By Nick Cunningham, a Vermont-based writer on energy and environmental issues. You can follow him on twitter at @nickcunningham1. Originally published at OilPrice

The IEA struck a dour tone on the state of the global economy in 2016 in its latest monthly Oil Market Report, and even included a stark warning that the markets could “drown in over-supply” because of rising storage levels around the world.

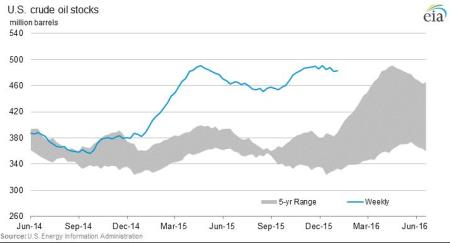

Oil analysts have closely watched storage levels as an important barometer of where the markets were heading. The thinking was that inventories would rise as the supply overhang persisted, but storage facilities would then drawdown relatively quickly as production slowed. But in early 2015 a funny thing happened: Inventory levels surged to their highest levels in 80 years in the U.S., pushing oil prices down into the $40s per barrel.

By April, oil stocks began drawing down. Oil prices rose to the $60s and everyone thought a rebound was well on its way. But by the end of the summer, inventories began rising again and prices crashed. As of early 2016, there is a lot more pessimism as storage levels have barely declined from their 80-year highs of 490 million barrels in the United States.

(Click to enlarge)

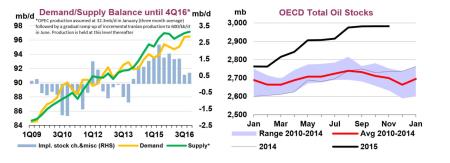

Around the world things do not look much better. The IEA says that the world added 1 billion barrels of oil into storage in 2015. Worse yet, global inventories could climb by another 285 million barrels this year before all is said and done. The stock build will likely “put midstream infrastructure under pressure and could see floating storage become profitable,” the Paris-based energy agency concluded. Last year the IEA warned that available storage could entirely run out.

OECD oil inventories are just shy of 3 billion barrels. In the fourth quarter of 2015, oil storage levels increased by 1.8 million barrels per day (mb/d), a record high for the time of year. In fact, the fourth quarter is normally a time that stocks are drawn down, not added, and there have only been four other times in which inventories climbed at the end of a given year.

(Click to enlarge)

The IEA cautioned that the lack of transparency and good data on storage capacity levels in most parts of the world make it difficult to “assess whether there is currently additional spare storage capacity outside of the US.”

In fact, oil tankers at several key trading hubs have had some difficulty unloading their volumes because of a lack of onshore storage capacity. In Europe, one important area to watch is the Amsterdam-Rotterdam-Antwerp (ARA) hub, an area that has seen tankers back up because storage onshore has “remained at close to full capacity amid difficulties moving product into central Europe.”

Adding to the storage woes will be the nearly two dozen tankers from Iran that have been sitting offshore holding Iranian crude that were trapped because of sanctions. They could soon set sail.

Despite the dire warnings that the world could soon run out of storage space, which would depress oil prices even further, market conditions do not currently reflect this phenomenon. While the market is in a state of contango, in which front-month cargoes are sold at a lower price than oil delivered in the future, the near-term prices are not discounted enough to justify floating storage. That is because there is actually still plenty of onshore storage capacity.

The U.S. still has 100 million barrels of available storage. Moreover, there will be an additional 230 million barrels of storage capacity added by the end of 2016. At least half of that will come from China, which is building out its strategic oil reserve. The Middle East is also slated to add capacity in the coming years. The UAE is expected to add 10 million barrels. Other countries with forthcoming storage facilities include South Africa, Mozambique, Brazil, and the Dominican Republic. Texas is also expected to build 32 million barrels of new capacity.

In short, there should not be a shortage of storage space for oil. If that is the case, there will two effects on prices. On the one hand, available storage should help avoid the catastrophic crash in oil prices to somewhere in the teens or as low as $10 per barrel, which one investment bank recently forecasted. If there is a place for oil to go, then the world will not “drown.”

On the flip side, ample storage space means the downturn could persist. If there is a place for oil to go, there is a “disincentive for countries to limit production” as Reuters puts it. It is possible that both of these effects happen at the same time: no deeper price crash from current levels, but a more drawn out recovery. Goldman Sachs summed up the situation in a recent research note. “With more outlets including storage, excess production can be maintained on a longer time horizon before surpluses saturate markets and breach logistical and storage constraints,” Goldman Sachs concluded. Only if storage levels fill up entirely would it “create an outright collapse in commodity prices, which is the basis of our $20/bbl oil scenario.”

Interesting if true, but it does seem to be contradicted by numerous stories of older tankers being commandeered into work as off-shore storage facilities. I think while it may well be true that there is still a lot of storage available globally, but its not as simple as that – you can have a global oversupply of something while still have many local and regional bottlenecks for all sorts of technical and logistical reasons.

this. it probably varies greatly by region. those regions with available storage will not be compensating for those that fill up. prices will continue to slide until production will have to decrease.

PlutoniumKun,

An example of a local bottleneck is the Rotterdam et al. one. Last year continued low flow in the Rhine prevented shipping much cargo upstream into the center of Europe. I’m guessing that oil was part of the backlog.

Not to mention the fact that if tanker companies made money in 05,06,07 and oil prices were higher then – why would tankers be empty now? Are we supposed to believe that a huge amount of onshore storage facilities were built between then and now? Why would there have been such investment in storage between then and now- unless the speculators decided they could manipulate the price again – like they did when the ICE was created and they took Natgas to 13mmbtu and later when they drove crude to 147. It’s just more evidence the markets and the exchanges are corrupted.

No shortage of storage at all if you leave it where it is in the first place. It’s not like oil in the well has anywhere else to go.

‘you wanna know how to fix a hoarder?…get’m hooked on crack and they’ll sell it all’

~Chappelle

https://www.washingtonpost.com/news/worldviews/wp/2016/01/21/this-amazing-map-shows-where-most-of-humanity-lives/ (an ole friend has been on my back for yrs…Watch the Caspian Sea Aby)

That population dense area is also the #1 source of a monstrous amount of pollution on land, air, and sea.

We could keep it in bank vaults?

At 2-3 million bpd excess production, the available a new storage will fill up pretty fast. Depending on what you are storing, the product can deteriorate as time goes on. So I doubt storage will do much more than act as a damper on price swings, but will not affect overall rolling price averages.

I have also read that a lot of oil in storage is not really oil but condensate which few facilities can process.

Jef,

It’s true that refineries in the US Midwest and Gulf Coast are set up to refine heavy oils, not condensate, but they do use it for blending; refineries on the East Coast can refine it. A major use for condensate is as diluent for heavier grades; the US has been exporting millions of barrels to refineries in eastern Canada for years, initially to blend with heavy imports and then for blending with heavy crude from the oil sands in Alberta.

Venezuela has been pretty desperate about bringing in enough to blend with the gunk that is their major crude. That stuff is very similar to Canadian oil-sands bitumen, which is something worth keeping in mind when we see the statement that Venezuela has the largest reserves of crude oil in the world. It does, but it takes refineries on the US Gulf Coast to refine it. (A couple of refineries in China can too: they’re newly built to handle it because that’s all Venezuela has to pay back more than $50 billion in loans with.)

I’d call this essay interesting in the immediate term, not very useful months out. It’s a snapshot and not a prognostication. What it does highlight is the lack of transparency in all this. I wrote the other day that we don’t really have financial or fossil fuel markets as governments, corporations, central banks, commercial and investment banks, and brokers are all so intertwined that prices do not reflect market forces per se but a hybrid of inputs.

Does not seem to address the issue of pricing. Maybe it is storage at a reasonable price. There are three costs of owning a commodity besides the price of the commodity. Storage cost, insurance and interest. If these three costs are not covered in a contango situation then there is no reason to store the commodity and as storage is used up the cost to store increases. Accordingly this will put downward pressure on front month prices until these costs can be covered to buy the crude and sell it in the future. It seems if enough crude is stored it will then cause prices to move to backwardization which seems like it would be a downward death spiral. Combine that with an economy moving into a severe recession which will destroy demand further.

here’s offshore Houston:

http://www.marinetraffic.com/en/ais/home/centerx:-95/centery:29/zoom:9

the red squares are oil tankers anchored in the Gulf waiting to offload —

interactive site, you can check other ports, click the ship shaped icons for details

rjs,

Lots of ships there, all right. Some are crude carriers, but there are many oil-products tankers and liquified-petroleum (propane) tankers too, along with a couple of LNG carriers, and some just labeled “tankers.” My guesstimate was that about half of the ships on that view were crude carriers, and many of them had a US port as the previous port of call so they weren’t necessarily bringing in foreign crude.

That’s a great site.

btw, your “click to enlarge” links aren’t working…you should be able to just copy/paste the entirety of the original and preserve all the html that goes with it, including that of such graphics…

Does anyone have any idea as to how well/badly downstream oil companies have been hit by persistently low oil prices? Buffett’s increased his stake in Phillips 66 very recently as per the co’s Form 4’s. This one, Marathon Petroleum etc are trading at really low P/E’s right now and have amassed quite a bit of inventory.

Exxon is the poster boy of an “integrated” oil company, and their stock price is holding up better than most. Valero is mostly refining and retail, so they are pretty good too. They benefit from the oil price drop, at least temporarily, because they take their time about reducing pump prices.

thanks for the heads up !

any info on why prices at the pump in So Cal are still holding steady at $2.79?

They have high state and local gas tax. Can be as much as buck on top of federal gas tax, depending on local. At least that’s what a google search said I did a week ago.

But it costs money to keep CA paved.

Not high tax, problem has always been too few refineries, big one had accident.

The Long-Beach refinery had an accident and California air pollution people are making them do environmental upgrades. That has kept the refinery from coming on line. Since California gasoline has major differences in formulation then gasoline can not come in from outside the state. To get environmental approval to build a new refinery is near impossible across most of the US so no one will build a new refinery. In addition, as I posted yesterday demand for gasoline is below 1997. Generally any refinery below 100,000 barrels a day is uneconomical. Since demand has been dropping over the years there will not be any new refineries constructed. Besides most banks do not want to finance them because if a companies goes BK and the bank gets stuck with it they will get stuck with any environmental clean up expenses associated with it.

Why were these storage facilities ever planned in the first place if it took such dramatic oversupply to make them necessary?

Who is paying to store the oil? Is it still on the oil companies’ books, or have they sold it to someone else?

They sell it, because inventory is bad.

Another half billion in storage by mid year, all full… But maybe Russia cuts quiet deal with Saudis, price recovers to Saudi new target, maybe 60. Hard to time, recession further complication. E&p with good credit eventually do well.