A cultural interlude of sorts. As John Helmer noted by e-mail:

I’ve offered readers the opportunity to judge for themselves which of four “Wrestlers” they prefer for aesthetic reasons, whatever they might be. I’m also guessing that if the Oracle Group’s advice is followed, aesthetics have nothing whatever to do with asset valuation, any more than the non-existence of underground gold ever had for his AIM-listed companies.

By John Helmer, the longest continuously serving foreign correspondent in Russia, and the only western journalist to direct his own bureau independent of single national or commercial ties. Helmer has also been a professor of political science, and an advisor to government heads in Greece, the United States, and Asia. He is the first and only member of a US presidential administration (Jimmy Carter) to establish himself in Russia. Originally published at http://johnhelmer.net/?p=12970” rel=”nofollow”>Dances with Bears

Forgery in the Russian art market is diminishing. “The situation is becoming much better. There are now very few fakes,” reports James Butterwick, a London-based dealer and specialist in Russian art. “This has nothing to do with the experts. The market is the expert now, and it’s become very difficult to buy a picture of dubious authenticity. Save us from the academics and the connoisseurs.”

Art dealers and authentication experts say that in the current Russian art market rising prices and time are gradually pushing forgers and the network which has supported them out of business. The effect of time is to produce more and more evidence of the history of the art work for sale – the painter’s history; the provenance or record of ownership and resale; and the catalogues of public exhibition.

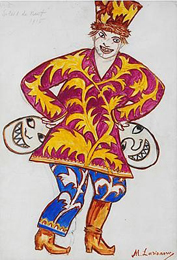

In March Butterwick took 30 Russian works from 1890 to 1930 to the Maastricht fair of the European Fine Art Foundation (TEFAF). It was the first occasion on which this genre was officially recognized by the organizers of Europe’s leading fine arts fair, although the TEFAF website fails to identify Russia as the country of origin, putting Butterwick down as from the UK. He in turn identified some of his works as “Ukrainian”. The costume design by Mikhail Larionov of 1915 (right) was one of the exhibits. Other artists his sale included Natalia Goncharova, Lyubov Popova, and Alexander Bogomazov.

In March Butterwick took 30 Russian works from 1890 to 1930 to the Maastricht fair of the European Fine Art Foundation (TEFAF). It was the first occasion on which this genre was officially recognized by the organizers of Europe’s leading fine arts fair, although the TEFAF website fails to identify Russia as the country of origin, putting Butterwick down as from the UK. He in turn identified some of his works as “Ukrainian”. The costume design by Mikhail Larionov of 1915 (right) was one of the exhibits. Other artists his sale included Natalia Goncharova, Lyubov Popova, and Alexander Bogomazov.

Butterwick has been identified as advisor on Russian art acquisition by the Oracle Capital Group in London. This calls itself an “independent multi-family office, dedicated to providing personalised services to high net worth individuals and their families.” Exactly what it’s independent of, Oracle doesn’t say. Its management comes from a variety of well-known Russian corporations and their outlets in London, Luxembourg, Geneva, Cyprus, or the Caribbean, where Oracle also has offices. The Oracle advisory board is filled with British frontmen from the boards of Polyus Gold, Sistema, Otkritie, and SUEK, some with titles and one with a connexion to ex-prime minister Tony Blair. In addition to advice on art, Oracle also sells wine, real estate, lawyers, accountants, and insurance.

Butterwick provides a tougher asset security test than Martin Graham (right), currently the Oracle chief executive. Between 2003 and 2009 Martin was chairman and marketing director of the Alternative Investment Market (AIM) at the London Stock Exchange. According to Russian mine licensing officials at the time, AIM was a platform for pump-and-dump schemes which inflated the value of Russian assets. Click, for example, on the story of Stephen Dattels and the Karelian diamond plot, er play, Everfor Diamonds. Graham credits himself with having “personally led the exchange’s transformational growth strategy focussed on driving market efficiency.”

Butterwick provides a tougher asset security test than Martin Graham (right), currently the Oracle chief executive. Between 2003 and 2009 Martin was chairman and marketing director of the Alternative Investment Market (AIM) at the London Stock Exchange. According to Russian mine licensing officials at the time, AIM was a platform for pump-and-dump schemes which inflated the value of Russian assets. Click, for example, on the story of Stephen Dattels and the Karelian diamond plot, er play, Everfor Diamonds. Graham credits himself with having “personally led the exchange’s transformational growth strategy focussed on driving market efficiency.”

According to Graham, he manages “several billion dollars for about 40 European families”. Two of his pieces of advice for managing large amounts of money are: “Don’t invest in anything you don’t understand”, and “don’t sit on your investments for too long.” In the market for Russian art that seems to be a recommendation to buy paintings for their resale value.

For those who cashed out of Russian assets from AIM share trading, and want to put their money on their walls, they need to make sure the “transformational growth” in Russian art prices is stable. According to Butterwick, with credible provenance and exhibition history it has become “very difficult to buy a dubious work.” The technology of authentication isn’t the reason. Chemical analysis verifies paint and paper or canvass. It identifies when a work may have been painted. “A chemical certification can only prove a negative. It cannot prove who painted a picture.”

Butterwick (below, left) has been in a bitter controversy over the authenticity of paintings by Kazimir Malevich and Natalia Gonchareva with Patricia Railing (right), the president of the International Chamber of Russian Modernism (INCORM).

According to Butterwick, “if you know that Goncharova painted 300 pictures before 1914, and someone claims to have uncovered 416, there is a problem.” According to Railing, “the turmoil of the Russian Revolution and the oppression of artists in Stalinist Russia…meant that numerous works by avant-garde artists disappeared, and could resurface.”

Railing says she is an art historian specializing in the Russian Avant-Garde, not a dealer. “Art is not a commodity, although the market treats it as such,” she told Art News last year. In uncovering and recognizing new works by Russian painters of the early 20th century, Railing implies that rarity has been a market manipulation to sustain high prices; dealer commissions, too.

A group of Russian experts forming the International Confederation of Antique and Art Dealers of Russia and the CIS (ICAAD) has publicly challenged INCORM to meet in Moscow with officials of the state museums, as well as ICAAD members, to resolve the authentication disputes that have been aired in the art media. ICAAD also issued this report on Goncharova “to bring the attention of the wider public [to] this systematic faking of work by Goncharova and to protect her legacy.”

“It is theoretically possible,” the ICAAD report concludes, “ that original works by Goncharova created before 1915 with obscure provenance exist, but it is scarcely probable: this period has been well documented by contemporary art historians, whilst her work was actively exhibited and recorded in catalogues of the time.” The report reproduces several works entitled “Wrestlers” attributed to Goncharova, concluding that only one (below, left) is genuine, while the second (centre) is dismissed as a copy of a photograph (right).

ICAAD warns against paintings that are “sold for a fraction of their open market value, giving the buyer the impression that he has ‘got a bargain’. When offered for re-sale however, these paintings become worthless since no credible dealer, auction house or museum will touch them.”

For Railing’s self-defence, read this.

Since February, in one of the longest-running art forgery cases of its kind, a St. Petersburg court is hearing a criminal prosecution of Elena Basner for defrauding a collector, Andrei Vasiliev, by certifying as genuine a painting called “In the Restaurant” attributed to Boris Grigoriev, who died in 1939. In 2009 Vasiliev paid $250,000 to a dealer – a bargain price compared to those which attested Grigoriev’s canvasses have fetched at Christie’s. Basner admits receiving a fee of $20,000 but denies attempted fraud. The court must decide whether Vasiliev’s picture is the original, and a second at the State Russian Museum is a fake, or vice versa.

Cross-examination by the prosecutor last month revealed there had been contradictory assessments of the painting by different experts from different museums. This was explained by the use of at least one faulty device for testing for phthalocyanine, a pigment chemical which did not appear in Russian painting until well after the Grigoriev work was reportedly painted in 1915. Technical methods have been relied on by the prosecutor in court to show that Vasiliev’s work lacked the pencil design which the artist used in composing his pictures; and for demonstrating that the materials used in the work date from about 1970. For more details, read this.

The trial continues on April 7. Basner is being held in custody in the meantime.

The authenticity of the trade in Russian Avant-Garde paintings has attracted most of the attention of buyers, museums, experts, and dealers to date. For the role of the international auction houses – Christie’s, Sotheby’s and Bonhams – read this.

What of the Russian painting which followed in the 1930s, becoming known as Socialist Realism? According to Butterwick: “I’m not aware of faking in socialist realism. Two reasons – there’s not sufficient value to warrant the cost of [forgery]. There’s also no market. That’s because all the pictures are in the museums. The museums took everything, and without circulation, there can be no market.”

One of the new museums specializing in Socialist Realism is the creation of Alexei Ananiev, which he established in Moscow in 2011. For more on how Ananiev made the money before its conversion, and the scepticism of the London Stock Exchange toward his Promsvyazbank, read this. The attempt at a London initial public offering failed in 2012. At present, Ananiev and his brother Dmitry have been obliged to support the bank’s capital base with a loan of something less than $100 million, and a promise that if the government contributes too, the Ananievs will attempt another IPO to raise the value of their share collateral.

Sergei Ananiev apparently didn’t consult Oracle on whether to invest in Socialist Realism for his walls. Instead, he has done asset marketing on his own. Ananiev, he told Art News a year ago, “sees Socialist Realism as a historical Russian style, inherited from such 19th-century masters as Ilya Repin. There is a century-long academic tradition, which fortunately for this art has been transferred from one generation of painters to another and preserved.” Art News reports Ananiev saying this in front of Isaak Brodsky’s painting of military chief Kliment Voroshilov on a cross-country ski.

Ananiev displayed the painting at initial public offerings, er gallery shows, in London and Moscow last year. Reviewing what it saw, the Financial Times claimed “Soviet art was not known for its subtle observations on the human condition.” The newspaper also noted that Ananiev and Promsvyazbank had paid Sotheby’s to display his collection, but not to sell it. Not yet.

The newspaper, apparently unaware of the controversy over the fake Goncharova Wrestlers of 1909, thought highly of Olga Vaulina’s Wrestlers, painted in the 1930s. “Full of insight and psychological drama”, the reviewer wrote. “A feeling of dread permeates Olga Vaulina’s 1930s “Wrestlers”. Two lumpy bodies address each other, as if in the opening seconds of what will be 10 hard-fought rounds. There is no sense of spring or sharp movement, just a latent, forbidding strength.”

Moscow specialists aren’t as hostile towards Socialist Realism as Butterwick, nor as pessimistic about the possibility of the value takeoff Ananiev is working for. Yekaterina Kartseva, co-owner and founder of Privatecollections.ru, says that current prices for the artists in this genre vary sharply. “I can not say what the price order is, for there are names at different levels, such as works by Yuri Pimenov, which are more expensive; even more expensive, [works by] Alexander Deineka. There are many different levels, there were many artists. Some were better known, some less. In any case, they all grow in value.”

“There was a great surge of interest in Soviet art in the late 80′s and early 90′s. Then there was the famous Sotheby’s auction in 1988, when a large amount of work was sold. Then too there was a spike in terms of value. Now in the West the demand has ebbed. But at the same time in Asia this genre is still very much in demand, for example in China. We regularly sell paintings of Socialist Realism to China.”

Yevgeny Zyablov, chairman of the board of Art Consulting, says “in this genre there is a problem mainly in mistaken attribution, not the problem of counterfeit.” What he means is that without brand-names, advertisement and promotion – as Ananiev is doing it – the market is uncertain how to handle the supply; aesthetic judgement is hesitant; asset valuation is uncertain. “In the Soviet Union there were hundreds of thousands of artists; all of them had the appropriate education. They are all painted similarly. Now the pictures can be worth hundreds of thousands of dollars. But the main problem is that when the [artist’s] signature works to sell a painting, what value to assign to the unknown painters, compared to the well-known ones.”

Zyablov is almost admitting there were too many good paintings of the Soviet period for them to promise large re-sale multiples to collectors now.

Of course aesthetics have nothing to do with the valuation of investment-grade artwork – otherwise a high-quality fake would sell for just as much as a high-quality original by a “brand name” artist. The best treatise on the subject of art forgery is Orson Welles’ last major film, the documentary “F for Fake” also known as “Vérités et mensonges”, which portrays legendary forgers Elmyr de Hory and Clifford Irving.

I always liked Picasso’s action of writing “Faux” across the front of spurious artworks sent to him for authentication. These are collected for their own sake. (Not everyone can boast that they have a genuine Faux Picasso in their collection, disauthenticated by the artist himself!)

I’m not sure if we can assert that the Financial World led the Art World into Faux waters or the other way around.

The best ‘rule of thumb’ to use in art collection is, “Only buy what you like. Never invest.”

The same advice for home investors, sorry, home buyers – you can actually save the world that way, by not contributing to bubbles and subsequent meltdowns.

We get back to the problem of allocation of resources. When bubbles continue over extended periods of time, late comers to the party lose their perspective. They pile on what they perceive as an endless funride. Education yet again is the key. Informed decisions depend to a large extent on the information available to the “consumers” caught up in the frolic. Here is where the meme fabricators of our MSM and associated media play such an outsized role. Unfortunately, the only sure mechanism for short circuiting this bubble cycle is ‘Crash and Burn.’ I speak not of your garden variety market crash, but epochal dislocations, such as Ye Black Death, or Thera Goes Boom.

Personally, I think squatting on a large scale is in the cards.

This could get confusing. I wonder if a faux faux means a fake faux on a fake Picasso or if it’s a real Picasso with a fake faux? And that’s before you get into the complexities arising from the French love of repeating short sounds such as “Fi fi”, or “ton ton” and so on. So you could have faux faux Fifi avec vrai tonton and so on. Sorting it all out in the gallery with a pas vraiment vrai Oxford English accent making it all sound a little too “chichi” could be an issue. Thankfully, I guess, the masters of the universe have solved that problem for most people no matter how many “fakes” are attached.

Zut, alors, mes ami! The biggest ‘fakes’ are those self same “Masters of the Universe!”

Of course, I can imagine a ‘reproduction’ Rodan tastefully displayed on a Pier One wrought iron table in a Faux Finish ‘marble’ nook.

One can never be too “chichi” BB. (A fake faux on a real Picasso? Line me up another ‘bump’ honey. I’m feeling faint just contemplating that!)

Eh oui.

There’s really no reason why the real painting should be worth any more than the fake. Both should be worth zero, now that anybody anywhere can see them both on the internet anytime they want.

A simple rational economic argument clearly explains why this should be so.

When you had to go to the library to view a picture of the real painting, you could say the real painting is valued as the summation of the negative utility produced by library visits, across all viewers, who need to check out the art book with the painting’s picture in it. Nobody would go to the library to get a book with the fake in it, so the fake is worth a lot less, since the summation of negative utility is far less.

Now there’s no diminution in utility required to view either the real painting or the fake. They are both instantly available on the internet. In fact, if your monitor is large enough, you can view the real painting as a life sized replica on your wall! The fake is no longer even relevant.

it’s only a matter of time before all these prices go to zero, so it doesn’t really matter one way or the other.

‘Course that would be art deflation – who knows how much QE that will take to fix?

Great analysis! Indeed, the same logic can be applied to pornography versus real “lovemaking.” Both can be reduced to zero worth when ‘feely’ style virtual reality becomes commonly available. I think Neil Gaiman uses the VR idea in the Sandman series. (The entire concept of Love is a minefield. Why should Art be any different?)

this is why cave painters like the ones in Lascaux painted deep down in caves where almost nobody would ever go.

so it would be hard to make the fakes that confuse everybody about what’s real!

Besides, it’s hard to fake a cave.

http://lascaux.fieldmuseum.org/behind-the-scenes/the-reproduction

http://archaeology-travel.com/exhibitions/lascaux-international-exhibition-to-travel-the-world/

If the anthropologist’s theory that the paintings were religiously inspired and used for sympathetic magic has any weight, then only the “Initiated” would get to view the best works. That way, the line between ‘real’ and ‘faux’ would no longer have meaning. Also, if the story about Picasso and the ‘perfect’ fakes is true, aesthetics would be the only legitimate measure. (Picasso was once shown some works by a genius level forger, purporting to be his. His reply was something along the lines of; “If they are fakes, I would be proud to have painted them myself. Let’s just say that I approve of these canvases.”)

the entrance into the cave was original money… you don’t have the trust of the gatekeeper, you don’t go in…

A fake fake

That would be the real thing

Does the Law of Diminishing Returns kick in?

Henry James’ story, “The Real Thing” is relevant.

There is a huge difference between aesthetic value and monetary value. Monetary value is determined by the combination of rarity and demand. Authenticity is related to a work’s rarity, which is why it’s important in monetary terms. If a work isn’t authentic, then it’s no more rare than any other skillful fake, or copy, no matter how well done.

Aesthetic value has nothing to do with rarity. A painting reproduced on the Internet can actually be more aesthetically pleasing then the real thing hanging on a museum wall. There are paintings that please me far more when I view them online than when I view them in a museum. A beautifully photographed, hi resolution image that can be enlarged and examined in great detail on a decently sized computer display is far more satisfying (to me at least) than the same thing hanging inertly on a wall.

As far as Goncharova is concerned, the most aesthetically rewarding of the three wrestler images is the one on the right, the photo. I’m especially impressed by the contrast of lights and darks, which produces a powerful effect. The other wrestler images, including the pair of wrestlers by Vaulina, are feebly composed, with no particular contrasts or tension, just juxtaposed, inert figures.

Before photography, artists could not accurately depict a horse in motion, running. Likewise a good eye sees artistic scenes that require photographs. The next interesting thing is that sometimes this enhances artistic depiction because it is easier for the artist to sort our light and shadow. Whatever. The real funny thing is that art is so much like money. It is valued, today, as needing a pedigree, like the gold standard. Where, art should should be considered in all its faults, the history, the artist, the subject – who is to say which is more valuable?