Yves here. While many of us have been busy with other things (watching the toxic trade deal fight, or the seemingly neverending Greece negotiations, or maybe taking a break to visit graduations), the oil industry keeps hoping that its long-predicted rally in the second half is about to kick in. Arthur Berman sounds a cautionary note.

By Arthur Berman, a petroleum geologist with 36 years of oil and gas industry experience. He is an expert on U.S. shale plays and is currently consulting for several E&P companies and capital groups in the energy sector. Berman is an associate editor of the American Association of Petroleum Geologists Bulletin, and was a managing editor and frequent contributor to theoildrum.com. He is a Director of the Association for the Study of Peak Oil, and has served on the boards of directors of The Houston Geological Society and The Society of Independent Professional Earth Scientists. Originally published at OilPrice

The U.S. rig count dropped by 10 rigs this week after only falling by 3 last week. No doubt some analysts will say that this increase is somehow important and that a return to normal–i.e., high oil prices–is around the corner.

Well, don’t get too excited because the rig count that matters–the horizontal Bakken, Eagle Ford and Permian plays–only fell by 2 rigs after not falling last week. This is a normal fluctuation when oil is $100/barrel.

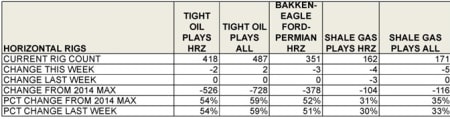

Table 1. Rig count summary by play through May 29, 2015. Source: Baker Hughes & Labyrinth Consulting Services, Inc.

(click image to enlarge)

(click image to enlarge)

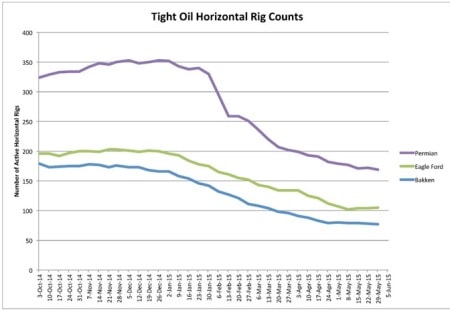

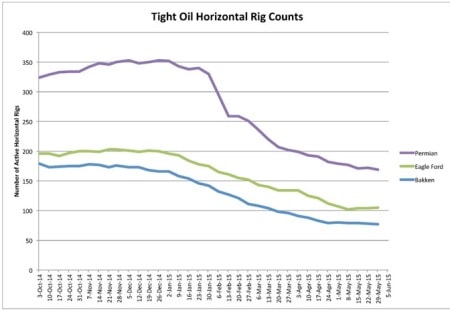

The rig count decline is effectively over as shown below in Figure 1.

Figure 1. Tight oil horizontal rig counts. Source: Baker Hughes & Labyrinth Consulting Services, Inc.

(click image to enlarge)

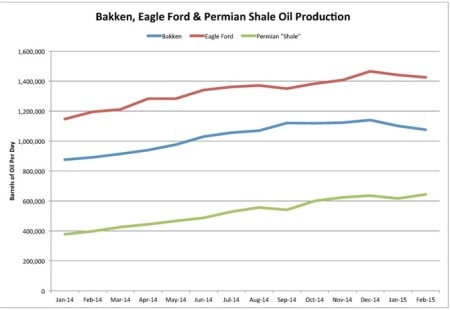

Production has fallen and will fall more but rig count is the wrong measure at this time. The real measure is capital given to U.S. tight oil companies. And there seems to be plenty of really stupid capital that thinks that investing now means buying low. Good luck with that once oil prices fall.

Figure 2. Bakken, Eagle Ford and Permian “Shale” tight oil production. Source: Drilling Info & Labyrinth Consulting Services, Inc.

(click image to enlarge)

There have been a steady stream of articles championing the ingenuity of U.S. tight oil producers for figuring out how to maintain production with fewer rigs. It doesn’t strike me as ingenious to produce more oil at low prices that ensure losing money.

OPEC will meet on Friday (June 5, 2015) and most doubt that a production cut will result. If that is the outcome, expect the recent rally in oil prices to end badly. If producers cared about their investors and shareholders, they would be slashing production by shutting in wells. That might help oil prices rebound sooner and then, they could sell the oil at a profit instead of losing money while celebrating their own ingenuity.

…

Here is the thing, if the last decade or two have taught the logical and realistic anything, it is that investors do not know anything about anything; the people who sell ‘investments’ make money regardless of outcome (and have rigged it so that even if they are stupid enough to buy their own twaddle they win anyway) so they care not a bit about their customers; and most American business owners do not have a clue how to actually produce anything and rely on some weird calculation that has no basis in anything but magical thinking. So why the hell shouldn’t the investment people be selling the investors oil production by ‘ingenious producers’ and why the hell wouldn’t the American producers believe that OPEC will save their asses by cutting their production. Hell even before the incompetent MBA age you didn’t go into the oil business without being a huge gambler. And as with most gamblers, and now even fewer know when to back away from the table, slot machine, oil rig. The next one is going to be the winner!

I wish I thought logic would out. Every time the money folk take a hit, I wonder which of these are backed by some ponzi form of derivative so that each loss is not just one but has been magnified many times that. Will this be the piece that tears down the crumbling shack of our ‘banks’ and so-called economy? But as far as I can tell, the people on this blog are among the few exceptions to the magical thinking of investment and the delusional idea that if reality does interfere the losses can be privatized to a working class. The same one that were largely drained dry the last time the magical thinkers blew everything up and were not even allowed a small portion of the so-called recovery.

The smart hedgie: How divisions does OPEC have?

The Billionaire: How many police departments, correction, off duty cops does the working class have?

By your logic everyone is ignorant, greedy or both. While this might be true it falls way short in explaining what is going on.

What is happening with domestic FF production, and what is going on with banking/finance is all in benefit of our National interest. All of it is MASSIVELY subsidized in order to function, to keep it standing. “They” have literally told us as much.

It seems pretty clear that all the top players in this global game of musical chairs are doing the same thing in a struggle to secure that last chair when the music stops. To continue the metaphor, the hope is that everyone will be good sports when it comes down to it. We shall see.

Quite right. And we know who they are, the too-big-too-fail banks who are swimming in QE money. With huge reserves at their disposal, they have been doing on lending sprees. Since they can’t lend to the average home owner/sucker any more, they found the next best thing – tight oil. And as the lending spree is the last thing to shut down, they have continued to extend new credit to the drilling rigs.

We know they can not turn a profit with the going rate at around $60/barrel. So they have basically become ponzi schemes where they need to take out ever larger new loans in order to finance out of the previous loans that they can’t pay. But when they do this, they only increase their overhead. Now, instead of needing it to be at $110/barrel, it needs to be at $150/barrel because of the added financing cost. Its’ already turned ugly, the crash has already happened.

Right now, we are in the concealment face of the disaster.

Thanks to QE, the banks face zero direct risk for continuing to lend to the rigs. In fact, they see it as a bonus as it means more equity and mortgage assets that they can in turn sell off in the still fully functional and unregulated derivatives markets. So they are making money hand over fist. And what do they buy with this money? Derivatives. What could possibly go wrong?

Just as in 2007, the whole thing will continue until the reserves are existed, or until the drilling rigs implode. If the fed launches tapering, as they seem to really really really seem to want to do, that will stop the music right there. If they expand QE, the might be able to extend the day of reckoning for some time. But the longer that day is pushed back – the more sever the collapse will be.

I half expect it to collapse in the waning months of Obama’s presidency, probably shortly after he gives a major address bragging about how sound the economy is under his leadership.

Perhaps the readers of this blog should be thinking about how to “air-gap” their own personal lives and livelihoods against the coming Bonfire of the Equities and Securities. Perhaps Resilience and Survivalism should be discussed from time to time on this blog.

And who knows . . . if a critical massload of people could Resiliate and Survivalise themselves, they could find eachother and form up into Resilient Survivalist brother-sisterhoods preserving some small shreds of civilization and knowledge through the Coming Dark Age the way the Irish Monks kept certain aspects of civilized knowledge alive through their own Dark Age.

You’ve got the first chart in there twice, for some reason.

Mark,

What do you have against the oil industry? Why do you continue to masquerade as an oil man?

When you use terms like “stupid capital” and “doesn’t strike me as ingenuous” you are showing a bias that is unworthy of your industry association.

Oil prices have been an artificial phenomenon since OPEC started trying to control prices in the 1970’s. As you’ve pointed out in previous pieces, higher oil prices negatively impacted national GDP for the U.S. and it certainly encouraged U.S. E&P companies to try and develop more crude oil supply options.

Recently OPEC has not only taken their hands off the price control switches by refusing to cut production, but Saudi Arabia is employing additional drilling rigs that have driven up their production from 9.5 million barrels a day to about 10.5 million barrels a day over the past 4 months and has further stated that they want to increase their daily oil production to 12 million barrels a day. They are actively engaging in predatory pricing in an attempt to drive out the competition.

In the US, we are still struggling with our own government’s economic sanctions against our U.S. oil production operations (the ongoing crude oil export ban) that continues to allow Brent oil to be priced higher than WTI.

My recommendation is that we lift that ban, and allow our oil industry in the U.S. to fight on a level playing field. With our supplier costs decreasing and our technology continuing to allow more wells to be drilled per rig each year, and some prime oil assets, we can be competitive at current pricing levels. Admittedly, we will continue to struggle against a stronger dollar in the world markets which has effectively further lowered the price of crude oil domestically – but we’ll simply wait for that pendulum to swing back again.

In short, if OPEC wants to keep the world’s oil prices lower – pretty much at their own expense – I say we let them! It’s good for the economies of most of the oil importing countries and certainly removes a lot of revenue from countries that have often funded a lot of international mischief. Even so, we should not be burdening our own domestic crude oil industry in a way that essentially provides OPEC a subsidy at the expense of the U.S. Eliminate the crude oil ban now! http://bakerinstitute.org/research/lift-or-not-lift-us-crude-oil-export-ban-implications-price-and-energy-security/

If OPEC wants to keep prices lower, we will find a way to survive in the U.S. and prosper. If they want to try and raise prices again by cutting back on production, then we will also find a way to drive those prices back down again with additional production.

Oil Dusk

Behold the American spirit of free market competition. Of course they only hate competition when they are at the disadvantage. Instead, they would have the OPEC nations just role over and die so that we can take over their market share when ever we get ourselves in trouble. When they refuse to do so –gasp- we accuse them of “predatory pricing.”

Dude, that is what the free market is all about. See that tree over their? Here is your petard, you know what do so. (I have no idea what a petard is.)

Oh really, take a look at this chart and tell me if that seems credible to you.

http://www.energyvanguard.com/Portals/88935/images/peak-oil-us-production-and-consumption.jpg

taken from here

http://www.energyvanguard.com/blog-building-science-HERS-BPI/bid/44845/Cajuns-Living-Down-the-Bayou-and-Peak-Oil

The US is not energy independent. And the notion that we have a surplus of oil export is patently absurd.

That sound you just heard is you being bich-slapped by Mr. Physics. Our supplier costs are not dropping, they are in fact growing because of the new technologies are going after so called “tight oil” supplies. The very reason why its called “tight oil” is because the production costs are greater because of the nature of the resources being extracted, shall oil, tar sands, fracked oil, requires more energy to extract the given resources, making them less efficient and there by less productive, making your profit margins “tighter”.

But most of the OPEC nations are still extracting their sweet crude reserves, which is less viscous, fewer impurities, and are useful for a wide range of applications, not just for fuel but a whole host of production applications. They can produce oil far more cheaply than tight oil can.

And we all know Mr. Market prefers the cheaper and better suppliers.

Yes. The bold and decisive plan of “sit and wait for our problems to go away”. How could it fail?

Concur…. have to chortle at oil dusk umbrage tho “What do you have against the oil industry?”

They want to drive competitors down. The Saudis spend like $3 per barrel, so even if the price falls to $10, they’ll still turn a profit. They just want to get oil investors out of the market. They’re driving out oil investment and letting investors know they’ll do it again if those investors get back in to oil.

Skippy… It’s all about the cost of production. They have the trump card

More cheaper oil. More carbon skydumping. Yea!

Now, Mr. Berman is telling us that bankers in a profound lapse of judgement still provide the necessary capital in the face of dubious or even non existant returns on investment. That the oil production will produce a cash flow inadequate for even debt service much less honest to goodness profits. And further, the only hope of these mentally deficient bankers is that somehow, some way, they are timing their investments as buying in on the cheaper prices that will soon disappear with the rising recovery of global crude oil prices. He is warning that cheaper prices will not go away since the Saudis are leading OPEC in not reducing supply to increase price any time soon. The US producers are increasing production by opening new drilling platforms with a steady stream of capital that still seems to believe in them and future price increases. So why are they increasing supply? Mr Berman says,”There have been a steady stream of articles championing the ingenuity of U.S. tight oil producers for figuring out how to maintain production with fewer rigs. It doesn’t strike me as ingenious to produce more oil at low prices that ensure losing money.”

This simplistic supply and demand model driving the marketplace pricing of oil barely scrapes by the Econ101 threshold. Mr. Berman further demonstrates his value to shareholders and investors of all stripes to be warning of money losing propositions. All well and good. However, the complexity of what is going on is partially explained by simple capitalist nostrums and partially explained by Geo-political relationships and partially explained by Marxist analysis of absorbing surplus profits.

Adam Smith has written about the role of entrepreneurs, start ups with burn rates of cash as we call it now, in establishing new enterprises. Most businesses don’t make a profit out of the gate and can take years to break even before providing a return of capital and then a profit. It is not uncommon for investors to wait. It is deferred gratification. Or patience. But it is not stupidity leading the charge but calculated risk taking.

Then we have the Saudis who are primarily shaping market share by insuring a steady demand for their crude oil and refined production. It is peak demand that the Saudis are most worried about, not competition. They have more supply than the competition but may not have enough customers if prices go sky high again up to $150/bbl and beyond. The alternative energy suppliers, mostly solar, become too attractive to ignore. The Saudis are increasing supply to prolong the demand for their production, which is having an ancillary benefit to themselves of disrupting some of their competition.

“…in a speech in Riyadh, Naimi said Saudi Arabia would stand “firmly and resolutely” with others who oppose any attempt to marginalize oil consumption. “There are those who are trying to reach international agreements to limit the use of fossil fuel, and that will damage the interests of oil producers in the long-term,” he said.

U.S. State Department cables released by WikiLeaks show that the Saudis’ interest in prolonging the world’s dependence on oil dates back at least a decade. In conversations with colleagues and U.S. diplomats, Naimi responded to the American fixation on “security of supply” with the Saudi need for “security of demand,” according to a 2006 embassy dispatch. “Saudi officials are very concerned that a climate change treaty would significantly reduce their income,” James Smith, the U.S. ambassador to Riyadh, wrote in a 2010 memo to U.S. Energy Secretary Steven Chu. “Effectively, peak oil arguments have been replaced by peak demand.”

http://www.bloomberg.com/news/articles/2015-04-12/saudi-arabia-s-plan-to-extend-the-age-of-oil

Finally, in this age of financialized capitalism, super profits have dwarfed the traditional scale of wealth. $2 TRILLION in offshore profits of American companies waits to be repatriated by the right tax dodge from the government. A $Trillion in stock buy backs where cash is off loaded the corporate balance sheet and transferred to shareholders. The stock is then destroyed, reducing the outstanding shares available creating upward pressure on remaining outstanding stock prices due to diminished supply. $Trillions in profits destroyed in this capital destruction scheme of stock buy backs which can only be named as anti-fiat money, mirroring anti-matter of physics. The continued placement of billions into currently money losing US fracking companies is due to the need for the largest scale of investments for this largest of scale surplus profits of the Age of Financialized Capitalism. And if some of it goes down the drain, hey, that’s what credit default swaps are for! A lot of money is made in just moving the money somewhere, anywhere, but it must be at the large enough scale. There are not a lot places to find such scale, but the oil industry is certainly one. And it has been a dependable place for mountains of money to go when it can no longer be bothered to finance cute little cup cake stores and burger joints on main street or even a factory with a puny payroll of only 500.

Wall St can finance a money losing proposition until they themselves start losing too much. The investors they sell to may take the brunt of the downturn, but don’t think that will stop oil companies from continuing to hope for a break even point or maybe even a return to profits. The Saudis can not drop the floor under pricing too low for long, that would counter the long term strategy of prolonging the demand for oil by killing off too much of competition that will kill off production that can produce the glut that regulates oil at a reasonable price that supports steady demand and prolongs the oil age. If you kill off a significant portion of the competition, supply goes down and price goes up, maybe too high up forcing customers to embrace the pace of going to alternatives. Wall St may secure some of the fracking oil firms in the face of losing some money because they see that the Saudis are willing to also lose out on some profits. But not forever and it has hardly been a year since this strategy has been implemented. Capitalism has more intestinal fortitude to endure disruptions although this or that company in particular may not. I can’t help you to pick a stock, but I can show you the bigger picture that makes sense of losing some profits in the short term of months and years to ensure decades of profits. To find more certainty about oil and its prices, you also need to look at solar at the same time to see its costs fall to surpass coal, which it has done for the most part, then surpass natural gas. The Saudis are looking at exactly that combination of events to walk a very thin line.