Lambert here: Sadly, the authors cite “(Reinhart and Rogoff 2009),” but perhaps that’s just a ritual genuflection. However, the article puts the Industrial Revolution in a new light, and with the Opium Wars going on at more or less the same time, the Brits certainly were a busy lot!

By Jaume Ventura, Senior Researcher, CREI, Universitat Pompeu Fabra; International Macroeconomics Programme Director, CEPR, and Hans-Joachim Voth, Chair of Development and Emerging Markets at the Economics Department, Zurich University and CEPR Research Fellow. Originally published at VoxEU.

Towering debts, rapidly rising taxes, constant and expensive wars, a debt burden surpassing 200% of GDP. What are the chances that a country with such characteristics would grow rapidly? Almost anyone would probably say ‘none’.

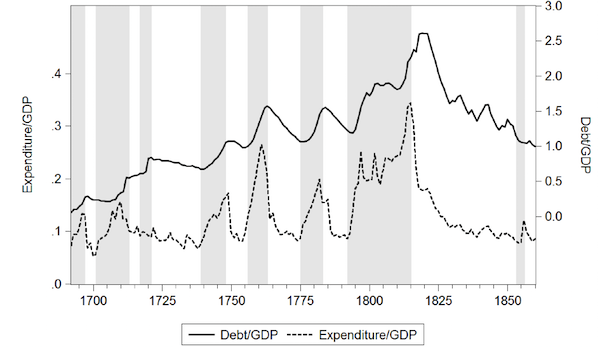

And yet, these are exactly the conditions under which the Industrial Revolution took place in Britain. Britain’s government debt went from 5% of GDP in 1700 to over 200% in 1820, it fought a war in one year out of three (most of them for little or no economic gain), and taxes increased rapidly but not enough to keep pace with the rise in spending.

Figure 1 shows how war drove up spending and led to massive debt accumulation – the shaded grey areas indicate wars, and they are responsible for almost all of the rise in debt. Over the same period, Britain moved a large part of its population out of agriculture and into industry and services – out of the countryside and into cities. Population grew rapidly, and industrial output surged (Crafts 1985). As a result, Britain became the first country to break free from the shackles of the Malthusian regime.

Figure 1. Debt accumulation and government expenditure in the UK, 1690-1860

Until now, scholars mostly thought of the effect of government borrowing on growth as either neutral or negative. One prominent view held that investment in private industry would have been higher had Britain fought and borrowed less (Williamson 1984). Another argument is that private savings decisions undid the potentially negative effects of massive borrowing – because debt eventually has to be repaid, private agents anticipated rising taxes in the future and neutralised the effects of debt accumulation (Barro 1990).

The Revolution That Wasn’t

In a recent paper, we argue that Britain’s borrowing binge was actually good for growth (Ventura and Voth 2015). To understand why massive debt accumulation may have accelerated the Industrial Revolution, we first consider what should have happened in an economy where entrepreneurs suddenly start to exploit a new technology with high returns. Typically, we would expect capital to chase these investment opportunities – anyone with money should have tried to put their savings into new cotton factories, iron foundries and ceramics manufacturers. Where they didn’t have the expertise to invest directly, banks and stock companies should have recycled funds to direct savings to where returns where highest.

This is not what happened. Financial intermediation was woefully inadequate – it failed to send the money where it should have gone. As one prominent historian of the British Industrial Revolution argued:

“the reservoirs of savings were full enough, but conduits to connect them with the wheels of industry were few and meagre … surprisingly little of [Britain’s] wealth found its way into the new industrial enterprises ….” (Postan 1935).

There were many reasons for this, but deliberate financial repression by the government was one of them. Usury limits, the Bubble Act, the Six Partner Rule that limited the size of banks – all of them were designed to stifle private intermediation, in part so as to facilitate access to funds for the government (Temin and Voth 2013).

Without effective intermediation, new sectors had to self-finance – rates of return stayed high because so little fresh capital entered to chase the sky-high returns. Allen calculated that the profit rate for capital rose from 10% in the 1770s to over 20% by the 1830s – capital’s share of national income more than doubled (Allen 2009).

Why Debt Helped

The inefficiency of private intermediation is crucial for debt to play a beneficial role. By issuing bonds on a massive scale, the government effectively pioneered a way – unintentionally – to put money in the pockets of entrepreneurs in the new sectors.

How did it do that? Before the availability of government debt, Britain’s rich and mighty – the nobility – overwhelmingly invested in land and land improvements. Status was closely tied to land, but improving it was not a profitable enterprise. Many forms of investment yielded a return of 2% of less. No wonder that noblemen were disenchanted with landed investment: By the 1750s, the first nobles were switching massively out of land and into government debt. The Prime Minister Sir Robert Peel advised: “every landowner ought to have as much property (as his estate) in consols or other securities…” (Habbakuk 1994). Many nobles obliged, shifting into an asset with a superior risk-return profile. As Lord Monson put it: “What an infernal bore is landed property. No certain income can be reckoned upon. I hope your future wife will have consols. . . ” (Thompson 1963).

The shift from investing in liming, marling, draining, and enclosure into government debt liberated resources – labour that could no longer be profitably employed in the countryside had to look for employment elsewhere. Because so much of English agricultural labour was provided by wage labourers, the switch to government debt pushed workers off the land. Unsurprisingly, wages failed to keep pace with output; real wages, adjusted for urban disamenities, probably fell over the period 1750-1830. What made life miserable for the workers, as eloquently described by Engels amongst others, was a boon to the capitalists. Their profit rates continued to rise as capital received an ever-larger share of the pie – while the share of national income going to labour and land contracted. Higher profits spelled more investment in new industries, and Britain’s industrial growth accelerated.

By putting debt at the centre of our interpretation of the Industrial Revolution, we can provide a unified explanation for a number of features that have so far seemed puzzling. Growth was relatively slow, especially in the beginning (Crafts 1985) – but technological change was probably quite rapid (Temin 1997). Government borrowing slowed capital formation on impact – but structural change was rapid over the period as a whole. Rates of return were high in industry, but little capital chased these returns. Wages failed to keep up with productivity despite the rapid move out of the countryside and into the cities. By emphasising how government debt issuance ‘healed’ the negative consequences of financial frictions, we can jointly explain rapid structural change and slow growth; rapid technological change and poor wage growth; massive government borrowing and the first take-off into sustained growth.

Good-bye to Downton

The issuance of government debt also accelerated social change – the rise of the capitalists and the decline of nobility. Without it, rates of profit in industry would have been less, and the decline and fall of the nobility as a dominant economic force would have taken much longer.

The solution that would have ensured the fastest growth – a much better financial system – would have preserved England’s social hierarchy entirely. Financial investment from the nobility would have flowed into new sectors via banks and the stock market, allowing the top 1% to earn high returns. The rise of the capitalists would have been long-delayed or been avoided altogether.

The Bigger Picture

How much of the situation in industrialising England has any relevance for the world as it is now? Is this a tale from a distant island and period of which we know little – to paraphrase Chamberlain – or does it hold lessons for the present? Financial frictions are still very prominent even in the most developed countries today; changing the profitability of revolutionary sectors should have first-order effects on the long-run rate of growth. The issuance of government debt may still crowd out investment that is, overall, inefficient.

These efficiency-enhancing effects of government debt may be all the more important in developing countries. There, the added benefits of debt that we did not discuss – such as providing a safe store of value, and a certain source of liquidity (Holmstrom and Tirole 1998) – may tilt the overall scoresheet even more in favour of government borrowing. None of this is to say that debts may not become excessive (Reinhart and Rogoff 2009) – but when we consider the dangers of debt, we should keep an eye on its potential benefits as well.

References

Allen, R (2009), “Engel’s pause: A pessimist’s guide to the British Industrial Revolution”, Explorations in Economic History 46 (2): 418–35.

Barro, R J (1987), “Government spending, interest rates, prices, and budget deficits in the United Kingdom, 1701–1918”, Journal of Monetary Economics 20 (2): 221–47.

Crafts, N F R (1985), British Economic Growth during the Industrial Revolution, Oxford: Oxford University Press.

Habakkuk, H J (1994), Marriage, Debt, and the Estates System: English Landownership, 1650-1950, Clarendon Press.

Holmstrom, B R, and J Tirole (1998), “Private and Public Supply of Liquidity”, Journal of Political Economy 106(1): 1-40.

Postan, M M (1935), “Recent trends in the accumulation of capital”, The Economic History Review 6 (1): 1–12.

Temin, P (1997), “Two views of the British industrial revolution”, The Journal of Economic History 57(1): 63-82.

Temin, P and H-J Voth (2013), Prometheus Shackled: Goldsmith Banks and England’s Financial Revolution After 1700, Oxford University Press.

Thompson, F M L (1963), “English landed society in the nineteenth century”, English Landed Society in the Nineteenth Century.

Reinhart, C M, and K Rogoff (2009), This Time is Different, Princeton University Press.

Williamson, J G (1984), “Why was British growth so slow during the industrial revolution?” The Journal of Economic History 44(3): 687-712.

Ventura, J and H-J Voth (2015), “Debt into growth: How government borrowing accelerated the Industrial Revolution”, CEPR DP No. 10652.

Heroin makes one feel good, but the crash can be horrendous. As someone not addicted to narcotics myself, it sure doesn’t look like the benefits are worth the cost.

Endless growth and industrialism has resulted in us and the planet being on the brink of extinction. To me, this post is presenting a potent argument against debt, especially government debt I suppose.

One sided nonsense.

Debt simply allows more parallelism between economic actors and results in more progress:

If you think that civilizational progress is a net negative, that humanity should have remained in the dark ages of the gold standard, with a life expectancy of 40 years, then debt is indeed bad.

If you think that progress is a net positive, then debt, as an enabler of entrepreneurship, is a net positive as well.

Even those who are debt averse recognize that there is a difference between “good debt” that finances investment in productive assets (and can eventually pay for itself) and “bad debt” that does not. The problem is that most debt these days does not “enable entrepreneurship.” Instead, it refinances old debt. Or it finances economically unsustainable enterprises like fracking.

For some reason many in the progressive camp have come to equate the liberal position with easy money policies and more debt. Because growth.

I think this is a cop out. I think a real redistribution of wealth means a redistribution of real assets. Unencumbered. And a debt jubilee. And a society with more equality even if there is little or (gasp!) no growth.

What “easy money”?

There’s been no “easy money” since 2008, when interest rates hit the zero bound all across the developed world…

“Quantitative Easing” is not “easy money”, as price levels and the lack of inflation is showing.

Various of the posts this morning go to a basic physical dynamic, in that as linear creatures, we associate progress with accumulation; energy, assets, complexity, etc, while reality is fundamentally circular, in that what goes up, comes back down. While biology deals with this in various significant fashions, such as individual organisms living and dying, while the species propagates, there is one major feedback loop our generation has to address and that is that money functions by circulating, like blood in the body, but our current philosophy is to accumulate as much as possible and while this appeals to our basic desires, the larger process needs to recognize the larger reality and not just appeal to those basic impulses.

As it is, it ends up working like storing fat in the heart and blood vessels and that is not a good idea.

In other words we are “terminally gullible” allowing the “1%” to give societies heart attacks through their hoarding which usually involves the attempt to make money off money rather than investment in real production to meet societies’ needs for goods and services.

Basically. It is a common and reasonable assumption that money is a form of property, but the reality is that it is a form of public commons, much like a road system.

I remember that Bob Dole had a campaign slogan in 96; “We want you to keep more of your money in your pocket.” To which I had a flip reaction, “Thank God its not my money, or it would be worthless. ”

Yet that’s the reality, as I thought it over. It’s not my picture on it. I’m not responsible for maintaining its value. I don’t hold the copyright and those who do are quite serious about defending it. Basically we “own” money in the same way we own the section of road we are using. It’s value is in its very fungibility. That we can exchange it as necessary.

As an asset, every bill is theoretically backed by a debt/obligation. That makes it a contract and if people thought of it as such and not as property, society’s sense of how it functions and what it is and how it has to be treated would change drastically.

It really is a massive voucher system and you no more want excess vouchers, than you want high blood pressure. Much of what has gone on in finance over the last thirty five years, has been about creating and managing massive amounts of surplus capital, without letting it get into the actual economy and cause inflation. So it has been stored in these edifices of wagering/derivatives, inflated asset values, etc. and now it’s to the point the tail is wagging the dog, as the entire economy has become dominated by this need to keep the bubble from bursting and looking at China this morning, it’s not going to last much longer.

“without letting it get into the actual economy and cause inflation.”

The only way to get this excess capital ‘into the economy’ is to spend it on something…

…these guys can’t even spend all their income, let alone their savings.

There is a reason this pile of financial wealth, which has always been there in relative terms, never gets spent or causes inflation.

Meanwhile, people are looking for jobs, our infrastructure deteriorates, and worthy efforts like scientific research are starved for funding.

More spending on those things wouldn’t hurt.

There can be no GDP growth over time without growth in government debt or running a trade surplus.

Since the advent of monetarism in the EU GDP growth for the EU as a whole has cratered.

The Damage of the Thatcher Sea Change

Growth in use of limited resources is another argument, but it is possible to have GDP growth without growth in the the use of those limited resources.

For a government sovereign in it’s own currency, government debt is DINO.

A cursory inspection of graphs of GDP and G since WWII at least (data is readily available at FRED) GDP tracks G precisely. One could hardly make the argument that GDP drives G, since G precedes GDP on the Arrow of Time.

There is a saying that correlation does not mean causation. There is also the reality that if an event is never observed in the real world then it isn’t possible.

” government debt is DINO” except when created by bonds which the interest becomes larger than the bond in time.

Note I said ‘sovereign’ in it’s own currency.

A sovereign is not constrained by the interest rate (mathematically). It can always create the interest no matter what the rate. This is unlikely to ever be necessary.

In the US the Fed controls interest rates. Is the Fed going to raise rates high enough to undermine the government or the economy? It would go against it’s mandate.

Over the past 35 years or so the rates on bonds has headed inexorably towards zero:

10-year Treasury

Japan’s bond rates have a similar history:

Japan 10-year government bond

Is zero percent yield punitive? Would you gamble on the rates going up?

” ‘ government debt is DINO’ except when created by bonds which the interest becomes larger than the bond in time.”

How would you prefer your government created money in tally sticks?

http://wakeupfromyourslumber.blogspot.com/2006/01/money-101.html

Yes, tally sticks in the form of direct deposits into Fed accounts from keyboard to reserves.

And all of this industrialization happened with a gold-backed currency?

Not entirely. The pound was off of gold from 1797 to 1821.

Is my reading of this off or am I correct in thinking the basis of this analysis is a loanable funds model ?

British industrialization wasn’t just aided by debt; tariffs also helped the growth of British industry. It wasn’t until the middle of the 19th century that Great Britain reduced or eliminated their protective tariffs.

Industrialized first…

First.

It reminds me of the physics of equality.

It’s not just everyone gets an equal amount of X, but also we all get it at the same time. No one gets it way before everyone else.

So, timing is an issue. And since we don’t live in a frictionless world, any outcome is path-dependent, due to heat loss. That’s another issue.

From Ingham, ‘The Nature of Money’

“It is significant that the two most successful states of the capitalist era – Britain and the USA – have also been the most indebted (Ferguson 2001: 133-141).

But any successful extension of ‘infrastructural’ power by means of credit-money can only take place within a legitimate institutional framework based on an acceptable and workable settlement between creditors and debtors.”

Ingham paints an interesting picture of how the Bank of England integrated the two main sources of capitalist credit-money that had originated in Italian banking, public debt in the form of state bonds and private debt in the form of bills of exchange. And most importantly they were introduced into an existing sovereign monetary space.

I think one of the main takeaways is that there needs to be a balance of power between the private and public debt structures. Right now private banking is too powerful.

The sovereign monetary space was first given stability by a gold/sterling standard but it was realized that the true stability was the social acceptance of a money of account. A sovereign monetary space implies a willingness to cooperate socially.

they have also been the most imperialistic.

my takeaway from this post, whether intended or not, is that debt = imperialism

It’s expensive to control people far from home. So if a country is imperialistic, they are very likely to be heavily indebted. I don’t think the converse is true, though. Some indebted countries are not imperialistic.

True. Basically, empires are characterized by a flow of goods from the periphery to the centre, while those get paid by money from the centre. The obvious result is debt. Naturally, the Empire has never the plan to balance its positions. Already the Roman Empire had heavy economic and monetarian (especially because of the use of “physical” money that worked, as usual, deflationary) issues due to this state of affairs.

“A sovereign monetary space implies a willingness to cooperate socially.”

That “willingness” depends upon a society getting its “redemption” of money just right; not too little and not too much from all partners in money or “near money” creation sovereign governments, private banks and shadow banks.

Here’s Adam Smith’s take nearly 240 years ago on the matter by way of reference to money creation by the American colonies and sovereign states:-

“The paper of each colony being received in the payment of the provincial taxes, for the full value for which it had been issued, it necessarily derived from this use some additional value, over and above what it would have had, from the real or supposed distance of its final discharge and redemption. This additional value was greater or less, according as the quantity of paper issued was more or less above what could be employed in the payment of the taxes of the particular colony which issued it.”

“A prince, who should enact that a certain proportion of his taxes should be paid in a paper money of a certain kind, might thereby give a certain value to this paper money; even though the term of its final discharge and redemption should depend altogether upon the will of the prince. If the bank which issued this paper was careful to keep the quantity of it always somewhat below what could easily be employed in this manner, the demand for it might be such as to make it even bear a premium,…..”

( Adam Smith. “The Wealth of Nations” Book II, Chapter II. 1776 )

I think that brings up some interesting points especially on ‘near money’. As Ingham points out, all money is credit but not all credit is money.

I think this gets into the liquidity problems people talk about. I think some of the problems we have had since 2008 have been making this ‘near money’ money good.

Deregulation and ignoring fraud and predatory practices have not served us well.

“I think this gets into the liquidity problems people talk about. I think some of the problems we have had since 2008 have been making this ‘near money’ money good.”

This comment is close to Gary Gorton’s analysis in his book “Misunderstanding Financial Crises.”

“Following his dissertation advisor, Schumpeter, Minsky argued that banks are central to the operation of a capitalist economy and that the assets and liabilities of banks largely determine the financial framework of the economy (Minsky 2008 [1986], p. 354). The fragility of the financial structure is based on the quality of loans made by bankers. If bankers finance risky operations, they become fragile. Before the invention of securitization, banks were interested in granting loans only to creditworthy customers. As Minsky argued, a successful loan officer was considered to be “a partner of a borrower” (Minsky 2008 [1986], pp. 260-261). Financial innovations such as securitization and Credit Default Swaps, however, have separated risk from responsibility, contributing to a deterioration of loan quality and hence greater fragility. Deregulation allowed banks to engage in all sorts of risky activities many of which are incompatible with the role banks are supposed to play. Many of the larger banks have changed so much that it is unclear whether they can be called banks—since they did little underwriting, and tried to shift risks off balance sheets—either by packaging and selling assets or by purchasing “insurance” in the form of CDSs.” (Wray and Nersisyan 2010 )

From above “by packaging and selling assets”. They sold these into the shadow banking system largely funded by money market funds. I think this is still poorly regulated and here is where we could have the liquidity crisis.

You wonder why if adequate shelter is classed by many as a fundamental human need the supply of mortgages at the lowest possible interest and with the potential for deposit subsidy perhaps cannot be undertaken solely by Federal government or a trust at arms length like the Federal Reserve given that for commercial banks this is their greatest profit opportunity area and therefore the greatest temptation to engage in lax under-writing standards. We have had two major recessions in less than a hundred years caused by commercial banks blowing house price bubbles. Isn’t it time we engaged with reality that some human beings will always engage in selfish and thoughtless activities that are often severely detrimental to the optimal functioning of human societies?

At first I thought Aristotle was being too clever with his analysis of causation, but now, after years of reading macroeconomic articles on the internet that have nearly ruined me financially, I realize just how smart the dude was.

Also Miguel de Cervantes was a smart dude too. Burning all those chivalrous romance books so they didn’t mess with people’s heads.

There should be a law against macroeconomics. Or at least a public incineration of articles and scholarly papers. Anything that assumes an “equilibrium” goes into the fire. Anything that assumes “rational agents” is toast. Anything that seeks a single cause for a phenomenon gets the torch. What would be left? Multiple regression analyses, of course. There we have to look for rigor of method. What sort of fudging did the data get before analysis? What sort of ruse was used to generate “significant” results? Is multiple regression a defensible method or simply a parlor trick of faux mathematical glitter used to confuse the impressionable readers into believing randomness is correlation and correlation is a form of causation? Most would go into the fire. What would be left? Not much. But that’s the way it should be.

Actually, economics would need some serious and independent framework made by physicists who do not deliver works to serve interests or ideology. Than, economics might have a bright future between sciences like Metereology and Astrology. ;)

Here is the original Ventura’s and Voth’s research paper this article is based on:-

http://crei.cat/people/jventura/DIG.pdf

It would appear that the NeoLiberal strategy of driving down wages whilst simultaneously pursuing imperialism is the core of their research take-away!

The more I think about it the more I think Ventura and Voth’s “big idea” is a re-working of Jared Diamond’s “Guns, Germs and Steel” and Andrew Bard Schmookler’s “The Parable of the Tribes.” No discredit and all praise to Ventura and Voth the mechanics needed working out and stating for a specific case.

How about this for an interpretation:

Government debt was used to buy goods and services locally that was then shipped abroad to fuel the wars. This then put money into the production economy, thus spurring industrialization to cover government purchase orders.

Basically the same thing that pulled USA and the rest out of the great depression by producing for WW2.

One modern example would surely be South Korea. They borrowed quite a bit too to industrialize. Sure there was a crisis back in 1998, but in general they are better off.

While it is beyond dispute that debt can and serve useful ends in the building of both national economies and nations proper – in his treatise on money, John K. Galbraith describes in detail the massive issuance of scrip by the infant U.S. government to fund the war of independence, so liberal that the resulting hyperinflation led even folks like Ben Franklin to near-despair – to ignore the role of “looting of the colonies and the vanquished” in the rise of great empires like Britain, as the present author does, is an omission of first rank.

In the modern-day USian empire, the looting is no less in scale but is more cleverly disguised, via what can be called “reserve currency colonialism”.

What they say is true, but what they ignore looms larger. This period represents the height of British Colonialism whence the newly “United” Kingdom pillaged a large part of the globe to fund its government deficits and provide labor and materials for the private sector growth.

Akin to writing a history of World War II and ignoring the Soviet Union’s participation.

An interesting article. However, I would even go farther and state that debt is the very basis of “economic growth” in the given – and thus highly flawed- economic system . ( Very simplified: More debt= more money = more “growth” ; – one man`s money is very basically the other man`s debt…. ) And ideally, it is the state (who is an ideal “spender”, and only very rarely a “saver” ,making him only better for the given purpose) who takes the majority of the burden, and not the entrepeneurs themselves. This way, costs are socialized (more general: “externalized”) and gains are privatized (“extracted”); – the conditio sine qua non for capitalist production. (Possible benefits for society come only later, if at all. In the example, it took 80(!) years just to break even for Average Limey) The deliberate destruction of the self-sustaining (“non-profit” ) commons during the 18th century played of course a major role, as well (Millions of African peasants without soil = profit for Monsanto, one might say…) , as it, as usual, provided extremely cheap labour to the manufactury owners, and thus a huge competitive advantage over the rest of Europe, that worked as an ideal export market, but over domestic traditional labor as well.

To understand why massive debt accumulation may have accelerated the Industrial Revolution, we first consider what should have happened in an economy where entrepreneurs suddenly start to exploit a new technology with high returns. What are the chances that a country with such characteristics would grow rapidly?