If you have not had the opportunity to do so yet, please read the earlier posts in our CalPERS’ Private Equity, Exposed, series:

• Executive Summary

• Senior Private Equity Officers at CalPERS Do Not Understand How They Guarantee That Private Equity General Partners Get Rich

• CalPERS Staff Demonstrates Repeatedly That They Don’t Understand How Private Equity Fees Work

• CalPERS Chief Investment Officer Defends Tax Abuse as Investor Benefit

• CalPERS, an Anatomy of Capture by Private Equity

• CalPERS’ Chief Investment Officer Invokes False “Superior Returns” Excuse to Justify Fealty to Private Equity

• CalPERS’ Senior Investment Officer Flouts Fiduciary Duty by Refusing to Answer Private Equity Questions

One of the not-well-recognized channels by which private equity orthodoxy, meaning the general-partner-favoring party line, is propagated and defended is via private equity consultants. CalPERS’ consultant, Pension Consulting Alliance (PCA), performed this role during the most recent Investment Committee meeting.

Pension Consultants: The Stealthy Power Behind the Throne

Jay Youngdahl, an attorney who has regularly advised pension trustees, argued in a 2013 paper, Investment Consultants and Institutional Corruption, that investment consultants are an unrecognized power behind the throne. From the abstract:

Investment consultants stand as gatekeepers between large investors, such as private and public retirement funds, and those from “Wall Street” who design and sell financial products. Investment consultants hired by these asset owners practically control many investment decisions. Yet, as a whole the profession failed to protect asset owners in the recent financial crisis and has yet to engage in serious self-examination. Much of the reason for the failure can be traced to institutional corruption, which takes the form of conflicts of interest, dependencies, and pay-to-play activity. In addition, a claimed ability to accurately predict the financial future, an ambiguous legal landscape, and a tainted financial environment provide a fertile soil for institutional corruption. This institutional corruption erodes the confidence and effectiveness of the retirement and investment systems today.

Former banker, now independent private equity researcher Peter Morris confirmed this pattern. As he said via e-mail:

Some pension consultants have said publicly that something is wrong. As long ago as 2009, Watson Wyatt Worldwide (now part of Towers Watson) wrote that “The exponential growth in private equity that occurred between 2004 and 2008 has led to a significant misalignment issue in the industry.” Towers Watson named several reasons for this misalignment. The reasons included excessive fixed management fees; portfolio company fees, such as transaction fees; lack of transparency; and carried interest that extracts an excessive share of any alpha that the manager has generated. Another of its reports (in 2008) described the result: “…investors are often paying up for leveraged beta (market returns multiplied by gearing). This is clearly a very good deal for the managers, but not necessarily for their investors.

This is a succinct and accurate analysis of what is still going on.

One might wonder why pension consultants are so influential. The reason is that the most valuable service they provide is not the one for which they are nominally hired. A 2005 SEC report described their formal role:

“Pension consultants” provide advice to pension plans and their trustees with respect to such matters as: (1) identifying investment objectives and restrictions; (2) allocating plan assets to various objectives; (3) selecting money managers to manage plan assets in ways designed to achieve objectives; (4) selecting mutual funds that plan participants can choose as their funding vehicles; (5) monitoring performance of money managers and mutual funds and making recommendations for changes; and (6) selecting other service providers, such as custodians, administrators and broker-dealers. Many pension plans rely heavily on the expertise and guidance of their pension consultant in helping them to manage pension plan assets

However, their most important function is to provide a liability shield for pension fund executives and trustees, which in CalPERS’ case is its board members. As Youngdahl explains:

Trustees operate within a web of laws and regulations that are extraordinarily vague, such as ERISA,* yet which carry within them the specter of personal liability. The apocryphal line that is often repeated in the field is that such lawyers tell trustees that the trustees will be sued and “lose their house” if they violate their fiduciary duty by deviating from the Wall Street model of investment. The governing legal structure in the United States for most types of plans provides a level of legal protection, a kind of good faith defense, for trustees who rely on the opinions of experts.

So what is the net result? Pension fund officers and board members can escape liability for their actions by relying on the advice of hired guns. Yet these outside experts do not become liable as a result because they craft their advisory agreements so as to limit their role. The use of consultants and counselors has the effect of making no one legally responsible for bad decisions.

Think this is an exaggeration? In 2012, the State of California sued Northern Trust and PCA over $95 million of losses suffered by the Los Angeles City Employees’ Retirement System (LACERS) due to securities lending in the runup to the crisis. (Regular readers of this site will recall that securities lending was one of the two proximate causes of the collapse of AIG). The complaint argued that PCA earned large fees to act as the adult in the room, yet did not monitor Northern Trust’s actions. PCA’s rejoinder was that it assumed no such duty in its contract with LACERS.

PCA’s Defense of General Partners in CalPERS’ Investment Committee Meeting

In some ways, it is unfortunate to single out PCA, since they go to greater lengths than most of their peers to avoid conflicts of interest. For instance, they do not manage a private equity fund of funds, as private equity consultants Hamilton Lane and Russell Investments do. It goes without saying that needing to have access to private equity investments in order to package them into your own funds is not conducive to taking a tough line on the practices of general partners.

But as we’ll see, PCA is inherently subject to the biggest conflict of interest of all: that of needing to validate that the idea of investing in private equity as an asset class is ever and always sound. As Peter Morris pointed out:

The head of “alternative” investments at a large pension fund will likely benefit if it allocates more capital to his area. So will the consultants who advise the fund to do so (more complexity is always more profitable for them). That does not mean the decision is always in the interests of the fund’s beneficiaries.

We see that dynamic at work in PCA’s remarks at the last CalPERS Investment Committee meeting. Here are the first remarks by Mike Moy of PCA:

Mike Moy, Pension Consulting Alliance: So I’m just going to add a couple of observations, because I thought that Ted’s synopsis of what’s gone on in the private equity space was excellent. We see, as you can see, on page four of 17 in the exhibits, it’s not on the slides, that the absolute performance of private equity has been higher than the actuarial rate, and higher than your peer groups have been doing. It hasn’t been higher than your benchmarks, but Andrew is going to talk a little bit about that.

The expectation that those rates of return will continue is very high.

It’s critical to recognize what Moy did in the first sentence above. He put the Consultant’s Seal of Approval and Liability Shield on Chief Investment Officer Ted Eliopoulos’ remarks on private equity, which we debunked at length earlier in the week. Recall that Eliopoulos positioned CalPERS’ participation in private equity as necessary because it was the only asset class that CalPERS expected to beat its overall return requirement. Recall that Oxford professor Ludovic Phalippou found that claim to be puzzling, since other investment strategies offered similar or higher historical levels of return. Similarly, Eliopoulos also presented investing in private equity as consistent with some of CalPERS’ “Investment Beliefs,” namely, that it offered a rate of return commensurate with the risks involved and that private equity firms shared “our long-term time horizon.” The very fact that CalPERS’ private equity returns over the past decade have been hundreds of basis points below CalPERS’ benchmarks says that private equity has been a massive failure as far as offering enough return to compensate for the risks in concerned. Similarly, private equity has an investment life of four years, while CalPERS has to think in actuarial terms, meaning decades-long perspectives. It’s quite a stretch to say that private equity funds and pension plans like CalPERS operate on the same time frames.

Finally, as we’ll discuss shortly, the “expectation that those rates of return will continue is very high” has no analytical foundation.

Andrew Bratt, the “Andrew” to whom Moy referred in his overview, predictably hewed to the party line:

Andrew Bratt, Pension Consulting Alliance: Good afternoon. Andrew Bratt, PCA. Very briefly — I’m cognizant of the time — I want to talk quickly about the benchmark issue. As you know, your current benchmark is a custom public market index plus a premium, which is common amongst your peers, but it is also problematic, in that the public markets are generally more volatile than the private markets, especially over a short period of time, such as one year. In our report, we also include the State Street Private Equity Index, which is a peer-based index. And as you’ll see in our report, CalPERS has consistently outperformed that index.

The second point I was trying to make here is that the Private Equity Program is cash flow positive. Has been so since 2011. Distributions from private equity investments have exceeded capital contributions made to fund new investments to the tune of $17.5 billion just over the last three years. We are not confident that this will continue indefinitely into the future. Once the ongoing sellers’ market subsides, I think that the program — combined with additional contributions made for new investments, we think that the program will ultimately turn back into cash flow negative status in time.

Bratt, like Moy, tiptoes around the dead body in the room, that CalPERS’ private equity program has fallen well short of its benchmarks for a decade, and thus cannot be depicted as a sound investment on a risk/return basis. Bratt points out that the return benchmark isn’t perfect, which could serve to suggest that the private equity underperformance as at least in part attributable to the volatility of the benchmark. But that isn’t true. First, CalPERS has underperformed so spectacularly that the causes can’t be attributed to short-term market moves. Second, the underperformance holds true over a series of measurement periods (ten, five, three, and one years) and has also persisted as the performance comparisons are updated monthly. And third, the “greater stock market volatility” works in favor of, not against private equity, since private equity general partners fudge their valuations when the stock market is performing badly.

Notice also that PCA provides a “peer-based index” which shows that CalPERS is doing better at private equity than most other limited partners. That does nothing to obviate the fact that CalPERS is not being paid enough for the risks it is assuming when it invests in private equity.

PCA’s Whistling-in-the-Dark Reassurances About High Acquisition Prices

Towards the end of his remarks, Bratt mentions that it’s now a “sellers’ market.” That’s often a warning of froth. Moy tries to reassure CalPERS on that front:

The fear that Andrew referred to with respect to the pricing right now in the private markets is at the highest it’s ever been. We have observed very high level of discipline among the managers. They’re not running out making investments, because they realize that buying in at a high multiple is not where it should be. As it relates to what’s going on in the industry, there’s been a tremendous amount of publicity over the last six months. We authored a paper about a month ago that was quoted in one of the magazines, one of the newspapers that follows the industry and accused us of shilling for the private equity managers.

We looked at the paper again to read it for content, and concluded, well, what we were really doing was telling everybody what the industry has been doing, and we encouraged our clients in that paper to collaborate and work together to apply as much pressure as they can to the managers to improve transparency and to lower costs. So we felt that that was a misreading by the author of the article of what the paper was intended to do, but it coincides with what Ted had mentioned during his opening remarks in terms of the direction you’re going.

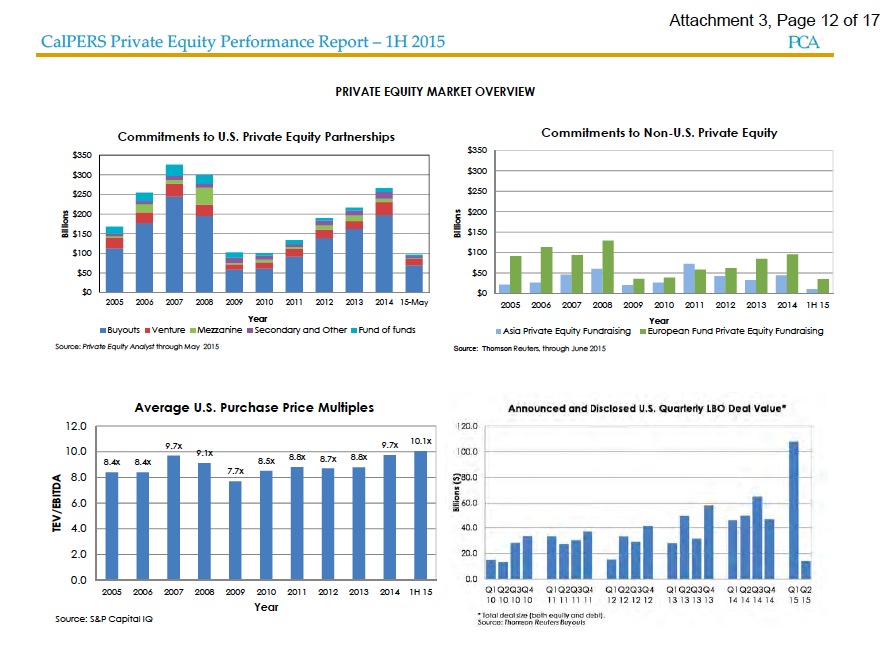

Moy is obliquely referring to the chart in the left bottom quadrant in his slideshow. You’ll notice how it is made less prominent by including it in a crowded page.**

Monoline insures of CDOs were also cognizant that risks were high in the subprime market from 2005 onward and also believed they were exercising “great discipline.” We know how much that served to protect them from the downturn. And when you eyeball the chart on the lower right, you’ll see the data also belies the claims of “great discipline.” If private equity buyers really were being more selective when prices are high, you’d expect that to translate into lower levels of transactions. Yet you can see the tremendous spike in the first quarter of 2015, and even when you average it with the apparent sharp drop in the second quarter, you still see an average level well above any of the previous half-years in that chart.

Naked Capitalism reader Jim Haygood was perplexed at how little attention CalPERS board members and staff gave to the state of the private equity market. From a comment earlier in the week:

As the WSJ reported last year:

Still, 40% of U.S. private-equity deals this year have used leverage above the six-times EBITDA ratio deemed the upper acceptable limit by regulators, according to data compiled by S&P Capital IQ LCD.

That is the highest percentage since the prefinancial-crisis peak of 52% of buyout loans in 2007. Such lending all but disappeared during the crisis but has risen each year since 2009.

These loans, provided by a group of banks, are often sold to a wider group of lenders and investors. Regulators are concerned that in the event of a financial downturn and diminished demand from investors, banks may find themselves stuck with large pipelines of risky debt.

In all the well-justified controversy over private equity fees, are board members even asking about embedded leverage?

As credit spreads lurch higher, leverage is about to become a very big deal indeed, both for PE partnerships and for the usual-suspect anencephalic banks who got stuck with their crapulous paper.

Actually, a lot of this “crapulous paper” will wind up in credit-oriented private equity funds, in which public pension funds like CalPERS also invest, as well as junk bond mutual funds.

It’s important to remember that the only reason the takeover boom of 2006-2007, which was the last time valuations were this rich, did not end in tears was due to the fact that the “rescue the banks” programs of ZIRP and QE by design greatly lowered borrowing costs and also drove investors into risky assets, helping takeover activity and thus deal pricing. The access to cheap funding allowed private equity firms to refinance loans that were set to mature in 2012 to 2014 that most observers had otherwise expected to produce a wave of bankruptcies.

In other words, the Fed bailed out private equity. Yet even with that assistance, the industry has shown mediocre returns and is again making acquisitions at price levels that historically have proven to be bad bets. And with interest rates as low as they are now, and the Fed champing at the bit to increase rates, there will be no central bank deus ex machina to recuse private equity from itself this time.

PCA’s Unconvincing Defense of Its Work

Finally, several readers pointed out that Moy’s reference to a newspaper or magazine article that charged PCA with “shilling” for private equity managers was clearly a reference to our post: Leading Pension Consultant PCA Shills for Private Equity Firms in CalPERS/CalSTRS Carry Fee Row. We continue to be The Blog That Must Not Be Named, but we also wonder if upgrading us to the status of a print publication was meant to misdirect the curious from the post in question.

We encourage you to read the PCA memo at issue, which is embedded in the post, as well as our close reading of it in the text proper. We think you’ll agree, particularly in light of the further evidence provided by PCA’s performance in the Investment Committee meeting, that our conclusion then still stands:

So if you want to know why limited partners like CalPERS are so cognitively captured by private equity, you don’t need to look much further than the complacent consultants they hire to get “objective” advice. It’s hard to find solutions when even supposedly independent professions find it more expedient and/or more profitable to be part of the problem.

____

* Public pension funds like CalPERS are not subject to ERISA but the overwhelming majority choose to comply with it.

** Note that PCA placed also placed this critically important chart in the part of the page where it will get the least attention. As this article explains:

The Gutenberg diagram is a concept that maps out something called reading gravity. Reading gravity describes a habit of reading in the western world: left to right, top to bottom.

It suggests that the bottom left area of the page will get least attention as our eyes scan the page from top left to bottom right and that our glance would end up in the lower right portion of the page.

Dear Gov. Brown,

I’m certain you would like to eat your lunch. Yves is coming to take it. You have been warned.

Note to CalPERS: I hereby offer to become your next Pirate Equity investments manager. I’m pretty sure I understand this stuff better than Real, that faker, and all ther rest of your staff, after having followed Yves’ work for awhile now. I’ll work for cheap too–I’ll take 60K a year–and even move to Cali, if I have to. Also, I’m not a dissembler like these consultant goofballs. If you’re doing stupid sh*t with your money, I’ll tell you about it, scout’s honor!

You guys obviously need some help and while normally I would never consider living in California, I’d make an exception in your case, since you’ve obviously got a shortage of intelligent, honest people to choose from and it’s getting pretty pathetic watching this whole farce.

I’m serious, 60K a year and moving expenses is all I ask. Yves’ got my email address if you want to schedule an interview.

Actually, CalPERS should try to hire this gal (from today’s link on Pope Francis and Catholic Economics):

This post is a must read.

I’ve the strong impression that the PE/PCA/PensionFund relationship is like the Subprime CDO/ratings agencies/PensionFund relationships. As everyone who reads NC knows, in the subprime CDO case the issuers of subprime CDO debt (Magnetar’s Trigris Fund being the poster boy) paid the ratings agencies for their credit evaluations. Standard & Poor’s and Fitch both initially gave Tigris good ratings based more on hope than on analysis. With a good rating from 1 or 2 of the big three ratings agencies the CDO’s were deemed a safe buy by Pension Funds, index funds, MM funds, etc.. The sound rating shielded the CDO buyers from charges of negligence and let them avoid doing their own due diligence. It all worked, until it didn’t.

In the case of PE it’s the PCA who has a profit incentive (but not a quid-pro-quo) to be uncritical of PE offerings, and the Pension Fund Board can use the PCA’s recommendation to shield them from charges of negligence.

Didn’t the Pension Funds learn anything from the 2008 debacle? Do they think this time it’s different?

What might a better way look like? (Same goes for other kinds of financial advisers, large and small)

Are there other models to ensure skin in the game for PEs (i.e. non-leveraged skin)?

How to make the consultants’ fees linked to outcomes? (Or would it be better to just get rid of the consultancy role, and/or change the laws so that LPs can’t rely on consultancies to give them a Get Out Of Jail Free Card, and so that consultancies cannot write contracts in ways that give themselves a Get Out Of Jail Free Card. (And would this require legislation at state level, or national? And/or regulation by other captured entities?)

How can pension funds avoid being held hostage by captured entities of one kind or another? Is it possible in the existing system?

That’s absolutely the right question. How do we prevent intellectual capture, why involve PE at all? Is the entire game rigged?

The tell that PCA is totally captured by PE comes from Andrew Bratt’s remark (shortened for clarity):

I know that your benchmark shows that PE performance sucks but why don’t you try our PESOI (*) instead. We guarantee that you’ll feel soooo much better.

At that point the Committee’s – non-captured – remarks should have been on the lines of:

Thank you Andrew for your valuable input … please send your (egregiously huge) invoice through the usual channels … Now could we move on to our next speaker (or agenda item).

Interesting question: Could the choice of inappropriate benchmark constitute a failure of fiducial duty ?

(*) Private Equity Snake Oil Index

On page 13 of the linked slide show, a chart of “Average U.S. Debt Multiples” (debt/EBITDA) appears twice. These are industry-wide figures reported by S&P Capital IQ.

But what is the debt/EBITDA ratio for CalPERS’ own PE investments? Chances are, due to their inability to ‘drill down to the underlying,’ they haven’t a clue. Probably that should have been the second chart. But when CalPERS staff requested it from the GP, he whacked their hand with a ruler and said, ‘Get outta here, punks.’

Anyhow, using the generic 5.5x multiple reported by S&P, we may ask ourselves: is that high? An April 2013 article in CFO has this to say about that:

So bank covenants limit debt/EBITDA to 5.0x, while the PE industry as a whole is above the redline at 5.5x? AH HA HA HA. As Towers Watson is quoted above, “…investors are often paying up for leveraged beta (market returns multiplied by gearing).” That means in the next recession, they get leveraged losses.

Obviously, no one could possibly foresee such an outlier event occurring.