By Eric Tymoigne, Ph.D., Assistant Professor of Economics at Lewis and Clark College and Research Associate at The Levy Economics Institute. His research expertise is in: central banking, monetary economics, and macroeconomics. Originally published at New Economic Perspectives

While visiting the London School of Economics at the end of 2008, the Queen of England wondered “why did nobody notice it?” In doing so, she echoed a narrative that had been promoted among some prominent economists: the Great Recession (“it”) was an accident, a random extreme event and no one so it coming. This narrative is false. Quite of few economists saw it coming and it was not an accident. A previous post showed how different theoretical framework about financial crises lead to different regulatory responses. This post studies more carefully the mechanics of financial crises and how an economy gets there.

Debt Deflation

Definitions of financial crises can be more or less broad. Some economists restrict the definition to banking crises, others may use a statistical definition that takes a specific percentage fall in a financial index. In any case, financial instability has increased since the 1980s.

The most serious financial crises involve reinforcing feedbacks between asset prices and leverage, leading to a downward spiral of debt write offs and fall in asset prices. These financial crises are called “debt deflations” after Irving Fisher’s analysis of the Great Depression. The main implication of a debt deflation is that market mechanisms breakdown under the combination of over-indebtedness and deflation: lower prices do not clear markets but make matter worse.

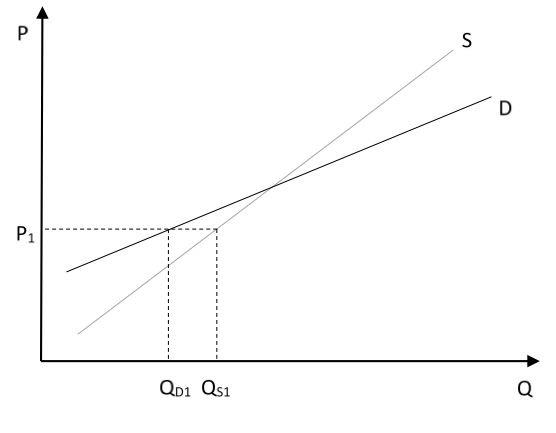

One way to represent that graphically is with the following supply and demand diagram. The demand curve is upward slopping because higher prices lead to higher wealth and so higher demand for goods and services. There is an equilibrium point but it is an unstable equilibrium, i.e. price mechanisms do not bring the market to equilibrium. For example, at P1 there is a surplus of goods and services, this leads to a fall in prices. The deflation decreases the quantity supplied but also quantity demanded in such a way that the surplus grows. A similar result can be found by postulating a downward slopping supply curve. As prices fall, more goods and services are supplied to try to service debts.

Figure 1. An unstable equilibrium

There are many feedback loops involved in a debt deflation but the process starts with some economic units that become “overindebted.” The following present Fisher’s argumentation in his 1932 Booms and Depressions.

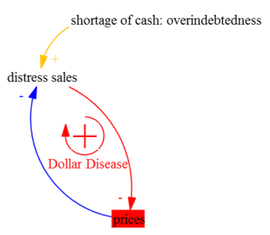

Step 1: Overindebtedness and distress sales

Some economic units, e.g. (non-financial) businesses, are unable to pay their debts with their available monetary assets (cash and bank accounts). This means that businesses in difficulty must find ways to sell non-monetary assets to recover enough funds to service their debts. They liquidate their inventories, sell other types of financial assets than monetary assets, and sell some superfluous real assets (Figure 2).

Figure 2. Step 1: distress sales

Note: The “+” sign means that things move in the same direction: more overindebtedness leads to more distress sales (and less overindedtedness leads to less distress sales).

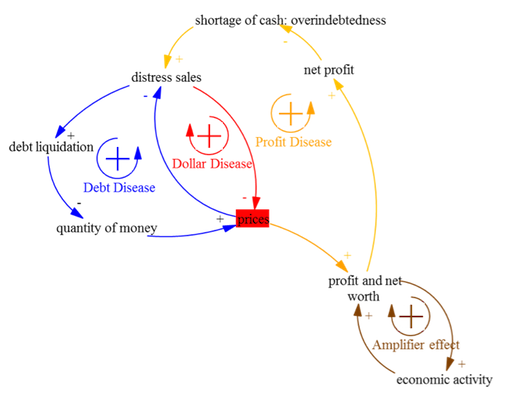

Step 2: Distress sales and deflation, the “Dollar Disease”

The sudden massive sales of non-monetary assets lead to a decline in their prices. The lower prices of assets lowers the ability of businesses to recover funds from the sales. Businesses are then forced to sell more at distress, which further pushes down prices. This is the first reinforcing feedback loop of a debt-deflation.

Figure 3. Dollar disease

Note: the sign “-“ means that things move in the opposite direction: higher distress sales lowers prices, leading to higher distress sales.

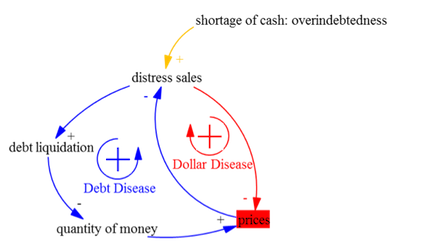

Step 3: Deflation and Debt Liquidation; The “Debt Disease”

Once they have recovered some funds, businesses service debts owed to banks and government, which reduces the money supply, and service debts owed to others (e.g. corporate bonds held by households). Some businesses may have to default and ultimately their debts are written off by creditors, which negatively impacts the creditworthiness of businesses and the net worth of creditors.

Following the quantity theory of money (which Fisher promoted), the decline in the money supply lowers prices even further, so there is a second reinforcing feedback loop: more distress sales leads to more debt liquidation, which leads to a lower quantity of money and so lower prices and then more distress sales.

Figure 4. Debt disease

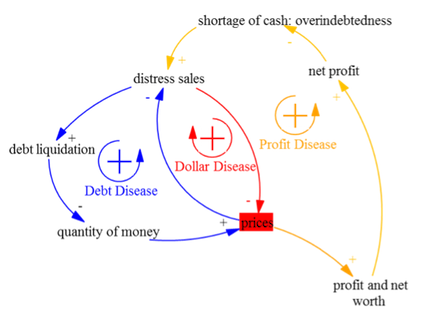

Step 4: Prices and Profit and Net Worth, The “Profit Disease”

The debt and dollar diseases create a deflationary spiral that is reinforced by additional feedback loops. First, as asset prices fall, the profit from sales and net worth of business falls given everything else, which further increases their overindebtedness and so feedbacks into the dollar and debt diseases. Prices of assets fall even more.

Figure 5. Profit disease

Step 5: the “Amplifier effect”

Decline in profit and net worth means that non-financial businesses have an incentive to lay off employees. Some banks may also have to close because losses from debtors are too high to be sustained by their balance sheet. Households, who record a shrinkage of their income and prospect of unemployment, lower their consumption and may have difficulty to service their debts. Rising unemployment reduces aggregate spending, which further reduces profit and aggregate income. In addition, the declines in spending further pushes down the value of goods and services and other real assets. Now households in addition to businesses have problems to service their debts, which reinforces debt write offs and decline in the net worth of banks.

Figure 6. Amplifier effect.

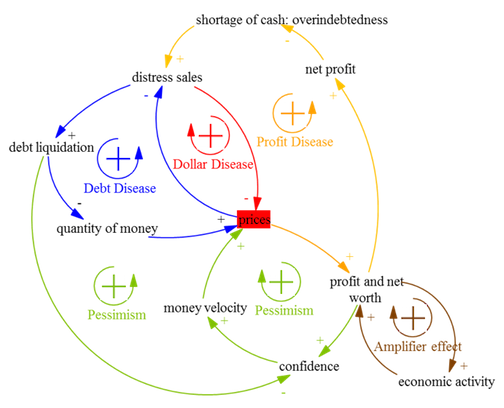

Step 6: Pessimism

As the economy records falling prices, declining economic activity, rising unemployment, rising default, and shrinking balance sheets, confidence among economic units declines and hoarding rises. Higher hoarding lowers the velocity of money and so prices are pushed further prices down (again this presentation follows the quantity theory of money). Lower confidence also decreases the willingness of banks to grant credit, and increases their willingness to hang onto their reserves to meet withdrawals, interbank payments and other dues at the lowest cost possible; the overnight interbank market freezes.

Figure 7. Confidence crisis

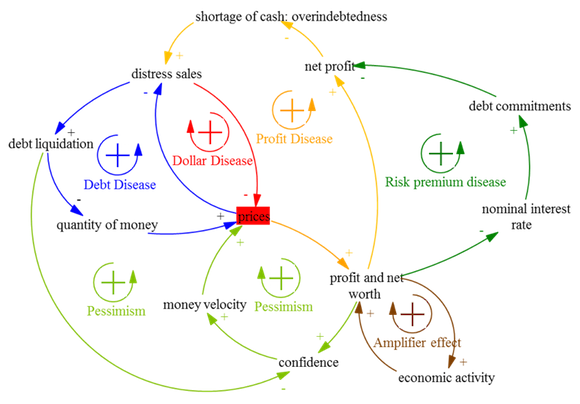

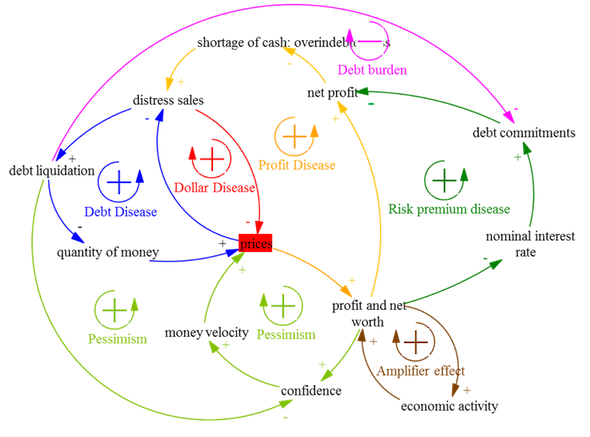

Step 7: Interest-Rate Spread

With the crisis of confidence spreading and with raging deflationary pressures and economic crisis, interest rates shoot up. This quickly spreads through the outstanding debts if interest rates on financial contracts are floating rates, which squeezes net profit (profit – debt commitments) and so increases overindebtedness.

Figure 8. Risk Premium Disease

Conclusion: Debt deflation

Overindebtedness and deflation feed on each other through several feedback loops. All these feedback loops make things worse and worse: difficulty to service debt leads to lower prices, which increases the difficulty to service debts.

If left alone a debt deflation stops only when the amount of outstanding debts has been lowered sufficiently through repayment and write offs to make the serving of debts bearable. The decline in the debt burden loosen the need for distress sales (Figure 9). Of course in the process, banks closes, households lose their savings and become unemployed, businesses close, and resources are wasted (output is left to rot, labor power and knowledge is left unused and decays quickly, capital equipment depreciates, etc.). According to market proponents this is fine because a debt deflation punishes all economic units that made “bad” decisions. Banks that overextended credits, businesses that did not satisfy their customers, households who are not flexible enough, etc. As Treasury Secretary Andrew Mellon stated during the Great Depression: “liquidate labor, liquidate stocks, liquidate farmers, liquidate real estate…it will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up from less competent people.”

There are two main problems with this view. First, as explained previously, what is considered in hindsight a “bad”/incompetent decision at the time of a crisis may have been necessary prior to the crisis in order to keep up with the competition and to avoid losing market shares and income. Second, a debt deflation is not a selective process. It destroyed economic status indiscriminately by spreading through decline in net wealth, loss of job, loss of savings, decline in confidence, shut down of financing opportunities, and overall decline in economic activity. Think of a fire that starts because someone smoke in bed. This person may “deserve” to have a destroyed home but, if nothing is done to stop the fire, the entire town may be destroyed.

Figure 9. A stabilizing loop

Origins of debt deflation

While the mechanics of a debt deflation are well known and widely accepted, what causes them is subject to debate: why are economic units overindebted in the first place? Again, keeping with the distinction of previous posts on macroeconomic topics, this section makes a difference between the real exchange view and the monetary production view.

Real Exchange Economy View: Efficient Markets and Imperfections

In this view, money and finance are neutral and financial markets are efficient. The Efficient Market Hypothesis (EMH) states that markets tend to allocate scarce resources efficiently (i.e. toward the most productive economic activities) and to allocate financial risks toward economic entities that are most able to bear them. Former Fed Chairman Alan Greenspan illustrates well how the EMH is used in real world situation:

development of financial products, such as asset-backed securities, collateral loan obligations, and credit default swaps, that facilitate the dispersion of risk… These increasingly complex financial instruments have contributed to the development of a far more flexible, efficient, and hence resilient financial system than the one that existed just a quarter-century ago. (Greenspan 2005)

The EMH also states that market mechanisms tend to self-correct and to eliminate any disequilibrium such as bubbles or crashes. In order to introduce the possibility of financial crises either markets have to be imperfect, or market participants have to behave imperfectly/irrationally.

In terms of market imperfections, a lot of emphasis is put on the existence of asymmetries of information. Banks have much less information about the quality of a project than potential customers. Bankers try to protect themselves by requiring collateral. This is supposed to give an incentive to economic units who request an advance of funds to do their best to make their project successful (otherwise economic units lose the collateral).

Following a negative random shock, the value of collateral declines, which leads debtors to limit their entrepreneurial effort—because a decline in the value of the collateral means that they have less to lose by defaulting—, which increases the chances of financial difficulties. Banks take notice and start to ration credit. This, in turn, generates a credit crunch, which leads to further declines in net worth and collateral and so less effort and greater default risk.

Recent research efforts in the REE approach have focused on the reversion mechanisms (how a crisis occurs) instead of the propagation mechanisms (how a crisis spreads following a shock). Crises are endogenized by linking effort to the business cycle. The more effort individuals put into their business, the more productive they are, which leads to a greater supply of commodities and so lower prices. Lower prices lead to lower net gains, which leads to lower effort and so greater risk of default.

Given that the mathematical models developed to back this theory are all set in in real terms, and given that the random shock is one applied to the productivity of an input (e.g., land), this type of analysis applies well to a pre-capitalist agricultural economy. Nature decides which economic state occurs (good or bad weather). Financial crises are equivalent to weather calamities that decrease agricultural output.

The imperfection view can be complemented by the Monetarist view of financial crises and by the irrational approach developed by behavioral economics. The former states that financial crises are due to the incompetence of policy markers, and the latter states that behavioral imperfections of individuals contribute to the emergence of crises. People have limited cognitive capacities that restrict their capacity to acquire and interpret information, and market participants care about things that a “rational economic man” should not care about. As a consequence, a market economy is prone to bubbles, herd behaviors, cascade of information, and misallocation of resources, leading to overindebtedness and ultimately a debt deflation. One may try to correct for these behavioral problems by creating markets that provide signals that allow market participants to make the right decision.

Monetary Production Economy View: The Financial Instability Hypothesis

According to the MPE view, the previous type of analysis obviously lacks important aspects of capitalist economies. For example, government deficits do promote financial stability, which is seen as an empirical puzzle in the REE view given that deficits ought to crowd out investment and so make things worse. The REE view is also too micro-oriented and lacks a system-view of financial crises that recognize major sources of instability outside the realm of individual behavior/effort.

The Financial Instability Hypothesis (FIH) is an alternative to the EMH. The main claim of the FIH is that periods of economic stability are a fertile ground for the growth of financial fragility, i.e. the growth of the risk of debt deflation. Hyman P. Minsky, who relied on the work of Fisher, Keynes and Schumpeter, is the main developer of the FIH and provides a more detailed analysis of what “overindebtedness” means and its impacts.

Financial Fragility

According to Minsky, the degree of financial fragility of any economic unit—how badly overindebted they are—can be classified as hedge finance, speculative finance or Ponzi finance. Hedge finance means that an economic unit is expected to be able to meet its liability commitments with the net cash flow it generates from its routine economic operations (work for most individuals, profit from going concern for companies) and monetary balances. Even though indebtedness may be high (even relative to income), an economy in which most economic units rely on Hedge finance is not prone to debt deflation, unless unusually large declines in routine cash inflows and/or unusually large increases in cash outflows occur. Even then, monetary savings are usually available in a large enough amount to provide a buffer against unforeseen problems. As such, it is not expected that the servicing of debts will be problematic and so no refinancing (going into debt to service existing debts) and/or sales of non-monetary assets is expected.

Speculative finance means that routine net cash flow sources and monetary balances are expected to be sufficient to pay the income component (interest, dividend, among others) but too low to pay the capital component (debt principal, margin calls, cash withdrawals, among others) of liabilities. As a consequence, an economic unit needs either to go into debt or to sell some non-monetary assets in order to service the principal due. Economic units usually expect that rolling debt over will be possible instead of liquidating assets. The length of time during which routine cash flows are expected to fall short of capital repayment depends on the economic unit. The business model of banks is such that refinancing is usually needed to service the capital component of liabilities, as such banking requires a reliable and cheap refinancing source. Other businesses may only have a temporary need to roll over their debts.

Ponzi finance, also called interest-capitalization finance, means that an economic unit is not expected to generate enough net cash flow from its routine economic operations, nor to have enough monetary savings to pay the capital and income service due on outstanding financial contracts. As a consequence, in order to service a given level of outstanding debts, Ponzi finance relies on the growing availability of refinancing sources, and/or an expected liquidation of non-monetary assets at rising prices. At the microeconomic level, an economic unit that uses Ponzi finance to fund its assets is highly financially fragile. At the macroeconomic level, if key economic units behind the growth of the economy are involved in Ponzi finance, the economic system is highly prone to a debt deflation.

Note that this categorization is not merely a measure of the use of external funding, i.e. of the size of leverage; but also, a measure of the quality of the leverage. At the core of this analytical categorization is an analysis of the means that are expected to be used to fulfill financial contracts. Hedge finance is not expected to require any refinancing operation or liquidation of non-monetary assets to service debts; Ponzi finance requires a growing use of refinancing and liquidation to service debts. This has important regulatory implications as explained previously, because knowing HOW one can service debt because as important, if not more important, than knowing IF one can service debts: low default probability (IF) does not mean low financial fragility (HOW).

Ponzi finance should be differentiated from the existence or not of a “bubble.” The categorization does not aim at measuring the accuracy (however, defined) of the price of assets used to service debts. Ponzi finance is a more important concept than bubbles for the purpose of economic stability. Ponzi finance means that leverage and asset prices end up going up together and feed on each other on the upside. Higher leverage requires higher collateral value and so higher asset prices, and the funding of assets at a price that grows faster than income rises requires higher leverage. This is the crucial dynamic regardless of the correctness of the value of asset prices because, bubble or not, the size of a potential debt deflation grows with the duration of the use of Ponzi finance. Without Ponzi finance there cannot be a debt deflation because there is no leverage involved in the asset-price appreciation. Without a debt inflation, there cannot be a debt deflation.

Ponzi finance is also different from fraud (which can prevail at hedge, speculative or Ponzi stage). Ponzi finance is an unsustainable financial process regardless of the legality of a financial structure. Indeed, in order to persist it requires an exponential growth of financial participation, which is not possible because, ultimately, there is a limited number of economic agents that can or will participate.

The H/S/P categorization does not apply to monetarily sovereign governments, i.e. governments that issue their own nonconvertible currency and that issue public debt denominated in their currency. Examples of monetarily sovereign governments are the United States Federal Government, the Japanese National Government, the United Kingdom National Government, the Chinese and Mexican Central Governments. Examples of non-monetarily sovereign governments are national governments of the Eurozone, the United States under the gold standard before 1933, state and local governments in the United States and, any country that issues securities denominated in a foreign currency. When a government is monetarily sovereign, it has a monopoly over the currency supply and so always can meet payments denominated in its currency as they come due. Hedge finance applies to all sovereign government that issues its own currencies. In addition, the federal government may provide bonds and other default-free liquid securities that boost the liquidity of the balance sheets of the private sector. The long period of financial stability in the United States after World War II was the result of highly liquid balance sheets in the private sector due to large government deficits during World War II that flooded the private sector with safe assets.

The Financial Instability Hypothesis

According to the FIH, during a period of prolonged expansion, the proportion of economic units involved in speculative and Ponzi finance grows, and so the risk of a debt deflation increases. The period of expansion may record minor recessions—e.g., the 1991 and 2000 downturns in the United States—that do not significantly tame the state of expectation of private economic units and so do not significantly make underwriting practices more prudent (so the FIH is not a theory of the business cycle but rather focuses one what causes significant downturns).

Contrary to the behavioral explanation, irrationality is not at the heart of instability. The boom, with its mania, just amplifies the dynamics that emerged previously during a period of prolonged expansion. Contrary to the market imperfection explanation, market mechanisms promote instability not stability. The heart of the problem is not found in individuals making dumb decisions but rather in the system in which they operate. Capitalism is a much more financially unstable economic system than those that previously existed. Capitalism incentives and mechanics push economic units into Ponzi finance.

There are several channels through which financial fragility grows and they have to do with anything that changes the relation between income and debt service. Anything that pushes an economic unit from a case where income is greater than debt service to a case where income is less than debt service. This can happen either because income level (or growth) falls and/or debt service level (or growth) rises. Factors that impacts both are described briefly:

- Structural causes:

- Banks are speculative units: the maturity of banks’ liabilities is short relative to maturity of banks’ asset so they need to refinance all the time. Banks aim at lowering maturity of their assets to limit the maturity mismatch, which promotes speculative finance in non-bank sector. For example, in the US, the 30-year mortgages is not a product of private banking but of government intervention, and it must be subsidized to persist. Banks much prefer at shorter-term mortgages (say 10 years) that require households to refinance, which creates a dependence on the direction of home prices (if home prices fall refinancing may not happen).

- Change in the banking business: move away from the originate-and-hold model to the originate-and-distribute model, which create adverse incentives in terms of underwriting and debt reworking.

- Economic causes

- Search for profit and market share, and market saturation: ROE = ROA x leverage.

- Inequalities: the need to use debt to sustain a given standard of leaving has increased (student debt, healthcare debt, etc.)

- Unexpected events: The FIH leaves some room for adverse random shocks (say a hurricane destroyed many houses and businesses, which triggers massive payments by insurance companies)

- Policy reasons:

- Deregulation, desupervision and deenforcement: fraud grows and underwriting worsens.

- Fiscal policy: A period of prolonged expansion that is led by a monetarily sovereign government will not lead to financial instability. Fiscal deficits boost macroeconomic profit and personal savings and provides cash flows as well as safe financial assets to the private sector. However, as shown in the previous post, government’s willingness to reach a surplus, combined with the automatic stabilizers, means that non-government sectors may be forced to deficit spend.

- Monetary Policy: During a period of expansion, the central bank raises interest rates and that increases the debt burden. Minsky is of the opinion that fine tuning and preserving financial stability are not compatible and argues for a central bank that focuses on financial stability.

- Socio-psychological reasons

- Long period of prosperity leads to a decline in risk perception because economic news is good and it is too costly to look too much backward.

- Uncertainty means that economic units rely on norms to make decisions. These norms are rationalized through a convention, which is mental construction about the current economic trends and about what to expect (think new economy/era convention). There is a strong incentive to stick to the convention to avoid losing market share or avoid drawing attention of regulators. So if Ponzi finance is considered normal, a bank will do it to avoid losing market shares and profit, and will find comfort in the fact that “everybody else is doing it so it is ok.”

How to deal with financial crises

Financial crises that are severe create a lot of damages if they are not managed through government intervention. This government intervention involved both quick fixes to deal with the immediate problems and long-term policies to prevent moral hazard and promote stability. The recent responses to the Great Recession provide examples of what not to do:

- Stop the liquidity crisis: central bank provide funds at penalty rate, against safe collateral, to solvent institutions. One may argue that, during a crisis, a lot of financial assets that previously looked safe may now be unsafe because of the lack of confidence and because of poor economic prospects. For example, prime mortgagees may default because they lost their job. There is a way around this issue. Central banks should accept only financial assets that were created by following strict underwriting, that is, those that involved hedge finance and speculative finance prior to the crisis. Central banks may record losses on them given that a debt deflation impacts even economic units with strong creditworthiness, but that should be minimal. Do not provide liquidity against Ponzi finance inducing financial instruments.

- Recent crisis: Fed provided advances at near 0% rate, against poor to toxic collateral (accepted at par), to questionable institutions, to non-bank entities

- Stop the solvency crisis: Bank holiday to examine the books of financial institutions in details for a given period of time (say a week like during the Great Depression) and close insolvent banks. Act to sustain income and lower debt burden. Lower the debt burden by reworking debts of economic units who would be solvent with the reworking (during the great depression, government bought interest-only mortgages from banks and replace them with 30-year fixed rate mortgages). To sustain income, large-scale long-term fiscal policy such as a job guarantee program (great depression work programs were started in matters of days).

- Recent crisis: no significant analysis of books (only 2 Fed people sent at Lehman brothers, superficial stress test), insignificant and slow fiscal action to stabilize income (700 billion was not enough and was implemented over years), hide losses of financial institutions by widening level-3 valuation (aka mark-to-model), injection of capital in banks via Treasury without any real congressional oversight, no significant reworking of debts on non-bank agents.

- Change incentives and regulation, supervise and enforce: prosecute top managers for fraud, cease and desist orders, major reworking of regulation and supervision to deal with problems, promote hedge finance and if necessary forbid Ponzi finance.

- Recent crisis: Not a single prosecution of top executives even though fraud is obvious (ask FBI, and rating agencies that finally had a look at mortgage contracts), civil instead of criminal cases (the financial institution pays fines and promises not do it again), no major reregulatory trends, no enforcement of existing laws prior and during crisis.

Even though a financial system may be on the brinks of collapse and panic is generalized, regulatory must follow the law. If necessary, regulators may use emergency executive powers (bank holiday) to shut down the financial system temporarily and get to the bottom of the problem. Lenience will lead to long-term instability because the existence of government safety net promotes moral hazard. Without safety net, such as a central bank acting as lender of last resort, economic crises would be very severe.

To go further: Ponzi finance and the balance sheet

When an economic unit is involved in Ponzi finance, it has to go into debt to service principal AND interest. Say that there is a balance of $100 on a credit card that represent expenses for the month and that there is also $10 of interest due. To service the credit card debt, one must open a new credit card to pay $110 due on credit card #1. The following month $110 + $11 of interest is due on the second credit card. The amount of financial liabilities grows. Another way to service credit card #1 is to sell some assets worth $110. So Ponzi finance implies that net financial accumulation (NFA) declines because either financial asset falls or financial liability rises. We know that NFA is related to net wealth:

ΔNW = ΔRA + NFA

Given everything else, Ponzi finance leads to a fall in net worth. There are two ways to mitigate this decline:

- Overtime the assets funded in a Ponzi way may start to generate enough cash flow to cover debt service. Say that a company was just created and needs some time to get its business to earn an income. In the meantime, it needs financing to pay employees, get the business set up, etc. During that time, the net worth of the company will fall but it is expected that ultimately the business will be profitable and generate enough cash flow to pay creditors. One may call this income-based Ponzi finance: for a while income is insufficient but there is an expectation that this is only temporary.

- The price of real assets and the price of financial assets that are still on the balance sheet go up fast enough to more than offset the rise in debt and the liquidation of assets. The recent housing boom that allowed households to record massive increase in net worth while they were going massively into debt is an example of such dynamics. The underwriting worsened so much that the only way to make a mortgage profitable was to sell the house at a high enough price to cover interest and other payment due to creditors. One may call that asset-based Ponzi finance, or pyramid scheme: there is no expectation that income will ever be enough to service debt, the liquidation of the collateral and other assets is the only expected means to make the Ponzi financing profitable and to keep net worth rising.

To go even further: Income vs. Cash inflow

In most presentation of the FIH, income and cash inflow are not distinguished carefully. For example, the FIH is often presented from the point of view of the business sector with profit (U) reflecting the ability or not to fulfill debt service (DS) so that U > DS is hedge finance. At the macroeconomic level, U is determined by the Kalecki equation of profit.

At the theoretical level that may be good enough but not at the empirical level. Income and cash flows are two different things. Income is about measuring gains in net worth, cash flow is about measuring change in monetary assets. The Kalecki equation of profit does not say anything about monetary gains, i.e. gains of monetary assets. For example, an increase in unsold inventories raises profit because higher inventories increase real assets. Similarly for households, personal income includes quite a few items that are unrelated to monetary gains. Vegetables grown in the garden, service provided by owning a house, among other things, are counted as imputed income. Unfortunately, creditors demand monetary payments so earning an income in real terms does not help to service debts.

What is really important is what Minsky called the “cash box condition” and expectations based on it: how cash inflows plus monetary balances compare to cash outflows now and in the future? That may or may not be related to profit and personal income. The cash-flow statement, rather than the income statement, together with the expectation embedded in financial contracts, give a better idea of the financial fragility of an economic unit.

That’s it for today! We are done with macroeconomic topics. Next is the final topic of this series: Money! Money! Money! Moooneeyy!

Economics is the art of obfuscation, hiding reality through complexity.

Complex mathematical models built on fundamentally flawed assumptions.

The complexity on top hides the flawed assumptions underneath.

Let’s do simple, non-economic analysis of 2008.

2008 was the first housing boom to blow up the global economy.

Japan had the mother of all real estate bubbles that burst in 1989; its effects were only felt locally.

The Japanese economy has never recovered.

Lesson for straight thinking, non-economists – don’t let housing booms get out of control.

Unfortunately, economists run the show and we have housing booms all over the world.

What was the transmission method for housing booms to spread globally?

Complex financial instruments.

Securitization allowed banks and other lenders to lend recklessly (NINA mortgages) as they could sell the debt on.

Prudent lending to people that can pay you back is essential for the financial system.

CDS’s are unregulated insurance products that allow insurance products to be sold with no buffer for potential payouts. How AIG went down.

This is just silly.

The simple analysis reveals:

Australian and Canadian economists look to be the next to learn about housing busts.

No one learnt a thing about CDS’s.

No one learnt a thing about ensuring banks and other lenders take responsibility for prudent lending, especially China.

Economists, what do they do all day?

I’m with the Queen on that one.

I guess you are reading the wrong people. Don’t expect anything good coming from economists from harvard, MIT, and other ‘reputable” institutions who are on medias on the time. The ones to follow are in the links provided above .

Nature is inherently cyclical. A happy medium is also a flatline. To a certain extent, everything contains the seeds of its own destruction. Capitalism presumes to overcome this by mimicking the ecosystem, not any one organism and so particular entities come and go, but the system simply fluctuates. Socialism and communism presumed to create societies as organic units and so they rise and fall as units.

The overlooked fallacy of capitalism is that the medium, the monetary system, functions as a unit, while being the playing field on which the rest of the economy functions. So rather than lots of little entities, from companies to individual nations, rising and falling, we have created a global monetary bubble, that is being managed by ever more short sighted people, based on their ability to ride the beast, not any long term perspective. So it is becoming a vortex of financial efficiency, in siphoning value out of everything, rather than circulating it efficiently. The eventual solution to this problem will be making finance a public function. Much as private governments, aka, monarchies, were eventually replaced by government as a public utility.

In order to make this system more resilient, it would have to be constructed bottom up, with local banks serving their communities and creating feedback with more regional entities, to both police and be policed by.

While the Federal Reserve is often viewed as a takeover of the national finance by private banks, in which risk is public and rewards are private, it is also a first step toward a fully public banking system, because eventually risks and rewards have to be integrated. So either we go back to a system in which banks issue their own money, or we go forward to where banking is a community function.

one BIG problem, IMO, is that when people point out to bankers that they do fraudulent things, they shrug and say, “that’s just what bankers do”. REALLY??? Perhaps built into the financial sector is that strong tendency to accumulate money to oneself. Until the culture changes, where the financial system is not populated by those to whom it is a game to end up with the prize, no number of fancy graphs will explain it or fix it. As Greenspan himself said, he failed to take into account the human element of finance.

https://www.theguardian.com/science/blog/2014/nov/20/banking-cheats-bankers-financial-sector-dishonest-behaviour

http://www.counterpunch.org/2015/03/06/the-moral-compass-of-bankers/

http://whyfiles.org/2014/bankers-dishonest-when-banking-is-on-their-minds/

And this economist who wrote this article saying this. Here we have the root of the misery of the financial system, when economists collude in silly parsing like that.

from Wiki:

the pitcfhforks are coming.

The idea here is that Ponzi finance is a problem even if it uses legal means. Does not preclude fraud.

Illegal Ponzi scheme is too narrow a view of the problem.

thank you, that is much clearer than my comment!

If you read the article closely; the author is not suggesting Ponzi “schemes”. That is something different. He defined the term Ponzi Finance, just so people would not confuse the two. As he said, Ponzi finance (for instance Amazon.com initially) is okay so long as the investors know that they are sending money into a system that is inherently unsustainable.

It is when information is withheld that Ponzi finance becomes a problem. Ponzi finance is essential for start-up businesses (most anyways). However, when one party to the Ponzi finance sells its stake in the company w/o mentioning to the buyer its inherent instability–THEN it becomes a problem.

excuse my ignorance, but when did all this start? and why do people knowingly invest in unsustainable systems? who gets left holding the bag?

It may be useful to disaggregate bankers into subsets to provide more color.

Look at money center, regional and community banks, for example.

Then add in other depository institutions such as mutual savings banks, thrifts and credit unions.

While each one may be subject to overlapping macro and policy influences, the impacts on their balance sheets and income statements will also reflect local differences.

Transparency and more rational, tangible capital requirements would both help all consumers be more confident in their choices. Wouldn’t you feel more comfortable sitting down across the table with someone from your community, who lived and shopped and participated locally, than dealing with an anonymous voice far away?

local and smaller banks, CUs, etc are more subject to regulation and accountability paperwork than the behemoths at this point. plus they are more visible in their community and that helps keep them honest, IMO. This is not to say that there is not local embezzlement, but it is found and prosecuted and people are sent to jail. There is not a culture of looting as in the larger financial industry, which is never prosecuted in a meaningful way, or even recognized as being more than an integral part. One can still vet a local financial institution for reliability. The large ones have been allowed to become so convoluted in their assets and connections that I don’t think they are worth contemplating.

Agreed. But this is the way it persists on being and when you have banker-wankers saying things like this:

“In no case could a client receive interest payments because that would go against the nature of a loan, Banco Bilbao Vizcaya Argentaria SA BBVA -2.22 % Chief Executive Officer Carlos Torres Vila said.”

I really have to say “Really? Except when we’re getting it, eh?!”

The above is related to an article in the WSJ today on ‘Battle Brews in Spain, Portugal over Negative Rates’:

http://www.wsj.com/articles/in-spain-and-portugal-bankers-and-borrowers-fight-over-negative-rates-1463287864

As the article points out, the banks in Denmark on the other hand, are PAYING thousands of borrowers interest on their home loans after negative interest rates were established some years back…….

Once again we have another perfect example of the ‘Do as I say……not as I do’ situation. We bail out ‘Wall Street’ so it’s safe and secure, but we can’t bail out ‘Main Street’ because….hey….homelessness.

Solution?

Let’s all move to Iceland instead!

Iceland knows the difference between good and bad. They jail ‘boysterous’ bankers, keep good bankers operating ie. female bankers…..but more importantly, a type who, under no circumstance would pay $675,000 for a leader, female or male otherwise, to wax lyrical about….who the f**k knows….The birds and the bees perhaps?!.

And they also elect decent women to run affairs of state who reject austerity, jail bankers, and get the economy growing again. See: http://www.spiegel.de/international/europe/cleaning-up-the-men-s-mess-iceland-s-women-reach-for-power-a-620544.html

Perhaps America simply needs a good ‘Woman to Believe in’ to ‘Make America Great Again’……..to get a ‘Future to Believe In’……..

There are economist who saw 2008 coming, e.g. Steve Keen and Michael Hudson.

All the economists in positions of influence are Neo-Liberals who follow modern supply side, economic theory.

Neo-Liberal economics has fundamentally flawed assumptions about the true nature of money and debt.

All the economists in positions of influence did not see 2008 coming.

Those confined to the margins jumped up and down trying to be heard, but no one was listening.

In 2005, Steve Keen, saw the crisis coming and the private debt bubble inflating.

In 2007, Ben Bernanke, could see no problems ahead.

The Central Bankers use the new economics and haven’t got a clue what going on.

Central Bankers do not understand money and debt, which are opposite sides of the same coin.

None of their solutions work because they don’t understand the problem, which is debt.

When bankers don’t understand money and debt you are in trouble.

We are in trouble.

As the people in charge don’t understand money and debt we have housing booms around the world.

The effects of housing booms are front end loaded with massive money creation taking place feeding into the economy.

The sting in the tail is the 25 years of repayments on mortgages.

Boom and bust.

Debt is effectively like borrowing your own money from the future, where the repayments cover the money borrowed and the interest is for the service rendered by the lender.

The lender pretty much creates the loan out of nothing with today’s reserve ratios after years of banker lobbying. The lender creates the money out of nothing to purchase the asset (e.g. house) and you pay him back plus interest for the service he has provided.

The asset acts as a guarantee should you default; the lender can repossess it and cover the outstanding loan.

The money is created in one go at the front and is paid back slowly over the term of the mortgage.

The front end loading with a very long sting in the tail, the money pours into the economy quickly during the boom and the money is extracted slowly with the repayments.

When the bust is quick and sharp then the outstanding loan cannot be recovered by selling the asset (house).

Housing is not a very liquid asset during the bust phase and they are hard to get rid of before the bank starts shredding its balance sheet with wholesale money destruction.

Australia and Canada, its coming your way soon.

Can’t speak for Canada, but the Australian housing bubble has a number of non-monetary factors keeping it inflated: a low supply of housing (especially, affordable housing) and strong demand, in part caused by relatively high levels of immigration. Other than Labour’s policy of reforming negative gearing (questionable as it is), I am unaware of any national policy to deal with under supply of housing.

The new paradigm, there is always one of those.

All bubbles burst.

Plus 1

When you have money that must be loaned into existence, of course you have all of these problems. My goodness, arrows and feedback loops pointing everywhere in the diagrams above. Now compound the problem by ensuring that bad lending is not punished by capitalist creative destruction. Bankers sell a product (debt), of course they want to sell as much as possible. But we’ve decided that we must eviscerate the money itself in order that there is no longer any such thing as a bad debt. It won’t work.

Just separate money and credit. Problem solved. Bankers can lend to their heart’s content…but the real economy would not be decimated every time they reach for too much champagne.

I can remember when bankers were joked about – they got to work at 9am and left at 3pm to go golf. I remember a number of savings and loans that had (permanent) neon signs advertising thier passbook saving rates of 7%. Years and years and years this went on – stability and banking just seemed the way things were.

Now maybe none of the above has anything to do with the broad middle class, declining inequality, and rising prosperity. And correlation isn’t causation – but I find it quite a coincidence that rising prosperity of bankers translated to falling prosperity for everybody else…

‘The H/S/P [Hedge/Speculative/Ponzi?] categorization does not apply to monetarily sovereign governments.’

Silliness. Unfunded social promises are an archetypical example of leveraged Ponzi finance, in that they pay current participants using funds that should have been invested to meet future promises.

An example is Social Security, currently 17% funded and projected to reach 0% funding in 2034. That the government can print scrip to make payments doesn’t alter the fact that it’s a slow motion, multi-generational Ponzi scheme which took 99 years to hit the wall.

Nah. Social security won’t go bankrupt unless Congress want it to. We should remove trust fund and payroll tax as they are respectively unnecessary and harmful.

SS payment can be done by crediting account when needed. Real resources can be found easily.

https://m.youtube.com/watch?v=cdRnU8NnFnw

complete codswallop

From page 3, bottom paragraph:

https://www.ssa.gov/oact/tr/2015/tr2015.pdf

Who cares. “Reserves” are just bonds gov pays to itself. Trust fund is just a political scheme to create some artificial accountability.

You need to think in terms of the allocation of resources not funding. You could have all the funds in the world but if there are no young people or young people willing to support old people the funds wont help much.

Exactly, SS problem is a real problem not a financial one. Putting money is a locked box won’t do any good given that we can print as needed (nor will do private saving retirement accounts). We need to raise worker productivity, encourage immigration of productive labor, train people for taking care of an aging society, have infrastructure for aging society, etc.

We can do it easily over the time frame we have but we need to move away from “we are going to run out of money” state of mind. We will need much more gov involvement today to tackle the issue

I can’t decide if its just ironic or deliberately evil that the biggest threat to SS is the liquidationist practice of “austerity”. By de-funding commerce it dismantles our inherited capital stock. In turn this leads eventually to real resource constraints as our ability to deliver them is destroyed.

A hypertrophied obsession with funding future activity leads directly to destruction of the means to that activity, a total confusion of real wealth with its empty signifier: money.

Those reserves were pre-built up ahead of time by the doubling of FICA taxes starting in 1983 in the Great Reagan Rescue. The stated premise was that the baby boomers were going to bankrupt Social Security otherwise, so lets pre-tax them double and put the extra money into a reserve to be paid back to them once they went onto Social Security. Of COURSE the reserve will go back down to zero. It was deSIGNED to go back down to zero. That’s when the last of the pre-paying-by-double Baby Boomers are expected to be dead. Then the system goes back to pay-go.

Pretending that the pay-back-out of the Baby Boomers’ Built Up Reserves back to the zero which existed beFORE the FICA tax was doubled to begin with . . .means that Social Security thereby goes “bankrupt” . . . is just Peterson-Clintonite propaganda designed to cover up the fact that the Bush-Greenspan Regime pre-spent the surplus on Bush Tax Cuts in order to pre-commit the surplus to covering up for the deficit-debt creating Bush Tax Cut budget hole. Social Security and the pre-paying Boomers who lived long enough to collect back their pre-paid-for benefits would be accused of causing an unpayable debt balloon. This was to divert attention from the pro-upper-class government embezzling trillions out-of/ against the SS Surplus in order to short circuit thinking about the REAL solution, which would be to re-tax the upper class enough to claw back everything they legally stole through their Bush Admininstration’s Bush Tax Cuts.

When I look at all those diagrams when put together in the first half of the article, they look to me like a “Mellon Engine”. A carefully designed Deflationary Depression engine designed and used ON PURPOSE to create the kind of real-asset super price-cuts designed to allow the Mellon Classes to buy up distressed people and assets for cents on the benjamin. I think the mainstream economists saw it coming and secretly approved of it because they are paid by the Mellon Classes for whom they work. Greenspan certainly engineered the credit bubble on purpose to create an asset-price bust for the benefit of the Mellon Classes. He also advised the Reagan-era SS-rescuers to set up that SS Surplus with the intention of embezzling it back out to the Mellon Classes instead of paying it back out to the FICA taxpaying Boomers who paid it into existence to begin with. When Greenspan claimed to be “surprised” by the bust, he was lying.

Social Security can be structured to be funded indefinitely by law like other federal programs including a subset of Medicare.

I’ve been doing some reading up on Citibank’s bailout 2007-2008 trying to find out more details about who stood to lose what (before the bailout) and why they didn’t lose (because of the bailout). Interesting note that a prior City Bank leader is widely understood to be one of the primary culprits behind the Crash of ’29.

Is it possible that large-scale banking and finance are just plain bad ideas? If there is always some incentive to game the system, destabilize societies on a large scale, and then invoke mandatory poverty on the population, why keep them at all? Maybe the entire idea of functional, benign financial markets is myth and they are all inherently unsustainable.

yes. http://neweconomicperspectives.org/2016/03/money-banking-part-9-banking-regulation.html

If you look, the majority is trying to go back to the past, itself mythology, whether it’s experts in religion, statism, PM currency, whatever, and is upset about helplessly watching history repeat.

The young people have already repudiated the debt, with no replacement. The market is a lagging indicator relative to demographic deceleration, reverting to reflect the reality when the market manipulators get done choking themselves. The programmers have simply out wall streeted Wall Street.

The majority borrowed and spent promising economic slavery for other people’s kids as the collateral. Why would a kid get up in the morning for a $15/h4 make work jobs and a massive excess capacity of unaffordable housing, the quite predictable outcome?

Taxing production for consumption doesn’t end well, and the public, private and nonprofit corporations aren’t selling anything producers want to buy. It’s always some bipolar duality nonsense.

Programming kids from birth to accept debt slavery only lasts so long. Congratulations; Wall Street built a cheap replica of the Roman Empire. The US Constitution is obviously a farce, government is illegitimate, and the majority has no exit.

Unlimited growth and population control, artificial bipolar variability, is a false choice.

it should be “sloping,” not “slopping” … just sayin’

In Fig. 4, the text says “more distress sales leads to more debt liquidation, which leads to a lower quantity of money and so lower prices and then more distress sales”, but the arrow from quantity of money to prices has a + sign. Which is correct?

+ means moving in the same direction: more leads to more, less leads to less. So lower M leads to lower P (and higher M leads to higher P). Is that clear?

If you follow the logic then even one distressed borrower will result in a downward spiral. But we know that is not the case. The story needs thresholds – what quantity of distressed borrowers turn the system critical?

Right, the argumentation in Fisher’s starts with a general state of over-indebtedness. He is focused on undéstanding the dynamics at play once the threshold (whatever it is) is reached.

Empirically, that threshold is impossible to find and the only thing one can really do is to note general trends.

This is fine though because we should get worried long before we reach the tipping point.

To put it differently, if your mechanic tells you your breaks need to be changed, your next question is not “when will they stop working?”. This is not a relevant question because it is impossible to know. ” soon” is the best the mechanic can say, and “soon” may be next week or next year depending on how you drive and other conditions.

1. Selling off loans to third parties with no skin in the game, perhaps without the knowledge and permission of the home buyer.

2. Third party securitizers paying rating agencies for a grade.

3. The market for mortgage backed securities globalized, not contained or localized, maximizing the risk of over demand. The package hides the garbage inside. Quantity over quality is rewarded.

4. “Insure” the end product with fake insurance with nothing to back it up.

And nobody notices that the entire process was designed to blow itself up?

Australia and Canada and somewhat UK is a proof that Ponzi finace could have been going on much longer in US. SO, what happened in US that stoped the continuation of Ponzi re-finance?

Diferences: Canada and Aus have forced the income to service debts up by using minimum wage, while UK and USA did not. What happened in USA?

In 2006 Democrats took the Congress and imediately made an issue about fraud and lack of rgulation of mortgage companies. The leverage presented a problem and they forced stronger regulation of mortgage industry. At the same time the panic about baloon mortgages and flexible payment option, NINJA loans, became widespread alarm ( with reasonable case) and Democratic Congress was warning about such Ponzi finance and refinance. Basicaly, it was political will that stoped continuation of Ponzi finance.

What determines the sustainability of debt? Interest rate and income level that suports those rates.

Again, lowering interest rates lowers monthly payment burden on income so leverage can go up while the burden on income stays the same. Or income can go up to again allows for higher leverage while burden stays the same.

It is the burden on income that should be fixed. Say 41% total servicing of all debt or 33% of income for mortgage. In loan officer parlance 33/41 is a rule set by banking laws to have loans aproved.

But after APR change fix to flexible after 2-5 years period, those 33/41 rules don’t work anymore. Burden of servicing goes up forcing a refinance back to 33/41 rule by lower rates.

Why am I describing dangers of flexible rate loans (secondary loans) while it is widely known about it? It is the issue that points to the burden of SERVICING the DEBT as the prime cause of the problem and it should not be forgoten about it. Level of debt is not an issue but the burden of monthly payments.

To keep the burden on the level it is necessery to refinance once the burden increases (end of grace period of fixed APR for ARMs). When the Congress stopped such refinancing on stated income from continuing which was necessary for initial loan to increase leverage (and house price with it/ colateral value asessment) it triggered this process. I felt it myself when i refinanced my ARM in 2007. The terms for loans became more rigorous and my wife was RE broker at the time with all connections to loan officers.

So, “Some economic units, e.g. (non-financial) businesses, are unable to pay their debts with their available monetary assets ” in step one is caused by inability to keep fixed burden on income that supported such leverage. Inability to refinance back to 33/41 once ARM kicks in is what makes it impossible to pay the debt servicing burden with stagnant income.

If Democrat’s Congress increased income by raising minimum wage as they started regulating mortgaging there would be no trigger. It was income level and interest rates that determine burden on income for loan servicing.

It is not a blame on Democrats that Ponzi finance started and that they stoped it triggering the deleverage process, it had to be done at some point, but they should have known what is going to happen if income is not increased to keep up with ARM change to flexible rates(higher rates). It is the blame on banks that they increased interest rates after fixed rate period without any reason but demand for higher profits which killed their profits in the end. If they did not increase interest rate the problem would not be triggered while loan aproval could be more rigorous as Congress demanded it.

Banks realized the damage and stoped issuing new loans excusing themselves by “risk” assesments.

Deleverage was started by reevaluating the “risk” of default while increasing the risk by increasing the interest rate after the grace period.

Increasing the rate of interest on existing loan is increasing the risk of default on stagnant income. This increase of rate increases the burden on income which banks call the risk of default. This feedback loop is what needs attention to see where the crisis is triggered.

Well I’ve got to let loose one big ‘At last!’ in response to the author’s recommended core action in response to another financial crisis:

‘Bank holiday to examine the books of financial institutions in details for a given period of time (say a week like during the Great Depression) and close insolvent banks. Act to sustain income and lower debt burden.’

I think this is the first time NC has presented someone who, I believe rightly, thinks it evident the most efficacious course of action in response to Lehman (if not earlier in the saga) was shutting down markets long enough to assess the scope of the damage, and developing a plan for dealing with the the mess. Instead, Paulson deliberately blew it up and went straight to Congress, and repeatedly to the Fed, for money to contend with the consequences – and they were terrible. Bernanke and all apologists for him insist to this day that ‘the world’ was on the brink of a catastrophe – that it in fact all came down in the end to particular conversations with particular parties deeply concerned with ‘what happens’ if some portion of the system was to fail, that some ‘it’ had to occur or we all died.

That was the necessary BS that was bought that allowed the ‘leadership’ to loot the nation – and keep it on coming, as it is near universally agreed another crisis will be met the same stupid way.

Here’s an idea or two: a minimum wage rate that reflects economic circumstances. Laws against usury. An independent arbiter who can raise that minimum to benefit all economic parties. Laws which regulate large inflows and outflows of capital. Laws regulating derivatives and securitisation. Laws…oh, dream on….