Yves here. In case you have not been following economic releases from Europe closely, one intensifying problem is that the Eurozone has moved into deflation. Deflation was at an annualized rate of 0.6% in January, and reversed somewhat in February to a mere 0.3%. Declining oil prices are a big culprit, but commodities prices have been falling for some time based on weakening demand from China, with oil the last to fall.

While most analysts argue that oil prices will start to rebound in the second half of the year, oil production continues to rise. And unlike the bullish shale gas promoters, many of whom have to continue to produce in order to service debt, some oil majors like Exxon and BP have warned that prices could remain low for years.

The reason for focusing on the disparity in measurement between the US and Europe is that Europe is using its inflation measures as cause for alarm, and the reason for launching QE, while the Fed is discussing raising rates.

Cross-posted from Washington’s Blog.

Anyone with a pulse knows that Europe is stuck in a downturn worse than the Great Depression.

Most think that the U.S. has fared better … but that is debatable.

Mega-bank Société Générale’s strategist Albert Edwards notes:

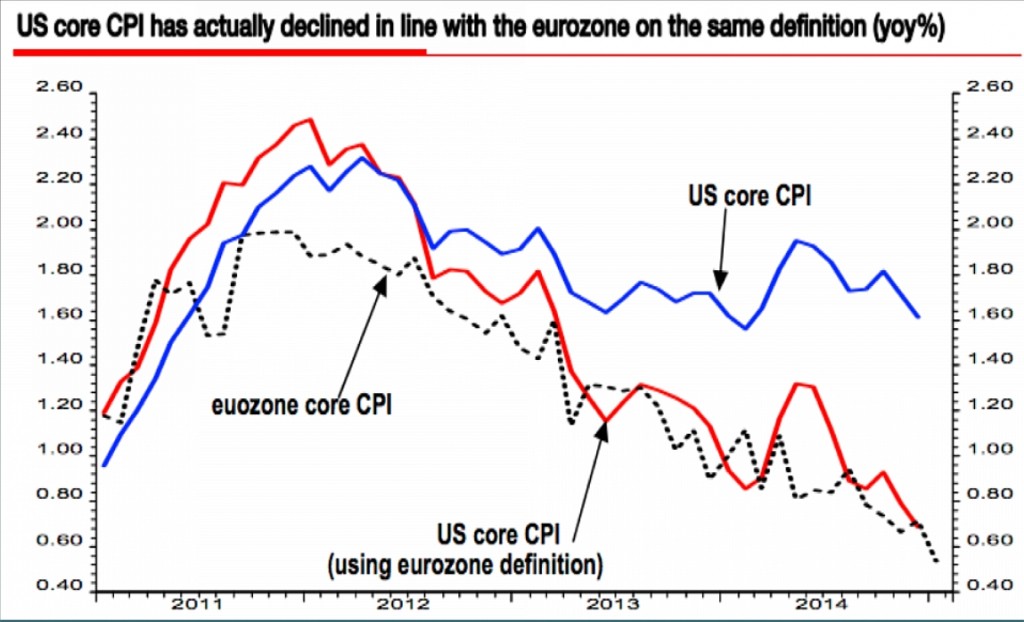

“Core Inflation in the US would be just as low as in the eurozone if measured on the same basis, despite the US having enjoyed much stronger growth!”

By way of background, the U.S. government has long ignored energy and food prices when reporting on inflation. As former Assistant Secretary of the Treasury and Assistant Editor for the Wall Street Journal, Paul Craig Roberts explains:

The inflation rate, especially “core inflation,” is another fiction. “Core inflation” does not include food and energy, two of Americans’ biggest budget items.

And – in contrast to the U.S. – the European method of calculation attempts to incorporate rural consumers into the sample (while the US maintains a survey strictly based on the urban population) and excludes owner-occupied housing from its scope (while the US calculates “rental-equivalent” costs for owner-occupied housing).

In any event, if calculated the same way, America’s crash in core inflation would be as obvious as Europe’s.

Re: “Core inflation” does not include food and energy, two of Americans’ biggest budget items.

That says a lot.

Just as the unemployment rate is a false portrayal, divorced from reality.

Yet our leaders continue to base their decisions on these falsehoods. Knowingly.

For a long time, I would’ve agreed with this assertion. Then I got curious about inflation forecasting, and downloaded CPI and core CPI data from FRED to analyze it, along with some other series.

Core CPI is less volatile than headline CPI because it excludes volatile food and energy commodity prices. When headline CPI drops below core CPI (it is 1.7% lower now), it tends to mean revert to the core rate over the next year or two. Thus the core CPI (or alternately, median CPI or trimmed-mean CPI) better captures the trend.

If the sharp drop in headline CPI in the past six months is extrapolated forward, it would project a deepening descent into deflation. But mean reversion to the core CPI sends exactly the opposite message: last month’s negative headline CPI report is likely to swing positive again soon.

My inflation model is based on the latter effect. I use because it works, not because the gov’t told me to. Currently it projects 1.70% core inflation in the next 12 months, and 1.91% headline CPI inflation. We’ll see.

That’s helpful, but note several things:

1. Your 1.91% is still below the Fed’s target, and hardly a justification for rate increase saber-rattling. This looks to be all about the Fed getting antsy about the mess it created with ZIRP and wanting out as soon as it can justify it, workers and unemployment be damned (of course, they’ll lose nerve when markets swoon….)

2. The big issue is divergence, with Europe using deflation as an excuse for QE, as in lowering the Euro, which BTW Greece is doing too (funny how no Germans are thanking the Greeks for that one….)

Divergence is what’s upsetting the market.

Ms. Market likes to see all the world’s central banksters pulling their oars in unison.

Now with the ECB rowing with all its might, while the Fed drags its oar, the boat is going in circles. And so are the sharks circling round it.

I would still stick with core inflation, since oil price is really reflected in many other things that are calculated in core. And oil price is also affecting the food prices. But food is not such a bigg part of expense and poor get it almost free from food stamps and donations. But restaurant prices should be included in core. I do not know if they are.

Only problem i find is with how “rental-equivalent” distorts it.

Real problem would not be fixed by using house prices as is, because that specificaly does not affect purchasing power. What trully affects peoples purchasing power is monthly payments and property tax, both are affected by housing price and directly affect purchasing power which is why inflation is important to be calculated. But, monthly payments are affected by interest on mortgage.

So, instead of “rental-equivalent” it should be monthly payments with property tax used into the core inflation. That is possibly even more flat then “rental equivalent” in some periods.

This is not about the price of oil, but of energy — or do you never, ever directly consume electricity for light and electronic gadgets, gas for your oven, domestic fuel for heating or gasoline for your car?

And as for food — I know that many people no longer really cook in the USA, but I did not realize the North American society had advanced to such a stage of abandonment of a basic household activity that the price of food has become irrelevant. But then, what are those large, well-equipped kitchens used for?

The large, well-equipped kitchens are for the display of granite countertops.

However, as I cook stuff for Food Not Bombs, that is, more than some people, I’ve noticed a considerable rise in the prices of the foods I buy over the last year. I thought it was odd since, supposedly, a significant component of food prices is energy cost. The phenomenon may be local — my neighborhood is being radically gentrified and the supermarkets may be trying to get into Whole Foods mode, starting by imitating Whole Foods pricing structure.

Local restaurants in the Bay Area have begun going under because of the rise in food prices.

Americans cook less than people in any other developed nation. The kitchens you see on TV are aspirational, for the top 20% still clinging to middle class status and where someone in the family still has the time and training to cook.

The economy has certainly been crapified in the US to an amazing extent, but I would say that we’re doing better than the peripheral European countries. The situation in Spain, Greece, and Italy in particular seems desperate from my readings at this blog.

In regards to inflation, I will never understand why housing costs aren’t figured into this accounting. I always remember hearing that you’re supposed to pay 30% of your income on housing, but in my regions of the country this is simply not realistic. It should figure into inflation. And the Fed has certainly helped re-inflate housing costs as best they can.

That may be the real issue. Europe is looking for one number that covers Germany, Englans, Sweden, Spain, and Greece. I suspect on a country-by-country basis it would look a lot different and, given that most Europeans are still local buyers, that would be a lot more accurate.

The argument the comparison makes is interesting on its ow.n. If it is incorrectly calculated, that is a problem.

The endless arguments of which method is more or less useful is only interesting, in this context, if we use the same metrics to compare. One wonders if apples to apples results would very widely different? If so, understanding why might be instructive.

Verifying the correctness of this comparison is above my pay-grade. <wink>

Yes, there is a much bigger issue, which is a pet peeve of mine, that of trying to find some sort of single measure to understand complex phenomena. Never a good idea. Value at Risk (VaR) is the poster child.

and if they were to use the employment figures the US used during the Great Depression – we’d find we are there. The only reason we’re not seeing soup and bread lines is the government figured out how to hide our national shame with food stamps. Extend and pretend, paper it over, cut SS payments by taking out anything that might resemble real inflation. Yeah, the economy is roaring along, just like the roaring 20’s.

The gap also gets some coverage from food banks, which only enter the national awareness between Thanksgiving and Christmas but are open year-round, and provide another crucial source of food for people who have been disqualified for food stamps or who get a really raw deal on them (I know here in WA there is a tier at which the government acknowledges you are impoverished enough to need food assistance, but not yet truly desperate enough for their algorithms, at which monthly aid is $16/person).

There’s been a big rise in the number and size of “tent cities” over the last few years, which I believe we called “Hoovervilles” last time they were the housing option for a large number of Americans….

It would be useful to have a census of tent cities. I wonder if there is one? Or a map?

Greenspan is trying to explain the situation as a tinderbox of potential inflation. That has to be handled very carefully lest it take off. With all that money on the Fed’s balance sheet. Whereas Bernanke said that all that money didn’t matter because it was either in a big pool of reserves and would only be used if there were good loans for the banks to make, or, in the case of the Fed buying assets, the Fed could just let them “run off.” What is the real story here? Does it have anything to do with 13 trillion dollars waiting offshore to be repatriated by the international corporations? That could cause inflation couldn’t it? It seems like fear of inflation is making the Fed crazy; it is making Greenspan sound terrified. And he’s the very guy who recently said that raising interest rates doesn’t do anything to rein in inflation.

Alan Greenspan went in front of congress and told them, he just couldn’t understand how his bankster buddies could crash the system. The crime of this millennium, so far.

He is a putz of the first order, running a three card monte game without even realizing he was the mark.

Greenspan making millions selling crappy advice is not inflationary. Walmart worker getting an extra quarter an hour opens the gates of inflation hell.

What is the real story here?

Fed economists are clueless, and for everyone else’s sake should be fired. They are the useless eaters.

Ignore Greenspan. He is, literally, an Ayn Rand follower and, therefore, intellectually dead.

Inflation and deflation are figments of our imagination. Especially when people glibly interchange price deflation (or more accurately – disinflation) and debt deflation – then make multi trillion money decisions based on whatever they’ve spooked themselves about.

Or maybe they do know better and it’s just a cover story to justify some other end. Then everyone babbles about Econ 101 and phony stats like they know what they are talking about and all this stuff is as immutable and uncontroversial as Natural Law.

Am I the only person who actually shops for food?

You see the strange thing is that I have noticed food prices have actually increased. That is retail food prices at my local mega mart big box purveyor of industrialized garbage. The price per pound for fresh(ish) beef has increased, the price per pound for fruit has increased, originally we were told that this was due to a) drought conditions in the west and midwest and b) increased fuel costs. Whilst a) is unfortunately unchanged b) has seen a massive decline recently yest the price of fresh meat and produce remains higher than last year.

have I missed something in describing inflation/deflation when looking at prices? I know that we cook the books based on dynamic scoring and assume that I will purchase a cheaper alternate when the price of my standard food item increases (Cat food any one?), but that was done to hide inflation not to hide deflation. Can any one tell me what has decreased in price?

I recently purchased a new washing machine, durable goods category. The price was not much different than I had paid 10 years ago, however due to the crapification of the white goods industry i expect this machine to last about a week and a half, had I purchased a machine of a similar quality to the previous machine then the price would have been a factor of 2 or 3 higher.

I am basically just not seeing the deflation except in fuel costs and of course in the value of my house.

It depends on the country.

Where I live, while prices for vegetables and fruits are stable, those for chocolate and rice have increased substantially in the past few months. Overall, I do not see much impact from lower energy prices, nor from more favourable exchange rates.