Lambert here: IMNSHO, there’s one ginormous flaw in this paper that’s perhaps too obvious to note.

By Ron Kaniel, Jay S. and Jeanne P. Benet Professor of Finance, Simon School of Business, University of Rochester, and Robert Parham, PhD candidate in Finance, Simon Business School, University of Rochester. Originally published at VoxEU.

Correlations between media attention and capital flows to investment vehicles are well established. However, the question arises of whether this is due to new information conveyed or if it is just an artefact of the attention itself. This column employs fund rankings from the Wall Street Journal to investigate the issue. It shows that media attention does drive these investment decisions, even if no new information is conveyed. It further argues that financial intermediaries are aware of this effect and exploit it.

It is a well-established fact that there is a correlation between an investment vehicle (such as a stock or a mutual fund) garnering media attention and capital flows into that investment vehicle (e.g. Sirri and Tufano 1998). But is this relation causal? Being mentioned in the news is, after all, related to having some news to report. Are observed capital flows a response to the underlying news about the investment vehicle, or to the media mention of this news? And even if investors respond directly to the media mention, do they respond to the information content encapsulated in it (i.e. to the news reported by the media) or do they respond to the mere mention of the investment vehicle?

Establishing a causal link from media mentions to investment flows has proven difficult due to the endogenous nature of media coverage and the omitted variable problem involved, though recent work has made some progress on that front[1]. Determining whether this causal link is due to the information being conveyed or is merely caused by the attention directed at the investment vehicle has proven even more difficult.

In a new paper (Kaniel and Parham 2015), we exploit a clean natural experiment in which the Wall Street Journal has prominently published the top 10 mutual funds, ranked within various commonly used investment style categories, every quarter since 1994. Rankings are simply based on the funds’ returns during the previous 12 months, ensuring both minimal editorial impact and quasi-random assignment around the publication cutoff (rank = 10). We use this setting within a regression discontinuity framework to demonstrate that:

- Media mentions cause increased capital flows;

- But only when these mentions are prominently placed;

- Even though the mentions convey no new information; and

- Mutual fund managers respond to the implicit incentive created by these increased flows, engaging in tournament behaviour to increase their chances of garnering media attention.

Media Mentions and Capital Flows

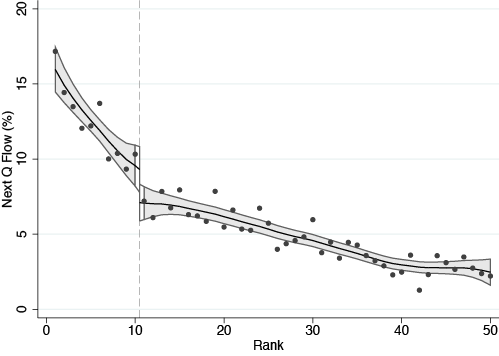

Figure 1 graphically depicts a clear discontinuity in capital flows following publication between funds which appeared in the ranking (and thus garnered media attention) and those which did not. The figure presents mean capital flows into funds, during the quarter after publication, by fund rank, overlaid with two smoothed kernel regressions from both sides of the publication cutoff, and their 95% confidence bounds. The discontinuity, between funds ranked 11 (unpublished) and 10 (published), represents a 2.2 percentage point increase in flow of capital into the published funds during the post-publication quarter. This is a hefty 31% increase in capital flows (from 11 to 10), which is even more striking when considering the fact that the increase in returns between the two ranks is about 3% (or 0.6 percentage points). Importantly, a discontinuity exists only at rank 10 but not at any other plausible cutoff. The media effect on flows is roughly 7 times larger in magnitude than the effect of the well-documented performance-flow relation which shows that funds with higher performance garner more flows, as investors chase returns (e.g. Chevalier and Ellison 1997).

Figure 1. Mean capital flows into funds in quarter after publication, by rank

Note: mean capital flows into funds during quarter after publication by fund rank, overlaid with two smoothed kernel regressions from both sides of the publication cutoff, and their 95% confidence bounds

Hence, a clear causal relation exists between media attention and subsequent investor behaviour. This causal relation is supported by the fact that rankings around the publication cutoff are extremely fluid. For example, a fund which started the last day of a 12-month ranking period at rank 10 has more than a 25% chance of ending that day (and the entire 12-month ranking period) with rank > 10, and thus not being published. This is to say that published and unpublished funds are strongly randomly assigned around the cutoff, and the only notable difference between funds at rank 11 and at rank 10 is the media attention.

But is this effect the result of new information being conveyed? Or is it merely the prominence of the media mention that drives investment behaviour? Two other features of this natural experiment are helpful in answering these questions.

First, as the publication takes place during the first few days of the month following a 12 month period, all the information used to construct the rankings is already publicly available, such that any interested party can construct these rankings tables in advance of the publication. Hence, no new information is revealed in the publication.

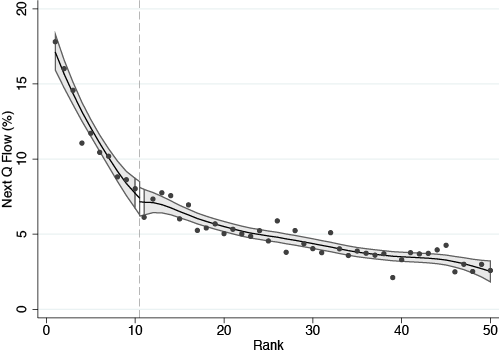

Second, similar ranking tables were also published by the Wall Street Journal for within-quarter months (months that do not follow the end of a calendar quarter), but these rankings were not published in the Investing in funds – a quarterly analysis special issue, but rather less prominently in the back pages of the regular section of the newspaper, thus garnering much less media attention. Figure 2 repeats the analysis of Figure 1 for these within-quarter rankings and finds no discontinuity in capital flows. It is therefore evident that the prominence of the publication plays a critical role in investor persuasion.

Figure 2. Mean capital flows into funds in quarter after publication, by within-quarter rank

Note: mean capital flows into funds during quarter after publication by within-quarter fund rank, overlaid with two smoothed kernel regressions from both sides of the publication cutoff, and their 95% confidence bounds.

Fund Managers’ Response to Incentives

The existence of a media effect on consumer financial decision making implies that fund managers’ payoffs resemble a call option due to the implicit asymmetric incentives induced by the extra flows. Discontinuity in capital flows implies that, for funds around the rank 10 cutoff, there is a greater upside to increased rank than a downside to decreased rank. For example, a fund ranked 11 a month before the end of a ranking period which drops from rank 11 to rank 20 by the end of the ranking period will, on average, see a 0.8 percentage point decrease in capital flows. Rising from rank 11 to rank 10 will, however, generate a 2.5 percentage point increase in flows. Do fund managers react to this implicit incentive, and if yes, how?

Consistent with theoretical predictions by Basak et al. (2007) and Cuoco and Kaniel (2011), funds ranked near the rank 10 cutoff at the beginning of the last ranking month, and only these funds, ‘diverge from the herd’ by increasing tracking error volatility relative to their category in an attempt to make the list. A closer analysis reveals that funds are well aware of the trade-offs induced by this risk shifting – within funds ranked near the cutoff, only those that are unlikely to be ranked as top performing funds next quarter increase tracking error volatility (and risk a performance decline relative to the category). Diverging from the herd is the optimal risk-shifting policy in such a tournament setting, and the fact that funds exhibit such a behaviour shows that:

- Financial intermediaries are aware of the existence of a media effect, and strategically react to it.

- Financial intermediaries are willing to take the risk of harming their performance to increase their chances of winning the tournament.

Furthermore, we show that ‘making the list’ (and garnering media attention) causes funds to increase advertising activity (in terms of average ad size, number of ads, and advertising expenditure), in an attempt to capitalise on the media attention. This is especially true for funds in the 6-10 rankings, which comprise the bulk of advertising in the quarter following publication.

Concluding Remarks

Investors exhibit ‘limited attention’ behaviour, and react to ‘information-free’ media attention. Financial intermediaries predict this behaviour, and exhibit tournament behaviour to try and capture flows caused by media attention. These results fit well with the predictions of the model by Merton (1987), in which investors have a limited ‘consideration set’ of investments from which they choose, and when they hear of a new investment opportunity, they add it to the limited consideration set, rather than systematically searching for the investments most suitable for them.

References

Basak, S, A Pavlova and A Shapiro (2007) “Optimal asset allocation and risk shifting in money management”, Review of Financial Studies, 20: 1583–1621.

Chevalier, J A and G D Ellison (1997) “Risk taking by mutual funds as a response to incentives”, Journal of Political Economy, 105: 1167–1200.

Cuoco, D and R Kaniel (2011) “Equilibrium prices in the presence of delegated portfolio management”, Journal of Financial Economics, 101: 264–296.

Engelberg, J E and C A Parsons (2011) “The causal impact of media in financial markets”, Journal of Finance, 66: 67–97.

Kaniel, R and R Parham (2015) “WSJ Category Kings: The impact of media attention on consumer and mutual fund investment decisions”, CEPR Discussion Paper, DP10923.

Merton, R C (1987) “A simple model of capital market equilibrium with incomplete information”, Journal of Finance, 42: 483–510.

Sirri, E R and P Tufano (1998) “Costly search and mutual fund flows”, Journal of Finance, 53: 1589–1622.

Endnotes

[1] Engelberg and Parsons (2011) demonstrate how extreme weather events which may disrupt the delivery of local newspapers sever the link between local content publication and local trading.

Lambert again: Let’s take the authors’ model, a bulleted list, and number it:

- Media mentions cause increased capital flows;

- But only when these mentions are prominently placed;

- Even though the mentions convey no new information; and

- Mutual fund managers respond to the implicit incentive created by these increased flows, engaging in tournament behaviour to increase their chances of garnering media attention.

Surely we’re missing a step?

- Mutual fund managers plant puffery in the compliant press

And the increased capital flows (#4) are then skimmed to plant new stories (#0). It’s a virtuous cycle!

Of course, that would be fraud. Or a phishing equilibrium. And it be fair, capital flows fund advertising, too, as the authors point out. Nevertheless!

Hmmm. SO not only is the market not efficient, “new information-free” publicity garners new investment. No wonder retail investors ALWAYS lag the market.

Limited sample size, but it sure seems like every time USA Today touts an investment it goes krunk about a week later and ends up on its face in the gutter.

Not sure about the mechanism, could be an effect more like the shrimp on a cruise buffet. Tasty at first, then explosive decompression.

I’ve never seen a shrimp explode. Are you trying to pull a fast one on us or what?

no no no, not a fast break. more a back door cut.

to be clear, i’m referring to the alleged tendency of buffet shrimp to elicit disgustation in a manner similar to cruise ship vectored norovirus and i was trying to be o forget it.

and to front back to what you previously said below, not only is that not your opinion, Kahneman’s quote on regression means that the first-quarter layup is likely to be interpreted as relevant to the fourth-quarter fall, which it may in fact be, but man muss immer umkehren good becomes bad and bad becomes good when overthinking future consequences. blowing up the apparent variance is what overmatched teams do when they’re desperately trying to get through single-elimination tournaments (no long term without the not-long term). does this mean being in the news is a harbinger of doom, regardless of the headline? Sports Illustrated referenced its own curse by putting a black cat on the cover.

can there be a front without a back? is such thing as “‘information-free’ media” possible? how can I express the wonder which your writing elicits without collapsing those dimensions to a lesser inversion?

you could try principal components analysis!

You may be right about the shrimp. I was just posing a theoretical question. I know full well That Just because I’ve never seen a shrimp explode DOESN’T MEAN THEY CAN’T EXPLODE!

That’s the point I guess of the post. If you’re a shrimp you need to risk the explosion iif you wanna be a lobster. But to me, frankly, those are animals and men are men. QED. :-)

“can there be a front without a back?”

Yes. The back of the front is the front itself.

aka: Circle (or ellipse)

Give it a twist and its a Moebius Strip

none of this makes any sense to me, if people didn’t pay attention to the back pages of the newspaper, why would the sports section always be there?

also, with the internet nowdays there is no back pages. It’s confusing what’s front and what’s back. Nobody can tell anymore.

that would tell me that publishers have no incentive to put sports pages on the back pages of the internet; this is a prediction that’s empirically verifiable. It’s not my opinion. anybody can see for themselves.

Also, why would a mutual fund manager tweak their performance to get a high rank in quarter “n” if that jeopardized their chance for a high rank in quarter “n+1” or even “n+f” where f = some future quarter not very far away. maybe because they just like to go for the easy lay-up? I don’t know about that. also why would the authors say the manager is risking a performance fall by boosting tracking error when with equal probability they’re risking a performance rise. This is mathematically true, it’s not my opinion.

but the biggest problem I see is the claim that being in the news brings you money. It depends on the news! hahahaha

Q:

A: Pump and Dump.

hellllooooooowww honkey town. what’s the matter you fkkers don’t like advanced math and explodiing shrimp? you jes wanna yack about Hillary and Trump? Oy Vey wada buncha noodle heads. That’s white people for ya. Only 9 comments and it’s already time to start drinking — Usually that’s luchhtime. You need to do your brainwork before the drinking or you can’t make the sense you need to make to be taken serously. One.five glasses of wine and thhat’s it for most of you.

What’s a black man or a white man with a tan gonna say about 9 comments? YOu guys aren’t trying. There should be something said about symmetric probability distributions and expectation values for random variables. It should have been said by 8 a.m while youze still sober! Too late now. All this work gone to waste. wheres all th mathematicians and physics dudes who comment here. Don’t put the burden on me ’cause I’m only an amateur. You guys are pros. You can walk circles around me in polar coordinates. Who needs x^2 + y^2 = r. that’s for high school

Bernie! Bernie! Bernie! He’d put these mutual fund fkkers on the ropes with one punch. All those dots in theh graph would be a HELL OF A LOT FLATTER, that’s for sure. Don’t blame Bernie if you don’t like exploding shrimp. WTF? It’s time all the lazy people do get their asses off the sofa and donate to Bernie. I donated $100 dollars. If I can do it, anybody can do it. Are you gonna talk about Hillary and Trump the rest of your fkking lives? I mean really.

You, as I have possibly reposted before, think you’ve got problems. Faced with an unenviable choice between sitting and watching one of the most awful TV series ever made while spending another weekend with my mother-in-law during which I am completely convinced that someone alters the space-time continuum, or trying to steer the conversation round to a discussion of anything other than what her cat is doing, I more-or-less forced her to read the article and the attached comments.

Well, she said, after completing her way through yours above, that is why I do not read anything other than the Daily Mail (apart, she had to add, from the Telegraph on a Saturday but that is mainly to have something to put the cat litter tray on) because you don’t have to have run-ins with that sort of unsavoury person.

I, for once, was in full agreement.

well what did she think of the Post? Thats the main attraction. I’ve spent most of today reading probability theory and watching Borat videos on YouTube. Sasha Baron Cohen is amazing, an incredible talent. Your step mother should be careful when she reads the Telegraph online or she might accidently put the computer screen underneath the cat litter tray. honestly check out the Borat videos on YouTube and watch them with the Mum in Law! They’re hysterical.

The post? Oh, she said that she didn’t understand hardly a word of it and that’s why she leaves it all to the nice chap with the clean fingernails in Barclays Wealth Management to sort it all out He takes his shoes off when he comes in. He also gets a cup of tea in the good porcelain and a slice of her homemade fruit cake. And Munchkin likes him too (that’s the cat) and she’s a good judge of character.

The Barclays guy skims a 5% fee off the funds under management whatever the underlying performance. Let’s face it, we’re in the wrong business.

No, I daren’t show her any Borat stuff on YouTube.

Its all about Lobb’s crazzyman… because not – all – is the same… but you can get most to believe it…

Skippy…. at least in the former case I know the creator… personally…

OK, but what do I bet my $30 on?

lunch!

If r is the radius then it’s x^2 + y^2 = r^2 (assuming the circle is centered at the origin of course).

if we’re talking circles, i’d actually like to bring up a point that has disturbed me for a long time.

why is it pi times the Radius squared? when you take the volume of a sphere and collapse the dimensions, you get 4 pi r squared, and when you collapse that you don’t get 2 pi r.

there has been an absolutist frame of reference perpetuated on western culture for millenia. all you have to do is use diameter and not radius, and the differentiations work perfectly. 1/6 pi d cubed collapses to pi d for a perimeter. but that requires recognizing that a circle has two sides, that the front is not the back. this frame was finally broken in 1948, when Claude Shannon advanced our knowledge a bit.

Very interesting.

Try building an airplane with your formulas.

If diameter is used, differentiation of the formula of the area of a circle will not yield the formula for the circumference of a circle. Likewise, differentiation of the formula for the volume of a sphere will not yield the formula for the surface area of a sphere if diameter is used.

As far as I know, moving from 3D (sphere) to 2D (circle) is a projection transformation rather than a differential process, though I am not familiar with Claude Shannon’s work.

This is a recipe for an echo chamber