As hedge fund manager David Einhorn says of companies he shorts, “No matter how bad you think it is, it’s worse.”

The latest example of that syndrome at the giant California public pension fund CalPERS that it recently selected a fiduciary counsel, Robert Klausner of Klausner Kaufman Jensen & Levinson, who has previously served the seedier, less capable end of the public pension fund universe. Starting in 2004, the press, including in the New York Times and Forbes, has described him as involved in serious improprieties, including regularly getting kickbacks from class action law firms and using his law practice as the foundation for running a much larger and more lucrative pay-to-play operation.

CalPERS’ due diligence was so deficient that it apparently missed damning information that was in the public domain, failed to run basic conflict of interest checks, and ignored basic considerations regarding suitability of experience (his most eminent client appears to be the Louisiana State Employees Retirement System, which to put it politely, is far from a model of good governance).

This dubious appointment suggests either gross incompetence on the part of staff or worse, that they recommended a tainted lawyer because it was understood that he would advance staff’s agenda in return for encouraging the board members to attend his “educational” seminars, which have been widely criticized. They are now under scrutiny as part of an investigation of the Jacksonville Police and Fire Pension Fund, where Klausner has acted as general counsel since the late 1990s. Klausner has recently hired a criminal defense firm to handle the subpoenas issued by the City Council, as well as a public relations firm.

In addition, Klausner is not a member of the bar in California. The San Diego city attorney had objected strenuously to Klausner’s hiring in the late 1990s, writing, “….an attorney must be licensed in California to render advice on California law to a California client.*” A 2005 article suggests that the licensing issue was a justification for ending his engagement. I have conferred with the California State Bar Association, which reviewed the exceptions to that rule to me. None of them apply to Klausner.*

Moreover, as we will discuss in a post this week, Klausner gave advice to the board in its last Governance Committee meeting, law professors and experts in relevant California law rejected. And troublingly, CalPERS’ general counsel Matt Jacobsen allowed Klausner to opine on matters, most importantly the California Public Records Act, that are clearly outside his purported area of expertise, that of fiduciary counsel. To their credit, the two attorneys on the board, Richard Costigan and Dana Hollinger, were clearly alarmed by some of Klausner’s arguments and took issue with them, but they were steamrolled by more vocal members of the board.

Background: The Critically Important Role of Fiduciary Counsel

Of all the advisors a pension fund employs, fiduciary counsel is arguably the most important. The fiduciary counsel is the high priest, the arbiter of probity and the guide to making sure the pension system meets the required standard of care, which is to place the interests of its beneficiaries first and foremost. A fiduciary is required to subordinate his interests to that of his beneficiaries.

Fiduciary counsel is hired by the board, which is the board of trustees, or in the case of CalPERS, the Board of Administration. However, there is a gap between theory and practice. In CalPERS’ case, as occurs in other public pension systems, the candidates for fiduciary counsel submit requests for proposal that are vetted by staff. In CalPERS’ case, they are scored and staff makes a recommendation to the board before the board interview and vote. This process allows the staff to influence the decision, which also occurs when the fiduciary counsel contract is up for renewal, means that there is a significant risk that fiduciary counsel will see himself as serving staff, or at least needing to be attentive to its agenda, even though it is the board that is formally his client.

Needless to say, fiduciary counsels, much like trust and estate attorneys, should be conservative and free of conflicts of interest. ERISA, with which most public pension systems comply with voluntarily or via being subject to legislation that incorporates some or all of its provisions. ERISA stipulates that its rules against “prohibited transactions” are “absolute” and cannot be waived by disclosure or client consent. From an ERISA overview by Wagner Law Group:

ERISA section 406(b) also prohibits transactions that involve any type of self-dealing by the plan fiduciary. A plan fiduciary is prohibited from using the plan’s assets in their own interest or act on both sides of a transaction involving a plan. Further, fiduciaries cannot receive “kickbacks” or any other payments for their personal benefit from third parties in connection with performing their fiduciary duties on behalf of the plan.

Klausner’s Multi-Decade History of Questionable Conduct

Klausner’s main client base is $500 million to $5 billion public pension plans where police and fire chiefs hold key board seats. Sources allege that that his power and influence come from creating $200,000+ retirement packages for many of them.

As a California attorney and CalPERS beneficiary who reviewed public information about Klausner put it:

What I see in the reports and in the August 20, 2014 CalPERS board transmittal from [CalPERS general counsel] Matthew Jacobs’ office, is that staff cherry-picked Klausner knowing full-well that he is in the business of providing “cover” in the form of aggressively staff-friendly “advice of counsel” – often unsupported by actual legal precedent – for otherwise blatant violations of fiduciary duty.

This reading is confirmed by the concerned raised by several board members during the fiduciary counsel selection process about how they were being presented with much less information about the candidates than they had received in the past.

Due to the length of this post, and this particular video segment, where multiple board members raise objections and concerns, we are not posting the transcript for this segment. However, we strongly encourage readers to watch it when they have time, because it is a case study of how the staff has chipped away at the board’s authority.

Here, staff takes the position that the board does not deserve to have the information it received in the past because it’s not required under California law. In other words, board members are being pushed to accept a lowest-common-denominator standard of review. This is particularly troubling given that the fiduciary counsel advises the board, and not CalPERS as an institution. Thus the board should feel free to set whatever parameters it deems fit above and beyond the legal nminimum.

To their credit, the board members that do object to general counsel Matt Jacobs and his staff trying to present the degradation of the review process as a fait accompli do not back down quickly. Priya Mathur, who speaks at the beginning of this segment, describes how the information about candidates was broken down into subcategories and repeats her view that not having this information makes the board more dependent on staff’s subjective overall ranking. As she makes clear, the candidates supplied information on their various aspects of competence and the board, unlike in the past, is now being denied access to that data (astonishingly, Jacobs takes the position at roughly 1:10 that it would be difficult to do this type of scoring when it was previously the norm).

Similarly, at 2:50, Richard Costigan makes the most vigorous objection to this process, and points out that other recent contracts provided detailed rankings and subcategory information. Again the legal team falls back on the lame, “That information is not required to hire attorneys.” And at 12:31, Dana Hollinger voices her support for the earlier objections and points out that an attorney that already knew CalPERS might be cheaper all in and that she wanted to see an overall budget. While her tone stays level, her face conveys her disgust. And at 2:12, JJ Jelincic had pointed out that the staff scoring process had not corresponded with board’s assessment: the lowest scored candidate last time got the highest marks in the board interviews.**

Back to the winner of a process in which staff put its finger heavily on the scale.

Robert Klausner has been accused of serious improprieties since at least 1999, some of which have garnered national attention. While it might be defensible to hire an attorney who has a whiff of sulphur about him for a narrow role like handling a lawsuit (and Klausner has successfully pled a Supreme Court case), it is quite another to engage someone who has a well-reported history of acting as fiduciary counsel to public pension funds that have become embroiled in major scandals, which include controversies over fees paid to Klausner himself, as well as having a “pay-to-play” business model by which he obtains additional, hefty fees for selling access to his clients through his educational programs.

As we will describe, this arrangement at times appears to have become a self-licking ice cream cone, since in at least one instance, Klausner failed to encourage his client to stop using a conflicted consultant, Merrill Lynch Consulting Services, that had made made payments to Klausner despite warnings by an independent expert of self-dealing. Klausner may well have profited even more by allowing the Merrill Lynch to stay on, by virtue of allegedly receiving kickbacks on the class action litigation against Merrill for clients that he had join that action.

An overview of the allegations made against Klausner:

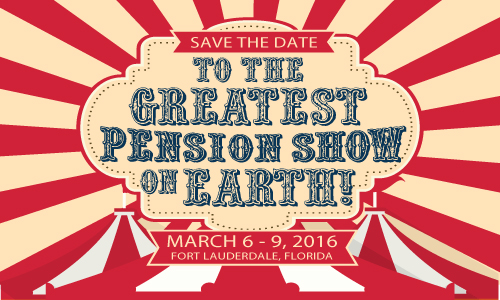

Involvement in pay to play. Klausner has long run “educational” programs for pension fund employees and trustees which are troublingly based on the pay-to-play model. Pension fund consultants and class action lawyers pay Klausner large fees, currently reported to be $30,000 per presenter, to appear before his annual conference, which typically has on the order of 200 participants. The advertisement for the upcoming event gives an idea of how serious the educational priorities are:

These events are free to the participants, which means they are the product being sold.

One former pension fund fiduciary said that attendees at events like this are in a similar position to a woman being taken out on an expensive date: she knows she is expected to put out. Another former public pension fund trustee wrote, “This is basically a dating service for placement agents and corrupt trustees.”

Thus part of the services Klausner was offering to CalPERS was that board members could take his “educational” courses in Florida in the winter months and it was included in his legal fees.

As discussed at length in a 2004 New York Times report by Gretchen Morgenson, as well as in a story in Forbes, the SEC launched an industry-wide investigation of pension fund consultants, particularly those affiliated with brokerage firms, as cases involving fraud and breach of fiduciary duty started to surface, since a consultant wearing his pension fund advisor hat could easily recommend investments that would generate lucrative brokerage fees at the expense of performance. As Morgenson story wrote:

Brokerage commissions are not the only source of revenue for many pension consultants. They also receive payments from money managers who attend annual conferences at luxurious resorts set up by the consultants. The conferences are billed as opportunities for money managers to meet pension plan officials, but critics describe them as pay-to-play mechanisms. They contend that the money managers recommended by consultants to pension funds tend to be only those who paid to attend the conferences….

Pension consultants aren’t the only ones holding conferences where money managers can hobnob with pension officials. Robert D. Klausner, a lawyer at Klausner & Kaufman in Plantation, Fla., whose firm provides legal counsel to many pension funds in Florida and elsewhere in the south, runs similar meetings.

Klausner & Kaufman’s sixth annual client conference was in March at the Hyatt Regency in Fort Lauderdale, Fla. Among the eight companies that paid to sponsor the 2003 conference were Merrill Lynch and Davis Hamilton Jackson & Associates, a money manager based in Houston that Merrill often recommends to its pension clients.

According to documents detailing the various advisers to police and fire pension funds in Florida, Mr. Klausner’s firm provides legal advice to 19 funds. Twelve of them employed Davis Hamilton as a money manager, or Merrill Lynch Consulting as a consultant, or both…

Davis Hamilton appears often among the pension fund clients of Merrill Lynch Consulting, even though the firm has produced less-than-stellar returns in recent years. Davis Hamilton has managed the Lake Worth Police Officers’ Pension Fund, for example, and for the six years ending in 2003, it beat its benchmark index only one-third of the time. For the year ending 2003, the police fund’s overall return, including both stocks and bonds, ranked in the bottom 26 percent of the peer group used by Merrill.

A trustee at a public fund in Florida, who asked for anonymity because he feared reprisals from the firms involved, said his fund is advised by Merrill Lynch and has employed Davis Hamilton. Although the money manager’s performance has been lackluster in recent years, this trustee said Merrill Lynch continued to recommend that the pension fund retain Davis Hamilton. The trustee said he was concerned that Merrill’s support of Davis Hamilton had to do with the fact that Davis Hamilton steers “virtually all” of the pension fund’s trades to Merrill.

In Jacksonville, Florida, the Police and Fire Pension Fund had been urged in 2002 by former SEC staffer turned forensic investigator Edward (“Ted”) Siedle to drop Merrill Lynch as its consultant. One must assume that Klausner either ignored or argued against that advice. When the pension fund eventually ended that relationship, Klausner had a piece of the action against Merrill by getting a kickback from the law firm, Bernstein Litowitz Berger & Grossmann (“Bernstein Litowitz”), that filed suit against Merrill Lynch Consulting Services for its conflict-ridden consulting activities after the SEC sanctioned the firm.

Law firm kickbacks. As described in a must-read report attached at the end of this post, Ted Siedle has been retained by the City Council of Jacksonville, Florida, to investigate the Jacksonville Police and Fire Pension Fund after a series of articles in the Florida Times Union alleged serious improprieties at the fund and the city conducted its own initial investigation. The resulting report recommended having the city’s lawyers be responsible for the fund’s regular legal work and for having individuals with investment experience serve as trustees.

After Florida governor Rick Scott ignored calls for an investigation of the fund, the city engaged Siedle to perform an investigation. His work was impeded by a purported lack of documents, including basic information like investment performance. It must be noted that it is virtually impossible to defend these lapses in light of the fact that this Jacksonville pension fund has been made voluntarily subject to all the provisions of ERISA, and the sort of records that allegedly were never kept are required under ERISA. Pray tell, what exactly was Klausner doing as this fund’s long-standing fiduciary counsel?

Note that the city counsel issued subpoenas to both the fund and Klausner to produce the documents and respond to questions on November 16. Klausner has retained a criminal defense attorney, Hank Coxe, to receive the subpoena.

Both recipients requested for extensions of time close to the deadline. On the 16th, the pension fund made an appearance and provided two boxes of records. Neither Klausner nor his criminal defense attorney, Coxe, showed up. A few days later, a Misty Skipper of the Dalton Agency, a public relations firm, contacted the Florida Times Union and said her firm was representing Klausner. Eileen Kelley, who has been ably reporting this case, said that heretofore Klausner had dealt with her directly and in her opinion, Klausner is in no need of a PR firm to promote his business.

One of the charges that Siedle makes at length in his report involves Klausner’s questionable relationships with class action law firms. The press called out Klausner for this activity more than a decade ago. For instance, as Forbes reported in 2004:

The outside counsel to the Jacksonville Police & Fire Fund, Robert Klausner of Plantation, Fla., receives a varying cut of lawyer fees for work on cases he refers to class action firms, on top of a retainer for routine work. Fund trustees seem largely unaware of Klausner’s arrangement. “There are a lot of suits we’re probably involved in because our attorney [Klausner] is involved in a lot of things,” says Barbara Jaffe, a Jacksonville fund trustee and an adviser with Wachovia Securities. Trustee Bobby L. Deal, a lieutenant with the Jacksonville police, says of Klausner: “He’s on retainer. If there’s any other compensation, I’m not aware of it.” Klausner says his pay is adequately disclosed and that it’s the job of the fund’s administrators to keep the trustees well informed.

Bernstein Litowitz also pays Klausner a sum he won’t disclose (and which [Max] Berger [of Bernstein Litowitz] puts at up to $30,000) to be the only class action lawyers with access to Klausner’s annual powwows of pension officials.

In the wake of the Forbes article, Klausner apparently saw fit to tidy up his disclosure. From Siedle’s report:

The September 20, 2004 letter stated that the Board entered into an agreement with BLBG [Bernstein Litowitz] to monitor the Fund’s portfolio and that in addition to any contingency fee agreement the Fund might enter into with BLBG, the General Counsel’s firm would be paid a fee from any class settlement in which the Fund participated.

The city of Jacksonville and Siedle have asked the fund’s administrator to account for all fees related to class action suits received by Klausner’s firm, as disclosed to the fund’s board. The fund administrator has yet to provide any such information. Siedle estimated that Klausner might have earned $3.3 million in fees from three named cases. Siedle regards his total as conservative, since he assumed that Klausner’s share of the class action fees was 10% based on statements made by Klausner, but other Florida public pension fund attorneys have reported that “class action firms routinely offer them 18 percent.”

As Siedle points out:

The Fund has entered into agreements with multiple securities class action law firms to monitor its investment portfolio in order to determine whether the Fund has suffered any loss due to violations of federal and/or state securities laws, calculate losses, identify breaches of fiduciary duty and other corporate misconduct.

Some have severely criticized these “portfolio monitoring” arrangements between pensions and class action firms. One highly regarded federal judge, Judge Rakoff, noted in 2009, that such an

arrangement was “about as obvious an instance of conflict of interest as I’ve ever encountered in my life.” He said he was shocked that persons with a fiduciary duty to monitor pension investments would choose “to save a few bucks” by hiring a law firm to monitor those investments that could only profit by recommending litigation.These arrangements are thus inherently problematic, regardless of whether Klausner received any additional benefit from them.

So far, Siedle and the city have been able to obtain only some of the recent monitoring agreements; the one with Bernstein Litowitz, which is the Jacksonville fund’s longstanding primary securities litigation counsel, remains outstanding.

Setting up lavish pensions for trustees and top pension fund staff. Klausner was fiduciary counsel to Detroit’s pension fund, widely seen among pension professionals as one of the most corrupt major public pension fund in the US. Klausner does not appear to have had a positive impact, since several board members have been convicted of criminal offenses based on conduct that occurred while Klauser was acting as fiduciary counsel.

The Detroit Free Press describes the third conviction, in late September. Key parts (emphasis ours):

Ex-Detroit pension trustee Paul Stewart is going to prison for nearly five years for his role in a bribery and kickback scheme that cost city pensioners and police officers $47 million in losses while the businessmen he catered to made off with $5.2 million….

Prosecutors said that Stewart instead catered to wealthy businessmen who needed favors and lavished him with gifts galore, such as a $5,000 casino chip, a Christmas basket stuffed with cash and trips for him and his mistress.

Specifically, the government argued that Stewart helped push bad investments through the pension board because businessmen were wining and dining him in exchange for his vote on deals…

But, [U.S. District Judge Nancy] Edmunds stressed, Stewart was part of a pay-to-play political climate in which kickbacks and bribes were the norm.

“Business was done at the pension board based on who could win the trustees — who could buy them dinner, who could buy them drinks. It was a highly charged and inappropriate way to do business,” Edmunds said.

As Chris Tobe, a former trustee of the Kentucky Retirement Systems and author of Kentucky Fried Pensions, said via e-mail:

When pensions want to do something sleazy they call in Klausner. He is most infamous for creating six figure pensions for trustees and retirement staff which is at the heart of the Jacksonville scandal. Before some went to prison Detroit trustees relied on his fiduciary counsel to travel the globe and attend resort conferences.

Similarly, the Florida Times Union reported in 2012 that Jacksonville Police and Fire Pension Fund Executive Director John Keane had had a second pension plan created for him in the late 1990s which could pay up to $200,000 per year, in addition to a $60,000 a year pension he was already receiving that year, on top of being paid a $283,000 annual salary as executive director. From the article:

Receiving one pension and earning another isn’t uncommon in city government — but in Keane’s case, it seemed all but unknown that he even was getting the second benefit.

Both former City Council auditor Bob Johnson and current council auditor Kirk Sherman said they were unaware of the existence of the pension program, which only covered a handful of fund employees, until this month…

Typically pension funds are set up by the City Council or Legislature, Sherman said, not simply by a board of trustees…

The Senior Staff plan is similar to the city’s three better-known funds…Unlike the other plans, though, the plan is not capped at 80 percent of final average pay…

City Council Finance Chairman John Crescimbeni was less understanding.

“I was shocked and that’s an understatement,” Crescimbeni said. “It underlines my belief that the pension fund is out of touch with being fiduciarily responsible for the fund.”

The Siedle report also points out that despite a directive by the City Council to cease funding this special pension program, since the city took issue with the legality of its very existence, a cash transfer took place subsequently that put this plan in an overfunded status. By contrast, the main plans are severely underfunded, at a funded ratio of a mere 39% in 2013, according to Florida TaxWatch.

Providing questionable advice to defend pension plans accused of pay-to-play abuses. One of the first public pension funds to have a whistleblower expose a conflict-ridden relationship with a pension fund consultant was the San Diego City Employees’ Retirement System. The whistleblower there, board member Diann Shipione, exposed the common practice of consultants and lawyers receiving payments from money managers they introduce or recommend to their clients.

In 2005, Shipione and former fellow board member Terri Webster, said that the board picked Klaunser to justify actions it wanted to take. From an article in the San Diego Reader:

Webster was suspicious of what the board was doing.

She particularly challenged the hiring of Robert D. Klausner, the Florida lawyer who was not licensed in California. …She questioned Klausner’s past advice: “He’s the guy from Florida that mostly supported the questionable issues without citing much case law.”….

The 1997-1999 period “was a time when the board was shopping for opinions and found somebody [Klausner] that would give the board opinions that it liked,” Shipione says. “The California law firms that gave opinions the board didn’t want to hear were fired. This guy would give all kinds of opinions that certain members of the board and staff wanted him to give.”

The article continues to discuss in some detail where Klausner provided opinions that were contradicted by more prominent firms and subsequent fiduciary counsel, even though he was not licensed to practice law in California.

As Chris Tobe summed up:

When corrupt pensions have an honest trustee trying to bring transparency to a plans investments, they call in Klausner to try to push him out. I know this because I was that trustee in Kentucky and it looks like Klausner is doing it again with CalPERS.

Of all the improprieties we have unearthed at CalPERS, this is far and away the most troubling. I hope readers will circulate this post widely, along with our companion piece today about how CalPERS is systematically violating open meeting laws to conduct its business out of public view. Be sure to include friends and colleagues in California, as well as posting it on Facebook and other social media. Remember that shortfalls in CalPERS’ funding are ultimately paid by taxpayers, so the proper conduct of the pension fund’s business is of concern to taxpayers generally, not just CalPERS’ beneficiaries.

I strongly urge readers to voice their concerns to the state Treasurer and Controller, both of whom sit on CalPERS’ board and are therefore share in the responsibility for this dubious appointment. Their contact details:

Mr. John Chiang

California State Treasurer

Post Office Box 942809

Sacramento, CA 94209-0001

(916) 653-2995Ms. Betty Yee

California State Controller

P.O. Box 942850

Sacramento, California 94250-5872

(916) 445-2636

In addition, if you are a California citizen, please alert your state Assemblyman and Senator, and demand that they look into this serious lapse of governance. You can find you Senate and Assembly representatives here.

Please also contact your local newspaper and television station, as well as the Sacramento Bee. Tell them you think this story is important for all California taxpayers and urge them to take it up. You can find the form for sending a letter to the editor here.

Later this week, we will discuss in detail how many members of the board are in the process of colluding, aided and abetted by Klausner, to violate the California Public Records Act in order to stymie the efforts of board members to get answers to basic questions about how CalPERS is managing its private equity program.

____

* Note that Klausner cannot claim an exception by virtue of opining on fiduciary issues. CalPERS, like all public pension funds, is not subject to the Federal statute, ERISA. Klausner could arguably advise a California private pension on ERISA matters, since that is Federal law. CalPERS is subject to California, not Federal statues, that have adopted certain elements of ERISA, such as its duty of care. Similarly, trust law, another important element in defining a fiduciary’s duties is also state, not Federal, law, although there are admittedly broad similarities. Similarly, one could make the argument that Klausner has members of the California bar at his firm, and one would hope that any written recommendations to CalPERS would be issued under their name. However Klausner has already given legal advice on the record on California law matters to CalPERS board members at an open board meeting. Moreover, the board decision regarding fiduciary counsel was to approve of Klausner personally, and not his firm. So the licensing issue would seem to be applicable.

Ironically, in the board interview, Klausner acknowledged the licensing question, pointed out that his firm did include members of the California bar, and then gave his justification for serving as CalPERS’ counsel despite not having a license (see here starting at 22:43): “I think what you hire fiduciary counsel for is their broad experience in all aspects of retirement system management and their insight into what causes problems and what leads trustees into unfortunate headlines.” Given Klausner’s track record, it is difficult to argue that he meets his own test.

Moreover, Klausner asserted at 22:30 that “Fiduciary law rarely crosses into the law of the jurisdiction, it’s pretty unusual” and indicated that the two members of his firm licensed in California would get involved in that case. That is the reverse of the position and course of conduct Klausner took in the CalPERS Governance Committee meeting, as we will discuss in detail later this week.

** There’s even more not to like in this clip. It is utterly lost on Treasurer John Chiang’s representative Grant Boyken that the selection of fiduciary counsel is not remotely like the review of other contracts for procurement of government services. The fiduciary counsel (at least when it performs its job properly) is a critically important advisor to the board, and not a mere vendor. And it bears mentioning that one of the then-current fiduciary counsels, Keith Johnson of Reinhart Boerner, the one that JJ Jelincic pointed out was given high marks by the board in the previous year despite being the lowest ranked finalist by staff. This year, he was excluded by staff from the final round.

The video segment also troublingly shows Jacobs pushing for having the board attend “educational” programs provided by fiduciary counsel. In the case of their top pick, Klausner, that means his gatherings where the presenters pay to have access to the pension funds. It’s not hard to imagine what a prize an institution of the size of CalPERS represents to Klausner, and he would presumably be extremely keen to cooperate fully with staff so as to assure again getting the top ranking when his contract comes up for renewal. Jacobs also urges the board to have fiduciary counsel act in what sounds disturbingly like more of a general counsel role, which is particularly inappropriate in the case of the staff’s recommendation of Klausner, with his lack of a California license.

Once again, thank you for all that you do.

Calpers has to accept the lowest common denominator of pretty much everything, CEO, CIO, legal staff, theyre all such competent informed wards of the state

One must read to savor, or dis-savor, the detail. Ick.

Again, if you saw this going on in your town council, the concerns would be obvious.

The Klausner infection recently spread to the Kentucky Teachers’ Retirement System, too. God help us.

Thanks. Got any links to local reaction?

“As a California attorney and CalPERS beneficiary who reviewed public information about Klausner put it:

What I see in the reports and in the August 20, 2014 CalPERS board transmittal from [CalPERS general counsel] Matthew Jacobs’ office, is that staff cherry-picked Klausner knowing full-well that he is in the business of providing “cover” in the form of aggressively staff-friendly “advice of counsel” – often unsupported by actual legal precedent – for otherwise blatant violations of fiduciary duty. ”

Just. Speechless.

Thanks for these continuing posts.

Yves, thank you for your brilliant and hard work uncovering what is the multi-layered corruption called CalPERS. As a Calif. citizen, I plan to contact my reps. to determine what, if anything they plan to do about this mess. It affects us all as Calif. taxpayers.

I don’t know he seems pretty competent if his job is to give closed door advice on how to avoid accountability and fleece the rubes all the while maintaining a nice scratch free teflon coating…/s

Sigh. Thank you, Yves, for your doggedness in pursing the many many failings of CalPers to do their job. This is just deplorable.

I’ll send off yet another letter & emails to Chiang, Yee and my rep.

Beyond offensive, and yes, this is an insult to all CA taxpayers.