By Lambert Strether of Corrente.

This Sunday morning, I thought I’d do an old-school media critique of the story the New York Times put up as this year’s open enrollment season for ObamaCare was about to begin. For whose who came in late, “TINA” stands for “There Is No Alternative” — in this case, to the ObamaCare marketplace — a phrase invented long ago by Maggie Thatcher, bless her heart. This piece lives and breathes TINA, as we shall see. I’m just going to work through the whole story, and here’s how it begins (the Times copy is indented throughout):

Many Need[1] to Shop[2] Around on HealthCare.gov[3] as Prices Jump[4], U.S. Says

By ROBERT PEAR and ABBY GOODNOUGH

[1] They may or may not “need” to (50% of the unenrolled believe ObamaCare would decrease their welfare, according an NBER study), but they are certainly mandated to; that’s the whole point of Obama’s program design.

[2] The “need” for shopping, and the value of shopping, goes unquestioned. (The Times reinforces this message with a second story, cheerfully headlined “Obamacare Shopping Is More Important Than Ever” — though the URL, “if-they-want-deals-obamacare-customers-will-need-to-switch-plans-again” shows the original headline must have been too over the top, even for The Upshot. I love “deals.” Apparently, the reporter is under the impression that ObamaCare’s open enrollment period is rather like “Black Friday,” where throngs of excited shoppers bust down the doors in quest of loss-leading flat panel TVs, instead of the risky and stressful process that it actually is. All polices must go! To the bare walls!

[3] “HealthCare.gov” is a neat piece of TINA all in itself. First, healthCare.gov is not about health care but health insurance; so the domain name suggests that the only way to care is through insurance. Second, the domain extension (“gov”) suggests that the only way for government to deliver health (care (insurance)) is through the ObamaCare marketplace, the resource to which the URL points. In fact, that’s not so, as readers with international experience know, but it’s not so even in the story’s own terms, as we shall see when we get to California. Of course, the URL is what it is, and the reporters aren’t culpable for using it, but since the URL was placed in the headline, it makes sense to give it due weight in our reading.

[4] The “jump” is spontaneous, it seems. Note the lack of agency.

WASHINGTON — In Tennessee, the state insurance commissioner approved a 36 percent rate increase for the largest health insurer in the state’s individual marketplace. In Iowa, the commissioner approved rate increases averaging 29 percent for the state’s dominant insurer.[1]

[1] Oddly, or not, the reporters don’t mention the possibility of an ObamaCare actuarial death spiral, although they may assume the lash for the penalty will really begin to bite this year. (And do we really want a health care system where citizens consumers are “nudged” like this, rather like cattle through a chute?)

Health insurance consumers[1] logging into HealthCare.gov on Sunday for the first day of the Affordable Care Act’s third open enrollment season may be in for sticker shock[2], unless they are willing to shop around[3]. Federal officials acknowledged on Friday that many people would need to pick new plans to avoid substantial increases in premiums[4].

[1] The use of “consumers,” as opposed to “citizens,” is by now pervasive and reinforced here.

[2] I love “sticker shock,” is if purchasing health insurance were the same as buying a car. Of course, when you buy a car, you typically don’t need to leave the car in the garage because co-pays and deductibles make it too expensive to turn the key. Or “shop” for a whole new model every year.

[3] Oddly, or not, “shopping” is always conceived of as a zero-time task. In fact, researching the policies, guestimating your income, handling the complex eligibility determination process, managing the bills, and making sure your taxes are properly handled are all what Yves calls “taxes on time,” but they’re never factored in as opportunity costs by ObamaCare advocates (This study, on the opportunity costs of delivering ambulatory health care, might point the way to working out ObamaCare’s tax on time.)

[4] Apparently, the “cost curve” isn’t necessarily “bent” for citizens consumers. If indeed ObamaCare “bends the cost curve” at all.

But, they said, even with a number of companies leaving the marketplace for health insurance under President Obama’s signature health care law, most people[1] around the country will still be able to choose from three or more insurers[2] in 2016.

[1] “Most people.” Says who, and how many?

[2] First the metric was enrollment numbers. Now the metric is how many products the shoppers can buy. In neither case is the quality of the product to citizens consumers ever a consideration.

“Shopping can save you money,” said Richard G. Frank, an assistant secretary of health and human services, who unveiled a huge collection of data on health plans that will go on sale on Sunday in the 38 states served by HealthCare.gov.

[1] Again, no word on quality.

Consumers have until Jan. 31 to sign up, but must do so by Dec. 15[1] to obtain coverage starting on Jan. 1.

[1] Right in the middle of the holiday shopping season, too. So not only must consumers be the engine of the economy during the “Holiday Shopping Season,” they have to run the ObamaCare guantlet, too!

Mr. Frank, on leave from his position as a professor of health economics at Harvard[1] , described the data in a positive light. “The Affordable Care Act has created a dynamic, competitive marketplace[2], with considerable choice and affordable premiums in 2016,” he said.

[1] Frank was on the faculty of Harvard Medical School’s Department of Health Care Policy. The DHCP is a little cagey about its funding sources, at least on its site (“Research is supported by grants from the federal government (largely NIH), private foundations, and some endowment funds residing in HCP”), but among them we find hedgie squillionaire John Arnold. I think it’s safe to say that evaluating the difference, say, between Conyer’s HR 676, and Sanders SB703, both single payer proposals, isn’t high on Arnold’s list.

[2] Wait for California, below.

Consumers[1] are not so sure[2].

[1] Sigh…

[2] “ObamaCare enrollees are less satisfied with their plans than people with other types of health insurance, according to a new poll” (The Hill).

“It really shocks me to see these plans with $5,000 deductibles,” [1] Belinda Greb, 56, of Vida, Ore., said in an interview. “It becomes an area of stress as opposed to making me feel secure[2].”

[1] And so it should.

[2] The ObamaCare marketplace is not “humane at the point of care.” Every interaction between consumer citizen and the healh care system should be considered as an aspect of care, and be humane.

Federal subsidies for low- and moderate-income consumers will keep pace with premiums for a benchmark plan, the second-lowest-cost “silver” plan, Mr. Frank said, and consumers who choose that plan can protect themselves and their wallets.[1]

[1] This is disingenuous; what matters is how ObamaCare nets out. See the NBER study linked to above.

“The vast majority[1] of marketplace consumers receive tax credits that insulate them from premium increases,”2] Mr. Frank said.

[1] In other words, some significant minority are not insulated, and go to Pain City and not Happyville, for reasons that are random: Jurisdiction, age, income, and so forth.

[2] Again, this is disingenous. The key point isn’t the subsidy, but how the product nets out for the citizem consumer.

A typical family of four with annual income of $60,000 will, on average, receive tax credits[1] totaling $5,570 in 2016, up from $4,850 this year, the administration said.

[1] Again, without calculating the net. Remember that 50% of those eligible for and unenrolled in ObamaCare think believe it nets out negative for them. They were smart shoppers who decided not to buy the product. The dogs won’t buy the dog food!

But some consumers[1] who have recently received renewal notices have been shocked by the decisions[2] they face.

[1] “Some consumers.” But we don’t know how many, and for all the bloviating in the health care business about being evidence-driven, we’re three years into the program, and it doesn’t seem to have occurred to anybody to have produced even a fake, corrupt study.

[2] Like the decision to guestimate your income to calculate your subsidy, bad if your employment is precarious, or in a recession when job losses rise; or the decision, if you’re on the bubble, whether to game your income figures, and, if so, which way.

Ms. Greb said she was too upset to finish a letter she got recently from her insurer, Moda Health, that said her “bronze” health plan, for which she pays $213 a month after a subsidy of $175, would not be offered through the exchange in 2016. The company offered her a similar plan[1] that would cost $265 a month if her subsidy stays the same.

[1] Rather, a plan it claimed was similar.

The new plan recommended by Moda has a deductible, the amount she must pay for care before the insurance begins to pay, of $5,500, up from $4,250 in her current plan, she said[1]. “People are putting off care[2] because of the expense.”

[1] And, as NC readers know, Mrs. Moda should also check to decrease the likelihood that she’ll be defrauded; she should check whether the network and formularies have been narrowed and, if so, whether her doctor is still in-network (assuming here directory is accurate; they often aren’t), and whether any drugs she needs will be covered.

[2] That’s not a bug; it’s a feature. It’s taken me awhile to understand that when we talk about “bending the cost curve,” we aren’t talking about costs to citizens consumers; but the cost of the health care system as a whole (ludicrously large by world standards).

The Obama administration said nearly nine out of 10 consumers[1] with marketplace coverage would be able to choose from three or more insurers in 2016[2]. That is important, Mr. Frank said, because in insurance and other industries, “competition intensifies[3] when there are three or more firms in a market.”[4]

[1] In other words, 10% of the eligible population is sh*t out of luck, and gets to take a ride to Pain City instead of Happyville, for entirely random reasons.

[2] So now we have a new arbitrary metric to put beside enrollment figures; note that neither have to do with citizen consumer welfare at all.

[3] Absent collusion.

[4] See Rule #1 of neo-liberalism.

In general, he said, “places with fewer insurers have higher premiums.”[1]

[1] Again, to be meaningful, this statement would need to net out the value of the health insurance product to citizens consumers. I mean, a product isn’t always better because it’s cheaper, right? It’s also curious that Frank doesn’t seek to learn from the exceptions to his generalization. For example, below the story points out that the prices are lower in California. Perhaps there’s a lesson here?

But the number of choices varies greatly. Consumers in the online marketplace can choose from 17 insurers in Ohio and Texas, 16 in Wisconsin, 15 in Michigan, 12 in Pennsylvania, 11 in Oregon and Virginia and 10 in Florida and Illinois.[1]

[1] So, again, the citizen’s consumer’s ride to HappyVille or Pain City is random with respect to jurisdiction.

But, an administration report said Friday, only one insurer is offering coverage in the marketplace in Wyoming, and consumers have a choice of just two insurers in Alaska, Hawaii, Oklahoma, South Dakota and West Virginia.[1] And that data, current as of Oct. 19, did not reflect the recent collapse of nonprofit insurance cooperatives in South Carolina and Utah.

[1] In other words, residents of Wyoming, Alaska, Hawaii, Oklahoma, South Dakota and West Virginia are second class citizens consumers with respect to the rest of the country. (And, assuming for a moment that health insurance equates directly to health care, disproportionately at risk for suffering or death; see Rule #2 of neo-liberalism.)

Brian Forrester, 48, of Punta Gorda, Fla., said he was pleased with the outlook for his coverage next year. HealthCare.gov indicated that the subsidy for his plan, provided by Blue Cross and Blue Shield of Florida[1], would increase more than the premium, so he would pay less: $98 a month, rather than $107.

[1] As we have seen, the experience of BCBS citizens consumers in North Carolina is very different, making North Carolina a second-class state with respect to Florida.

Mr. Forrester, a part-time driver for Uber[1], said he had used his insurance only to get a flu shot this year. “With my payment and subsidy,” he said, “Blue Cross will receive a little over $4,000 this year[2], and all they had to pay out is $12.71 to the pharmacy at Publix for a flu shot. I am the kind of customer that they want[3].”

[1] 48 and a part-time Uber driver. Isn’t this the greatest economy ever? (And is this a classic case of the reporter interviewing the cab driver?)

[2] Of course, Forrester’s income as a part-timer will fluctuate; we can only hope that ObamaCare doesn’t claw back more money on April 15 if his guestimate turns out to be too low and his subsidy was too high.) Amazingly, or not, the reporter doesn’t raise this question.

[3] Indeed!

Nearly a third of the people insured through the federal marketplace switched[1] plans this year, and more will probably need to do so to avoid big price increases[2] in 2016.

[1] Why are these “switching costs” never accounted for or considered a cost? I’d argue that one reason is that the designers of ObamaCare never experience them personally; they are covered by their universities, think tanks, or industry, or they have people to do that. See context #1 of neoliberalism; rules never apply to the rulemakers.

[2] But why? “Big” means the insurance companies aren’t just tinkering round the margins with their products. So, if the insurance companies who jumped in last year raised rates this year to avoid an actuarial death spiral, what does that say about the companies who jumped in this year with lower rates? To me (and I would imagine to the 50% unenrolled who think ObamaCare is a bad deal) that means (a) the insurance companies will make their margin with crapified policies, or (b) they’re trying to suck me in this year with low prices they’ll jack up next year, or (c) they’re incurably optimistic and filled with animal spirits, and don’t know their business. Or maybe they have a secret sauce. None of these alternatives bode well for my future health care and coverage needs. Turning to the classic parable: There was a twenty dollar bill lying on the street called ObamaCare. Insurance company A picked it up, and discovered it was a counterfeit twenty they couldn’t cash. So they dropped it. Now Insurance company B finds it, and says “Look! A twenty dollar bill!” Will their experience be different?

BlueCross BlueShield of Tennessee said the 36 percent rate increase was necessary because it had lost money on its marketplace[1] business[2] after underestimating the use of health care by its new customers.[3]

[1] An actuarial death spiral once again, unless the lash for the penalty really begins to bite.

[2] That is, profit-making or rental extraction, not necessarily a function of the delivery of care.

[3] The reporter writes “use of health care” like that’s a bad thing!

In Minnesota, officials approved increases averaging 49[1] percent for Blue Cross and Blue Shield of Minnesota, the largest insurer in the market. Even with the increases, the company said, “Blue Cross is likely to experience continued significant financial losses through 2016.”[2]

[1] 49% seems like rather a lot. I’m not sure why the reporter led with Tennessee’s 36%.

[2] More support foe a death spiral scenario.

Gov. Mark Dayton of Minnesota, a Democrat, said he was “extremely unhappy”[1] with the high rate increases.

[1] I bet the people paying the bills for crapified policies are even more unhappy!

The Iowa insurance commissioner, Nick Gerhart, approved rate increases averaging 29 percent for Wellmark Blue Cross and Blue Shield, the state’s dominant health insurer, and 20 percent for Coventry Health Care. The higher rates, he said, were justified based on the plans’ experience.[1]

[1] The dominant insurer gets a bigger rate increase? WTF?

Rates will rise next year by an average of 4 percent in California, one of the few states that actively negotiate prices, state officials said. In New York, state officials said rates would rise by an average of 7 percent. In Florida, consumers will see increases averaging 9.5 percent, the state said.[1]

[1] I think this is the most deeply buried lead in the history of the universe. Before I call out the beauty of it, let me just list the rate increases in this story, starting with the highest:

- 49 percent

- 36 percent

- 36 percent

- 34 percent

- 29 percent

- 29 percent

- 27 percent

- 20 percent

- 9.5 percent

- 7 percent

- 4 percent

See the outlier? The lowest rate is ~60% lower than the next lowest! Why would that be? Well, that’s the beauty part, the buried lead:

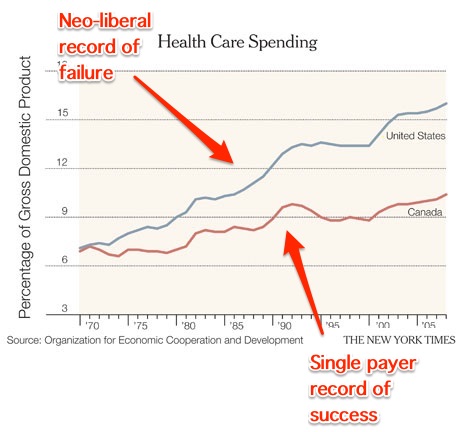

Rates will rise next year by an average of 4 percent in California, one of the few states that actively negotiate prices

In other words, California used its purchasing clout to beat better prices out of the health insurance business. So given that’s the lead — the most important news element — we might rewrite the headline thus:

California Uses Purchasing Power to Deliver Cheaper Health Insurance Policies to Its Citizens

Of course, we can’t have that; it’s a camel’s-nose-under-the-tent sort of thing. After all, if we admit that the State can use its clout to jawbone the insurance business, people might start asking awkward questions, like why the State can’t do the same thing for pharmaceuticals, medical equipment, and hospital costs. And if we admit the State can do that, why not dispense with the health insurance companies entirely, and move to single payer, which maximizes the State’s purchasing power across all sectors of the health care system? (Granted, that might be bad for the health care business — the extraction of profit and rent — but if you really want to bend the cost curve, in good faith, that’s where the logic buried in this story takes you.)

So you can see how important it was to bury that lead! TINA must be maintained at all costs.

But in Hawaii, the insurance commissioner this month approved rate increases averaging 27 percent[1] for the Hawaii Medical Service Association and 34 percent for Kaiser Permanente[2] health plans.[3]

[1] Back to the laundry list of percentages, with no rhyme of reason for the ordering.

[2] Last I checked, Kaiser was the paragon of efficiency and font of the HMO (now morphed into ACO) craze.

[3] And the story just trails off here; no peroration or summary or conclusion.

So that’s a sample of how to sharpen up your critical thinking skills by doing a close reading of the Times on ObamaCare; the unconscious bias toward the neo-liberal’s article of faith — “because markets” — is pervasive and just awful. If I were to suggest some topics where real reporting might be undertaken, the list would include:

- Investigate people’s actual experience with ObamaCare policy coverage over time;

- Investigate people’s opportunity cost in hours for navigating the ObamaCare marketplace, filing their taxes, and managing their claims;

- Investigate why price increases vary so much from state to state (and with business reporting, not statistical studies);

- Investigate whether ObamaCare really is “bending the cost curve,” and, if so, whether this trickles down to consumers in terms of either decreased prices or increased coverage;

- Investigate the differences between health care systems in other countries and health care systems in the US; compare for system cost, but especially for which systems are humane at the point of care.

And if you think burying the lead — as this story so clearly does — is sufficiently out-of-line, you might consider contacting the Times Public Editor, Margaret Sullivan. She’s been doing good work.

NOTE

It’s rather amazing that the only source quoted in the story is Richard Frank; surely the reporters’ Rolodexes are fat enough to include, say, Stephanie Woolhandler — also of Harvard — or the PNHP? Could do better!

Lambert– This article did not post.

WordPress woes I think — a browser ‘fresh fixed it for me anyway.

My bad. I can never remember whether it’s “spring back and fall forward,” or “fall forward and spring back”!

That’s because it’s “spring FORWARD, fall BACK” [the exact opposite of your guesses, which are identical, just in reversed order.

More sleep for all.

https://www.youtube.com/watch?v=zGmfiKowrYU

always twirling toward freedom…

I just saw on Washington Journal (C-SPAN) some guy from, I think, the health insurance lobby spouting the biggest load of old nonsensical blather, misinformation and downright falsehoods I’ve heard in a good long while. Among the choicest pieces of rotten turnips proffered was — when a caller phoned in to ask that old chestnut about why U.S. health outcomes are so bad when single-payer system countries spend less and achieve better — that, compared to France or Germany, you guys and gals across the pond are “more complex”, with “specific healthcare needs” and you measure things like life-expectancy “differently”.

The last time I heard such outrageous misinformation was when the Japanese claimed, with a straight a face as they could muster, that Japanese digestive systems were very specific and couldn’t tolerate non-Japanese rice.

Even the insurance lobby guy couldn’t be bothered to lie convincingly.

It really is state-sponsored looting. If ever anything warranted a boycott, it’s Obamacare’s “marketplaces”.

Looting indeed. At first we were led to believe that insurance companies would be limited to their take at 30% of premiums – but wait, there’s more: it seems the objective was to establish a 30% pure profit for the insurance companies. Well, who could turn that down – if they were a fucking insurance company. Or should i say extortion company? Yes, of course – those totally inefficient paper pushers are an extortion industry, period. And the use of “consumers” as opposed to citizens is at the nexus of the fraud. Obama just guaranteed the insurance companies a 30% profit at the expense of all citizens. And clever him, “shopping” eliminates the need for government alltofucking-gether. Yay! Hoodwink accomplished. So health extortion and its subsequent illnesses is a condition that cannot, by any means available, be cured the American health care system – because it is oil and water. God, this is so exciting, I can hardly contain my Obama-excitement. One word: healthcare.

Touché! You go gurl, Susan! I honestly cannot believe it is tolerated. I mean, you threw us Brits out ‘cos we taxed your tea, but people just grin and bear it with Obamacare’s obfuscation without representation? I am not usually given to strong language but really, WT and, indeed, F?

Thank you for well-stating Obama’s true legacy. Despicable.

(Him, not you!)

Such a boycott would have to be so fast and hard and near-unanimous that it could exterminate the insurance companies before escalating tax penalties make it too dangerous for boycotters to boycott. And also before a pro-bussiness government adds years of hard prison time to the penalties for failing to buy an Obamacare policy.

Oh, yes, and P.S. — sorry x1000 for Margaret Thatcher. I voted for her, please (add deity of your choice) forgive me. All I can say is that it made some sort of sense at the time. I put it down to a kind of mass hallucination.

Well, most of us have done silly things.

Maybe you could drop a line to Margaret Sullivan as recompense :-)

Clive: At the time we have been bombarded with an endless stream of propaganda (years of effort) about Bolshie Workers and Irresponsible Unions.

What was omitted were Arrogant Management, the case of the Bolshie workers, and the conflict between maximum profit (Tories) and full employment (Labor).

Murdoch was working his evil through the Sun (nud3es on P3), and the Daily Mail whihc was expert of right wing knee jerk issues to get the working class to vote with their prejudices, and not with their brains.

You can be forgiven, because none of us was experienced enough, nor educated in Neo Liberalism (we were all Keynesian then), and there was a hidden agenda, a well hidden hidden agenda.

My dear Clive,

Forgiveness is *totally* in order and please note that I am first in line (well, after whoever is in front of me…), *BUT*!!!! could you please explain how that happened? This is, I think, a very important thing to know just now.

A startlingly effective appeal to class, tribalism, identity and dog whistle politics. The genius (perverted genius that it was) of the right wing political faction which staged a quiet coup in England (it is important to note this never really took hold in Scotland or Wales) during the 1980’s and 1990’s — and I suspect too in the U.S. but there were subtle differences — relied on the same simple logical fallacy repeated over and over again. It went something like this:

The state has failed

The left believes in state intervention

The left has therefore failed

The right doesn’t believe in state intervention

The right is removing state intervention

The right is therefore successful

Now, so far, so ordinary. The really clever part was, through imagery, the press, advertising, academic capture, prevailing perceived international threat and cheap jingoistic tropes to add the following:

The state has failed

But individuals can succeed

You want to be successful

You can therefore only succeed if the state is dismantled

The right is dismantling the state

Therefore the right will enable you to succeed

and, conversely:

The left believes in state intervention

You cannot succeed unless the state is dismantled

Therefore clever people like you who want to succeed have realised that you cannot support the left

Of course the whole thing is, now that we can analyse it with the benefit of 20 years of experience and hindsight, a pile of utter tosh and you can drive a truck through the holes in the arguments. But at the time, well, I certainly was duped. The right’s propaganda is devious as it is both subtle and overt at the same time.

For me, it tweaked that almost primal, base fear of failing (or missing out on something, or being dumb not smart or not being my “able to make it on your own” — that sort of thing; even now I’m not able to really nail it and quantify exactly how it appealed).

The really sad part is of course how deeply ingrained all this wrong thinking has become. It will take a lot to dislodge it.

Ah well maybe few can really see the end from the beginning, of things they haven’t seen play out. Hindsight is 20-20 in other words (and in the U.S. the historical understanding is deliberately kept abysmal – no MEANINGFUL history is taught but lots of meaningless facts are memorized, and those who made it to the middle class were not about to teach their children the class consciousness that often made is possible so … ).

It is interesting to see generational warfare as deliberately creating the inability to carry any personalized family etc. knowledge forward. Don’t trust anyone over 30 said the young Boomers, but those prior generations knew class struggle for sure.

“Don’t trust anyone over 30”. Dumbest slogan ever. And of course not all Boomers believed it.

Worst President ever… until the next one.

Beautiful. Whenever I hear “bend the cost curve,” I want to puke.

Please, he didn’t say which direction that cost curve was going to bend, or how much, or how fast… Give the effer the benefit of his dissimulation and obfuscation, okay? He’s only one man, after all… We are not at war with/ in Syraq… We are not on the way to global war to preempt and pretermit and obscure the causes of global collapse…

A similar story on the TIINA of Obamacare was done by the PBS NewsHour this past Friday. The callousness and cluelessness of Judy Woodruff and a “healthcare” analyst is astounding as they discuss, “One development this fall that’s turning into a concern for some consumers, a series of collapses of an alternative to traditional insurance plans known as co-ops. Nearly a half of them, which were created through the Affordable Care Act, are now shutting down.” Judy and her gusset’s solution: “Get out there and look for another plan!”

“Go out there and look for another bill of goods!”

Got a transcript on that?

Lambert, probably this,

http://www.pbs.org/newshour/bb/open-enrollment-time-know-obamacare-costs/

And thanks for your magnificent work on this subject!

Yes, outstanding work by Lambert here.

Yes. Lambert’s Obamacare and insurance industry take downs have great information.

How is this bending the cost curve in any way but UP – this is about a 15% increase in one year? ——- “A typical family of four with annual income of $60,000 will, on average, receive tax credits[1] totaling $5,570 in 2016, up from $4,850 this year, the administration said.”

My partner is having to save for taxes because of Obamacare. I think the next tax cycle is gonna revulse and revolt masses of people like her very much.

And she’s got a $6k deductible. Six fucking thousand dollars before they lift a GD finger! Seriously, what in the goddamn fuck is this ridiculous, nothing, worthless, extortionistic “product” of these motherfucking mobsters!

(sorry for language)

Hell with it. Unsolvable. Everything everywhere too deeply fucked. We are a failed species. Enjoy what’s still left to enjoy.

Right with you on this one.

it’s infuriating and your post was cathartic to say the least. There is no area left untouched by this massive corporate grab shitshow!

@omg the stupid: the issues of universal health care and gun control seem to have been solved by virtually every other “wealthy” country in the world, and by MANY that are not (wealthy). Only we, in the good ole U.S. of A. seem to find these things “unsolvable.”

But then — Oops, I almost forgot — we are Exceptional…

” unless the lash for the penalty really begins to bite. ”

Once again: a perfect opportunity for a tax resistance campaign, since substantial numbers of people (50% of uninsured? Is that right?) are ALREADY deciding it’s a bad deal. They should be encouraged to refuse to pay the penalty. The IRS is forbidden to collect it except from refunds (raising a good question whether it really IS a tax, right, Mr. Scalia?), so if you can avoid a refund, you can avoid the penalty. Might be worth having to pay a bit more in April, dontcha think?

People who have to pay substantial penalties because they refuse to buy a faulty product are going to be very politically PO’ed.

Question – how does ObamaCare work with hospital bills if the policy is always changing? Slightly off-topic, we learned the hard way (car accident where the other driver was at fault) that a hospital has 3 years to actually send a bill. In our particular case, the hospital sent a $2500 bill AFTER the insurance claim had been settled and almost 2 years after the accident. All perfectly legal apparently.

My wife is self-employed and get ObominableCare through CoveredCa.

She is doing better this year so we tried to decrease the deductible, and failed. Covered Ca wanted to have a verification of projected income (which is an impossibility).

We’ll get a tax claw back for the excess subsidy, but because CoveredCa would not decrease the sumsidy, We intend to go to small claims court and demand the penalty back as damages.

Hey Lambert, I have a puzzle for you. I live in New York, and I know for a fact that BlueCross offers ACA plans here. They offer them on their own website (https://www.empireblue.com/health-insurance/new-york-health-plans/) and through the Freelancers Union as well. Now I’m not saying they’re great plans or anything, but why is it that when I search the NYS healthcare exchange website (https://nystateofhealth.ny.gov/) the BlueCross plans don’t show up at all? The only plans that come up, and I tried with various selection options for individual, couple, family, all the different “metal” selections (god I hate that “bronze”, “silver”, etc. bulldookie), are from companies I’ve never heard of before (not to say they’re not better than BC/BS of course) but it leads me to ask, what other options for New York citizens, er I mean consumers, are not being offered on the exchange and WHY NOT? This is very odd to say the least. It stinks of something though not sure what exactly…

I can’t answer, but are there other NY readers who could help?

I’ve never used the NY ACA site but I am told by someone high functioning (tax lawyer) that the only info you can get on ACA plans in on the state’s site, as in any other source is not considered valid. Or maybe put it another way, my understanding is if you can’t buy it through the state site, it is not ACA compliant (part of it being an ACA compliant plan is it is offered on the exchange).

This is not correct. QHP’s merely must be certified by the marketplace, not sold there. Issuer’s can offer plans “off-exchange” only. However if a plan is offered on the exchange it must be sold off the exchange. So if you can’t navigate the NY State of Health but meet all the eligibility criteria and aren’t looking for premium subsidies you can fight the plan to sell to you (more “tax on time”). (See question 5 here). To sum up, plans are either “off exchange” or “both off & on exchange”.

They certainly should be there – New York state banned non-QHPs, so the Marketplace should carry every ACA-compliant plan available in the state. In fact. the web page you linked to says exactly that:

“To see if you’re eligible for a subsidy, click the button below to visit the NY State of Health website. When you’re ready to shop, you can find our plans on NY State of Health as well as on empireblue.com.”

Are you in Empire’s Service Area? Maybe you’re in the Excellus BC/BS Service Area? Possibly consult this map : http://info.nystateofhealth.ny.gov/PlansMap ?

Thank you for point out that health care is a completely different thing than health insurance! This slight of hand use of language has gone on for so long unquestioned. It’s like saying we all need transportation and then offering up auto insurance instead of things like public transit and the transportation infrastructure.

It is laziness – it is far easier to claim a legacy of creating a gargantuan health insurance app than actually putting in the hard work to reform the distortions in the healthcare industry.

It is not laziness. It is calculated greed and evil. And every single person involved with the creation of the entirely mis-named Affordable Care Act (or as someone else here called it, ObombinationCare) is guilty of being calculatedly greedy and evil.

Yes, of course you are right.

Thank you for correcting it.

The important point to remember is that health “care” premiums are so small, insignificant, minuscule, and tiny that they are not worth worrying about….There is no inflation!!! !!!!!!!!

http://www.bls.gov/cpi/cpifact4.htm

“Although medical insurance premiums are an important part of consumers’ medical spending, the direct pricing of health insurance policies is not included in the CPI. As explained below, BLS reassigns most of this spending to the other medical categories (such as Hospitals) that are paid for by insurance. The extreme difficulty distinguishing changes in insurance quality from changes in its price forces the CPI to use this indirect method.”

Yup, and hedonically speaking, your all living longer (well, actually the rich are living longer and the poor are not, but in the aggregate, averagedly, the people who really count are living longer….So quit yer bitchin’

And see, here’s a table – medical hardly went up at all:

http://www.bls.gov/news.release/cpi.nr0.htm

And with the increasing foot amputations, a hedonic improvement occurs. Once your feet are cut off, you save money on shoes, slippers, galoshes, nikes, socks, and pedicures…..and general foot stank!

Thanks for your pains.

This is truly mean on your part Lambert and so true. Thanks for the Great Run Down on Amerikas citizens corp. health care plan from hell voted in by both willing parties for their puppet masters.

Fresno Dan the last last sentence, yes the hurry up and die already health care plan;)

One major change to policy that I haven’t seen highlighted, is that this government program, with its requirement for shopping between alternatives that are both complex and obfuscated, is not just a tax on time. The level of sophistication required to have a prayer of keeping your relationship with your doctor, or of having all your medical needs covered within your network, causes the program to border on the predatory. It is an unequal tax on mental and intellectual competence.

I grew up knowing that my education gave me an advantage in identifying and avoiding traps in contracts in the private sector. But most government programs used to make a real effort to provide access even to under educated people. They tried to reach a minimum threshold for intelligibility that was well below the reading level of the average high school graduate.

Tell me that someone with a 6th grade education, or someone with undiagnosed early alzheimers, or just a 60 hour work week plus kids, can navigate and make sense of these options well enough to sniff out the best bargain. This is the opposite of paternalism. Leaving aside the problems of unequal educational access, the proponents of the idea that health care recipients should be informed consumers either don’t know or don’t care that the need for health care can temporarily or permanently take away the ability to read, think rationally and communicate.

I supported Obamacare, and still think it’s bettter than returning to no insurance for preexisting conditions etc. (Especially since so many lost what plans they had and so would be newly uninsurable under the old system)

But I never imagined that plans would be crafted such that the surgeon was in and the anesthesiologist was out, or the hospital was in but the emergency physicians group for the hospital was out. If the goal was a subsidy for bankruptcy lawyers as well as insurance companies, I’d say they succeeded.

“Your relationship” with “your doctor”? All relationships that don’t conform to market customs are invalid and therefore subject to nationalization.

As awful as the Obamacare plans sound, yesterday I was speaking with an over-65 year old employee at the local Jewel-Osco grocery store (a large, local, unionized chain). He mentioned that the only reason he continued to work at the store was for the health insurance plan, since his wife has heart problems. I commented that the plan must be fairly attractive. He told me that, to the contrary, the deductible for the plan was $10,000 per person, but that at least there was a limit on out-of-pocket, unlike Medicare. He viewed the plan as a “catastrophic” plan and said that the last time his wife had to go into the hospital for surgery, they were only out of pocket $12,000! So even some of the corporate plans, in this case for a large, unionized labor force, are grossly inadequate.

Part of the reason for ACA was because insurance costs were going through the roof, yearly double digit increases, etc. Employers were dropping coverage at a rapidly increasing rate and individuals were generally either unable or unwilling to purchase individual plans. It truly was an insurance bailout plan, not health care reform.

As for union coverage, as with anything other coverage community rating could kill the ability of some locals to cover much. My union struggled for years to keep reasonable coverage for its membership, always being hit by double digit increases (lots of cancer and other expensive diseases). One of the reasons I found the whole cadillac plan tax to be so offensive, is that I knew we were already in that category and our coverage was the minimum that any American should have, even though it goes without saying not one ACA ‘compliant’ plan has that minimum. But it is now considered a luxury plan because it runs to five figures to cover a participant AND because no one has to come up with another 5 or 6 thousand dollars in medical expenses before the assholes will pay for a friggin’ thing. Gotta get everyone on the system where they pay thousands and thousands for their “free” physical, and forgo any other care because they don’t have several more thousand dollars to lay out before they have the “privilege’ of paying 20% of any other bill for coverage not to mention an even larger percentage of the cost of any prescription. Which is why that Cadillac Tax is designed that ALL employer plans will be hit by it in a few years – and is something that no one will pay except for the privileged executive suite.

The truly sad thing is that our system was so broken before, that people can pretend that this is actually an improvement for a few years because of the Medicaid expansion (not that that really is all that good either). Crapification, aka bending the cost curve, is all about making sure that NO one who isn’t on the outskirts of the financial spectrum (too little or too much money) gets to go to the doctor but the insurance company still gets their required cash.

Texas may have 17 insurers, but the plans are all the same in their suckitude. They play actuarial games with premiums, copays, and deductibles, but the entire thing is rigged and no amount of shopping will turn up a plan that anyone in their right mind would want to buy.

Last year Aetna offered a variety of POS (point of service, piece of shit?) plans, which had the very slight advantage of offering limited coverage for out of network providers. So, you know, if you were willing to pony up a substantial amount of your own cash for the provider of your choice, you would get a little something in return for the $6000 plus per year you were being mandated to pay in premiums. Those plans are all gone for next year. Nothing left but EPO and HMO plans, all of which are varieties on the same sorry theme. What a total, unmitigated, steaming pile.

It’s not just that HMOs don’t allow you the choice of a provider out of network which might be a better provider that one might prefer, it’s that they are also certain bankruptcy plans if you happen to end up in the hospital and have an out of network radiologists or something contribute to your care. Even if the hospital is in network, not all the medical professionals working at it might be. That this guaranteed bankruptcy goes under the name of “insurance coverage” is a joke.

Assurant and Memorial Hermann both offer PPOs in Texas. Check out finder.healthcare.gov for those and other non-QHPs.

In Minnesota there is NO AVOIDING “substantial increases in premiums.” Personally, my cheapest plan available went from a monthly of $266 to one of $420, and the deductible went from $5k to almost $7k. So my first insurance dollar won’t kick in until I’ve paid almost $12k. Compare that with my penalty for not buying next year of $1k.

Remember that if the average bronze plan premium available to your zip code exceeds 8% of adjusted gross income, you may Opt Out. Riding nekkid, self-covering CARE, out of pocket, and giving the finger to the extortion.

Is that just the premium, or does it include the deductible?

Premiums… and it actually is LOWEST cost bronze plan… viz:

last year , H /w filing jointly, monthly premiums for two were around $800 total.

$9600/ yr / .08 = $120K AGI… My agi is a lot less than that, so we can Opt Out.

I don’t know why this factoid isn’t discussed more… I think the vast majority of lower middle class self-employed ‘contractor’ class is in this ‘bracket’.

Frankly, I think folks feel a need for insurance, confuse insurance with care, and are terrified -just terrified – of not being ‘covered’ . If the bronze plans exceed 8% of your AGI, would you by choice Opt Out? Or, do you feel a need to be insured?

The cold hard facts are that for a person in moderately good health, self-insuring is cheaper, more cost effective, and doesn’t entail the byzantine obfuscation of co-pays, deductibles, etc., much less 30- 40 cents on the dollar going to a parasitic insurance industry that does not add one whit of value to the CARE equation.

One problem I do have: price discovery of any services… unless you are an insurer, getting this information ahead of receiving care, and ‘shopping’, is impossible.

Can we insure the health of a mortal critter?

Or, should we all pay our own way for routine ‘well-care’, and add more to a collective kitty for the terrifying-just terrifying- catastrophic health disaster for non-fatal situations, that force bankruptcy?

Oh, I left out dignified, palliative end-of life compassionate care & the ‘death panels’ .

Much to ponder, and we never had the national discussion.

Few years ago lived in Germany. Doc requested chest x-ray and I did it. Although I have insurance told them I would pay out-of-pocket for x-ray. Cost 65 Euros (~$85). Cost included picture and radiologist report. Thought to self was I don’t need health insurance to pay for that if that is the true cost.

I will note that another rate increase on the low end of your list is NY. NY-DFS has what is called an “effective rate review” process and is not shy on cutting requested rate increases from issuer’s (see the tables here). Similarly Oregon has very public rate review processes . However you are seeing these states start to allow higher rate increases and this is probably because they are worried about solvency (See the recent issues with Co-Ops you pointed out).

I will argue with the categorization of rates being “random with respect to jurisdiction”. If your rates are higher or plans are exiting I’m going to guess it’s due to the power/greed of your friendly local hospital monopoly (also here). Now if there was some better way we could negotiate those prices down… wonder how we could do that…. left as an exercise to the reader I suppose

Lambert Strether, you’ve written the first (that I’ve seen, & I’ve searched, for the past 3 years) valuable analyses of the U.S. health insurance situation. I’ve just discovered you, but already you’ve broached topics that greatly concern me & that I haven’t seen discussed anywhere else. I’ll recommend your writings to anyone I know who might read them. Very few folks have any grasp of what’s happening, we need to increase that number.