By Gaston Gelos, Division Chief of the Global Financial Stability Analysis Division, IMF, and Hiroko Oura, Senior Economist, International Monetary Fund. Originally published at VoxEU.

Concerns about potential financial stability risks posed by the asset management industry have increased recently as a result of the sector’s growth and other changes in the financial landscape. In particular, bond funds have grown significantly, and funds have been investing in less liquid assets. At the same time, banks have largely retrenched from market-making and proprietary trading, while insurance companies are less able than in the past to act counter-cyclically. These and other developments have potentially contributed to augmenting market liquidity risks.

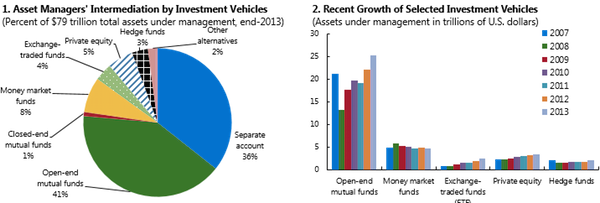

Although risks from some segments of the industry – leveraged hedge funds and money market funds – are already widely recognised, there is debate about the systemic risks, if any, associated with less-leveraged ‘plain vanilla’ products such as mutual funds or ETFs (Figure 1).

Figure 1. Products offered by asset managers and their recent growth

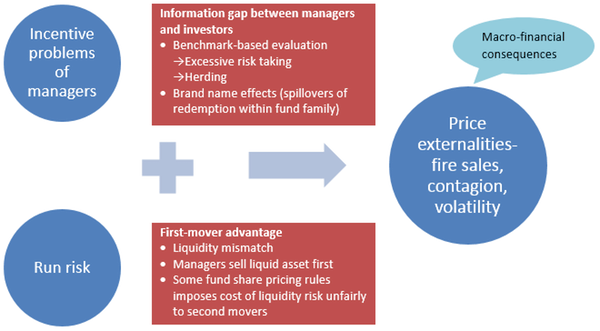

Any potential systemic risks from these plain vanilla products are likely to stem from price externalities in financial markets and their macro-financial consequences. Systemically important effects may arise if features of the industry tend to amplify shocks or increase the likelihood of destabilising price dynamics compared with a situation in which investors directly hold securities.

Two main risk channels are important in this context (see Figure 2): first, incentive problems related to the delegation of portfolio management decisions by end investors to funds, which, among other things, may lead to herding; and second, a first-mover advantage for end investors (that is, incentives not to be the last in the queue if others are redeeming from a fund), which may result in fire-sale dynamics.

In the recent Global Financial Stability Report of the IMF, we assess the empirical relevance of various aspects of these mechanisms (IMF 2015).

Figure 2. Unleveraged open-end funds and systemic risk

Source: IMF staff.

Do mutual fund flows affect prices?

A first question is to ask whether mutual funds affect asset prices.

- First we investigate the dynamics of fund flows and prices in various markets. Although causality is difficult to establish conclusively, ‘surprise’ mutual fund outflows appear to reduce asset returns in smaller, less liquid markets such as emerging markets, and to a lesser extent in US high-yield bond and municipal bond markets. Moreover, fund flows help predict price movements in various markets.

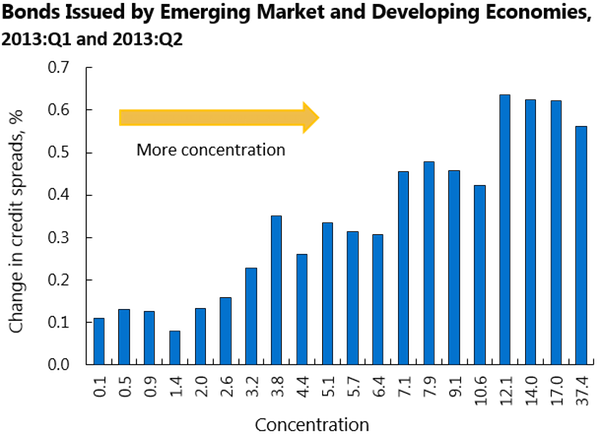

- Second, we find that greater mutual fund ownership concentration adversely affects bond spreads in periods of stress. During the global financial crisis in 2008, bonds with a higher ownership concentration experienced larger increases in spreads. Investor concentration also made bonds from emerging market and developing economies more vulnerable to the 2013 taper episode (Figure 3).

Figure 3. Bond ownership concentration and its effects on credit spreads

Sources: eMaxx; and IMF staff calculations.

Note: The largest five holders among mutual funds are identified for each individual bond. Bonds are sorted in different buckets on the horizontal axis according to the share of the bond held by top five mutual funds. The vertical axes show the average change in credit spreads (bond yields over benchmark government bond yields of the same currency and similar maturity), for bonds in each bucket.

What drives redemptions? What can mitigate the risk of runs?

- Using US funds data, we find that fund flows decline during periods of uncertainty and high risk aversion (high VIX) and after weak returns of funds and their target asset class, indicating that investors pursue momentum strategies. Investors also display a flight to quality, switching away from equities to bonds during turbulent times.

Funds manage these run risks with various liquidity management tools, including cash buffers and redemption fees. Funds with higher liquidity risk (those with retail investors and less liquid assets) tend to charge higher redemption fees, and fees are effective in reducing fund flows’ sensitivity to returns, including during stress periods (Figure 4).

Figure 4. Fund flows and redemption fees

Sources: Center for Research in Security Prices; and IMF staff estimates.

Does asset managers’ behaviour amplify risks?

In line with the existing evidence for US equity mutual funds (Chevalier and Ellison 1997), investors inject money into winning funds more than they punish poor performers. This convex performance-inflow relationship could encourage poorly performing fund managers to take riskier bets (risk-shifting).

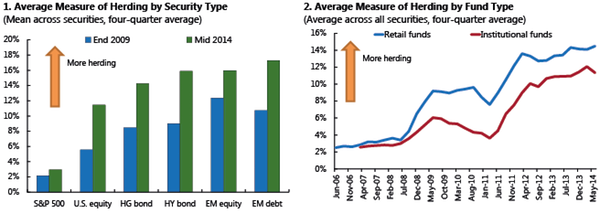

Moreover, we find signs for herding among mutual funds. Herding is measured as the extent of correlated trading across US mutual funds, applying the method developed by Lakonishok et al (1992), and using the funds’ security-by-security holding data. Herding is more prevalent in less liquid and less transparent markets (emerging market assets and high-yield corporate bonds) – consistent with theory (Bikhchandani et al 1992). Herding is also more widespread among retail-oriented funds. It has been on the rise across fund styles. This coincides with the adoption of unconventional monetary policies in the US and could be related to an accentuated search for yield by mutual funds (Figure 5).

Figure 5. Herding among US mutual funds

Sources: Center for Research in Security Prices (CRSP); and IMF staff calculations.

Size, investment focus, and contributions to systemic risk

An active discussion is currently taking place in international regulatory fora about the possible designation of large funds and asset management companies as systemically important financial institutions (SIFIs). We did not aim to provide a final verdict on this question – but we tried to gain some insights into the relationship between fund and asset managers’ characteristics and their systemic risk contribution. We measured funds’ contribution to systemic risk using the conditional value-at-risk (CoVaR) method (Adrian and Brunermeier 2011) and related them to the size of funds and their asset management companies (AMCs) and investment focus, among others.

- Although larger funds tend to contribute more to systemic risk, the type of investment they conduct seems to matter more. Moreover, a fund’s systemic risk contribution bears little relation to the size of its AMC. This suggests that an emphasis on products and investment focus is likely to be important in the context of the discussion on SIFI designation, in addition to size.

Implications for the oversight of the industry

- Although more work needs to be done, the evidence so far indicates that oversight of the industry should be strengthened and expanded. In addition to traditional investor protection objectives, it should cover the risk of funds and AMCs viewed individually (microprudential oversight) as well as market-wide financial stability risks (macroprudential oversight). Securities regulators should shift to a more hands-on supervisory model, strengthen their own risk analysis capacity, and conduct stress tests. This task should be supported by global standards on supervision and better data and risk indicators. The roles and adequacy of existing risk management tools – including liquidity requirements, fees, and fund share pricing rules – should be re-examined, taking into account the industry’s role in systemic risk and the diversity of its products.

Editor’s note: The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management.

References

Adrian, T and M K Brunnermeier (2011) “CoVaR”, NBER Working Paper, No. 17454.

Bikhchandani, S, D Hirshleifer and I Welch (1992) “A theory of fads, fashion, custom and cultural change as informational cascades”, Journal of Political Economy, 100: 992–1026.

Chevalier, J and G Ellison (1997) “Risk taking by mutual funds as a response to incentives”, Journal of Political Economy, 106(6): 1167–200.

Frazzini, A and O A Lamont (2008) “Dumb money: Mutual fund flows and the cross-section of stock returns”, Journal of Financial Economics, 88(2): 299–322.

IMF (2015) “The asset management industry and financial stability”, Chapter 3 of Global Financial Stability Report, International Monetary Fund, April.

Lakonishok, J, A Shleife and R Vishny (1992) “The impact of institutional trading on stock prices”, Journal of Financial Economics, 32(1): 23–44.