Yves here. As we pointed out early on in the oil price bust, following the argument of John Dizard of the Financial Times, shale gas operators, aka frackers, were often carrying so much debt that they simply could not afford to cut production. They’d keep pumping, even at a loss, to generate cash flow to keep servicing their obligations. Over-production would tail off only when the money sources dried up.

As we’ve since chronicled, even though rig counts have fallen, shale gas production has actually increases. Arthur Berman provides a detailed look at tight oil and shale gas output, and confirms that the rig count cuts for shale gas have not been deep enough.

By Arthur Berman, a petroleum geologist with 36 years of oil and gas industry experience. He is an expert on U.S. shale plays and is currently consulting for several E&P companies and capital groups in the energy sector. Berman is an associate editor of the American Association of Petroleum Geologists Bulletin, and was a managing editor and frequent contributor to theoildrum.com. He is a Director of the Association for the Study of Peak Oil, and has served on the boards of directors of The Houston Geological Society and The Society of Independent Professional Earth Scientists. Originally published at OilPrice

Spending cuts for oil-directed drilling have dominated first quarter 2015 energy news but rig counts for shale gas drilling are too high.

Investors should pay attention to this growing problem. Bank of America fears sub-$2 gas prices now that winter heating worries are over. Low natural gas prices affect the economics for gas-rich oil production in the Eagle Ford Shale and Permian basin plays as well as for the shale gas plays.

Meanwhile, an orgy of over-production is taking place in the Marcellus Shale. Well head prices are now below $1.50 per thousand cubic feet of gas because of limited take-away capacity and near-saturation of regional demand. Even companies in the Wyoming, Susquehanna, Allegheny and Washington County core areas of the Marcellus play are losing money at these prices.

The rig count for shale gas plays has decreased by only half as much as for the tight oil plays. The reason appears to be that most shale gas companies do not have significant positions in the tight oil plays and must continue to drill to maintain production levels.

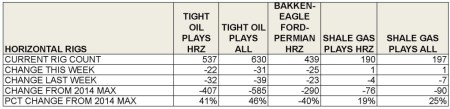

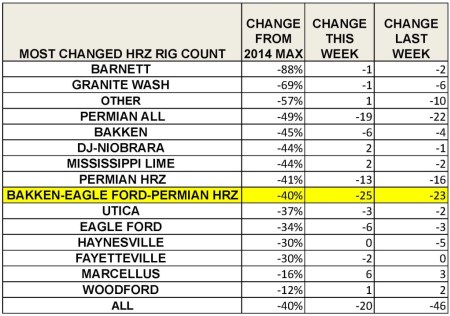

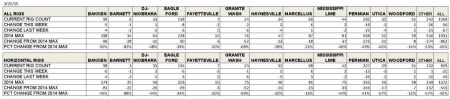

Shale gas rig counts have dropped only 19% for horizontal rigs and 25% for all rigs from 2014 highs. The corresponding decrease for tight oil plays is 41% and 46%, respectively, as shown in the table below.

Rig count change table for tight oil vs. shale gas plays as of March 20, 2015. Source: Baker Hughes and

Labyrinth Consulting Services, Inc. (Click Image To Enlarge)

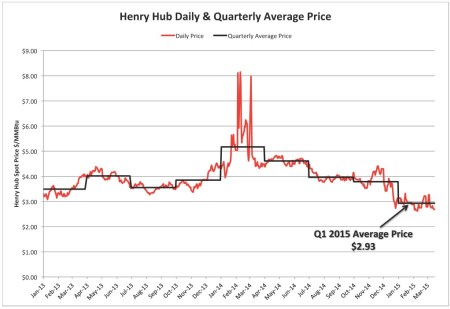

This has puzzled me because the shale gas plays are not commercial at less than about $6/mmBtu except in small parts of the Marcellus core areas where $4 prices break even. Natural gas prices have averaged less than $3/mmBtu for the first quarter of 2015 and are currently at their lowest levels in more than 2 years.

Henry Hub daily and quarterly average natural gas prices. Source: EIA and Labyrinth Consulting Services, Inc.(Click Image To Enlarge)

Most shale gas producers either do not have positions in the tight oil plays or are strongly gas-weighted in their production mix. These companies must continue to drill in shale gas plays despite poor economics in order to avoid the consequences of falling production levels.

The only criterion that seems to matter to investors these days is production guidance. If production drops, stock value will fall even farther than it has already. This will trigger loan covenants if asset values fall below thresholds set out in the loan agreements. When that happens, the loans will be called unless the companies can come up with more cash. This might result in bankruptcy. So, the drilling must continue as long as there is capital.

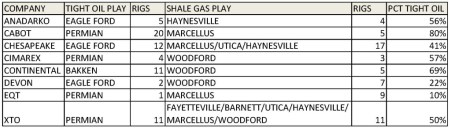

The table below shows the companies that have overlapping positions in both tight oil and shale gas plays based on current drilling activity.

Current rig counts for companies with positions in both tight oil and shale gas plays. Source: DrillingInfo and Labyrinth Consulting Services, Inc. Rig counts may differ from Baker Hughes because the source is different. (Click Image To Enlarge)

All companies in the table except Continental Resources are gas-weighted so maintaining gas production levels is important to them for the same reasons it is important to operators without tight oil exposure. Overall, the companies in the table operate only about one-third of all rigs in the shale gas plays. Shale gas is otherwise characterized by a different set of companies that feel they have no choice but to continue drilling and hope that investors don’t notice or care.

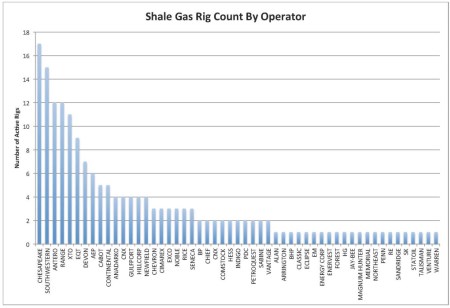

Shale gas rig count by operator. Source: DrillingInfo and Labyrinth Consulting Services, Inc. Rig counts may vary from Baker Hughes because the source is different. (Click Image To Enlarge)

But don’t oil-weighted companies face the same concerns about production levels?

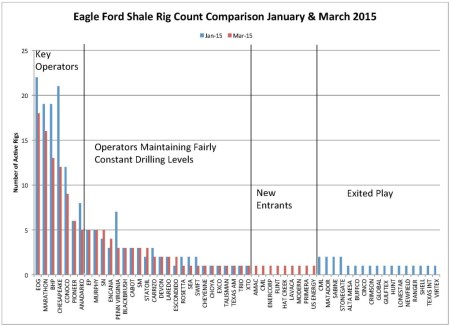

I compared the change in rig count from January to March 2015 by operators in the Eagle Ford Shale play to understand how rig counts are being reduced. I found that key operators were strategically reducing their activity to the best locations in core areas in order to affect production levels the least (see chart below).

Eagle Ford Shale rig count comparison by operator, January and March 2015. Source: DrillingInfo and Labyrinth Consulting Services, Inc.(Click Image To Enlarge)

The next most active class of operators are holding drilling fairly constant in this most productive of tight oil plays. Then, there are a small number of new entrants to the play that are more than balanced by operators exiting the play. My previous post on Eagle Ford well performance showed that there are ample locations in the most commercial parts of the core areas for well-positioned operators to optimize production with fewer new wells.

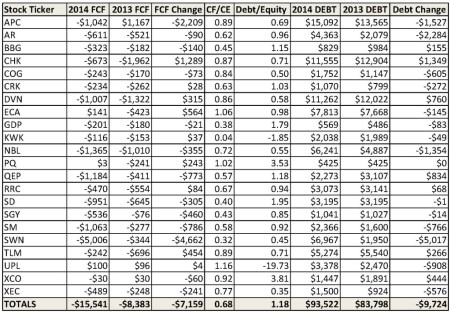

It is worth noting that the top group of operators in the Eagle Ford Shale play have reasonably good balance sheets (see the table in my previous post) and are not particularly vulnerable to loan covenant threshold triggers. This cannot be said for many of the top operators in the shale gas plays shown in the table below.

Summary table of 2014 year-end financial data for natural gas-weighted U.S. land-based E&P companies. All dollar amounts in millions of U.S. dollars. FCF=free cash flow; CF/CE=cash flow from operations/capital expenditures. Source: Google Finance and Labyrinth Consulting Services, Inc. (Click Image To Enlarge)

The table shows financial data through year-end 2014. What it reveals is not pretty. 2014 negative cash flow reached $15.5 billion, an increase of $7.2 billion over 2013. Much of this increase involved Southwestern Energy’s puzzling acquisition of Chesapeake’s West Virginia Marcellus Shale position that increased that company’s negative cash flow by almost $5 billion over 2013.

On average, shale-gas companies earned only 68 cents for every dollar that they spent in 2014. Total debt increased almost $10 billion to $93.5 billion and average debt exceeded stated equity by 18% excluding companies with negative equity including the now-bankrupt Quicksilver Resources.

Shale gas plays are commercial failures. The misuse of capital to continue to increase production while destroying price and shareholder equity has gone on for too long. Investors should demand that shale gas companies cut rig counts at least as much as tight oil companies have.

Rig Count Summary for the Week Ending March 20, 2015

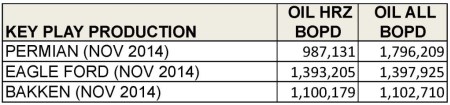

Rig counts are important today because they may indicate future trends for oil prices. Horizontal wells in the Bakken, Eagle Ford and Permian basin plays produced about 3.5 million barrels of crude oil per day in November 2014 (see table below). These are, therefore, the key plays to watch for rig count decreases.

U.S. key tight oil play production. Source: Drilling Info and Labyrinth Consulting Services, Inc. (Click Image To Enlarge)

The horizontal rig count for these key plays–Bakken-Eagle Ford-Permian HRZ-dropped 25 rigs this week (23 rigs last week) and was down 40% from the 2014 maximum. The horizontal rig count for tight oil plays overall dropped 22 rigs this week (32 last week) and is 41% lower than the 2014 maximum (see the first table above in this post). Rigs for all tight oil plays were down 31 this week (39 last week) and are 46% lower than 2014 maximum rig counts.

Summary of most changed rig counts by play. Source: Baker Hughes and Labyrinth Consulting Services, Inc.(Click Image To Enlarge)

The plays with the greatest change from their respective 2014 maximum rig counts may be viewed as the least commercially attractive to producers. This suggests that the Barnett, Granite Wash, and Permian All are the least attractive.

It is interesting that the Bakken moved into this category this week. Well head prices in the Bakken have now fallen below $30 per barrel. The play is geologically solid but wells are expensive, the pay-out times are fairly long because relatively low decline rates for a shale play, and rail transport adds a lot to the cost of each barrel of oil.

The overall U.S. rig count for the week ending March 20, 2015 was 1,069 of which 1,030 were land rigs. Only about 25% of total land rigs and 11% of horizontal rigs are drilling outside of the major shale gas and tight oil plays. Detailed data for all of the plays are shown in the table below.

Summary table for all U.S. land rig counts. Source: Baker Hughes and Labyrinth Consulting Services, Inc. (Click Image To Enlarge)

This and other data continues to suggest decreasing U.S. tight oil production and increasing world demand. Rig count continues to fall for the critical oil-producing plays and that means that things are on track for an oil-price recovery sooner than later.

Investors should carefully examine why shale gas players have not reduced rig counts more. Continued drilling in the Marcellus will crush natural gas prices further. The fact that there are 34 rigs running in the Haynesville Shale is economically baffling. We may only speculate on why there are 51 rigs in the Woodford Shale and why some operators now call it the SCOOP play

I was lucky, or unlucky, to have worked through both the Dot.Con bubble and the R/E.Con bubble as a client-facing in-house service provider subcontractor.

The moment I saw the Fracking Stampede, that old smell of dried blood came back. We were coding faster than possible to write clean code (instead of ‘bloat’ code) and cobbling together coded libraries rather than integrating them, and STILL the VCs were pouring money into more software! Anything that had the shiney bauble of ‘Internet’ attached was gold. We all saw the tsunami coming, but the VC’rs did not, and the BankBroksters did not even care. “Slap some lipstick on this pig. Greed is good!” Then one Monday we came to work and there was our pink slips. All of us. The offices were locked and in receivership a week later.

Fast forward a few years, and I found myself right in the heart of the R/E.con, working as an in-house contractor for a big property developer. The design consultant fees were egregiously bloated, the City/County developer fees and offset costs were disgusting. The asking prices for barely finished, ‘throw some stone countertops and fake wood floors and shove it out the door’, were astronomical!Yet Ownership kept buying more properties! Classic Tulip Bulb mass insanity ‘flipping’ mentality. Borrow, hogswallup, flip; borrow, hogswallup, flip. You could see the prices going vertical. Then one Christmas Eve I got the urgent call to come into the office. There were the principals and corporate attorney, a pink slip, an NDNCA. By January 1, it was shut down and everyone laid off.

So is Shale Fracking a bubble? Oh, yeah! Is oil/gas production, and more importantly, deliveries going vertical? You bet! Will, at some moment in history, it all collapse like a cascading pachinko game house of cards? Yeah, baby! And with it, the senior plays will all be upside down, and the junior plays will be worthless, overnight, as all the Mom and Pop 401ks and pension funds take a great . big . dump. Who knows how many times this is over-leveraged? 10x? 100x?

We know there won’t be a bailout, and there won’t be a QEn. Only smoking moon rocks and 100,000s of SuperFund cleanup sites, tarantulas and tumbleweeds. But America has ALWAYS been that way, from the moment the Pilgrims landed. Grifters and bonanza plays. The Fracking Bubble collapse will simultaneously trip the Student Loan Bubble collapse, which will trip the Commodities Speculation Bubble collapse, which will trip the Commercial Retail Properties Bubble collapse.

No stops. No floors. Straight down. Down . to . the . bottom . of . the . sea….

One is reminded, whatever the actual provenance, of the collapse of the World Trade Center buildings… all. the. way. to. the. bottom… with lots of little people burned and crushed and jumping and later dying of the powdered industrial products they inhaled while trying to escape, or more poignantly, trying to save and succor others… While the Mob stole the steel, smeared with human remains — http://www.chicagotribune.com/chi-0109290145sep29-story.html. And the firefighters and police, noble people all, fought over who would get the overtime pay in the city budget…

I understand most B-school dudes and dude-ettes get to play the Beer Game, which I hear is taught to expose our Betters to the challenges of supply chain management. https://www.youtube.com/watch?v=7ilJRuAapvA I ain’t the first person to note the very much larger applicability of what should be learned from what happens, invariably, in that simulation, to the whole post-sylvan political economy — boom and bust are built into the “system” of fear and greed that dominates, apparently, everything that matters:

The Beer Game was developed to introduce students, managers and executives to concepts of system dynamics. The purpose of the game is to illustrate the key principle that structure produces behavior. Players experience the pressures of playing a role in a complex system and can see long range effects during the course of the game. Each player participates as a member of a team that must meet its customers’ demands. The object of the game is to minimize the total cost for your team. Lots of little clues in there, though as to seeing “long range effects during the course of the game,” even though players are told that almost all previous runs produce the same result (overproduction of beer, or shale gas, or whatever, followed by collapse), I’d say that their is limited appreciation of the self-serving actions that almost invariably ensue in the role-playing..

I see from Google that the notions of the Beer Game have been extended to “system dynamics,” and other B-school noises, but not so much to the teaching of or indoctrination into ethics and morals that we all pretend are the ideals. Although I did find this little slightly mordant, futility-perceiving link to a description of one mode of failure in “What is the beer game?”, at http://maaw.info/TheBeerGame.htm:

At this point all the players blame each other for the excess inventory. Conversations with wholesale and retailer reveal an inventory of 93 cases at the retailer and 220 truckloads at the wholesaler. The marketing manager figures it will take the wholesaler a year to sell the Lover’s beer he has in stock. The retailers must be the problem. The retailer explains that demand increased from 4 cases per week to 8 cases. The wholesaler and marketing manager think demand mushroomed after that, and then fell off, but the retailer explains that didn’t happen. Demand stayed at 8 cases per week. Since he didn’t get the beer he ordered, he kept ordering more in an attempt to keep up with the demand.

The marketing manager plans his resignation.

Lessons from the Beer Game

1. The structure of a system influences behavior. Systems cause their own problems, not external forces or individual errors.

2. Human systems include the way in which people make decisions.

3. People tend to focus on their own decisions and ignore how these decisions affect others.

Lessons Related to the Learning Disabilities (described in Chapter 2)

1. People do not understand how their actions affect others.

2. So they tend to blame each other for problems.

3. Becoming proactive causes more problems.

4. The problems build gradually, so people don’t realize there is a problem until its too late.

5. People don’t learn from their experience because the effects of their actions occur somewhere else in the system.

The players eventually discover a little of Pogo’s wisdom. According to Pogo, “We have met the enemy and he is us” (p. 54). ”

When you add in the tiny reality that in any pyramid, the very few at the top “get filthy rich” from the Game as constructed, without the immanent constraints that seem to apply in other living systems, you get what we’ve got.

Um that’s all well and good…but should you mention *why*? Do you think it might have something to do with monetary policy? Dot-com, Real Estate, and now this, fracking and the oil price catapulted upwards because money is free, simple as that. And now, even before money is becoming “un-free” anywhere in the world, the spiral downwards is happening right on schedule.

Yeah, those are all parts of the behavior set, that in smaller human gatherings seems to be shortstopped by having to look the “marks” in the eye. But having names for all the torture tools tends to draw one in fascination to the individual bits of inventiveness and technology, rather than compel revulsion at the schema. Old, http://www.viralnova.com/medieval-torture-devices/ and new: http://listverse.com/2013/10/19/10-gruesome-torture-devices-used-in-modern-times/

Speaking of downward spirals…

Mr. Berman,

Love your work. Could you be more specific on your Woodford comment. There is the Cana area and the Scoop area. Some parts are dry gas, some condensate and some predominantly oil.

“We may only speculate on why there are 51 rigs in the Woodford Shale and why some operators now call it the SCOOP play.”

It’s not the rigs, it’s the oil wells you want to count, and whether they are producing or not. The rig count could have dropped to zero after its Oct14 peak, and you still would have had rising production, albeit at a slower rate, instead of the current rate which has slowed only marginally. The rig reduction will effect the number of wells however, and in turn, with fewer wells, once the inevitable output decline sets in for the newer wells, then the overall production will slow (as I dont think enough of the older wells are declining fast enough overall to offset the rising production from some of the newer ones.) This assumes no resurgence of rigs drilling new holes of course. So the 50% rig count drop is already significant and the faster that drops, the faster the turn toward reduced production. When that is depends on how the existing wells are utilized, as not all are even producing at the moment. It would be interesting to see data on all of the wells and how many are seeing rising production, declining, etc, and how many are not yet even ready for production.)

The depletion rate for tight wells is really high based on the data I’ve seen – parabolic to hyperbolic curves. So for conventional wells a well count is reasonable and production can continue after the rigs leave, the tight wells require redevelopment in a short span (12-36 months) in order to keep producing and redevelopment requires rigs.

The whole Marcellus play, in my professional opinion as a licensed geologist in multiple states, looked like a huge real-estate ponzi. I suspect that the whole thing is exactly like the banking sector – cheap debt to build out a facade, owners extract profit, when it pops leave the empty corporate shell for Ch7 vultures and government to clean up the huge mess while the (former) owners keep what they extracted.

The Bakken is somewhat different (less of a ponzi, different environmental issues), but expect the same there eventually.

HR Housekeeping: The Conspiracy of Stupidity

So, the conspiracy of genetic stupidity has reached out and grabbed many, again, just when they thought they were going to reach escape velocity, and were surprised when the gravity was family, friends, and co-workers. Don’t look back; prepare for the gate at the end of the next cycle. Your empire identity isn’t working for you.

The development and empire curves are convex and concave relative to each other. Those who made the gap did so with resonance, the help of a stranger. Hard work and intelligence is necessary, but without the ability to see beyond the empire, you remain blind. Some who made the gap fell back, because they didn’t recognize anyone on the other side.

The empire is what it is for very good reason. Most compete to get their way, and so fall prey to empire. Don’t expect the blind to lead you anywhere but backwards. Life is a marathon; build surplus, beyond the reach of others, so when the empire reaches out to grab you, you always have another gear.

We all do stupid, expedient, best-is-the-enemy-of-better sh-, but because the political majority prints money for the purpose is no reason to make a habit of it. If you want to be popular, do nothing, talk like you know things others do not, and be born rich. Feudalism hasn’t changed in thousands of years. If you want something done, do it, and expect gravity to align against you.

The one thing you know is that empire is not reality; money in the form of real estate inflation is not wealth. Rocket science is not required to build a blind alley and attack others as they pass. The shortest distance is never a straight line, because time is an illusion maintained by gravity. Don’t live in the time of others and expect to get anywhere.

Just because the State decrees that 2 and 2 is 5 for one group, and 2 and 2 is 3 for another, in an education system built for the purpose, doesn’t make it so. Samsung or Apple, Bank of America or Bank of China, makes no difference to labor. Labor doesn’t have a political party, and it doesn’t make decisions based upon a FILO bankruptcy queue, one way or the other.

Most tend to run things into the ground, and then assume that living from the resulting emergency to emergency is normal. That others will print money to feed the ignorance should be of no surprise. Nothing changed with Lehman or TARP. A lot of people temporarily woke up to the fact that they were on a slow train to death, and the Fed administered more of the same.

Monetary and fiscal policy is irrelevant to your life, unless you assume that empire is reality, which is why the critters spend all their time digging their own grave, expecting a different outcome, and steal what life they can, from others headed in the other direction. Genetic expression depends upon environment. Don’t plant your seed in dirt.

Adaptation is not about what you want. The point of marriage is to build something new together, not to fight over who’s parent you are going to live with. Printing money and giving it to one group, to create jobs for another, to pretend to work, while machines crank out product for dumber and dumber people, disconnected from nature, is not an economy, no matter how many time the Fed moves the baseline, to prove that stupidity is productivity.

Don’t measure yourself by other people’s yardsticks and expect to escape gravity. MS didn’t scale up because its products were effective, nor will its successor, in a chain of bait and swaps, relying on the unreliable to create economic activity, in an increasingly closed system, of shrinking potential under increasing pressure.

Building an electrical operating system, even for Maglev with no physical switching gear, is a walk in the park relative to raising children within the empire, because the bridge requires a foundation of faith, which is nowhere to be found in the empire, including its church. Married people don’t have friends or enemies; they have union, and promote trade accordingly, equal rights and affirmative action or no.

I have more horror stories about government unions corrupting private unions than anyone, but this too shall pass. It’s HR’s job to exclude you. Herds exist to avoid change, which is why predators exist. The cleanest dirty shirt is not the path to the future. Even rust has a purpose. Neither a lender nor a borrower be.

I’m afraid you’ve completely missed the big picture.

Natural gas prices are falling as a result of increased productivity of natural gas fracking. The Marcellus and Utica are some of the most efficient natural gas production areas in the country. Right now, so much natural gas is getting produced in the northeastern region of the United States that there is not sufficient take away capacity to transport it to other regions where they bury the natural gas production from other plays. In about five years, a much greater percentage of the natural gas in this country will be coming from the northeastern United States and the pipeline system will catch up with this.

Take a look at natural gas futures. They are currently projected to remain below $5 an mmbtu through 2025.

http://www.cmegroup.com/trading/energy/natural-gas/natural-gas_quotes_globex.html

Your assertion that marginal prices for natural gas wells are $4 an mmbtu are not consistent with reality. They are much higher in some plays (like the Eagle Ford and Haynesville) and much closer to $2 an mcf for parts of the Marcellus and Utica. Investors in the dry gas portions of the Eagle Ford often aren’t even renewing their leases for this acreage – since that area is so much less productive than the Marcellus.

The good news is that lower natural gas prices are a good thing for the country.

Low natural gas prices encourage more utilities to switch from coal production to natural gas production. It also encourages more trains to switch from diesel to LNG. Both of these developments reduce greenhouse gases and are a net plus for the country.

Also, since our natural gas prices are the lowest in the world, it’s a huge boost for many industries and many manufacturing jobs are returning to the US.

Regarding the latest production increases, oil production has not slowed down yet in the U.S. for primary reason. There is a time lag between the point when oil wells are drilled and those same oil wells are fracked. Typically this is about four months. Since oil prices fell in earnest in the December time frame, we’ll see some major production reductions by the April / May timeframe.

One of the problems that we continue to face in the oil industry is the restriction that prevents us from selling our crude oil to other potential countries; this outdated law creates a situation of monopsony. The US crude oil surplus is building up because refiners aren’t equipped to burn the sweet oil that we now produce in the US and the refineries shut down for maintenance this type of year. In addition, they’ve recently been on strike. Furthermore, the dollar is very strong now. The result of these two factors it that the domestic oil drilling companies get a $10 haircut on the differential between WTI and Brent and also another $10 haircut on the strong dollar. Outside the US, most drillers feel like they are facing what would normally be a $70 oil price.

I’m afraid you’ve completely missed the big picture.

Natural gas prices are falling as a result of increased productivity of natural gas fracking. The Marcellus and Utica are some of the most efficient natural gas production areas in the country. Right now, so much natural gas is getting produced in the northeastern region of the United States that there is not sufficient take away capacity to transport it to other regions where they bury the natural gas production from other plays. In about five years, a much greater percentage of the natural gas in this country will be coming from the northeastern United States and the pipeline system will catch up with this.

Take a look at natural gas futures. They are currently projected to remain below $5 an mmbtu through 2025.

http://www.cmegroup.com/trading/energy/natural-gas/natural-gas_quotes_globex.html

Your assertion that marginal prices for natural gas wells are $4 an mmbtu are not consistent with reality. They are much higher in some plays (like the Eagle Ford and Haynesville) and much closer to $2 an mcf for parts of the Marcellus and Utica. Investors in the dry gas portions of the Eagle Ford often aren’t even renewing their leases for this acreage – since that area is so much less productive than the Marcellus.

The good news is that lower natural gas prices are a good thing for the country.

Low natural gas prices encourage more utilities to switch from coal production to natural gas production. It also encourages more trains to switch from diesel to LNG. Both of these developments reduce greenhouse gases and are a net plus for the country.

Also, since our natural gas prices are the lowest in the world, it’s a huge boost for many industries and many manufacturing jobs are returning to the US.

Regarding the latest production increases, oil production has not slowed down yet in the U.S. for one simple reason. There is a time lag between the point when oil wells are drilled and those same oil wells are fracked. Typically this is about four months. Since oil prices fell in earnest in the December time frame, we’ll see some major production reductions by the April / May timeframe.

One of the problems that we continue to face in the oil industry is the restriction that prevents us from selling our crude oil to other potential markets. This creates a situation of monopsony. The US surplus is building up because refiners aren’t equipped to burn the sweet oil that we now produce in the US and the refineries shut down for maintenance this type of year. In addition, they’ve recently been on strike. Furthermore, the dollar is very strong now. The result of these two factors it that the domestic oil drilling companies get a $10 haircut on the differential between WTI and Brent and also another $10 haircut on the strong dollar. Outside the US, most drillers feel like they are facing what would normally be a $70 oil price.

Oil Dusk,

Two things:

Natural-gas production from the Marcellus is indeed crimped by insufficient takeaway capacity (pipelines); the same applies to the Utica. To say, though, that things will be much better in about five years, after expansion of pipeline networks, is to overlook the decline of production in legacy fields: it’s nearly equal to new production, in the Marcellus. Rate of decline nearly equals rate of new production and rate of decline is increasing. There is little growth of production, as a result.

Your bringing up the “restriction that prevents us from selling our crude oil to other potential markets” is puzzling. It is possible to export crude, if a permit is obtained, and that is done all the time. Oil was exported to refineries in Italy last year, as one example. And crude is exported to Canada without a permit required. As of December 2014 the US was exporting about 180 million barrels of crude oil a year. Not much, compared to the big exporters, but we do export.

Another reason for puzzlement: What would happen if US producers could export crude without needing permits to do so? You point out that prices outside the US are higher than current prices here; that means that it would be much more attractive, to producers, to export crude than to sell it to US refineries at US prices, so US refineries would have to bid higher in order to secure the crude they need–and that increased cost would be passed on to the consumer of refined products such as gasoline and diesel here in the US. Well, that would be good news to the producers anyway.

US refineries, now, they can export refined products without restriction, and they do: the US exports refined products cracked from about one billion (not million) barrels of crude oil each year, at a significantly higher profit margin than is gained from selling crude. Almost all of those products go to Canada and Mexico with the rest sold to Central and South American countries. Selling your crude, as Saudi Arabia and the Gulf countries and Russia do, is to lose the profit that refining your crude and selling the products would bring you. Saudi Arabia, at least, is finally acting on this recognition and building refineries especially as joint ventures with other countries; Saudi Arabia, in other words, is catching on. For the US to export its crude is to go backwards.

So: Unrestricted export of crude would make oil producers happy as they would get higher prices for their product. Restricting export of crude makes refiners happy because they pay lower prices for the crude they refine, and export refined products at prices based on world, not US, oil prices because they can. It’s good to keep in mind what both groups want, when considering the question of whether or not US crude oil should be exported freely.

Dear Synapsid,

There is plenty of natural gas production growth potential; individual well production rates are way up in the Marcellus and Utica and there are plenty of high quality drilling locations to come. The low prices do tend to reduce the number of wells drilled – which is consistent with falling rig rates. Would you choose to increase production much in this current natural gas price environment? Don’t use that fact to suggest that there are not considerable natural gas reserves in the world. There are huge volumes of natural gas and oil reserves that are technically recoverable:

http://www.eia.gov/todayinenergy/detail.cfm?id=14431

———————————-

The law that prevents US oil and gas producers from selling to other countries is negatively impacting WTI prices in favor of Brent prices by something close to $10 a barrel.

There are exceptions to this law permitted to both California and Alaska and, most recently, some condensate production. This accounts for the majority of the volume of exports you are quoting.

If US companies could export crude oil freely, they would be able to find the most efficient refineries for this output – especially the ones that have the equipment and have made the investment to extract the highest value from it. This would allow those refineries to maximize the economic benefit of that oil stream. Why can’t we allow the invisible hand of our economic system to work on behalf of US oil and gas producers that drill wells in the US?

Isn’t the government supposed to be encouraging more companies to do business in the United States? This particular law encourages US producers to invest outside of the US in order to benefit from the higher prices that this export law supports.

You’re suggesting that because our refineries can make a lot of money, we should accept the punishment of our oil producers? Really?

What’s wrong with allowing our economic system to determine winners and losers? To suggest that the utility of our country is better served by favoring refiners over producers makes me question the bias in your answer. Keeping this law in place will require the US to import an extra half million to a million barrels of crude oil a day that we should be producing ourselves.

Here’s a study from Rice University on this matter:

http://bakerinstitute.org/media/files/files/0bfec984/CES-CrudeOilExports-Medlock-032515.pdf