By Claudia Olivetti, Professor of Economics, Boston College, and M. Daniele Paserman, Professor of Economics, Boston University; Research Affiliate, CEPR. Originally published at VoxEU.

Intergenerational income mobility is currently not very high in the US compared to other developed countries. This column shows that US intergenerational income equality was high in the 19th century but plummeted between 1900 and 1920. The income-mobility ladder was thus pulled up during the so-called Great Gatsby era.

Income inequality has shot to the top of the public debate in the US and elsewhere. One typical reply – especially in the US, the ‘land of opportunity’ – is that what matters is equality of opportunities, not equality of outcomes.

If children born into disadvantaged environments have a decent shot at getting to the top of the income ladder, static inequality measures would matter much less. Indeed, Alesina and La Ferrara (2005) argue that Americans are relatively averse to redistribution exactly because they perceive income mobility to be relatively high.

Today, however, such intergenerational mobility is not exceptionally high in the US. Corak (2013) shows that US mobility is lower than that of most other developed countries. In recent research we look into whether the US ever was the land of opportunity and if so, when the ladder got pulled up.

New Research

Obtaining historical estimates of mobility is challenging because of the absence of readily available data that allow linkages across generations. In our recent work, we overcome this barrier using a unique methodology that exploits the fact that first names carry rich information about socioeconomic status (Olivetti and Paserman 2015). The goal is to take a long-run perspective and track social mobility in the US between 1850 and 1940.

To illustrate our approach, suppose rich men named their sons Edward in 1850, while poor men named their sons Sam. One can then look at how Edwards and Sams are faring in 1880 to get clues about social mobility across generations. If the 30-year-old Edwards are on average better off than the 30-year-old Sams, we would conclude that intergenerational mobility is relatively low.

The same idea can be applied to fathers of Emmas and Sallys to study how daughters’ economic status (proxied by their husbands’ occupational income) is related to that of their fathers. This procedure allows us to estimate mobility consistently over time and for both genders, and to identify long-run trends in intergenerational mobility.

Main Findings

We find that:

- The father-son intergenerational elasticity – defined as the percent increase in a child’s income associated with a 1% increase in father’s income – increased by 24 points between 1870 and 1940.

This increase is consistent with the findings of other authors (e.g. Ferrie 2005, and Long and Ferrie 2013), who document a marked decrease in men’s intergenerational mobility in the US between the late 19th century and the second half of the 20th century.

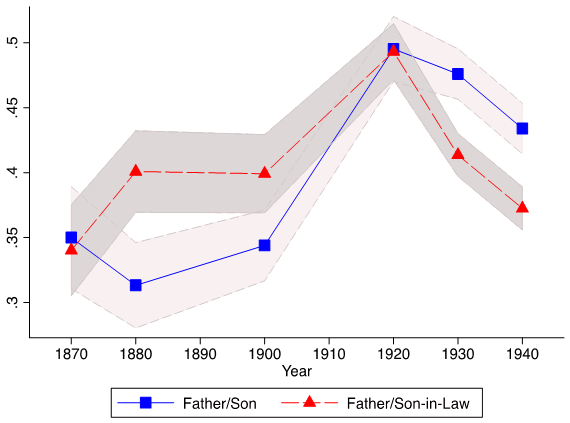

- As shown in Figure 1, the elasticity did not increase smoothly over time; it was relatively flat throughout the second half of the 19th century, then increased sharply between 1900 and 1920, followed by a slight decline between 1920 and 1940.

The intergenerational elasticity between fathers and sons-in-law displays a similar trend between 1870 and 1920 (mostly flat between 1870 and 1900, and a sharp increase between 1900 and 1920), suggesting that there was a substantial degree of assortative mating.

Figure 1. Intergenerational elasticities

Note: The figure presents point estimates and 90% confidence intervals for the father/son and father-son-in-law intergenerational elasticities. The values on the horizontal axes represent the year from which the son’s (son-in-law’s) sample are drawn. The elasticities are obtained from a regression of son (son-in-law) log occupational income on imputed father’s (father-in-law’s) log occupational income. See Olivetti and Paserman (2015) for details of the imputation procedure. Occupational income is based on average earnings in the occupation in 1950.

Factors Explaining the 1900-1920 Drop in Intergenerational Mobility

A higher elasticity means that income differences are more persistent, so intergenerational mobility is lower. Our finding of a sharp increase in elasticities between 1900 and 1920 is very robust, suggesting that this was a key inflection point in the evolution of mobility in the US.

- An exploration of historical, demographic, and economic trends suggests that regional differences in economic development and fluctuations in income and wealth inequality were the main factors driving the observed patterns in economic mobility.

The industrial revolution did not spread uniformly across the US. Regional income diverged significantly in the second half of the 19th century. By 1900 income per capita in the south was barely half of the national average (Kim and Margo 2004). If fathers and sons tend to live in the same region, large economic disparities across regions will translate into a high correlation between father’s and son’s income.

- Our analysis suggests that geographic differences in the degree of economic development can explain about half of the increasing elasticity between 1900 and 1920.

- The expansion of public schooling in the early 20th century can also contribute to explaining the decline in mobility between 1900 and 1920 because the wealthy were in a better position to take advantage of access to schools (Parman 2011).

In the modern context, there has been an upsurge of interest in the link between inequality and intergenerational mobility. Part of the increase in intergenerational elasticities between 1900 and 1920 could also be explained by an increase in inequality or an increase in the return to human capital. Piketty (2014) documents that the top decile share of wealth in the US increased substantially between 1870 and 1920, and then dropped in the following two decades. The timing of the increase in inequality overlaps remarkably well with the increase and later decrease in our estimates of intergenerational mobility.

Concluding Remarks

Our findings suggest that the ‘Great Gatsby curve’ documented in cross-sectional data (either across countries, Corak 2013, or across US states, Chetty et al. 2014) is an empirical regularity that can also be found in time series data.

Editors’ note: Also see the blog version posted on LSE USAPP blog.

References

Alesina, A and E La Ferrara (2005), “Preferences for Redistribution in the Land of Opportunities”, Journal of Public Economics.

Chetty, R, N Hendren, P Kline and E Saez (2014), “Where is the Land of Opportunity? The Geography of Intergenerational Mobility in the US,” Quarterly Journal of Economics.

Corak, M (2013), “Inequality from Generation to Generation,” in (R. Rycroft, ed.) The Economics of Inequality, Poverty, and Discrimination in the 21st Century, ABC-CLIO.

Ferrie, J P (2005), “History Lessons: The End of American Exceptionalism? Mobility in the US since 1850,” Journal of Economic Perspectives.

Kim, S and R A Margo (2004), “Historical Perspectives on U.S. Economic Geography,” in (V Henderson and J Thisse, eds.) Handbook of Regional and Urban Economics, Volume 4: Cities and Geography. Amsterdam: North-Holland.

Long, J and J P Ferrie (2013), “Intergenerational Occupational Mobility in Britain and the U.S. Since 1850,” American Economic Review.

Olivetti, C, and M D Paserman (2015), “In the Name of the Son (and the Daughter): Intergenerational Mobility in the US, 1850-1940,” American Economic Review, 105(8): 2695-2724.

Parman, J M (2011), “American Mobility and the Expansion of Public Education,” Journal of Economic History.

Piketty, T (2014), Capital in the 21st Century, Cambridge: Harvard University Press.

When times are tough then it is more important than ever to help out family and friends, the result of that is: Whenever there is an unemployed friend or family around and there is a job-opening then a friend or relative is likely to be hired. Call it cronyism, xenophobia or whatever. The result is the same, insiders do well and keep their positions, outsiders upward mobility is blocked by insiders looking our for themselves.

The outcome is not pleasant nor good. Meritocracy dies during tough economic times.

& a second factor might also be that first generation immigrants face a lot of xenophobia and are therefore stuck in low-paying jobs, second generation immigrants have less xenophobia to deal with so do better (upwards mobility) and so on with third generation with a better chance of doing better etc etc

The UK has had a privately educated elite for centuries.

Private schools and universities are the mechanism the US uses for social stratification (based on the UK model).

The US and UK have similar atrocious levels of social mobility.

The UK being the second lowest in Europe, after Portugal.

http://www.oecd.org/centrodemexico/medios/44582910.pdf

No doubt much of it had to do with reinvestment of the the vast wealth generated in America due to supplying the troops in WW1, both prior to the US entry and during the US phase of the war.

As for this: “The expansion of public schooling in the early 20th century can also contribute to explaining the decline in mobility between 1900 and 1920 because the wealthy were in a better position to take advantage of access to schools”. It is a nonsensical and self contradictory statement. Public schooling most manifestly did not help “the rich”, that favorite hobgoblin hereabouts, “gain access” to education for they already had this. It helped others gain access; this is why they are called “public schools”. Moreover, if the data for this graph is the input, the notion that there was “decline in mobility between 1900 and 1920” is unfounded.

Furthermore, that period was not about “equality of opportunity”, as if there was such a thing or it could be actually controlled; it was about an abundance of opportunity, which is another thing altogether. It was also, pace the brief period of Wilson’s “war socialism”, an era of limited government and limited taxation.

Of course, such fact will hardly meet a mention here as Marxism occludes all reality.

Oh, and most nations in Europe have elite schools, public and private, and have had traditionally much more permanent class stratification than either the America or the UK have had; Lastly you can bet that when historically compared to the UK, the economy of Portugal has more or less been a joke for the last 300 years. As Portugal modernized (and got wads of EU money, some coming form the UK), of course “inter-generational” income has gone up. How could it not? This has not much to do with private schools either in the USA or the UK, at least not directly, and only indirectly in so far as tax monies from those dread private school attendees got somehow in the pockets of the Portuguese politicians and their clients.

Honestly, one cannot make this stuff up.

You think VoxEU is run by Marxists? You need to get that knee seen to.

Any good figures on how the post-WWII decades up to the 80s compare?

One other thing happened about the turn of the century: The frontier closed. No more access to land without capital. You could no longer get started in farming, ranching, mining, logging, etc. without money.