going up!!!

So voting for a Fed rate increase is voting for a weaker labor market. That is what the Fed is trying to create. So people who support it who are workers are turkeys voting for Thanksgiving.

However, the reality is the taper tantrum in 2013 led the Fed to lose its nerve, and a market hissy fit will likely do the same again.

Ok. Then please give a layman’s summary of what you think should be done. Because everyone is critiquing what our government, the EU and their demands regarding Greece et al are doing wrong but I have read absolutely ZERO about what any of these very knowledgeable critics WOULD do instead…. What policies should regular working stiffs dependent on salary and savings be FOR??

We’ve discussed it repeatedly on other posts: much higher Federal spending. Some of that could come in the form of revenue sharing to state and local governments (a program implemented by Nixon and undone by Reagan; Nixon made sure there was anti-fraud oversight).

Yes, it’s too complicated, too Gordian, to begin to tease out the end of the rope to try to unwind the tight little knot that’s strangling us ordinary people. The Haves have fixed it so they can’t lose: mobile “money” that can fly ahead of interest rate changes, and “growth” that can be “fostered” by moving production to lower tiers of the downward-spiral course in the Race to the Bottom. If interest rates stay down or drop further, lookie, Maw, Free Money! If they rise, all of a sudden there’s arbitrage opportunities, and those trillions in invisible-to-the-tax-system bucks will at least “earn” whatever the interest increment increase is, with leverage and bubble blowing for all! or at least those in a position to have their “people” position their positions to take advantage of every little blip, or flip. And have I missed something, or are those high-speed traders still “front-selling the market”? http://www.thewire.com/business/2014/03/fbi-to-investigate-wall-streets-latest-blemish-high-frequency-trading/359938/

So, SRSLY, does it matter to us mopes and muppets what the Over-Feds do with, or oracularly pronounce about, that “controls everything” interest rate? We are apparently in some kind of quantum swirl where all our simplistic idiotic old Newtonian notions of how everything connects and behaves are, as a predecessor to the present Press Secretary, Mr. Earnest, once said,”no longer operative.” http://www.nytimes.com/2003/02/16/weekinreview/the-nation-the-nondenial-denier.html

Where’s the guy with the huge biceps and the big axe to cut through the unentangleable?

This is exactly why there needs to be a global law that CBs aren’t allowed to lower interest rates below 2% – because you set up an environment where ZIRP gets “baked in” resulting in mispricing of homes, stocks, bonds, commodities, derivatives, malinvestment, corporations selling bonds to finance stock buybacks, sovereigns and corporations taking on unsustainable medium term debt when rates are eventually “normalized”, etc…and then the potential for all these huge dislocations whenever CBs deem it necessary to nominalize rates. (there will never be a “good time” to do it)

If your only tool is monetary policy – which is making interest rates go up and down – now they can’t use their tool anymore. Not much of a “policy” IMO.

Not to mention savers bear the brunt again of subsidizing the financial system – and it is another transfer of wealth from the 99% to the 1%. It’s hard enough for the 99% to save without getting a negative real return after inflation (and maybe even taxes!) added to your woes.

nominalize s/b normalize. dang spell checkers.

Except the people should be able to borrow directly from the Fed at below 2%.

Collectively, the people should be rated safer than banks because the people, collectively, can tax themselves or authorize money creation to back stop the direct-lending People’s Fed.

The other thing “the people” can do is every time the Mongols and Visigoths and Teutons invade and burn their homes and rob them blind and carry off their women, they can say “Oh, well,” and turn back to their workbenches and plows and desks and tools, and bust their asses to re-create yet another pile of Real Wealth that will draw the barbarians back to strip them bare yet again.

Great public infrastructure projects like the Great Wall or the best paid legions couldn’t keep them out, sadly.

Thank you Yves. I almost barfed. I thot for a minute that all sanity had left this blog.

Perhaps the better summary is that we are in uncharted territory.

1. Normally the effectiveness of interest rate policy on economic activity is exaggerated BUT it does have some impact on housing and commercial real estate, witness how overly low interest rates led to housing bubbles here, in Spain, Ireland, etc.

2. Choking off interest rates thus impacts housing/building and through that the broader economy

However….

3. Because no one fixed the housing market (the problems with private securitization, failure to restructure mortgages of borrowers who had defaulted or were stressed but would be viable with a mod), housing prices on average have only corrected to “normal” at best levels nationally, when the past pattern has been for housing in a housing correction to overshoot on the downside, which means you get a strong bounce of activity off the bottom when it recovers. So housing hans’t played a strong role in this “recovery,” which is one of the reasons it has been unimpressive

3 argues that raising rates would not be as dampening as it would normally be. However, you have:

4. The Fed set out explicitly to use wealth effect as a stimulus. That appears to have worked to a degree, given that the “recovery” has been concentrated in the top income cohorts

5. At super low rates, the impact of any change in interest rates is higher than at higher interest rates

6. As the post explains, the Fed is being way too hair trigger in wanting higher interest rates.

And we also have the fact that mainstream economists (as Parenteau explained) have failed to call for enough fiscal stimulus. Oh sure, they might give it lip service, but per 1, they think interest rate policy is far more powerful than it is (as in, for instance, they believe low interest rates will stimulate business borrowing generally, which is barmy. Any businessman will tell you that whether he expands his business depends on whether he sees an opportunity. The cost of money is never a driver, save in businesses like finance where the cost of money is one of the biggest costs of doing business. For a Main Street businessman, the cost of money is not a driver but can be a constraint).

Yves I think it’s a cart/horse situation, pretending money is free and risk no longer exists just prolongs malinvestment. Businesses that have no business keeping their doors open (or opening their doors in the first place) suck the oxygen from viable enterprises trying to employ, innovate, and grow capital. We now have ten companies each with zero revenues that are valued at >$1 billion. The poster child for this of course is Japan where they have pretended their banks are solvent for several decades. That we have Citi, 7 years after starting to shovel tens of billions of giveaways into their maw, struggling to pass the Fed’s softball “stress test” should be the tell. Is that what we want, legions of old zombies (and new zombies) staggering around? While savers, retirees, insurers, and the general public starve on the thin gruel of 0.1% interest on their bank CDs?

Seriously? Who cheers when they raise the rent?! How will making money more expensive suddenly cause folks to innovate and build new products and hire people?

ZIRP sucks because it’s NOT SPENDING. Fraud got us into this mess, not cheap money. Bottom line: raising interest rates will harm the economy by reducing demand, banksters will still outperform Mom and Pop into the poor house with their shady derivatives and high frequency trading, and housing will cost more in the medium term (rest assured prices won’t correct to historical norms until big finance has unloaded its entire inventory of foreclosures).

It’s shocking that so many commenters want to raise rents in the middle of the worst recession ever.

I agree with the previous post that ZIRP is the reason for this mess.

And since things are definitely going south, when summer comes the Fed will not raise rates. I will go further to add that because ZIRP is the problem and the Fed believes it is the solution, they will never raise rates again. Ever. The Fed is boxed into a corner and faced with an existential threat. This is forcing them into an irrational, insane position.

We the people are going to have to pry their hands from the levers of power.

A whole other dimension to the Fed’s plight is the global competitive devaluation game, which the Bank of England started during the financial crisis, and the Fed promptly copied.

Six years on, the Fed has ended its QE program as of last year, but the ECB just started one. As a result, the US dollar is soaring higher, leaving the US (and China, pegged to the dollar) as strong-currency outliers in a devaluing world. Dollar chart:

https://research.stlouisfed.org/fred2/series/TWEXMMTH

Yes, everybody else ought to cut it out with the competitive devaluing, so we can all return to sane policies. Unfortunately, under the nightmarish post-1971 monetary regime of ‘all fiat, all the time,’ every currency issuer can do any cockamamie thing they want. The result, as you would expect, is a series of fiery train wrecks.

So? that only begs for controls and regulations….

TIme for the UN to step in and regulate those central bankers.

The blue helmets and Hans Blick can occupy the Marriner Eccles building, searching for the weapons of mass financial destruction. This time they will find them

Tones, I agree with you that the interest rates may never go up (probably not until well after 2020) because the banks will lose money if they do go up and banks are only here to make money.

If someone can explain to me why it is ok for savers to earn nothing (or get pushed into risky investments) while speculators get free money, then I’m all ears as to why it’s a bad idea to start raising rates.

To ‘splain:

Because this is what happens when a granny past her use by date decides, from the bowels of her experience in the cathedrals of neoliberalism, reading the entrails of neo-keynesian dogma, that it should be done. Keynes, determined saving was the product of consumption, not necessarily the wellspring of investment to fund production, a position arrived at through the exigencies of British funding of WWII where government supplied credit became the driving force for the British war economy. The credit so created also produced an indebtedness, record-breaking for the period, of £12-15,000 millions [contemporary U.S. $ 48 – 60 billions] in war costs (helped through Lend-Lease assistance). Restoring the normal economy from wartime controls kept the British public on rationing basis until the mid 1950’s to service balance of trade doctrine, about a decade after the end of the European war to control public consumption and push economic export to service the national ‘debt’. Keynes had been long dead at this point (d. April 1946 IIRC). Probably a needless gesture and maybe one that finally cost Britain its empire. In the short of it, ZIRP is purely a neoliberal reading of neo-Keynesian delusion and should be warning not to follow anything the acolytes of that religion have to say. Zero interest is pushing a false economic string – really gets no-one anywhere but looks like something is happening, like economic collapse.

Sounds like an anti-woman slur.

Yep. The commenter needs to correct. Adding, without, of course, derailing, or making an admin rerail, the discussion.

Colorful language is often a temptation in itself; I have succumbed many times.

Because this is what happens when a granny past her use by date . . .

Anti-Yellen slur.

What you on about? You being the thought police? Seems more likely a measure of your reading incompetency. Please enumerate five or more women directly slurred, if you can, from the words used. Or are you just out to quell discussions?

Your comment is out of line, and we’ve had other complaints in other threads about the decay of the caliber of discourse at NC. Attacking Yellen on her age and gender IS a smear. Would you ever denigrate Krugman by calling him a grandpa, which I assume he is by now?

Your initial comment just makes you and the site look bad, but you are too pig headed to see it. An ad hominem attack, which is what your “granny” remark amounts to, is a logical fallacy, and in your particular form, a cheap shot. So the one who is dense here is you, and you are just digging your hole deeper.

And this is private, hosted space and we set the rules here. Your persistence in defending a slur means you are accumulating troll points rapidly.

Please be advised: (Paypal) Confirmation number: 05T81928KM769921J

will never happen again.

When you see the words old woman written in my comment; then and then only is your raging justified. I am not aware that granny is a perjoritive, my experience to the contrary granny is a term of endearment, nor I am not responsible for whatever abuse you have suffered that makes you find as you do. Past use by date? can that possibly mean the contents may have spoiled? or gone off? Is it possible at all that neoliberal theology and the sparks holding FED Chairman maybe not have a clue? This one seems incompetent to assemble a two coherent word response to a yes or no question put to her. Am I supposed to respect that? What for, the position? the intelligence? something else? Do say, pray tell.

By the way, I found your “Econned” a tour de force with the exception of a couple historical presentations which may have been maladroit writing errors.

As I am sure this will be censored from the site as is the wont of adolescence and immaturity, I will end anything further, even reading of the offerings here.

Its been, hasn’t it.

Oh, oh! You don’t know when to quit, do you?

this kind of blackmail is exactly why we have so little good journalism in the mainstream media.

that’s OK. I’ll pick up the slack. (soonish)

Using a term of endearment with someone in a professional setting is condescending. Can you imagine a financial analyst on an earnings call calling Jamie Dimon “honey”?

This is what Lambert describes as a reader assisted suicide note, and we are only too happy to oblige.

I’m more than happy to offset the donation you won’t make. Yves can email me the amount.

Confirmation number: 05T81928KM769921J will never happen again.

If it does happen, that will be a bigger problem for Pay Pal than anyone else, eh?

I’m just a little stuck on the past her use by date can you explain that part term of endearment description?

Late to this, but let me add a few points.

1) “Thought police”? No. Words aren’t thoughts, right?

2) “a granny past her use by date” in its totality, for me. I agree that “granny” isn’t relevant in a professional or policy context; it’s Yellen’s neo-liberalism, not her gender or age, that’s relevant. So why bring up the other?

3) “use by date” is “the last day that the manufacturer vouches for the product’s quality.” So, in other words, you’ve framed a person as a thing, a commodity, to be purchased. Worse, you’ve raised the issue of what characteristic one would purchase Yellen for, were her “use by” date not to have passed. Since this is a family blog, I won’t go into detail, but I can’t think of any examples (modulo tortured exculpations) that aren’t Rule #1 violations.

4) Your contribution buys you, among other things, skilled moderation, which has occurred in this case. It’s not NC’s problem if you get yourself into trouble.

So don’t let the door hit you as you flounce out. Assuming you can get your head through the door jambs.

I’m going to take a different tack on this, having slept on the matter and given it some thought. I always think that the loss of any contributor / supporter is something to lament. Okay, there are limits and on occasions, you’re maybe happy in the short term to see some people go. But it’s never A Good Thing.

So Formerly T-Bear, before you say something you’ll maybe regret, please take a little while to have a think and apologise to Yves and Lambert — and even, though thru’ gritted teeth it may be — Janet Yellen too. I’ve done it myself in the past and when you’re made a mistake — even if unintentional or due to people not having the same understanding about what you were trying to say and the point you really wanted to make — it is always the best thing to do. And if it makes it any easier, even Yves on the rare occasions she makes a blunder is quick to say sorry and that’s fine, everyone understands and moves one. A proper apology when needed (not as Lambert would say a non-apology apology) shows everyone that there is actually some hope for the world and we’re not just going to drown in our own collective bone headedness.

@ Clive, 11 March 2015, 04:27 AM

Responding to your comment. That bridge is burnt and will not be crossed. A principle is involved here, it is a matter of the ability to speak itself, the exchange of thought, ideas and opinion. It obviously does not exist on these pages under the sponsorship of Yves or is it instilled in the self control of the lynch mob that frequents here. I have nothing to contribute to such, not now, nor in the future. It is not my loss. I have now said all I intend saying here. Please be wary of the mob here, their path will not end well. Finis.

Yves: “Would you ever denigrate Krugman by calling him a grandpa, which I assume he is by now?” I don’t see why not. He’s been called worse things on sites that allow free speech. The man can barely form a sentence, and to me he comes across as a village idiot. I do not believe he has children, which is a shame because I think you only begin “thinking” when you do. There is a reason he won the pseudo-Nobel – he touts the banker line. Listening to clowns like him, our world (air, water, soil) is doomed!!!!! because, according to him, all we need is more and more growth, more and more broken windows.

Grab hold of yourselves, take a long look in the mirror, and imagine your children being left with the debt we are incurring for them, the filth, corruption, pollution, lack of resources. Let’s just throw some extra money at the problem, pull forward a shit load more population in the process, and we’ll be living (or choking) well? Get a grip.

Krugman has children? He wouldn’t be saying what he’s saying if he did.

Yves – I was right, Krugman DOES NOT have children. I would have been surprised if he did.

“Your initial comment just makes you and the site look bad, but you are too pig headed to see it. An ad hominem attack, which is what your “granny” remark amounts to, is a logical fallacy, and in your particular form, a cheap shot. So the one who is dense here is you, and you are just digging your hole deeper.”

Oh, my, such an attack! Thanks for keeping evil people off this site. That way no real anger, frustration or feelings need ever surface; it’ll all be one uninteresting flat line.

Jawohl mein führer.

Your comment reads like “a woman past childbearing age has no value.”

If they can still cook and clean they have value.

It’s not hopeless!

Youze guys, I mean really. I just mean really,. Take a few deep breaths and count to 100. Then take a walk. There’s a real world out there!

Sometimes it’s amazing, just to look out the dirty window of a bus at sunlight on the branches of a tree against a blue sky. Just to look out of yurself and see something real. And If that doesn’t work there’s xanax. It’s better than bile.

somtimes you don’t even have to look out the window. there was a woman on the bus a few months ago who was certainly past childbearing age, certainly she would have been biologically capable of being a grandmother — but the more I investigated her physique and general anatomical coherence the hotter and hotter she got. Finally I decided, in my mind, whoa! she is hot! Nice tits are not at all a prerequisite for hottness, but she had a very nice bulge out of her chest and evidently a curvature of hip to butt that just said “THIS LOOKS GOOD NAKED” That’s what I thought anyway. I’m just being honest. I have no idea how old she was. That really didn’t occur to me, frankly. It was more a matter of being overwhelmed by the female physical vibration. It was an act of nature. I don’t know if she could cook or clean but frankly that would not have been a primary concern. There’s always restaurants and cleaning happens on its own when it can’t be postponed any longer. That’s been my experience anyway.

Really. I would have avoided this whole controversy and describe the Fed’s problem by saying something like “Janet can’t get it up”.

But then again, professionalism and political correctness are not one of my strong points.

Money hoarders have no right to a yield, and speculators aren’t getting free money.

A few years ago before ZIRP kicked in, we took a nest egg and parked it in our financial institution for a year or so. With the interest we earned in that period, which we paid taxes on, plus the money we were able to save from working in that time, we were able to then put 20% down on a modest house and get a 30 year fixed rate mortgage. A mortgage I did my best to make sure would stay with that financial institution and so far it ha,s rather than be sold and packaged for others to speculate on.

Does that make me a hoarder? Should I have invested in some CDOs instead, maybe after I set myself up as a corporate entity in the Cayman Islands first?

I call it being a responsible citizen.

Although I’m sure the Wall St types would call it being a sucker.

We have a winner: Stupidest comment of the day

Wrong. You do not have a right to return on financial assets. If you think you do, you are the perfect mark for Wall Street. And one more substance-free attack on another reader and you get put in moderation.

Wrong. Seeking more that sub 1% point for a savings account is NOT money hoarding nor is it anything close. The point is not worthy of serious discussion.

Let me repeat: you do not have a right to a return on financial assets. Do you miss that a bank actually provides services to you in with that savings account, as in record keeping, safety, and ready access? Are you prepared to keep your savings in cash at home and be at risk of loss via fire or theft, and earn no interest?

Your concept that you deserve a return on your money no matter what is what Michael Hudson called “usury capital”. It plays a major role in the mess were are in of unsustainable debts:

In keeping with his materialist view of history, Marx expected banking to be subordinated to the needs of industrial capitalism. Equity investment – followed by public ownership of the means of production under socialism – seemed likely to replace the interest-extracting “usury capital” inherited from antiquity and feudal times: debts mounting up at compound interest in excess of the means to pay, culminating in crises marked by bank runs and property foreclosures…

The result is that today’s economy is burdened with property and financial claims that Marx and other critics deemed “fictitious” – a proliferation of financial overhead in the form of interest and dividends, fees and commissions, exorbitant management salaries, bonuses and stock options, and “capital” gains (mainly debt-leveraged land-price gains). And to cap matters, new financial modes of exploiting labor have been innovated, headed by pension-fund capitalism and privatization of Social Security. As economic planning has passed from government to the financial sector, the alternative to public price regulation and progressive taxation is debt peonage.

http://michael-hudson.com/2010/07/from-marx-to-goldman-sachs-the-fictions-of-fictitious-capital1/

“Are you prepared to keep your savings in cash at home and be at risk of loss via fire or theft, and earn no interest?”

If interest rates go negative, then yes – with the exception of a small household account used to pay bills.

Saving is hoarding, and nothing entitles a saver to interest any more than a business. No one has a right to profits.

Save when everyone is spending.

Spend what you have saved, when people have no money. You can stimulate the economy.

Remember, there is money in non-profits. That is, it’s not always about profits and no profits.

I still don’t like the term hoarding which to me implies keeping everything for yourself to deprive others but I understand your intent better when you include businesses in the comment. I agree – no one is entitled to collect interest and I believe an economy could be run just fine without it, something I would very much like to see. For myself and I suspect most people who aren’t ridiculously wealthy, saving is something done so the money can be spent later either for a large purchase or in retirement, possibly negating the need to take out a loan at all.

So I will stop asking for interest as soon as the banks start charging me when I take out a loan.

And of course there’s no inherent natural right or entitlement to anything at all but that another topic…

“Money hoarders”? Seriously? Saving a percentage of your income is HOARDING?

Y = C + S

Remember that???

The part that upsets me about the statement is not having some form of savings is asking for financial ruin. As it is many that were ruined in 2008 were ruined because they weren’t prepared to lose a job for any length of time. Let’s not even get started about how much our rent seeking system wants us to have on hand for medical issues. Sure I could park my money in an HSA if I want to give it back if I don’t use it after the year is up(hubby’s doesn’t allow a rollover.)

I think there might be some confusion regarding meaning of “hoarding”. Prior to reality TV making the word a household name, hoarding simply meant to accumulate against potential scarcity. So saving = hoarding in economic terms.

The funny thing is I don’t want to “hoard” however, the way the system is set up not saving means that when things go wrong that unlike Wall Street you’re up sh!t’s creek without a paddle. It isn’t like Congress is going to give my household a bailout. Saving is a way to ensure that when you or your spouse gets sick that you can still pay the bills.

That’s the nature of a monetized capitalist economy: it creates a strong incentive to save money rather than real things like food and medicine.

It’s hard to save food, fresh food, beyond few days, in any economy.

and stocking up on medicine is made illegal.

The thing is, what you are saving is not assets but a claim on assets. It’s considered prudent for households to save a portion of their income but the fact they don’t spend their entire income creates a hole that needs to be filled somewhere else, otherwise economic activity contracts.

Ideally, society as a whole agrees to guarantee fundamentals like food, housing, health care and a reasonable pension, that way households aren’t forced to build gargantuan emergency funds against inevitable business cycle downturns. Where that doesn’t happen you create enormous demand leakage from people all doing their darned best to be “prudent” (and people who aren’t paid enough or are unlucky or a little more short-sighted endure unbearable suffering). Because after all what you are really saving is electronic digits in a bank database, not an actual hoard of food or drum of gasoline that you can consume in an emergency.

There’s all sorts of kneejerk feels to the idea that “saving = good” but the reality is not that simple. Also, your equation is missing the + I for investment, which could actually be an economically productive activity.

Yep. Exactly like that Pac-Man game, except that people don’t take those digits quite as seriously for some odd reason.

I loathe Wall Street and refuse to participate in it’s casino that cheers when jobs are sent overseas or people lose their insurance so as of right now their is no investment in anything other than securing my family’s future-

Granted those who speculate in the financial/industrial economy deserve nothing but grief for their efforts. Real investing means improving personal skills, increasing the health of the ecology wherever you happen to be, and strengthening family bonds and local community connectedness. Even implicitly thinking that any of these meaningful investment strategies can be replaced with the market economy is an invitation for a deserved disaster.

+

Good point and thank you.

this is sleight-of-hand. money-hoarders should have a right to not have the value of their money eroded by inflation.

please don’t interpret this post as an endorsement of the idea that inflation is the economy’s worst nightmare.

If someone borrows money from me to buy a house and makes money after 20 years, I think it’s reasonable to charge interest on that money.

And if he loses money, we can talk about joint venture or profit /loss sharing, but not forfeiting interest.

Ok I’m actually ok with that I guess, as long as we DOUBLE SOCIAL SECURITY NOW. Or else you might as well say people to old to work (for any number of reasons including age discrimination) have no right to live.

i think it is entirely possible that inflation, like time, does not exist

No wage inflation for sure.

It became extinct many years ago.

Spend money on Social Security.

Get some kind of parity between Social Security and public employee pensions – that’s one way to unite all workers.

And as I mentioned earlier, lower the age for S.S.

Let those who have saved (or hoarded) earn more.

Encourage people to retire (with some sense of security) to open up jobs for the young.

Public employee pensions, like those of the Michganders who worked for Detroit and other cities that have been “libertarianated” by our new Rulers? Like the ones that ass___e Walker has been ripping in Wisconsin? Like what’s happening in FL where I live, and so many other places? Not a great benchmark, though it could be if we ordinary people were smart enough not to be “e-conned” by the teabag sellers, not to get suckered so easily into thinking that pushing other people further down the slippery slope somehow would keep us from sliding down and away into the Black Lagoon ourselves. Like the old Russian joke about the peasant who freed a genie, who promised one wish, but said he would give the peasant’s neighbor double whatever he gave the peasant: after a lot of thought, the peasant says, “Okay, make me blind in one eye…”

All those you mentioned would benefit from being in one single plan for all. We need to unite and get everyone on the same page.

At the least we should increase the minimum SS monthly payout. It would also be nice to see a zero coupon government security paying out 100-200 basis points above inflation, solely for small savers with balances under one hundred thousand dollars.

Maybe that security could be issued by, say, a Postal Bank?

That’s an interesting idea. If you want the security you must maintain your account at the public bank.

We can also lower the retirement age for Social Security.

That way, jobs will open up for the young.

I would do that by print and pumping money into the trust fund.

Environment impact? Minimal.

‘Hoarders’ is a loaded term.

OK jackas..

Then tell the bank not to ask for freaking interest on someone else’s money they ‘loan'(shark) out. They are entitled to yield, right?

No one is entitled to a return on hoarded assets nor on investment. Arguing otherwise is declaring you have a right to the income from another person’s labor.

Ian, I think Yves explained the potential outcome of the FED’s raising rates above. Please reread what she has said. There seems to be no positive outcome to higher interest rates in the current environment. I think you might want to reread this:

https://www.questia.com/library/journal/1G1-301181026/the-housing-crash-and-the-end-of-american-citizenship

I am NOT saying it is fair that small savers are losing while those on wall street are benefiting.

Positive outcome for whom? ZIRP was a huge negative outcome for some.

No matter what happens there will be winners and losers.

In addition to Too Big To Fail, now, we have Too Frail To Disturb.

“Please, no rate hikes. You will bring down the and housing market, the stock market…and the house of cards built on derivatives.”

I love the mixed messages emanating out of Washington. “The economy has turned the corner” but “the recovery is still fragile, so we can’t raise rates”. It’s like telling a patient that he is fully recovered, but will be kept on life support just in case.

I would say that, back when everything was working, savers got a cut of the extra wealth that was created when others borrowed their savings and invested them in productive enterprises. It wasn’t strictly the right to be paid a return, it was a right to a share of whatever returns there were. Lately, whether it’s the fault of the Club of Rome and their damnable accuracy, or whether it’s soi-disant industrialists who can’t be bothered to do any work, or even create work for other people to do, or whether it’s something else, the new wealth isn’t there.

I have a feeling that the real Curse of ZIRP will happen when rates are raised and we find that no-one has the spare cash to pay any interest at all.

> the extra wealth that was created when others borrowed their savings

Deposits don’t create loans. Loans create deposits.

Nice plots and all, but out of the larger context they are just stage props. How about looking at the velocity of money for a start? With zirp there is no pressure to increase velocity so that the aggregate economy _can_ return more money that it borrowed. And since it basically means the economy hass access to a quasi-infinite reservoir of zero-velocity money (the Fed) money with zero potential barrier to pull from it(aka intereet rate), there’s little incentive to do the work of speeding money up (therefore the practice of parking them in the financial market, real estate, etc.) With the unfortunate side effect of draining money from subsectors that do work, since their return on capital cannot be as good.

So yeah, the aggregate economy and the workforce aren’t doing well, but the zero rates argument blindly ignores the underlying dynamic. And doing more of the same while expecting a different outcome is one definition of madness.

This post misses an important ongoing shift in the Fed discussions in monetary policy as it relates to interest rates. Historically, yes, job growth, and NAIRU would precipate rate hikes. Not so for this economic expansion cycle. Repeatedly the Fed has moved the goalposts with respect to raising rates from 6.5% UE rate under Bernanke to 5.3%-5.5% NAIRU rate under Yellen last year to several intangible “foreign risks.”

Rates can be left at nr near the zerobound indefinitely now when policy leans on such intangibles, much like the war on terror will never end until the Empire enters a state of collapse such that it can no longer afford to fight the war on terror. We are not there yet.

Leaving monetary policy on interest rates data dependent on foreign risks at this point supports leaving rates at or near the zero bound indefinitely. This supports the idea that the Fed funds rate will remain at or below 2% for some time to come and that the era of financial repression will be with us for much longer than those at the Fed and others that think rates can be normalized to 3.75% by the end of 2017.

We would all do well to recall that the Fed discount rate went zero bound in the very early 1930s never to recover north of 2% until the mid 1050s.

The goalposts have moved.

1950s.

‘the Fed discount rate went zero bound in the very early 1930s never to recover north of 2% until the mid 1950s.’

Not so. The New York Fed’s discount rate was 2% as 1941 began. In Oct. 1942 it was cut to 1.5%, where it remained for several years. In Aug. 1948, it was raised to 2% again. Never was the discount rate cut to zero. Info is listed on page 668 of this document:

https://fraser.stlouisfed.org/docs/publications/bms/1941-1970/BMS41-70_complete.pdf

Yes, when the Fed cut interest rates below 2% (an event that went largely unnoticed at the time), I got a big sinking feeling that this was a move we’d come to regret.

Part of why we got where we are was sheer Fed panic. The Fed used to engage in 25 basis point interest rate cuts to signal that it was serious. During the crisis, it repeatedly engaged in 75 basis point cuts, so the line became “75 is the new 25”. There was little justification for these big moves, particularly since the Fed was implementing alphabet soup facilities to provide extra liquidity. But the amplitude of the cuts is a big reason why they wound up in super low rate terrain.

Yes, there’s an asymmetry between the rapidity with which rates are cut, compared to the leisurely pace at which they rise.

It mirrors an asymmetry in markets themselves. In stylized form, a typical 4 to 5 year economic cycle consists of stocks rising for 3 or 4 years, followed by a brief, brutal recession and bear market lasting 12-18 months.

As Rhett Butler advised Scarlett O’Hara:

“I told you once before that there were two times for making big money, one in the up-building of a country and the other in its destruction. Slow money on the up-building, fast money in the crack-up. Remember my words. Perhaps they may be of use to you some day.”

Sounds like chewing your food slowly but when you have bad stuff, it comes out rather quickly.

funny Haygood. This makes me think that we are ready for the Woody Allen technique of dubbing – for bringing history forward, as in What’s Up Tiger Lily? It is one of my all time favorites; but somewhat nonsensical. Let’s do a re-dubbing of Gone With the Wind. It’s high time.

NAIRU was demonstrated to be invalid decades ago:

Because one of the tenets of NAIRU theory is that the NAIRU can shift over time, it is impossible for any given historical episode to debunk the NAIRU. In the 1990s, for example, unemployment fell below the then-forecast NAIRU level without inflation accelerating dangerously. Scholars have generally responded by arguing that this shows the NAIRU fell in the 1990s due to a mix of demographic factors, technological change, and greater openness to trade. When the actual unemployment rate began to shoot up in 2008, conventional estimates of the NAIRU also rose with it, as a partial explanation for why we didn’t see economy-wide deflation.

Of course, another interpretation would be that NAIRU-based predictions fail because the underlying theory is wrong. As far back as 1987, economist (and, later, Federal Reserve Vice Chair) Alan Blinder was arguing that “it may well be that Keynesians caved in too readily to the natural rate hypothesis” and pointed out that the Phillips Curve’s predictive problems can be fixed by allowing for ad hoc supply shocks — the exact same thing needed to make the NAIRU work. A later paper by Robert Gordon, similarly, takes the view that you just need to add oil price shocks to 1960s-style Keynesian models to make things work.

A middle ground would be to argue that perhaps the NAIRU did correctly characterize the economy of the 1970s. Back then, after all, a large share of the American workforce was represented by labor unions. Union contracts often included clauses that provided for automatic raises in the case of inflation. It’s easy to see why any particular person would love to have such a clause in his contract. But it’s also easy to see how widespread use of such clauses could inadvertently set off a spiral. Whether or not this was the case three or four decades ago, it’s not a major issue in the American economy today, when many fewer workers have such contracts.

http://www.vox.com/2014/11/14/7027823/nairu-natural-rate-unemployment

See another long-form NAIRU debunking:

http://bilbo.economicoutlook.net/blog/?p=26163

But having said that, most Fed economists believe in NAIRU.

I agree that the employment figures are not strong; so that the US economy does not need a tightening cycle; but if interest rates are to be flat for a “considerable time”, should they be at zero or 1%? It seems wise to me to prefer 1%, because that leaves room to cut again if they are wrong: for the big policy risk is going into another cyclical downturn with rates already at zero and a huge Fed balance sheet.

There can also be paradoxes: an expected future rise in interest rates can drive people to buy houses or companies to buy plant before the finance cost rises. Also are below-zero interest rates genuinely interest rates or a macroeconomic stealth tax, since the Government is the main beneficiary?

What an incredibly educational post. Thank you!

‘It’s not likely, based on your own core measure, that we will see much inflationary pressure in the next 12 months. It takes 12 months or so for current gas prices to feed through into the rest of the economy.

Headline CPI (including food and energy) is more volatile than core CPI. It tends to mean revert to core CPI, since spikes and crashes in commodity prices usually don’t last long.

Currently headline CPI is 1.7% lower than core CPI. With energy prices having stabilized, the expectation is that headline CPI will converge with the core CPI (that is, by climbing higher) over the next 12 months.

The Federal Reserve will not raise interest rates because doing so would push the economy back into a depression. If you want to see our future, look at Japan.

They’re boxed in and have lost control.

It will be interesting to see the language and excuses that are trotted out.

A modest interest rate raise will go over fine, and nobody’s talking about a Volcker-like frontal assault. It probably will have little or no effect on either employment or inflation at this point. If I could post an image in comments I’d share Corporate After-Tax Profits

W/out IVA & CCAdj

http://research.stlouisfed.org/fred2/graph/?g=UHx

With IVA & CCAdj (just so nobody can say I didn’t touch the base)

http://research.stlouisfed.org/fred2/graph/?g=UI5

So there’s some wiggle room, and only hidebound, labor-hating wingnuts who’d probably be fine with slavery’s return disagree that the economy is badly out of balance.

Interest rates aren’t the economy’s big problem. Inflation, disinflation or deflation aren’t the economy’s big problem. Employment and wage levels aren’t (quite) the economy’s big problem. We have hit the wall. Our problem is where does any late-stage capitalist economy go once all the big, free economic inputs (land, slaves, timber, minerals, rights of navigation, etc—usually gained through conquest) are already developed? Some things are really hard, but I cannot in all honesty deny that Larry Summers has a point. (He’ll burn in hell, regardless of this, I’m certain.) So tinkering with this interest-rate-lever here and that tax incentive there isn’t going to have anything more than local (and invisible) effect, and the benefits of those are temporary. Has anyone besides me noticed that the business cycle seems to be shortening?

NDD and I go back a ways and I have always liked his reliance on data. I do exactly the same thing. But the data is incomplete both in range and depth, and I’ve said this many times: Once you get too far away from permissions and expectations when thinking in the realm of economics, you go awry..

Pity those aren’t quantifiable.

Anyways, good to see you again, NDD.

agree, especially with the late-stage capitalism assessment.

Culture and knowledge are free, and they can be readily tortured into permissions by a government that (say, by way of the 10th Amendment and the Treaty Clause) can conspirewith any other nation to legislate over and around the Constitution. Suicide, er, “twade” pact leaks suggest that intellectual property and public purpose are the next commons to be enclosed.

Point taken, though that wasn’t the kind of permission I was talking about. What I meant there was a tacit acceptance of price rises by consumers. I distilled a whole sheaf of transaction behavior into “permissions and expectations,” not all of which are positive. For instance, panic buying (the way many home buyers did) in the expectation that either interest rates or home prices were about to rise significantly would be an example of a negative motivation for pulling the trigger on a purchase. Positive motivation is easier to define—anytime you feel, without equivocation, that you’re getting good value for your money.

Fact of the matter is, most people gave up their power as consumers (myself included, I’ll admit.) by ceasing to shop around and hesitate before making purchasing decisions, like the Great Depression generation did. Seems that the horror stories about what it was like to grow up doing without is no substitute for the heuristic conditioning of actually having lived in want. Since 2009, this hesitation made a roaring comeback very quickly:

Household Debt as a Percentage of Disposable Income:

http://research.stlouisfed.org/fred2/graph/?g=13Nu

Inflation isn’t as simple as supply and demand implies it is. It’s not even as simple as cost-push vs demand-pull inflation models suggest. Part of it is a perception of value (unquantifiable). Part of it are your prognostications about your future well-being (see the chart linked to above). Part of it is, broadly defined, social/political (that company is run by SOB’s and I refuse to do business with them—again, this is unquantifiable). Part lies with blame shifting (can’t blame me for hiking prices, if OPEC hadn’t hit us with a boycott, we wouldn’t have to). Part of it is, as I said, people just giving up (if I don’t buy this at this price, somebody else will. I have no power, time, leverage and/or inclination to dicker over price and desperation-purchases are a few out of an infinite range of rationalization blends. None of which are quantifiable.).

Does any of this matter? Economists lump all this under the heading of “demand” but businessmen pay very close attention to all this. Ask anyone in marketing and public relations. And an economic shock tends to bring some of these considerations forward. This is, I’m certain, part of the sluggish economy we’re witnessing worldwide and if George Washington is right, the deflation the global economy seems on the cusp of.

Wow — this message board is a fabulous example of the post hoc fallacy. ZIRP is not causing poor job creation. ZIRP is a poor second choice “solution” from a government body that’s at least acting while the real solution — federal spending (and financial re-regulation, but that’s a whole different matter) — has been relegated to the idea of the crazies. Congress hasn’t been doing its job for years. So let’s not get all frothy at the mouth over ZIRP.

To me, the real solution is getting money to the people who need money and will spend that money…in the quickest and most direct way possible….without having it diverting to imperial adventures or Big-Brother-hood.

The million dollar question is how? It isn’t like the Fed OR Congress operates or cares to be concerned about household economics or that there is any narrative to suggest they’d have the will to buck either of their favored interests to provide the means for the average American to spend or have their own version of a writedown(placing the money government gives them on upside down houses or on lowering those student loans).

The government can borrow or print money and put that into Social Security and Medicare and we can lower the age so more people can retire for the young to take over.

Can and will are two different animals though. As it is Congress has suggested things move in the other direction by raising the age so they don’t have as many of those treasuries maturing and they can keep their slush fund.

Don’t get me wrong, I AGREE with you. The government that represents us makes choices and we could just as easily print money to fund the elderly’s retirement as we do war. However, Congress has little interest in helping the average household.(Exhibit A being food stamps) Both parties are far too busy doling out money to the savvy businessmen who control oil, farming, health care. banking and accepting kickbacks. And the Fed has a limited toolbox that they seem to believe does not include helping Joe Average beyond handing money to banks in hopes that THEY will help Joe Average(and look how swimmingly THAT is working out.)

I know one of the current diversions is “blame the Boomers,” and many who want to finish us off, collect their Entitled Inheritances and magically find middle class jobs seem just fine, at bottom, with planting the old folks on an ice floe and pushing them out into the stream.

Our Rulers thank you for buying their lede so mindlessly. Old people HAVE to work. Social Security is not enough to live on, and some of the younger folks are all hot to steal even that, default on the Special Treasuries and keep the trillions of WAGE DOLLARS that we, and you, have paid into the Old Age Security “Trust Fund.” You think lowering or raising the SS full retirement age will increase your share of the looting? How many of you have any idea of the real nature and scope of military and state-security spending? Or what could so easily be done to “fix” SS and Medicare-Medicaid, but for the vampire squids among the post-Boomers who run things?

Hang together, against the cancers and predators who are killing all of us, or wander separately to the killing floors of the meat packing plants.

The bad news is that the fact that Congress hasn’t been doing it’s job isn’t going to change anytime soon. Furthermore, both corrupt parties pretty much have created the narrative that the government spending money is the end of the world pretty much meaning we’re going to do the opposite of what needs to be done. How much does anyone want to bet Congress cuts food stamps even though the CBO has stated it’s a stimulatory program?

I think it is more that most readers hate the Fed and so will use any stick to beat a dog.

And it is not correct to say that ZIRP plays no role in the economy being lousy. Negative real rates deprive retirees and others who live on savings of income. The Fed literally believes that retirees should just spend their principal faster, when most cut spending instead.

I definitely don’t hate the Fed. However, I do question their motives and methods from time to time(even as I understand the term limited toolbox.). It’s been fairly clear for a while that pumping money into the banking sector is not a solution for problems like the employment sector or the wages in it. It deals with macro solutions and unfortunately that isn’t helpful for those of us dealing with micro problems(wages not covering increased costs in health care or the increased costs of investment in education, etc, etc)

I believe the Fed views its real primary mission is to assure the health of the payments and banking system, and to support financial markets. These objectives are met in large part by engineering sufficient net interest margins to make loans attractive to the banks and enabling “speculative” gains by steepening the yield curve. Accordingly, I expect any interest rate increases will be primarily concentrated in the intermediate and longer term segments of the yield curve regardless of deflation in commodities and energy prices. I believe this policy set is also intended to constrain US dollar appreciation.

Real yields for savers remain negative on the short end of the yield curve out to ~5 years. Previous rate increases since the 2008 financial collapse have had relatively short shelf lives.

The imbalances, maladjustments and social equity issues resulting from monetary and regulatory policies over the past two decades are self evident.

Is the IS-LM model still driving policy?

To your last comment, yes. As discussed longer form but maybe not in a direct enough fashion in this Parenteau post, or in passing often when we’ve discussed the loanable funds fallacy.

. . .when we’ve discussed the loanable funds fallacy

This is confusing, as the excerpt below from your reply yesterday describes what I interpret as loanable funds.

The normal state of affairs is for households to save for large purchases, retirement and emergencies, and for businesses to tap those savings via borrowings or equity investments to help fund the expansion of their businesses.

That implies, to me at least, that businesses borrow(ed) from household savings, and that households give up the use of that money for the duration of the loan to businesses.

When a student, let’s say, borrows $100K to go to university, from a bank, does that money come from someone else’s savings or is that $100K ghosted out of nothing by the bank?

Securitization precedes deposits.

it seems that the interest rate hike is coming because the fed is worried that the stock markets are overheating – late, as usual. i’m not sure another reason is needed – it never did take its employment mandate seriously.

I seem to recall a flurry of articles about a lack of entrepreneurship and banks making small business loans. QE and low rates have driven money to quick returns not to business plans. ZIRP has led to hoarding. Sure we call it a stock, not a mason jar,but stocks have gone up too high and too regularly to take money out of stocks.

Electeds are hearing this message, and pressure is building to fix it.

there’s a good reason to this hoarding. with rates at or near 0%, most investment opportunities look very unappealing to most people. why take on risk to get a 1% return on your money when you can get 0 for no risk?

In my case my “hoarding” is not in the stock market. I’m not willing to make a quick buck off exploiting a worker. My saving is good ol cash. Maybe someday I’ll have enough to put some into municipals or something that I see as a helpful rather than harmful to my neighbors. Until then I’m okay with dollar bills even if right now I don’t “earn” as much as those playing Wall Street.

Fish gotta swim,

Birds gotta fly,

Fed’s gotta raise rates,

Don’t ask why!

With apologies to Kurt Vonnegut.