Five years ago this month, GMAC became the first mortgage servicer to announce that they would suspend foreclosure operations, due to irregularities in their document preparation. Within a few weeks every major mortgage servicer in America followed suit. This is usually called the robo-signing scandal, but to be more precise we gave it the name foreclosure fraud. It ended with the five leading servicers, including GMAC, signing the $25 billion National Mortgage Settlement.

Except it didn’t end, and this past week I was handed inconvertible proof of that fact. The scenario is so fantastical that if I didn’t have a working knowledge of foreclosure fraud I wouldn’t have believed it. But it appears to be very real.

Bill Paatalo is a former cop who worked in the mortgage industry as a loan officer and, from 2002-2008, the President of Wissota Mortgage in the Midwest. Since 2009, after experiencing his own mortgage trouble through a loan with Washington Mutual, he became a licensed private investigator specializing in securitization and chain of title analysis. He testifies as an expert witness, working with foreclosure defense attorneys and pro se litigants.

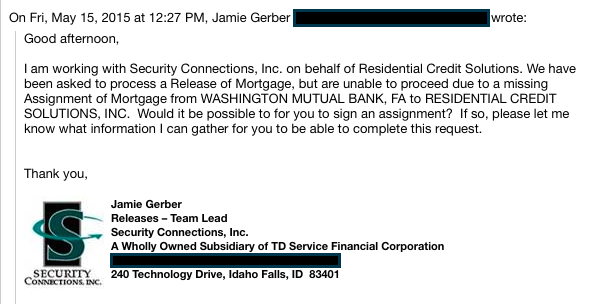

On May 15, Bill got an email out of the blue from Jamie Gerber, “team lead” for a company called Security Connections. Here’s that email:

To back up, Security Connections, of Idaho Falls, ID, is a document services provider for major mortgage companies (their motto: “Bringing you peace of mind”). Bank of America used Security Connections years ago on mortgages originated by First Franklin Bank. We have this deposition of Security Connections robo-signer Krystal Hall, who admitted to signing 400 assignments of mortgage per day without knowing any underlying information about the transactions. That deposition is from November 2009, so they’ve been at this a while.

This brief description of Security Connections from job site Indeed.com helpfully explains that “if you are missing documents or need a mortgage recorded, we have a highly trained department with the skills to locate and record these documents.” They add:

With the implementation of many privacy laws, SCI is extremely sensitive to the needs of our clients. We understand that client-provided information supplied to us for the purpose of completing contractual obligations must be safeguarded. SCI goes the extra mile to satisfy and ease the concerns of our clients while still maintaining a low cost structure.

So this is a third party document processor, designed to give mortgage companies plausible deniability for fabricating mortgage paperwork. And they’re coming to Bill Paatalo, a known expert in fighting foreclosure fraud, to get him to forge a mortgage assignment, so Residential Credit Solutions can get clear title on the mortgage.

Why? Don’t they have their own teams of signers to do this work? When I talked to Bill about it, he noted that he has been solicited in the past to identify deficiencies in mortgage documentation, kind of like a hacker being asked to identify vulnerabilities in an IT system. This seems different – perhaps entrapment, getting Bill’s name on a forged document to prove his culpability in foreclosure fraud and ruin his credibility as an expert witness. More likely, Jamie Gerber just needed an assignment involving Washington Mutual, Googled the company, and Bill’s name came up because he has WaMu expertise.

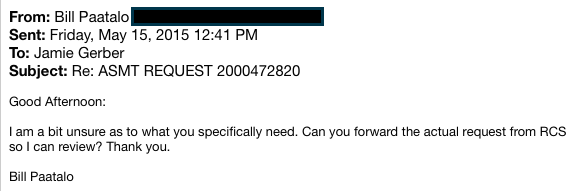

Little did she know that Bill was pretty savvy in these matters. Here’s his response, playing dumb to reel in more information:

Bill, who never had any dealings with Security Connections before, wanted to see the Residential Credit Solutions request, because it would show their authorization to fabricate the document. RCS, by the way, just got nailed by CFPB for “failing to honor modifications for loans transferred from other servicers” and “treating consumers as if they were in default when they weren’t.” They paid $1.6 million in restitution and civil penalties. The company, specializing in servicing delinquent loans and based in Fort Worth, Texas, only has $95 million in total assets.

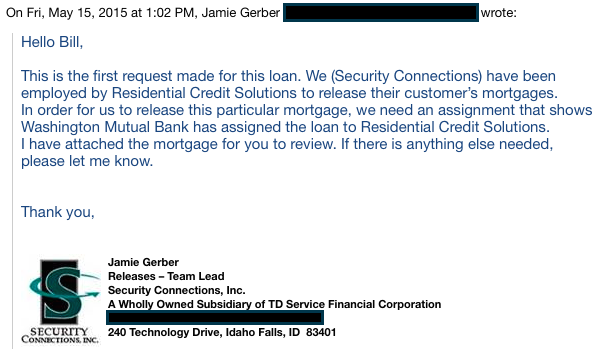

Here’s Jamie Gerber’s reply:

A quick note: a release of mortgage could happen when the mortgage is paid off, or could also happen in a “deed in lieu” foreclosure, where the family gets a release of mortgage and agrees to hand over the home without debt. Given Residential Credit Solutions’ profile as a delinquent loan specialist, the latter is more likely in my opinion.

RCS clearly hired Security Connections to clean up their documents. They want to acquire this property, but can’t resell it without the missing assignment, so Security Connections was asked to fill in the blanks on the chain of title. This will allow RCS to basically steal this property in a deed in lieu foreclosure, when they wouldn’t be able to foreclose on this borrower in a court, for example, without that assignment.

And as noted in the email, Jamie Gerber handed this stranger the borrower’s mortgage (actually the note), confidential information in potential violation of privacy laws. So much for “We understand that client-provided information must be safeguarded.” I won’t make the same mistake, though I will tell you that the home is in West Haven, Connecticut, and the 30-year fixed-rate loan was taken out on January 22, 2002 for $134,400. The borrower’s signature is on the note.

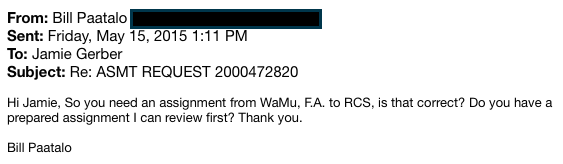

So Bill tries to draw out more information.

Since they just asked him to fabricate an assignment from scratch, Bill is clearly looking for some template, some example of what Security Connections does. Here’s Jamie’s reply, a couple weeks later (things must have gotten busy in Idaho Falls):

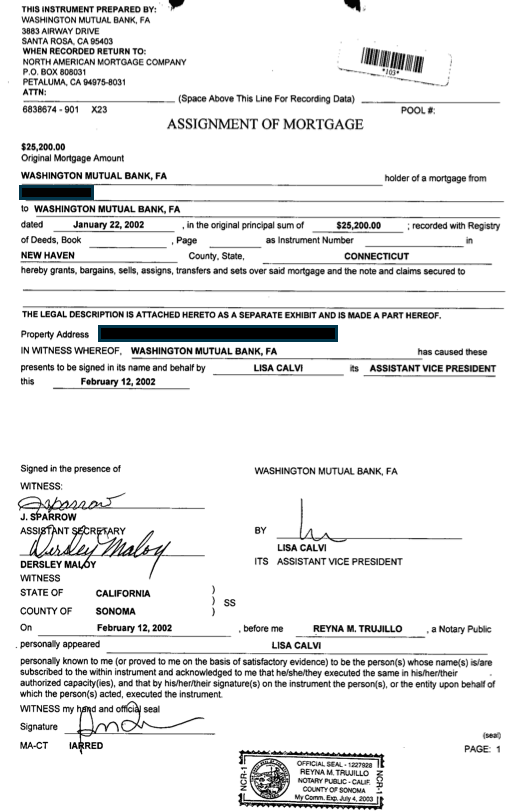

So yes, Jamie sends along a mocked-up assignment of mortgage, with blanks for where Bill can add the name “Residential Credit Solutions.” A notation under that line says “The legal description is attached hereto as a separate exhibit and is made a part hereof.” That separate exhibit would have been Bill’s responsibility. The assignment is pre-signed by Washington Mutual officials and pre-notarized, with a notary stamp. My guess would be that Security Connections is using some old assignment and repurposing it, with the recipient of the mortgage’s name to appear later. The discrepancy between the amount due on this assignment ($25,200) and the amount on the note ($134,400) helps give it away. “It was basically filling in a document that would appear as though it was done in 2002, on behalf of WaMu, which has been dead since 2008,” Bill told me. Here’s that mock assignment (I blacked out the borrower’s name):

This is a solicitation to commit a felony, to fabricate a mortgage document, presented in such a way that it looks like a fairly routine practice. My suspicion is that these fake assignments allow Residential Credit Solutions to secure properties in deed-in-lieu foreclosures that they would otherwise not be able to do anything with, because they would not have a full chain of title. That’s theft, or foreclosure fraud, if you prefer.

Bill’s experience is that document fabrication continues at the same rate that it ever did. “They can sign settlements, but as long as no one is going to jail, it’s a profitable business venture,” he said. “What I believe is that nobody knows who owns what, so the only thing they can do is recreate chains of title. They’re marching this garbage into our courtrooms on a daily basis.”

Don’t hold your breath expecting anything to come of this; state and federal law enforcement washed their hands of foreclosure fraud long ago. But we should recognize that it continues unabated.

Hundreds of years ago, a name for folks who could be bought to provide false testemony / witness for a fee were called ‘Men of Straw’ because they would advertise their trade by placing a piece of straw in their shoe while hanging out in the court hall. Today it’s called robo-signing or some quaint English word other than fraud or criminal activity.

RICO. Soliciting criminal activity.

The first, IMHO, men who perverted the laws through false testimony and false swearing since the Magna Carta was signed were The Men of Straw….it was the original sin in the context of law. That, today, a company or companies advertise (like the straw of old) their services (Ct loan Solutions and too many to name others) to create mortgage transfers, servicing rights etc. based on manufactured documents and Notarized affidavits in violation of Notary laws, done for a fee and submitted to courts with knowledge of it’s illegality, it’s fraud upon the court should, in my view, outrage and disturb the entire legal profession, especially judges who are being hoodwinked through a wall of Legal BS into subverting the very foundations and trust of their calling. For what? a justification of the neo-liberal economic system – the parasite (as Micheal Hudson has said in his new book) that feeds upon the commons – the host, who through the convolutions of law, is not recognized by the body as a parasite but, instead, a part of the body until finally, the parasite kills the host.

Well put, Tom.

Though the federal government appears to have washed their hands of these crimes, I am continuing prosecution efforts on their behalf. http://www.phhmortgagemustbedestroyed.weebly.com

no…it seems trujillo is still a california notary…extended thru 2018…witness maloy seems to have died in 2007…

some how posted to wrong comment…meant for comment below

Bless your heart, Mr. McCrae, for your efforts in trying to bring justice to those fraudulently foreclosed upon. You are tilting at windmills, you know, but your work is most admirable.

Reyna M. Trujillo, the notary public, doesn’t show up in a google search…

Is Bill Paatalo planning to send this on to the CFPB? What other options are there? A qui tam lawsuit against Residential Credit Solutions or Security Connections?

That’s hilarious!!!

Like the CFPB gives a shit.

it is a set up against bill…in his “loss” last year in federal court in montana, he got a ruling the industry is terrified of…one which I have been waiting for a jurist to finally make…

as to the set up…it is an attempt to discredit him so that if and when anyone notices his “victory” it can brushed aside…

look at the fine print of the emails…get beyond the robosigning…dykema

dykema is the orange county foreclosure king who made sure former congressman christopher cox became sec chair so he can do a mister magoo on enforcement of sec rules in respects to securitizations and derivative disclosures…

dykema owns td service financial…the parent of the company sending the emails to bill…

trust deeds are NOT mortgages…but the ftc will never go after lenders for false advertising…a trust deed is a conditional sales transaction…like a rent to own with an option to buy…mortgages have certain consumer protections…trust deeds do not…half the country is infested by trust deed financing…

in a trust deed state there is no “equity” argument since there is usually no judge involved in the home “repo”…it is very much like a car repo…we pop the lock and drive off with it…

but in these ucc-1 type home financings…most lawyers homeowners use have no background in commercial finance transactions and are not aware of the mountains of historical case law which requires extreme specificity and exacting detail with which to invoke ucc-1 type shortcuts to take a home where the payments are in arrears…there are cases in almost every judicial district where a business owners lawyers were able to make a lender cry when they showed a judge the bank employee made a fatal typo on a UCC document filed with the state…

bill is not the only person being targeted to be set up as we speak…

so the first step in fighting a “trust deed” foreclosure is to force the case into a judicial foreclosure by pointing out a defect in the trust deed…

example…in texas, if someone dies the lender can not move to take the home via trust deed trustee sale…

why…because the contract requires the specific second party to be available and the party to the contract doesn’t exist anymore…

sadly, most lawyers in trust deed states are not aware enough of that possibility to invest the time and energy required to provide the admissible evidence to force the case into a judicial foreclosure…

so what was the gift bill has given(or maybe we should say the judge used bill’s loss to lay down the prerequisite) via his lost federal case in montana ?

bill made an argument and had provided enough detail so the court specifically noted that the error in the captioning was “fatal” in respects to the party foreclosing and they should have been forced to foreclose in state court instead of using the trust deed trustee sale process…it does not seem like bill asked for that relief so they could not “give” it to him…but they were sending up a flare for other lawyers to see…

so now you know how bill saved the world…the world just doesn’t know it yet..

oh wait…I guess now they do…

happy hunting lps… and a happy hello and how are ya to my friends at the usfn…don’t choke on your lunch today guys…it ain’t over til it’s over…

What kind of genius concocts a scheme like this? Under the facts as described in this case, it ought to be possible to legally cure the defects in the chain of title so that the homeowners can get their release. But emailing a perfect stranger to the transaction to solicit his participation in fabricating documents to be signed under oath? Bizarre

Why do you give credibility to a known securitization audit scammer, who couldn’t even keep his own home.

http://www.cpapracticeadvisor.com/news/11294791/homeowners-being-duped-by-securitization-audits-according-to-fraud-examiners

http://mortgageattack.com/law/securitization/

“Rock” …. hmmmm. Never seen you post here before. Wonder what bank, er, criminal you work for?

“Rock” is perhaps linked to Bill Paatalo’s competition, the “crime fighting duo” of Storm Bradford and Bob Hurt who’s two articles are linked directly back to Storm and Bob in the two links provided.

They do not espouse securitization and third party beneficiary arguments as viable, but to attack the initial loan fraud or contract deficiciencies by the lender…

And the fun never ends in foreclosure fraud land….

Retired but amused.

Bob Hurt and Storm Bradford article links, direct competitors to Bill Paatalo.

The fun never ends in foreclosure fraud land.

My thoughts exactly….

rock …seriously…three reebees may make a tribunal but three florida notaries do not make a judge…you are the company you keep…seriously shouldn’t you be posting on zh or helping jim marr find some secret ancient alien technologies…or visit the 8 hairs with mr Ickes at shwe dagon??

Rock “coincidentally” has his office in the same building as the crooked operation known as MERS. I suppose they compare notes, being just down the hall from each other. He just works for the servicers, banks, and MERS. Ignore everything he has to say.

In nonjudicial foreclosure states such as I practice in, the debtor has to bring the lawsuit to stop the mortgage and so has to prove standing. Both the federal and state courts are interested in just two things: 1) Did the debtor sign a note, and 2) did the debtor sign a deed of trust? If the answer to both of those is “Yes,” nothing else is going to matter. Since the debtor is attacking the untimely transfer of the deed of trust into the REIT under the PSA (really the only point of attack available), these cases get dismissed out of hand or disposed of on summary judgment.

On the other hand, in relief from stay proceedings in the bankruptcy courts it is the creditor, not the debtor, who has the burden of proving standing. Since this is a federal court, the requirement is constitutional; the creditor must show it has a real case or controversy. In this scenario, arguing ultra vires under the PSA is a defense, not a request for affirmative relief. The debtor is simply saying this creditor does not have the case or controversy and so lacks standing. The problem is, as I’ve noted here and elsewhere, that the bankruptcy courts are ignoring this distinction, ruling that the debtor does not have the authority to defend himself, and allowing creditors to proceed without standing. This means debtors have NO forum to defend against creditors who aren’t legally creditors.

It isn’t going to end until the patented software programs are prohibited and confiscated. The computer software is actually doing the business – from origination to REO. It is described in the 1003 loan application software patent as “seamless automation”. So, if we want this to stop we have to demand that their software and all of its encryption capabilities be exposed and disposed.

Deadly Clear, it ain’t gonna end until some of these crooks and thugs wind up with

three hots and a cot.

DeadlyClear, where can I find out more about this?

“What I believe is that nobody knows who owns what, so the only thing they can do is recreate chains of title. ”

And that’s why they’re getting away with it: if they don’t, the entire property title system falls apart, and some of the lenders and processors go broke. Furthermore, from the court’s point of view, they go from routine processing to a gigantic can of worms. So they funk it, justice and law be damned. Anyone been in a local court when they were asked to question the standard procedures? I have. The judge stopped paying attention about half-way through (our lawyer was none too good) and confirmed the rubber stamp procedure. That’s what they do, unless you encounter a rare individual.

Yeah, that seems to be the conundrum. Our legal system has almost completely embraced the rubber stamping approach to justice.

HART KING LAW FIRM COVERING FOR ARROWHEAD MHP IN GLENDORA CA

HCD IS HELP ING WITH FALSE TITLES

I M HOMLESS..NOW PARK MANAGER HUSBAND STOLE EVERY THING IN MY HOME…WHERE IS THE BEEP BEEP JUSTICE..I NEED HELP I M THE FOURTH PERSON TO LOSE HOME

rmonterastelli50@ gmail com I NEED an atty

THE remedy is for some good and proper judge to simply award title to any home to the homeowner/occupier whenever chain of title cannot be determined. The house goes to the person(s) in the house fully and unconditionally.

AND send fraudsters to jail. No exceptions.

Is there a word for when fraud becomes so pervasive that the perpetrators don’t even realize that it is fraud anymore?

Don’t they call that “finance” ?

Yes – “Costanzadized”

“Jerry, just remember, it’s not a lie if you believe it.”

– George Costanza

The borrower’s address is visible in the 6th image. Might want to redact that, as with the address the borrower’s identity can be found through an assessor.

Yet more proof the law is sacred only to schoolchildren and the working class who still believe in fairy stories. Though we might wish otherwise, the law is just a different kind of war, a weapon wielded against those too poor to fight back.

Naked Capitalism: “This is a solicitation to commit a felony.”

Mortgage Industry: “And your point?”

Really excellent post. That people even enter this market baffles me. I guess they have no choice….

Using documents that lie, as false proof, is not new.

The conviction and execution of Urbain Grandier for “witchcraft” is one historical example. Among the … er, um, evidence used to convict Grandier was a written pact purported to be between he and the Devil. The pact was later proved to have been written by Mother Superior, Jeanne des Anges, the primary accuser of Grandier. Such later proof was of no benefit to Grandier as he’d already been burned at the stake.

381 years later and despite of oodles of technological sophistication our courts still have difficulty in discerning which documents lie, and which are truthful.

More on Urbain Grandier, and “The Devils of Loudon,” is found here:

https://en.wikipedia.org/wiki/Loudun_possessions

Always good to hear from Stupendous Man, who knows a thing or a thousand about foreclosure fraud.

Always good to hear from Stupendous Man, who knows a thing or a thousand about foreclosure fraud. And obscure witchcraft verdicts.

I shouldn’t be surprised, but I am. One would have hoped that the last get out of jail free settlement with lenders would have included provisions for very stiff penalties if practices like robo-signing were to reemerge. And yet here we are. Document forgery in the name of theft.

I’m curious where this particular case goes. Thanks for posting it and following this beat.

Documentation isn’t what stopped the foreclosures; fear of taxes did. The banks had already made hash of pooling the mortgages for the REITs at the heart of these investment plans, and a reasonable reading of the regs indicated that foreclosures were likely to further expose the trusts to tax penalties. When the IRS indicated it would give the REITs a free pass in spite of their gross noncompliance, the foreclosures restarted.

The most interesting part of this is the “outsourcing of criminal liability”. No doubt RCS never explicitly solicited SC to engage in anything below board. Similarly SC themselves are unwilling to get their hands dirty directly and are outsourcing the actual forging of these documents.

I would suspect these laywers of “legal insulation” also take place within these companies. Employees are given vague instructions, legalities go unscrutinised, good faith is stretched past breaking point and above all no real paper trail is left courtesy of the digital age. These companies can be liquidated and erased in clicks. I doubt any actual serious work is even done within the US itself,more than likely emailed abroad for further insulation purposes.

A hungry DA could this whole scam alive. Unfortunately most DAs are too well fed.

Great Post! I wish I could say I found this surprising, but I don’t anymore. It’s obvious these days that all of the worst practices that lead to our most recent financial crisis have been revived with heavy encouragement from our government. Seven years of ZIRP, no prosecutions of banksters, deliberately ineffective revolving door regulators who issue a few bare-minimum, cost-of-business speeding tickets and a legal title system that is such a putrid can of worms that one dares to wade into the mess for fear of collapsing the entire system or being targeted by it. What else could be expected under these circumstances? It’s past time for us to clean house in this country, but first the financiers who corrupt our elected officials, judges and regulators must be brought to heel.

did anyone notice that the notary’s stamp indicates her commission expires July 4, 2000 YET the instrument/assignment is dated Feb 12, 2002?????

I think it may be 2003.

I’ve been going down this road for 8 years with Wells Fargo and the Wisconsin Circuit courts and the Eastern District of WI affirmed by the almighty Seventh Circuit. What a bunch of criminals. Don’t think for a minute the judges aren’t in on this scam. Thanks David.

Anyone able to interpret this 2010 deal between FDIC and Dennis Stowe, President/CEO of Residential Credit Solutions? It’s $169B and it’s not RCS.

https://www.fdic.gov/buying/historical/structured/AmtrustNP/Reissuance_Purchase_Money_Note.pdf

Helps to know how Stowe and RCS made off like bandits in the first PPIP auction in 2009. This is James Kwak on the topic.

http://baselinescenario.com/2009/09/24/just-baffling/

I wonder if was an insider deal. Stowe was at Niagara and Saxon. There was a Niagara guy at FDIC but I’m not sure he overlapped with Stowe there (Theodore something; deceased.)

Propublica presented US Treasury data which shows RCS getting $42.8M to modify loans in 2009 and by mid 2015, having spent $3.4M on borrowers, and $3.8M on itself to get the job done. I’ve seen elsewhere they got an additional $16M, which is $58M, a decent chunk of their $96M. Here’s their free money’s use graphed on a blog:

http://homeburglarz.blogspot.com/p/what-did-dennis-do-with-his-42800000.html

Here they are not following HAMP properly–putting the wrong figures into a calculation that then dooms the mod. If they have been doing this to everyone it ought to blow sky high.

http://pasteboard.co/msJEoEQ.jpg

The FDIC’s press release after RCS got the first PPIP deal stated that RCS would implement HAMP. Was it a contract? because they do not do it. Witness CFPB’s slap, and the wrong data used to calculate allowable forbearance:

https://www.fdic.gov/news/news/press/2010/pr10160.html

I’ve searched the net looking for sentences like “RCS finally modified my loan.” No luck.

Ahh america the fraud capital of the world.Can you imagine these fraudster lawyers , servicers,judges and banksters go home and feed there family and buy things with all that money that is stolen from throwing families out of there houses and the judges and our government protect them what bunch of slime bags they should hide there face they are all a disgrace to the human race, thats all part of a big scam that our government is invoved in what a disgrace,THEY ARE ALL LIVING LARGE WITH STOLEN MONEY.I,m having the same problem here in new york with a servicer rushmore loan management they have all fabricated and forged document

I don’t get it – What am I missing? Why would Security Connection reach out to Paatalo, a complete stranger with no connection to WAMU or RCS? Why would they think a complete stranger would sign an assignment of mortgage between entities with which he had no connection? What would be the stranger/Paatalo’s motivation to become involved in such a fraud, such that Security Connection thought it would be productive to reach out to him? Was there a missing email where Security Connection offered money to the stranger/Paatalo for his cooperation?

Perhaps they ran out of people who were willing to commit fraud on their behalf, leaving them to resort to mere strangers, alas. Maybe the FBI is a good place to turn over this complaint. Because there is nothing “civil” about this story. It is criminal to the core. Thank you for sharing this troubling tale. The legal system is so broken, I think it may take us doing peaceful demonstrations at the trial court steps where everybody holds up signs that say, Remove Judge so and so from the foreclosure bench, and demand regulators review all rulings from that judge. Or bring a lot more people to court to watch the cases so they pack in just to watch and scrutinize the judge. We could also do a nationwide “flash mob” concept where we all send out a TILA rescission letter in the same week to our servicer pursuant to the Jesinoski unanimous decision of the Supreme Court, in January 2015. The servicer has just 20 days to file a lawsuit to contest your rescission. A rejection letter does not work for them. The reason it is worth a try is because the true lender has still not appeared even years later so the loan was never truly consummated right, because we know now that CW did not lend us a dime. They impersonated a lender and were paid a fee to do so. If we all do TILA in the same week, they won’t know what hit them. And Supreme Court ruling trumps all courts. They gave the borrower a way out of this circus with a non judicial remedy. The servicer must file a lawsuit to challenge it and first they have to prove they have standing, which they can’t do without more robosigning. And 20 days is a short time if thousands of rescissions come in all at once. Neil Garfield details the requirements at his blog. What may be our last resort, is looking like the best resort. The high court gave us a weapon to fight back. If the “lender” was just an impersonator, who did I sign the collateral of my house to? The chair has nobody in it taking the position of the lender. We may as well have been sitting with a masked marauder who was waiting till our signature ended up on the note, ready to steal our signature to enrich themselves and their other hidden partners in crime. If a loan only needs to be paid one time as per the mortgage contract, because overages in many parts of that document get paid back to the borrower, maybe there are overages due to us because we were a party in interest when the loans got paid off over and over again. My bankruptcy judge said, its an interesting proposition, but then he shrugged it off.

A servicer might, for example, deny a loan modification to a borrower because it also owns a second mortgage on the same property and doesn’t want to write down that asset, as required in a modification. Levying outsize default fees is another tactic — the fees typically go to the servicer, not the lender, but they can still propel a property into foreclosure more quickly. And foreclosures aren’t a good outcome for investors.