Lambert here: One of my crotchets is the trope that markets “heal.” Markets aren’t organic beings, so they can’t do that. Worse, the trope presents its user as a physician, knowledgeable in the art of healing, putting their art at the service the suffering. Obviously, for today’s crop of neoliberal economists, that’s just a ridiculous presumption, bordering on effrontery.

By Stefano Scarpetta, Director for Employment, Labour and Social Affairs, OECD, Mark Keese, Head, Employment Analysis and Policy Division, Directorate for Employment, Labour and Social Affairs, OECD, and Paul Swaim, Senior Economist, Employment Analysis and Policy Division, Directorate for Employment, Labour and Social Affairs, OECD. Originally published at VoxEU.

The labour market recovery in OECD countries has been steady but slow since the Great Recession. More worrying [to whom?] is the fate of wage growth over the same period. This column assesses the implications of stagnation in the labour market for growth, wages, and inequality. It finds that structural weaknesses in labour market performance have become more visible as markets recover from the Great Recession. The policy response must include macroeconomic policies aimed at strengthening investment, and structural policies to support growth while nudging workers towards higher-skilled jobs.

The Jobs Gap Is Closing (Finally)

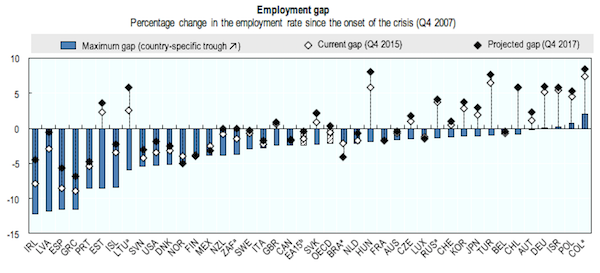

The jobs recovery has been underway since the first quarter of 2010, when the OECD average employment rate reached its post-crisis trough, with only 58.6% of the population (ages 15-74 years) employed. This was 2.2% lower than the employment rate in 2007, corresponding to 20.3 million missing jobs. Despite the slow and uneven nature of the economic recovery, the jobs deficit had fallen to 5.6 million by the end of 2015 and the OECD Employment Outlook 2016 (OECD 2016) now projects that the jobs gap in the OECD area will close during the course of 2017 (Figure 1). While this is welcome news, the fact that the Great Recession depressed employment for nearly ten years testifies to its severity and the price workers have paid.

Figure 1 The jobs recovery continues, but remains incomplete in the majority of OECD countries

Notes: a) Annual values calculated using employment data from the OECD Economic Outlook Database and UN population projections; b) Aggregate of 15 OECD countries of the euro area.

Source: OECD calculations based on OECD Economic Outlook Database and United Nations, World Population Prospects: The 2015 Revision.

As is usually the case, averages tell only a part of the story. Some countries experienced only a shallow or short recession and employment in these countries has long since returned to, or climbed above, its pre-crisis level. Indeed, employment rates are now more than 5% above their end-2007 levels in Chile, Germany, Hungary, Israel, and Turkey. At the other extreme, the jobs deficit is still large in Greece, Ireland, and Spain (where the jobs gaps are currently 9%, 7.9% and 8.5% respectively, and projected to remain sizeable, albeit smaller, by the end of 2017). While it is encouraging that employment is now rising quite rapidly in these hardest-hit countries, a full jobs recovery remains some way off and there is a risk that it will not be achieved before a new recession arrives.

The Crisis Also Adversely Affected Earnings and the Resulting Wage Gap May Be Difficult to Close

The Great Recession was characterised not only by severe job losses but also by widespread and often deep wage adjustments. Real wages fell sharply during the crisis in hard-hit countries such as Greece, Ireland, Portugal, Spain, and the Baltic States, but wages stagnated or barely grew almost everywhere. Comparing real wage growth between 2000-07 with that between 2008-15 suggests a sharp deceleration in a number of countries, including the Czech Republic, Estonia, Latvia, and the United Kingdom. By 2015, real hourly wages in these countries were more than 25% below where they would have been if wage growth had continued at the rate observed during 2000-07, and this wage gap exceeded 20% in Greece, Hungary, and Ireland. The wage story is also discouraging in some countries not experiencing a wage gap in this sense (or only a small gap), as in Japan and the United States, where this reflects a continuation of the wage stagnation that already characterised the pre-crisis period. There are a few happy exceptions, most notably Germany, where wage growth has been significantly stronger since 2007 than during the pre-crisis period.

Table 1 Cumulative gaps in real hourly wage growth and real hourly labour productivity growth since the crisis

Percentage shortfall of the Q4 2015 value with respect to a counterfactual value calculated assuming the pre-crisis growth rate (Q1 2000 to Q4 2007) had continued after Q4 2007

Notes: a) Q1 2002 to Q4 2007 for Poland; b) OECD is the weighted average of the 27 OECD countries shown (not including Latvia and Lithuania).

Source: OECD estimates based on national quarterly national accounts.

Whether workers can ever recuperate the potential wage gains lost since 2007 is uncertain, especially if labour productivity growth continues to stagnate. The prospects for returning to vigorous wage gains is thus closely tied to whether the global economy manages to move from the current low growth equilibrium characterised by low investment, subpar productivity growth, and historically weak international trade. This in turn calls for a comprehensive policy response, including more ambitious use of fiscal policy and additional structural reforms. Labour market policies will need to contribute to this broader effort while also balancing the short-run need to complete the recovery with the longer-run imperative to support a return to stronger and more broadly-shared wage growth.

Making Better Use of Workers’ Skills Would Provide a Boost to Productivity and Wages

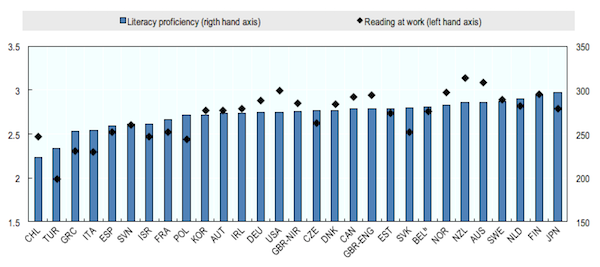

Skills policy can play an important role in boosting productivity and wages. In the past, most of the attention has been on skills development through the expansion of education and improvements in the quality and content of curricula. New analysis reported in the Outlook [SH1] shows that it is equally important to assure that workers can make full use of their skills at work. Among equally educated and skilled workers, those who make fuller use of their information processing skills on the job are more productive, earn higher wages and have higher job satisfaction. There are large international differences in skills use that do not closely track cross-country differences in workforce proficiencies. For example, Japanese workers have considerably better literacy skills than their US counterparts, but use their reading skills significantly less at work (see Figure 2). Governments can and should enact policies that nudge employers towards better skill use. Doing so would help to lower the risk of the overall economy becoming stuck in a low-growth equilibrium, even as it improves the well-being of workers.

Figure 2 Skills proficiency and skills use across OECD PIAAC countries

Average proficiency scores and average skills use at work among the working 16-65 year old populationa

Notes: a) Countries are ranked by their average proficiency score in literacy and numeracy; b) Data for Belgium correspond to Flanders.

Source: Survey of Adult Skills (PIAAC) 2012, 2015.

A Smarter Approach to Structural Reform Is Also Needed

Moving OECD economies away from the current slow growth equilibrium requires a renewed effort at structural reforms. While there is a broad consensus on the beneficial effects of well-targeted and fully implemented reforms of product and labour markets on productivity and hence average living standards in the long run, these reforms often face strong political opposition due to concern about their short-term distributional effects. These are important concerns in the context of high inequality. The new evidence presented in the Outlook [SH1] points the way toward smarter reform strategies that reduce, or even avoid, the temporary disruptions associated with the implementation of structural reforms. For example, it is shown that reforms to employment protection rules, which can temporarily depress employment, tend not to have that effect if implemented during an economic expansion and in countries characterised by large segmentation in the labour market. Moreover, the evidence suggests that complementary measures to promote greater internal adaptability of firms and more effective unemployment benefits can further help minimise short-term adjustment costs. Both the current weakness of productivity growth and the fact that most OECD countries are in the middle of an expansion indicate that now is a particularly good time to consider implementing additional structural reforms.

Bottom Line

As labour markets continue to heal from the impact of the Great Recession, structural weaknesses in labour market performance become more visible, including stagnant wages in the lower and middle ranges of the earnings distribution. This requires a coordinated government policy response, with macroeconomic policies aimed at strengthening investment, and growth being supported by structural policies, even as they help workers to navigate today’s difficult labour markets.

References

OECD (2016), Employment Outlook 2016, OECD Publishing, Paris

Summers, L (2016), “Interest rates are at inconceivable levels, and we must confront what that means”, WONKBLOG, The Washington Post, 6 July

Teulings, C, and R Baldwin (2014), Secular Stagnation: Facts, Causes and Cures, VoxEU.org, CEPR Press, London

+1 effrontery.

noun: effrontery; plural noun: effronteries

insolent or impertinent behavior.

Three little words seem to be absent: work force participation.

Gross unemployment figures do not cut the mustard. They hide as much as they reveal.

Additionally, what is the real rate of inflation in things that hit the bottom 85% hard (food, fuel, housing).

Upskilling is a boondoggle. Many people lack the ability to adopt the kinds of skills these economists are talking about, and a great deal of work doesn’t require those kinds of skills. Economists never seem to understand that turning janitors into IT professionals makes no sense. We need janitors, and adding more IT people simply drives down their already stagnant wages and creates a glut.

“Economists never seem to understand that turning janitors into IT professionals makes no sense. We need janitors, and adding more IT people simply drives down their already stagnant wages and creates a glut.”

A glut of workers isn’t the only problem with “upskilling”.

Adding more bodies to a field (like IT in this case) tends to result in the de-skilling/simplification of that field to the extent that anyone can do it. And as the skill required to do the job diminishes, so does the wages paid.

On a related note, I have always wondered if “employee performance reviews” were simply a way for managers to find out what tasks are best de-skilled/simplified by having their employees disclose their most important/demanded tasks and what is required to complete each task.

Quick clicks for the eye test:

Civilian Employment-Population Ratio (EMRATIO)

Civilian Labor Force Participation Rate (CIVPART)

Steve H.

July 25, 2016 at 7:38 am

Thanks for that! Any discussion of employment should always include those figures.

Now a cynic might think they are not brought up to disguise the true state of the labor market and make it look better than it is….but that would be cynical…

James Levy

July 25, 2016 at 6:12 am

Agree completely! And I see your three little words, and raise you three: Fraud, fraud, FRAUD!

https://pando.com/2014/03/22/revealed-apple-and-googles-wage-fixing-cartel-involved-dozens-more-companies-over-one-million-employees/

Maybe, just maybe, that has something to do with low wages…

The other thing economists can’t figure out – businessmen don’t want to COMPETE, and they don’t WANT to do anything fairly….

Good points, my take on upskilling is that it’s a way to get gov’t to pay for worker training, or worse to establish a loan program where potential workers take out loans to train, in order for companies to not have to pay for training or view workers as an investment that needs curation, or be committed to maintaining the workforce rather than replacing with robots or fleeing to low wage economies. The usage of “nudge” in two, albeit related, passages is also pretty funny, a nudge to upskill, and a nudge to hire hire those people is pretty incremental and implies that everything is great [for whom I think must have been a lambert addition] and just a little tune up will fix everything and we can continue on without a course change. Upskilling also implies a need for H1b’s, so looks like a win/win for the jeff immelt’s of the world, as well as fanning the flames of the nonexistent or at least misnamed “meritocracy”

“While there is a broad consensus on the beneficial effects of well-targeted and fully implemented reforms of product and labour markets on productivity and hence average living standards in the long run, these reforms often face strong political opposition due to concern about their short-term distributional effects. ”

Broad consensus was posited in the anonymously passive voice.

Are the authors auditioning for a gig at Third Way, or on the WaPo op-ed page?

Thanks for highlighting that, I read over it the first time through in a state of cognitive dissonance on the term “nudge”. Claiming broad consensus without any evidence, claiming that increasing productivity will better worker living standards while when productivity was high that didn’t happen, just went to profits, and what, pray tell, are those “.short-term distributional effects” Sounds pretty high brow without saying anything of substance at all.

Bad abstractions, ahoy! It’s strange, but hardly rare, that an article discussing low wage growth fails to mention unions. Poor Kalecki. The political dimension of wage determination fades out and we’re left with mysteriously generate “policy alternatives,” a technocratic social illusion.

I dunno Lambert, it sounds like some physicians I’ve been to. Making serious claims they can’t back up with real logic and evidence, that is.

“as markets recover”

Lambert states that markets are not living organisms so when the author implies that markets recover he is making the market a sick patient. A patient of whom? How can markets recover? All of these “living-type” analogies do not work when commentators forget that the market is made up of individual people such as Lloyd Blankfein who trade and sell financial things and sometimes they defraud other people who are in the market and sometimes their corruption affects everyone as it has since The Great Recession. It is, oh, so easy to just forget that fraud lies at the bottom of the past recession. Healing can only occur when the fraudsters are outed, prosecuted and jailed. The market is rift with evil double dealing that can be easily ignored when any analysis of the recession is attempted. I look at my bank account and see my savings continue to dwindle because I don’t care to gamble on that corrupted “market.”

Nice, another great joke post. In addition to the skill nonsense Levy mentions, I’m quite curious about the claim on

That is some fun intellectual gibberish. Investment isn’t weak; rather, it’s aimed at the wrong areas, and aggregate growth isn’t the problem; inequality is. In fact I love how the authors pay lip service to inequality in the beginning, claiming they are going to address it, and then throughout the rest of the piece they refer to wages merely in aggregate. Oops.