Lambert here: Wait, I thought gentlemen preferred bonds? Guess not. Anyhow, we don’t do a lot here on the trading beat, but I was struck by two things in this post: First, the sheer breadth of the problems; and second, the fact that I knew the names of a lot of the companies that are in trouble.

By this point, readers know I’m a Maine bear, so this post fits all my priors, but I’ve gotta say the greatest recovery ever is looking a little long in the tooth, and just before the real 2016 campaigning starts, too. I remember in 2008 that “It was Lehman wot did it” (allusion) and put Obama ahead for good — imagine, the greatest orator of our time found it hard to deal McCain and Palin a knockout blow — but I’ve always felt that was because the Democrats still had some lingering good will with the voters on the asset side of the balance sheet for being “better on the economy.” I would imagine Obama’s squandered that. On the other hand, the Republicans have been peddling the same nostrums for a generation; can anybody take them seriously? If the Yellen can’t keep pumping blood into the zombie economy, 2016 could be a very interesting year.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

“Large amounts of potential and realized losses”: Moody’s

The US junk-bond market, after years of record-breaking issuance, has nearly doubled to $1.8 trillion since late 2008, one of the miracles the Fed’s QE and ZIRP performed. Those were the good times. Now Fed-blinded investors are cracking open their eyes.

It didn’t help that the week was punctuated by some juicy bankruptcies, including steelmaker Essar Steel Algoma, which filed in the US and Canada – for the second time in two years and for the third in 25 years – as it struggles with over $1 billion in debt. And Millennium Health, a malodorous mess I wrote about in July [“Leveraged Loan” Time Bomb Goes Off, JP Morgan Did It].

Energy junk bonds are sinking deeper into the mire. For example, natural-gas driller Chesapeake Energy’s 6.625% notes due in 2020 fell 7 points last week to 58 cents on the dollar. Or the misbegotten Occidental Petroleum spin-off California Resources; according to S&P Capital IQ LCD, its 6.00% notes due 2024 dropped to 64.50 cents on the dollar.

Beyond energy, specialty chemicals maker Hexion’s 6.625% notes due 2020 fell to about 81 cents on the dollar. And Mallinckrodt Pharmaceuticals, based in Ireland, with its US headquarters in St. Louis, Missouri, got hit by a tweet from short-seller Citron Research, after it took a break from eviscerating Valeant. As Mallinckrodt’s shares plunged, its 5.625% notes due 2023 dropped from 94 before the tweet into “price discovery,” with quotes around 85.

When tire-maker Titan International reported sharply declining revenues, its 6.875% secured notes due 2020 fell three points to 82.25. Scientific Games, which caters to lottery and gambling organizations, also reported crummy quarterly results; its 10% notes due 2022 plunged six points early in the week, to about 81.

Then there was Men’s Wearhouse whose blood-soaked investors are ruing the day it acquired Jos. A. Bank. Its shares have been getting hammered relentlessly since Friday a week ago, and its bonds are now down to 85 cents on the dollar.

Sprint’s 7.88% notes due 2023 plunged over 5 points to 84.50 cents on the dollar. Satellite communications company Intelsat Jackson, the US subsidiary of Luxembourg-based Intelsat, is edging closer to the brink, with its 7.75% notes due 2021 dropping nearly 5 points to 53 cents on the dollar.

You get the idea. S&P Capital IQ in its LCD HY Weekly described the junk-bond debacle this way:

Bad news amid low-volume, jittery market conditions led to some big downside movers again this week. Broad momentum was also negative amid signs of retail cash outflows from the asset class and higher underlying US Treasury rates after the blow-out November jobs data skewered bonds.

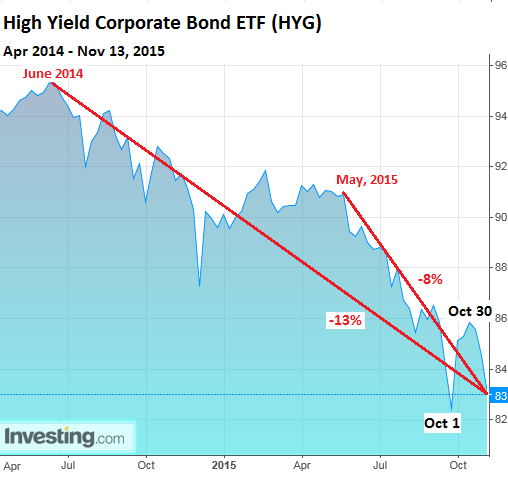

The junk-bond based High Yield Corporate Bond ETF (HYG) has fallen for eight trading days in a row. It’s now just a hair above where it had been on October 1, at the bottom of the summer panic. It’s down nearly 8% since May and over 13% from its recent peak in June 2014. The ballyhooed rally in October has once again turned out to be just another sucker rally:

Not that these junk bonds have been issued over the past few years to fund productive activities that would generate cash flows with which to service the bonds. Far from it. According to LCD, in 2015 so far, the proceeds from 46% of the newly issued junk bonds were used to refinance maturing bonds, paying early investors with money raised from new investors.

Another 30% of junk bond issuance was used for M&A. Valeant is a prime example. It’s teetering under $38 billion in debt and has a tangible net worth of a negative $33 billion. If it craters, the bloodletting among creditors will be brutal.

And 16% of the junk bond issuance was used for “corporate purposes” and “other,” such as share buybacks, special dividends back to their private equity owners, and even some investments in productive activities, while 4% was used for LBOs.

The number of “distressed” bonds (defined as bonds whose yields are 10 percentage points higher than Treasury yields) has ballooned, Moody’s pointed out: there are currently 616 distressed bonds, over six times as many as last year, and the most since 2009.

This “massive increase” in distressed bonds “anticipates a rising default rate,” Moody’s said, as these companies have trouble raising new money to pay earlier investors.

The problem is moving beyond distressed bonds. Year-to-date issuance of dollar-denominated junk bonds is down 16%. But it’s much worse at the lower rated end. Over the past six months, the average monthly issuance rated Ba1 to B2 plunged 30% year-over-year, and issuance rated B3 or lower plunged 56%.

Many of these companies are essentially locked out of the credit markets and face default when the money runs out. Investors, who for years took huge risks to get a little extra yield, just as the Fed had wanted them to, are now feeling the pain.

“The burst in distressed corporate debt issues and the general rise in high yield interest rates has left investors sitting on large amounts of potential and realized losses,” Moody’s said. Those losses in market value since last year amount to $112 billion.

Of these losses, $50 billion are on energy bonds. The remaining $62 billion are on junk bonds issued in other sectors. And this is “pointing to more widespread poor performance among industrial firms.”

Moody’s warns: “Any potential rebound in high yield corporate issuance and debt valuation will be limited by the ongoing softness in global heavy industry activity.” So any rallies will once again be just sucker rallies in the darkening saga of the Fed-induced junk bond boom.

What’s next? A credit crunch. And Moody’s offers unnerving comparisons to 2008 and 1999! Read… Last Two Times this Happened, it was Mayhem

I’m sure Valeant looked like a super-sure thing a little while ago, but… negative $33B?? It reminds me of Borders’ bankruptcy a few years back, where they were valued at something like $80M before including the $1B in debt.

That said, I would have appreciated a little more context from Wolf. I’ve seen lots of graphs with downward-pointing, scary-looking lines and lists of wobbly companies. My big question is, “Is a $112B loss that much?” Out of a $1.8T market, that’s only a bit more than 5% (1/20), which hardly seems catastrophic. I appreciated the info showing how >50% was not in energy, but context helping judge the significance of the $112B number would help.

Another question is, “What’s the dollar-value of bonds of companies locked out of the market? When/if they go bankrupt, is that another $100B? $300B?” That sort of context would help more than knowing the decreased issuance of bonds at lower credit ratings.

Does anyone else have that context to share?

This is an excellent anf timely point and is one of the reasons that Zero Hedge needs to be taken with a grain of salt. Their apocalyptic articles with razor-jagged graphs rarely tell the whole story. No one is denying the import of Wolf’s article above but the “when” is as important as “if”.

Market timing is something NC doesn’t do. What struck me, as I said, was the list of names — brands, I guess — that I knew. (Maybe that’s always true, and I’m just new to this; I’ll watch out for lists + jaggy chart as an editorial formula in future.)

For example, Scientific Games is state lottery machines. Though lotteries are vile, a lot of states use them to fund stuff like schools (which I grant is better than funding them through fines and judgments through law enforcement for profits). ‘

Now, I had always thought lotteries were recession proof. This fact, and the use to which the lottery funds are put, would argue that states would keep buying these machines if they could (or upgrading them).

And nobody’s called a recession, but here’s a lottery infrastructure supplier in trouble. Just seems sketchy.

“…the proceeds from 46% of the newly issued junk bonds were used to refinance maturing bonds, paying early investors with money raised from new investors.”

There’s a finance term for that sort of arrangement, but it’s eluding me at the moment. Something Italian … let’s see:

Zamboni scheme? Nah, that’s hockey.

Gazpacho marketing? Nope, too soupy-sales-ish.

Omerta financing? (No one will tell me if that’s it or not.)

Ida Lupino? Whoops, that’s some long-deceased movie-industry chick.

The Ricci tensor? Gah – that’s #%&^! relativity theory. I give up.

ahaha.. Took me a while to twig what the hell you were mumbling about. You, of course, refer to the infamous and electrifying Piezo scheme.

Gazpacho is not italian! But it was funny to me. However, it is not surprising to read the phrase you quoted since this is the way corporate financing works these days. Business go round after round of financing in a very short term basis, specially those involved in online services. The proceeds of the following round are used in part to repay early investors and if this amount is so high it is because the previous round occurred… 9 months ago? Business plans are short term sighted and milestones have to be achieved in terms of months, not years. This speaks the language of uncertainty, the language of stress, too rapid decissions, short term risk taking. You don’t buy bonds for long term business financing and you will not wait 10, 5, or 3 years to see a benefit. You want that the following round, in less than a year, provides with the gains you expect. Investors are playing the game of benefitting from the future hypothetical profits of companies. In other words, you, as an investor, try to get a benefit that will, or will not materialize 3 or 5 years later. Speculation at its purest. And on top of it, the smart guys collecting, without risks, a lot of potential future business revenues in the form of fees.

What i don’t buy is the narrative that such risky behaviour is driven by the Fed. These speculators are not Fed-blinded as Richter writes. They know what game are they playing and they are willing to do so.

To say it in a different way, because the current business conditions aren’t as good as the “solid recovery” would imply, investors have decided to cash now the benefits of the future. This is quite risky in the present uncertain conditions. And unfair for the next generation.

Okay, I’ll bite; The term that came to my mind as I read this was “Ponzi Scheme”

Soupy Sales!!! It’s been a long time since I heard or read his name. I loved that comic when I was a kid. He would be the patron saint of junk bond dealers, right?

The proper term for the dynamic you describe is “FEDerico Fellini-esque investing.”

Early investors are Godfathered?

The Ponte Vecchio scheme? For bridge loans?

Your ‘bridge loan’ wouldn’t be from the Banco Ambrosiano, would it? After all, Milan is just ‘up the road’ from Florence. (That’s a little too much like selling the Brooklyn Bridge and owner financing the sale.)

Do you mean a “Fonzie scheme”?

https://youtu.be/GeF3hew6McY

Is “Madoff” an abbreviation of an Italian name?

I’m sure “Because he made off with the money” is a joke that’s been made, but for due diligence…

As Wolf points out, a substantial portion of junk debt is used for M&A and

corporate looting‘special dividends.’Private equity holdings are heavily leveraged, to the tune of about 5.5 times EBIDTA. Companies that can refi face heavier debt service. Those that can’t face default. But it’s nothing that valuation smoothing can’t fix for institutional investors /snarc.

Two big junk bond ETFs (symbols HYG and JNK) provide a rough intraday reference, but a broader daily BofAML junk bond spread index — unaffected by ETF premia and discounts from net asset value — is published by FRED:

https://research.stlouisfed.org/fred2/series/BAMLH0A0HYM2

This junk spread peaked at 6.83% on Oct. 2nd, and was at 6.19% yesterday, suggesting that financial stress has receded a bit. BofAML’s investment grade corporate bond index sends a similar message, having peaked at 1.80% on Oct 2nd and declined steadily to 1.62% yesterday.

https://research.stlouisfed.org/fred2/series/BAMLC0A0CM

We need to keep a watchful eye on these ‘coal mine canary’ spreads. But they ain’t blowing out to new wides right now. Everyone back in the pool!

Thanks for the spread data.

Carlyle’s Unwanted Debt Exposes Growing Problem on Wall Street

Couldn’t happen to nicer folks.

If you want bloodletting try going short. That’s what I did. That was a mistake. The asteroid didn’t come from the sky it came up from the ground right under my telescope. The telescope I set up to find asteroids in the night sky, making my neck sore from staring. Bit it was a volcano not an asteroid. It came right up from the ground and burned my butt. Why isn’t there any posts that warn about the volcano? Maybe they think we shouldn’t be surprised. Maybe this analysis is just for “entertainment purposes”. Speaking personally, I want to make money. If I want entertainment I’ll go to Youtube and check out Rhianna videos. There’s a volcano for you! That’s the good kind though.