Despite the market jitters of last Friday, which were triggered in part by the recognition that the odds of Greece reaching a deal with its creditors are far lower than had been widely assumed, Greek-related coverage has ratcheted down, even as Greece seems certain not to get any funds released in the April 24 Eurogroup meeting and is very likely to miss the end of April deadline for getting its reforms approved by the Troika and Eurogroup. Per a Bloomberg story yesterday (hat tip George P):

Greece and its creditors remained at loggerheads with time running out to unlock aid and avert a default.

The sides haven’t even set 2015 budget targets, let alone on policies to meet them, an official representing creditors said Monday, asking not to be named as talks aren’t public. Euro-area finance ministers said in February that a list of measures must be agreed upon by the end of April.

In keeping, Mohamed El-Erian said yesterday in a Bloomberg column yesterday pegged the odds of a “Grexident” at 45% (although El-Erian also conflated a default with a Greek exit, when we have pointed out the first does not necessarily mean the latter; given that the Greek government wants to remain in the Eurozone, it would be the ECB that would be the one to force a de facto Grexit by cutting off its bank system life support, the ELA). Greece’s lenders seem willing to continue pushing Greece into submission negotiating past the old drop-dead date.

But the official enforcers have gotten even firmer in their position: Greece must do its homework, as in prepare detailed reforms, and has to hew closely to the existing structural reforms. Christine Lagarde of the IMF last week increased the pressure by saying it would not give Greece a grace period on its payments coming due, as some had hoped.

Never mind that Greece has actually done more in the way of complying than any other European victim and has also shown the worst economic results. Various European officials have stated that they’d rather not have Greece default but they are not prepared to cut Greece any favors in order to avert that outcome. Making sure Greece complies, in other words, is worth the cost of what they believe will be short-term disruption. And they clearly don’t care one iota as far as the cost in Greek lives is concerned.

It’s puzzling to see the Greek government’s apparent failure to acknowledge that the Troika is effectively insisting that it cross its famed “red lines” such as pension “reform” and implementing labor “reform” which means further lowering wage rates. With another government, there could well be important jockeying going on behind the scenes, but heretofore, the ruling coalition has been disconcertingly open about its schisms. And Tsipras still seems to be hostage to the more radical representatives, who represent one-third of Syriza’s block. If they bolt, he no longer has a working coalition.

But if the government plans to hold firm, it really should impose capital controls, which would allow it to talk more openly to the public about what will happen if they do not reach a deal with their creditors. Similarly, if Syriza were to call referendum to convince its creditors that Greece really will default (and maybe exit) if they don’t budge (something the lenders seem to understand full well), it is similarly not clear how they can campaign candidly with no financial firewalls in place.

In the meantime, Greek officials continue to take desperate measures to buy more time and avoid default. Yesterday, for instance, the central government ordered local authorities to move cash and deposits to the central bank, presumably so the national government could, um, borrow them.

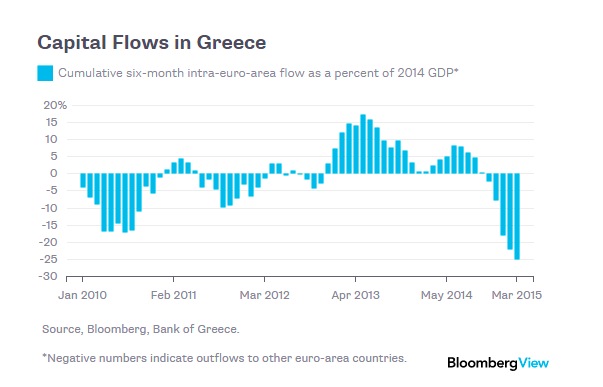

This chart from a a different Bloomberg story (this one by Mark Whitehouse) shows what the failure to impose capital controls (in combination with the ECB stoking the bank run) has cost Greece:

As Whitehouse pointed out:

Greece and its creditors would do well to step back and survey the wreckage as they enter yet another week of brinkmanship: Data on capital flows suggest they’ve undone years of confidence-building in a matter of months….

Data from the Greek central bank, which records each euro that leaves the country as a liability, suggest the capital flight has reached unprecedented proportions. Over the six months through March, about 62 billion euros ($67 billion) were taken out of Greece. That’s the equivalent of a quarter of the country’s gross domestic product.

Admittedly, we did have the Foreign Minister try to upset the apple cart by wrangling advance funding of a newly-inked pipeline deal with Russia. Russia and the Greek government denied any such deal was underway. This may have been an effort to pressure Tsipras, but all it did was yet again make the government look as if it is in disarray. Perhaps the moderates are trying to cut a deal with its old nemesis, Pasok, so it can ditch the radicals. But if not, there is no way Greece can reach a deal with the creditors. The hardliners will not bent to the Troika’s demands. Yet Tsipras and Varoufakis remain in denial that they are on a collision course, and their counterparts have now made it very clear that they are not pulling out of this game of chicken.

The Greek government released data today showing that, contrary to what yours truly had surmised, Greek authorities had increased their primary surplus for the first three months of 2015. However, as Bruegel explains, that result was achieved by taking short-term expedients, most important cutting expenditures and delaying payments, that can’t go on for long:

In conclusion, the data published today suggest there has been an improvement in the primary budget, mostly due to expenditure cuts. Revenues over-performance is mainly explained by increase in the public investment budget, whereas ordinary revenues have not yet picked up sufficiently to absorb the underperformance of the first two months of the year. At the same time, expenditure control is mainly achieved by postponing payments to suppliers, which can be effective in improving the budget in the short term, but the postponement of state payments suppliers may hurt the real economy even further and is in fact unsustainable of the state wants to receive the necessary supplies.

So Greece is already worsening its austerity merely to keep negotiating. And before readers argue for a Grexit, as opposed to a mere default, the bear in mind that the costs. both short-term and long term, to the already-desperate Greek public really would be higher.

It is still astonishing that the European elites have convinced themselves that adhering to the procedures used to implement clearly unsuccessful austerity programs are so important as to justify creating a failed state. Is this what the European project stands for? It’s sadistic and destructive, but there seem to be no cooler heads who can deter the power players, the ECB and the IMF, from this course of action.

Greece is the new Vietnam. An example must be made.

Well, that’s encouraging, since the Vietnamese won.

At truly terrible cost. The example was made, nonetheless.

A bit like throwing stowaways overboard before the Titanic hits the iceberg. Forgive me for not being too encouraged.

The ECB will reform them into the Stone Age

I would draw parallels to something in South America instead.

Blow me away Skip. I was just going to say that. It’s obvious, although unreported in the “news”, that Greece sits on a serious fault line. On the west it has the ECB, IMF, NATO plate; on the east is Russia and the new Eurasian behemoth. Which one is going to budge?

As you’ve pointed out regarding Russia and Greece, Russias’ better strategy is to sit back and pick up some of the pieces after a Greek implosion, on the cheap. It is now time to assume a Greek implosion and start figuring out who would get the best ‘deals’ out of such an occurrence. As someone on another thread mentioned, the real reason Libya was destroyed could well have been to stop Gadaffi from establishing an independent African Investment Bank.

What will be the qualities of a Greek “failed state?” Who can exploit those qualities for their own selfish ends? That’s where the ‘action’ will be next year. (I’m still worried about a Greek Civil War next spring.)

The most probable “real reason” for the Libyan disaster is stupidity.

Some people just want to get their hands bloodied, and there are plenty of Team Blue elites who supported the Iraq War and wanted to show how they would have done Iraq.

Ellen Brown had an interesting take on the subject:

Libya: All About Oil, or All About Banking?

http://truthout.org/libya-all-about-oil-or-all-about-banking/1302678000

Wednesday 13 April 2011

by: Ellen Brown, Truthout

“”Later, the same general said they planned to take out seven countries in five years: Iraq, Syria, Lebanon, Libya, Somalia, Sudan and Iran.

What do these seven countries have in common? In the context of banking, one that sticks out is that none of them is listed among the 56 member banks of the Bank for International Settlements (BIS). That evidently puts them outside the long regulatory arm of the central bankers’ central bank in Switzerland.””

“”The BIS does to national banking systems what the IMF has done to national monetary regimes. National economies under financial globalization no longer serve national interests.

… FDI [foreign direct investment] denominated in foreign currencies, mostly dollars, has condemned many national economies into unbalanced development toward export, merely to make dollar-denominated interest payments to FDI, with little net benefit to the domestic economies.””

“” Libya’s wholly state-owned bank can and does issue the national currency and lend it for state purposes.

That would explain where Libya gets the money to provide free education and medical care and to issue each young couple $50,000 in interest-free state loans. It would also explain where the country found the $33 billion to build the GMMR (Great Man-Made River) project.”

So let me get this straight. Greece is perhaps to be kicked out of EU but is very likely expected to remain a loyal part of NATO? Screw that. If Greece is kicked out (and kicked further down) then it should not only exit the EU but also exit NATO and expel all NATO troops, evacuate the bases.

July 1914… “Wir konnten night anders…”

Yes. From a certain point on no protagonist could change it’s course without facing severe problems at home.

And those points of no return were reached easily and really fast because every one of those protagonists took that external crises as a chance to draw the attention away from internal problems, and because none of them cared to see how that crises was seen from another point of view.

Also every protagonist used only a reduced form of information in the disinformation campaigns it subjected its citizens to.

Of course parallels end there.

A few years later the league of nations was created to settle international disputes through negotiation. To bad it, as well as the UN, most of the time fell short of the goals.

For a site that had been so enthusiastic about MMT it is surprising that NK has not been more critical of SYRIZA for failing to seek an exit from the Euro. Granted that apparently the people do not want to abandon the Euro and the complication that a Euro exit might result in being forced out of the EU, it remains the case does it not that the best and most democratic result for the Greek people would be the return to a sovereign currency.

I think many prominent MMT advocates are a bit overoptimistic/blasé about calling for an exit – and I’d class myself as an MMT supporter as well; it would’ve made sense 5 years ago maybe, but given the economic damage that has occurred to Greece in the last number of years, it really would be much worse (economically/socially) if done now – so the best they can hope for is ‘damage control’ with Europe sticking together at this stage, and somehow muddling along.

Economically, MMT’ers tend to be spot-on at evaluating all available economic possibilities, but I think maybe can sometimes ignore the likelihood of political issues that will affect economic conditions, limiting the (politically available) range of those economic possibilities, such as the potential for politically motivated sanctions against countries that would have a big economic effect.

Still – we just don’t know what Europe is going to turn into in the next couple of decades; maybe the economic and social cost of an exit today, would be the brighter option compared to what the EU might turn into – we just don’t know.

How could the economic damage of the last few years weaken the case for a sovereign currency in Greece? If anything it should strengthen it.

If they issue a parallel currency as a sovereign currency (ala TAN’s), then they should do that regardless – the case for that is strong.

If they regain a sovereign currency through an EU exit, it will be economically and socially catastrophic – they should avoid that if it’s possible.

Because it’s just so wonderful now? People aren’t already living on starvation wages, out of work, etc? It’s better to stay in the EU and allow the rich looters of the EU steal all of Greece’s most valuable land and resources? Better to get hollowed out by the EU looters entirely than to kick their asses to the curb and go it alone? OR talk with Iceland and Latin America and China/Russia about a new economic backstop.

Lets compare the economic damage of various countries with their own currencies who defaulted and devalued with Greece.

Iceland Unemployment peaked at 5.5%*

Argentina 1-years later was having 9% economic growth**

Greece unemployment at 26% economic growth fell 25% since 2008.

The negatives of leaving the Euro aren’t objective just emotional knee jerks against change.

*I guess since Iceland had the largest financial crisis on recorded its not the best comparison.

**I guess since Argentina and a financial primary budget deficit and trade deficit unlike Greece has now its not the best comparison either.

Ya but we need to factor in that Greece has been getting hammered economically for years now, and an exit is going to cause one hell of an added blow to their economy, on top of the current damage – this is not like them exiting 5+ years ago, when it would have made most sense.

So, it’s not comparable to Iceland in that regard (they weren’t under economic stress for so long), and I don’t know enough about Argentina’s case there, but I doubt it is comparable either.

The damage from an exit is not just speculative/emotive, it would be real – and I don’t think anybody really knows what the scale of that damage might be, especially if Greece ends up facing indirect economic sanctions in one form or another – we just don’t know what would happen politically, with Europe, or with the world economy even, past that point.

So, I wouldn’t portray it as a particularly rosy option. Maybe it will still turn out to be the better option in the end though.

The existing damage makes it easier, not harder, to start growing again after a Grexit. It means there are lots of unemployed people and lots of unused capital. Greece can get a big and quick boost just by getting some of the wasted potential production back into action. That would have been less doable early in the crisis. The absolute economic level will be worse than that with an earlier exit, but because current conditions are so back, the relative improvement will be better.

I don’t know about that really – they still have to trade with the rest of the world in order to import the resources they will need, and the destruction of industry that the last 5 years has caused, means that their trade balance from an exit today, will be worse than it would have been 5+ years ago.

That’s a big deal, for a struggling economy trying to go its own, in a world where all nations are engaged in the zero-sum game of trying to export their way to recovery.

In that sense, they’re definitely worse off – they might have more labour to hand, but will they be able to efficiently combine that labour with resources they will have to import? The devaluation they will have to do, would – I imagine – be much higher; and I’m not sure what kind of added damage that means to their economy.

there is no wasted production available

greece is not marriner eccles america with a capital strike but infrastructure in place…

I wish it was…

it is a country with a future stuck in the past…with one too many political supplicants wanting to bow down to kyffhauser and find “acceptance” by submission…although the french are allowed to have a parallel currency, commonly known as the CFA, with French government backing for the former african colonies, the ECB does not see that as non conformity with the rules…

because some vichy are more equal than others…

the situation in greece legally is a mess…by example, here in the USA there is late night 1-800 operators are standing by marketing (or there was) for real estate investment training…part of that training was based on ignoring the road blocks banks may make and asking the existing owner to allow you time payments in your purchase…owner financing…well….go try doing that in greece…you will be told it is illegal for private owners to provide financing and record the security instrument…I tried a dozen ways of putting transactions together…but the human capital is not there to work around problems…it might be different today…but there were no business sections in the book stores…and no tax planning books either…

it is europe in that it is west of the urals…

map the national highway system with a satellite view…you might notice something a little south of athens…other than athens to thesaloniki…the road to the third largest city, patras, is an old road that has been there for 50 years plus…they are “sorta kinda” getting around to finishing the actual highway…and there is only a “planned” highway across northern crete..must be using the same people who worked on the boston bigdig…

I wish it were different…if the human capital was there…forget the political capital…that could be dealt with…but the human capital is just not there…for those who are with the in crowd…they only worry that the pockets in their pants are full…too much zorba…not enough thinking…

In theory greece could make a go of it…but the reality is no way in hell…it would not be in its current mess if there was the human capital in place…

but other than foolishly wanting to let go of the french trained “Xiros” brothers, et, al, syriza has done a much better job than I expected in managing the media and perceptions…but sooner or later, one needs to deliver…and although much of what the three stooges (imf, etc) have demanded does not and has never worked anywhere….Hellas needs some cold turkey adjustments if it wants to survive and thrive in the modern world…

You can’t say Greece lacks unused capacity, because we *know* those unused people and were making and selling things 5 years ago. For the most part, the skills and equipment are still there. And poor roads are one of the #1 thing the government can fix with expenditures, employing a lot of people in the process.

See Varoufakis on why the Argentine case is not germane to Greece. Iceland also had its own currency before its banking crisis, so its case is similar to Argentina:

http://yanisvaroufakis.eu/2012/05/16/weisbrot-and-krugman-are-wrong-greece-cannot-pull-off-an-argentina/

And again, Mosler trolling Varoufakis with damn good arguments is Warren Mosler’s critique of that Varoufakis piece.

Nobody says that there won’t be temporary disruption, but prophecies of doom are not based on logic and experience, rather on non sequiturs and outrageous assumptions. As Weisbrot noted in the debated text, the differences between Greece & Argentina are in Greece’s favor – so Greece’s chances for pulling an Argentina now are better than Argentina’s were back then.

In particular YV’s “the fact that internal demand relies entirely on ‘animal spirits’ (i.e. on the optimistic expectations) of investors into goods intended for local consumption.” is complete and utter nonsense – “economics” that would make a Chicago-school fanatic blush, and Mosler’s critique is a necessary antidote, showing how far gone, how pathetic YV’s argument is here.

Unfortunately, an all too common example of “lefties” being more conceptually imprisoned, factually to the right of the most extreme right. In other words, YV is saying that people are & must be, tautologically, slaves to the wealthy investor job-creators (foreigners deigning to buy our exports, without which we would all die?). It is as if Keynes had never lived, as if no decent government had ever existed, as if there had been no Enlightenment, as if no “slave” had ever taught his “superior” with sword and bayonet that they were free.

I suggest you read our own alex m. on this topic. He seems a good representative of Greek opinion, which is very heavily opposed to a Eurozone/EU exit (the two go together). He thinks going it alone is beyond the capabilities of Greek society and government. I hope he pipes up here, but has stated that while Greece has the physical resources to be more of an autarky that it is now, it is sorely wanting in the human, as in administrative, resources.

And people who do not believe they can manage a course of action will not be able to execute it. If the Greek leadership believes a Eurozone/EU exit will be a disaster, they will produce that result.

How is Alex M a good representation of Greek opinion? He is American.

He has an opinion that is common among diaspora Greeks that is a very skewed and negative view of Greece that is not based on facts.

I have spoken to actual highly educated Greeks FROM GREECE and they dispute what you say. They say Greece is very capable of succeeding with the Drachma and been out of the E.U.

The Greek majority doesn’t want to leave because almost every god damn party in Greece has induced fear among the uneducated with there propaganda campaigns of what a disaster it will be to leave. And never explaining how it would work. And how it could be a success.

Nothing will get better until they leave. Even if it was going to be a disaster it is still a road they have to cross.

There was a 2014 Gallup poll that I (re)posted here that had 52% of Greeks wanting the Drachma and only 32% wanting the Euro. So Greek attachment to the Euro is exaggerated. Whether separation from the EZ means separation from the EU – who knows? Politics means more than “legalities”. Existence of EU citizenship rights and of EU members not in the EZ seems to argue against, not for, this implication.

Lapavitsas (& Flassbeck) have a book on how it might succeed. And Varoufakis sometimes speaks from his more thoughtful heart, not his emotional head. I have more faith in Syriza’s ability to execute the right plan than to take a deep breath and choose it, though I have not lost faith in that at all. Sometimes you learn to swim by jumping in the water in spite of your wise resolutions, and it is not necessary to hope in order to undertake and persevere.

Mosler disagrees

Agreed. There seems to be an over-recognition of the costs/pain of a Grexit. Clearly, defaulting and possibly leaving the Euro will have major costs. However, I do not see how anyone could conclude that these costs would outweigh the costs of continuing with the current regime; essentially one that would have Greeks live as debt slaves for the remainder of their lives.

The strong ensure that the weak always suffer when they fight back. The capitulation and collaboration of the Vichy French allowed France to escape the ravages suffered by Greece. Imagine how much better off Greece would be today if they had not fought so vigilantly against the Nazis!

When Yves writes:

If we end up living our lives as rational actors, then what is the worth of standing up to any brutal power? How do we value those who aspire to higher, more transcendent values?

What these comments demonstrate is a fear sitting just below the surface for all of us : what if it’s the dollar/pound/Euro etc in my pocket that takes the hit ? Well this is a polite website, but we all know the impolite answer. Of course there will be ‘ contagion ‘ ( banal jargon ) and no-ne has any idea how great that will be, but like a patient in a plague infested town who hasn’t yet been infected the opportunity is still open to leave and go off into the unknown . But at least one – the Greeks – will be free of the risk of the plague and certain death .

I literally do not care what the contagion would be. I literally do not care if it hits the dollar. I would be THRILLED if the contagion wrecked utterly the Western neoliberal facade that has been constructed on the graves of the people. Sure, it would be “painful” (economic pain is a trifle and totally wussy compared to actual, REAL pain and suffering in the REAL world) but just as the pain is unavoidable for Greece to get out from under the yolk of EU slavery, we all must endure the pain necessary to toss the yolk of slavery of neoliberalism that we all slave under. There’s a better life possible on the other side of the pain.

Even the ECB is looking at the option of Greece using IOUs, which effectively would be MMT once Greece accepted the IOUs for taxes: ECB examines possibility of Greek IOU currency in case of default – sources

And the Greek Gov doesn’t have to stop at simply taxing the IOUs:

– they can sell bonds denominated in IOUs (as a way to recycle IOUs, beyond just having taxes)

– they can form a central bank to provide liquidity in the form of IOUs

– they can form trade agreements with foreign countries that provide a way to recycle Greek IOUs back to Greece

BTW, Zerohedge had a great graphic on what the new IOU could look like :-)

No one is going to buy Greek bonds at any rate that Greece can afford in any significant volume. Read Rob Parenteau on TANs. The IOUs will be acceptable only to the extent that they are not disproportionate to the tax liabilities that the issuer has to for the TANs to extinguish. Greece is not seen as creditworthy and its government is not held in high repute, so foreigner will not want to hold them. More important, it is just about certain that the Eurozone authorities will not allow Greece to have a central bank in addition to the Hellenic National Bank, which is a branch of the ECB.

That’s all true, but with a primary surplus Greece doesn’t need to borrow, and basic MMT holds that *nobody* can issue currency in excess of what the tax system will eventually require without generating serious or even hyper-inflation. MMT holds that Greece *can* issue enough TANs to get the economy back to full employment, although IMO it will take a while because of all the damage from austerity.

The real issue will be political. With even a partial escape from the austerity straighjacket Greece could easily have the highest growth rate in Europe because they’re so deep in depression. But seeing success by a left government using MMT policies will engender fury in the rentier class running most of Europe and they will try anything to mess it up.

See the post. Greece has a primary surplus now ONLY by virtue of pursuing unsustainable practices, namely, cutting spending even further (and the government is already so hollowed out that it barely operates) and deferring payments.

And even if Greece defaults, that does not wipe out its debts. They will be restructured and the IMF is ALWAYS senior. Would you be a subordinated lender to Greece? If so, I have a bridge I’d like to sell you.

I agree Greece will be very limited in borrowing for a long time, although there are options to do it indirectly via quasiprivate companies and regional governments. But, MMT holds the government doesn’t need to issue *any* debt; they can just print, and the Greeks might as well try. I don’t think the MMT claim for debt/money equivalence is correct, because it’s based on the usual econ nonsense assumptions like perfect forecasting and Ricardan equivalence, but I still think they’d be far better off under a limitation of inflation from printing rather than the Troika’s insane budget surplus requirement.

But, MMT holds the government doesn’t need to issue *any* debt; they can just print, and the Greeks might as well try.

That is not what MMT says exactly. It says governments don’t need to issue bonds – which are often called debt- they can just as well only issue the debts which are called “money” or “currency”. That is what governments did for most of human history. There can be situations where bonds might be a good idea, but they aren’t essential.

I don’t think the MMT claim for debt/money equivalence is correct, because it’s based on the usual econ nonsense assumptions like perfect forecasting and Ricardan equivalence,

Not at all, these have nothing to do with it. The MMT claim for debt/money equivalence is based on not being insane. Money is credit=debt, always and everywhere, and there is hardly anything else you need to know about money. Other theories of money aren’t even theories really, but semantic confusions and category mistakes. Everybody used to know this more or less – as FDR said long before “Ricardian equivalence” – “Government credit & government currency are one and the same thing.” But a lot of MMT fans don’t really understand this, don’t understand MMT and say things like government debts aren’t real debts, that the word “debt” should not be used etc. because it is misleading etc MMT just says accounting is true and that there is nothing going on but the accounting. Claims that issuing bonds or money doesn’t usually mean all that much are based on multiple, usually cancelling inflating/deflating effects.

I agree with everything else..

I try to explain your point this way.

Even those who doubt the “debt” “is” “money” must recognize that in the real world, debt passes for money. Indeed, it is accounted for as money.

A check written on bank account is an order to the bank to pay money to the person named in the check, which is otherwise a debt, owed by the bank, to the person who draws it. The bank may honor the check by cashing it, or it may honor a check by crediting i’s liabillity to an account it owes to the payee presenting the check. Basically transferring its debt from one account creditor to another.

Every business firm that follows GAAP and reconciles its checking account records the balance of its checking account as cash, as though the checking account balance were money. The balance of checking account is not cash, though, it is only a debt owned by the bank.

One doesn’t need to be an MMT economist to understand this. I’m not an MMT economist, but I can understand it, and even explain it, as I’ve shown here.

MaroonBulldog: Yes as far as you go, but you are saying “a debt” (a check) is “money”, which remains basically undefined. The MMT / circuitist / creditary /institutional, Mitchell-Innes view is the reverse, that money is always a kind of debt, defined in terms of debt, not vice versa as you do above.

Debt = credit is the primary concept. So then, after the question “what is money?” (answer: negotiable debt) of course you have the question, “what is debt?” Debts are “debts to” not “debts for” money or “debts for” anything else. – for a non-existent medium of exchange – which would be a useless, uninformative circular pair of definitions. Defining money in terms of credit/debt means you don’t get to define debt in terms of money! Debts are nothing but immaterial, moral relationships between two agents – and that is all.

Plenty of MMT fans, probably the majority, don’t read Mitchell Innes or Wray closely enough and confuse themselves thoroughly about what MMT says. While they think they are doing the opposite, with bold “new” (hah!) ideas, their recommendations amount to following the path of degeneration of the basically correct Keynesian consensus into the present swamp of nonsense.

I’m not an MMT economist. I’m not any kind of economist. I’m a lawyer with a little past experience, long ago, as an accountant. I have a lawyer’s set of terms and definitions pertaining to money, and a lawyer’s prejudice that accounting should follow the law: Here’s the jargon I understand.

1. Obligation: a duty to do, or not to do, a certain thing.

2. Damages: a compensation in money, provided by a law, as a remedy for detriment proximately caused by the breach of an obligation.

3. Right: the benefit of an obligation.

4. Debt. First, the burden of an obligation. Second, in relation to a lawsuit, the burden of an

obligation to pay damages, or in short form, an obligation to pay, money.

I still haven’t said what money is, but we’re getting there.

To understand what these words mean in the context of the tradition in which I am using them, we have to go all the way back to the history of Ancient Rome. At the beginning of their tradition, the remedy for an injury–unlawful harm–was retorsion. If A did wrong to B, B or B’s family did the same wrong to B in return. It was “private” justice. The Bibilical injunction, “an eye for an eye, a tooth for a tooth,” illustrates the remedy and it’s limitation–no more than an eye for an eye, no more than a tooth for a tooth–for the Romans were not the first or only Mediterranean people to have this law. But Rome changed it, for good reason. Retorsion can get out of hand–an eye for an eye make the whole world blind. So the Roman state changed the rules. Instead of taking an eye, the plaintiff must sue in court, and if the plaintiff wins, the plaintiff must accept a compensation in money: So many pieces of silver for the loss of a tooth, so many more for the loss of an eye.

So, I say, about twenty-eight hundred years ago, in the precursor of our tradition, money came to function (and to be defined in practice) as that which bought a defendant out of a lawsuit, and that which a plaintiff became obliged to accept in settlement. Now, I know the MMT economists like to explain money by telling a story about money deriving its value from the states acceptance of it in payment of taxes. I don’t deny that story is true, but I assert that the story I tell is just as true., and both stories are part of a bigger picture.

Now, as far as debt and money go, “debt” is legally defined (in some contexts) as an obligation to pay money, and to “pay” means to deliver money. If I have an obligation to pay you $10, the obligation is satisfied if I deliver a $10 bill to you, because that’s what the law says it takes to satisfy the obligation. If I have an obligation to pay you $ 10, and I give you a check for $10, and you take the check to the bank and cash it, and the bank gives you a $10 bill, then my obligation to pay you $10 is satisfied when the bank gives you the $10 bill , because the law says that’s when my obligation to pay you is satisfied. If instead of giving you a $10 bill, the bank credits its liability account to you with an obligation to pay you $10 in the future, because you asked them to deposit the check, then I’m off the hook, not because you’ve been paid–you haven’t–but because you accepted a liability (debt) of the bank in lieu of payment.

So checks aren’t money, and bank accounts aren’t money, but Federal Reserve Bank notes backed by nothing are money, because the law says you must accept those Bank notes as payment of debts, but it doesn’t require you to accept checks or bank account entries in payment. But checks and bank account transfers serve the same purpose as money, and so might as well be money, as long as creditors and tax collectors are willing to accept them as substituted performance for an obligation to pay money.

To round this out, does my definition say money is a store of value? No, nothing in the story I told requires it function as a store of value. Does my definition say money is a medium of exchange? It certainly doesn’t require it: I can offer to trade two of my oranges for three of your apples, and no law says I must accept money instead if you insist on accepting my oranges while refusing to tender your apples. Immediate exchanges do not create debts. Debts are only created by obligations to do, or not do, things in the future. Finally, is money a unit of account. Yes, because it is the measure of obligations, so it is the logical unit of accounting for them.

Please don’t double post. That’s what spammers do, so you’re training Akismet to think you’re a spammer.

I know the MMT economists like to explain money by telling a story about money deriving its value from the states acceptance of it in payment of taxes. I don’t deny that story is true, but I assert that the story I tell is just as true., and both stories are part of a bigger picture.

Right. But you are not completely correct about the MMT definition of money. The MMT aim is to give the biggest picture story, which includes both the state money story often misidentified as the MMT story, and your story. State money, backed by taxation, is just a type of credit money – and there isn’t any other kind of money than credit money, which covers everything that has ever been called money in history back to Old Kingdom Egypt & ancient Mesopotamia – and beyond. The aim is to understand what has been functioning as money, what has not changed for closer to 6000 (maybe even 40,000! – the age of the oldest tally sticks) years. The book to read is the Credit and State Theories of Money: The Contributions of A. Mitchell Innes, and in particular Mitchell Innes’s papers of course.

By the useful, correct, MMT, philosophical and ordinary-language definition of money, checks are money, bank accounts are money. And Federal Reserve notes certainly are backed by something. Why on earth would anyone want them if they weren’t? When you have money in a bank account, you have money just as if you had a $10 bill or coin, which is just a bank account with the US government. One is no more final payment than the other, although they, especially the $10 bill, are often wrongly called that. The true final payment is when there is no credit/debt relationship at all, when you owe the bank or the government nothing, and either one owes you nothing.

“debt” is legally defined (in some contexts) as an obligation to pay money, and to “pay” means to deliver money. That “definition” (Not!) was what I was criticizing. If you define money in terms of debt, defining debt in terms of money is absurdly, uselessly circular.

The story you give is essentially what MMTers call the debased “legal tender” form of chartalism due to Schumpeter. Much better than the mainstream, but not the best, the simplest, the truest story.

The point is that accounting, law, economics should follow logic and philosophy. MMT is “worldly philosophy” – probably more than MMT economists realize. As philosophy, it tries to make general definitions of what is familiar, what everybody knows but doesn’t actually understand. It is about analyzing the relevant concepts that these stories presuppose, about understanding what is between the lines of the kind of definitions you gave . Not just “defining” one concept by a synonymous one or a short circular chain, or making bad distinctions like that between “payment” and “acceptance” above. Or defining “obligation” – wrongly, impossibly or circularly as a “duty to do … a certain thing”, which is the “debt for” [a certain thing] mistake I alluded to above. It sneaks the commodity theory of money in the back door. It puts the “certain thing” on a pedestal – not the social, moral relationship at the heart of the matter.

The point is that once actually understands these trivial things that everyone “understands” already – one realizes how few people understand them. e.g. how not having a job guarantee is a crime as purposeless, as strange and crazy as randomly shooting into a crowd. Or for another, Geoffrey Gardiner, in that volume, notes that millions of accountants do procedures – but hardly any know why they do these procedures, why there are actually no other procedures conceivable. And some MMT fans call these inconceivable-to-be-otherwise procedures – like calling FR notes or T-bonds liabilities or debts of the Fed or the Treasury “conventions”!

Sigh. Money is a social fiction created by societies for convenience. It, being a non-real entity, can be setup any way a society wants it to be. Money isn’t an electron, a proton, a molecule, which all actually exist with or without human society. Money isn’t a natural law like acceleration due to gravity, the speed of light, etc. It is made up as a convenience only.

Yep, I’m assuming GREXIT. Once you give a mouse an IOU, he’ll want MMT. And once the mouse has MMT, he’ll want to reneg on the euro-denominated debt (which may as well be GREXIT by that point).

The trick is getting the elites to accept payment from the plebs in the form of IOUs, especially when the elites can avoid paying taxes. In which case do what any sovereign government does, sell them bonds in exchange for the IOUs. It’s a win/win; it gives the elites a way to reduce their revulsion at accepting IOUs from the masses. And it gives the Gov a way to mitigate inflation of IOUs. And the only cost is to pay out interest on the bonds in more IOUs. :-)

Thanks for the link on TANS by Rob Parenteau. Will read later today.

Reneging isn’t an option. Greece will almost certainly default but then it will go into negotiations about restructuring the debts. Look at Argentina.

And if they do it within the EU, Greece might actually get what they asked for in the first place, after lots more damage and agonizing. So in the end they might come out ahead.

Not true, given that Greek voters want to stay in the EU. And last I checked, unlike the EU, Greece was a democracy.

Greece is small enough to be a democracy. The EU is too large to be anything but an empire. So yes, Greece was still a democracy, even if the last time you checked was this morning, and it may still be a democracy a while longer.

Democracy. Yeah right. Democracies in the modern form are only veneers. Democracy is touted and supported by the West (the US) only to the point short of actually allowing the People to actually change some core societal organizing principle. As soon as a democracy allows its people to ACTUALLY have its way (for instance, nationalizing natural resources so they can be used to benefit the actual citizens of that country) it becomes the focus of a “regime change” campaign. It will see a CIA-driven coup in its near future. The democracy will be crushed indirectly or directly by the West until or unless it relents, goes back to just a veneer of democracy where people are allowed to vote on minor issues and choose what puppet will “serve” in their government – but that puppet will never EVER do anything to actually change the status quo of neoliberalism and privatization.

Having your own currency is not a magic bullet. MMT discussions are in the context of 1. A sovereign currency issuer that 2. Already has its own currency. Greece is NOT that.

I wanted to put in a chart I had seen yesterday, and I could not find it again in time (I am under the weather) that showed the economic trajectory for Greece if it left the Eurozone. The GDP would fall by about 20%. Do you seriously think Greece can take that from where it is now? Greece would suffer even more capital flight (no rational person would hold currency in Greece to take losses from conversion to drachma), massive disruption due to having to sort out all its contracts in Euros, would be subject to suits from citizens over the loss of EU rights, would sacrifice valuable EU agriculture subsidies, and would be a less attractive trade partner to the rest of Europe than it is now, due to having to deal with border issues and a volatile currency.

And essential imports like pharmaceuticals and energy become vastly more expensive. Imports are nearly 34% of Greek GDP, versus 16% for the US. And the US is much more capable or ramping up production to replace some of its imported goods if we really wanted to than Greece.

None of these are problems that having your own currency will fix.

I guess the question is what serves as the fountainhead? If velocity of capital is nil, then that fountainhead isn’t working.

The Gov spending IOUs into circulation and taxing it out of circulation (or putting bonds into circulation to take IOUs out of circulation) would create a functioning fountain again.

Well, getting out of the euro does not mean getting out of the EU. Most of the disadvantages that you list imply Greece out of the EU, but it can have the new drachma and still be in the EU. Not sure how trade boycotts would work against an EU member state…

Sorry, but every legal analysis I have read says otherwise. Eurozone exit means EU exit. See, for instance, this ECB paper:

https://www.ecb.europa.eu/pub/pdf/scplps/ecblwp10.pdf

The paper you cite specifically says the rest of the EU *CANNOT* expel a state:

It suggests sanctions as an alternative but admits even that is legally wobbly.

So, no, EMU Grexit doesn’t require or even permit EU Grexit. Certainly there will be significant forces in the EU seeking to expel Greece but they can’t use the treaties to do it.

Yves Smith: “… every legal analysis I have read says otherwise. Eurozone exit means EU exit. See, for instance, this ECB paper:”

———-

According to that ECB opinion: “...there is no treaty provision at present for a Member State to be expelled from the EU or EMU.”

So, assuming Greece does not voluntarily exit the EU, how is Greece legally expelled ?

That chart is just a forecast, and based on very limited info. Factually countries that ditch excessively hard and deflationary currencies do well even with large foreign debts and extensive interactions with other countries on said currency. Examples include Argentina and the many major countries that ditched the gold standard during the Great Depression. Do you have any counterexamples where ditching a hard currency led to disaster?

“That chart is just a forecast, and based on very limited info.”

Yes, but what are the proper inferences to draw from the limited info that one has?

If I understand Yves’s points correctly, they reduce to this: (a) MMT only applies, and therefore only predicts successful consequences, in cases where certain required conditions exist, and (b) those conditions do not exist in the present case of Greece. By “condition”, I mean asserted fact that needs to be true for a consequence to follow, but that may not be true at all in the real world. If the limited info that Yves has is enough evidence to show that the conditions for MMT success do not exist, then Yves’s opinion is supported, and she owes you no further proof.

There is no reason the new drachma must necessarily trade at a huge discount to the euro. But tax collection needs to be in place first. Without that you are correct to doubt whether a healthy new currency can be established. MMT would say it cannot. Furthermore the Greek govt must not redenominate bank accounts, or at least it must do so sparingly. Else the economy will be flooded with new drachmas which will immediately lose their value. And voters will be pissed.

What I see is in Syriza is a lack of understanding, a failure to appreciate options, which will create its own failure. Whenever we see the assertion the Greeks have no option but to fail we must revisit first principles. The world is great and good above all real — finance is imaginary, a human construct, and if it does not result in human prosperity it can and must be changed. To say it cannot lacks imagination.

Huh? I don’t mean to be harsh, but if you believe that, I have a bridge I’d like to sell you.

The Greek government is going to have to nationalize banks and redemonimate all bank accounts in drachma, for starters. That implies it will want to force redomination of all Greek law contracts into drachmas.

Agreed. ReintroduCtion of the drachma might return Greece to growth or……to 20 years of civil war.

So better to remain slaves to the EU elite and just accept being the deep, true center of utter starvation poverty in the EU. That is CLEARLY the best option. Maybe the Greeks can literally sell every last acre of THEIR land to the elites of Europe and work out a nice indentured servitude deal so they will at least get some food.

No. Better to remain in the euro and for the

Duplicate comment deleted. Please don’t double post; you are training Akismet to believe you are a spammer, since that’s one thing that spammers do.

I would not label elected leaders standing up for the Greek people “radical”. The so-called leaders selling-out their people to the neoliberal slavemasters are the real radicals. And do we really still think that default and Grexit are worse than permanent debt-slavery? Perhaps a reassessment is due.

Very well said! One of the great tragedies of the last few years has been that so many so-called “moderates,” on both sides of the Atlantic, have deluded themselves that slowly marching into slavery is somehow better than making any attempt to throw off their chains. :(

I never called them radical. However, SYRIZA is an acronym: Συνασπισμός Ριζοσπαστικής Αριστεράς, Synaspismós Rizospastikís Aristerás. That translates as “Radical Left Coalition”. So it is completely fair for the press to call Syriza “radical left” since that is what they call themselves.

Yves, unless my eyes are deceiving me, these are quotes from your piece:

The left wing of the Syriza party is hard line. Many are out of the two old Greek communist parties.

I did NOT call Syriza radical. I have repeatedly said the moderates which dominate the party are pretty bourgeois. The left wing is another story.

Sad fact of the modern world. “Radical” left is the ho-hum standard “moderate” left of the 70s. Today’s “liberal” left are literally equivalent to Nixon Republicans of the 60s/70s.

Perfect and accurate description from http://stopmebeforeivoteagain.org/stopme/chapter02.html:

“The American political system, since at least 1968, has been operating like a ratchet, and both parties — Republicans and Democrats — play crucial, mutually reinforcing roles in its operation.

The electoral ratchet permits movement only in the rightward direction. The Republican role is fairly clear; the Republicans apply the torque that rotates the thing rightward.

The Democrats’ role is a little less obvious. The Democrats are the pawl. They don’t resist the rightward movement — they let it happen — but whenever the rightward force slackens momentarily, for whatever reason, the Democrats click into place and keep the machine from rotating back to the left.

Here’s how it works. In every election year, the Democrats come and tell us that the country has moved to the right, and so the Democratic Party has to move right too in the name of realism and electability. Gotta keep these right-wing madmen out of the White House, no matter what it takes.

(Actually, they don’t say they’re going to move to the right; they say they’re going to move to the center. But of course it amounts to the same thing, if you’re supposed to be left of center. It’s the same direction of movement.)

So now the Democrats have moved to the “center.” But of course this has the effect of shifting the “center” farther to the right.

Now, as a consequence, the Republicans suddenly don’t seem so crazy anymore — they’re closer to the center, through no effort of their own, because the center has shifted closer to them. So they can move even further right, and still end up no farther from the “center” than they were four years ago.”

Well if anyone living in Europe had any delusions about the EU / Troika giving a contintental f”*k about the majority of it’s constituents this should change that, but of course it wont. I wonder how bad & obvious it would have to get before the counterfeit coin finally drops. I sometimes wonder at what point did the German people figure out that Hitler wasn’t such a good idea after all.

That’s an appropriate wonder. I’d guess Germans figured out Hitler wasn’t a good idea when they became victims. Until then they kept believing in – as Gunter Grass would put it – Santa Claus.

In the western world today we have a civilisation run by Darth Vader and the Emperor, who are presented as good guys combating terrorism and protecting the nanny state, making our cradle to grave security safe. We won’t figure things out either until we become victims. No empathy for the Greeks until we share their fate.

if the problem is the purported “radical wing” of the radical party…

then the prime minister should let them come out from the shadows and stand in front of the lights…let them make their arguments before the TV cameras…give them their 15 seconds of fame to satisfy the ego…and let them look like the fools they are….they will crawl back under the table with their bottle of tsipouro never to be heard from again….

the best way to deal with a loud mouth making noise from the cheap seats in the peanut gallery is to put the heckler up on the stage….

as the wise old american said….

the best disinfectant…

is sunshine…

give them the stage and move on…these loud mouths can burp out slogans…but a coherent plan is well beyond the genius found at the bottom of a bottle of booze…

it’s time to get to work…summer is around the corner and there is pastitsio to make and arni to prepare…and jet skis to tune up…grab those tourist euros and get to work…

Thanks for that last paragraph. Evidently, the Scots have received your message, and maybe they can send a group to have a brainstorming session with the U.S. Democratic Party.

A couple of questions:

First Greece: Wouldn’t a default be better from the (1) point of view of the Greeks themselves but worse from the (2) point of view of the Troika? (1) An exit from the euro means economic collapse outside the common currency with the danger of new currency attached (it’s not the old drachma) (2) Yet default within the eurozone means pulling down the euro further (collectively). Your argument seems to head in this direction.

Second, bigger: How does Spain, which seems to trapped in corruption even worse than Greece in its political and banking sectors, hold out a hope of avoiding the same fate?

Yanis Varoufakis interview on Democracy Now this morning (4/21)

http://www.democracynow.org/2015/4/21/greeces_yanis_varoufakis_the_medicine_of

An example must be made:

interpretation: vocabularies lag reality by some 200 years or so…

Important electoral results in Finland. I have always been puzzled by their stance on Greece – this opinion piece helps explain:

http://rt.com/op-edge/251525-finland-eu-northern-independence-greece/

I think the wheels are coming off the wagon.

I think Wolf Richter’s article a few days (weeks) ago explained things best. Basically: the smart-n-savvy people who run Greece know that staying in the Euro increases their chances of future looting. What smart-n-savvy Greek wants to go back to a worthless Greek currency.

The smart-n-savvy people in all organizations know that centralization increasing the looting potential. Hence, we centralized until death (not a very catchy slogan, I know… But that’s what political bullshit is for).

Will the ECB continue to prop up the Greek banks when the Greek government defaults? If yes, then Grexit is off the table and muddling through with renegotiating the debt is the way forward. It is possible that the ECB does the opposite and forces the Greeks out of the Euro. I think we will find out in the next couple months.

Howard Lippitt

Currency unions have been tried before in history. So far, every one has failed, except the Euro.

A few thousand fiat currencies have been tried in history. A hundred or two are still extant, all the others have failed.

Based on lessons drawn from the experience of history, one would expect this Euro fiat currency union to fail, too.

But if failure is predictable, the path to failure is not, or has not been, until now. Now the problems of Greece are showing us the way; the Finnish elections are teaching us why.

Juliania’s “wheels coming off the wagon” metaphor is apt. “Falling apart at the seams” would also work.

Just a quick public service announcement: Italy debt to GDP= 155% and growing. Europe can bail them out…right? Time to dust of f the fiscal Union playbook.

Greece should default(already when the crises started) and exit the EMU. This is a Gold-Standard-regime that will not(impossibly) last in the long run, more money or not. Greek(and the Troijka) government is “killing” it´s people with the ongoing severe depression(like 1929-31). Greece can impossibly pay off their debt(ever) unless there will be an undemocratic(EU-elitistic) fiscal union with EU-bonds(Germany have to pay, a country already under big regional financial stress. Germany i.e can not balance it´s big current-account surplus through private consumtion(without debtbubbles!). Taxes still have to be increased in the whole of EU-union. And a lot not to cut off welfare(in panic) in the next business-cycle downturn(just around the corner).

The greek people are afraid not to be part of the european community if abondoning the euro. They should not. Unfortunately the new greek government came to power under these terms. A very difficult task to say the least.

No fixed currency-regime have survived for a long period. EMU is a gold-standard. The difference between countries in output-gap(potential output) and productivity makes the economies bound to continuous crises within the union. Why have the EMU-area survived until 2010? You know the answer: Credit/debt and falling interest-rates.

“It is still astonishing that the European elites have convinced themselves that adhering to the procedures used to implement clearly unsuccessful austerity programs are so important as to justify creating a failed state.”

Well said, Yves. Allowing Greece to default would be a huge mistake. And if they really wanted to avoid a failed state they would need to do more — a “Marshall Plan” for Greece, for example.

The problem is that they have painted themselves in to a corner from which there is no “poros,” i.e., passage. I.e., they are trapped in an aporia, the Greek term for “impasse.” If they allow Greece to persist with the Syriza anti-austerity program, then other countries in “the zone,” will insist on similar programs, which will totally undo all their (futile) plans for “recovery.” That bill could only be paid by yet more “quantitative easing,” which would only put Europe even farther out on that already rickety plank. And if they decide not to help Greece, then Greece will certainly default, plunging the European (and world) economy into a crisis comparable to the Lehman collapse.

On the Greek side, Syriza has no choice but to persist in its anti-austerity program because otherwise their whole reason for existence would be undermined and they would be removed from power. But if they do persist, then there is a chance they’ll be forced to default, which would cut them off from any source of funding and make it impossible to proceed with their program anyhow.

So!!!!!!

If there were ever a moment for cutting that proverbial Gordian knot, it is now. They should simply declare to the world that they intend to default and let the chips fall where they may. If Cuba can defy the “developed world” for so many years and survive, then so can Greece.

World wide crisis (who said, in every crisis, there is an opportunity?) – is that when a new global reserve currency might emerge? Is that the opportunity, for those are calculating, some are waiting for?

Yes, precisely. An opportunity. Worldwide economic collapse would get the oligarchs off our backs (by trashing their “wealth”) and the world would be free to start over without benefit of the monetary mirage. This is (and has for some time) been the prime topic of my own blog, where I predicted such a collapse would take place years ago. (http://amoleintheground.blogspot.com/2009/02/shape-of-things-to-come-part-8.html)

Boy, was I wrong! But I can still dream, can’t I? Call me Utopian, but I do believe that only an extreme event can save us. Not a God, as Heidegger claimed, but a total collapse of the system that keeps God (aka money) spinning in thin air, with nothing but faith to support him.

There once was a God named “cash”

Whose kingdom collapsed with a crash.

Thanks to a fracas

Stirred by Yanis Varoufakis

All that money got tossed in the trash.

However it is the 1% who view a crisis as an opportunity. The rest of us are in “see no evil, hear no evil” mode or we’re reacting to every new thing the rulers throw our way.

I’d love to believe a economic collapse would create reform and a better system but it’s wishful thinking. We are the most spoiled, apathetic people in human history. We are not capable of fighting for anything. We do the only thing we can do: hope the current system, which has enriched us materially, continues to do so. All our eggs are in that one basket. The 1% will continue to rule after an economic collapse because they will be in the best position to manage events and they will certainly look out for their own interests. For the other 99% it’s an updated version of Klein’s “Shock Doctrine”. Unfortunately the 1% won’t miss out on their opportunity.

I hate to admit it, but you are probably right. :-(

I think it’s possible that different elites may rule. China or BRICS or something. Good. When the U.S. empire dies I’m dancing on the grave. But that’s different than thinking it will mean a much more humane global economic system will arise, that seems fantastic at least on a global scale, though of course it would be desirable.

Agreed. I see it as a race against time. Will the global economy collapse and bankrupt the US military before Washington starts WW3? The bonus being the quisling leadership of America’s allies will be discredited in an economic collapse, which could mean the US losing its allies.

The disconnect amazes me. Given the Ukraine situation I’d say we are closer to nuclear war than we ever have been, even during the Cuban Missile Crisis. Yet such a situation is treated with indifference. This makes the possibility of it happening greater.

Personally the one thing I do hope for is a return to a gold standard. Put a leash on these politicians and bankers. Asia can certainly lead the way on this front. Though seeing the West no longer has any gold, our 1% will likely resist such a standard. Will that mean we end up living on the wrong side of the Gold Curtain?

Since everything is fiat, if we want to support Greece we have to be compatriots.

If everything is fiat, then we are all Greeks now. What I just wrote may not be right, but that’s the way I feel.

Debts that can’t be paid, won’t be.

Except….

Except when you borrow from the Mafioso.

Then, you will pay even when you can’t pay…if you catch my drift.

Now, who is the real Black Hand?

And you realize, all the important debts in the world will be paid, even then the debtors can’t.

That’s Realeconomik.

Sorry, no Santa Claus and we are not in Kansas anymore :<

Prolly won’t get seen down here, but this is from Zerohedge: “Greece May Sign Russia Gas Deal As Soon As Today”

http://www.zerohedge.com/news/2015-04-21/europe-isolated-greece-may-sign-russia-gas-deal-soon-today

And if so, follow the money: “Russia (Gazprom) gives Greece money, which Greece uses to repay the IMF, which uses the Greek money to fund a loan to Kiev, which uses the IMF loan to pay Russia (Gazprom).”

Again, this is a win-win in so many ways, for both sides, I cannot understand why it won’t happen.

Where does ZH get this stuff???

One, the Russians have said they aren’t advancing any money, and any funds Greece gets will be way down the road, too late to do any good as far as Greece’s cash crunch in concerned.

Assuming the ECB doesn’t cut ELA after a partial default…..wouldn’t the net result for Greece be, in effect, a debt haircut? Still in the euro, no hyperinflation, a big new budget surplus because they no longer have to make onerous debt payments. Remaining Greek debt would be stable and asset values should recoup losses steadily.

That’s a pretty big assumption there. The Eurocrats have so far acted as if they believe their own press. That is not a good indicator of the existence of the moral courage to admit mistakes and temper ones’ positions. Who ever has the unenviable job of being seen to reverse course on the Eurocrat side can pretty much give up their career. That will take someone who will act upon the principle of “for the greater good.” Seen any saints in European politics lately?

No. But I Have seen one God. His name is Mario….and he has resisted crushing the Greek Financial system against those who would love nothing more. Seen this way the assumption is not that big.

Of course the Eurocrats don’t believe austerity polices will fix the economy – rather the opposite, they have higher and loftier goals than that. The underlaying agenda is as it have been from the very beginning, to crush the european nation states and create the European super power. Crisis are opportunities for fanatics who strive for utopia. Cant make an omelette without crushing eggs.

As Monet said something like this; we will slice of their sovereignty in thin slices so they wont even notice what happens, every slice apparently “harmless” to the nations sovereignty. Greeks, Spaniards and so on have now been so immersed in EU propaganda that they do believe that being a free citizen in a sovereign state is an disaster path compared to being subjects to the EU elites.