By David Miles, Imperial College Business School. Originally published as a chapter in the VoxEU ebook, Brexit Beckons: Thinking ahead by leading economists, available to download free of charge

To some, the Brexit referendum was a failure by economists to persuade UK voters that leaving the EU would entail major economic costs. This column argues for a more nuanced view by making two points. First, it questions whether there really is a consensus about the costs. While all the mainstream estimates were negative, they ranged from rather small to nearly 10% – a range that hardly sounds like a consensus. Moreover, the key mechanism – Brexit’s impact on productivity growth – is not something economists really understand. Second, a rational voter could accept the cost as a tolerable price for having greater independence from EU decisions. Economics does not tell us that a voter who makes such a choice is ignorant, irrational, or economically illiterate.

There is some angst in the economics community about a perceived failure to persuade UK voters of what some see as the overwhelming consensus that Brexit would bring major economic costs. In a thoughtful letter to The Times (28 June 2016), Paul Johnson, Director of the Institute for Fiscal Studies (IFS), said: “… it is clear that economists’ warnings were not understood or believed by many. So we economists need to be asking ourselves why that was the case, why our near-unanimity did not cut through.”

The latest survey of academic economistís views conducted by the Centre for Macroeconomics in the wake of the Brexit referendum, asks:

- “Do you agree that the economics profession needs an institutional change that promotes the ability to communicate more effectively with policymakers and the public at large and to make clear when economists have a united view?”

- “Do you agree that we need to introduce leadership to help achieve this improvement through coordinated efforts?”

Was There a Consensus?

But is there really a consensus about the costs of the UK leaving the EU? Even if there is some sort of consensus around central estimates, is there an agreement about how uncertain such estimates are and how large that uncertainty is? Is it so clear that, even if there was a united view from economists, it was ignored?

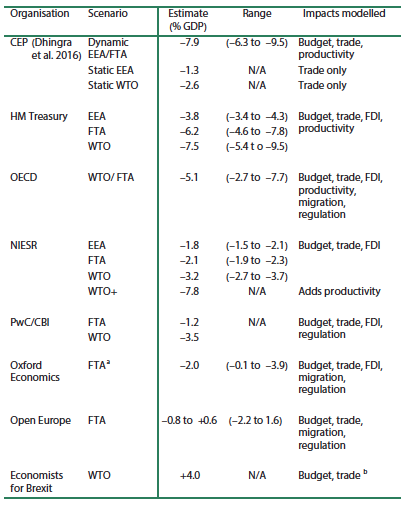

The IFS Report, Brexit and the UK’s Public Finances, published on the eve of the referendum, provided a comprehensive summary of estimates of the long-run impact on GDP of Brexit (Emmerson et al. 2016). Table 3.1 of that report (reproduced below as Table 1) shows estimates of the impact on 2030 GDP, ranging from a cost of a few percentage points to up to nearly 10%. There is a consensus here only in the sense that nearly all estimates are for a negative impact. But the differences in estimates are so large that it is surely a stretch to see this as a ‘united view’.

We Don’t Understand the Key Economic Determinant – Productivity Growth

One factor here is that the mechanisms that could create a long-run hit to GDP are not very well understood. A critical factor – indeed almost certainly the critical factor – is how productivity will change as a result of the UK being outside the EU. One element of that link is that between Brexit and FDI, and then between FDI and productivity – neither of which is at all easy to predict.

Table 1 IFS summary of Brexit impact studies

Notes: a: FTA with moderate policy scenario used as central estimate; range includes “liberal customs union” (-0.1) to “populist MFN scenario” (-3.9); b: regulation impacts assessed separately. Estimates are for impact on GDP in 2030.

Source: Emmerson et al. (2016).

More generally, economists’ understanding of what has driven UK labour productivity in recent years is very low. In the period since the financial crash of 2007-2008, labour productivity in the UK has reached a level that is probably around 15% or more below that which seemed likely on the eve of the financial disruption. The Bank of England has applied thousands of economist-hours to trying to account for this fall. It still remains largely a mystery why productivity has been so poor eight years after the crash and when many other economic indicators (e.g. unemployment, stresses in bank funding and credit availability) have returned to something that looks normal.

The single biggest determinant of the long-run costs of Brexit – its impact on productivity – is something which the post-financial crash evolution of UK output per head should make us very unconfident about predicting.

Trade-Linked Impacts Are Easier to Estimate

The purely trade-related aspect of a hit to GDP from Brexit may be more reliably estimated. And the economic mechanism at work here is more intuitive: if less trade means less specialisation, then a country ends up devoting more resources to areas where it does not have comparative advantage. There is a good deal of empirical evidence that openness is inked to productivity. And some of that evidence is very stark – look at North Korea and South Korea. It is indeed overwhelmingly likely that a retreat to become a much less open economy would be very bad for incomes. But the relevance of that observation to how a UK outside the EU will fare is very far from clear.

In any case, the trade-only effects of Brexit (i.e. setting to one side the potential knock on effects on productivity growth over time) are often estimated to be rather small. A Centre for Economic Performance study puts the trade effects on 2030 GDP at between 1.3% and 2.6% of GDP (Dhingra et al. 2016). No one should think that 1-3% of GDP is trivial. But that number should be seen in context – UK GDP is now nearly 20% lower than a continuation of the trend the economy seemed to be on before the financial crisis of 2008.

Do We Know Voters Ignore Economic Estimates?

But suppose we put to one side the rather wide range of central estimates of the long-run effect of Brexit on GDP, and also ignore the enormous uncertainty about any one such central estimate, and stick to the view that there was a consensus amongst economists about the effects and that this was that Brexit is significantly bad for incomes. What is the evidence that such a consensus (to the extent that it existed) was ignored by those that voted to Leave? I think we should be realistic as economists about how little we really know here.

One point is obvious. A rational voter could accept that there would be an economic cost to leaving the EU but think this is an acceptable price to pay for not having to accept some EU decisions over which the UK has limited say. There clearly are decisions of this sort – from judgements by the European Court of Justice, to rules on financial regulations (e.g. the strange decision to make capital requirements on banks maximum harmonisation, or EU rules on bonuses), to accepting the right of entry of people to whom other EU countries have decided to grant citizenship.

Economics has little to say about whether someone who values avoiding being tied by such decisions, and accepts in return the likelihood of a lower income by a few percentage points, is ignorant, irrational, or economically illiterate. For many years the mantra of many from the European Commission has been the desirability, even the necessity, of “ever closer union”. What does economics tell you is the right answer to the question, “How much should I pay to avoid that?”

As it happens, I did not think it worth paying the price to avoid the risk that the fuzzy concept of “an ever closer union” could create damage down the road. I do not, however, believe those who took a different view were ignorant or befuddled. It is not right to think that if only they understood the economics of it they would surely have voted differently.

See original post for references

Perhaps after over thirty years of being told “There Is No Alternative” and watching their jobs vanish and their incomes decline, a majority of British voters no longer believe anything economists tell them?

Yes, I agree that that’s the real issue. The experts made recommendations that served them and their patrons.

Why would they believe economists? As J K Galbraith said, “The only function of economic forecasting is to make astrology look respectable.”

But no worries; the Centre for Macroeconomics thinks better PR will fix this.

Or maybe not!

The article looks at predictions for GDP in 2030!

Since when has any economist predicted with any degree of certainty any countrys’ GDP over a decade into the future??

Economists are deluded and attach far more importance to themselves than do any members of the public who only have to look at how well they have done historically.

When the collapse comes Economists, Bankers, and Financial types will be valued for what they can accomplish with their own two hands.

In other words, they’ll be eaten first.

“Better PR”

Didn’t we hear this from the Republican party too? “If only we could get our message out more clearly to the (little) people then they would vote for us in droves?” Blindly ignoring the fact that voters and non-voters of every stripe and hue are all very well aware that the GOP activity – as distinct from their message – is toxic.

.

Whenever I hear an economist or economic pundit make a prediction about what evil will befall you/us/them I always wish for a handy summary of the last 20 years of predictions from this same economist, and their outcomes, so that I can assign a probability value to the current expectoration.

Somebody should produce an App for it.

But you hear the same thing from the Democrats. “White blue-collar workers are voting against their own self-interest in droves. Must be because they’re bigots.” I know for a fact there are people in the Democratic Party who get out and knock on doors and talk to people of all kinds about why they need to vote for the Democrat. I’d like to hear from some of them, but their voices never get out from the DNC. I don’t want to hear what Debbie Wasserman Schultz thinks, or what Chuck “Congress is Bought by the Banks” Schumer or Patrick Murphy have to say. I’d really like to hear what regular, committed precinct workers think.

I consider most economists a class enemy and their recommendations as ploys to scam me. I also know that my country was a lot better off in the 90s despite GDP being far lower than today.

My sentiments exactly!

I like the little things – using South Korea vs North Korea as an example of the advantages of “free trade” when the foundation of the South Korean economy was extreme protectionism enforced by a brutal military dictatorship and an aristocracy of legal monopolies. Meanwhile, I think we can be fairly confident in saying that “lack of free trade” is not the sole or even the primary problem with the North Korean economy.

Similarly, as it pointed out here often in relation to these kinds of articles, the totally unexamined and automatic conflation of GDP with “incomes”. A decrease in GDP does not mean a decrease in all incomes, anymore than the increase in GDP in the US and UK over the last several decades has meant a rise in all incomes.

When people say the “economy” will be harmed by an action, I’ve taken to asking – and it applies to brexit – whose economy ? Before neoliberalism allowed Capital to hoover up all the gains in productivity and keep it, wages and productivity were at least loosely coupled. If I don’t get any more of the pie, why should I care if the pie is bigger. Most if not all economists only talk about the economy of Capital, giving scant regard to the economy of labour. I think some brexiters couldn’t see how dewealthing some rich people was going to hurt them – especially if they are on social welfare or benefits.

I agree, except that it would be dishonest to say there’s nothing in it for labor. Instead of choosing between a bigger piece of the pie or stagnation, the choice offered is how quickly labor’s piece of the pie will shrink to nothing.

“Economics has little to say about whether someone who values avoiding being tied by such decisions, and accepts in return the likelihood of a lower income by a few percentage points, is ignorant, irrational, or economically illiterate.”

“Live Free or Die”, the state motto of New Hampshire which was adopted in 1945 would be far past “accepts in return the likelihood of a [lower income by a few percentage points]”.

There are people who are willing to make the trade off of a everything from a few points of lower income to none.

Isn’t this not far from the kind of decision people make all the time when they don’t take a higher paying job for some reason or other? They put something else as more important.

There’s a technical economics term, “rational expectations.” It includes assumptions like perfect knowledge of market prices for eternity. When I was taking Econ 101 we were told about a weaker form of rational expectations. When you’re trying to study the economy you assume the abstract “consumers” are making reasoned choices. You are assuming that you can understand why they made their choices, even though you would not have chosen the same way. I thing too many professional economists start from that reasonable assumption and then go on to think that the only rational choice is the one they would make themselves after a very abstruse analysis. That’s why it can be misleading to look only at money returns. There are other values, but many economists forget about them.

“… it is clear that economists’ warnings were not understood or believed by many. So we economists need to be asking ourselves why that was the case, why our near-unanimity did not cut through.”

I don’t remember anyone saying ” wait, let’s hear what the economists have to say about this “, as if we were waiting on a pronouncement from the gods of economics to make up our minds for us. These people really aren’t as important as they like to think they are. And, if I remember correctly, the number one reason for voters of all political stripes to vote leave (according to Lord Ashcroft’s research) was a desire to re-assert control over national decision making. Economic considerations were well down the list.

The population understand that economists ‘have no clothes’. Economists are rightly blamed for falling living standards, caused by economists generally having no clue and being able to predict very little compared to the expectations they constantly raise. Raising expectations too high is common among academics.

The remarkable thing about this peice is the sense of entitlement: that economists’ views should prevail in a rational world, even after economists have systematically failed society in a way that no other academic discipline ever has or probably ever will.

I keep hearing stories where British news types are lamenting the potential crash of the London housing market but… for the Brexiters… isn’t that a good thing?

If you’re among the dispossessed, asset-lacking proles of the west, a trueborn native of Albion or the expensive parts of the states, isn’t a massive crash in the power of international capital a good thing, regardless the costs to your masters?

I’d wager half of the ‘ill’ effects of Brexit are seen as boons to places like, say, the Midlands.

Just so.

I WANT another housing crash. The last one didn’t touch me (my home’s actual value has not changed much at all pre- or post-crash). A housing crash serves to remove the artificially inflated garbage that the Fed keeps pumping in lieu of feeding the REAL economy (finance and housing are NOT stable or long-term ways to support any economy). A crash would put homes down again where they belong so people who work for a living can actually afford to buy one again instead of feeding the Wall St vultures who buy up tracts of homes so they can turn around and suck rent from the productive class (suckers).

A housing crash in all markets is just what is needed so people who live and work at various locations can actually afford to LIVE there again.

This is all the economists and neoliberals fault because they have pimped the idea that a home is an “investment, investment, investment” that you should borrow against (go into major league debt over well beyond the huge debt of the original mortgage) to make you FEEL like you are wealthier than you are. Go out and borrow heavily against your “investment” to buy ever more expensive cars, clothes, travel, etc…all on a huge 2nd, 3rd, or 4th mortgage or home equity loan. To neoliberals (and the Fed) THAT is economic strength and “growth” right there. Spend money you DON’T have but that you imagine you have by going DEEEEEP into debt.

A home is a HOME, not an investment. It’s a place you reside within, relax within, sleep and eat within, raise a family within. It’s a place to be away from work and bosses. It is NOT an “investment”. It’s a debt that, if you stick with it, you can pay off and have no more debt (in a couple months me and the wife will PAY OFF our mortgage and be done with that shit. No more mortgage payment. We weren’t stupid enough to buy into the bullshit that our house is “wealth” or an “investment” that we should, nay, MUST borrow against to buy shit we simply don’t need: a REALLY big screen TV or mega home theater, a Lexus or Mercedes, put in a swimming pool, go on debt-funded world vacations, etc. Soon we’ll just be saddled with a single, small new car loan (for a Chevy Spark, not a damned Mercedes or similar). The idea of no longer having the bank and a mortgage sitting over our heads like the Sword of Damocles).

A new car loan? Uh oh, you’re no longer a member of the Elect! This means you’re no longer eligible to lecture others on acceptable purchases and your preaching privileges are hereby revoked. *ZAP*

Plenty of people bought big screen TVs when economic times were better, when they had the good paying jobs they were later laid off from, bought on Black Friday when electronics are dirt cheap, etc. Same for those cars and vacations — easy to do those things before your husband/wife gets sick and insurance won’t pay, etc. etc. etc. Are there morons? Yes and those people make the rest of us look so much better, *self-satisfied sigh*

As soon as somebody starts lecturing others about how virtuous they are with money, I instinctively duck.

Going forward, it will be interesting to see how quickly nihilism spreads in the West. As much as anything, Trump represents a segment of the American public wanting to blow up the entire system. In countries, like Canada, where entitlements still benefit a large majority, the propaganda from economists and politicians is still effective. The trend, however is nihilistic. In a way it’s a good thing because people are finally opening their eyes to the truth. It’s also a bad thing that the only way to change the system is to destroy it. Plus it’s very bad that people’s standard of living is falling to such a degree they are being woken from their slumbering apathy. I can also be fatalistic, as well as nihilistic. You allow criminals to run your society then it is inevitable we eventually reach this point. The sooner we wake up the better?

‘It’s also a bad thing that the only way to change the system is to destroy it.’

Why should it be a ‘bad’ thing when everything else has been tried and failed except that ‘very bad’ thing? Once the affected think there is nothing to lose, expect everything including the BAD things. History backs it!

“Freedom’s just another name for nothing left to lose.”

1. At grass root levels, especially in densely populated areas, working people saw their jobs and wages being undercut by european migrants who were happy to work for lower wages as those wages are relatively high compared to where they came from. Add to this that those migrants behave differently and have different habits and those who don’t work seem to congregate in numbers that intimidate people and sometimes engage in petty crime, it’s easy to see that some people wanted that aspect to change.

2. The belief that those making everyday decisions on people’s daily lives, some as petty as what light bulbs we could use or not use, meant that people wanted a democracy of elected people making the decisions. When you have a system already that is bad enough whereby people that are elected are not bound by their election promises and you have to wait another 5 years to have a minor say in any change, anything worse than that to voters was deemed not to be good.

3. The restriction on only being able to trade within Europe means that we might not always pay the best prices for our goods.

4. Finally the lie that the money we currently pay weekly into the EU would be used elsewhere.

These are the main reasons just over 50% of the voters voted to leave the EU. Economists seem to overstate their importance and all so often are only giving their best guess and will only influence people wealthy enough to own plenty of shares. The majority of the population do not own shares.

Simon Wren-Lewis has spent a lot of time asking why British media presented an image of consensus around austerity spending when no such consensus existed among actual economists: he called it mediamacro, I think. Did the IFS join him in this? I don’t remember it. I rather thought Wren-Lewis was left to fight a lone battle with some quite smug business journalists, like Robert Peston. Like other commenters I suspect what’s new here is not the misalignment of economic assessments and media reporting, but the misalignment of economists’ political preferences and media reporting, now more widespread than before.

Mediamacro it was.

I keyed in on the phrase: “There is some angst in the economics community about a perceived failure to persuade …” Economists should be afraid. But much as they fail to understand how economies work they fail to understand why they are no longer persuasive. Even the public expects an expert to be right some of the time.

There is a disturbing similarity in this piece to the structure of global warming denial… first there is no consensus and then there is technical uncertainty sufficient to call the consensus (such as it is) into question. The significant difference in the two scenarios is what the first poster, goeff, pointed out: the systemic unreliability of the discipline of economics. If the physical sciences were as unreliable as mainstream economics, whether or not there is a consensus on global warming might be somehow significant. As it happens though, there is an empirical reality that does not depend on any consensus for its reality. And this applies equally to the movement of atoms and the movement of wealth, whether we are competent to understand the details or not.

Of course, Miles is correct that voters have motives other than reducing costs. That good point deserves more support than a bad argument about economic consensus.

I have never quite understood the lament about Brexit.

It is not like the EU is going to miraculously become some marvel of economic health.

Good point. I’m not really knowledgeable enough to comment further, but I have wondered something similar myself.

The elites are lamenting because it hurts them economically and they don’t like being disobeyed. More objective sources are lamenting because they see how the people already harmed by the Tories and the EU, who were likely Leave voters, will bear the brunt of the outcome. Lots of people who voted Remain will also probably be hurt, and are rightly afraid of Tories unleashed and rising racism and general rage.

Rather like the US election, our glorious ruling class keeps delivering only two horrible options and no escape route.

Trust me, the UK will unquestionably be worse off economically, and the Tories and UKIP would use their ability to weaken labor regulations to screw workers. While a big driver of the vote was to kick out workers that were perceived correctly to be suppressing wages, the UK will lose a ton of its export businesses because they depend on being in the single market, and costs will rise due to sterling being much weaker. So although the Leave voters were revolting against a system that was stacked against them, exiting the UK won’t make things better and will probably make them worse.

“…UK GDP is now nearly 20% lower than a continuation of the trend the economy seemed to be on before the financial crisis of 2008.”

The article wrongly attributes the causes of 2008 crisis to UK’s membership in the EU, while it’s a notoriously known fact that the real cause was Anglo-American deregulation of the FIRE sector. It follows, then, that Brexit would mean more deregulation in the City and further stalling of British economy.

As late as 1923, John Maynard Keynes was a doctrinaire free trader, who regarded “departures from it as being at the same time an imbecility and an outrage.” Yet in April 1933, he gave a formal lecture, National Self-Sufficiency, to acknowledge that, while economic internationalization has important benefits, it also has important costs, and he makes a case for relatively more self-sufficiency. Inter alia, he said the benefits of trade are not as important as they were in the 19th Century because in 1933 tradable goods and services constitute a shrinking part of national economies. “National self-sufficiency, in short, though it costs something, may be becoming a luxury which we can afford, if we happen to want it.” He discusses the reasons why we may want it, including the suggestion that, contrary to the assumption just before the start of WWI, when economic globalization was at its highest point ever, peace may be easier to keep if national economies are not highly integrated.

Speaking as an economist, it is totally clear to me that no economically rational voter would pay a moments attention to any “Brexit” prognostications by any economist. Why? Firstly, because the question to be voted on offers two choices “Stay or Leave” without any clue whatsoever about how either choice would be implemented. “Stay” might seem a simple default choice, but its consequences would depend on the future evolution of an EU already in crisis and heading for major changes with quite unpredictable effects. And “leave,” as we all now can see, has so many possible variants that no consensus either on which variant would be chosen or on its effects would be conceivable. Therefore, any pronouncement by an economist being inherently irrational and probably contradicted by the estimate of every other economist, the only economically rational choice for a rational voter was to disregard all the economists. But even that level of analysis leaves out the elephant defecating over the whole thing: the voters were being asked to participate in a purely advisory, legally meaningless, exercise whose only possible direct effects (besides settling a backroom knife fight among several gangs of Tories) would be purely psychological. So actually the rational voters were those who saw through the whole fraud and abstained.

A very good point.

What the economists who are all in a tither about is NOT that the voters didn’t “understand” their warnings, it is that the voters simply do not buy the economists automatic statements that neoliberalism is good. That IS at the heart of this whole thing, at the heart of the EU. Open borders, free flow of capital, free flow of (now commodified) labor, technocrat-enforced austerity for the many (but butt kissing for the rich, the banks, corporations).

Economists are upset that the voters didn’t buy into the idea that cheap labor is a good thing. That ever-reducing taxes on corporations is a good thing. That stripping away the ability of a nation to serve the best interests of its own citizens during economic down-turns (by deficit spending/running up the debt in counter-cyclical fashion) is a good thing.

What I say is that economists are failing to understand reality. Their models, their “theories” (not actual theories as in science, just political preferences) are wrong, have been repeatedly proven wrong by objective reality again and again and again and so need to be jettisoned. The economists are having a problem understanding that their field of fanticism is irrelevant, contrary to what people want and contrary to what people need. They need to come to grips with the fact that their entire adult career path is a house of sand that needs to be kicked over by the beach strongman and then washed away with the tide. Them along with it.

What we are seeing is “Reality” has to be created and maintained each day and the dominant reality, neoliberalism, is loosing control. Monopoly power granted by a ruling elite to a select few has been the dominant mode of human social construction for- forever. This worldview is based on exploitation. Extracting resources form the natural world without restraint or care to the future and unconcern for the labor needed to make that extraction possible. The whole construction held together by the threat or actual use of violence.

The new reality that is needed is a worldview that does not seek profit from every aspect of life. A worldview that seeks to protect and learn form nature without the underlying desire for conquest and exploitation. Only then can any sort of stability be reached.

I am reminded of the fact that native peoples had difficulty comprehending the concept of personal ownership of the natural world. If you conceive yourself as part of a larger whole, it is an impossibility to view yourself as owning that larger part. A psychic crackup is the result of such efforts.

As humans, we choose our reality. The choices available flow out from your basic starting principle. One pole is humans are masters of the natural world. The other is the subservient view that humans are part of nature, not its master. This is the ongoing struggle that is playing itself out. Why the dominant elite continue to double down on their efforts to remain in control and prove to the rest of us that they have control over the natural environment and their efforts determine outcomes. This worldview only works when the world is bountiful, but fails utterly when the world is exhausted.

The question is, can we as a species, make the transition to a more cooperative relationship with our surroundings. Can we redefine our power relationships, both individually and in our larger social structures. We must choose our path.

I think that the crisis of 2008 destroyed a lot of people’s faith in economists, and rightly so. It was an event that was considered impossible within their models and they still haven’t been able to come up with a good explanation for it.

Corruption. Corruption and greed in free flow, even with the outright blessing of government. That is what caused it.

Not only can their models not explain 2008, they indicate it COULDN’T have happened. Fraud doesn’t exist in neo-classical economics; humans are rational actors with perfect knowledge. If you go someplace like one of the multiple economics subreddits and ask them how it happened, you’ll get a muddled explanation about how the government required banks to give out bad loans (a blatant lie). Fraud will never, ever be mentioned (‘liars loans’, what’s that?). Everything is perfectly fine with Wall Street, talking about a culture of criminality is ‘not a serious critique’. We’re all just jealous moochers who want other peoples hard-earned money.

Butt this is all insane.

Suppose I told you that if you didn’t accept the standard of living of Bangladesh, that this would hurt economic growth. Would that make you want to live like an average Bangladeshi? Of course not! If you have to live in sub-poverty, who cares what ‘the economy’ does!

So with unlimited immigration, it DOESN’T MATTER WHAT THE ECONOMY DOES – the average person will eventually be reduced to misery, the profits of ‘the city’ be damned. The brits voted for personal survival. Period.

Just screw the system because it is screwing us.

Good points from Fosforus and Robert Chittum and others.

I am deeply suspect as to the legitimacy of the entire exercise precisely because proto-fascist Cameron chose to subvert the final authority of Parliament by immediately treating the result as if binding. That was no ordinary error. It was like a surprise bank stress test, and the losers are not the UK, but Europe, and especially Germany, which is under tremendous, sustained US pressure re Russia, re Monsanto, Google et al ‘trade’ deals, re Greece, re Syria and re general approach to the world as a whole. There is no way Cameron would not have known the likely immediate consequences in ‘market’ terms. A roundhouse right that connects immediately for all those who bought what was sold, plus the option to try to squeeze some sort of concessions from the rind of the European project. I don’t expect to see an Article 50 invocation as once the US/EU trade deals are signed, and Clinton elected, all eyes will be waiting for the gloves to drop.

The US decoupled rising productivity from rising pay in the 1970s.

The rest of the West has begun to realise that economic success means little to them as they will get none of the benefits.

In fact economic success usually has a downside for the majority with off-shoring of jobs and the immigration of cheap labour to suppress wages.

When economic success means nothing to the majority, economists have no role to play in influencing the majority.

The EU had 40 years to sell itself, it didn’t.