By Nathan Tankus, a writer from New York City. Follow him on Twitter at @NathanTankus

An economy is not just an aggregation of a category of transactions. An economy is an aggregation of transactions that happen in a set of locations that are geographically located and connected through space and time. The fewer legal and de facto barriers there are for the movement of people, legal entities, financial investment and physical capital between locations, the more geographic disparities in unemployment (of both labor, physical capital and space) and economic growth emerge. Without regional and national institutions for balancing out these disparities (or when they are not designed well enough to manage the task at hand) these disparities become self reinforcing.

Recessions accelerate disparities between locations because as the unemployment rises and businesses start to fail (or at least close local branches), the drive to find the most economically prosperous location you can rises. Leaving your city where the unemployment rate is 6% to find a place where the unemployment rate is 4% is not as compelling as when your city’s unemployment rate is 13% and somewhere else there is an unemployment rate of 11%. Even worse, recessions hit certain geographic areas much harder than others, so the pressure to leave is increased. All this leads me to my topic today: Puerto Rico, a geographic region that is part of the United States and has suffered uniquely from these dynamics.

Labor

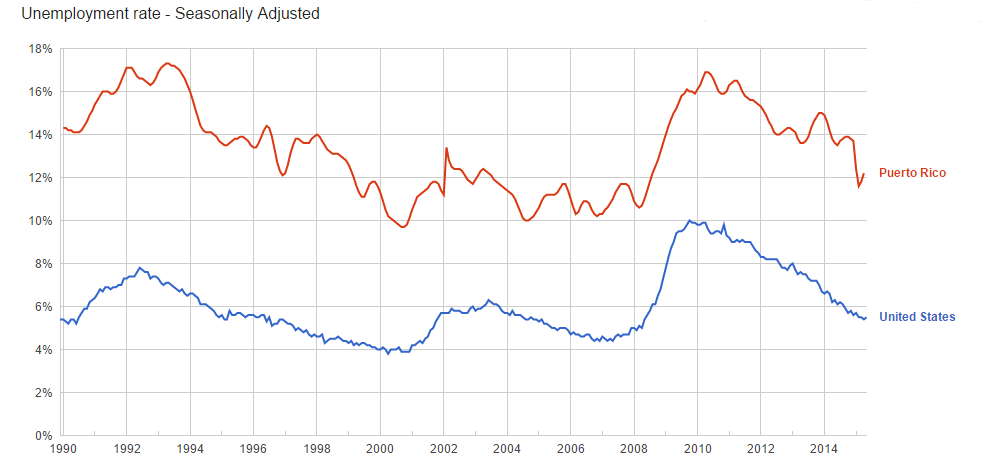

According toe the Bureau of Labor Statistics, unemployment has stayed above 10% in Puerto Rico for at least 25 years. This is a shocking indictment of American economic policy in the region. Whatever your position on the acquisition of Puerto Rico by the United States over a century ago, the United States has utterly shirked its duty to foster employment.

Moreover, Puerto Rico’s unemployment rate has stayed above 10% despite redefinitions intended to present a rosier picture. A broader measure of unemployment would probably be on the order of 25-30%, similar to the official youth unemployment rates. The youth unemployment rate is especially important because young people are the people most likely and able to emigrate.

Superficially it is tempting to think that emigration would alleviate Puerto Rico’s problems. The people who leave would largely be unemployed people and thus reduce the burdens on the local economy’s support system.

But unemployed people (i.e., people still actively seeking work) tend to be young and those who truly need employment, ie those that are supposed to support the rest of the population. Additionally, despite their status they still need to consume and use basic necessities (often supported by federal transfer payments). Their exit, to quote Paul Krugman, “tends to increase the size of the market wherever they go, decrease it where they come from.“

Five million Puerto Ricans now live in the mainland of the United States. I’m sure some would have left for other opportunities but I’m also sure many would have liked to stay home if there was an economy to stay a part of. Further, the emigration has only hurt the local economy more and the high unemployment rate has been preserved. The process may be much less brutal and may involve mostly emigration rather than starvation, but the logic is the same as the wealthy land magnates of England who demanded that the population shrink more and more to deal with the “overpopulation problem”. How many people gone would satisfy our modern-day equivalents? I guess a population of zero is technically fully employed.

Industry

Despite what you may have read in the press, Puerto Rico really does have an economy. Its issue is lack of public investment and unemployed resources. Because Congress has for over a century been unwilling to settle Puerto Rico’s status, it has rewarded (and thus attempted to quiet outrage against) its status to make it a tax haven for corporations. These tax incentives combined with general prosperity in the post-war era have developed Puerto Rico’s economy and shifted it from being mostly agricultural, but they have not done very much for ordinary Puerto Ricans. As the National Puerto Rican Chamber of Commerce commented:

Gross National Income (GNI) has also declined as a fraction of Gross Domestic Product (GDP) during this time period [tax incentives from the 1920s to the 1970s], meaning that more foreign entities and individuals were transferring their economic output to locations outside of Puerto Rico.

In other words, production had been happening there but profits and income have been repatriated elsewhere more and more. In the 1970s changes in tax incentives led to very strong growth in wholly-owned subsidiaries in Puerto Rico. However, those same incentives tended to encourage pharmaceutical and other very capital intensive companies to come to Puerto Rico, but they had limited employment gains. Even that meager gruel served to Puerto Rico was taken away in the mid 1990s.

Since these companies were very capital intensive, the tax cuts were merely phased out over the next decade and their ability to divest from Puerto Rico by that time was relatively small, it didn’t cause a huge jump in unemployment (relative to the trend) but it has been a persistent drag on its economy ever since and will continue to be in the future.

To the extent that corporate tax benefits have provided any benefit, it is federal corporate tax benefits that create an incentive to move without dragging away other spending. Corporate tax benefits provided by specific geographic regions come at the expense of social spending and tax cuts that would do more to attract business than “supply side” benefits, to speak nothing of the cost savings infrastructure spending delivers to business. This leads the larger point that a federal spending program of a similar dollar amount would have done much more for their economy than these tax incentives.

Of course, the larger story of Puerto Rico is an economy that has suffered the loss of real economic resources (largely people) because of a lack of demand. It benefited, albeit unequally and to a much smaller extent than the mainland, from the prosperity brought by the the post-war period but suffered much more in the persistent downturns since the collapse of the Bretton Woods era. Due to its geographic isolation, downturns tend to stop orders from the mainland earlier, and start them up again later. This means that a recession in the rest of the United States hits the economy harder and longer. Transfer payments such as food stamps (which only reached Puerto Rico in the 1970s) have stemmed the bleeding but not healed the wounds coming from persistent recessions. Of course, they also suffered from Clinton era welfare reforms which reduced transfer payments again. The history of federal intervention in Puerto Rico has been a history of haphazard and at best uneven benefits.

So is Puerto Rico “Like Greece”?

In a word? No. As others have commented, Federal counter-cyclical stabilizers (shortly falling federal tax receipts and rising social insurance expenditures) have stabilized their economy and kept it limping along for decades but it hasn’t been able to provide an adequate economy for its citizens or stem the outflow of people. There are also interesting legal differences between EU member states and American states highlighted by the tenuous position of Puerto Rico.

However, simply not being a society that is about to or near collapse is not the standard that Puerto Rico should be judged. What Puerto Rico needs above all other things is an economy developed to serve the population, not tourists or multinational corporations who are at best fair weather friends. In short, it needs what the rest of the United States needs: a Reconstruction Administration financed by the federal government, similar to the one it had during the New Deal. Since the United States took control of Puerto Rico, the minimum obligation it had was to provide employment and rising living standards to at least the United States average. It has defaulted wholesale on that debt and needs to start paying up.

While conventional wisdom in econ holds that free movement of labor and capital will lead to equilibrium and “factor price equalization”. Once again, econo-theorizing undone by harsh reality.

I’m still trying to find the theory on how exporting the “product” of every baby farm in the world to the USofA leads to “equilibrium” in the USofA.

Yup. Krugman has only started to acknowledge this in public. The post I linked to two years ago rails on him for just “thinking” of this now when it’s obvious from his economic geography literature even when he jury-rigged equilibrium in there.

I emigrated from PR about nine years ago for undergraduate studies, fully knowing I would not return. To explain why, here are some brief “Puerto Rico Fun Facts”.

The island has no formal economy: mostly un-banked / cash based transactions, everything revolves around personal ties, bribery to attain government services is common.

Puerto Rico’s two largest employers are both doomed: Banco Popular (the largest bank) and Government (the largest employer). PR’s banks are full of worthless paper in the form of commercial real estate, residential real estate, and auto loans. The Government, on the other hand, is saddled with debt, incompetency, and corruption.

Speaking of corruption, its the status quo. Everyone is in on it.

Did you know Puerto Rico has 78 municipalities, each one with its own mayor and a municipal legislature? That’s right. 78 local legislatures plus 1 national bicameral legislature. That is a whole lot of bureaucrats and politicians feeding on the trough. Mind you, the island is 105 miles long and 35 miles wide.

In short, Puerto Rico’s biggest problem is that its full of Puerto Ricans.

PR_ExPat needs more convincing evidence to support his claim that Puerto Rico is corrupt. Comparing the number of PR incorporated cities by the size of its population—78:3,548,397 (2014 est.), or an average city population size of 45,487, tells us nothing. It should be pointed out that PR incorporated places are like US counties, they cover the entire territory, i.e., everyone lives in one.

Here are some “fun facts” about population sizes of incorporated places in the 50 United States. Only 62.7 percent of the population (198.2 million) live in 19,508 incorporated places, for an average population per city of 10,058. But, that’s only part of the story. About 85 percent of all incorporated places had fewer than 10,000 people. https://www.census.gov/content/dam/Census/library/publications/2015/demo/p25-1142.pdf

For example, Kansas has 105 counties for a statewide population of 2.9 million, 2.4 million of which also reside in 627 incorporated cities, or an average population of 3,828 per city. http://factfinder.census.gov/faces/tableservices/jsf/pages/productview.xhtml?src=bkmk

Kansas is not abnormal; Iowa has 947 incorporated cities for a population of 3.1 million. Even the fact that California has 482 cities for a population of 38.3 million (average: 79,528) gives an incomplete picture: it also has 1,102 school districts and about 3,400 special (mainly single-purpose) districts. At the other extreme, look at the concentration of power in Hawaii; it has four counties, the City and County of Honolulu, and one school district (and no incorporated cities) for 1.4 million people—hard to get political accountability there.

If you like the horrible Puerto Rico economy now, you’ll love it with a $12 or $15 federal minimum wage.

RE: How Recessions Crush Certain Geographic Areas:

From the post: “the United States has utterly shirked its duty to foster employment.” This is true for all parts of “failed-state USA”, not just Puerto Rico, way to go Barry!

Then look at housing in places like Detroit and most of the remainder of the Midwest: In the face of a critical housing shortage, tens of thousands of quite livable places are going begging, sometimes for as little as $1000 (Check out Realtor.com or any similar site)!

“Let them eat cake” says Barry and his plutocrat buddies, “we need TPP”!

so, Puerto Rico is Ireland rather than Greece?

a 21 century version of 19th century Ireland. Basically without a lot of the starvation but with a similar amount of depopulation.

I was just wondering out loud yesterday if there were an opposite phenomenon to Minsky’s theory that the good times always lead to a crash – do the bad times reach critical mass as well? Poverty tells us that it is just a condition that gets worse unless there is some intervention. So the bad times lead to even worse times; to abandonment of civilization. (Altho’ to hear hard-core neoliberals talk, I get the impression that they like desperation because they can make such good profits from it.) Yesterday on the Greece coverage there was a blurb from one of the Leftist (in Syriza) explaining how marxist economics in Greece has always managed to operate within a greater capitalist structure until recently and implying that everything went to hell because now there is just “too much capitalism.” Crowding out more socialist government measures.

Puerto Rico’s Amazingly Horrible student test scores may have some relation to the problem.

you have causation reversed

I wrote “some relation”. What direction of causation did you imagine I said?