By New Deal Democrat. Originally published at The Bonddad Blog

On Monday I gave what I think is a reasonable roadmap to the next recession. I want to follow up on this a little.

The post from nearly 10 years ago was entitled, Are Hard Times Near? The great decline in interest rates is ending.” The theory is right in the title. Since the 1970s, real average hourly earnings had declined. Average Americans coped by spouses entering the workforce, by borrowing against appreciating assets, and by refinancing as interest rates declined.

By 1995 the spousal avenue peaked. Borrowing against stock prices ended in 2000. Borrowing against home equity ended in 2006. When interest rates failed to make new lows, the consumer was tapped out, and began to curtail purchases. A recession began – and its effects have lingered and lingered. Hard Times were indeed near.

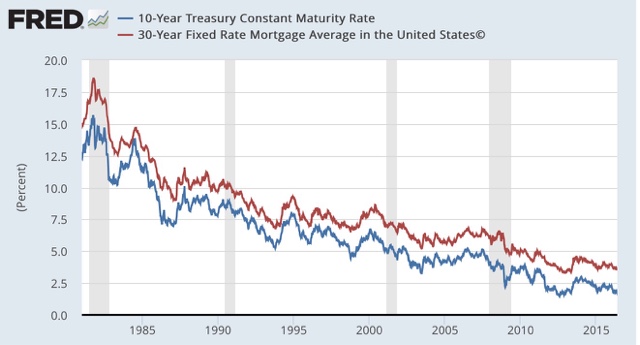

Here is a graph from 1981 of mortgage rates and 10 year treasuries:

In that article in 2007, I wrote that the consumer might yet have one more chance to refinance debt. In fact after the recession it turned out there were two: in 2009 and again in 2013. Ten year treasuries made a 60 year+ low in 2013 at 1.50%. Even if treasuries, and mortgage rates tied to them, make a new low, the floor is somewhere north of 0%. That -1.5% decline in a mortgage payment on a $250,000 house would be $3750 a year, or a little over $300 a month. That’s the most extreme case. Even if interest rates make new lows, households that refinance are likely to see more on the order of $100 or $200 per month of freed up cash — not enough to power much consumer spending.

Yesterday Molly Boesel of Core Logic confirmed this, writing in her blog

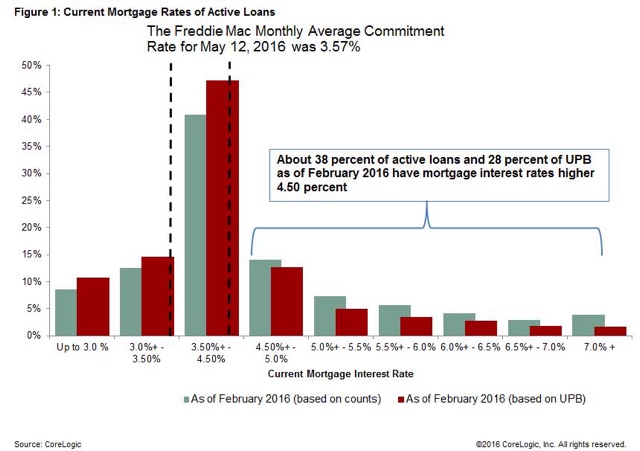

Because a refinance isn’t free, a simple rule of thumb is to add 100 basis points to the current market mortgage rate as the rate at which borrowers would have an incentive to refinance…. According to the chart [bleow], most borrowers hold mortgages with rates up to 4.50 percent, with 62 percent of mortgages and 72 percent of UPB in this range.

If mortgage rates rise as predicted, we will certainly see refinancing volumes fall in 2016. Note there is a small share of outstanding mortgages with interest rates of about 300 basis points or more above the current market rate.

Currently nominal wage growth is running at about 2.5% YoY. Real wages have been boosted in the last 2 years by collapsing gas prices. Once that is over, what happens next? Even 2% YoY inflation eats up nearly all of consumers’ wage growth. A 3% YoY inflation rate means real wages decline.

So the bottom line is, we are already in a period – a period that I expect to last an entire generation – where real gains by average Americans won’t be available from financing gimmicks, but must come from real, actual wage growth. At the moment I see little economic or political impetus to make that happen, even though average Americans understand via their wallets the issue all too well. Eventually it will happen, but I believe between now and then is another recession, one that I fear is likely to be worse than the 2008-09 recession because it is likely to include a spasm of wage-price deflation.

– See more at: http://angrybearblog.com/2016/05/refinancing-is-dead-a-generation-of-hard-times-will-continue-until-secularly-real-wages-improve.html?utm_source=feedly&utm_medium=rss&utm_campaign=refinancing-is-dead-a-generation-of-hard-times-will-continue-until-secularly-real-wages-improve#sthash.2RrtJtB0.dpuf

But think about all the great mansions that are about to be built as monuments to all this wealth concentrated in rich people, in the corporate oligarchs, the new labor barons, and media barons, and prison barons, and workhouse barons. A new Gilded Age in America is upon us.

There’s your next gimmick.

People who can’t afford this are losers anyway.

http://www.nytimes.com/2016/05/29/realestate/condo-on-madison-square-park-most-expensive-sold-of-the-week.html?&moduleDetail=section-news-5&action=click&contentCollection=Real%20Estate®ion=Footer&module=MoreInSection&version=WhatsNext&contentID=WhatsNext&pgtype=article

Japan killed their economy 25-30 years ago. We killed our economy in 2007-2008.

You’d think after 8 years of part time jobs, the highest U-6 rates ever, the highest food stamp participation rates, completely rigged GDP and inflation figs, millions of lost jobs, a 20 trillion dollar debt, and the great Obamacare debacle- people would catch on. Maybe they have. The propaganda generators in this country are very good at ignoring the bleak things and showcasing the bright spots.

We are rearranging the chairs on the Titanic. The last two chairs to slide in will be equity and real estate markets. The only remaining question for these artificial markets- will come when today’s equity holders try to sell to tomorrow’s under capitalized bag holders. That time draws near.

Not yet. Wells Fargo have just introduced 3% down mortgage to lure out the next generation suck.. ehm millenials.

Yes, when you don’t prosecute, the crooks will do it all over again.

That’s just nuts. The rates would have to be in subprime zone to attract any secondary market interest (MBS). That would mean that these loans will stay on Wells’ book. Either the rates are so high, few would avail themselves of this product – or Wells has done so well that it can afford to steal market share from its competitors by taking stupid risks. Or, much worse. I have to wonder what the regulators think of this product. I would love to hear what bank regulators think of this.

They are trying to force out renters into the rigged, rat housing market.

You’ll find ridiculous, scum sucking rent hikes everywhere that’s got anything at all going on for it. Not everybody, even those who can afford it, even wants a house.

They also see people with means still sitting on savings despite the low interest rate returns and not getting into the rigged, rat stock market. So they’re trying to suck that up too.

Bottom line: the global economy as currently constructed is one that is trying to get as much money to the top, connected people before they bring on the robots.

Robots and automation will put a big dent in the financial sector: FIRE. Robots and software don’t pay rent, take out mortgages or loans, or purchase insurance of any kind. They are trying to get as comfortable as possible before the coming storm.

“We” did not kill our economy. Our government in collusion with JPMorgan, Wells Fargo, US Bank, Citigroup and Bank of America killed the economy.

Let’s be fair. AIG, Lehman Brothers, Merrill Lynch, Goldman Sachs, Morgan Stanley, and assorted shadowy hedge funds deserve some points for destroying our economy, too.

Well, for sure. But, it wasn’t “us.”

Real gains aren’t going to happen without those who create value becoming organized and active. The slow, painful death of unions has been the death of this country.

The time for the return of the Wobblies is now.

-yours for the one big union

And what are IWWobblies suppose to organize if there is no industry to organize?

One suspects that the loans in the high end of the second chart are mostly people with so few years left on their mortgages that refinancing doesn’t make economic sense mixed in with people who have credit scores or incomes so poor that they can’t refinance.

Some of them are people who are still upside down, and who couldn’t get a loan mod and managed not to default and lose their property while trying. It’s fairly sickening how much more they’ll end up paying for their dwellings than they’d pay if they were able to re-fi. Or it loan mods weren’t a toxic hoax.

Well, for affluent Americans, perhaps. For the broader economy, those not in the top 20% or so of households, the recession began long before 2006. I’ve noticed a number of more educated authors over the years falling for this inaccurate framework that the short-term GDP metrics somehow have anything to do with the living conditions of the general public.

We don’t need to look for the next recession. Most Americans haven’t recovered from the one two times ago. I mean, tapping home equity? Borrowing against stocks? Who exactly had all these financial assets in the first place in the 1990s and 2000s? People who were already doing better than most Americans.

http://thehill.com/policy/finance/trade/281496-geopolitics-moves-to-center-stage-of-obama-trade-deal-push

Jeffrey Frankel, professor of capital formation and growth at Harvard’s Kennedy School of Government, said that if the United States doesn’t pass TPP “Asians are going to interpret it as a U.S. withdrawal from their region, and they’re going to get closer to China.”

Is the TPP a finance trick to reduce the price we pay for consumables manufactured in low-wage countries? If we do benefit from lower priced goods and services, what is the net gain or loss for American consumers whose real wages are stunted by further outsourcing of jobs? And how long do any benefits of tariff-free goods and services last when any “free” trade agreements are passed?

Are these trade agreements also a maneuver to boost shareholder price? If so, do pension plan investments feed the monster and exacerbate wealth inequality?

One counterpoint: the move to lift the minimum wage to $15 is getting stronger by the day. It is true that establishment people like Clinton will give half-hearted arguments for $12, but raising the minimum wage is change that comes from the people. Most people with ‘power and influence’ are too blind to understand how they are suffocating the economy.

Great post. Thanks.

I doubt rates will really rise much, if at all. The Fed raising the funds rate will more than likely cause a flight to safety, dropping treasury yields and therefore mortgage rates, since wall street is generally aware of the grim reality of the US economy. This is what happened last time they moved the fed funds target.

Also, the refi chart is only including Freddie Mac loans.. does anyone have info on Fannie Mae rate composition or non-conforming mortgages?

That -1.5% decline in a mortgage payment on a $250,000 house would be $3750 a year, or a little over $300 a month…likely to see more on the order of $100 or $200 per month of freed up cash.

The freed up cash is an illusion. The refinance fees ($3000 and up) are added to the existing mortgage. Plus the home-ower begins a new mortgage debt cycle with 99.999% toward interest and .001% to principal. All the money paid towards interest is up in smoke.

Right on, rps! Most people have no clue about The Rule of 78s or ever look at their amortization schedule. They just jump for joy that they will have a nice tax deduction from the interest they pay on their mortgage. What a sham(e)!

I don’t follow your math? Refinancing is a great deal for the participants. Banks make money on the churn, and existing homeowners make money by paying less interest without any corresponding increase in the principal they owe. It doesn’t reset a debt cycle. It merely reduces the interest owed on a debt. If a homeowner chooses to extend the length of the loan, that would increase the ratio of interest to principal, but so what? That’s neither an illusion nor a sham. Interest payment isn’t money up in smoke. It’s money you pay in exchange for a longer time to pay it off. If you pay off a mortgage in 15 years instead of 30, you pay less interest. If you do it in 5 instead of 15, you pay even less interest. If you pay cash up front, your interest cost is zero. The longer the timeframe, the more freed up cash flow in the present. The shorter the timeframe, the less interest will be paid over the life of the loan.

The harmed party in the multi-decade housing market refinancing game of lower interest rates and higher asset prices is a third party we almost never talk about, namely, renters.

I think rps is correct. In a refinance you are taking out a new loan on the remaining principal and the way 30-yr mortgage loans work means that for several years the borrower is paying mostly interest. So, if you are ten years or longer in a 4% loan, you might save very little over the remaining life of the loan going to 3.5%, if you consider the fees and go back to a 30-year loan. There has to be a loan officer out there who could clarify. I’m not saying refi doesn’t benefit the creditor – it sure can – but lowering the monthly payment isn’t the only consideration.

You can refinance for any term you want – generally in 5 year increments. So if you were 10 years into a 30 mortgage and wanted to keep the same maturity but take advantage of the lower rates, you could do a 20 year loan (rates would be even lower since the term is shorter). Or, if you wanted to cash out, you could restart the mortgage at 30, take out 50k or whatever it is, and keep the same payments.

The closing costs and broker fees would have been paid in the original mortgage as well so the APR is still going to be lower by the same amount. Yes you will have to pay the fees again, but I think most people would rather finance the extra 3000 in costs considering a typical 300,000 mortgage saves about 50k in interest charges just for one percentage point of difference.

With Arthur Burns, William Miller and Alan Greenspan the US chose the Path to Perdition

An interesting article from Liberty Blitzkrieg.

US firms realise that wages cannot cover the cost of living and so they are offering employees loans directly.

Crazy!

“Many of the 100 employees of the Atlanta insurance provider “live paycheck to paycheck,” she said, and were borrowing against their 401(k)s. After realizing the company wouldn’t be liable if employees defaulted, she signed up with Kashable about two years ago.

Kashable’s interest rates typically range from about 6% to the high teens, lower than what people with middling or low credit might get on their own, said founder Einat Steklov.”