Yves here. While the analysis in this post shows clearly how much and when home purchase costs have increased, in terms of the relationship to average wages, I strongly differ with the proposed solution of addressing the problem via mortgage finance. Subsidies to housing via the inefficient channel of subsidizing mortgages (the interest deduction, for starters) is what helped propel prices into being out of whack with worker wages in the first place. Moreover, given that the average job tenure is a mere four years and a few months, it seems insanely risky for people to buy a house, in that the time between jobs will deplete savings, and housing transaction costs are so so high that if one needs to lower one’s housing costs, or move to get a new job, the cost of selling a home will chew into equity unless the buyer was lucky in terms of how the local housing market performed relative to when they bought and sold.

The best remedy to high purchase prices is more good rentals. Heretofore, rentals have been generally enough “worse” than owning so as to lead people to want to buy a house, aside from the concern that one is paying money to a landlord when you could instead be accumulating home equity. But as Josh Rosner said, “A house with no equity is a rental with debt.” If you aren’t sure you can stay in a home long enough to accumulate real equity (enough to recoup transaction costs and have a gain), it’s not sound to buy a house. And if more people rented, the quality of tenants would be better than they are now, leading to an improvement in the quality of rental properties generally.

The offset is that historically, housing was how people accumulated wealth. A home was a forced savings mechanism. When you retired, you would live mortgage-free, at lower cost than during your income-earning years, and you could tap into the equity by selling the house and either renting or buying a more modest home. But that model, as indicated above, has been undermined by job instability and the high cost of buying a home in the first place.

By Marc Lavoie, Professor of Economics, University of Ottawa. Originally published at the Institute for New Economic Thinking website

Obviously, the nominal dollar cost of a house or a condo today is much higher than it was 20 or 30 years ago. Indeed, it’s even higher than what it was just a couple of years ago. While a number of indices look at the price of housing by deflating the nominal dollar price of a house by the consumer price index (CPI) to measure the rate at which housing prices are rising relative to the general rise in prices of consumer goods, I wish to measure the changes in housing prices in terms of how many weeks of labor time, paid at the US median weekly rate, it takes to purchase an average residential property.

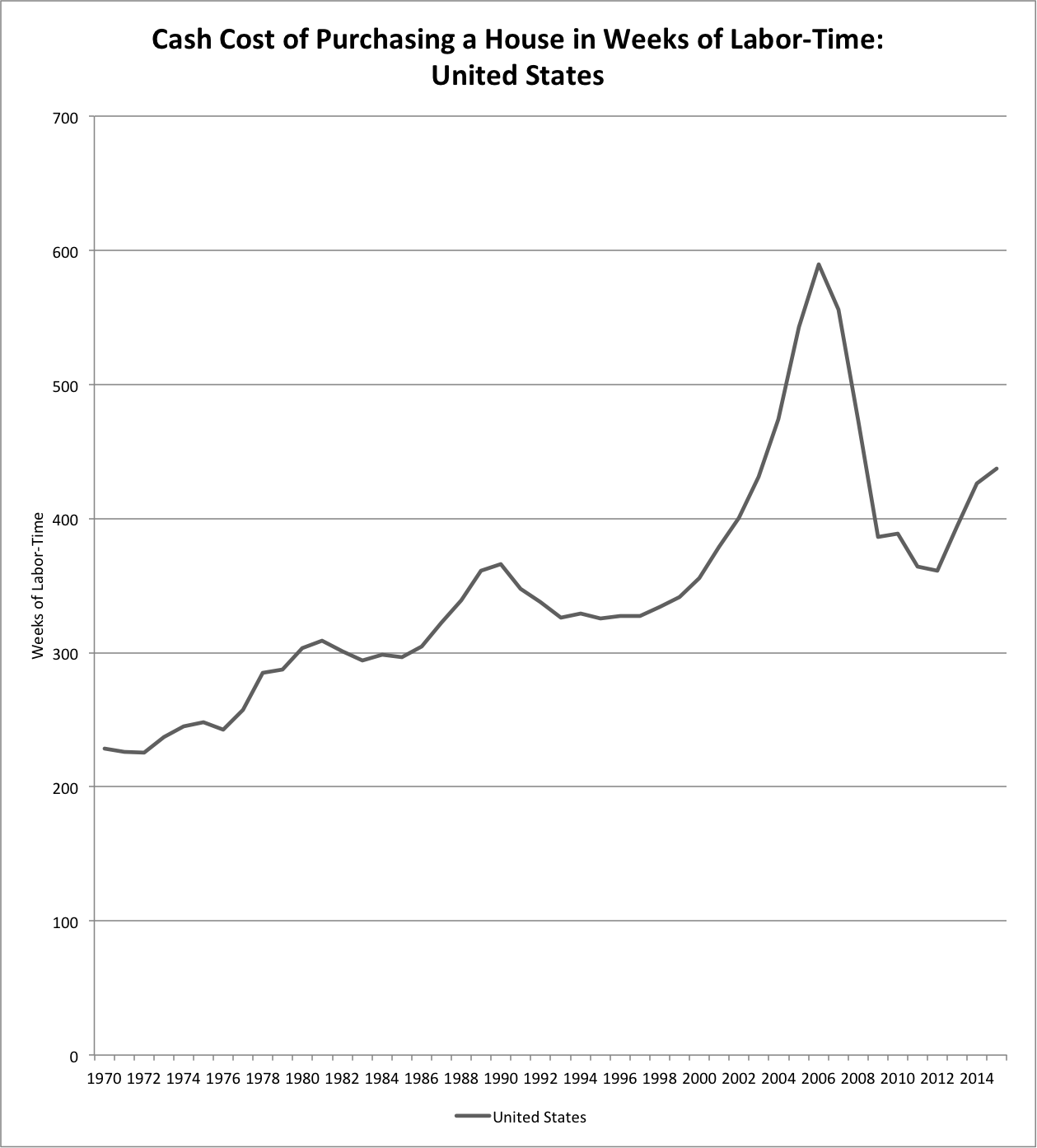

This is a pretty simple exercise: all that needs to be done is to divide the average selling price of a property by the median weekly wage. The result, from 1970 to 2015, is shown in Figure 1 below.

The figure shows clearly that the cash cost of a residential property in terms of weeks of labor time has changed considerably through a series of cycles. The cost rose slowly but continuously between 1972 and 1981, despite the two oil shocks of 1973 and 1979. The anti-inflation policies and the brisk increase in interest rates that the Fed under Paul Volcker had imposed on the American economy in 1980 and 1981 (and subsequently on the rest of the world) brought on stagnation in housing prices by measure of weeks of labor time from 1981 to 1986. This was followed by another period of rising costs, from 1986 to 1990. Housing prices then declined slightly and did not return to their 1990 level until 2000, despite the Clinton boom years. The low interest rates that the Fed granted to compensate for the 9/11 attack and the stock market debacle of 2000 and 2001, as well as the financialization of the economy and the deregulation of the financial sector, then led to the extraordinary increase in the cash cost of residential properties from 2000 to 2006, as can be readily seen in Figure 1. The fall in the dollar price of houses from 2006 to 2012 was mirrored by its fall in terms of weeks of labor time, bringing the cost in 2012 back to its value of the early 1990s. Finally, housing prices recovered from 2012 to 2015, so that in terms of weeks of labor the 2015 price is no different from what it was 12 years earlier.

The cash cost measured by of weeks of labor time of a residential property in 2015 is approximately twice as high as what it had been in the golden years of the early 1970s. Similarly, when that cost reached its apex in 2006, it was also approximately twice the cost in terms of weeks of labor time that buyers had to face in the first half of the 1980s.

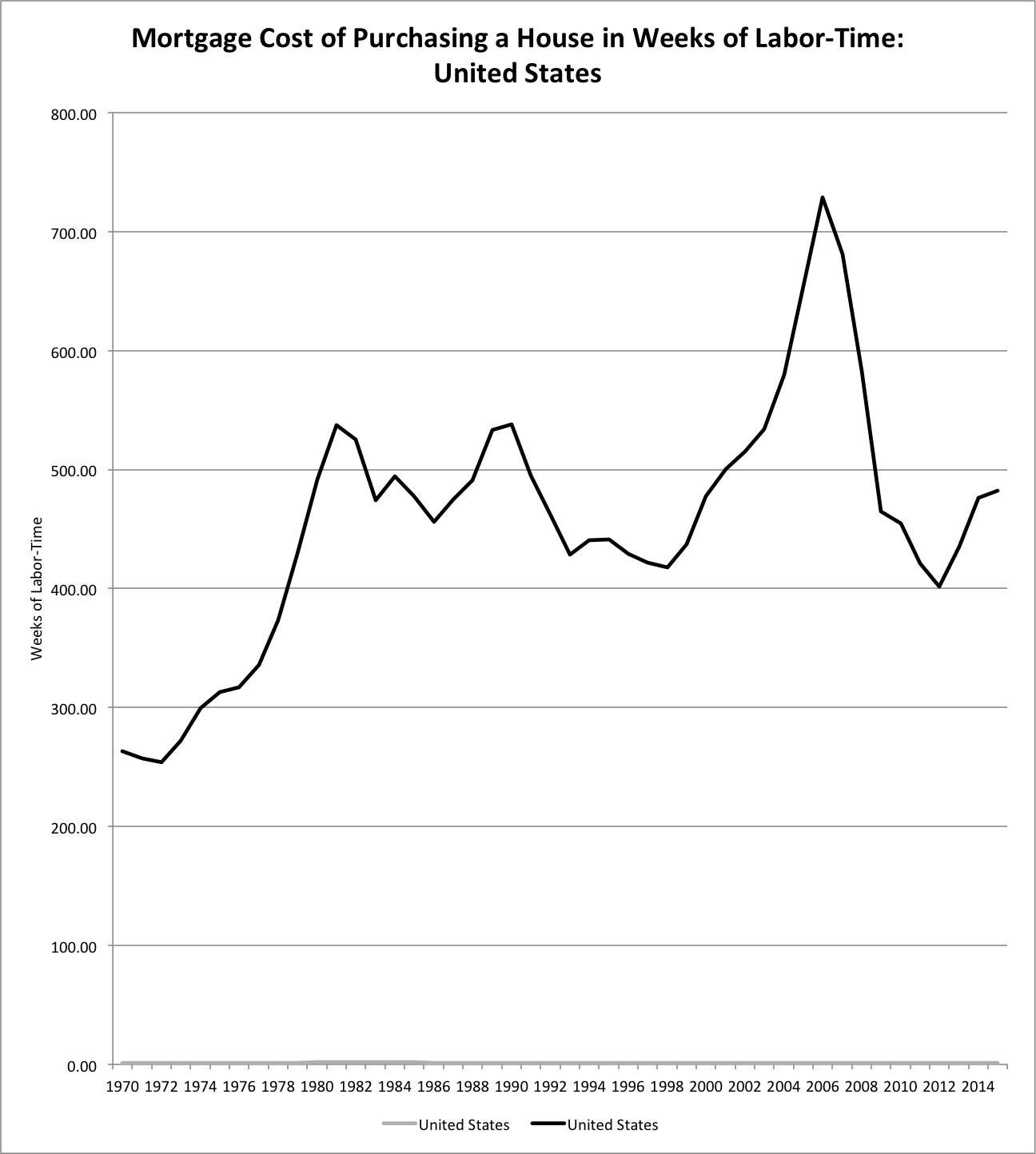

Most home buyers, unless they inherited wealth from their parents, are unable to pay cash for their properties, so it is more interesting to assess how much it costs Americans in terms of weeks of labor time to purchase the average residential property when the buy requires a mortgage. This is shown in Figure 2. Obviously, different purchasers have financed their property through a variety of schemes, too numerous to be considered here. For ease of computation, the numbers are based on some simplifying and arbitrary assumptions. I assume that the whole value of the dwelling is financed through a series of three five-year fixed mortgages, amortized over 15 years and based on the nonjumbo fixed rate on 15-year home mortgage loans. Of course, since we don’t know what interest rates and wage rates will be after 2016, the numbers for the years after 2011 are estimates based on an extrapolation of recent numbers for these two variables (with a return towards trend values in the case of interest rates).

The evolution of the mortgage cost of purchasing a residential property in terms of weeks of labor shows some similarities but also some differences with the evolution of the cash cost, as seen by comparing Figures 1 and 2. The mortgage cost of purchasing a house in the 1980s was already twice as high as buying and financing the average property in the early 1970s, and the 1990s saw a substantial decrease in the mortgage cost of purchasing a property. Subsequently, the mortgage cost, just like the cash cost, went through an extraordinary increase in terms of weeks of labor time, moving from 418 weeks in 1998 all the way to 729 weeks in 2006. Indeed, on the verge of the subprime financial crisis, the mortgage cost of an average property was three times the mortgage cost of an average property of the early 1970s. No wonder so many new buyers were forced to default on their mortgage loans! By 2012, however, the mortgage cost was similar to the one that existed in 1998 as well as in 1979, just before the Volcker interest rate shock took effect. Still, in 2015 the mortgage cost of purchasing the average property is estimated to be twice as high as the mortgage cost of the early 1970s.

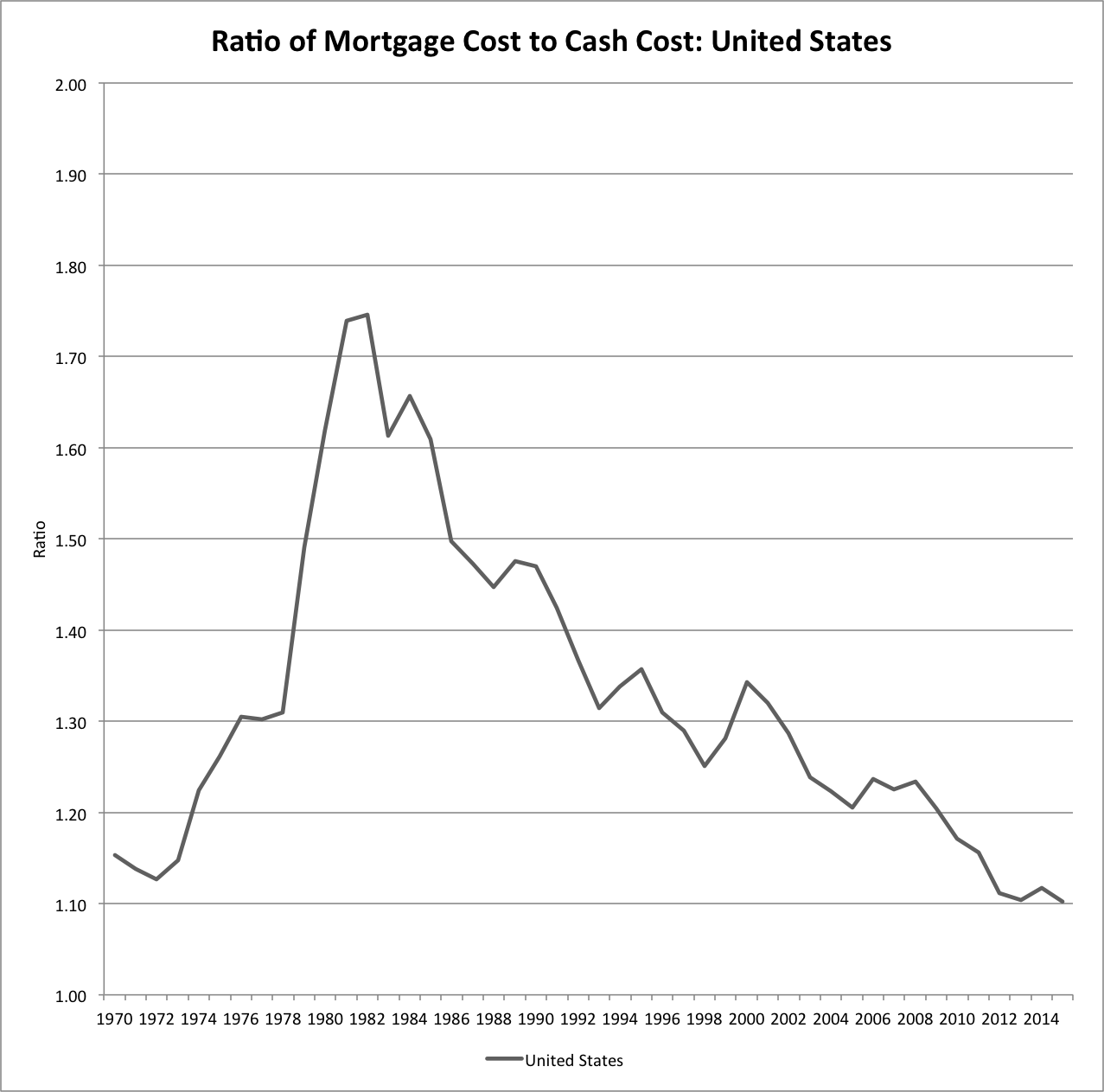

The impact of mortgage interest rates can be further assessed by Figure 3, which measures the evolution of the mortgage to cash cost ratio of purchasing a residential property in terms of labor time. Looking for instance at the situation of someone buying a house in 1986, the mortgage rate in 1986 obviously has an enormous impact on this ratio, but since under the assumptions outlined earlier the mortgage needs to be renewed in 1991 and 1996, the mortgage rates in these two years will also play a role.

In a fair world, one would expect the cash cost and the mortgage cost in terms of weeks of labor time to be the same, and hence the ratio described in Figure 3 to be equal to unity. However, this happens only in the early 1970s, although there is a tendency to get back there in the 2010s. (Remember that from 2012 on, the interest rate at renewal time is based on a forecast, as is the growth in weekly wages, so the actual data stops in 2011). The reason fairness would require that this ratio be equal to 1 is that, as argued by the Italian economist Luigi Pasinetti in his well-known 1981 book, Structural Change and Economic Growth: A Theoretical Essay on the Dynamics of the Wealth of Nations, a fair interest rate is such that the purchasing power of one hour of labor stays constant through time, even when its monetary equivalent is lent or borrowed. This occurs when the nominal interest rate is equal to the growth rate of nominal wages.

Thus, a fair mortgage rate is such that the cash cost and the mortgage cost of purchasing a house is the same in terms of weeks of labor time. Mortgage rates are currently very low by historical standards, not only in nominal and real terms but also in terms of the growth rate of nominal wages, as shown by Figure 3, but they would need to be even lower to fulfill the standard of fair rates and achieve a unity ratio. Pro-growth fiscal policies that could eventually lead to faster growth in wages, without interest rate increases, would further help in bringing mortgage costs towards cash costs, which is something that is not unthinkable today since central bankers are now more aware of the long-term negative consequences that their short-term inflation targeting policies may inflict.

While some fairness has nearly been achieved in terms of the mortgage rates being charged to house purchasers, there still remains the fact that buying an average residential property today requires about twice as many weeks of work paid at the median wage rate than it did 40 years ago, when the United States was still considered a land of opportunity and of social mobility. From this standpoint, there is no inter-temporal or inter-generational equity. This conclusion could however be questioned by some observers, by arguing that most of the cost increase in residential units could be attributed to the desire of households to acquire ever bigger houses. For instance, newly-built houses in 1973 had on average 1660 square feet; in 2014 they had 2680 square feet. Assuming that the price of a newly-built house is the same as that of an average house (obviously a doubtful assumption), this would imply that in 1973 the cash cost of one hundred square foot of housing required 14.4 weeks of labor time; in 2014, the cash cost of one hundred square foot of housing required 15.8 weeks of labor time, only about 10 per cent more than in 1973! Therefore, whether current households suffer from an inter-generational inequity depends on whether one believes that the average size of houses is a free individual choice or whether one believes that, at least to some extent, it is being imposed by the construction industry and society as a whole.

I ran into a quote some years ago claiming that homeowners do not riot…

The homeowners not rioting item has to be high on the list of Fed governor considerations as they ponder interest rate moves. The Fed’s time-honored path has been to cut interest rates which would induce home price reflation leading to a semblance of more home equity for citizens. There is a similar benefit accruing to stock market participants when market averages increase, as 401k balances reflate.

The stabilization of existing homeowner and small investor balance sheets has a parallel in the banking sector. Increasing home prices go along with more demand for sales and borrowing, leading to lending, fees, interest and account cross-selling opportunities. All of those help stabilize the banks, as seen in the ongoing downtrend in number of troubled institutions. After the events of 2008, it is no surprise that Job One of the Fed has been to get the banks healthy to prevent a global collapse and blood in the streets, with a side benefit to those who owned homes.

The renters are outside looking in and chasing higher rents. The rental unit growth has not helped the poor devils as much as it did the unit owners. Renters do not seem to be in anyone’s natural constituency, at least as presented through the Fed actions.

Renters are unpredictable, that’s why. A renter can adjust household spending as needed based on their income. Things go bad, they can find a cheaper place to live and will scale back expenditures – nobody can depend on them for an income stream.

The homeowner, on other hand, has a lot of skin in the game. They will keep spending via credit cards even when income doesn’t keep up. They’re stuck with a fixed cost of keeping a roof over their heads, their kids are in schools where appearances must be kept up. Toys, clothes, etc… They live in a social circle where appearances must be kept up (cars, phones, etc..) They are more pressured to maintain a specific standard of living because they lack the flexibility of the renter. This makes them a more consistent revenue source for banks and retailers.

Yeahhh. Youre not renting. Rent prices are insane. I cant find a place under 1k within 50 miles of denver. I currently pay 800/mo in an 800sqft place with 4 roommates. 2bd 1bath.

I am sorry you paying so much in rent and getting so little. That really sucks. I most certainly am renting, I pay a fortune. However, you may miss the point I made.

The author of the post was effectively proposing making mortgages even cheaper. That is a government subsidy. All that will do is bid up housing prices further.

I am proposing subsidizing the construction of more rentals. More supply will lower prices. And if they are apartments or townhouses in complexes (you know the sort of compromise between a house and an apt), they are more energy efficient by virtue of not being a freestanding building (and they can be built to be more energy efficient in other respects). To the extent new apartments are being built in cities, it’s almost all luxury units. We need more housing for the middle class (and that includes for families) and you could have vouchers for a certain % (say 20%) of the units to go to lower income people with a rent subsidy.

The Barbican in the City of London was originally what they called “council flats” and it was designed to be mixed income: some townhouse type units which were priced high, mixed with middle and lower income units. It’s now all owned rather than rental and priced high due to it being in the city. The apartments, though small, are very well designed. They don’t feel anywhere near as compact as they are.

Even when the banks have stolen all the foreclosures……MILLIONS OF THEM……the homeowners did not riot. Should the banks EVER get my home, I will not go quietly. I will be certain to riot, even if it’s just me.

It’s society as a whole in which the construction industry belongs… E-Z no tax gains that make you feel like a genius!

Houses keep on getting bigger and so do the mortgages and maintenance costs. Most will not be able to pay off the mortgage so they are making a bet that they will be able to downsize or reverse mortgage. But they are making this bet without even playing around with demographic numbers!

I like to look at listings in neighborhoods with 2500+ square foot houses built in the 80s and early 90s… most of the time nothing has been done since it was purchased and we know what age cohort lives there… this means major work is coming up and many listings will be flooding the market in a few years…

And when many try to downsize at the same time, prices will come down, hindering sales and reverse mortgaging… meaning no money for maintenance. I don’t want to be anywhere close to those areas.

I know a few downsizing couples shopping around for a smaller home… the numbers just don’t work… the smaller homes are too expensive because nearly none were built over the last few decades and the new ones are built for the expected rich retiring boomers. Many will have to change cities to downsize.

Personally I’ve zeroed in on mid-to-late 50’s construction as being the “sweet spot”. Old enough to have had the major work done, old enough to be very well-built, new enough to adhere to existing building codes without being a historical antique. The stuff from the 80’s and 90’s is absolute overpriced garbage.

In my area, you can easily pick up 1950’s “starter homes” in the rust belt of upstate NY for 50k thru 70k all day long, some are brick with separate brick garages and hardwood even. Newer mechanicals, vinyl siding, new roof, 3 br 1.5 bath, etc etc etc avg ~1400 sf. and they are in absolutely beautiful condition, with taxes around 1500/yr.

So why would I buy some newer overpriced monstrosity that needs work and is built like a house of cards?

I totally agree with your evaluation of the Sweet Spot! …. Although in the Kansas City area the prices are almost double (recently rising to $120-175 thousand) … Still I’d never go for anything around here constructed after late 1970s.

Also, for some reason.., even though the purchase price is more, our taxes are in the same range as yours…..

I need to convince Phyllis that snow is really her friend. Those are good prices for the property described. Here down South, houses from the forties are a cut price version of what you described. The one we bought is from ’45, and a ‘spec’ house, so, lots of work, but affordable. The previous owners make a difference. We’ve found that there are a lot of cut throat ‘rental’ rentiers out there. They do their tax deferrals without much maintenance and then dump the property. That’s what we ran into.

If only everyone wanting to buy a house worked in construction for a year, a lot of the ‘overpriced junk’ would sit on the shelf till those cows came home. I could do an entire post about Oriented Strand Board, or Particle Board in construction by themselves. (You could too I’m guessing.)

Massachusetts desperately needs graciousness and lucidity in its miserable Hillary picking existence Ambrit: and that means you!

Alas, I suspect you would be much happier, however, in Vermont, or New Hampshire or even some of the far out places in Maine, and the farther north, within reason, the better off as things get hotter and hotter. Upstate NY also has some truly amazing areas.

Still, we do have Western Ma which still has some “real” old new england earthyness left, or parts of it do at least, so do consider us if you can convince Phyllis to go for a round of

sheer madnessmoving.Hmmm… How’s the Art scene there?

(I hope we’re not talking about regions like the ones in Lovecraft.)

I guess I fell for the “common sense assumption” that all housing ‘up there’ is highly priced. Details, details.

The fine tuning of climate ‘predictions’ leaves me somewhat skeptical as to the accuracy that predictions will have. Micro climates will be shifting around like weasels in a super collider.

You should come up here to visit. Fall is a great time.

Good point! I have a friend whose son just closed, on a beautiful 3 BR home with great landscaping in a Syracuse suburb, for $74k. The house was built very well in the late ’40s.

In Rhode Island you can find very well built homes from the late 19th century and early 20th c. all over the place. Outside of wealthy enclaves– like the east side of Providence, Jamestown, Middletown, Barrington, etc.– most of these homes are now selling for less than $130k.

There is no way you are finding anything on the East Side of Providence for $130k. You’re not even touching Woodlawn in Pawtucket for those prices. Proximity to Brown Univ and Moses Brown makes the East side a very desirable neighborhood for the well to do.

Which is I why I specifically excluded the East Side from my comment!!! A nice house near Blackstone Blvd. can fetch a million. A house near Chad Brown (nothing to do with Brown U. or Moses Brown , on the other hand…

Different arguments can be made on those periods that are the best sweet spot, particularly for small houses. The framing I saw in the 50s was terrible. They had shifted production to “mass” and were using cheap new growth pine with all construction techniques oriented toward speed rather than quality. You are perhaps referring to the next level up.

The 50’s also had problems of lead paint, asbestos, poor wiring that is actually more dangerous (because more deceptive) than knob and tube, and poor quality lead soldering in pipes, poor grade bat insulation that is now an actual nuisance (expensive) to remove before you can put in new insulation, poor quality and practices re. concrete in foundations, lack of proper site planning to avoid flooding/humidity/other issues and so on.

Still your idea of small investment is excellent, and can really pay off if someone is willing to put in a lot of work over time. A good argument can be made that 1910 and close to gets the best value per dollar of renovation. But regardless of sweet spot, If you can find someone who really knows construction (and who is NOT involved in the home “inspection” racket) and have them examine any potential properties, it will really pay off – but granted not easy person to find.

Gadzooks! The home inspection racket!

Down here we now have a “REO Property Maintenance” racket to go along with the Property Inspection one. The central rentier doesn’t want much. Just insurance, all tools, cheap labour, and the subcontractor to buy needed materials on a monthly rolling repayment scheme. The kicker for me was, no mention of rates or flat prices anywhere. A classic ‘use someone elses’ money’ scam.

Another year or two of this and American housing will experience a big round of “creative destruction.”

Meanwhile, the hobos have reconstituted the Wal Mart tent encampment, it being in some waste ground adjacent to the older Wal Mart in this town. So far, the cops have left the squatters alone. There are lots of down and out looking folks passing through with backpacks and bedrolls on their backs. Some younger couples in the mix now. No children yet, but we’re expecting some to turn up sooner or later.

All this makes me feel like I’m living in a new Canterbury Tale.

That house would cost $500k in Seattle.

The natural future of the over-sized homes is that they will be split into 2 or 3 dwellings. I know this is against current zoning rules in many areas, but that will be changed, or ignored.

I take Yves point, but I suspect things will work out differently mostly because if they don’t there will be an even more precipitous decline in the middle class which would threaten the democracy itself. The authorities have some control over money supply, and control over fiscal policy. If housing prices decline rapidly in nominal terms, the system will collapse. We ran the experiment in 2008. The system would have collapsed without some pretty extreme steps which amounted to providing public balance sheet when we ran out of private balance sheet.

So my guess is that we will just find a way to boost money supply regardless of the sacred cows that need to be slaughtered to do it. For what little its worth, I suspect the cow that is ultimately slaughtering will be price stability. So housing may be the only real “asset”that most people get to finance against a fixed rate liability.

I believe a lot of our North American housing stock is a product of planned obsolescence. It will not lead to wealth… bad materials, too large, too far from services, bad infra…

Planned obsolescence is a feature, not a bug, of the supply side virus that infects the economy. Once upon a time, capital assets were built to last, whether solid cars, solid houses or other items. There is an evil marketing genius (for example, the Bernays sauce) needed to induce buyers to accept shiny, new objects at the expense of durability. Of course, nobody held a gun to their heads to make them buy.

I have to take umbrage with the cars notion. Modern cars have never been more reliable. Despite the anectdoctal stories, new cars by and large are very much trouble free.

Trouble free, and designed to fail within 10 years.

Right, there was indeed a period where Japanese corporate philosophy toward quality forced American car manufacturers to improve durability, but there is now global collusion rather than simply American collusion and while the durability has indeed gone from 4 years to 10, the latter is unfortunately becoming more and more of a hard upper limit which is not at all driven by physical or technological limitation, but only by what they can get away with.

THIS and I speak as someone with a lifetime of pro mechanical background. Modern cars are designed to keep you on the upgrade/payment treadmill for life. And yes I heard that from the dealership manager where I worked back in the 80’s.

As for myself I drive a *very* old AMC jeep. Still works just fine.

Not the one with the Dasher motor? I used to have one when I delivered the Rural Mail. The right hand steering system makes stuffing the mailboxes so easy.

When planning for retirement I avoid “investing” too much in stuff that ends up in a junkyard.

The second car is typically the retirement killer.

If you go on the Rightmove UK site and search for a typical 3 bedroom ‘semi’ (duplex) in any County town outside London or the South East (for example try Shrewsbury, Chester, York) you find that a substantial interwar bow-fronted brick built house with garage is in the 200k to 240k (sterling) range, that translates to around $300k to $360k. Whole compact suburbs of these things look far more attractive than the vinyl sided favelas spread like blight all across the US. It usually comes with a walkable town with a historical town center and strong public transport links (well, less strong than in mainland Europe, but way stronger than the average town of 100k to 200k population here).

To be sure, properties approximating this can be found in remote regional towns, such as for example Cumberland, MD – but you simply cannot exist there without a car, if you want to have any kind of regional (or international) travel footprint.

Anybody who knows of a substantially brick built community in an attractive town with strong regional public transport links _anywhere_in_the_USA_, do please let me know.

Chicago has many neighborhoods within its borders where you can find various sized brick homes built pre and post WWII, including good reliable 24 hour public transportation (that doesn’t close down at 9p and roll up the sidewalks for the night). In fact, many city millennials don’t own cars. There’s also the burbs bordering the city with older small/large brick homes. These communities rely on the CTA public trans., suburb services and Metra trains

Chicago is more than the overpriced upper Michigan Avenue Mag Mile tourist trap strip

Chicago has many neighborhoods with various sized brick homes built pre and post WWII, including good reliable 24 hour public transportation (that doesn’t close down at 9p and roll up the sidewalks for the night). In fact, many city millennials don’t own cars. There’s also the burbs bordering the city with older small/large brick homes. These communities rely on the CTA public trans., suburb services and Metra Rail.

Chicago is more than the overpriced upper Michigan Avenue Mag Mile tourist trap strip

Neighborhood link: http://www.choosechicago.com/neighborhoods-and-communities/list/ Metra Rail: http://metrarail.com/metra/en/home/maps_schedules/metra_system_map.html

Rebuilding housing stock every 50 -100 years actually does have some advantages but, at least as practiced now, one of them is not sustainability.

If I’m not mistaken the Japaneese used to also rebuild frequently, but on a scale and with materials that were very sustainable.

Planned obsolescence in housing? Not just North America anymore. The Europeans have caught on big time. You can make almost anything so it won’t last (AND won’t be easy to replace) with a little ingenuity and a good neoliberal attitude.

I was a long time renter and felt lucky to find a three bedroom single family home to rent near public transportation in the Boston suburbs. As my kids got older though, we desired a bit more space as the rental was about 1000 sq ft. I tried in vain to find anything that we could rent in the area and it just did not exist. Most rentals were two bedrooms, with three bedrooms being rare. The town I lived in had a policy of ensuring that newly built rental property would be unattractive to families as too many kids adversely affects the town budget. The costs of education far exceed what the town recoups in terms of property taxes associated with new buildings. All around me the latest drive is to build town home villages for 55+ aged individuals where you can go from active to fully cared after.

So my wife and I purchased a home. I have never been a strong advocate of owning a home because the maintenance costs can be unexpected and very high. Maybe other markets are different, but the rental stock is definitely underwhelming for families in my area, but it’s clear that towns in Massachusetts would rather not attract too many new students as it hits the budget very hard. This to me argues that we need better mechanisms to fund our public education, but I suppose that goes with anything that should be a given right.

My wife and I would have remained renters except that Landlords can be dreadful in this area (MA), but home ownership is indeed very expensive and building equity in housing is now pretty much a rigged lottery.

As Yves points out, the solution would be more rentals (and my opinion a better rental system). When you start digging into it, it’s amazing how many areas there are in which Capitalism is poorly suited. Short of Mom and Pop enterprises (and that will always have a certain level of inconsistency), rentals are no exception. Sooner or later, the profit motive sucks all the goodness out of it.

Why is the comparison between renting and buying always in terms of money. and almost never considering other factors? An owner can grow plants and vegetables, possibly even have chickens. Real food. Pets are allowed without extra fees. Paint the walls and hang pictures. Those are my reasons for buying a house.

Economics site :) All things are viewed from a strategic economic vantage point. The freedom to control your immediate surrounds is the true compelling reason to own vs rent. Sure, there’s a substantial burden of maintenance but the benefits of being able to tailor your home to your liking balances those out – maybe not for everyone.

Because none of those perks matter all that much compared to being able to pay your bills (even when unemployed), move for work when necessary, accumulate assets over time, retire to something other than poverty (owning might be better there) etc..

I live in communist New York City. I rent and have pets, can and have sublet my apartment legally, have painted and done more, because as a tenant in my type of agreement I have better property rights in some ways than even co-op owners do.

I want staff to take care of my hassles. That is a big part of what I get with paying rent. I don’t want to have to deal with plumbing breakdowns. And I do not want to have a freestanding house and have to deal with a roof that has to be redone every so often, biolers that need maintenance, a yard, or a car, evah.

I’ve had major issues with the housing situation in this country all my life. I grew up in rural SE central Michigan (40 miles South of Jackson); my family lived in an old farmhouse built in 1890. The house had been refurbished sometime around 1940 but certain amenities were missing. While the structure was sound, the central heating did not fully function and we relied on convection forces arising from a broken furnace to heat the house. Most of the issues were related to poor maintenance such as not having a hot water system. The beauty of the situation was that we were situated on a hill about 120 feet from the road; the house was surrounded by five acres of lawn, trees, gardens, flower beds and shrubs. I have many fond memories of life in that ramshackle house. Most people would have found the situation unacceptable however as major amenities were not working.

Yves, I’m sympathetic to your solution of more “good” rentals. I’ve lived in rental housing my entire adult life (I’m 60) having never overcome my aversion to large mortgage debt or my inherent distaste for the home selling/buying industry. However, I have to add the following caveats. I’ve been fortunate enough to live in what are considered to be “good” and “better than good” rentals for many years now (yes, I know, most rental communities refers to themselves as “luxury” housing and many do not live up to that) and the experience has gotten progressively worse and more costly.

Rents have increased much faster than inflation and, in my area at least, not even the addition of new rental stock has abated this trend. In fact, rents at these newer communities are even more expensive in terms of $/sq ft. In addition, the terms of leases make it difficult to move even when you want to. I’m required to give 60 days notice of vacating but I only get notice of the new rent two weeks before I would need to give notice if I intended to leave at the end of my current lease. Needless to say its difficult to find a new place in that short a time period as vacancy rates are low. Getting an early start on finding new place is not a solution as most communities will tell you that they don’t know what their availability will be more than a few weeks out.

Why don’t I just go month-to-month at the end of my lease to give me more time? Well, I would but my community charges a whopping premium of 89% to extend on a MTM basis! Thiis actually progressively gone up from ~ 30% over the past 4 years. Shorter term leases (up to 6 mos) have progressively smaller, but still expensive, premiums I have complained bitterly to county officials about this to no avail. They’re completely toothless and not at all interested in any form of rent control, rent stabilization or limits on MTM premiums.

Finally, the rental living experience has gotten progressively worse as more and more people are seeking rentals having lost their homes or not being able to afford homes. There’s more noise (and even upscale, expensive apartments have little or no noise insulation), more parking hassles, less consideration for neighbors, etc.

If rentals are to be a solution to high housing costs then 1) some form of price controls or stabilization need to be in place (and most govt officials are not sympathetic to this) and there need to be limits on ridiculous MTM and short term lease premiums and 2) the rental experience has to be improved.

And yea there are transaction cost to moving from a rental, though not those of selling a house. First month rent and security deposit equal to last months rent which there is very little accountability in ever getting back (these two can run into thousands of dollars), sometimes paying two rents at once for a short period of time if you can’t get leaving one rental for another to perfectly align, moving costs. It can take a very serious bite of an ordinary income. And average leases seem to be getting longer and longer and there are fewer and places you can start out month-to-month. Leases are good for those who want to lock in costs, but not at all good if actual flexibility is desired which is supposed to be one of the benefits of renting. Still seems a better bet than buying around here, but that’s not saying much.

The more and more parking hassles and noise is probably because more and more people are squeezing into those one and two bedrooms as the only way anyone can afford rent. The literal rent is too damn high.

This is a good description of the problems with renting I have experienced as well. And I would add the reduction in available rentals and increase in noisy neighbors/parking issues caused by the airbnb boom out here that most towns are failing to regulate effectively.

Nuclear marriage maximizes financial NPV for what should be obvious reasons, and genetic NPV due to recursive RNA imprinting. All empires have employed Family Law to remove due process and maintain feudalism, liquidating natural resources until the ponzi implodes. With no due process underpinning the constitution, no law, technology, or financial engineering is going to stop runaway debt and demographic collapse. All empires travel backwards at inception, and this one has nowhere to go. The best the ,Fed can do is kick the can, to a dead end, as expected. The bridge isn’t made of gold or silver.

A house is an expense. A home to raise children is an investment, for which the majority has no equity. Majorities don’t vote for nuclear marriage, surprise. Real investment emigrated the moment Family Law was incorporated.

If they could just print without assigning the debt to your children, they would, but they can’t. It’s always the same shell game.

Just checking. May is here.

This chart and analysis misses the most basic change since 1970 : two income households. Two incomes means families bid twice as much for houses and rentals. A better graph would be household income versus purchase cost.

I have had similar thoughts for a long time. I would guess the multiple is a bit less than 2x, because two incomes doesn’t always mean double the income – one partner often earns less, for various reasons.

The participation rate is studiously omitted from the analysis.

‘Fairness’ is a rather loaded term compared to, say, ‘equilibrium.’

Interest rates fluctuate; labor compensation fluctuates; house prices fluctuate. These measures are only weakly related. Thus ratios formed from their values will wander all over the map.

If these ratios were fixed, we’d be living in a centrally planned economy … or in a housing project.

Life in the Ceausescu Projects, comrades — it’s better than you think. We’re even allowed to grow flowers in the window boxes. :-)

*chucks another empty vodka bottle out the window*

Grey goose, w a corona chaser

I keep mine in the garage, a wall for each, so the neighbors have something to talk about every time I open the door.

I knew a woman who lived in the original Desire Project just after WW2. That was when a planned economy was a good idea, and projects were run like apartment complexes, complete with minimum standards and ‘enforcement’ of same.

The trick is in how one manages the resources. In many instances, anarchic libertarianism doesn’t cut it.

This conclusion [twice as many weeks of work to afford a house over the last 40 years] could however be questioned by some observers, by arguing that most of the cost increase in residential units could be attributed to the desire of households to acquire ever bigger houses.

It would be more accurate to say that marketing, the MSM and even the POTUS have imposed the ever expanding house size on a gullible public. But then it has imposed a hell of a lot more than that, such as the notion that having a giant resource sucking family that looks like a musical instrument (8 or more different size “tones” standing in a row) regardless of low mortality rate is the only patriotic thing to do unless you are a dirty communist. Even today, the advantage goes to large families in many things and this is just plain nuts.

As Groucho Marx famously said on-air when a family of 10 or 12 came on his 1950’s TV show, all arranged in a row by age so each one was a little taller than the next, “Well well, (eyebrows go up and down) I enjoy a good cigar myself, but at least I take it out of my mouth once in a while.”

Unfortunately, the Groucho bit is apocryphal.

http://www.snopes.com/radiotv/tv/grouchocigar.asp

I watched that particular episode when it first aired and those shows were live. I was with my parents who were not exactly prudes, but they did a double take none the less when Groucho made his remark. In fact we all did a double take, it was the 1950’s after all and the networks were pretty stiff. I was young enough so my parents were a little embarrassed at my presence, so they didn’t break into conversation on it, but there was an awkward silence where i imagine they exchanged a bunch of eye rolling glances at each other. I pretended not to have noticed anything so as to lessen any embarrassment they might feel. And the show went on with Groucho not missing a beat.

While the link you provide gives what is probably a more accurate description, the snippet of conversation before the bombshell does ring a bell, the gist of it has stayed with me very sharply all these years so I know full well it actually happened.

I re read the article and it claims the shows were not live, heavily edited and that the episode could never have occurred. I remember the show being live though that is a detail that could have occurred to me simply because of the remark.

I realize it’s always possible I re created this in my mind after the fact, but I doubt it. As to how it could have happened, well no idea other than that it did. I imagine Groucho got in some hot water for it, but he was a big name and that show (not so much to me) was quite popular and I suppose it got quite a boost.

I have argued for some time, that buying a house since the 1970’s has really be taking a bet on long term interest rates. It has worked out well for the past 35 years (with a blib there in the naughties) but if interest rates every return to normal, it will be a very painful experience.

Assigning debt to future generations is doomed to fail.

What’s all this nonsense about house size?

The big driver of housing costs in the expensive parts of the US is land rent, equivalently site value.

I own (or, shall I say, the bank owns) a 2800 sq ft colonial in a nice Boston suburb. The same house would cost a fraction of what it does here in my wife’s hometown in the Midwest.

I did an analysis like this maybe ten years ago. It’s outdated, obviously, but still relevant.

http://www.kaleberg.com/househours/

Your analysis has a problem in that it doesn’t take into account that people have to live somewhere, and the choice is usually between buying a place or renting a place. People don’t look at the total mortgage cost of a house. They don’t. It doesn’t make any sense for them do to so. They look at the monthly (or annual) cost of living in a house so they can compare that cash flow to the cost of a rental. For most people, the goal isn’t to own a valuable asset, though that is a nice perk if it comes to pass. The goal is to have a place to live.

Buying a property as opposed to renting a property is also a way of hedging against a rise in real estate prices. Most people don’t explicitly price this in, but, in areas where housing costs are rising, this can be a big factor. Most people don’t have access to rental price insurance or a corresponding financial option. If they rent and rents rise, it costs them money. If they buy, they know roughly what their costs will be.

I’ve done a more recent analysis. It’s just as naive, but it is updated. The big surprise was the housing bubble.

http://www.dailykos.com/story/2016/05/02/1522091/-House-Prices

“[A] fair interest rate is such that the purchasing power of one hour of labor stays constant through time, even when its monetary equivalent is lent or borrowed. This occurs when the nominal interest rate is equal to the growth rate of nominal wages.”

How is that “fair”? The lender is not compensated in any way for his not having the money available to him during the time the borrower is using it, nor is he compensated for the possibility that he might not get it back at all.

Rents here in SoCal have skyrocketed. Angelenos are now paying 60% of their income – up from 47% – towards rent. It’s not sustainable.

The best solution to Housing and rental prices is to get the government out of

the housing business… The FED manipulating interest rates, the tax code offering tax breaks, Fannie & Freddie controlling mortgages. Had they let failures, foreclosures and defaults occur.. House prices and rents would have dropped like a rock… aka more affordable for both purchasers and renters..