Lambert: Sure! Paying back debt with money that’s worth more than the money you borrowed. What could go wrong?

Claudio Borio, Head of the Monetary and Economic Department, Bank for International Settlements, Magdalena Erdem, Senior Research Analyst in the Research & Statistics unit of of the Monetary and Economic Department, BIS, Andrew Filardo, Head of Monetary Policy, Bank for International Settlements, and Boris Hofmann, Senior Economist, Monetary and Economic Department, Bank for International Settlements. Originally published at VoxEU.

Concerns about deflation – falling prices of goods and services – have loomed large in recent policy discussions (see e.g. Cochrane 2014, Muellbauer 2014, The Economist 2015). The debate is shaped by the deep-seated view that deflation, regardless of context, is an economic pathology that stands in the way of any sustainable and strong expansion.

However, the almost reflexive association between deflation and economic weakness is not so obvious. Seen as a symptom, deflation need not only arise from an aggregate demand shortfall, but also from greater supply, which would boost output. And seen as a cause, while it may be damaging – by pushing up real wages and unemployment, raising the real value of debt (debt deflation), or inducing consumers to delay spending – it may also be beneficial, by raising real incomes and wealth and making export goods more competitive. The cost of deflation is ultimately an empirical question.

Moreover, while the impact of price deflations of goods and services is ambiguous a priori, that of asset price ‘deflations’ – falls in their nominal values – is not. As is widely recognised, for given prices of goods and services, asset price deflations, in the form of declines in equity and property prices, erode wealth and collateral values and can undercut demand and output. Goods and services price deflations often coincide with asset price deflations. It is possible, therefore, to mistakenly attribute to the former the costs induced by the latter.

Data limitations have so far made it difficult to answer these questions. In our recent paper (Borio et al. 2015), we take a step forward based on a newly constructed data set that spans more than 140 years, 1870-2013, and covers up to 38 economies. In particular, the data include information on equity and property (house) prices as well as debt, relying in part on Schularick and Taylor (2012) and, for house prices, Knoll et al. (2014). The results are quite revealing.

Price Deflations and Output Growth: Link or No Link?

We define deflation in the prices of goods and services simply as a fall in the corresponding price index (here, consumers prices is CPI). We further distinguish persistent from transitory price declines as the former should be expected to be more costly. We identify persistent deflations as periods in which prices remain below the previous peak for at least five years.1

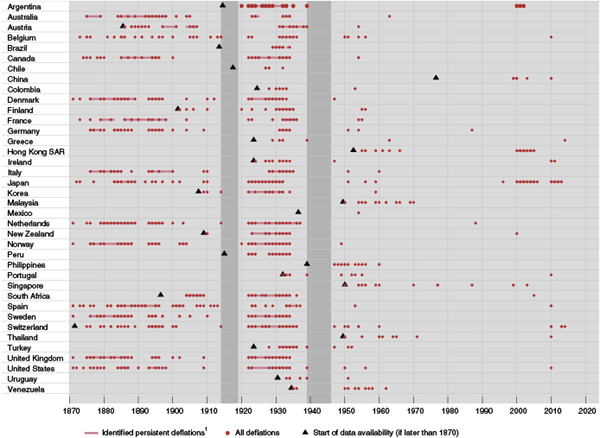

Figure 1 provides a bird’s eye view of the deflation record. Deflations are not so rare; in our sample, countries have been in deflation some 18% of the time (years). And, as is well known, deflations were very common before World War II. The bulk of persistent deflations took place then, only four have occurred postwar (in Japan (twice), China and Hong Kong SAR). That said, transitory deflations have not been that rare even in the postwar era; there have been well over 100 deflation years in our sample.

Figure 1. Deflations: Not so rare

1 Persistent deflations in the price of goods and services (consumer prices) identified as periods following price peaks associated with a turning point in the five-year moving average and peak levels exceeding price index levels in the preceding and subsequent five years. Troughs identified as lowest price index readings after the peak.

Sources: Schularick and Taylor (2012); Global Financial Database; International Historical Statistics 1750–2010; national data; authors’ calculations.

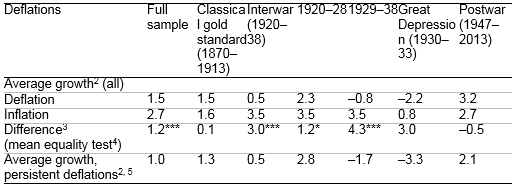

A preliminary assessment of the link between deflations and growth (measured in per capita terms) does not suggest a clear negative relationship. A comparison of all inflation and deflation years indicates that, on balance, inflation years have seen only somewhat higher growth (Table 1). The difference in average growth rates is highest and statistically significant only during the interwar years, particularly in the period 1929–38 that includes the Great Depression (some 4 percentage points), and much smaller at other times. It is the experience of the interwar years that influences the full sample results. Indeed, in the postwar era the growth rate has actually been higher during deflation years, at 3.2% versus 2.7%.

Table 1. Goods and services price deflation and per capita real GDP growth (38 economies,1 1870–2013, annual data, in per cent)

1 As listed in Graph 1. 2 Real GDP growth per capita. 3 Between average real GDP growth per capita during inflations and deflations. 4 */**/*** denotes mean equality rejection with significance at the 10/5/1% level. 5 Persistent deflations identified as periods following price peaks associated with a turning point in the five-year moving average and peak levels exceeding price index levels in the preceding and subsequent five years. Troughs identified as lowest price index reading after the peak.

Sources: Schularick and Taylor (2012); Global Financial Database; International Historical Statistics 1750–2010; The Maddison Project; national data; authors’ calculations.

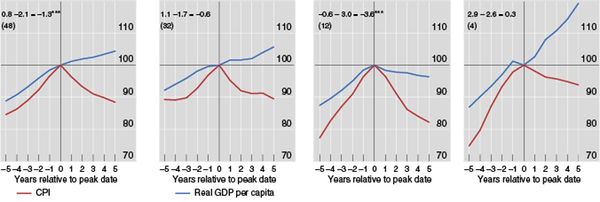

Likewise, focusing on the change in per capita growth in the wake of persistent deflations, we find only a weak link (Figure 2). While mean growth rates are mostly lower in the five years post-peak, the difference is large, 3.6 percentage points, and clearly statistically significant only in the interwar years, when the Great Depression took place – the subperiod that appears to drive also the results for the full sample. The difference during the classical gold standard period is 0.6 percentage points but it is not statistically significant. In fact, in the postwar era, average growth was even 0.3 percentage points higher in the five years after a price peak, although the difference is not statistically significant. Moreover, only in the interwar years did output actually fall post-peak. The benign output performance during the classical gold standard period is what has led previous researchers to characterise such deflations as ‘good’ (Bordo and Redish 2004, Atkeson and Kehoe 2004, Borio and Filardo 2004, Bordo and Filardo 2005). On this basis, the same could be said of the postwar deflations.

Figure 2. Output cost of persistent goods and services price deflations1 (38 economies,2 1870–2013, variable peak3 year = 100)

Notes: The numbers in the graph indicate five-year averages of post- and pre-price peak growth in real GDP per capita (in per cent) and the difference between the two periods (in percentage points); */**/*** denotes mean equality rejection with significance at the 10/5/1% level. In parenthesis is the number of peaks that are included in the calculations. The data included cover the peaks, with complete five-year trajectories not affected by observations from 1914–18 and 1939–45. For Spain, the Civil War observations are also excluded (1936–39).

1 Simple average of the series of CPI and real GDP per capita readings five years before and after each peak for each economy, rebased with the peaks equal to 100 (denoted as year 0). 2 As listed in Graph 1. 3 For the definition of a peak, see Graph 1.

Sources: Schularick and Taylor (2012); Global Financial Database; International Historical Statistics 1750–2010; The Maddison Project; national data; authors’ calculations.

Price vs Asset Price Deflations: Which Ones Are Costly?

To what extent does the weak association between deflation and growth change once we consider asset price deflations? If anything, it becomes weaker, and the evidence confirms the expected role of asset prices.

This is the case if we examine all years of increases/decreases in the CPI and asset prices in a simple multiple regression (not shown). This indicates again that a negative link between deflation and growth is only visible during the Great Depression and that, by contrast, output growth and asset price changes are significantly positively correlated over the full sample and most subsamples.2 The link is especially strong with house prices in the postwar period.

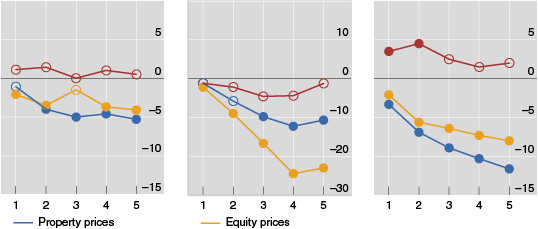

The results are actually starker if we consider persistent deflations. Here we examine the behaviour of output following peaks in the respective CPI and asset price indices (Figure 3).3 We find that the change in growth in the wake of persistent CPI deflations is uniformly statistically insignificant except for short horizons during the postwar era – where, however, deflation appears to usher in stronger output growth. By contrast, output growth always weakens in a statistically significant way following equity and property price peaks. Taken at face value, the output slowdown in the wake of both equity and property price peaks is sizeable. For example, in the full sample, the slowdown is quite similar for both sets of asset prices – cumulative growth is about 10 percentage points lower by the end of the five years.

Figure 3. Change in per capita output growth after price peaks1 (in percentage points2)

Notes: The estimated regressions are: , where y is the log level of per capita real GDP and are, respectively, the CPI, property and equity price peaks. A circle indicates an insignificant coefficient, and a filled circle indicates that a coefficient is significant at least at the 10% level. Estimated effects are conditional on sample means (country fixed effects) and on the effects of the respective other price peaks (eg the estimated change in h-year cumulative growth after CPI peaks is conditional on the estimated change after property and equity price peaks).

1 The graph shows the estimated difference between h-year cumulative growth after and before the price peak. 2 The estimated regression coefficients are multiplied by 100 in order to obtain the effect in percentage points.

Source: Authors’ calculations.

What difference does the presence of high debt make to all this? In other words, is there evidence that high debt makes deflation more damaging – Fisher’s (1993) so-called ‘debt deflation’?

This is hard to find in the data, but a damaging interaction with house prices does emerge (not shown). Specifically, we test whether the change in growth after price peaks depends on the level of public and private debt at the peak. There is little evidence that this holds for CPI peaks. By contrast, the growth slowdown appears to be considerably larger when a measure of ‘excess’ private sector debt is interacted with property price declines.

Conclusions

The evidence from our historical analysis raises questions about the prevailing view that goods and services price deflations, even if persistent, are always pernicious. It suggests that asset price deflations, and particularly house price deflations in the postwar era, have been more damaging. And it cautions against presuming that the interaction between debt and goods and services price deflation, as opposed to debt’s interaction with property price deflations, has played a significant role in past episodes of economic weakness.

Inevitably, our results come with significant caveats. The data set could be further improved. We have focused on only a few drivers of output costs. We have only a few episodes of persistent deflation in the postwar period. And present debt levels are at, or close to, historical highs in relation to GDP. This should caution against drawing sweeping conclusions or firm inferences about the future.

Even so, the analysis does suggest a number of considerations relevant for policy.

- First, it is misleading to draw inferences about the costs of deflation from the Great Depression, as if it was the archetypal example.

The episode was an outlier in terms of output losses; in addition, the scale of those losses may have had less to do with the fall in the price level per se than with other factors, including the sharp fall in asset prices and associated banking distress.

- Second, and more generally, when calibrating a policy response to deflation, it is critical to understand the driving factors and, as always, the effectiveness of the tools at the authorities’ disposal.

This can help to better identify the benefits and risks involved.

- Finally, there is a case for policymakers to pay closer attention than hitherto to the financial cycle – that is, to booms and busts in asset prices, especially property prices, alongside private sector credit (Borio 2014 a,b).

Author’s note: The views expressed are those of the authors and not necessarily those of the BIS.

References

Atkeson, A and P Kehoe (2004), “Deflation and depression: is there an empirical link?”, The American Economic Review, 94(2), May, pp 99–103.

Bordo, M and A Filardo (2005), “Deflation and monetary policy in a historical perspective: remembering the past or being condemned to repeat it?”, Economic Policy, 20(44), October, pp 799–844.

Bordo, M and A Redish (2004), “Is deflation depressing: evidence from the Classical Gold Standard”, in R Burdekin and P Siklos (eds), Deflation: current and historical perspectives, Cambridge University Press.

Borio, C (2014a), “The financial cycle and macroeconomics: what have we learnt?”, Journal of Banking & Finance, 45, August, pp 182–98. Also available as BIS Working Papers, no 395, December 2012.

——— (2014b), “Monetary policy and financial stability: what role in prevention and recovery?”, Capitalism and Society, 9(2), article 1, pp 1–27. Also available as BIS Working Papers, no 440, January 2014.

Borio, C and A Filardo (2004), “Looking back at the international deflation record”, North American Journal of Economics and Finance, vol 15(3), December, pp 287–311. Also available, in extended form, as “Back to the future? Assessing the deflation record”, BIS Working Papers, no 152, March 2004.

Cochrane, J (2014), “Who’s afraid of a little deflation?”, The Wall Street Journal, 17 November 2014.

Fisher, I (1933): “The debt-deflation theory of great depressions”, Econometrica, vol 1(4), October, pp 337–57.

Goodhart, C and B Hofmann (2006): “Goods and asset price deflations”, in House prices and the macroeconomy, Oxford University Press, Chapter 5.

Jordà, O, M Schularick and A Taylor (2013): “When credit bites back”, Journal of Money, Credit and Banking, Supplement to vol 45(2), pp 3–28.

Knoll, K, M Schularick and T Steger (2014): “No price like home: global house prices, 1870–2012”, CEPR Discussion Paper 10166.

Muellbauer, J (2014), “Combatting Eurozone deflation: QE for the people”, VoxEU.org, 23 December 2014.

Schularick, M and A Taylor (2012): “Credit booms gone bust: monetary policy, leverage cycles, and financial crises, 1870–2008”, The American Economic Review, vol 102(2), April, pp 1029–61.

The Economist (2015), “The high cost of falling prices”, 21 February 2015.

Footnotes

1 More specifically, we follow a three-step procedure similar to that used by Borio and Filardo (2004): (i) identify candidate peaks using a five-year moving average; (ii) date the local peak using the underlying series; and (iii) eliminate transitory deflations by requiring the peak to be higher than the price index level of the preceding and subsequent five years. The symmetrical restriction around the peak ensures that persistent deflation episodes do not overlap.

2 This is consistent with Goodhart and Hofmann (2006), who compare the impact of goods and services prices and equity prices on output growth for a subsample of our historical periods.

3 This is a local-linear projection-type regression in the spirit of Jordà et al. (2013).

All well and good – but those ordinary people who amidst austerity measures & deflation who edged Hitler into the Reichstag, don’t give a continental f””k about the above. Maybe it’s not hard to see why occassionally the real world wakes up the ivory towers with a jackboot up the arse.

i thought that hitler was preceded by an era of hyperinflation not deflation

This conclusion seems to be very convenient as it puts saving the financial sector as a policy priority. The economic discipline has a poor record on conflict of interest. Should I be putting two and two together? Probably not. This paper is probably just a product of a discipline gone awry. I think Lambert’s comment is most apt. From a systemic perspective we have developed a system whereby expanding private sector debt is a necessity, and the authors want us to buy into the idea that paying back that debt with money that is worth less than the money that bought that debt is OK, and perfectly sustainable. What happens when debtor’s default because the value of their debt is greater than the value of their income? Peace on earth?

If central banks are fearful of deflation, it may be time they examined the causes. A reasonable theoretical argument can be made the ZIRP itself leads to deflation in the mid to long term. There is no shortage of empirical evidence to support this, esp in JPN, EUR and US.

ZIRP lowers borrowing costs. The longer term effect will be business will have the ability to supply more goods and services at a lower cost (assuming a competitive market). In other words increased aggregate supply. On the other side, very few consumers directly benefit from reduced borrowing costs, eg credit card rates has not fallen considerably. However those consumers who are net creditors have been robbed of yield. With less interest income they are less able to spend. Coupled with increased inequality, this is reduced aggregate demand. So, in the long term, increased aggregate supply and decreased aggregate demand is deflationary. Perhaps central bankers skipped Econ 101?

Yes I agree & Lambert is correct – I wasted a few hours the other day arguing with some economics teacher or whatever. He has a pet – it is his little tweek in economic policy that is needed to save Greece & the EZ. I mentioned aspects from what I consider to be the real world, while he clung to his model, to which he had it seems given powers to transform the world.

I am just sick of these dickheads with their models, who think the world is still 18th century Newtonian clockwork & pretend they are scientists & not a bunch of priest equivalents drowning in their own dogma, who also think that the debateable truth in one aspect of a historical event is all that should be considered.

A ship of fools + I’m cold turkey nicotine at the moment.

Well it ties in nicely to what the BoE has been saying in the UK about not worrying our pretty little heads with the deflation we’re running into (http://www.theguardian.com/business/2015/apr/12/uk-deflation-negative-inflation-fuel-food) Nothing to see here.

Considering we have an almighty property bubble in Southeast England (London specifically) that has slowed down over the past 6 months, I don’t see how all this doesn’t portend some rather unpleasant days after the election next month.

“Lambert: Sure! Paying back debt with money that’s worth more than the money you borrowed. What could go wrong?”

What does it matter if the money paid back is worth more than the money you borrowed when the dollar is the reserve currency of the world??? As I’ve always heard here, we as a sovereign nation can’t go broke. I really would like to see the 1% lose their ill-gotten gains and real price discovery occur. Did you forget about MMT when you made that statement? (I didn’t read the full article yet but was surprised to see that headline comment, so I had to reply).

Besides, prices are high not because of the “free markets”, they are artificially high because of QE and the manipulators on Wall St. How can it be deflation when the mirage of QE and market manipulation is gone?

Besides, removing the artificialities of the current corrupt system can’t be true deflation – it’s the free market at work and price discovery occurring as it should.

The only thing that caught my eye was Lambert’s comment that paying back debt with money that is vastly more valuable than the money you borrowed might be a small problem… yes indeed. And without deflation, can there be inflation? Just stop all the rationalization about the instantaneous value of money. It’s nonsense. Besides which nobody even knows what money is. Still, after all these years. Er, millenia. Time to evolve.

We used to know the value of money when there was a gold standard, or similar in the past including tally sticks. Something to peg value. I’ve been wondering, why does money have to be pegged to something that can be manipulated? Why not peg it to the price of water or some commodity that is everywhere. So much of it that it can’t be manipulated. Water itself could not be traded for money, just money pegged to it’s value. I’m not an economist or even close, but I do believe I understand the value to everyday citizens of deflation. And with sovereign money being the reserve, how much could it impact government debts and people debts? All it takes it forward thinking. We’re still stuck in a medieval monetary system at it’s base. I totally agree, time to evolve.

“We used to know the value of money when there was a gold standard…”

TedWa,

I submit to you, sir, that except on a few rare occasions, this never occurred. The value of gold money varied depending on the quantity available relative to necessity. Whenever there was an abundance of gold, there was inflation (Spain, 49’ers), during scarcity, deflation (William Jennings Bryan). In times of great necessity such as wars, the returns to monarchy from tally sticks, as a tax, were higher. Thus it’s ‘peg’ varied dependent upon necessity. Metal coin was clipped. Warehouse receipts were issued in excess of stores. There were as many different ways to skin ‘the cat’ as there were monies.

Look a little harder, dig a little deeper historically and at MMT and you will see that this was true, even from the earliest days of money.

> What does it matter if the money paid back is worth more than the money you borrowed when the dollar is the reserve currency of the world???

It matters a heckuva lot when you are a currency user and not the government, e.g. the entire private sector. Deflation is killer for debt-laden households and businesses. Wall Street is an exception, as a politically connected industry they loot up the bubble and down the bust with equal facility.

It’s unclear to me how you suggest QE leads to high prices. ZIRP on the other hand certainly does add jetfuel to the speculation bonfire.

QE is ZIRP with another name. If income is already deflated how could it be deflated any more? Deflation would only be catching up with already deflated human value. The only thing in price discovery that will be impacted is speculation that has driven prices up or down.

Bailing out speculators of their bad debts only fuels the fire of mal-investment and solidifies already inflated values and profits. No losses for the banks remember? QE

A topic well worth visiting. Deflation relative to what, that is the question.

Well, we have deflation how in the UK so guess what? I’ve decided to put off all those purchases lest they become cheaper tomorrow. That holiday? Can wait until next year. The house build? Can wait until winter. I even gave up food for lent, and hey presto it’s cheaper now after Easter- time to feast! I feel so optimal, so efficient.

Of course Im buying even more goods and services because they are cheaper.

Well, for one thing, if your time value of your future work is greater than the time value of the money you borrowed, you’re ok. I could probably state the equation in integral calculus terms, but my keyboard doesn’t do that. So trust me on that one.

Then it becomes a macro problem when they always want to get the “consumer” to borrow so much from his/her future working career to finance current consumption that the “consumer” spends all 40 years of at once.

Then they wonder why they ran out of demand – and get all twitterpated about “deflation”.

+100 just for starters

The minotaur we need recycles money. And in order to perpetuate the minotaur, recycling money requires that we recycle everything. Trash, junk, used up, used, gently used, and almost new.

If there’s something I’d like to buy that I can’t afford, I tend to wait for the price to come down before I decide to buy it. I certainly don’t wait for the price to go up. If deflation causes people to delay purchasing, it’s because their wages are going down, not because prices are going down. Correlation is NOT causation. Which means there is a big difference between wage deflation (what we are now experiencing and have been for some time) and price deflation (which, in the USA at least, is a mixed bag).

As for the rest of this article: whenever I see a graph like that my head spins and I reach for the nearest Alka-Seltzer.

Yeah, what the heck were those graphs all about? What happened to labeling the axes and giving a title to each graph? And why were there three of them? I’m getting so tired of reading articles and looking at graphs and trying to figure out what data they represent. Using a chart wizard, creating graphs is simple stuff.

“Sure! Paying back debt with money that’s worth more than the money you borrowed. What could go wrong?”

Lambert,

Don’t articles like this give you the creeping suspicion that other examples of the same kind of spin, such as the rhetoric concerning the Federal deficit, is more than incidental? Considering that the TBTF’s are sitting on piles of cash reserves with the kind thanks of QE, wouldn’t it be so nice to have it increase in value? Especially since it can’t be spent.

I’m reading Nomi Prins book All the Presidents’ Bankers in which she posits that it wasn’t so much that the bankers during Roosevelt’s New Deal were opposed to emitting currency into the economy, they were opposed to the fact that the currency wasn’t being emitted through them (control issues). In both cases, the circulation of money is being or was wanted to be curtailed, especially through the lower echelons of income level. Now, add into this scenario the Big Scare rhetoric of avoiding potential runaway inflation due to low interest rates, ‘which could occur at almost anytime’, that’s so much in the headlines in the face of the snail’s pace of economic recovery.

Remember, it’s not that the value of real assets/commodities change. What changes is the value of the dollar. One of the best ways to make money is to create scarcity. It’s a feature, not a bug! Banks are doing what they have always done. First by inflation, then by deflation…

United States Dollar

the TBTF debts would also increase in value and, as you are probably aware, they dwarf their assets by about 50:1

since inflation is the opposite of deflation, and if we really shouldnt worry about it, then why should we worry about the either?

Because it’s not a zero sum game!!!

Deflationary periods are what we call depressions. Most people don’t think of it in this way but in a deflationary period, the value of things aren’t going down. Things still have the same utilitarian value as they did during inflationary periods. As an example, the utilitarian value of food still exists in it’s ability to control hunger. In that, nothing has changed. What has changed is that the value of money has increased through it’s scarcity relative to need.

Many people would think that it’s great that the price of things are going down, or, vice versa, the value of the currency is going up. Few realize that, although the price of a can of beans went from 68 cents to 37 cents, it makes no difference when you don’t have the money to buy them.

My grandparents and parents went through the Great Depression. People literally didn’t have money, they bartered if they had a resource to barter. Those that didn’t, begged.

Be very clear about this….starving people can be very, very, nasty customers.

“I know of no severe depression, in any country or any time, that was not accompanied by a sharp decline in the stock of money, and equally of no sharp decline in the stock of money that was not accompanied by a severe depression.” ~ Milton Friedman

To echo craazyboy’s comment: IMHO the real problem with deflationary episodes is the bubbles that precede them. Mainstream economics alas seems unshakably wedded to the neverending chasing of the ‘we can have the upside of the boom phase without suffering the bust’ unicorns. And from a ‘rational self-interest’ perspective, rightly so – there’s good money and prestige to be had from telling pols and the financiers they serve that with the right models and the right policy tweaks, they can at last bag one o’ them thar economic unicorns.

Lambert betrays his bias with his first words: “Paying back debt …” But what about a person with no debt? How about someone who is a saver? Granted, most middle class savers have been wiped out by the pro-inflation monetary policies, but only a generation ago people still saved. And I think the world was a better place, financially speaking.

I know someone will come back and say: But you don’t understand. Our whole financial system is built on debt and the gospel of perpetual growth, so only a fool hopes for deflation. To which this fool says: Once you question the gospel of perpetual growth, then the whole thing starts to unravel.

1. We can’t move into a postwar scenario because in our current scenario, the war never ends.

2. Deflation is a problem for anyone who is in debt and doesn’t print his own money, and it conveniently happens whenever those who control the money believe the rest of us are too strongly demanding a piece of the pie.

isn’t debt, short of a default, always paid back with more money than was borrowed?

i admit that, as someone with no debt and no assets, i find the idea of deflation interesting. in every scenario there are winners and losers. i don’t see why the highly leveraged and wealthy should always come out as winners.

deflation is neither good nor bad just like inflation. both can result in spirals but one lowers growth while the other erodes purchasing power. i’m not convinced that lower groaf is necessarily a bad thing.