Mr. Market had a swoon on Thursday because the data are coming in in a mixed picture, which always makes things confusing, and in a combination that does not look conducive to Fed friendliness. On Tuesday, the preliminary estimate for first quarter GDP was a mere 0.2%, well below consensus estimates. And even worse, when you backed out inventory increases, the economy contracted. The analyst community fingered one-time factors like the lousy weather and the port strike, but remember, they knew about that and their previous estimates were higher. The open question is how much of the downdraft was due to factors that are still in play, like the strong dollar.

By contrast, today we had much stronger news on the jobs front, with pay increasing in the first quarter by 2.8% and prior week jobless claims falling to their lowest point of the last 15 years. But Personal Income and Outlays for March showed “somewhat cautious” spending, which does a bit to reconcile the difference between what the GDP report said versus the later jobs data. Nevertheless, this combination made investors decidedly unhappy, since the Fed is itching to get out of ZIRP and is looking for signs that the labor market is strong enough to handle interest rate hikes.

In comments, New Deal democrat took issue with the conventional wisdom that consumers would soon open their wallets and spend their gas savings:

Income was flat, but spending rose .4%, because people dug into their savings. The personal saving rate fell from 5.7% to 5.3%. I.e., consumers started to spend some of their gas savings in March. Gallup’s daily numbers suggest that has continued this month.

I try to avoid listening to financial media commentary on data releases, but managed to catch snippets of discussions on Bloomberg and CNBC. Blooomberg took the “the first quarter was just a pothole” line, while the CNBC crowd simply denied the first quarter results (“The economy doesn’t feel bad”).

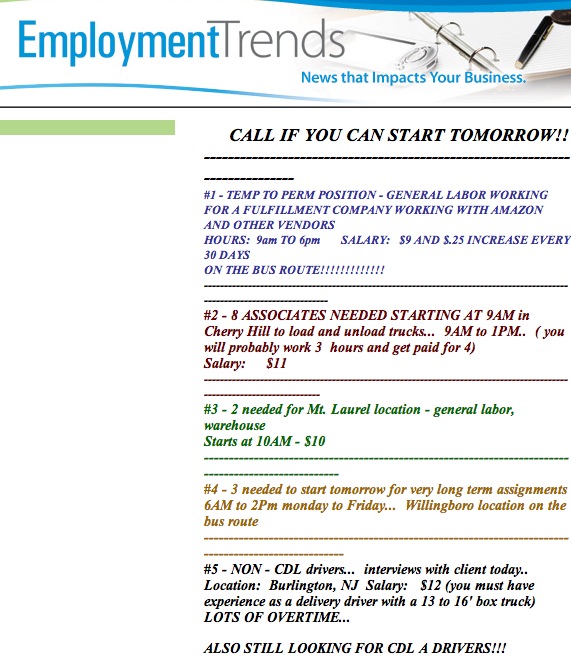

In our last request for members of the commentariat to tell us about how their local economy was faring, the picture was that a few sections of the country, like the Bay area and Washington DC, were smoking, others like the Minneapolis-St.Paul area and Seattle were humming along nicely, while others were more mixed, with the most prevalent pattern being that upper income areas were doing well and middle-lower income were not. This is consistent with the fact that job ads in Carol B’s part of New Jersey don’t seem to be participating at all in the supposedly improving labor market (as in she’s been sending job listings off and on for years and the wage levels and conditions for this sort of job hasn’t budged):

So we’d love to hear about conditions in your area. Are restaurants, stores and hotels busy or slack? How is the real estate market? Do you see signs of changes in business openings and closings? Some indicators, like whether dentists are getting more or less busy, or architect bookings, are particularly good leading indicators.

In particular, we’re curious as to whether your local economy got caught in the first quarter downdraft, and what you think the trajectory is, Is the two tier “recovery” more or less on track, or do you see changes in the dynamics?

Working class Chicago neighborhood on north side. Realestate prices are soft and inching down and people in my condo association are resigning themselves to the fact that their homes will NEVER be worth what they paid and local gentrification is a pipe-dream. One bar / restaurant opens and another closes. Feeling of just barely treading water. Gun violence up. Everyone has a job though.

Chicago: Edgewater (west of Broadway).

–Real estate. Stuff sells slowly, but things cell. Houses move faster than condos. Yet many of the houses here are rambling Victorians with high asking prices, so that take longer sell.

–Condo prices are erratic. Some neighbors still can’t get what they paid. My place, after eleven years, has appreciated, maybe, 10 percent. New property-tax assessments indicate that they city sure is hoping that appreciation is happening.

–Weird little trend, three or four instances: People are buying the neighbor’s house and tearing it down to have a sideyard. The neighbor is often an elderly person who has held on for years. Result: mini-Versailles?

–Weird little trend, three or four instances: Rehabbing two flats into single-family houses. The pug has to have its own room!

–News is that the parking structure of the former Edgewater hospital is being torn down to put up fifteen houses, at $1 million a pop. That’s a lot of money, especially this far north in Chicago.

–From January to April, we see businesses that couldn’t make it through the last calendar year fail. Christmas was okay, but not all around. Several empty storefronts from Clark and Lawrence to Clark and Hollywood. From Clark and Peterson/Ridge up into Rogers Park, it is economic devastation. I’ve never seen so many empty stores. Unnerving.

–In short, housing sells in an attractive neighborhood. (The good local array of schools matters.) The general economy, as indicated by retail and restaurants is only so-so.

According to some census data that Lambert posted, I found my neighborhood, Edgewater, at something like 35 of 100 in Chicago. So, top third for income, although there’s a big gap between the top 5 neighborhoods and the rest.

The restaurant business suffered a bit I think mostly because of price shocks. Those that could raise prices did, and survived. Real estate is crazy (North of Dallas). Toyota and State Farm moving here has created a feeding frenzy. Houses that took a year to sell are now selling in a day for twice what they are on the tax rolls (this is close in, not halfway to OK where they are still building like crazy). The appraisal district is loving this, but homeowners not planning to sell aren’t.

For most of the last 5 years I couldn’t find a local machine shop that wasn’t busy making parts for the oil/gas industry. It was so bad that one of my customers ended up buying their own 5-axis milling machine so they could get things made quickly. Now many of these shops are calling me.

I don’t know where the “money” is coming from to support these housing prices. The energy slowdown hasn’t spooked anyone I know. A RE buddy of mine is putting unsolicited offers on houses to turn around and sell, so the demand must till be there.

Real Estate in North Dallas is indeed crazy. My co-worker managed to get 4 offers on her house after the first open house.

Downtown Dallas condos seem to be fizzling out already though.

The next housing crash will be brutal.

REstaraunts in my area have a new revenue stream, gambling machines. Adds an additional 10 to 20% to the revenue stream which goes directly to the bottom line.

Farmers seem to be holding steady.

Several other businesses have closed. It isn’t looking good.

Doesn’t that 10%-20% have to come from less spending some where else?

From one of the worst income disparate states in the country, it really depends on where you live.

If you live in Boston/Cambridge, Weston, or Wellesley, things are probably great. Maybe you work at a college or at one of the hospitals, or are somehow connected to a certain developer here. If you live outside this utopia, you are living in dystopia. While jobs appear to be growing, the pay sucks, even worse, we have employers being paid by the state to stay here! One employer in my city actually threatened to leave if he didn’t get his tax credits. SNAP benefits plummeted over the past year by 10%, but that was likely due to a small eligibility rule change, but we still have a ridiculous 785K on SNAP here. So like most of the country, if you’re in the top income percentile, things couldn’t be better, if not, you get to see the $12/hr Craigslist/Indeed job creators and probably are no longer a homeowner, where ownership has crashed.

http://research.stlouisfed.org/fred2/graph/?g=19Qw

http://research.stlouisfed.org/fred2/graph/?g=19Qu

http://research.stlouisfed.org/fred2/graph/?g=19Qv

i’ve seen nor heard of little change in my rural NE Ohio area, & although spring planting prep is running a bit late, weather forecasts indicate they’ll catch up this week…i’ve read of layoffs at steel pipe mills in Youngstown and Lorain, due to less drilling..

btw, the idea that people are “saving”, as was reported in February, or “digging into their savings”, as they’re reporting now, is pretty much hokum…personal consumption expenditures have been running pretty much close to 80% of total income month to month, with minor fluctuations of less than 0.5% monthly (ie, see here: http://www.bea.gov/newsreleases/national/pi/pinewsrelease.htm

when the increase in income is greater than the increase in outlays, you’ll usually see a corresponding drop in revolving credit…this month, we’ll likely see revolving credit increase a bit…”savings” has little to do with it…

San Antonio real estate market looks a lot like Dallas: smoking hot. There’s little inventory, and tax notices with increases of up to 10% (the max allowed) have just gone out, producing the usual expressions of outrage. We tried to get a reservation at one of the local trendy restaurants yesterday, and the earliest we could get for dinner was 7:30; the place was packed all night. My guess is that the oil field downturn hasn’t quite sunk in yet.

Yet Houston is looking at a BK due to tax minimization to draw corporatist in.

Skippy… visages of selling the girls off to protect the angels thingy…..

In SF, the bubble is in full self-perpetuation mode, with construction of all sorts going on in at a dizzying speed. SF is building up, and 15-20 story condo buildings are the new norm. The lines for weekend brunch are interminable. Step off the curb, and you risk getting run over by a 30-year old driving a Tesla or a Maserati. Or a gleaming Google bus.

In upstate NY where I spend time, things are depressed but stable. No discernible change from last quarter.

This QE-induced, wealth-effect ‘boom’ is concentrated where the wealth is concentrated: the coasts and trophy cities.

I concur, even more so here in Silicon Valley. Crappy 2 star “hotels” are $300/night. The Westin is typically $900 (!!). Happy hour at Fleming’s was totally packed on a Thursday night. Reservations needed well in advance, not just for Evvia or Zola’s but also Rangoon Ruby or even Sam’s Chowder House.

Good personally, we sold our house in Menlo Park in 8 days last month, right into the feeding frenzy. Above asking price, fast close.

week trip to Portland – homeless heaven! bifurcated market – good homes are selling in days yet there are a lot of empty storefronts. Top restaurants packed but second tier not. Powell’s still a treasure.

My story is not typical though… we are way up in the 1% through my accidental discovery of how to do some magic that billionaires will pay for. Now casting about for appropriate retirement situation and figuring out how best to support Bernie Sanders.

Upside exists for sure, but not being distributed evenly…

Thanks for the report. Ya know, if Yves had the time to concentrate only on investigative journalism… She’d probably be setting Bernie’s agenda. (Normally, I’d never say such a thing, but since it’s out there…)

I live and own a business in the East Bay; (Custom stained glass; restoration and new). Wealthy (by any normal standard) homeowner clientele. I can’t tell you how many multimillion dollar houses I’ve been called to where deferred maintenance on 100 year old windows has become a must-fix, gaping-hole problem and the new owner cries ” I can’t afford to that!”. And we’re talking an $800 repair on a 1.5 million dollar house. Had one client tell me the had to buy in an off-the-market sale (for 4.5 million…thanks Trulia for the info!) because they “kept getting outbid”. So while the tech hipsters, the realtors and the financial/corporate drones are eating $14 bowls of “artisanal” mac and cheese, everybody else is struggling mightily. I make enough to keep my nose above water but it’s getting harder. I rent a studio for $850 (rent just went up by $50), no health insurance (ACA, my ass!) and no retirement. My high school teacher girlfriend commutes 3 hours one way to her job because she can’t afford to live closer. That’s 30 hours a week and 10 bridge tolls a week…In the last 3 months,even the wealthy or well-to-do (my clients) are showing HUGE signs of fried-ness and stress. DEFINITELY feels like the last sputtering gasps of an overly-lean, high octane silly-FIRE-money economy. I think we’re already in a recession, it’s just that the top 20% don’t know it yet.

PS Lambert I’ve got some great “spring” garden pics for ya if ya tell me where to send them.

Use the contact link in Water Cooler. Thanks!

I have a small cafe in San Francisco. Something weird has happened in the neighborhood where my business is located. In the last six months, I’ve seen business during the weekdays drop 10-20 percent, sometimes more; on the weekends, it shoots up about 10-20 percent. The difference between a Sunday and Monday can be as much as 50 percent. Clearly these people who come by on the weekends are doing rather well. Makes me think San Francisco, at least where I’m located, has become a bedroom community of sorts, with many apparently jumping on shiny white buses that take them south.

I live in the DC metro area and since I’ve been out of work since July 2013 I feel very disconnected to the local economy. I can’t tell you about restaurants because I can no longer afford to patronize them. With few exceptions I only spend money on rent, food, utilities, gas (not much) and insurance. On my few and far between excursions to stores other than grocery stores I’ve noticed that most of the salespeople have little to do and a lot of merchandise is discounted. Many people in my apartment complex are moving to save money on rent. I am moving to a smaller apartment in the same complex – will save me ~ $300/month.

The job picture may appear good if you listen to self-serving pols bragging about how “all the jobs lost in the recession have been regained” – but they ignore the difference in the quality of the jobs and the associated compensation and benefits as well as population growth.

A good site to check out is http://www.dailyjobcuts.com/, may have been posted before, but here it is again…

one of my favorite subjects

http://globaleconomicanalysis.blogspot.com/2015/05/investigating-gdp-deflator-wildly.html

Funny how those numbers are all over the place

High end restaurants here (Sacramento) do very well thank you. I really think McDonalds is starting to have problems. I think DEL taco is eating their lunch…you can get 4 tacos for considerably less than a Big Mac and fries.

At least in CA in my price range, desirable houses go fast.

I live most of the time in Sacramento. Seems like RE is in a bubble again with home prices being too high. But I think there’s low inventory. Of course, Blackstone (?) bought a bunch of low end real estate in foreclosure sales some years ago, and I think that reduced inventory leading to this bubble. I wouldn’t advise anyone to buy here now, unless they absolutely had to.

Economy is toddling along. Lots of high end restaurants downtown & midtown Sac seem to be doing well enough, plus ditto for clubs for the GenY/millennial set. That said, it’s sad how poorly some of Sac’s cultural institutions are doing. Lots of taxpayer dollars being poured into stupid NBA King’s arena (with no less than 2 documentaries about NBA Mayor “Democrat” Kevin Johnson and his fabulous “story” about keeping the Kings in Sac. Now hearing rumbles that the Kings could still be bought away from here after taxpayers are on hook for million$ for this stupid arena), but no money for culture. The Sac Philharmonic has been dark this year and not sure about next year. Sac Ballet – a feeder for the “Bigs” – has limped along. The art museums struggle.

I also live pt in San Diego, and that whole county has gone nuts. RE back up into the stratosphere. Well it’s desireable to live there, but it’s a question where the money comes from. What I see there is the Orange Countification of San Diego with prices rising for all kinds of things – movies, theatre, restaurants, you name it. Stores do always seem very busy. Business appears to be booming. But there are areas of the county where the poor folks live, and that’s where you do see boarded up stores, crumbling and fading businesses and so forth. Usual dichotomy between the wealthy and the poor with not much in between.

My friends are all of an age where most bought houses when they were affordable. I bought my SD house at the rock bottom of the market after the last crash and got a smoking hot deal plus super low mortgage rate. I wouldn’t buy now in SD. It’s unrealistic.

And so it goes in boom and bust CA.

LOL “it’s a question where the money comes from” LOL.

Janet Bernanke just prints it up in her basement. “Full” employment, the largest asset bubble in the history of the world, banks charging you to hold your money and paying you to take a mortgage…and QE4 on its way.

100% of “growth” in the last 30 years has been from increases in debt, at zero interest of course you can continue to service it. Increase in wages, income, real net worth? Not so much. We replaced central banks with highly-leveraged hedge funds that can “never” get a margin call. Up, up, up…until someday everyone looks at everyone else and asks: “you got any money good collateral? All I got are these little pieces of paper”.

As for McDonalds – yes, I think they’re in trouble. Anecdote: went hiking outside of Sonoma (think: wine country, high end everything, lots of money there). My friends stopped at a Jack in the Box in Sonoma on the way to the hike to use restroom. The place looked nice, was clean, etc. Stopped at McD’s on way out to use rest room – boyohboy, horrible. The place looked filthy to me; couldn’t use restroom at all due to disgusting conditions (and I’m used to pretty bad pit toilets in the woods); worker appeared to be “cleaning” the floors with disgusting looking filthy water; ICK factor. My friends bought “food” to eat. Well I don’t eat that GMO crap anyway, but I wouldn’t even buy a cup of coffee in a place as dirty at that McD. What a difference between the 2 fast “food” places. Something’s not good at the Tarnished Arches.

Rural Northern California. A few more cars in restaurant parking lots. Mexican restaurant went out of business. New businesses mostly tattoo parlors, thrift stores, head shops. More people at the local gym. Residential

Real estate feels slow.

MICHIGAN: Well, you just have to read about the mass foreclosure (1/7th of all homes) due to unpaid property tax PLUS the next phase of the water utility shutdowns in Detroit to get the picture: things are not good, not improving, and add in the attention now paid to police bullying, and it’s 1967 redux in the making in the Motor City.

Here in bucolic Ann Arbor, it’s quiet, very quiet, too quiet. Shopping is down, stores are empty more often than not. Clerks are dying for a bit of conversation. I don’t do restaurants, usually, but the campus trade is keeping what little there is alive. We are a company town, and that company is U of M. On the whole, it is a nasty employer, and generates a lot of nastiness in its workforce, which filters through the city.

On Tuesday, the State-sponsored referendum to raise the sales tax from 6 to 7% is predicted to fail miserably. There are no good things about this proposal: it is touted as “the only way to fix the roads” yet more than half of the funds are slated for other goodies. A sales tax is regressive (hits the poor worst and first), and it’s the first revenue source to shrink in a downturn. Since we’ve been in a downturn since 2001, this would be an auto-fail. The legislature hasn’t the political will to take income tax increases, because GOP.

The governor Rick Snyder is making noises about running for President. In 1992, an amendment to the Michigan constitution imposed a lifetime term limit of two four-year terms for the office of governor. Prior to this, they were not limited as to how many terms they could serve; John Engler, the governor at the time, served three terms as his first term occurred prior to the restriction. Rick is in his second term. He wouldn’t stand a chance at a Senate seat. This might be a way to get him out in only 6 years…he’s a darling of the U of M crowd, because he once taught a course…

It’s a beautiful state with ample resources and many good people. There’s also rabid GOP, fundie, redneck majorities in most places. the economy has never recovered, for those penalized into poverty. I am thinking there isn’t a better place for grassroots…

I was glad to see the feds going after Quicken Loans for destroying people’s lives through mortgage fraud.

There are small business failures every month. The big business failures got bought up by foreign companies: Chrysler, for example; or bailed out, like GM. they finally cut a deal with the King of the Ambassador Bridge…that must have galled the State and Feds.

Downstate Illinois and Iowa . State institutions particularly Universities doing better in Iowa Illinois is massively underfunding due to the neo-liberal attacks from both parties on state workers and pensions depressing local economies. Caterpillar suffering from its trade treachery backfiring all over it and the mining bubble. Smaller manufacturers like me trading water as has been case for years though whatever is going on in China is helpful ( is it mass sickness from the pollution? plus neo Maoism? ) Ag economy bubble bursting once again China related Ag propaganda focuses on maybe 9 billion by 2050 but fails to note all growth is in the region from India to Africa not the big money customers like Eats Asia which may even now be in decline. Pig slaughterhouses are running full with recent immigrant labor including the Chinese owned one but if Bird flu cuts off all exports of poultry there will be a crash in the cheap meats. China is already eating as much meat per capita as Europe so there should be a nasty burst of the US farm bubble

Here in the Deep south, Hattiesburg Mississippi, things are barely scraping by. Local real estate brokers are putting their best face on a lackluster market. In the close in older suburb we live in, sixty and seventy year old 1400 to 1800 square foot houses in fair to good shape are being offered at between eighty to one hundred thousand dollars. then, they sit on the market a while. Anything much over one ten just sits there and moulders. The farther out suburbs are getting by at one twenty to one fifty for twenty to thirty year old houses in the two thousand square foot range. These usually go with a half acre or better, unless they are in one of the “premier” gated communities.

Most of the local job openings are for retail, truck drivers, or medical support skills. Restaurants are doing fair, but there are no high end eateries in this town. The next town over, Petal, had what we consider a warning sign; the local McDonalds closed. This place was next to the High School to boot! Most chain food vendors are at best half full, even at lunchtime now. A lot of the locals are holding their breath, worried about what this summer will bring. (Most people here you talk to have already prepared themselves for some sort of contraction.) Local car lots are sending out a lot of mailings and doing the radio show “showroom floor” broadcast ploy every weekend now.

One big tell to Phyl and I is the sudden explosion of foreclosures and pre-forclosures on Zillow. This is especially noticeable in the more rural areas in the South.

Pittsburgh PA is booming sort of. The city has gentrified in the last ten years due to healthcare and higher education. Lots of new places to eat, single bedrooms are becoming unfordable unless you work in either of those industries. I work at one of the “pristine” national banks in the city, who will not advance you from your lowly entry level position unless you create a shrine to the company at your cube, or maybe its supposed to be for you boss. Anyways lots of new apartment buildings are going up quickly (within the last year) and i’m hoping that relieves some of the rent pressure. Don’t see how this continues, with insane student loan bubble and healthcare basically being a branch of the government who is bankrupt. Looking forward to investment opportunities when it all goes to hell.

Comment from a cousin moving from Queens to Delray Beach, FL, (Borscht Belt South): She told us last night that the vultures snapped up all the decent properties in that area as of last year, and there is a bidding war for homes going on there…mostly by New Yorkers and retirees who want to escape the nasty winters the NE has been experiencing, she claims. On the other hand, a friend was there last summer in FL, cruising across the state in his camper, and did see many boarded up homes…location, location…

Away from the coasts, there is much poverty in Florida, houses that hardly can be called that, many look like shacks in the rural areas. But, vacation condos still being built like crazy in Orlando. There is an army of low wage workers who keep this place going, with many struggling. Today I was in Palm Beach Gardens (was there for some months during the build up of the bubble) and it was as if there never was a housing crisis, as if the higher purpose of life consists in driving a Porsche.

Hotel prices incredibly high in NY (nothing to be had under 400) last week, and this in April and not even a major convention going on Same in Miami ($800 per night resorts booked up), even in Hilton Head Island, 250 a night properties booked solid. Where is the money coming from, I also ask myself. Did that QE actually end up flowing into the wallets of the middle class.

Seattle’s boom is astounding to me. My salary and existence are out of the loop, so I am a spectator. There are construction cranes everywhere. My impression is that Seattle is being converted into a colony for the global elite like Boston, San Francisco and DC. At times I feel pride that this provincial harbor city gets to be in a special club, but I am outside of it. I have no idea who can afford luxury cars, pet bathing, Whole Foods, condos-in-the-sky, $30 dollar entrees, boutique clothing, Michael Bublé concerts, nail painting and all the rest, but I see it going on full blast. I would be curious if the other boom cities are still pleading poverty. Seattle and King County should be raking it in on property and business taxes, but instead we’re getting transportation cuts, low income housing shortages and tent cities. At a recent event I heard that the King County government doles out $500,000 a year to civil legal services. That’s pretty shameful and it shows.

This sounds a lot like what’s going on in Austin right now. We were there last week and the amount of highrise construction in the downtown area is astounding. They say 250k is the minimum for a small condo, and they quickly go up to 1 million. Traffic is intense and claustrophobic. Lots of signs of discretionary income.

Austin construction is indeed crazy. I can only think there is a huge influx of Californian’s snapping up those cheap $250k condos.

@armchair, you’ve captured Seattle pretty well… I live in Seattle, and my mom lives in one of the Eastside suburbs. I’m a struggling musician out in this here city and most of my friends are in the same boat. One interesting thing I’ve been noticing amongst my peer group as of late is the hatred of Amazon amongst long time residents of Seattle. They are blamed for all of the ills of the city, the increase in traffic, the destruction of historical buildings to construct ugly condo complexes, the slow death of the music and arts scene, etc. This city truly is becoming a playground for the wealthy and an increasingly poor place to live if you aren’t in the economic top 20%. What surprises me is that we have several of the largest multi-nationals in the world (Boeing, Amazon, Microsoft, Starbucks) many billionaires (Allen, Gates, Schultz, Bezos) and our infrastructure and public services are falling to shit. These people, and these companies are a blight upon the city and a real example of neo-liberal mentalities in action.

As for my mom in the suburbs… My family has been out there since the late 70’s when the neighbors were a forest and small farms. Now it is a nightmare of McMansions, Porsches, Teslas, etc. As house prices keep rising all the long time residents are being crushed under steadily increasing property taxes. It is sad. A friend of mine owns a small business in the area. Neither he and his wife, nor any of their employees, can afford to live in the city they work in! So yes, King County looks great on paper, but if you aren’t making $60k+ a year then life is getting increasingly shitty.

Another Seattleite chiming in – working downtown, living at the very southern edge of the city, where I could probably throw a brick to Tukwila if I were in better shape. The bifurcation is intense. Downtown & trendy neighborhoods seeing fancy condos, office towers, corporate campuses, and outlying areas are just building more potholes. I take the light rail to/from work and there are patchy attempts to gentrify along the line, interspersed with failing small restaurants and vacant lots whose owners are hoping to get bigger money for them than developers are willing to gamble. Pot shops seem to be a pretty thriving industry, though, given how many of them we have, medical and otherwise…

I read somewhere that there are over $60,000 millionaires in the Puget Sound region. Now, I know a million ain’t what it used to be, but if Washington had a progressive state income tax to replace the regressive sales tax (10% in Seattle!) maybe they could fix some of the potholes that people drive their BMWs and Mercedes over.

The Utah economy is good, unemployment is @ 4%. We had a low snow year but the ski season was excellent. Here in PC real estate is unbelievable. It has sky-rocketed to pre-crash levels and the people keep coming. Rumor has it that the buyers are from Florida and California, which makes sense. Saw on CNBC that they are easing credit just a tiny bit and stimulating the housing market – but that doesn’t begin to explain our boom. I’d be tempted to explain it by the Fed’s largess to the 1% – and Yellen’s recent bizarre comment that money is not a good store of value. I’m wondering if a rush of money going into real estate inflates the general economy, or just keeps it steady while the oil patch crashes.

Minneapolis is doing rather well. A lot of construction downtown (not just the Vikings stadium), and in the southwestern area of Minneapolis still a lot of tear downs to ($200k house torn down for $500k+ house). And the IT job market is quite nice. I’ll be reemployed soon. Uptown restaurants are mixed, but the places I like are still open.

Why is Minneapolis doing well?

Some thoughts on that:

1) UnitedHealth Group is headquartered just west of town, in Minnetonka, and it sounds as if ACA exchange participation was good for them.

2) The rest of the usual suspects (Best Buy, Target, Cargill) have had struggles. US Bacorp seems ti be doing ok.

3) It occurs to me that quite a bit of our unemployment over the last few years may have been exported to western ND; I know a few guys in the TC metro area who work the three weeks a month driving truck in ND and spend their week off at home in MN. Whether they stay employed out there remains to be seen.

High North Dakota plains:

Picture a salesman, eyes bugging out of his sockets, neck swiveling frantically: “It’s gonna be big…ya can’t lose. BUT YOU GOTTA BUY NOW!”

That’s pretty much the sentiment. East money is a hell of a drug.

Greetings from a former North Dakotan. I read the Williston Herald online every day and check local RE listings often. Things are still pretty crazy out there thanks to the boom. I’m so glad my parents, who lived there all their lives, are both gone now–they would have hated what’s happened to their hometown. Please keep posting–it’s nice to hear from someone who’s there.

SW VIrginia checking in. The retail market appears to be limping along. Now hiring signs are still in minimum wage establishments, places like Walmart, Target, and TJMaxx have increased their wages some but it does not seem to have trickled yet. On the housing market front, my little burgs are turning and burning fairly well, (with the caveat of being priced appropriately)however, the Roanoke market seems to be saturated thanks to Norfolk Southern shedding it’s corporate office and moving it to Atlanta(no good deed goes unpunished since the state intervened for Norfolk Southern and gave it millions to build an intermodal it’s closed down a terminal and closed it’s corporate offices and is balking about providing management workers for the intermodal. But hey I’m sure in a few years it’ll decide to move BACK to Roanoke after getting tax incentives for bringing those job BACK because- job creation.) *:head:desk:*

“The economy doesn’t feel bad” — of course it doesn’t, if you are a television commentator making 6-7 figures a year.

I live in a small college town about 100 miles from Seattle. Here, some people are benefiting from real estate values going up as more Seattle people move here for retirement, buy second homes, or invest in rentals, although values are still not near where they were in 2007. In the town, 60% of the housing are now rentals. This county is the fastest growing in the state. However, the poverty rate in the county is around 27% and jobs are scarce.

In Seattle itself, there are cranes everywhere and neighborhoods are being transformed by the construction of condos and apartments as the city becomes more densely populated. This is preferable to increasing the sprawl of suburbs but the traffic is now beyond terrible. In the Ballard neighborhood, a 1100 square ft brick rambler recently sold for $717,000 – the asking price was $559,000 but it was bid up. The city has become extremely expensive (one reason I no longer live there). Thankfully Seattle recently raised the minimum wage to $15 but even that won’t get you far. There are a lot of high paying jobs in Seattle but many of them seem to be taken by imported talent from China and India.

I should add that a high percentage of the rentals in my town are owned by absentee landlords, who of course have no invested interest in the welfare of the town or its neighborhoods.

Mid-state Maine is a lot like upstate NY: “Things are depressed but stable.”

Real-estate: Takes three years to sell a house. A few condos being rehabbed in downtown Bangor. What are these “construction cranes” of which you speak?

The university is expanding enrollment without building new dorms, so we get a bump from constructing privatized dorms financed by private equity. These create social ills like drunken-ness and party culture. And the buildings will all fall to bits in a few years, but IBGYBG.

The expanding student population has also given restaurants and local breweries in the area a bump, and that’s good because it makes us a destination (and it’s preferable to the barber shops that were our equivalent of tattoo parlors and pawn shops; we used to have six, IIRC).

Never been worse. Got laid off from shitty little Milwaukee non-prof last fall. Picked up some work, but it’s not steady. I would have been better off on UI. The city looks like it’s in bad shape, too. Met a guy at a bus stop who was very happy with his $10/hr job at a sausage factory. As important as bratwurst are to Wisconsin, that’s not what made Milwaukee a big city. The breweries are gone except for Miller and some craft breweries. The Harley-Davidson parking lot looks mostly empty most of the time, though once in a while some E. Indian engineers will get off the bus there. There’s gentrification in certain parts of the city: Bayview, Walker’s Pt. & the 3rd Ward is now beyond gentrified. The old warehouse/industrial zone near Miller Parkway is now big box stores. One of the office supply places is closing its downtown store presumably because it doesn’t generate enough sales. No surprise there. There is less and less in downtown with each passing year. And if you go west from downtown on the city streets rather than I94 you see the ruins of an old industrial city: abandoned machine shops, empty corner bars, abandoned groceries, boarded up homes. Think Detroit at a less advanced state of decay, with brats & beer and slightly more big box stores & yuppies.

Elsewhere, my brother’s looking to trade his house 30min from Sheboygan for a cheaper one in town. Sheboygan’s in bad shape, with lots of foreclosures. My brother is economizing because he’s a public school teacher whose pay has been cut in the aftermath of the Walker/Republican cut in state education funding. All the small town news stories are about local school district budget cuts. Band here, art there, French, German, teacher positions, teacher renumeration, maintenance…

Out here in Orange County, CA, the economy seems to be doing quite well. Stores, restaurants, and malls are busier than any time since the Great Recession started, at least. House prices have returned to nutty values (generally 10:1 median income to median price), although not to the bubble peak even in nominal terms, so still distinctly lower than than the peak in real terms. I do know some middle-aged people who lost good careers during the GR; they do have work now with decent pay but it’s consulting/temping work. A failed retail mini-mall nearby, built at the end of the bubble, finally rented to a tire store after standing empty several years. There are a number of grossly underutilized mini-malls about but even in the housing bubble we had that.

We have those too. The modus operandi appears to be step 1) give developers tax credits to bring jobs into the region 2) build a mini mall that has lower rent due to said tax credits 3) move business from previous locations for lower rent. 4) later. rinse and repeat.

We presently have several strip malls, one has 4 of 32 spots being utilized, despite that we’ve got a Regent plaza coming in 2015 being built. It makes me wonder how many of the Spradlin Farms or the other strip mall occupants will relocate after it is built.

Kansas City appears to me to be peaking in terms of non-single family unit construction (biz and multi-family/high rise). I inferred from an architect friend that future billings and biz aren’t looking so hot. Most of the biggest employers continue lay-offs, except Cerner which continues to hire young, impressionable grads to toil in their IT Healthcare shops. When the current round of construction projects ends (2 years maybe?), it could get bleak again.

But the Royals keep winning and the beer scene keeps getting better, so we get past any worries about the future!

everybody here at my company just got a temporary (but multi-month? multi-year? depends on length of softness) 10% paycut, which will supposedly reduce layoffs

Jeff N, where are you located?

Pend-Oreille County, WA. Current location.

Mine re-opened last year and is employing 180 additional people. Local business is money and barter based. Newport, WA receives support from HUD programs. North of that, because of the addition of the mine jobs, some small communities do not qualify for some HUD programs. The Federal Gov’t looks to cut Federal payments for land that is un-usable for economic development, as that land is part of National and State forests. WA State’s take was $21 million, reduced to $1 million. Pend Oreille County will have to make up for the loss by raising taxes and fees. Land prices remain variable and mostly fantastical. Local businesses will look to rely upon tourism this season, beginning Labor Day weekend.

Illicit meth manufacturing is of some concern, unlike Stevens County to the west where it is a major industry. The illicit narcotic pipeline flows from Spokane and provides some economic benefit. With the legalization of marijuana, more people are concentrating on private sales of marijuana than other narcotics – mushroom availability is sporadic and other hard drugs are virtually unknown. Prostitution in northern Pend-Oreille County contributes no significant economic activity.

County profits by police look to increase as revenue falls short. There is notice of County Assessors and wildly swinging property values subject to taxes based upon no known rationale other than collecting taxes.

One gun shop opened in Ione, WA by the small airport. Honest businessman supplying hunters, has video store on-site, personal mining supplies for gold-panning, etc.

Papermill is present, as well as grocery stores providing constant employment. There are more un-employed than jobs. Most people go to Idaho for cigarettes and alcohol. Rural Resources (USG and State) has a significant social support presence.

I live in the DC metro area, but have some connections to other places. DC looks really good on the surface, but there are undercurrents that are not good. Fairfax County schools are facing a pretty serious deficit, I can’t remember the amount, many millions. Over 2000 people have been laid off in the past few years and more layoffs are coming, although bear in mind it is a very big school district. They are laying off teachers in subject areas that have low enrollments.

Federal employees have been hammered for the past 5 years. You can tell what arguments the Republicans are going to use against feds by paying attention to the “survey” and “research” results that show up about just before they launch an attack. This winter one supposed study showed that federal employees feel more secure in their retirement prospects than employees in the private sector. Two weeks later they trotted out the proposals to make feds pay 6% of their salaries for the pension part of their salaries. Plus they wanted to sabotage the G fund of the Thrift Savings Plan, which probably caused a ruckus among retired feds, because that proposal got dropped like a hot potato. If we get a Republican Prez and keep the congress in their hands, there will be gutting of fed benefits, and agencies like the EPA and FDA are going to really get slammed more than they have been. My friends at the EPA lost nearly 3 weeks of pay due to the sequester. Of course, private contractors will benefit, as they continue to do.

We also own property in Santa Fe County, NM, south of the town near the Turquiose Trail. We recently refinanced, and found that the property value lost more than 10 percent of its value. This isn’t necessarily indicative of Santa Fe city, but my sense is the area is not hopping.

Finally, I grew up in Lebanon, PA, and have been considering moving back there to save money (kids starting college) ;-( A couple of friends who are realtors told me last summer that the market never really recovered after the financial collapsed. The town never recovered after the steel mills left in the 80’s. I have been watching the real estate market there lately, and have seen houses being sold, so it’s not totally terrible. I think it might be the case though that things have been bad for so long, eventually some improvement was bound to happen, since it does have a decent location in terms of access to highways and large markets. But even if things start to pick up, there is a generation or more of people who had their dreams completely destroyed by the harsh economic conditions. There is also a lot of drug use and crime. It was a decent place to grow up in the 60’s & 70’s.

In the 70’s my uncle bragged to my sister that he made $15 an hour at Bethlehem Steel. Today, the website for the Lebanon Valley Economic Development Corporation states that it is trying to bring companies into the area that will provide good paying jobs, like $15 an hour.

New Orleans is a tale of two cities. Jazz Fest is in full swing for tourists and well-heeled locals; daily ticket 70 bucks, well beyond the means of most New Orleanians. Unemployment is officially 6.7% but nearly 62% of the city’s African American men (16-64) are out of work. Gentrification is also in full swing in the “sliver by the river,” historic sections of the city that didn’t flood. Loft conversions and condo developments are making old warehouses look like New York’s SoHo. Hipsters and bobos have taken over the Marigny and Bywater. Young white professionals are moving into the Treme, Seventh Ward and other historically black neighborhoods renovating homes that families who’ve owned them for generations can no longer afford to keep.

The economy feels hollow. Between taxes and flood insurance home ownership is precarious for many working class folks across the Gulf. And the state is bust thanks to Gov. ‘Bobby’ Jindal who came into office with a $1 billion surplus and is leaving the state $1.8 billion in the hole. Yet, when a democratic representative in the state house suggested taking Medicaid expansion money to ease the financial straits the public hospitals are facing, his republican colleague replied that even if it were true, the idea was a non-starter because “around here, Obama bad.”

We used to live in ‘Nawlins ourselves. Gentrification is happening all along the Gulf Coast. Having young white anything moving into Treme is a big change from the “olde days.” Bywater was always full of hipsters. In our day though, hipsters weren’t affluent, just hip. Flood insurance is a major driver of gentrification. Here in the Mississippi Gulf Coast, (we being just north of there,) the knowledge that the Feds are removing the subsidization of flood insurance rates is driving low wage workers out of self owned homes and either out of the area, or into densepack, ‘future slum’ apartments. Some of these places need their own Sheriffs Department substation, they being truly “wretched hive[s] of scum and villainy.”

As for the Jazz Fest, well, where do I start. How about this; we looked into taking a “booth” at the Jazz Fest to display and sell some of Phyls watercolours. We expected to pay something a little ‘rich’ for the 10′ x 10′ space inside the larger tent . Hah! The first weekend costs $1090, and the second weekend $1390. Two artists can share a “booth,” but the price goes up. The vendor must supply all equipment, and no refunds for any reason. It rained this Jazz Fest, and, as usual, the crowd was heavily populated with heads and drunks.

The old unofficial motto of New Orleans was “The City that Care forgot.” This can now be expanded to include the entire Nation.

Correction — that’s 52% of African American men out of work. And we wonder why “the crime problem” here is so bad. I’m surprised it’s not worse.

Southern Arizona seems to be poking along. (I’m in Tucson.)

One thing I’m seeing: Houses for sale that either don’t sell or go through multiple price cuts. Meanwhile, I’m seeing all sorts of apartment construction, especially near the University of Arizona. A lot of these places will charge megabucks for rent, and I wonder what the market is. The average UA student isn’t that affluent.

The target market is the well-financed studentS who will pay it all off later by any means necessary. Better find a roomie…

Tulsa, Oklahoma: another oil bust (remember the 1980s) is setting in. Companies are announcing losses, shutting down rigs, laying off workers. There have been a few bankruptcies, but not too many yet. City and state tax revenues are already down. Oklahoma’s Red State politicians, of course, assume God, or Mr. Market, or anyone other than them will deal with it, and return to posturing on tested shop-worn social issues like guns and gays.

Detroit suburbs, near Wayne Airport: Over the past few months I’ve seen a couple or three closed restaurants demolished, and a couple of restaurant openings. Occupancy seems to be more bimodal than usual: the fortunate eateries are quite full; the lesser ones are quiet. While driving around the area I’m seeing lots of commercial real estate for sale/lease, and a particularly large number of freestanding buildings for sale with operating businesses still struggling along in them: a radio/electronics shop, an aquarium supply, a tanning salon (actually closed for the season, never reopened in April).

Ex-housemate had a slow tax prep season; her company merged with another mid-range accountancy a couple or three years ago, and the acquired part have un-merged this year by walking out.

I’m still getting plenty of work.

Carson City, NV area – real estate around town and in the Reno/Sparks area has been picking up over the last year, but still far from bubble era price levels. Home prices around Lake Tahoe have actually been falling a bit as the market is dominated by vacation homes. We’ve seen some of the more expensive properties for sale for several years by now.

Unemployment is pretty high, a fair number of empty shop fronts and the majority of local businesses seem to do OK rather than well. Fairly few help wanted signs.

I’m from a former auto bedroom community in Michigan, and am moving to Los Angeles. NAFTA killed this state. It is deceased. The only decent jobs in little suburban towns are medical workers paid for by gm/ford/state retiree insurance.

Small businesses open and quickly close. The big chain stores do alright but sell fraction of a penny garments for inflated prices. It’s the typical united states pauperization story, except there are barely any people on top here, it’s all bottom.

It’s sort of a false economy funded by manufacturing pensions, when those people drop dead it’s going to be brutal. Banana republic.

Haven’t been in los angeles long enough to say anything.

Southern Maine

Recently moved from Portland to smaller town 15 minutes South.

Portland: Flurry of multi-units being built in the last year. 4 plastic looking ones within 3 blocks of our old apartment. Decent amount of store fronts empty. Other than multi-family construction an continued expansion of health care buildings the biggest/wealthiest large town seems to be treading water.

Smaller town: Our realtor has been selling a lot of lower priced ($100-150k) homes in the last few months. Higher priced homes see multiple moderate price cuts and may take 6 months to a year to sell. Trying out the local restaurants and have been surprised at how many are empty or have less than 6 people in them at prime hours on Friday or Saturday night. Local Shaws grocery store is typically very empty and has 2 for 1 deals on meats. Likely due to competition from new Market Basket. It is dominating and I think Shaws and Hannaford are worried. The 10-20% lower prices are huge for most people with typical Maine size salaries.

The move has helped highlight the binary nature of the economy in Maine and the whole country. Whole Foods killing it in the higher income city and bargain Market Basket dominating in smaller town. Demand for high priced condos versus small $100k houses.

I also do some work with college endowments and hear frequently that meeting operating expenses via tuition versus having to dip into the endowment can come down to very small changes in enrollment. Growing # and salary of Admins, huge building programs, and “need” for luxury facilities to attract students all driving the problem.

I moved to Silverton OR, since I moved here I have seen small business come and go. Most of the stores were niche market stores to the rich who live out in the rural area around Silverton. those stores did not last long.This town is the process of gentrification .It is a bed room community for Salem OR ( the state capitol ) and metro Portland OR. if the trend continues It might be like Newport Beach CA. I would have to move once my elderly mom passes away. I hate to say it, I might have to live in Phoenix ( the east valley Gilbert, Mesa, or Chandler AZ). I lived there 3 years ago Because houses are the cheapest in the country .

I’m an early 30’s American expat permanently stationed in far southern Spain. My employer (fed gov.) pays my rent/utilities and an allowance to cover the differential cost of living in EU. My DoD agency has approved the first pay raise since 2011- after litigation- twice. Our agency continues to shrink, causing consternation. Where 20 years ago, there were tens of thousands of employees in Europe alone in my agency, now there are only a few thousand. The median age of my colleagues is now over 60.

In the local environment, Spain is having elections. The current party, the PP- which is center right, or left use the US as a unit of measure- is fighting off a series of parties to the left, some of which are looking seriously like Syriza in Greece. The writing may well be on the wall. The Spanish gov. just announced a “huge” GDP gain of <1% from Jan-March. There is nothing driving the economy in Andalucia! Most Andalou households may have one employed person with ~3 generation living together if lucky. Young people who are already the least educated in EU- having a Spanish university degree means that you have the equivalent knowledge of the UK O level- are losing any jobs skills that they had as they have never had permanent employment. Beer is cheap here- 90 euro cents. However people stay out all night and drink one. My cleaning lady has 3 jobs and makes less than 700 euros/month. She is very happy with her situation. The German tourists are rolling as the summer season approaches. I chatted with a couple from Thueringen recently. When I compared the current situation in Spain in relation to Europe as a new Raj, they looked quixotic and nervous but said, "wir wollten es aber nicht so." It's hard to say who 'wir,' are in that context.

Suburban/rural New England.

+ Heard an ad on the radio advertising jobs at a produce warehouse claiming good wages and “a long list” of benefits.

– Not a local phenomenon, I’m sure, but there are lots of Kevin Spacey e*trade ads on tv, intimating that if you can notice that too many hipsters are sporting beards or that no one’s buying portable dvd players anymore, you too can hit it big on the stock market. I consider this an indication either that the smart money wants the dumb money to get back in before the crash, or that e*trade thinks our memories of 2008-2009 have faded sufficiently.

The only ads I’m hearing on the radio are for OTR truck drivers and the shipyard in Pascagoula.

Another sign of the times is that the small tradesmen I’ve been seeing at the local DIY building supply stores are becoming more and more sullen and angry. Anecdotally, the percentage of homeowners making tradesmen wait for their money is increasing. (This, as usual around here, is heavily concentrated in the gated community segment of the population. I don’t know enough yet to figure out if this is a sign of belt tightening among the remnants of the ‘middle class,’ or if it means those with money know they can make everyone else wait, and enjoy the prospect.)

Or, perhaps, they’ve been so inculcated in the culture of credit that they don’t register the difference between buying on credit cards and not paying the plumber promptly?