Lambert here: The article concludes with these words: “Liquidity is a latent variable and as such, policymakers are better off making extensive use of soft information and qualitative tools.” Hmm. That sounds very much like a plea — from Citi, no less — for light touch regulation. Readers?

By Matteo Regesta, Interest Rates Strategy, Citi, and Alessandro Tentori, Head of International Rates Strategy, Citi. Originally published at VoxEU.

Market liquidity is all about smooth and rapid executions of large transactions. But why is it hard to keep big markets liquid? This column looks at liquidity in fixed-income markets, assesses new trends (as well as the EU’s new market instrument rules), and makes recommendations to policymakers to avoid illiquidity – a timely reminder that the social costs of illiquidity should not be underestimated.

Market liquidity is often defined in terms of the smooth and rapid execution of large transactions. However, there is no guarantee that large and frequently trading markets will stay liquid under all circumstances. With the introduction of the EU’s Markets in Financial Instruments Directive 2, known as ‘MiFID2’, time-varying market liquidity is quickly becoming a key feature of large and deep fixed-income markets (such as the market for European government debt). For example, trade transparency rules require the regulator to provide a robust model of bond liquidity. Incorrect liquidity calibration could lead to a large number of ‘false positives’, i.e. illiquid bonds which are defined as liquid.

This matters not only for end investors, but also for market makers who ultimately provide liquidity to markets.1 Disclosing a transaction in an illiquid security exposes the dealer to liquidity risk in addition to market, credit and operational risks. Hedging liquidity risk is always problematic and often even impossible. The dealer’s rational response might vary from not quoting at all to maximising the bid/ask spread, reducing the trade size or a combination of the above.

Liquidity risk gives birth to one of the paradoxes of regulation in fixed-income markets – the aim for more transparency might depress market liquidity and distort the price-finding process, with the ultimate collateral cost of reducing transparency. Fixed-income markets mainly differ from equity markets in terms of the number of securities per issuer and the resulting fragmentation and bifurcation – the splitting in two – of liquidity.

Measuring Liquidity in European Government Bond Markets

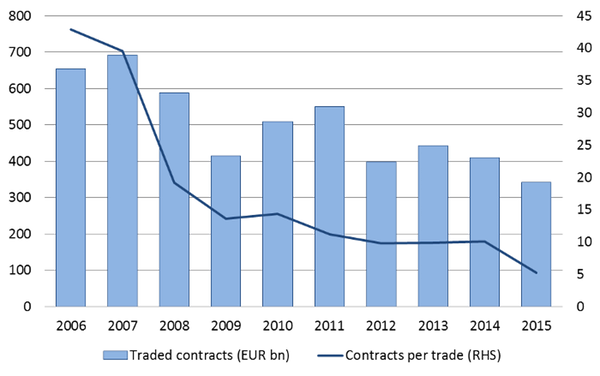

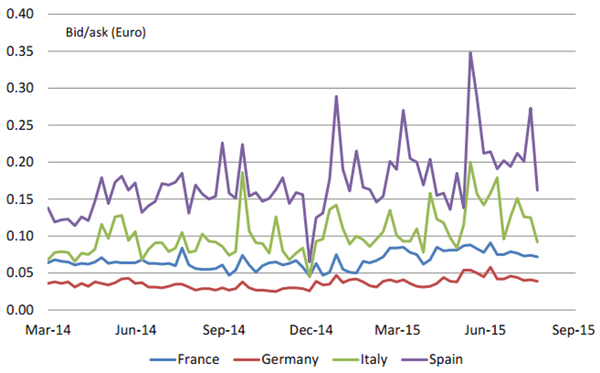

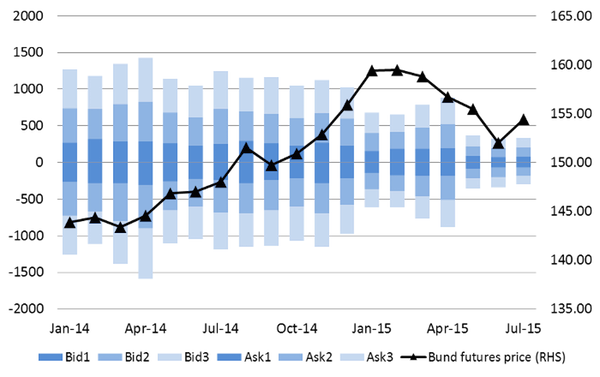

Measuring liquidity in markets for liquid fixed-income securities is not straightforward. Based on various measures, Regesta and Tentori (2015) suggest that liquidity has been on a declining trend for some time. For example, both traded volumes in Eurex fixed-income products and the number of contracts per trade have been on a long-term declining trend (Figure 1). In contrast, we don’t have clear evidence of a change in market structure by looking at bid/offer spreads (Figure 2), which creates some degree of ‘liquidity illusion’ in our view. In fact, a more granular analysis of the limit-order book for Bund futures suggests that top-price level liquidity has declined significantly during the course of this year (Figure 3).

Figure 1. Declining volumes on markets for fixed income futures

Source: Eurex.

Figure 2. Bid/offer spreads on electronic markets for European government bonds

Source: BondVision, MTS, Tradeweb

Figure 3. Measuring market depth

Note: Data shows the average daily sizes for Bund futures (in number of lots) available from the exchange at the top price level, i.e. the best three bids and offers.

Source: Eurex.

Analysing the Drivers of Market Liquidity

A decline in market liquidity creates major challenges not just for bond market participants (short term) but also for the financing structure of the economy (long term). We find that several forces might be having a negative effect on liquidity conditions:

- Financial regulation: According to the UK Department for Business, Innovation and Skills, we are already seeing the negative effects of regulation on fixed-income markets, that is, a declining allocation of capital to market-making activities and a reduction of inventories (Fender and Lewrick 2015).

Furthermore, future changes in existing risk-management rules might trigger additional pressure at the microstructure level of European government bond markets. For example, we should not assume that sovereign debt will always be treated as a zero-risk weighted asset, as is the case under Basel III regulation.

- Monetary policy: While there is a rich debate about the effect of quantitative easing on market liquidity (see Kandrac 2014, Christensen and Gillan 2015), we don’t need models to understand that when a central bank manages in excess of 20-25% of the outstanding volumes in any market, the demand/supply equilibrium and the overall liquidity conditions will most likely be affected.

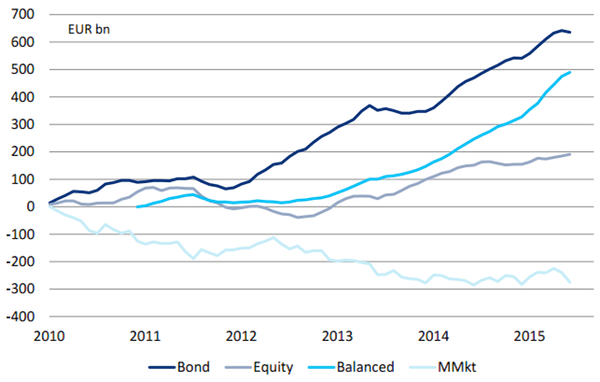

- Asset management: The European investment fund industry has seen a stellar growth in assets under management in recent years – total UCITS assets have increased by €3.6 trillion (65%) from December 2011 and by €4.6 trillion (102%) from pre-crisis levels.

Relative to 2011, sizeable growth has come from bond funds (€566 billion) and balanced funds (€475 billion), while money market funds have suffered about €118 billion in outflows (Figure 4). The importance of fund managers as “T+1 liquidity providers” should not be underestimated. The liquidity transformation function of the asset management industry could become a systemic issue in case of large and fast redemptions. In theory, investors who invest in mutual funds have also purchased an embedded liquidity option – the fund manager has a skew towards investing in less liquid instruments, while at the same time providing quasi-ready liquidity to his investors.

Figure 4. Rapid increase in assets managed by mutual funds

Source: EFAMA.

The Micro-Structure of Bond Markets

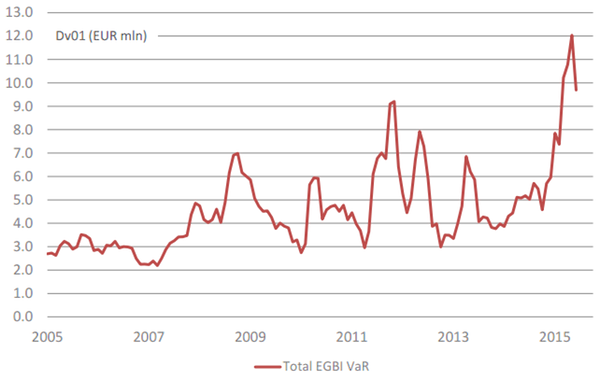

So far, so good, but why should we be concerned about liquidity issues? Liquidity is essential for the functioning of markets. A simple example illustrates the point (Tentori 2015): think of the market as a queue in which new arrivals (e.g. the primary market) and existing servers (i.e. market makers) are in equilibrium. In the case of sovereign debt, this stylised process can be described as new risk being created regularly by sovereign debt management offices – the risk is absorbed by market makers and then smoothly distributed to end investors. In order to process both new and existing risk, which is already at historical highs (Figure 5), market makers rely on customer flows (agency model) as well as on their risk limits (principal model). The ability to trade liquid instruments is essential for the hedging of large bond flows in a quote-driven market. If the regulator reduces the number of servers or fully prohibits principal trading, thus limiting dealers’ aggregate risk-processing capacity, then we might face the risk of congestion resulting in wider bid/offer spreads, lower liquidity and eventually higher yields.

Figure 5. Evolution of the market risk of European government bonds

Source: Citigroup.

Conclusions and Policy Recommendations

The social cost of illiquidity should not be underestimated. Theoretical models of the term structure of liquidity are being developed, but in our view we are still far from a full understanding of the price of liquidity in fixed income markets.2 In any case, we advise policymakers to consider the following three points:

- Monetary policymakers should take into account the illiquidity bias when extracting market-based information.

Also, negative side-effects of illiquidity on policy transmission should be evaluated when optimising any given policy strategy. Loops between central banks’ liquidity and market liquidity should be carefully explored in order to prevent a decline in revenues at the industry level, which would have severe consequences for both primary and secondary market liquidity.

- Regulators should thoroughly asses the full range of positive and negative effects of new rules on the micro-structure of markets.

Fixed-income markets might already be in a negative liquidity trend. Contingency planning should also be an integral part of the preparatory exercise before the introduction of new financial regulation.

- There is no single indicator of market liquidity.

This identification problem adds a layer of complexity to trend analysis as well as cost/benefit analysis of policy innovations. Liquidity is a latent variable and as such, policymakers are better off making extensive use of soft information and qualitative tools.

References

AFME (2014), “MiFID Seminar”.

Christensen, J and J Gillan (2015), “Does Quantitative Easing Affect Market Liquidity”, Federal Reserve Bank of San Francisco, WP 2013-26.

Duffie, D (2012), “Market Making Under the Proposed Volcker Rule”, Stanford University.

Fender, I and U Lewrick (2015), “Shifting Tides – Market Liquidity and Market-Making in Fixed Income Instruments”, BIS Quarterly Review, March.

Kandrac, J (2014), “The Costs of Quantitative Easing: Liquidity and Market Functioning Effects of Federal Reserve MBS Purchases”, Board of Governors of the Federal Reserve System.

Longstaff, F (2014), “Valuing Thinly-Traded Assets”, NBER WP 20589.

Regesta, M and A Tentori (2015), “The Market for European Government Bonds: Trends in Liquidity and Market Micro-Structure”, Citi Research.

Tentori, A (2015), “Flow Equilibrium and Congestion”, Citi Research.

Endnotes

1 Duffie (2012), Longstaff (2014) and Fender and Lewrick (2015) provide us with an exhaustive description of the market making environment and the variables affecting dealers’ behaviour.

2 Longstaff (2014) proposes an interesting approach derived from options theory.

“That sounds very much like a plea — from Citi, no less — for light touch regulation.”

Sure seems that way to me. And related, it seems that they want to delink liquidity and risk. They seem to be saying that funds need to invest in riskier assets and that liquidity needs to be available for these and provided by central banks.

I think this gets into the earlier problems of bailing out insolvent companies rather than resolving them. Liquidity can’t just be used to bail out every financial activity. It has many more important uses.

Most retail brokers (Fidelity, Schwab, etc) still have a ‘Bond Department’ that you can call. Why? Because unlike with stocks and ETFs, bonds are not an online market where you can just make a trade with a keystroke. Nope, even for US Treasuries, the broker has to buy or sell a bond from a dealer and then post the trade to your account. This can take a few minutes, even if you enter the order electronically.

We can only hope that the brokers and dealers have backup supplies of tin cans and string to keep communications humming in case of what economists euphemistically call an ‘exogenous shock.’

Another bizarrity is that the retail brokers’ platform for trading Treasuries can’t handle negative interest rates. When real rates on longer-term TIPS went negative in 2012, every TIPS trade had to made with an old-fashioned phone call to the Bond Department. That’s a lot of calls.

But then, the US is a country where a vast volume of payments is still made with paper checks. I know I sign mine with the flourish of a quill pen. Life is good in the 19th century, comrades!

Speaking of bond market liquidity, it dries up first in junk bonds. Forbes reports:

Junk funds are quite liquid, but their underlying assets (individual junk bond issues) are not. When redemptions occur, fund sponsors must sell them. But to whom? Better work them phones, boys!

I think they have the cart and the horse mixed up. I think “market” trading volume rises to match whatever liquidity the Fed pumps in. The Fed is “pushing on a string”, right? Ben was quite pleased when he discovered, after the fact, that the Fed could, in fact, increase the “wealth effect”.

‘Course in a world where HFT computers are “market makers” (where do they get their money?), junk bond prices , dodgy sovereign bond prices , and securitized crap prices are pushed up to the stratosphere and quite likely on the “asset” side of a TBTF bank, I’d be worried too. But I wouldn’t be able to get myself to write an article about how I’m concerned for society that central banks might mess up their stewardship of liquidity, and all the channels it flows in. That would be too much of a stretch for me. hahahahhaha.

Lambert, this is the most arcane thing I have ever read. It is saying that liquidity is unpredictable. That’s as far as I could translate this verbiage. “Therefore, in the USA of America, yes!” Liquidity is a latent variable; illiquidity catches you by surprise. Like sentiment. OK, so people panic even in liquid markets because the liquidity can’t insure liquidity. And so just use qualitative tools like diplomacy and good natured hints to persuade the markets? Something tells me we do not have a hope for a functioning system.

The author seems to be mixing up “illiquidity” and lack of buyers – or when these “assets” are grossly overpriced, it would be lack of greater fools, lack of bagholders, lack of falling knife catchers…etc…

No mix up I can see. “When no one buys your crap anymore” is about as illiquid as it gets.

Liquidity risk gives birth to one of the paradoxes of regulation in fixed-income markets – the aim for more transparency might depress market liquidity and distort the price-finding process, with the ultimate collateral cost of reducing transparency.

What price finding distortion are they talking about?

. . . A simple example illustrates the point (Tentori 2015): think of the market as a queue in which new arrivals (e.g. the primary market) and existing servers (i.e. market makers) are in equilibrium. In the case of sovereign debt, this stylised process can be described as new risk being created regularly by sovereign debt management offices – the risk is absorbed by market makers and then smoothly distributed to end investors.

Lets see if I have this straight. The more that an end investor knows about the debt being proffered by the market maker, the more distortion there is to the price finding process?