Wow, I took my eyes off CalPERS and managed to miss them trying to pull a fast one about their long-term returns. Fortunately, blogger W.C Varones caught it and Michael Shedlock promoted his find. And in an admission that Varones and Shedlock were correct, CalPERS removed the claims they deemed to be misleading…and substituted a different on that is just as deceptive.

And what has CalPERS done? Quickly edited its site to try to maintain the pretense that its return targets are achievable, when in fact we are in a “new normal” that is punitive to long term investors, be they pension funds, insurers, or individuals.

CalPERS has been on the defensive since it reported preliminary returns for its fiscal year just ended of 0.6%, when its target is 7.5%. Even though the final return is certain to be a smidge higher thanks to private equity doing well in the quarter where the data is not yet in, it’s clearly not going to change the overall dismal picture. Moreover, this result is particularly disturbing that governor Jerry Brown pushed CalPERS, to no avail, to lower its target to a somewhat more realistic 6.5%. The giant pension fund responded by creating a Rube Goldberg formula that (in crude form) will lower the target in years where performance exceeds 7.5%. With central banks locked in super low, and tending to negative rates, and any exit from those rates leading inevitably to large losses on assets unless one is heavily in cash (which CalPERS will never do), pray tell where where does this outperformance fantasy come from? For instance, fiscal year 2015-16 looks to be a last hurrah for bonds, with CalPERS having earned 9.29% in fixed income. But none other than bond maven Bill Gross has since warned that record-low bond yields “aren’t worth the risk.”

Here is the misrepresentation that blogger W.C Varones called out. From his post on August 1:

You probably know that CalPERS recently reported yet another year of investment results that fell far short of its absurd promises.

But did you know that CalPERS is actively, deliberately deceiving the public about its investment promises and results?

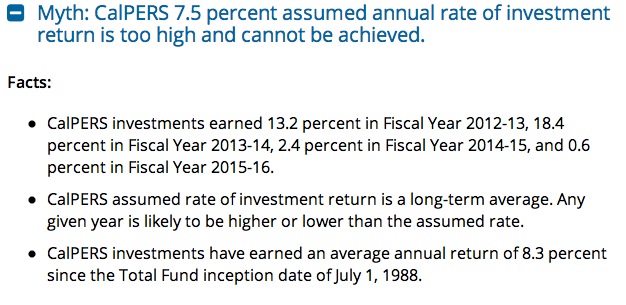

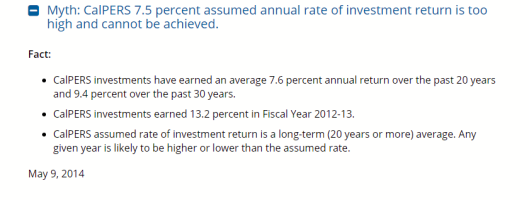

CalPERS has a section called “Myths vs. Facts” on its website where it tries to debunk critics of its rosy expected returns, which experts nearly universally believe are too high. Here’s what the site showed until mid-July:

This is a recurring theme of CalPERS propaganda: pay no attention to expert opinion, zero percent interest rates, or historically high valuations. CalPERS can always expect high returns because CalPERS earned high returns in the past.

After a second consecutive year of dismal returns, the statements above about 20- and 30-year returns are no longer true. This spreadsheet shows the past 21 years of returns, taken from CalPERS annual reports (we could not find data prior to 1996). CalPERS’ 20-year annualized return is now just 6.57%… and it’s about to go a lot lower because it is rolling off four more consecutive years of double digit returns from the tech/internet bubble.

Last year, CalPERS semi-acknowledged that it needed slightly less crazy assumptions, promising to eventually lower expected return… but only after it has a really good investment year first. That’s like a heroin addict promising to quit after just one more fix.

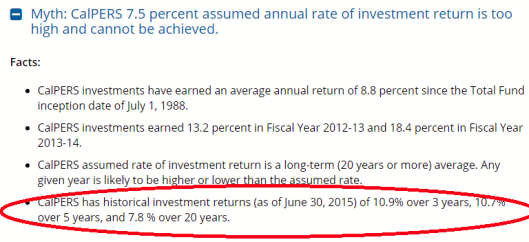

Given that the CalPERS “Myths vs. facts” statement was no longer true, we were curious to see what CalPERS would do after 2016’s bad results came in. And CalPERS did not disappoint:

Look what they did here. In mid-July 2016, after they had already reported 2016 results, they went back and cherry-picked time periods ending June 30, 2015. If we don’t cherry-pick the data, the truth is that CalPERS has missed its annual return targets for all of these time periods: 1-year, 3-year, 5-year, 10-year, 15-year, and 20-year — and the long-term returns are even worse than the recent years! CalPERS is deliberately misleading the public!

Yves here. Now CalPERS could have simply let this blow over, since Varones and Shedlock are mere unwashed bloggers, and there’s no evidence that the mainstream media, and in particularly, the California press had taken notice. As much as they are correct to point out that CalPERS is trying to pull a fast one, the statement on the CalPERS site is narrowly accurate.

But what did CalPERS do instead? Try to find another way to cut the data to fit its desperate need to claim its return assumptions are reasonable. This is what that section of the “Myths vs. Facts” page says now:

CalPERS has swapped one form of cherry-picking for another. Despite the effort to make “Total Fund” sound as if it’s an authoritative beginning, CalPERS merely found an excuse related to some sort of organizational. systems, or other change to select 1988. CalPERS was founded in 1932, so the selection of any date as a starting date for its entire portfolio results that is different than its regular 1,3, 5, 10 and occasional 20 year lookback is arbitrary.

And it’s easy to see why the choice of 1988 as a starting point would be particularly flattering. As of June 30, the stock market had not recovered from the 1987 crash as of June 30. For ease of getting the data, here’s the S&P 500 index value on July 1 of each year as a quick proxy:

1987 310.10

1988 269.10

1989 331.90

CalPERS is also misleading beneficiaries and the public in communications that have much broader reach. In a Sacramento Bee op-ed, CalPERS board president Rob Feckner, in an op-ed that was almost certainly provided by CalPERS’ staff, tried to minimize CalPERS’ 0.6% return for fiscal year 2015-16 by contrasting it with the 18% return CalPERS achieved in fiscal year 2013-2014. Chief Operating Investment Officer made the same pitch in a short video on CalPERS’ website. But as the data cited by Varones showed, this result is not representative. If you look ever past measurement period that CalPERS has traditionally se, when the fundamentals were generally much more favorable than now, CalPERS hasn’t met its benchmarks. What basis does it possibly have for believing it will do better in the face of such big headwinds?

With its head-in-the-sand response, CalPERS is making it difficult even for those who believe in pension funds to defend them. The best solution societally for retirement savings is to have them funded federally, since the US is a sovereign currency issuer, and needs to deficit spend on an ongoing basis due to the fact that businesses chronically underinvest. Moreover, having the federal government provide for an adequate level of retirement income would align incentives much better, since officials would correctly come to regard retirement payments as coming out of the productive capacity of the real economy, as opposed to the confused focus on financial asset values (remember, a financial asset is always and every someone else’s financial liability, and will have the value you hope it will have only if the party on the liability side performs well over time). But if we are in a second-best world of inadequate Federal retirement payments, professionally managed programs are clearly preferable to individual plans. Cathy O’Neil gives one reason:

It’s actually, mathematically speaking, extremely dumb to have 401K’s instead of a larger pool of retirement money like pensions or Social Security.

Why do I say that? Simple. Imagine everyone was doing a great job saving for retirement. This would mean that everyone “had enough” for the best-case scenario, which is to say living to 105 and dying an expensive, long-winded death. That’s a shit ton of money they’d need to be saving.

But most people, statistically speaking, won’t live until 105, and their end-of-life care costs might not always be extremely high. So for everyone to prepare for the worst is total overkill. Extremely inefficient to the point of hoarding, in fact.

Instead, we should think about how much more efficient it is to pool retirement savings. Then lots of people die young and are relatively “cheap” for the pool, and some people live really long but since it’s all pooled, things even out. It’s a better and more efficient system.

Another reason, as any fan of John Bogle will tell you, is that institutional investors pay vastly less in fees and costs than retail investors do, and those savings make a huge difference in total returns over a 20 to 40 year time horizon. And that’s before you get to the fact that 401 (k)s have all sorts of nasty hidden fees.

But instead of calling attention to the real problem, such as the destructive impact of central bank policies on savers of all sorts, as well as the damaging impact of bank-favoring post-crisis policies on growth, CalPERS is trying to snooker its beneficiaries on the fantasy that the old normal is coming back. 25 years of post-crisis malaise in Japan, near deflation in Europe, and nearly a decade-long weak recovery in the US, with no reason to expect better on any front, should disabuse them of that notion.

What CalPERS is so cavalierly tossing aside is its reputation for professionalism and accuracy. While its staff and board may reassure themselves that they are winning the image battle with their unsophisticated retirees, they are losing the war in the wider world, particularly with the media. For instance, I’ve heard more than one journalist volunteer that the “CalPERS Responds” feature, in which CalPERS defends itself against even minor criticism in the press, makes them look ludicrous by being unduly reactive. CalPERS needs to admit that it has serious fundamental problem with meeting its return targets. The longer it pretends otherwise, the greater the self-inflicted damage.

– Wow, I took my eyes off CalPERS

Rust never sleeps, you have to .

Don’t know how you do it.

Andonov, Bauer and Cremers offer a devastating critique of how perverse incentives affect public pension funds such as Calpers:

Thus, Calpers’ ill-fated move into risky hedge funds and private equity, to “justify” its rich 7.5% assumed return.

If Calpers discounted its liabilities at the current yield of 3.76% on the Barclays Long Credit A index — which happens to be half of Calpers’ assumed 7.5% return — then it would become obvious that Calpers is about 38% funded instead of 76% funded.

Drastically increased contributions from both state employees and California taxpayers would be required to make up the deficiency and to fund future obligations at a lower rate of return.

The governor’s inability to push through even a modest reduction to 6.5% assumed return shows in a stark light that Calpers’ cornered rats have their backs against the wall.

Given the short-term horizons that prevail in politics, they will go any lengths necessary to paper over the pension system’s gross underfunding, and to spare current employees and taxpayers from harsh cost increases and benefit reductions.

These are coming eventually anyway. Post-USSR Russia, which continued to “honor” Soviet-era pension promises with stipends of a few devalued rubles — enough for a loaf of bread and a half-liter of vodka to dull the pain — are a model of how California eventually will “soft default” on its luckless pensioners.

Exactly the sort of crap that makes the ISDS ‘projected profits’ clause a black hole of perversity.

Debts that can’t be paid, won’t be

i can scarcely imagine how much the oil, coal and nuclear power companies will claim in lost profits if we try to get off fossil fuels. thanks obama/clinton!

No particular method of retirement savings (social security, public or private pension funds, 401(k) or even money in a mattress) does anything about the central demographic problem of an ageing country and fewer workers per retiree. There are no warehouses full of depends, caprice classics, golf clubs,, and Coumadin. The consumption and production of these will be higher, and the people producing them will be getting proportionally less.

So, what should those pesky elderly people do? Die quickly?

That’s just not true. There is a tremendous amount of hidden labor reserves in this economy: people who are out of the labor force, kids who do resume-burnishing no-pay makework internships, people who semi or fully retire in their 40s or 50s who would keep working if they could get a decent job. And while people who do physically demanding work need to retire at a not-too-old age, pretty much everyone I know would like to work some in their 60s and 70s, partly to have a better lifestyle but also to avoid the fact that if you don’t have the distraction of the ups and downs of being in a structured environment, the inevitability of death looms much larger.

Look at how the US got way over its theoretical maximum productive capacity in WWII. The size of the workforce is monstrously elastic.

If you want to raise a real issue, it’s natural resource constraints. Demographics is a phony argument made by the likes of billionaires Pete Peterson and Stan Druckenmiller, who are promoting deficit hawkery, which assures lower growth, and generational warfare.

Guess the Social Security trustees got sucked in by the “phony argument”:

The trustees report devotes eighteen pages (pp. 82-99) to a discussion of demographic assumptions. All just wasted pixels, huh?

The CBO is solidly neoliberal and dedicated deficit hawks. We don’t have enough time to go after the CBO regularly, but we’ve pointed out that some of its methods are dubious and it’s been operating as a quasi-propagandi for years. And if you have deficit hawks running the show, you will have insufficient demand.

Even accepting CBO forecasts, the fixes for SS are easy, You eliminate the income ceiling. And the impact on the % of GDP it takes takes goes from 4% to 5%, which is hardly worth hyperventiliating about. Moreover, this should be PAYG and the US is a fiat currency issuer.

Is the demographics argument just plain wrong, or by “phony” do you mean that the argument is made in bad faith (that is, that they know it’s wrong but say it anyway)?

It is an enormous issue — written about regularly by the World Bank, the OECD, the BIS; basically everybody with a pencil, a brain, a green eyeshade and a functioning calculator. Allianz spells it out with brutal candor:

This is a matter of remorseless arithmetic. Ideological and monetary theories cannot repeal arithmetic.

Ah sir, but you are forgetting to things with this simplistic analysis. Everybody with a pencil, a brain, a green eyeshade and a functioning calculator knows these two things also

1) The surplus created to manage the increasing number of pensioners — which means most retirement systems are not exactly pay-as-you-go, and will be relying on a large aggregation of reserves that gets interest every year. Granted it is true that many different private pension systems did underfund their reserves by having big assumptions about the interest rates on which they justified the underfunding. However your simplistic equation is not including interest on the accumulated funds.

2) the “average income” and “contribution rate” part of your formula are both not independent variables; nor are they constant for all income brackets. Social security taxes are capped below around $120,000 income. No income above is taxed. And depending on which pension fund we are discussing, not all pensioners have the same contribution rate.

Hence you CANNOT USE AVERAGES TO DO THESE CALCULATIONS CORRECTLY. Your equation is too simplistic.

The problems of the future are real, but the fear mongering on these matters is usually more often the salivating words of people who real want to privatize public pensions because they will make a whole lot more money. That’s why they lie and push half-truths like the simplistic formula the above person.

You are correct however. This is a matter of remorseless arithmetic. Ideological and monetary theories cannot repeal arithmetic.

Except you have to use the correct arithmetic, and a little bit of algebra too. Something called a percentage rate that students learn before the 9th grade.

Here we are conflating Social Security, which is effectively PAYG and can be because the US is a sovereign currency issuer, with a savings and investment based pensions system. Those are two different beasts.

Labor force elasticity matters a huge deal. What matters to Social Security’s “cost” is its cost in terms of GDP and that’s a function of economic growth. We happen to be pursuing a terrible national strategy to achieve that (and we do what amounts to national policy. It favors big tech, which we let develop monopolies and oligopolies, which are bad ideas, the health care and higher ed sectors, both of which are bloated, banking and military contractors).

It’s less about demographics than about productivity. Productivity has been going up for decades and the results relatively shared, until the past 2 decades when productivity continued to rise but the results have been hoarded by the top 1% – .1%.

Great post. Glad other writers are picking up the CalPERS story. Thanks for staying on the PE and pensions case.

yes, these articles are eye opening.

After 32 years, each month a loaf of bread and a half-liter of vodka. Back in the USSR.

It’s not just CalPERS who engage in Disneyland-grade magical thinking — most seem to have their heads in the sand about the hollowed-out American economy. They’re like a Cargo Cult, waiting for the next boom cycle — except that it may never come again.

However, CalPERS staff seem to have had a hand in the looting. Their willingness to lead cover-ups goes far beyond what’s necessary for IBG/YBG political expediency. More like a Shock Doctrine set-up for vultures like John Arnold to step in.

Anyone seen this? http://transparentcalifornia.com/salaries/2014/state-of-california/

That link shows the 2014 salary and benefits of all CA state employees, the latest year they have on file. It is sorted by the last column “Total pay and benefits” in descending order. Guess who is the first line?

Theodore H Eliopoulos

CHIEF INVESTMENT OFFICER, PUBLIC EMPLOYEES’ RETIREMENT SYSTEM

State of California, 2014

Regular pay $406,784.94

Overtime pay $0.00

Other pay $332,809.39

Total benefits $116,949.04

Total pay & benefits $856,543.37

Now that you’ve probably lost your lunch, consider that none of these figures include Retirement Benefits cost. And no doubt there have been generous salary adjustments in the past 2 years.

Here are #2 and #3:

Curtis D Ishii

SENIOR INVESTMENT OFFICER, PUBLIC EMPLOYEES’ RETIREMENT SYSTEM

State of California, 2014

Total pay & benefits $757,062.83

Eric B Baggesen

SENIOR INVESTMENT OFFICER, PUBLIC EMPLOYEES’ RETIREMENT SYSTEM

State of California, 2014

Total pay & benefits $755,181.56

I have to tell you, this is chicken feed compared to what people in comparable private sector jobs, or even the people running much small funds at endowments. Of all the things to be upset about at CalPERS, it’s not their pay levels.

if calpers is so concerned about exorbitant fees maybe it should do a little introspection.

The salary of those three gets you what exactly? A portfolio that cant even keep up with a 60% stock 40% bond proxy. But at least they have Angelides on the hotline to run interference if they ever catch some heat

For getting paid that much one would hope theyd at least be able to stay awake through meetings or look up the definition of VaR

I agree with your observation that Eliopoulos is not qualified to be a chief investment officer. Board member JJ Jelincic said the same thing and was criticized for it. But Angeleides does not have any pull in California politics any more. Yes, he can likely get people to take his calls, but that alone doesn’t do much

Oxford professor Ludovic Phalippou says CalPERS could get well-qualified people from his program to work for them for what they pay, even with CalPERS being in geographically undesirable Sacramento. But CalPERS is likely loath to hire someone under 40 for these roles.

They just keep on keepin’ on. The CalPERS News link has an August 3 piece of how great they are doing with absolutely no data. And their President, feckless Feckner, has a piece on their “For the Record” section that is equally devoid of any substance, which was evidently written in response to a Sacramento Bee commentary.

You just can’t make this up.