Yves here. This post is important in and of itself, in debunking widely-publicized myths about the state of the Irish “recovery,” and it is separately a good example of how official statistics tell a very misleading story.

By Cillian Doyle, an economist with the People Before Profit Alliance of Ireland. Originally published at Counterpunch

Dublin.

Well, the latest national growth stats are in and, despite all appearances, the poster boy for European austerity is hands down the fastest growing economy in the Eurozone. With GDP supposedly running at 7.8%, we’re even outpacing the global titans of India and China.

The US media outlet CNN claimed that once again ‘Ireland is booming’. Yes, there it was: the dreaded b-word. It’s not that an uptick in economic activity is unwelcome thing; it’s more that in an Irish context, owing largely to the weak nature of indigenous Irish capitalism, the word “boom” is usually synonymous with bubble, and it seems another bubble could be building, but more on that later.

For now, let’s focus on where this seemingly robust growth is coming from. It’s true there has been a slight uptick in genuine economic activity place here with growth in things like personal consumption and construction, but this certainly cannot account for our current level of GDP, which suggests the place is absolutely abuzz with economic activity.

How can this be? Well the reason is that Ireland’s is a recovery built on sand – and some highly suspect statistics.

The ‘Great Recovery’; The Hope vs the Hype

The final lines of CNN’s report alluded to the real reason for our eye catching growth figures, namely ‘Ireland is widely known as a tax haven’. Yes owing largely to our status as a tax haven/offshore financial centre, our headline figures are dodgier than Donald Trump’s hairdo.

GDP isn’t a great measure of economic well-being at the best of times, failing to capture things like inequality, but in Ireland it’s effectively useless. The profit shifting of the multinational sector has rendered us a complete basket case where those figures are concerned.

If we were fortunate enough to have a crusading media they would be pointing this out time and again. Instead we have the likes of the Irish Independent cheerleading for this faux recovery and carrying quotations from IBEC, our big business lobby group, that this new boom ‘was reaching every corner of the country’.

You see right now we have two rival economic narratives vying for supremacy. The first one, which can be considered the establishment’s version, tells the tale of a great recovery and finds regular expression amongst the talking heads in our mainstream media. The second, which is one of ongoing hardship, has to fight hard to get its message across.

There is however a number of individuals/institutions who do Trojan work in countering the often shallow analysis and outright spin which emanates from on high. These include the Unite Union’s Michael Taft, the Nevin Economic Research Institute, Trinity College’s Professor Jim Stewart and University College Dublin’s Dr. Conor McCabe. Their work is required reading for those looking to get an accurate picture of our current economic condition.

Three Charts That Blow the ‘Great Recovery’ Apart

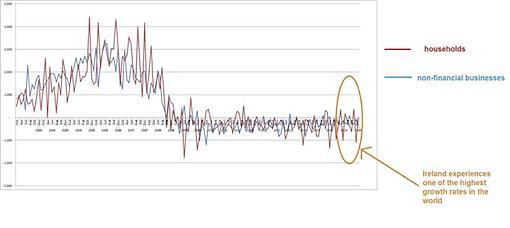

Conor McCabe’s chart below shows the gross amount of credit given to Irish households and non-financial businesses from period 2003 up until to today. This, in other words, is a measure of the increase/decline in the total amount of bank loans given to these groups in the period of the Celtic tiger and its aftermath. Naturally we can see high levels of credit in the run up to the 2008 as borrowing went hand in hand with the construction boom.

But if we look at credit levels today we can see they’re rock bottom, and yet somehow in defiance of all economic rationality we are recording massive levels of growth. Conor puts it nicely when he states, ‘Credit is the fuel for the engine. What we have here is a country that is claiming it can drive for 50,000 miles on a single tank of petrol. This is no economic miracle; it’s just bullshit.’

Credit Advanced to Irish households and non-financial businesses 2003-16

Chart 1. Irish Central Bank.

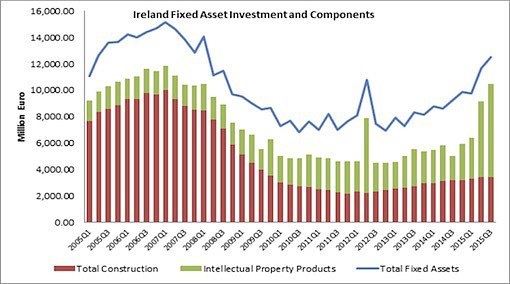

So we can see from the above that our growth is not being fuelled by credit, so what is driving it? Well that brings us nicely onto our next chart. Total Fixed Asset Investment or FAI is a measure of capital spending in terms of things like machinery, infrastructure, land, technology, etc. After all, you need to be building ‘stuff’ if you are going to build the economy.

Chart 2. Eurostat.

Construction is included under the heading ‘Total Construction’ to give you an idea of the impact that a decline in a major sector can have on an economy such as ours in the post 2008 period. Intellectual Property Products, which arise from investment in things like patents, trademarks, industrial design and copyrights, is included to highlight what is arguably the real driver of our current economic growth.

Take a close look at this ‘Intellectual Property Products’ measure. Anything look peculiar? Well wee see spikes (Q2 2012; Q2 and Q3 2015) which seem to just double in the space of a few weeks and then disappear. There’s clearly something up here, and that something is patents. With multinationals starting to relocate some of their intellectual property out of ‘bad tax havens’ (Bermuda, Cayman Islands, etc) and into ‘good tax havens’ (Ireland, Luxembourg, etc) our growth figures were give a massive shot in the arm.

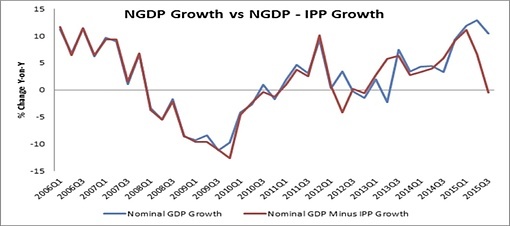

Our final a chart plots our nominal GDP growth together with GDP growth minus this IPP component. When we do this our supposed growth of 7.8% does the kind of disappearing act that the late great Paul Daniels would have been proud of. Some recovery, huh?

Chart 3. Eurostat.

As we’ve seen from above, the lion’s share of this growth is illusory. How many people does it take to administer the relocation of a patent to Ireland? Just a handful of select individuals, customarily derived from the usual firms Goldman Sachs, Arthur Cox, KMPG, etc, what the Tax Justice Network calls the pinstripe mafia. And whilst all this may be great for the bonuses of the bigwigs down in the Irish Financial Service Centre (IFSC), for the rest of us the effect is pretty negligible.

Back to the Bubble Economy?

Patrick Honohan, the former governor of the Central Bank, before riding off into the sunset warned that our growth figures were ‘seriously complicated‘ by ‘distorting features‘, which is pretty much what we have seen from the above.

The great boom that CNN reported on is really just a corporate tax bubble driven multinationals locating patents and other types of intellectual property here to dodge tax, hardly what you’d call laying the foundations for long term national recovery.

Is this country doomed to stumble from one tax break backed boom and bust to the next? Commercial boom and bust, property boom and bust and will it be corporate tax boom and bust? Because with the OECD’s BEPS project, the advent of Country by Country reporting, and growing talk of standardised European corporate tax rates, any of these could act as the pinprick for this this new bubble.

Given that it’s Eastertide, our establishment parties who are quick to crow about their Christian credentials, would do well to turn to their holy books for guidance. In Matthew 7:24-27 we hear the story of the wise man who built his house on stone contrasted with the foolish man who built his house on sand; ‘And the rain fell, and the floods came, and the winds blew and beat against that house, and it fell.’

A good article, and a necessary corrective. One of the interesting factors we saw in the last election was the huge surprise the government and the elites got when average people reacted really badly to a campaign based on slogans around the theme of ‘don’t let them screw up the recovery’. Many people just said ‘what recovery?’ Its clear that the nominally good economic figures convinced politicians and the elite that everything was fine, but forgot to ask ordinary people about their personal situations.

Having said that, there is significant growth in the economy, much better than the figures quoted suggested. Despite the restrictions on credit, property prices have risen very significantly in the past 4 years. Given the low levels of credit availability, it would seem that much of this is from foreign investors, mostly institutional buyers, plus a lot of ‘hidden’ cash returning to home. There is huge growth in Dublin, reflected in a major surge in rents, a clear indicator of a return to significant immigration (my own personal index is based on how far I have to walk in Dublin without hearing English spoken – in the boom years I could go a km in some areas – right now, its several hundred metres). There has also been a very significant increase in tax take, which certainly indicates that people are earning and spending more money. The best estimates I’ve seen are that ‘real’ growth is around 3-4% per annum – nowhere near the headline figure, but not insignificant either, and something most European countries would be delighted with. I suspect the main driver for ‘real’ growth is the weakness of the Euro – Ireland benefits particularly from this as our main trading partner is the UK, with its massively overvalued currency.

The issue, as usual, is our old friend inequality – both in terms of class and geography. Dublin is a mini-island of growth in the country – its very noticeable that there has been a near explosion of new cafes and restaurants around the city, and most are packed every evening. There is money around, and lots of it is being spent. But its overwhelmingly gone to certain sectors and people on higher incomes. A little bit is floating out to working class areas – self employed builders and decorators, etc., are doing quite well. Unemployment is decreasing very significantly (much more than is obvious as immigration from eastern Europe is filling many vacancies). But most small towns and cities around the country are visibly struggling and decaying, unless they have a good tourism industry (hugely boosted by the weak Euro).

The truth is that Ireland has been very, very lucky the past five years. Despite austerity and the crippled banking system Ireland has been a major sink for a lot of QE cash looking for investments, and the weak Euro has been a major boon to traditional industries like tourism and agriculture. Ireland is also strong in relatively recession proof industries such as medical devices and traceable services (especially in areas like software and gaming).

One less commented upon issue that will cripple Ireland for decades to come is that a deflationary environment is devastating to Irish banks. They had an easy life for years lending for mortgages, but the penny is slowly dropping with Irish consumers, mostly obsessed with property, that in a low inflationary environment you are very unwise to extend your borrowing for your home or investments. This means Irish banks will have to find a new source of income to try to cover their crippling liabilities. Given the level of incompetence they have shown, nobody really believes they will find one. The irony is that the Irish ‘bad bank’, Nama, will probably do best as rising property prices has allowed it to claw back a lot of money on the vast portfolio of junk it invested. But the regular banks now will really struggle to make an income to cover their existing liabilities.

You probably meant tradeable services, but on second reading your typo makes quite a lot of sense (software and gaming are indeed traceable).

ah yes, thanks, I did mean tradeable, its just spellchecker doesn’t seem to like that word…

There was also an explosion of cafés and restaurants during the Weimar republic so it does not necessarily reflect a healthy economy. Some research has also shown that countries that increasingly rely on tourism erode the quality of their economy.

http://www.unep.org/resourceefficiency/Business/SectoralActivities/Tourism/FactsandFiguresaboutTourism/ImpactsofTourism/EconomicImpactsofTourism/NegativeEconomicImpactsofTourism/tabid/78784/Default.aspx

And that’s why it’s all ‘bullshit’. “The regular banks will now really struggle to make an income to cover their existing liabilities.” Ireland is a microcosm of the USA. Regular banks, aka regional and smaller local banks?, cannot play fast and loose, only the TBTF branches in Ireland. The TBTFs are on the way out. Banks will evolve today just like they evolved before – to meet and deal with reality.

Fossil fuel consumption is what drives “the economy” and also it is the main factor that is driving humans and other species toward extinction. Collectively, we still haven’t come to grips with this obvious truth, nor will we ever. In fact, industrial civilization is built on sand (with our heads in it) and it is sinking fast.

I think the most shameful thing about the whole “recovery” is the total lack of any attempt to repair the damage to the built environment done during the boom years. This is really down to the imposed austerity I guess but a radical response to the massive unemployment triggered by the financial collapse would have been for the government to pay the newly unemployed construction workers to demolish the awful one off housing and subdivisons that were built all over the country. Most have zero walkability to services, jobs, retail, a lot were built in flood zones, they are uniformly ugly. In Ireland we decided to take everything that went wrong in planning in the United States in the past 50 years and decide that is model we wanted. Small towns all over Ireland are in dire straits, repurposing them for living in, instead of being a strip of buildings that you drive by would make an enormous difference in quality of life, put people to work, allow for sustainable local economies, and also save on the billions spent importing petroleum products that enable the Irish to drive more than anyone else in Europe. And this is in one of the smallest countries in the region.

The North American model is built on unsustainability since it is dependent on an abundance of space and resources. Once the resources are depleted or the degradation too costly, it’s time to move one. In this model, things are not built to last more than a few decades…

Any country applying this model without having an excess supply of land and resources will quickly hit a wall.

As one who has had to re-re-re-emigrate…

The Lessons learned from the last economic debacle according to Irish orthodoxy:

” We screwed up the economy big time.” “Now that we know how to bankrupt an economy…we can do it really, really fast this time.”

Economic planning by Zoolander

Me…I’m going back after the next crash. I believe Einstein when he said doing the same thing over and over again and expecting different results is stupid. I’m stupid. But I’ll be in good company.

Interesting article on market oracle comparing the economy of the UK including Ireland with that of the car market