Yves here. This post still indulges dubious ideas like “fiscal consolidation,” meaning running surpluses to reduce government debt levels,. Fiat currency issuers do not have a funding constraint and should instead seek to offset chronic underinvestment by the business sector. Businesses set their return targets higher than is profit-maximizing for them.

It is nevertheless awfully convenient for economists to be saying, “No one was running big enough deficits after the crisis!” Pray tell, where were their op-eds, papers, and official testimony at the time? And while more and more economists are calling for less reliance on monetary policy and more fiscal spending, there is also far too little mention of more automatic stablizers, which don’t require governments to act. But with neoliberal ideology still firmly embedded, few experts seem willing to pump for obvious solutions like better social safety nets.

Originally published at Bruegel

What’s at stake: The reluctance to use fiscal policy as a stabilizing tool in the current deflationary environment has been puzzling to many and a number of authors are now putting forward possible explanations.

The Move from Counter-Cyclicality to Procyclicality

In its 2015 Fiscal Monitor, the IMF writes that to be stabilizing, the fiscal balance needs to increase when output rises and to decrease when it falls. That way, fiscal policy generates additional demand when output is weak and subtracts from demand when the economy is booming.

Jeffrey Frankel writes that the heyday of activist fiscal policy was 50 years ago. The position “we are all Keynesians now” was attributed to Milton Friedman in 1965 and to Richard Nixon in 1971. In the late 20th century, most advanced countries managed to pursue countercyclical fiscal policy on average: generally reining in spending or raising taxes during periods of economic expansion and enacting fiscal stimulus during recessions. The result was generally to smooth out the business cycle (as Keynes had intended). It was the developing countries who tended to follow procyclical or destabilizing policies. After 2000 many political leaders in advanced countries pursued procyclical budgetary policies: they sought fiscal stimulus at times when the economy was already booming, thereby exaggerating the upswing, followed by fiscal austerity when the economy turns down, thereby exacerbating the recession.

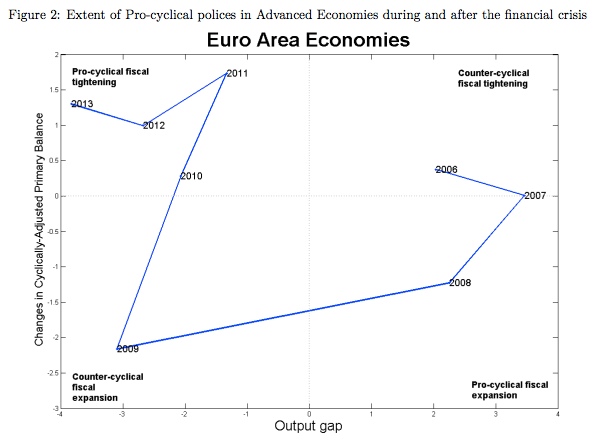

Alesina and al. (2014) show in the Figure reproduced below how the fiscal policy of Euro Area economies changed overtime, in relation to the economic cycle. For every year we show the change in the cyclically adjusted primary balance and the level of the output gap. The first and third quadrants represent episodes of counter-cyclical fiscal policy where governments squeeze the public budget while the economy is overheating, and vice versa. On the contrary, the second and fourth quadrants include years in which fiscal policy was pro-cyclical. The majority of the countries in the sample adopted counter-cyclical fiscal policies at the beginning of the recession (2008-09) but turned pro-cyclical after 2009, namely fiscal consolidations started when recessions were not over yet.

Source: Alesina and al. (2014)

A General Theory of Austerity

Simon Wren-Lewis writes that there was no good macroeconomic reason for austerity at the global level over the last five years, and austerity seen in periphery Eurozone countries could most probably have been significantly milder. As austerity could have been so easily avoided by delaying global fiscal consolidation by only a few years, a critical question becomes why this knowledge was not applied.

Simon Wren-Lewis writes that one set of arguments point to an unfortunate conjunction of events: austerity as an accident if you like. Basically Greece happened at a time when German orthodoxy was dominant. This explanation cannot play more than a minor role: mainly because it does not explain what happened in the US and UK, but also because it requires us to believe that macroeconomics in Germany is very special and that it had the power to completely dominate policy makers not only in Germany but the rest of the Eurozone.

Simon Wren-Lewis writes that austerity was instead the result of right-wing opportunism, exploiting instinctive popular concern about rising government debt in order to reduce the size of the state. This opportunism, and the fact that it was successful, reflects a failure to follow both economic theory and evidence. This failure was made possible in part because the task of macroeconomic stabilization has increasingly been delegated to independent central banks, but these institutions did not actively warn of the costs of premature fiscal consolidation, and in some cases encouraged it.

Larry Summers write that despite the overwhelming case for infrastructure investment, there is great resistance from those who think it will be carried out ineptly. It is understandable to doubt about the government’s ability to do big things when it fails in executing some of its routine responsibilities. In an era when public trust in government remains near all-time lows, every public task is freighted with consequence. The relationship is cyclical — if government can start being more effective, it will win more trust, leading to more effectiveness.

Josh Bivens notes that in the US the federal budget season came and went this year without any budget proposal hitting the floor of the U.S. House of Representatives. For Germany, Brad Setser writes that nothing appears to trump the commitment to balanced budgets right now. The long tradition of viewing public investment as different from public consumption and more amenable to debt financing has been forgotten as Germany’s governing coalition has made the black zero (the schwarze Null) the central goal of economic policy.

Emerging Economies Graduating from Procyclicality

Otaviano Canuto, Francisco Carneiro, and Leonardo Garrido write that evidence on the procyclical pattern of fiscal policy in developing countries was first found by Gavin and Perotti (1997), who showed that Latin American was much more expansionary in good times and contractionary in bad times. Talvi and Vegh (2000) then showed that such behaviour was far from being a trademark of Latin America alone as many other developing countries across the world espoused a procyclical fiscal policy stance. There are a number of different explanations as to why developing countries tend to behave in this way vis à vis industrialised economies. Some of the reasons most commonly found in the literature include credit constraints and political economy considerations.

Jeffrey Frankel writes that some developing countries did achieve countercyclical fiscal policy after 2000. They took advantage of the boom years to run budget surpluses, pay down debt and build up reserves, which allowed them the fiscal space to ease up when the 2008-09 crisis hit. Chile is the poster boy of those who “graduated” from procyclicality. Others include Botswana, Malaysia, Indonesia, and Korea. Unfortunately some, like Thailand, who achieved countercyclicality in the last decade have suffered backsliding since then. Brazil, for example, failed to take advantage of the renewed commodity boom of 2010-11 to eliminate its budget deficit, which explains much of the mess it is in today now that commodity prices have fallen.

Former Rep. Joe DioGuardi of Westchester County NY (whom I had the privilege of meeting several times) was one of the rarest of birds in Congress: the only CPA (as compared to hundreds of lawyers).

He points out that fiscal budgeting can’t be done correctly, using primitive cash-basis accounting:

At both the federal and state government levels, pension and benefit programs are run in a second-rate, sleazy manner. Their trustees owe no fiduciary obligation to beneficiaries, meaning no accountability. Governors and Congress are free to defer pension contributions, and that’s exactly what they do.

To hide these thefts, they use cash-basis accounting to obscure the long-term insolvency of these programs.

At this late date, in the tertiary “Madoff unmasked” stage of their Ponzi schemes, they simply can’t afford to adopt honest accrual accounting. Too much has been looted, and the sums needed to replace the defalcations can’t be raised even with 100% tax rates (i.e., indentured servitude with total confiscation of income).

Don’t believe their lies, or you’ll feel ambushed when they jerk the rug out from under you.

The US will produce many trillions more than the cost of the programs you mentioned such as Social Security which is a federal program under the jurisdiction of the gov’t. The share of GDP taken up will be relatively small and manageable for a superpower like the US for the foreseeable future. Or in other words as far as the infinite horizon forecasts go.

Arthur Anderson (RIP) obviously didn’t understand the difference between NYC and the Federal government, one of which has the ability to create US dollars and one of which does not…do you?

Using the same accounting standards to analyze any Federal gov’t program, like Medicare or SS, as you would to analyze a city or state program is unjustifiable and utterly misleading, for that reason. But go on, just keep slinging that “old time religion,” as Paul Samuelson called it. Gotta keep the peasants frightened! It’s for their own good…

http://www.youtube.com/watch?v=-V6-GnsvcG0

Accrual accounting has nothing to do with currency sovereignty, which serves as a “magic wand / mulligan / get out of insolvency jail free card” in MMT’s stately pleasure dome.

Try to name even one (1) prominent MMT advocate who is a Certified Public Accountant (as opposed to an eclownomist).

Betcha can’t! :-)

Winn Godly is the British equivalent. What did I win?

Wynne Godley would qualify, IMHO. His work is accounting squared.

You have, as always, still failed to actually demonstrate where MMT is wrong. I expect you’ll just ignore this like you always do, but please, tell me why we can’t get out of insolvency when we create the very currency. Hell, insolvency isn’t even the right word, because the national debt ISN’T MONEY OWED TO AN OUTSIDE ENTITY. Tell me why that isn’t the case. And don’t just sneer and joke because you think it’s fake money, morally wrong etc. I want to pin you down and get a straight answer from you for once. What is MMT wrong about?

The national debt isn’t money owed to an outside entity? Wow, what a premise. And here I always thought that U.S. government bonds and treasury bills and notes were instruments of the U.S. national debt.

I heard that the People’s Bank of China owns a few trillion dollars of United State bonds, for example. Also true of the Bank of Japan and of the the Saudi sovereign wealth fund. One of two conclusions must follow from the premise: Either (a) all those U.S. governments bonds and treasury bills and treasury notes are not claims against the U.S. national debt; or (b), the People’s Bank of China, the Bank of Japan, and the Saudi sovereign wealth fund are not outside entities. Please enlighten me by advising which is correct. I can’t tell. Both conclusions seem equally plausible to me.

Yes, and that debt is redeemable for… dollars. Replacing paper with paper. The US isn’t accountable to any outside entity for marking up those keystrokes in the computer. They can just do it.

That’s correct.

Though, they may want to have some say about the current arrangement.

That is to say, they may yearn to be free of the need to ‘accumulate dollar reserves.’

The whole discussion hinges on preserving the dollar hegemony.

They’re assets redeemable only in the currency we control the creation of. If tomorrow China were to say ‘give us trillions of dollars, now’ we could just do it. Mainstream talk of the US national debt inevitably acts like we’ve burrowed money from other countries to make up for a budget shortfall because we aren’t bringing in enough tax revenue. Even well-meaning people who just want to raise taxes on the rich talk about the issue like this. But this isn’t remotely what is actually going on. And when I stop to really think about it, that explanation wouldn’t even make sense. China can’t print dollars, so if they loaned us money we would, what, put it through a giant version of an airport currency exchange? Where would the US dollars we were exchanging the renminbi for come from in the first place?

And then you have the people who take some bizarre middle-ground position, like Krugman who thinks we should deficit spend in the short-term and then growth will overtake the increased debt, still incorrectly believing the debt matters (I’m not clear what he thinks the debt actually is. He doesn’t think its money owed to someone else, does he?). Or Trump who apparently believes the debt is money owed but that’s okay because we can just print whatever we need, which is, uh, less wrong? Of course he then gets attacked for being a buffoon even though he’s actually partially correct.

There’s a lot of cognitive dissonance about this subject that should be apparent to anyone if they just stopped and really thought about it for 30 seconds.

Realize got it right. RESLEZ so I can do without the INsuroDollaR in MMT and just print money but make all visitors buy anything in my country with my money and sell their money or hold it to draw on when short on paper and ink.

Just starting the nation.

Why, yes they are. They are assets, precious things to have. PIMCO owns quite a lot of them. So does Bill Gates and Wossisname Zuckerberg. Deposits at a bank are liabilities on the bank’s balance sheet.

Insovlency is the paralysis of a failed cooperational structure. There is no financial or physical constraint. The constraint is the choice by peoplle to refuse to cooperate within the framework of the structure. The only challenge, and it can be daunting, is replacing the failed structure with a successful structure. Intrinsic to the action of replacement is a new and refreshed idea of cooperation. Where does that come from? sometimes from govermint sometimes from “enterprenooors” sometimes from the residue of the culture itself.

You can print money until it’s piled in heaps that rise to outer space, but that alone doesn’t create the structure, it only creates the energy that can animate a structure that’s created by another means. These are “independent variables” as they say in math class. It may be MMT can work, in the right sort of cultural environment. I’m not saying it won’t work and it isn’t wrong. But it is incomplete, as a theory. As it is now, its an observation of a phenomenon but it’s not a theory of a phenomenon. if it was a football game, it would only be halftime..

Time for Guinness #2 and more laying around doing nothing of any redeeming value. At least I admit it, but all you guys think you’re being “eroodite’ by ranting yur nonsense here. ROTFLMAO.

Whatever happened to the NC beer drinking bash. it never happened What’s upp with that Are you guys all losers now or what?

“It may be MMT can work, in the right sort of cultural environment. I’m not saying it won’t work and it isn’t wrong. But it is incomplete, as a theory.”

MMT is not a theory. It’s a framework that accounts for the actual flow of funds in a monetary economy. To the penny. Accounting is not theory, it’s arithmetic.

If the sectoral balances identity, the basis of MMT, does not reflect a net flow of funds to the non-government sector, the economy will be in contraction, unless people draw down their savings (90% of us either have no savings or would run out of it in a cycle), or we run trade surpluses (we don’t) or unless businesses increase investment spending (they aren’t, at least not enough to grow the economy) .

When money flows MMT is what is happening. So MMT is reality, not theory.

To say MMT is incomplete is to say accounting is incomplete.

To call MMT a theory is to completely misunderstand what it is.

Me.

Even orthodox economists recognize the key difference between the public debt of a currency issuer and private debt.

Here is Michael Woodford, writing in 2001:

There seems to be a strong correlation between the “belief” in the notion of “store of value” and desire to keep what may have been disproportionately “accumulated” (some would say stolen), with the effects of widening inequality…who benefits from what stories, AND what are the referents?

“This lack of accountability creates an incentive for elected officials to curry favor with today’s voters at the expense of tomorrow’s taxpayers.”

This sentence neuters any argument the writer was trying to make.

Taxes don’t fund spending at the Federal level.

No no one has ever had to pay for the spending of past generations.

It won’t happen unless some morons in some future administration try to pay off the National Debt™ (our savings). But before any significant progress was made on that front the economy would implode and civil unrest would likely follow.

Clinton ran surpluses and we’ve been in perpetual recession ever since (although not officially).

It’s a recession when your neighbor is out of work, a depression when you are out of work.

Pensions represent security in the future, a claim on resources you can cash in at retirement. But that claim is meaningless without a real economy to back it up. What difference does it make how many trillions the US gov’t needs to pay itself if it has destroyed its own economy through self-destructive austerity? That future dollar can’t buy things if they don’t exist.

The most short-sighted thing a nation can do is damn its young people to unemployment, destroy its industry, and crater its economy in pursuit of meaningless budget balance. Don’t worry about digital accounting entries that can be marked up as needed. Worry if there will be enough doctors, houses, and medicine to go around for the elderly when they need it. It would be great if you could pile those things up in a warehouse to save them for later like you can with gold, but that’s not how the real world works!

I love folks like you two with a grip on reality!! THANKS.

Let’s present-value defense costs like we do pension costs, & see how solvent we are then.

By ‘solvent’ I mean of course whatever MMT calls it when your assets match your liabilities without giving effect to the printing press.

How can you have a coherent fiscal policy without a coherent economic policy? For 16 years we’ve had a policy of offshoring manufacturing because the Ivy Leaguers decided that America was just going to be the “management class” for the rest of the world. It’s right out of Thomas Frank’s book, Listen Liberal, with the added fillip of Republican’s every-man-for-himself ideology. Other than agriculture and resource extraction, we don’t have a great deal of anything left except a service/finance economy. Much as I am in favor of aggressive social safety net programs, in our case, that only would have papered over the deeper economic malaise. We are a nation adrift.

And that’s the whole thing in a nutshell. You could have just stopped right there Yves. Ideology/politics trumps economics every time. In fact, it’s been unclear for some time that there is any longer any such things as “economics” in practice since policies advocated can be easily predicted by an economist’s ideological leanings – plus his paymasters. Or as Sinclair said ” “It is difficult to get a man to understand something, when his salary depends upon his not understanding it!”

Remember, ‘economics’ was originally called ‘political economy’. It was understood right from the start that human and institutional agency played a big part. The drive to explain everything as if ‘markets’ were some natural law driven by uncontrollable forces is pure ideologically, cynically concocted to provide intellectual cover for, yep, human and institutional agency that negatively impacts the vast majority of people.

At the risk of beating a dead horse, the Democrats, most especially Obama, were not going to contradict the elite consensus about the need for austerity and lead us out of the new Depression. Instead we got promises of bipartisanship and comity, and the “pivot” to the deficit while we were still hemorrhaging jobs. The result has been the exact opposite of civility, culminating in Trump’s looming election.

wow. if there was just another dot or two, you could close the line segment into a loop and use Green’s Theorem to calculate the line integral around the simple closed curve to measure the amount of money flowing through the surface into “the bezzle” that’s off the graph. A lot of that may be in the Carribean or even London or Delaware or Switzerland. It could be anywhere, but it’s not on the graph, that’s for sure. This could be an appropriate use of physics equations in economics.

Love it. Does assume continuous derivatives though, always iffy when talking econ and politics!

‘And while more and more economists are calling for less reliance on monetary policy and more fiscal spending, there is also far too little mention of more automatic stablizers, which don’t require governments to act.”

I’m curious what some of these would be, if anyone has time to flesh this out.

I think it’s basically high marginal tax rates to dampen booms, and a strong social safety net to limit busts. The data show it works.

Things like food stamps and unemployment insurance. Expenditures go up when the economy is lousy and down when it is strong.

The concluding sentence misrepresents the Brazilian predicament:

Brazil – being a currency issuer – didn’t need to have a balanced budget in its boom years in order to be able to implement expansionary fiscal policy now that it is badly needed. However, widespread belief in the myth that the country could “run out of money” led to the adoption of austerity policies by Dilma Rousseff, after her reelection in October 2014. These policies – implemented in contradiction to her pledges in the electoral campaign – aggravated the brutal recession that has plagued Brazil for the last 18 months. The scandals that paralyzed Petrobrás (a company whose investment figures in normal times represent about 10 % of the economy’s total gross investment) and other large Brazilian firms are the main drivers behind the current economic contraction.