In case you had any doubts that Greece is supposed to act like a good debt vassal, the Eurogroup’s hissy fit over Yanis Varoufakis at last Friday’s meeting, which stoked a raft of unflattering articles, has now led it to demand to that Greek government remove him. Not that this is new news; there were similar rumblings in February, when the hostility between Varoufakis and German finance minister Wolfgang Schauble reached the level were Schauble refused to be in the same room with his Greek counterpart. The solution during the negotiations then was to isolate Varoufakis while Christine Lagarde, Eurogroup chief Jeoren Djisselbloem, and other top Eurocrats played conference room shuttle diplomacy to hammer out language that was presented to Greek Prime Minister Alex Tsipras directly, circumventing Varoufakis entirely (later reports described the memo as a fait accompli, with one account stating that Tsipras was told to take it or leave it, and another saying he was permitted to change one word).

Is Varoufakis really on his way out? Take this assessment with a fistful of salt, since the Eurocrats seem to believe that Tsipras is more likely to bend to their views than Varoufakis. In fact, by all accounts, Tsipras is very much in charge (despite all the uncoordinated mouthing off by various ministers; talk and decisions are two different matters). So there’s no strong basis for thinking that getting what the Eurogroup deems to be a prettier face as the Greek front person will change anything they care about. Nevertheless, here is the Financial Times’ account:

In a sign that Mr Varoufakis’s combative approach is prompting concern in Greece as well, a senior Athens official said the Riga meeting was likely to lead to him being sidelined as Mr Tsipras and his deputy Yannis Dragasakis take a more hands-on role.

Amid the acrimony, differences over a new list of reforms that is to be agreed by Athens were barely discussed at the meeting, putting off indefinitely a deal to unlock access to the funds left from Greece’s €172bn bailout…

Some eurozone and Greek officials believe divisions between Mr Varoufakis and Mr Tsipras are deepening and that a concerted appeal to the prime minister could still produce a deal by late May, the time many feel an agreement has to be reached if any aid disbursement can be made before the current bailout expires at the end of June.

Although there are wide differences between Athens and eurozone creditors on matters of substance the current stand-off with Mr Varoufakis is mostly on matters of process, officials said.

Because of the new government’s vow not to return to intrusive inspections by bailout monitors, formerly known as the “troika”, Mr Varoufakis has refused to engage with mid-level negotiators on the ground in Athens and has insisted a political agreement be reached at high levels instead. Eurozone leaders have stymied the strategy, insisting a deal be struck on a new economic reform plan with monitors in Athens before any talks on releasing aid money can occur within the eurogroup.

After creating the impression that Varoufakis is on the ropes, it later quotes an unnamed Greek source that says that Varoufakis would not be removed (assuming he is removed) prior to the reaching of a deal on the so-called bailout.

Varoufakis remains unpreturbed:

FDR, 1936: “They are unanimous in their hate for me; and I welcome their hatred.” A quotation close to my heart (& reality) these days

— Yanis Varoufakis (@yanisvaroufakis) April 26, 2015

And a Bloomberg article on the blowup at the Eurogroup meeting points out that Varoufakis is still popular at home:

Varoufakis has the backing of a majority of Greeks, according to an Alco survey published in Proto Thema newspaper. Some 55 percent of respondents said they had a positive view of him, compared with 36 percent who said they viewed him negatively.

Is this really a “process” problem? One of Lambert’s sayings is that when people in organizations say they have a communication problem, it’s actually a management problem. There’d good reason to suspect that this so-called process problem is a symptom of an outtrade on fundamentals. As we’ve said from the outset, there’s no overlap between the bargaining positions of the two sides. So as much as we’ve depicted the Greek government as being in denial about the willingness of the creditors to make concessions on structural reforms, the flip side is the creditors, or at least the Eurogroup, seems to be operating from its own case of denial: that if they can just get the right personalities and negotiating procedures in place, there’s an agreement to be had.

The problem, as we’ve said before, is that the government is boxed in by its coalition members. Even if the moderates in Syriza wanted to make concessions (and Tsipras and Varoufakis are both moderates), they need the support of the hardline left Syriza members, which are about 1/3 of their bloc. And they won’t give in. They’ll bring down the government first.

What are the bones of contention? We have said that the new government has repeatedly tried end-running the process set forth in the Eurogroup memo, which was for the government to produce a detailed list of structural reforms which would then be approved by the members of the Troika, and finally by the Eurogroup before the bailout funds would be released. The Greek side has instead tried going directly to the Eurogroup to get draft memos approved, going to the European Commission, and going to Merkel, now twice. That’s fed the Eurocrat complaint that the Greeks have wasted time. The various reform lists that the Greek government has produced so far have been dismissed as insufficiently detailed. Just based on media reports on their length, that beef seems to be valid.

But does that mean the solution is to let the bailout monitors beaver away? While Varoufakis’ detractors may have a point that he wants to negotiate too many issues at the key policy player level, the fact is that the two sides have no agreement at a high level. How does it make sense to work on details?

The row is over structural reforms. Even though the Greek side viewed the February memo as so vague as to leave lots of room for negotiations, as we read it, and events confirmed, said that the old, hated structural reform package was very much in place. In the view of the creditors, Greece can only kinda sorta negotiate it. The new government can swap some reform for others if it can convince the creditors that it won’t have a negative impact on the overall budget.

So if you buy the Troika/Eurogroup point of view, there’s nothing, or not much, to negotiate. Greece needs to get cracking on proving how it will do a better job of collecting taxes and crushing workers reforming its labor markets. That sort of thing gets done at the technical level and Varoufakis is out of line.

As an article in Jacobin by Syriza central coalition member Stathis Kouvelakis explains (hat tip Donald G) reviews where the government, or at least its critical left wing, is not going to budge on structural reforms: cutting (“reforming”) pensions, “reforming” labor markets, increasing the VAT, and privatizations. Mind you, the government has already given ground on the last two, by going forward on the Pireaus port privatization and saying it would increase VAT in February.

As we’ve stressed, pension reform is the bridge neither side is able to cross. Greece has the highest level of pensions in the Eurozone as a percentage of GDP. However, when you adjust for the age of the population, Greece’s payments are below the Eurozone average. But the Eurogroup ministers (and more important, the citizens they represent) believe the widely-publicized myth that Greece has lavish pensions. So they are neither willing nor able to sell a deal to their voters when the public believes that they are supporting Greek retirees at a more generous level than they get at home.

The fact that Varoufakis went directly for the basic impasse looks to be the proximate cause of why the Friday meeting became so ugly. From Bloomberg:

Varoufakis described the talks as “intense” and said his country is ready to make “big compromises” for a deal.

“The cost of no solution would be enormous not only for us but also for all,” he said…

In remarks to the assembled ministers, he defended protecting public pensions, a key sticking point in the negotiations. He threatened to walk away from talks if creditors pushed too hard.

When Dijsselbloem invited the group to respond, he was greeted by silence. He asked again, and Kazimir spoke up.

Varoufakis’s refusal to accept the conditions of its creditors particularly riled the Slovakian because his government has slashed the budget deficit and cracked down on tax evasion. His position also may have fallen on deaf ears among his hosts in Riga.

Latvia’s economy shrank by more than a fifth in 2008 and 2009 when the country was led by Valdis Dombrovskis, now vice president of the European Commission and a participant in the Friday meeting.

Dombrovskis pushed through some of the world’s harshest austerity measures — equivalent to 16 percent of gross domestic product. The Greek economy has shrunk by about a quarter since 2008.

So understand what this means:

1. Greece, like other borrowers, is expected “to accept the conditions of the creditors”

2. While all the other Eurogroup members are furious with Greece not getting with the program, the angriest are the countries that made their countries wear the austerity hairshirt

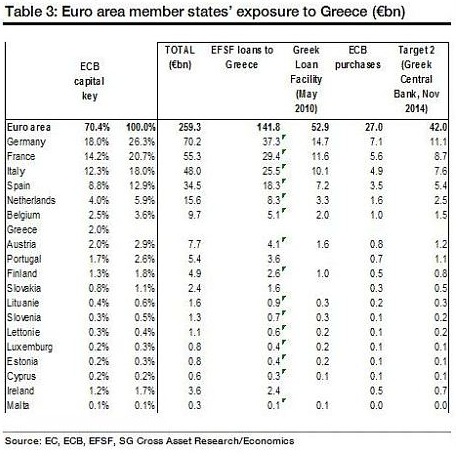

Why are the Eurogroup ministers taking this so personally? If Greece defaults on IMF debt, which is senior, in the next few weeks, which seems likely (for instance, the Financial Times reports that local officials are defying the national edict to turn over deposits so the central government can make wage, pension, and debt payments coming due), one would expect that holders of Greek debt would have to write it down. Here’s a recent chart of the national exposures, which does not include the 2015 increase in ECB exposure under the ELA:

This is why Varoufakis has acted as if the creditors would blink first, that European officials having to tell their populations they were taking losses on Greek debt (and for reasons we won’t bore you with now, those are likely to result in budgetary allocations) was a political third rail. But so is funding Greek pensions at their present level. Even though letting Greece default would pose much greater costs on all sorts of fronts, the pols can blame that on Greece, while they have no one to blame if they give in to Greece on pensions.

Mind you, cooler heads may prevail. But if anything, the ECB is even more bloody-minded. From the Jacobin article:

But a more representative sample of the views of the two major European institutions that together hold about two thirds of the Greek debt, the ECB and the European Stability Mechanism (ESM), are to be found in the interviews given on April 22 by Klaus Regling, managing director of the ESM, and Benoît Coeuré, member of the executive board of the ECB.

Both express a particularly tough line on Greece…

Regling went much further than Coeuré: commenting on the possibility of a “Grexit,” that is of Greece leaving the eurozone, he said calmly that this “is not the baseline scenario….of course it would be more manageable than five or six years ago because we have new institutions, the EFSF, the ESM, other countries in the euro area have made tremendous adjustment progress such as Ireland, Portugal, Spain.”

Regling also explicitly opposed the current plans of the Greek government to reduce some taxes and increase the minimum wage and pensions, saying that this amounts to “moving backward” and is putting negotiations in danger. Moreover he made it clear that the disagreement goes deep since the Greek government thinks that the approach of its predecessors is mistaken, whereas according to him, “the strategy was working.” “This difference has not been resolved,” he says.

He concludes by ridiculing the idea that the creditors might “back down because they don’t want a credit event, or accident,” saying that “our procedures for providing loans are very clear, and very well established. They are linked with conditionality, it is clearly written in the ESM treaty. We need a unanimous decision of our shareholders and the approval of six EU parliaments, and the parliaments definitely will check very carefully whether the conditionality — which is a key requirement — is met.”

While a Reuters story makes clear that the ECB will not be the one to pull the trigger on Greece, if Greece defaults, they may regard that as giving them enough cover to cut or refuse to renew or increase the ELA, forcing a Grexit.

Now this does look sadistic and it is, but you have to remember one thing: this is the Troika’s and Eurogroup’s game, and therefore they get to set the rules. Greece has thus been naive in seeing itself as in the position of negotiating as an equal. From the creditors’ perspective, Greece is a supplicant, and needs to act more like one if it is to have any hope of getting any dough.

There is no reason to think the creditors would do better if Varoufakis were replaced. The differences between Greece and its lenders fundamental, and having a more genial interlocutor won’t change that. Moreover, any new face is likely to be worse. While Varoufakis’ deputy might seem more palatable in the short term, any new Finance Minister would have to be a member of Parliament. All of his possible replacements are more left-leaning, less economically literate, and speak English less well. If they think Varoufakis was not accommodating enough, they won’t do any better with a new face.

Defaulting in May is particularly bad for Greece. The Greek public is overwhelmingly opposed to a a Grexit, and as we’ve indicated, it’s the ECB, and not the Greek government, that determines whether a default means a Grexit.

in kapa research for to_vima, 72.9% #greeks want to stay in the eurozone, 20.3% favor return to national currency. #greece

— Diane Shugart (@dianalizia) April 25, 2015

Note that to-vima is hostile to the ruling coalition, so the poll was probably structured to deliver conservative results. Nevertheless, as Kouvelakis explains:

The complication here is that defaulting in May means defaulting on IMF repayments, and this can entail enormous complications at the level of trade (the IMF can take sanctions that will make access to private credit for trade nearly impossible). Greece should preferably default on the ECB/EFSF loans, but these repayments are due in the summer and it seems nearly impossible to hold firm until then.

The Greek government appears to be in denial or paralysis. Officials have made conflicting statements on whether the ruling coalition is willing to hold its ground even if the cost is leaving the EU and on whether the government will have a referendum to resolve the matter if talks break down. On the referendum matter, financial time is already moving faster than political time. In most countries, the process for conducting a referendum involves lead time (a Parliamentary vote and a period of time, often Constitutionally mandated, before polling). With a default likely in early May, and a deal needing to be agreed at breakneck speed to avert that, Greece would seem to be past the point where a referendum could inform decisions.

Diane Shugart points out in a later tweet that the Kapa poll shows Syriza support at 36.9%, or virtually the same level they had when voted into office. However, that is a big drop from recent ratings.

While the cost of a Grexit would be extremely high in economic terms (I’ve seen a forecast of a fall of 20% in GDP, worse than anyone anticipates from continued austerity), Kouvelakis contends that citizens have been given only one side of the story:

The main element fueling this troubled atmosphere is, however, the fact that the scaremongering on the theme of the “Grexit” remains unchallenged at the level of broad public opinion. The right-wing opposition and the mainstream media, increasingly hostile to the government and using all possible arguments to push it towards full surrender, associate the break with the eurozone with an apocalypse — as they have done relentlessly since the start of the crisis.

But the response on the part of the government tends to be that this perspective will be avoided thanks to the “honest compromise” to which the Europeans will finally have to agree. Hardly a discourse, to say the least, that can mobilize Syriza’s base and prepare society for an eventual rupture with Europe.

Both Greece and its creditors look to be sleepwalking into a breakup that both profess they want to avoid. But the mutual distrust and denigration are classic divorce dynamics, and there is no relationship counselor in the mix. Tsipras is right to regard Merkel as his best, or more accurately, only hope, but the fissure may be too far advanced for her to paper it over, assuming that she is willing to do that.

Puleaze…. Can Varoof for once calm down his ego and try to be a public servant as in serving the public?

Hard to “calm down your ego” when you’re most likely correct in your economic analysis. His choice is to either resume the austerity, thereby dooming Greece to (at least) another five years of useless sadistic hardship, or to attempt to mitigate the neocon magical thinking and perhaps prompt the Grexident… resulting in (at least) another five years of useless existential hardship. Now, which of those is hubris?

In my mind, the choice is cowardly servitude or a proud suicide. As Yves has repeatedly explained, they lost all bargaining power way back, presumably for fear of angering the ECB, by foregoing Capital Controls and refusing to discuss Grexit. So Varoufakis is playing his only angle, and we’ll see where it leads.

Time to cue the Carol King: “Well it’s too late baby…”

In my mind, the choice is cowardly servitude or a proud suicide.

Very apt! We tend to imagine or have a slight bias toward the view that “democracy” insures we get the right person at the right time. Washington, Lincoln, FDR and so on, but this is simply not true – particularly when these so called democracies have been coopted by international corporatism. But even without that, the odds of the right person being in the right place are simply overwhelmingly against in the case of Greece, no matter how just the cause. As Yves pointed out back in February,

http://www.nakedcapitalism.com/2015/02/syriza-walks-back-initial-defiance.html

From the people who invented the Pyrrhic victory and the sword of Damocles.

I think you have it backward: Varoufakis is getting so much attention because he’s the non-egotist in the room. While the other finance ministers sought out their positions Varoufakis assumed his in the belief there was no other choice.

They are bland technocrats and he is passionate. Of course he eclipses them on the public stage.

I hate to tell you, but the Paris Match spread belies your view.

Touché. And the gig with the game company and …

I guess the EU doesn’t like it when leaders of other nations start quoting Roosevelt.

Varoufakis started quoting Roosevelt only after he was on his way to being sidelined.

How much Eurogroup antipathy toward Varoufakis results from his use of Keynesian economic theory? I can’t think of behavior likely to generate more hostility than to lecture the collective finance ministers on a subject they would have only a superficial awareness of and reflexively oppose on ideological grounds. Are they offended by the lack of a tie? The willingness to say “failure” among a group of elites to whom the word is anathema? Are they angered because they must deal with someone they don’t consider a part of their social caste? A non-politician telling a room of politicians (and their near-universal narcicism) they’re wrong can lead only to a bad end.

I’m reminded of the immortal words of George Carlin in his “treatise on Political Economy”: “it’s a big club, and you ain’t in it; it’s a big club and you and I are not in it.”

https://www.youtube.com/watch?v=H-PSCqhkWhg

Skynet still in action, Mr. Levy. Sorreeeeeeee!

His position is not Keynesian. Varoufakis has stated that Greece will always run a primary surplus. Any student of Keynes knows he’s thrown in the towel on austerity with that position. All he is arguing over is whether the Troika will use lube or not.

I don’t think you should be confusing Keynes with MMT. The problem with MMT is that they have a cavalier attitude toward current accounts and Greece simply can’t run any sizable fiscal deficits, because that would blow out the CA deficit again, which can’t be financed. On the other hand, V.s “modest proposal” is precisely a Keynesian response to the constraints imposed by staying in the Eurozone, based on investment led growth. It’s the Troika which determinedly refuses to understand the standard points about the connections between deficient AG and investment shortfalls, whether because they are simply catering to financial interests or because they actually believe in their cargo cult economics.

I am familiar with Keynes, MMT, and the Modest Proposal. The Modest Proposal is not the Greek negotiating position. The part that finessed the lack of being able to run a fiscal deficit to stimulate the economy, having the EU make what amounted to fiscal transfers via infrastructure spending funded by the European Investment Bank, has been firmly rebuffed. Varoufakis has not modified the Greek stance in light of that. Running a budget surplus in a depressed economy, and Varoufakis said Greece would “always” run a primary surplus, is contractionary per Keynes.

It’s Keynes the theorist of international trade and CA imbalances, which long pre-dates GT, that’s more relevant here. I think Varoufakis took the job to try and talk sense to the EU nomenklatura and that has failed. (It’s kinda like trying to talk to a Lacanian psychoanalyst, when all you encounter is “ontological” barriers, irrationalism, and aggressive non-sequiturs). But I don’t think you blaming him for at least trying is quite warranted. You’ve been bird-dogging this situation, for which I give you props. But your business negotiation background doesn’t take in the full political and economic dimensions, the political-economy, as it were. There is no “solution” without changing that.

You can’t change the views of people who have well-setttled economic views and have significant career investments in them, such as having written papers, having implemented austerity programs and regarding those as successes, as Latvia does to change them based on a few hours at most of talks, particularly with someone from a country seen as an economic failure. Wolfgang Schauble is widely known as a fiercely dedicated believer in austerity. Similar to what Max Planck has said about science, progress in economics takes place a funeral at a time.

Greece signed a memo at the end of February that gave it until the end of April to negotiate a deal. There was never any way Greece was going to change hearts and minds of anyone in a position of influence in that timeframe. But Greece could have hammered on key issues: “We’ve done more in the way of structural adjustments than any country. How can you expect us to make even deeper cuts in the light of the results we’ve experienced?” Instead, the government played into the existing “lazy, disorganized, argumentative Greek” stereotypes, which the media has been only too happy to amplify (go read the FT comments section, for instance. It’s painful).

Greece could have used its bully pulpit to carry its message to the broader European public but that never looked to be a focus, and in any event, would not have shifted the views of the key actors at the table. There was an outside chance a better campaign would have roused the European left, but it appears to be as feckless as its American counterparts.

“It’s impossible to get a man to understand something when his livelihood depends on him not understanding it” Unknown

I suspect it isn’t that he rejects Keynes, but cannot be relied upon to stand by his principles. He seems the type to flip if he senses it gains him an advantage –whether he really means it is a different story.

Yves, this is why I thought your arguments about messaging, presentation, and PR the other day inapt. The Greeks have been set up from day one to conform or be crushed. More coherent, concise and well-argued pronouncements from the Greeks would have meant nothing. This, as I stated then, is about naked power and the maintenance of hierarchies of deference and control. I will concede you are right about the way the Greek government went about this process (way sub-optimally) but at base I think my take on why it didn’t matter was sound.

No, you are incorrect. We stated from the very outset, Greece was never going to prevail on its own. It needed to win some foreign support. Greece has never made the case, for instance, that’s been made in the sympathetic media, that the bailouts all benefitted the bankers, that Greece has done a better job of implementing structural reforms than anyone else and they’ve still had an economic train wreck. Instead, government officials have made statements to the media repeatedly that make the government sound like a bunch of upset 13 year olds: “You can’t tell us to cut pensions. We are a leftist government!” As we said, the odds of success were not high but the way they went about it assured failure.

Look at this recent Martin Wolf op ed. He’s done a vastly better job than the Greek government, and he’s hardly a pinko:

http://www.ft.com/intl/cms/s/0/0308e296-e77b-11e4-8ebb-00144feab7de.html#axzz3YTDYQdN0

The government DID set out to make a PR case at the outset. And annoying your negotiating counterparties, which the government has managed to do, pretty much assures that they are going to get the worst treatment within the realm of possible options. The trying to end run the memo process (doing everything but presenting plans to the Troika) really pissed everyone off. It looked like grandstanding and defiance: “I’m not going to do my homework. Mommie Merkel will tell you I don’t have to.”

Moreover, the creditors do have a point. Greece’s plans to date have not only been sketchy, but they’d also been very optimistic as to how much and how quickly Greece can increase tax collections and streamline its government (and this actually is an issue, for instance, there are 133 government pension programs). Instead of drilling deeper into the plans it first tabled, Greece would submit new plans with substantial changes in the list of reforms (as in in large measure going back to square one) AND adding more leftist reforms that would cost more in budgetary terms too. So the government also looked to be poking the creditors in the eye (or being super incompetent) in how it was managing these negotiations.

For instance, it was widely discussed that everyone understood that Greece needed more debt relief. Varoufakis wanted principal writedowns, while the creditors instead were willing to extend maturities and lower interest rates which reduces the economic value of the debt. Even suggesting principal writedowns reflected a basic lack of doing homework, that accounting losses would trigger the need in many states to hit up taxpayers to make up for the “loss”. So this is one of the areas where there was a deal to be had and now that positions have hardened, Greece is almost certain to get a worse deal.

In addition, the pace of reform discussions has been very leisurely even as Greece has been devoting a lot of energy to trying to circumvent the process. Greece has been slow to deliver new versions and the “improvements” in terms of detail has been thin. So the point about “you need to work with the bailout monitors” isn’t as political as it seems. If the Greek government really is so thinly staffed or inexperienced that it can’t gin up the needed level of detail, then the Trokia insistence that its team work with Greece to develop those plans isn’t as nuts as it sounds (of course we know that they’ll also try to take over the process, but unless Greece demonstrates it can provide the needed detail and justify its forecasts, it’s made itself vulnerable to precisely this demand).

Finally, if the new government really intended to be defiant, or have any leverage, it needed to impose capital controls as soon as it got into office The bank run had started earlier in January so it could readily justify the action. It could also have said to its creditors, “Look, we campaigned as a pro Euro party and we are dedicated Europeans. But we recognize that all negotiations run the risk of failing. We thus need to work in parallel how to manage a Grexit in a way that is less damaging to the Eurozone and us alongside the primary focus of coming to a deal.” That would have freaked the Eurocrats out, and simultaneously allowed Greece the option of a “managed” Grexit (and allowed the government to assess it and educate the public on the tradeoffs of going that route v. continued austerity. Remember, in January, the government had more leverage because QE was not in place. One of the few tools the government had was also to spook Mr. Market, and cooly bringing up the Grexit option could have done that.

This is not academic because, as we discussed from the outset, the best of Greece’s bad options is a default within the Eurozone. That is also the one most palatable to Greek voters. But the ECB is ripshit with Greece, as is the IMF. Now they may hold their fire in the end, but this big public show of defiance has greatly increased the odds that the creditors get punitive. By contrast, if Greece had played cooperative in tone, followed the process, but kept patiently and cooly saying they could not budge on pensions and the pensions were not out of line, there would not be creditor animosity driving the decisions. Frustration, perhaps, but not animosity.

This is one (of several) similarities between Syriza/Tsipras and Dems/Obama. Neither seems to have a concept that public opinion can be led to, er, “change.” The polls are taken as read.

Frustration, perhaps, but not animosity.

Here I have to disagree. Remember that whatever was theoretically acknowledged by the EU was in the context of a EPP government. Being a member of the club gives you a lot of leeway that a political outsider doesn’t get. Especially true for leftists. Also the political context: Spain needs to show its people that dissent leads to catastrophe. And its working: Podemos lost its poll lead, losing voters to a save and conventionally fuzzy liberal alternative.

And I’d really appreciate a post about the benefits of capital controls. Might be I missed something fundamental, but I see little upside in any case except controlled exit or after the ECB pulls ELA.

If you read the latest story on the Financial Times, Varoufakis appears to have alienated people on all sorts of fronts. For instance, he had opposition within Syriza because he had not been a member of the party and failed to attend Cabinet meetings and get involved in the nitty-gritty of dealing with the ongoing crisis. He also kept trying to circumvent the process set forth in the bailout memo, which clearly said the deal had to be approved by the Troika first and then by the Eurogroup. He kept taking draft memos to the Eurogroup and putting the Troika teams on ice in hotels. The Eurogroup did not want to vet and negotiate memo details and were frustrated with Varoufakis bucking a process Greece had agreed to when it signed the February memo.

I’ve also repeatedly seen good negotiators able to win cooperation and trust even when they are representing a cause or issue the other side really loathes. So I have to differ with you on your premise.

The tail wagging the dog. Once you set the media off, it’s hard to make it do a 180 and as if that weren’t enough you have the issue of a public already viscerally convinced by one point of view. People who have been convinced that Grexit is equal to apocalypse are not going to be readily accessible to the merits of going it alone (which are not attractive even to a completely neutral audience).

Alas, the same phenomenon also applies to the Eurogroup who are incapable (by the same pickling process) of understanding that Greek pensions are not as lavish as propaganda has engineered them to be, to name but one meme, and then even if they did understand, they have the same insurmountable problem of communicating this to their own respective citizens against all propaganda those people have already been fed.

Incidentally, this same, amazingly irresponsible process, as it’s being used in Washington now in regards to Ukraine, is why we are very likely to see the war between Russia and the West escalate out of control.

“Incidentally, this same, amazingly irresponsible process, as it’s being used in Washington now in regards to Ukraine, is why we are very likely to see the war between Russia and the West escalate out of control.”

I disagree completely. The Russians and Ukranians know only too well what wars are like. I cannot imagine either one of them begging for a come-on. It’s the west that’s gone looking for and provoking war — thousands of miles from home where *other people* will suffer the consequences.

It’s madness.

What.a.travesty. Ukranians and Russians will both die in a war nobody but the US wants.

Sorry if I was unclear, but I am stating almost exactly the same thing as you. Washington is using a process of propaganda that will make it impossible for cooler heads to prevail with public opinion when the current Western originated escalalation gets out of control.

The inevitability of outcomes when these blind forces have been set into motion is what makes this whole thing so eerily like an actual Greek Tragedy.

i’m hoping for a deus ex machina to save the day

In alternate universe

Eurogroup Demands Schaubles’ Ouster

Eurogroup Demands Djisselbloems’ Ouster

Eurogroup Demands Lagardes’ Ouster

In this universe…”Great spirits have always encountered violent oppositions from mediocre minds.” -Albert Einstein

Mediocre minds exhibit violent oppositions to not just great spirits, but to average, or less, spirits as well.

Otherwise, they wouldn’t be mediocre minds.

Thanks for the quote Alejandro. Don’t know whether to find it uplifting or just sad about this universe.

Let us be fair to Varoufakis: He is a serious economist (his opponents, at best, are accountants). Anybody who read his book and followed his blog understands that Varoufakis intends to reform the EU towards the initial idea France had, of a monetary and fiscal union opposed to the US, away from the present unsustainable design (an americanised initiative to serve Germany’s mercantilistic project and bind Europe into the chains of NATO).

The point is, that nobody listens (and probably few understand anyway) on the EU side. This are the same people which are provoking a nuclear power defending a corrupt/bankrupt government in Ukraine, because they do not have the courage to say NO to Washington.

Anyway, if there is GREXIT, I assume yes, Varoufakis would be the best man to deal with it and I believe Tsirpas knows this.

The tragedy here is that no matter how qualified Varoufakis is as an economist, in the current situation, negotiating skills are paramount and he is clearly lacking in that domain. It doesn’t matter if you are right if no one will even speak to you and your people are too traumatized to grasp your arguments. And because a Grexit (which Varoufakis seems as opposed to as the Greek public) does not mean repudiation of loans, negotiating skills will remain one of the, if not the, single most critical aspect of the finance minister’s job.

But… are all Greeks negotiation-deficient?

Almost no one seems to remember that Greece last received a bailout tranche last summer. Since then, all Greek-Eurogroup interlocutors have not agreed on further pension cuts.

This is the entire reason the previous govt called new elections. The two previous FinMins refused to budge and negotiate on further pension cuts. There were no breakthroughs. In other words, nothing has changed.

The only added dimension in Varoufakis’s case is that he is much better at speaking English, and this has allowed him to enter into a PR blame game with the eurozone. They absolutely do not like the idea that their austerity policies are now under scrutiny.

The other added dimension is that long before Varoufakis even came on the scene, people in the EU Commission, the Parliament, and the Ecofin Group were threatening the Greek voters and telling them not to elect Syriza under any circumstances. They were telling them Syriza meant Grexit.

If anything, Varoufakis is the most moderate of all the economic and finance people in the party. Luckily, the new guy, Tsakolotos is the second most moderate, and he has been at Varoufakis’s side all along. But now the bench of moderates is empty. There is nothing but total instransigence after them: and their names are Vadavani and Lapavitsas, who is probably shuttling back from his job at the London School of Economics right now as we speak.

PR blame game with the Eurozone….

Be interesting to see where he is succeeding, domestically and/or in other European countries vis-à-vis the previous Greek finance minsters.

In present context “negotiating skills” is, to my way of thinking, nought but an euphemism for polite acceptance of the status quo.

V is, in this anything-but-greek tragedy, the Cool Hand Luke, and we as audience are being told “what we have here, is a failure to communicate” . . . as the poor fellow is beaten within inch of his life.

Remember, the guys that show up at your business every Friday to collect their “insurance” premium (i.e. protection money} are always polite and business-like, as long as you have the cash ready and don’t make a fuss. They have very civilized “negotiating skills” and talk a calm and reasonable talk — that’s the way they like it — no muss, no fuss.

What V is doing I believe, with his perpetual optimism and smiling geniality (at least in press conferences) is force the troika “negotiators” to doff the suits and ties and don the knuckle-dusters and baseball bats they’d prefer never to actually use because they give the lie to the suit-and-tie business demeanor and thus make their game less one of “authority” and more one of raw, unalloyed, uncompromising “power” . . .

Power can be taken away by greater power. Authority can only be given away, and is thus infinitely more secure (but only if you deserve it)

It’s like Rashomon….Cool Hand Luke to some, insincerity to anther, and insularity or detachment from reality to others.

If he can pull this off, he should be the leader, the charismatic leader, not Tsipras.

No, good negotiators can make a huge difference in outcomes. I’ve repeatedly seen cases where the person with less leverage got a much MUCH better deal than they should have by any objective standard due to the skill of their negotiator. Varoufakis apparently tends to go on too long in making his case (which comes off as domineering) and “explaining” in a manner that sounds didactic and is probably interpreted as condescending (and these people are not economically savvy so Varoufakis may get annoyed at how retrograde they are).

But this is a crowd of bad to mediocre negotiators. Remember, the finance ministers are all politicians. Negotiating is a very specific skill and is not the same as being a political pro. It’s also routine that most people in a position of authority fancy themselves to be good negotiators when most are at best average. That is likely one reason why they are upset about Varoufakis wanting to negotiate with them. Most of the hard technical issues get sorted out at the staff level. They deal only with the really high level issues..

Hi Yves,

I believe you would be right if EU were to believe that Greeks have some cards on their hands. Until very recently, their actions did not show that they believe the Greeks have any leverage at all. So, in this particular case, I don’t believe even the best negotiator of the world would have made any difference as negotiation requires at least a tiny bit of leverage.

The Greek side apparently considered that there would be a win-win solution that their opponents would come to realize. This is so childish that I looked for ways of interpreting their actions, looking for some smart tactics.

EU position is only set for punishing Greeks, that was clear even before the election. I think the only negotiation position that might look serious to the EU cabal would have been first introduce the capital controls (so that they could build their leverage) and send someone from the left wing of the party, Lapavistas, for example, to the negotiation table. Syriza did none of it.

I slowly grasp why KKE refused to take part in a coalition with Syriza.

Kemal

Whether by design or being forced upon it by the other side, he has become an issue, when most would say it’s better to be otherwise (not adding to the issues to be negotiated).

I happen to think he can do just as well, or acutally better, from behind the scene.

Sadly this is not about being right or wrong. This is about negotiating the best deal for the Greek people. Which by the way may not be austerity and staying. It could be amicable separation: a fixed exchange rate with Germany never made sense and now could be a good time to break it. But depending on how the peg break is managed the impact on the Greek economy and the Greek people can vary widely. That’s the sort of judgment you would expect from a finance minister. So less theatrics and clever word play and more technocratic competence. For some people it’s going to make a difference between having a job, or not.

I don’t think its about the money or the economics at all. I think this is about power, hierarchies, deference, and keeping Greece in its place as a subaltern. Money is a means to an end, not an end in itself. As someone who is scraping by, I can certainly perceive money as an end in itself. I just had to buy a car because in our wonderful rural setting (no snark) if you don’t have a car, you don’t have a job or a means to get to the doctor or the grocery store (no public transport or even taxis out here). So lordy did we need some money and we only had a certain amount and had to accept a less than optimal auto based on our cash budget. But the global Power Elite don’t think that way. They can’t imagine scarcity. What they can imagine is defiance and, perhaps, revolution. So the order of things must be maintained. Greece must suffer for they will not obey. I think that’s what it’s all about, not how many Euros Greece pays next Tuesday or down the road.

It is my understanding that it was Varoufakis who refused to be in the same room with Schaeuble. There is a photo with them both on the same stage that shows Varoufakis behaviorally exhibiting his contempt for Schaeuble, as much as a still photo can indicate.

I have heard it said political savvy is the ability to conduct a pleasant conversation with someone you detest. It doesn’t surprise me this is where Varoufakis might fail.

Ben, you may be right, but having observed Schaeuble in action in interviews alongside others, it is difficult to see how anyone as knowledgeable and as passionate about economic reality as Varoufakis is can effectively deal with someone who appears to be so irrational and ignorant.

The report was that it was Schuble who didn’t want to speak with Varoufakis. They have since mended fences.

http://www.businessinsider.com/report-german-and-greek-finance-ministers-not-on-speaking-terms-2015-2

As this drags on, I increasingly get the impression that the Greek Government – albeit acting like an orchestra which each member playing its own tune – on the whole knows that no meaningful compromis is to be found ahead of a default. A default would force the Troika to leave its current repetitive script of “reforms” (more can-kicking) and scramble to deal with an acute situation. At that point, Tsipras is right that Merkel will be the most important person to talk to.

Up until a default, Varoufakis can continue bullshitting the Eurogroup and fail to produce agreed (i.e. imposed) lists of reforms.

However, what happens beyond a default is a like guesstimating what is happening inside a black hole. The Greeks seem prepared to take that risk in order to force a writedown of debt. Default while remaining inside the euro could be one outcome. It would however take more time and uncertainty to handle that situation. But I am of the view that the Greeks are probably correct in thinking that more obstination is required to force a default, however without being perceived as deliberately seeking and wanting it or being solely responsible for it.

However, what happens beyond a default is a like guesstimating what is happening inside a black hole. The Greeks seem prepared to take that risk in order to force a writedown of debt.

Are you saying that the Greek people are prepared for a Grexit? The polls (not that that is any gold standard) would seem to indicate otherwise.

I meant that the Greek Government views it as a necessary step to force a default in order to bring everyone to the negotiating table. Any compromise without default would most probably be a win for the Troika. Default would not necessarily mean Grexit, but that could be one of many possible outcomes.

One question is whether the Greek Government believes it has a mandate to take things that far. Judging from how the Greek Government is playing its hand, I would say that it seems so.

The ECB has been making statements that come awfully close to “keep crossing us and no more ELA.” Plus if there is a default, former (non EU) central bankers have said they’d find themselves legally unable to continue extending it. And while the ECB does not want to be held responsible for forcing a Grexit, the default may give them the cover they want.

Plus did you miss the part about losing access to trade finance if Greece defaults on the IMF? Greece does not escape from the Troika sweatbox even in a default. Its primary surplus is gone, since it is already not paying its bills to vendors to get by. The economy will get worse in the event of a default which means tax receipts fall further. Greece won’t be able to function absent getting a loan from its creditors, which will just have stiffed. Tell me how that works. Greece may have to do a voluntary Grexit due to the loss of its primary surplus.

Yes, in the choice between a total mess or chaos, Greece will have to make up its mind. Those are the options.

Unless there is surrender towards the Troika and thus more can-kicking, with ensuing domestic political chaos, Greece must decide when to cause havoc. Havoc will hurt both at home and abroad. The IMF and the ECB may do their best to starve Greece. Will Putin and Obama not react in such a situation?

The Administration has fallen in line with the Troika. The Jacobin story contends it’s due to the government releasing some prisoners. That seems awfully minor to provoke the change. I suspect it has to do more with needing to preserve its chips for Ukraine.

As for Russia there is NO upside to intervening now. They’ll get whatever bits they want more cheaply later if things continue on the current path.

It is possible that Tsirpas will cave in and there will be another 1-2 years of bailouts to nowhere.

On the other hand, matters could develop their own momentum, like when the wall fell in 1989, and the situation become liquid. The exact opposite of what the Troika wishes but precisely the kind of game that Putin knows how to quickly turn to his advantage. If so, Obama would have to decide whether to jump or not.

Artillery shelling started again in Eastern Ukraine today. And since we all know that it is all connected.

As others have pointed out here, including myself, “legal” is a very mushy and elastic concept. Deutsche Bank is supposed to fork over to (someone) some $2.5 billion for LIBOR rigging, and there’s lots more where that came from, both civil and criminal (though very little enforcement) as has been detailed at this site. The Eurocrats committed what I would consider fraud and maybe breach of fiduciary duty in sucking prior Greek governments into this vortex in the first place.

“No legal way to leave the EU?” There’s a couple of old saws, one about how it’s better to ask forgiveness than permission, and “possession is nine points of the law,” etc. The Rulers have used their clubs to say what “the rules” are supposed to be. What is the source of “the law,” which requires either overwhelming force or a legitimacy based on some continuity of consent? “Iraq” was “legal,” until it was not.

Our US rulers do what they damn please; the commenters here seem to be perturbed that THIS TPP-TTIP “THING” is being shoved up the patoots of political economies all across the planet. Is that going to become the “legal standard” because corrupt politicians, some in their places by electoral fraud and some bought and paid for by the “beneficiary stakeholders,” say it is so? And all these tears for the Ordinary People who do the suffering and dying, after doing the labor — that teaches the rest of us what, besides the futility-driven conclusion that “Resistance is futile?”

I’m really curious about how quickly the managers of a suddenly-Greek-semi-autarky would be able to establish a fiat currency and start mending the nets… Of course, as others point out here, a lot of the polity there, specially those who have portable wealth, suffers from the same overdose of ME-ism and MORE-ism that plagues the rest of the “Real European Nations,” and elsewhere, and that’s a hard disease to remedy. And it looks to me like the whole “nation” thing will be a convenience for a little while longer, until the yokes and manacles and hobbles are riveted into place, but is on the way out. Tom Friedman, and others, applaud wildly…

this is my similarly optimistic take on the situation.

Excellent post. The Jacobin article is also great, but it seems to trip up on the issue of whether the Syriza governments statements are “contradictory” because unity is lacking and no consensus can be reached, or whether they reflect a negotiating strategy – we’ll talk, but we can walk. It’s as though one person making the same statements would qualify it as a strategy, while two or more persons means contradiction.

In any case, I’m more concerned about the apparent failure to build popular support for some form of exit. Certainly that must be regarded as part of any viable negotiation. Varoufakis’ occasional fiery statements would lend themselves to such a mobilization — I think he deserves credit for handling a truly contradictory position of negotiator and agitator well — but it sounds like the party is having difficulty organizing around a program of defiance that includes the exit option. That can only play into the EU’s hands by making it seem like Syriza has failed, as opposed to demonstrating there was no alternative to exit.

“All of his possible replacements are more left-leaning, less economically literate, and speak English less well. If they think Varoufakis was not accommodating enough, they won’t do any better with a new face.”

Very well said, although I think “speaks English less well” is a plus, in the Eurogroup’s eyes.

This has been a public relations negotiation from the start.

They should all speak in Greek and let their own translators handle the rest.

Why would any national representative, for any country, speak in English?

Varoufakis spoke Greek at the very first press conference with Djisselboem, and Mr. D. got up angry at what he had heard. The translator told him that the Greeks would no longer negotiate with the troika. In Greek, Varoufakis had actually said that the Greeks would no longer accept dictates from the technical team in Athens. In Greece, the word “troika” signifies the technical teams in Athens, and that meant chiefly Poul Thomsen of the IMF.

That’s playing on your own turf.

And Herr D didn’t look too good as the translator (his?) missed the nuance.

This is the point, more or less. Varoufakis is one of, if not the, most Europhilic ministers in the Syriza government. Most likely they hate Varoufakis because he’s been doing a good job explaining how what the Troika is doing is wrong, unfair, and counterproductive, and they don’t want to listen to him being right.

But I think the main reason they want to *replace* him is that they’ve decided to give Greece the boot and they want somebody who’s not such a good representative for Greece in the public eye. They want somebody they can blame for Grexit, rather than somebody who at least officially is opposed to it as much as possible, and somebody who won’t do as good a job of explaining to the public how wrong the Troika is and will be.

As Yves said, replacing Varoufakis will not have a meaningful policy effect. Varoufakis is an economist, not a politician, and a relative newcomer to Syriza, and so he’s not making the decisions within Syriza. Internally, he’ll be functioning as an advisor/external expert whether or not he has an official job. If Syriza wants out, it’ll be out whether or not he’s Finance Minister, and even if they were to re-assign him they’d still listen to his input. If it *did* have a policy impact it would be the opposite of the Troika’s supposed intent, since his replacement would likely be a Euroskeptic.

This looks to be an interesting new team.

http://www.tovima.gr/en/article/?aid=698505

“Furthermore, it was decided to establish a “political negotiation team” under Minister Varoufakis, the coordination of which has been appointed to the Alternate Minister of International Economic Relations Euclid Tsakalotos.

A special coordination team, under General Secretary Spyros Sagias, has been formed in order to assist the technical teams in Athens, while SOE president Giorgos Houliarakis will be in charge of the technical teams at the Brussels Group.

Finally, the General Secretary of Fiscal Policy Nikos Theoharakis has been tasked with developing a growth plan for the Greek economy, which will be based upon the new agreement that will be reached in June.”

It’s the exact same team, rotation of faces. Varoufakis behind.

Because replacing Varoufakis will not have meaningful policy effect, because of that, and because he is not a politician, he is better off receding from the spotlight and let those politicians do their politicking.

The (corrupt) politicians got Greece into this mess….Yanis should let them get another go at it?

In my opinion, there’s no point in trying to beat a rigged game, and this one is rigged to a fare-thee-well, and has been since the whole thing started. Get up from the table, cash out whatever chips still remain, and leave. Syriza should be educating the Greek people about this so that they see the way to the future. No one is plotting or piloting a future course….they are just going around in circles.

In my opinion they are replacing Varoufakis from the front line for one reason: The EG is giving most of the way and they want the negotiation to look like a win, and presenting it as “we killed this pretentious asshole” is good PR. This got reinforced when I heard Tsipras repeating, almost word by word, Varoufakis discourse yesterday on TV… (part 1, around 8:00-10:00)

At the end of the day even if Greece made structural changes in tax collection Greece still has a balance of payment problem? And just how much money has Greece lost and is going to lose on derivatives it bought?

We may be in danger here of losing the big picture from the point of view of the Troika. The position they are taking, in addition to propping up a failed design, itself propped up by a false economic paradigm, seems to be designed, at least in part, to protect certain “debtors”. Among these is Deutsche Bank. Its debt is many times greater than Germany’s GDP. There is no way in which the bank can be rendered solvent. Giving in to Greece may be thought by some in the European elite to lead to DB and others of its ilk suffering badly. Better the Greeks suffer than certain European elite individuals and institutions that are effectively bankrupt.

You describe the machinery as well as the purpose of austerity as it has been practiced on all of the European members but particularly those in the periphery. The Eurogroup and the ECB apparently feel that using Greece as an example (much the way our FBI uses acts of terrorism they themselves instigate) is relatively safe now from “contagion”, but as Yves and others have pointed out again and again, that will likely prove to be a more slippery slope than they bargained for.

I’ve made that point several times, though without any responders, that DB is the most thinly capitalized, highly leveraged mega-bank in the world, scarcely profitable and likely insolvent with proper accounting. Why do you think it is Germany that has been dragging its heels on the supposed banking union agreement? However the assets on its balance sheet amount to 1.6 trillion euro, which is just 40% of German GDP, (compared to JPM at $2.5 trillion or 15% of U.S. GDP). But the collapse of DB would saddle Germany with an immense, if partly temporary fiscal deficit, ruining their balanced budget fetish and costing them a long term loss in the tens of billions or more.

Let’s hope there are also some Germans pointing this out to the German media.

There must be German financial blogs with some commenters who know the facts.

You are certainly correct about Deutsche Bank. It’s the worst, but it’s not alone.

This time it’s not just the banks. The nation states have guaranteed the loans. Whereas ECB can write off its 140 bn. loss and move on, the other parties can’t. Ever. Pay. And whereas ECB would no doubt [illegally] replenish their losses, it takes time to establish what these are. Remember the Soros short?

None of which is Greece’s fault. It’s the chicken of EU’s extend & pretend finally come home to roost.

So I predict a “happy compromise” within the euro with (later) an eventual reduction of some debt [ECB] and ‘resheduling’ of the rest into infinity, based on profit, a la post-1953 Deutschland. Scheuble will probably announce his retirement in 2016 & Angela Merkel will be crowned Queen of Europe.

And Bloomberg included this paragraph as if it were normal: “Latvia’s economy shrank by more than a fifth in 2008 and 2009 when the country was led by Valdis Dombrovskis, now vice president of the European Commission and a participant in the Friday meeting. Dombrovskis pushed through some of the world’s harshest austerity measures — equivalent to 16 percent of gross domestic product. The Greek economy has shrunk by about a quarter since 2008.”

Latvia as an example? Check out its demographic free fall. You just have to go to its Wikipedia entry. I suspect that the Latvian government was using austerity to make the Russian minority flee the country. And now the population is down to what? Twelve?

And that is the formula for boiling a frog, i.e. the Western democratic tradition of compromise with the devil to the point of debt servitude, damnation and (very possibly) death. Whatever the specifics with regard to outstanding financial claims, it does not seem possible to argue with Varoufakis’s “Global Minotaur” analysis of the roots of not just the current Greek crisis but the post-2008 state of the global economy.

I’d always wondered why ‘Old Europe’ didn’t challenge the US abuse of its “exorbitant privilege” of ex nihilo reserve currency creation to pay its way in the world following the collapse of the WWII Bretton Woods monetary system in 1971 (an abuse so clearly described in Michael Hudson’s “Super Imperialism” and its sequel “Global Fracture” in almost real time, 1972 and 1977). That abuse went far beyond just getting something (the world’s wealth) for nothing to financing a military buildup which could be used to threaten not just bit players like Iraq but the very homelands of the lenders like China which had been financing the US “Empire of Debt” (Bonner and Wiggin).

It turns out that the PTB may have been worried that the monetary foundations of their wealth and power were threatened more by the disappearance of a Global Surplus Recycling Mechanism (GSRM) – i.e. something to do with the money they were piling up from the workings of even their socialist-tinted version of capitalism – than with the fear of an invading Russian army. Varoufakis suggests that Keynes was onto this need for a GSRM. Can someone provide some references?

News just in. Varoufakis’ wings clipped according to Bloomberg:

Of course. According to Bloomberg :)

Any reference to and reliance on ‘rumors’ and ‘sources’ associated with the institutions and the ‘internal Troika’ (internal to Greece) media, politicians and analysts is misguided.

You’re being taken in by b.s. and are only catapulting their propaganda.

There’s nothing wrong with Varoufakis, his style, his ‘ego’, his negotiation tactics, anything.

He’s right on the economics, the history, etc (given institutional and political constraints). He’s not going to be removed, there’s not going to be a compromise that does anything other than ‘appear’ to satisfy the ‘institutions’. It’s not going to happen whilst this government is still in office.

They’re trying to effect a regime change. They tried this before and succeeded. Not this time. Different ‘sheriff’ in town.

I had a personal dealing with Varoufakis (before he was in the Greek government, and on a matter having nothing to do with Greek politics) where he took one position, reversed himself 180, and tried pretending he hadn’t flip flopped. And he did it in a way that got a third person in a huge row with me. So I’ve experienced personally Varoufakis being an unreliable interlocutor, and this on a very low stakes matter. He seems to have a particular talent for stirring up fights around him.

Ah ! That explains the hostility. Fair enough. This being said being an as…le is not sufficient condition to being a failure. If it was the case, Apple wouldn’t exist…

I have separately mentioned in comments that Varoufakis thinks he has a Steve Jobs type reality distortion field when he doesn’t.

You should read the FT today on Varoufakis. He does appear to have gone out of his way to annoy people, like not going to Cabinet meeting when he is a newbie to Syriza, and insisting that the Troika monitors stay in hotels (as in not go to government buildings) and have information sent by e-mail or physically (I assume messenger). He could have slow walked the Troika just as well by letting them sit in a conference room and delivering too much info and making them dig through it. He does seem not to rattle easily so getting others upset would normally give him an upper hand.

The Euro group wants the kind of finance ministers they are used to– servile, yes-men, who don’t have a large twitter following. Unfortunately the Greek government apparently gave in to the demand, resulting in one of the worst strategic moves it has made so far.

Who said the new “negotiators” are going to be any different than Varoufakis?

Nothing has changed. It’s still the battle of the fantasies, fought out in the Land of Unicorns and Fairies.

European Elite fantasy: Tsipiras caves, and SYRIZA collapses to be replaced by the return of PASOK. Extend and pretend will go on, accompanied by the desired crushing of the Greek working class.

SYRIZA fantasy: Europe caves, and the final end is put off. Eventually the austerians are defeated and the Eurozone becomes a healthy, happy place.

“Negotiations” so far have been motivated by a need, common to both sides, to fantasize in public. The two sides hate each other, however, and so there will be a default, and the elites will force a Grexit. I really don’t see how changing the Greek team will do anything but forestall this outcome. The fantasies aren’t going to change, or become compatible one with the other.

If that’s the case, then a new team will be good to show the outcome is inevitable.

Hang in there, Edna. Just wait & see.

Why does anyone ‘trust’ bloomberg, of the FT, or Reuters, or any of the not-well-connected-to the SYRIZA government? Seriously, they’ve gotten NOTHING wrong with regard to the Greek government side. They are megaphones for the Troika side. Use them for hints to the “other side’s” tactics and desires. That’s it.

Absolutely agree.

I hate to tell you, but I have made posts based on information from reporters known to be close to Syriza (Ambrose Evans-Pritchard) that I’ve had to walk back because they were wrong. I’ve hardly ever had to do that as a blogger and I am not about to dent my hard-won credibility that way. The FT and Bloomberg have been much more accurate in calling the state of play than the Syriza-friedly outlets.

The problem has been one of politics and corruption, from its inception. You can’t use economics to get out of that … the solution lies in politics and anti-corruption.

I can only hope that the other Europeans will agree that their whole approach since 2008 is a failure, and deal with it … Varofakis seems to understand this … it isn’t just Greece, but this is why the other Europeans can’t admit it, because the mistake is too gigantic to contemplate … the EU/Euro/Nato will go down in flames, a bonfire of American and European vanities … Sic Transit Gloria Mundi … Nato post Warsaw Pact.

“Sic Transit Gloria Mundi”

“Wisdom is sold in the desolate market where none come to buy.” -William Blake

I have to point out that the link you give to prove the point that greeks’ pensions are not that extravagant is just a bad job by the WSJ. It starts with relative spending (as % of GDP) but then seems to switch to nominal values to prove its point. Well, duh, in nominal terms nobody’s surprised that a Greek pension is less than a German one. However, I note that in nominal values, a Greek pension is roughly similar to a Spanish one even though Spain GDP per capita is 50% higher. All in all, what I take from those figures is that Greek spending on pensions is not “extravagant” but it is definitely high (even if you factor in a 10/15% reduction since 2012).

With all due respect, you haven’t made any sort of argument why the nominal measure is a bad measure.

The nominal measure is a bad measure because it may mask wide differences between standards of living. A 1000€ average pension is not the same thing in a country where the average wage is 700€ than in one where it is 2000€ (French pensionners are moving to Portugal for this reason precisely + the sun).

If you had bothered looking at the average wages in Eurozone countries, it does not support the point you are trying to make. Greece’s average wage is higher than that of Portugal, almost double that of the Baltic countries, Hungary, and is well above that of Slovenia, Slovakia, Poland, and the Czech Republic. It it on the low end of the middle of the pack in terms of pensions, and in the low end of the middle of the pack in terms of wages. So tell me how its pensions are extravagant?

http://en.wikipedia.org/wiki/List_of_European_countries_by_average_wage

First of all I’m sorry if I sound vindicative, that’s not the goal… I really enjoy your analysis in general.

And you might be right (although my initial point seems to stand, the wage in the baltic states is roughly 40% less than in Greece whereas pensions, according to WSJ, looks more than twice as high in Greece) but the WSJ article doesn’t even try to account for that. In fact, in the article, they end up switching to nominal values when they want to adjust for demographics but I’d bet it’s the switch to nominal that change the rankings rather than the demographics. Once again, I have no firm opinion on Greeks’ pensions but, unless I missed something crucial, the WSJ post is not convincing (of course, reports that all Greeks are retired by the time they reach 50 and all draw a 4000€ monthly pension are even less convincing)…

You can check this and other info on the OECD website and also eu websites. These are the media’s sources.

“Too vague” = no Euroaristocrat cronies get paid.

When did we last see such drama? Ans. The Fiscal Cliff.

To the extent that Obama is a model for all Western politicians, then you have to be concerned about how this crisis will ultimately be resolved.

Aside: Varoufakis’ solution for Europe (QE + transfer payments) strikes me as essentially applying the US “solution”, which has led to extreme inequality and a meagre recovery.

=

=

=

H O P

Everything I’ve read from Varoufakis has been eminently reasonable.

How people write and how they come off in person are two different matters. I know people who have fierce writing personas who are quite mild mannered and eminently polite in person, such as Ambrose Evans-Pritchard. And you can’t judge at all how people operate when stressed from their writing.

Didn’t read all of the preceding comments so apologies if this has been addressed, but what are the chances that the Greek government can and will make meaningful reforms in the way it assesses and collects taxes? It seems to me that this would be one area which is only a win-win. Default or no default, it seems to me that Greece has no chance going forward if it can’t change its pervasive culture of tax evasion. And it would also seem clear that they can’t get popular support for this unless it starts with, or at least includes, the very rich.

Thoughts and predictions, anyone?

The chances are excellent under SYRIZA. The previous coalition government made the mistake of appointing a competent man, who was promptly fired when he presented his proposal. Despite the self-serving Troika propaganda ordinary Greeks DO want a fair and clear tax system. Meaning one in which tax is fairly apportioned according to income & wealth. The present system has always burdened the least wealthy. And by the way, 65% of Greeks (the employed) are taxed automatically through PAYE.

I raised this issue the other day but no one responded.

It seems to me that they could’ve taken some tax reform measures and/or made examples of some bad actors by now (tax cheats, corrupt officials, etc.) The fact that they haven’t done so, and haven’t tried (much) to highlight the suffering of the Greek people (populism) seem like red flags. The whole focus is on convincing “the institutions” to be reasonable.

Yves has also noted the lack of populist appeal as well as the fact that they have taken no measures to prepare for the possibility of a Grexit. They have dutifully paid and thereby dug themselves more into a whole that makes them even more dependent on a deal with “the institutions”. They are now scrapping the bottom of the barrel by asking/demanding that local governments to make funds available to the state and have asked or made plans for public employees to be paid in script. Billions of Euro have been pulled from Greek banks since they were elected.

Perhaps tax reform is suppose to be part of the ‘structural reforms’ that are being negotiated so they are waiting for an agreement before instituting reforms. Perhaps they haven’t had time to make firm plans for reform or do investigations. Perhaps the government is stricken with gridlock until these negotiations can be concluded. I don’t know. They haven’t really (yet) proven themselves to be reformers.

They have said they want to and it is clearly part of their reform plans. The Troika’s beef is that they project big improvements in collections faster than they think is realistic. And it does not help that tax collections if anything have gotten worse since Syriza took office (not due to any fault of Syriza, just that a lot of Greeks seem to have seen the new party coming in as some sort of excuse not to pay). There is apparently a big cultural problem that not paying taxes is seen as normal.

This would seem to be a big problem.

Syriza’s promises to end austerity are tightly tied to the abiltiy to reform the tax system. If they can’t reform taxes, then they have to sell off assets, reduce pensions, and do all the other bad things that they don’t want to do in order to pay the Troika.

The troika doesn’t trust that they can/will make tax reforms. The people apparently don’t take them seriously either (judging by your info that tax payments have fallen off).

To get the respect that they need they could’ve made examples of a few tax scoffs and corrupt officials. AFAIK, they haven’t.

=

What they have “accomplished” is:

Now, having run through all the liquid investments, they will have to:

Since they appear to be die-hard Europhiles, it seems that they will do (a) or (b) before (c).

=

=

=

H O P

Can we drop the term, “structural reforms”? Reform implies a change for the better, when that is debatable, to say the least. If the Greeks thought that the so-called structural reforms were for the better, would there be any disagreement? How about, “structural deforms” instead? ;)

Seriously, if you want a neutral term, “structural changes” is better, no?

destructuralism

Unfortunately, this is a term of art like “flat taxes” or “chained CPI”. Readers are having enough trouble keeping track of the moving parts, and it does not help their understanding if I use pet nomenclature that is out of line with with what the media and officialdom are using.

Well, to don the psychology/cognitive science hat for a moment, words have power. Even if we do not think that “structural reforms” are actually reforms, using the term activates the associations with the concept of reform in the brain, in the brains of our readers or listeners, and, yes, even in our own brains. Those associations affect thinking about these things. Even if we squelch thoughts like, “Well of course the Greeks should reform their ways,” they are still in the background and still have effect. Especially since the Greeks are not blameless for the mess they and Europe are in.

“Deforms” was a joke. But “structural changes” is not pet nomenclature, it is plain English. To adopt the jargon of our opponents in a debate is not to lose half the battle, but it gives up a lot. If you don’t like “structural changes”, at least say something like “so-called structural reforms”.

The right wing has been winning the propaganda battle for quite some time. Getting their terminology adopted as terms of art is part of why. George Lakoff and others have pointed out the problem for years. Words have power, and terminology is part of the battle.

In fact the sentence “structural reforms” is for me a marker of neoliberalism, and thus very useful to identify who is talking.

The Troika made it clear early on that they demanded concessions that were red lines for Syriza. Once that was obvious all the negotiations become a farce. Varoufakis has never been shy about saying a default inside the Eurozone is the best of all the bad possibilities if no compromise to austerity is available. He also has advocated the use of a parallel crypto-currency in sidestepping austerity.

From various articles in Varoufakis’ blog here is a default scenario {please comment on plausibility)

Greece declares insolvency.

ELA stops funds to Greek banks.

Greece nationalizes the banks.

Here is where the crypto-currency comes into play.

Greece recapitalizes the banks using a crypto-currency Crypto-Drachmas (CD’s) 1 to 1 for Euros.

There is already software in use to tie crypto-currency servers to ATMs

All bank debit cards automatically become CD currency cards, others can be issued

The problem with parallel currency is the tendency to hoard the good currency (Euros) and spend the bad currency (CDs) as rapidly as possible, devaluing the bad currency

Varoufakis has two bulwarks to slow or even halt the devaluation.

1. Taxes are charged in Euros but payment will be accepted in CD’s on a 1 to 1 value. But crypto-currency can be time dated. Any CDs that stay in circulation for more than 3 years will be accepted at a 50% premium. So CDs become more valuable the longer they are held.

2. Tourism accounts for over 17% of Greek GDP. All tourists would be required to exchange a certain amount of Euros for a CD loaded currency card issued by the Greece Central Bank.. Now I have lived in an American town on the Canadian border near Vancouver. Businesses there were willing to exchange Canadian currency on a 1 to 1 basis even when the Canadian dollar’s worth had dropped to 75 cents. The Greek tourist industry would be crazy not to do the same.

Another advantage is that tax avoidance becomes more difficult as all crypto-currency transactions are transparent.

Greece would have a constant inflow of Euros directly into the Greece Central Bank via 22.5 million tourists per year and could issue CDs to stimulate the economy,

Varoufakis then might truthfully state that Greece could run a 1.5% surplus in Euros while still using the Crypto-currency to stimulate the economy.

Any thoughts?

I don’t mean to be pedantic, or seem anti Syriza, but you need to understand the Eurozone/EU position.

1. The structural reforms were part of the IMF funding. They are equivalent to debt covenants. Thus the Troika was not “demanding concessions” but insisting that Syriza honor an existing deal.

2. Syriza wants 7.2 billion euros (the so-callled bailout money) UNDER THE CURRENT DEAL. The Troika says, “You can’t get money under the current program and not have the terms that go along with them.” The Troika was willing to drop the terms that were the worst and undoable, that being the commitment to increase the primary surplus to 3.0% this year and 4.5% next year. And they were also willing to let Syriza change particular structural reforms if they could persuade the Troika they would not have a negative budgetary impact.