By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

If you have a salary well into the six figures, stock options, nearly free healthcare, and other benefits such as access to free gourmet lunches and dinners at the company’s food court, you might have missed something that a lot of folks feel every day: It’s still a very tough battle out there in this job market. And here is why.

Today we got what was called a “stellar jobs report”: Non-farm payrolls rose 255,000 in July. In the other component of the report, the household survey showed that 420,000 new jobs were created. There are now a record 123.9 million full-time jobs. Government hiring was strong. Numerous sectors added to payrolls. And the unemployment rate remained stuck at 4.9%, with 7.8 million people deemed officially unemployed.

So everyone was happy. Well, certainly the stock market was. The S&P 500 closed at a new high. The Treasury market started worrying about a Fed rate hike, and the 10-year yield rose to 1.59%

But on an individual basis, on a per-capita basis – and this is what people feel when they’re looking for a job or asking for a raise – these “stellar” figures depict a job market that is only a little better than at the worst moment of the Great Recession.

On its population clock, the Census Bureau estimates that the US population on August 5, 2016, at 4:49 p.m. ET (yup, down to the minute) was 324.17 million.

That’s up from 308.76 million in April 2010. Since the darkest days of the Great Recession, the US population has grown by 15.4 million.

The Census Bureau also estimates that there are currently 8.6 births per minute, minus 4.6 deaths per minute, plus 2 arriving immigrants (“net”) per minute, for a gain of nearly 6 folks per minute. Everyone ages, so the young ones move into the labor force, but the baby boomers are fit and healthy and don’t feel like retiring, and so they hang on to their jobs for as long as they can, despite the rampant age discrimination they face in many sectors, particularly in tech, though obviously not in politics.

In 2010, 24% of the people were under 18. That was 74 million people. Millions of them have since moved into the labor force, elbowing each other while scrambling for jobs, as have those millions who were then between 18 and their twenties and in college or grad school. These millennials have arrived on the job market in very large numbers.

In April 2010, there were 130.1 million nonfarm payrolls. In today’s July report, there were 144.4 million. Hence, 14.3 million jobs have been added to the economy over the time span, even as the total population has grown by 15.4 million. So that’s not working out very well.

On average, 205,300 jobs need to be created every month just to keep up with population growth and not allow the unemployment situation to get worse.

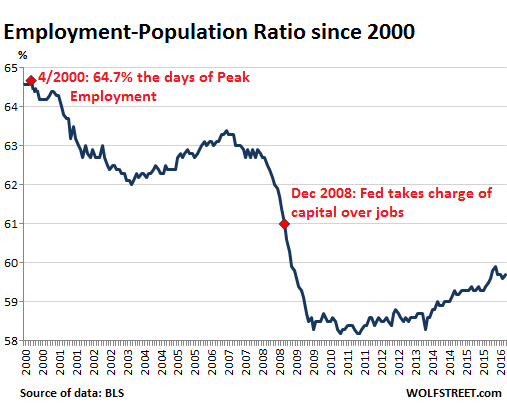

So clearly, for individuals who aren’t lucky, the employment math is very tough. The Bureau of Labor Statistics attempts to capture this dismal condition with its Employment-Population Ratio. It measures the proportion of employed persons to the civilian non-institutional population aged 16 years and over.

The ratio always drops during recessions, but before 2001, it always climbed to higher highs during the recoveries. The 2001 recession and subsequent recovery changed this. For the first time, the ratio never fully recovered, never got even close to fully recovering. That was a new phenomenon: employment growth could no longer keep up with population growth.

When the Great Recession hit, the ratio plunged from its lower starting point at the fastest pace on record (going back to 1948). The Fed’s efforts were all focused exclusively on bailing out bondholders, re-inflating the stock market, re-inflating the housing market, and generally creating what had become the official Fed policy at the time, the Wealth Effect (here’s Bernanke himself explaining it). This has re-inflated asset prices – many of them way beyond their prior bubble peaks.

But the Fed’s astounding focus on capital accelerated the already changing dynamics of the economy, at the expense of labor.

Despite the re-appearance of millions of jobs since the depths of the Great Recession in 2010, the Employment-Population Ratio didn’t improve to any meaningful extent until 2014. In other words, over the first four years of the recovery, the number of jobs created barely kept up with the growth of the working-age population.

Then in 2014, employment growth picked up enough to grow faster than the population. But this too began to stall in March 2016, with the ratio at 59.9%. The ratio has since dropped to 59.7%.

In terms of total population: in April 2010, there were 2.37 people per job. Now there are 2.23 people per job – only marginally better. And this miserably inadequate improvement from the lowest levels of the Great Recession is what individuals are seeing.

It explains the dichotomy: Economists, officials, politicians, and central bankers point at the millions of jobs created since the Great Recession and at the official unemployment rate which has dropped to acceptable levels, while millions of individuals are mad as hell because they’ve not made it into the group of lucky ones, and they’re seeing a job market that is only slightly better – on a per-capita basis – than it was in April 2010.

And this is why the economy is so rotten to the core. Read… “Shockingly, Boards of Directors Encourage this”: Gallup CEO

While his central point is correct–we’re still well below where we need to be to get back to full employment–his analysis ignores demographic changes, particularly the increase in the 55+ population. He should have used the EPOP ratio for 25 to 54 year olds–prime working age. The labor force participation rate has always dropped off sharply for the 55+ crowd (of which I am a member, still working full time plus). His figure of 200,000 jobs per month needed to keep up with population growth is way overstated–120,000 per month is probably closer to what’s needed. Using 120,000 a month as a standard, the US is 4 percent below full employment–about 6 million jobs short.

His point is that it hasn’t been and he should have supplied some data, but I’ve seen other reports (not just anecdotal) of how the employment level among people over 55 and even over 75 is up relative to historical levels despite labor force participation being so low among prime age workers since 2007. And with the shift to a service economy, many jobs are less physically stressful than when manufacturing was much more important, so more people are able to work longer.

And lett’s be real: who can afford to retire at 55, particularly these days with ZIRP? Members of the military I believe can retire with a full pension after 25 years of service, and there are some other places where that’s not uncommon (police, firemen, Federal judges, and people at the World Bank get obscenely rich pensions) but it’s pretty thin outside those areas. Pretty much everyone I know who didn’t work in private equity or become partner at some Big Firm You Heard Of expects to work until they are at least 70. So the “new normal” is longer working careers, and Wolf is trying to get at that issue.

The job market will always be ‘terrible’ unless/until we finally arrive at the point when there are generally more jobs available than there are people to fill them. Which is to say, we need to get to where Congress is willing to create and maintain a sustained labor shortage, using its power to spend money on economic investments to get there.

Only in such a jobs environment is it possible for market forces to drive up the wages/benefits of the working poor…and all other wage earners for that matter. If/when Congress does this, it will achieve an economic ideal:

Ahh, but won’t that scary inflation monster come and get us? Hint: not so much. If you step back and look at such an economy without paying any attention at all to money flows, you’ll see an economy that is functioning at the optimal level that is possible for any economy.

Right. But, he can’t use BLS data to buttress his half-baked argument on the one hand and then ignore their analysis for why Employment-Population Ratio is so low. Yes, EPOP for 55-64 has gone up. But, there are more retirees 65+ than ever.

If anything, I underestimated the number of jobs needed to keep up with the growth of working age population (205,000). Working age = anyone who wants to work and is old enough to work.

1. Immigrants who come into the US are mostly working age already and thus contribute directly to the workforce. Over 1/3 of the population growth is due to immigrants (Census, in the text)

2. Millennials are the largest generation ever. They have been entering the workforce in larger numbers than Boomers are leaving the workforce.

That older people aren’t retiring as they used to is old hat. Just a cursory glance at Google brings up Census data about it (reports linked below from 2008). They include this morsel: The number of people over 65 still working has doubled (up 101%) over the past 30 years.

http://www.bls.gov/spotlight/2008/older_workers/

Here’s the PDF of a study of older people working.

https://www.census.gov/people/laborforce/publications/Working-Beyond-Retirement-Age.pdf

The percentage has since grown as people who would want to retire cannot afford to, and thus continue working, since their cash flow from savings was crushed by the repression of interest rates.

By the way, in the 1990s, this was a figure that the government, and Bill Clinton himself, cited frequently to explain job growth needed at the time. But the number back then was 250,000 (population growth has since slowed). Remember? I do. The government, mercifully, no longer brings this up.

Police and to a lesser extent fire retirees will soon impact the ability of cities to provide what the public has come to expect for safety and related services. The bulge in retiree numbers underway and forecast for 2017, for example, represents a destabilizing factor in Chicago, among other cities. One result of that demographic shift will be more class warfare and other calls to revisit future pension qualification and terms.

That means that eventually there will be fewer programs with 20, 25 or similar years and then out at a full pension, especially those that are spiked by overtime in the last few years. In the interim, expect that there will be increased costs for municipal budgets, to be paid by a struggling tax base, through overtime and that a few dysfunctional cities may require National Guard input to deal with social unrest. The Rahm Emanuels of the world going to have their hands full.

For one reference.

See actuaries pension concerns article from ZH about pending pension matters.

The military uses a 2.5% per year (50% of your base salary at 20 years is the minimum to qualify for a pension). However, I believe the recent govt commission wants to go to a 2% per year rate and to offer a 401k-like option to those who don’t wish to serve 20 years. I wouldn’t be surprised if this “option” is eventually phased in as a permanent fiscal solution to the current pension system. Btw, I am a recently retired Master Sergeant and I am worried about how civilian wages and pensions seem to be worth less and less. Not a good sign for a healthy democracy when the military is the last good place to work. I would like to see labor have a bigger voice in how the pie is divvyed up… Great website btw, I really enjoy the articles.

Since there are at least two major factors at play here — age and gender — it’s also worth breaking it out by both. For instance, see here for men 25-54: http://beta.bls.gov/dataViewer/view/timeseries/LNS12300061Q and here for women: http://beta.bls.gov/dataViewer/view/timeseries/LNS12300062Q (change the start year to 1985, say, to see the modern era).

The patterns are similar, but men actually hit their all-time peak in 1990 and have declined ever since, while women hit their peak in 2000, and have declined ever since. Looking peak-to-peak, men went from 90% in 1990 to 89% in 2000 to 88% in 2007 to 85% today, whereas women went 71%, 75%, 73%, 71%. So men are down 5 points from their all-time peak and women down 4, and since 2007 men are remain down 3 points and women down 2.

At current rates, it will be another 3 years before men regain their 2007 peak, and would take 6 to regain their 1990 peak, and about the same for women. But more likely, we’ll hit another recession before those losses are recovered, and the long-term peak-to-peak decline will continue.

Small addition: ” but the baby boomers are fit and healthy and don’t feel like retiring, and so they hang on to their jobs for as long as they can, ”

The FED, through their action of keeping interest rates at “emergency ” levels, has ensured boomers cannot afford to retire. Any savings in 401k’s or already taxed accounts earn no interest.. Changing the assumptions one must make on how long those savings might last. Secondly, if one was fortunate enough to have worked for an entity which HAD a promised pension, the likelyhood of the pension fund actually being able to make the promised payments in full have been decimated by the FED’s actions…

Although they cling to their 7-8% return bogies… Anyone with basic math skills can see this is unlikely to be achieved..

And so, Yeah…. We hang on to our jobs/business for as long as possible in hopes that some measure of sanity might return to the oracles at the Eccles building.

Sanity or the Eccles building has nothing to do with it….

Absolutely correct, everybody looks at everything from their perspective – that is the problem with the world. Does Wolf really thing that people in their sixties and seventies want to work? Of course not, they wish they could retire, but they can’t because they can’t afford to.

I think he was being sarcastic.

I certainly want to work into my 70s, at least in some form; shuffleboard is a death sentence.

Do not, under any circumstance, let anyone put you in a “home.” My admittedly anecdotal experience is that that is a real death sentence. We’re both convinced that Phyls’ dad gave up and died quickly, as in a matter of months, when he entered the ‘senior assisted living facility.’

Also, you appear to have an interesting line of work; I almost typed “calling.” Many of us have suffered through mismatched labour categories out of the fear of ‘failure, starvation, homelessness, etc. etc. That’s why I support those ‘senior’ ‘continued learning’ programs at many junior and community colleges. Being conditioned in youth to equate self worth with work related metrics, such as shiny automobiles, big houses, flashy clothing and the lot can be a very difficult ‘habit’ to break. I would equate breaking that ‘habit’ with kicking an addictive drug.

Amen.

In a former life, I saw many assisted living facilities. There are some that are quite comfortable, if one can afford the $5,000+ per month. The rest range down to glorified people warehouses where spirits ebb faster.

In addition to the continued learning programs that you mention, I’d recommend greater interaction with youth as both groups could learn a lot from the other.

When someone utters the terminology “Boomers” [ form of ageism ] it detracts from what might be good analysis.

Disheveled Marsupial… one might as well say the old people were not responding – rationally – acoriding to whom is the bigger question….

I disagree. It’s a reference to demographics. Post war baby boom. You may be overly sensitive due to the “boomer bashing” that sometimes goes on, right or wrong, but I see no victims here.

I don’t think you understand, I’m not arguing about victims here, I arguing against faulty methodology and frameworks for observing humans in market setting and out…

https://aeon.co/essays/generational-labels-are-lazy-useless-and-just-plain-wrong

Additionally something I posted elsewhere on how such terminology and its resultant use can go off the rails. Sorta like some schools of econnomics where after a bit of time of dominance the results don’t match the assumption…. but hay…. why let that stop ya…

One criticism of Strauss and Howe’s theory, and the field of “generational studies” in general, is that conclusions are overly broad and do not reflect the reality of every person in each generation regardless of their race, color, national origin, religion, sex, age, disability, or genetic information[67] For example, Hoover cited the case of Millennials by writing that “commentators have tended to slap the Millennial label on white, affluent teenagers who accomplish great things as they grow up in the suburbs, who confront anxiety when applying to super-selective colleges, and who multitask with ease as their helicopter parents hover reassuringly above them. The label tends not to appear in renderings of teenagers who happen to be minorities, or poor, or who have never won a spelling bee. Nor does the term often refer to students from big cities and small towns that are nothing like Fairfax County, Va. Or who lack technological know-how. Or who struggle to complete high school. Or who never even consider college. Or who commit crimes. Or who suffer from too little parental support. Or who drop out of college. Aren’t they Millennials, too?”[6]

Disheveled Marsupial…. nice big compartmentalization project based on a wonky base line…. but hay… marketing, and business management bloody love it – !!!!! – Neil Howe in 1988 coauthored On Borrowed Time with Peter G. Peterson – too….

– in market setting

The key phrase.

As far as I can tell Strauss and Howe are philosophers and not scientists. As in they made up their theory ‘out of their own head.’ Non-falsifiable nothingburger.

However, cohorts do matter, in terms of shared experience. Most extreme being the 35% bodyweight males from Bhopal. Less extreme, cellphones and internet are pretty ubiquitous across most intersectionalities, but can be parsed out by age.

However, if you don’t care about people who ain’t buying what you are selling, ‘white affluent teenagers’ is an excellent demographic marker.

edit: minus-35% bodyweight

Yes… answers looking for preferred framing vs. experiences which require explanation.

Disheveled Marsupial…. perpetuating myths has a lot to do with how we arrived at this juncture.

Let’s step up the construction of those private prisons. That provides a twofer: getting more angry young males (especially those of color) off the unemployment roles (and the streets) and creating prison guard jobs. Plus, making fat returns for investors. Gee, what’s not to like?

not every addition to the population is going to need or want a job…

They will just starve? Maybe they just have rich parents.

As another perspective related to this topic, I graduated from college at the bottom of the Great Recession, and it took 3 years to find employment relevant to my degree. In those 3 years, I did not earn much and kept purchases and life choices limited. Since then, I have been one of the lucky ones to find a relevant job and am financially better off. But my position feels precarious, as if I am just one unlucky break from going back to struggling. I think this has been a common experience for those in the millennial generation, and it was jarring because growing up I was told by everyone/media that hard work equaled success. And then to have this sudden realization just when adult like is starting that things are rigged — it was nice to have a politician speaking to this experience, even if for a while.

WarnerC, my post-graduation tale is similar to yours. Happened to me during the early 1980s.

Believe me, I have never lost my cynicism re: the value of higher ed and where hard work will really get you.

Same, Slim.

Yes, indeed. For every person lucky enough to step from high school to an Ivy League college to a great job with no gaps and few loans, there are bunches of us who had “hard scrabble” periods burdened by parasitic student loan payments. It’s just more common now.

On a side note: we’re now paying the price for the folks who ignored the zero population growth movement back in the 1970s. Too many people, not enough resources. The less powerful are the ones being thrown off the back of the sled to the wolves now – but the 0.1% have the rest of us slated for the same fate sooner or later.

Two big problems in the current job market: Republicans blocking infrastructure repairs, and lack of labor /environmental protections in international trade agreements. If the government wanted people employed, they’d borrow lots of money at current (very low to negative) interest rates and patch up the country’s infrastructure. If the international trade agreements included real labor and environmental protections, there’d be both a level playing field and protections for workers and the environment. None of these things are happening.

This is why it’s important to defeat Trump, and put Hillary on notice (through continued mobilization at the local and state levels) that she’ll be primaried in 2020 if she doesn’t start protecting the rest of us.

Righty-ho! As if there will ever be a better candidate to primary her than Bernie.

Yes, I’ve heard that song before.

“Primary” Hillary in 2020 if not satisfied with results? By then she and her Grand Coalition of Country Club/Wall Street Republicans and Cat Food Democrats will have TPP, TTIP, TISA, etc., and maybe some brand new ones safely passed and signed. She will have privatised or at least Wall Streeted the Social Security System and Medicare. She will have worked with Congress to change the punishment for not buying Obamacare from paying a fine to serving years of hard-time in prison. And so forth and so on.

Once she gets all that irreversibly achieved, she will sit back and laugh at you. “Sure, kids, primary me all you want. Ha Ha Ha.”

Hillary on notice, somehow I don’t think she cares what anyone average citizen thinks and will do whatever the highest bidder asks of her. She never protected us and isn’t about to start-stop falling for it.

You too? Early 80’s here. Sometimes they made you feel lucky if you got a pat on the back.

I did two years at University in the mid seventies. I learned there the almost overwhelming value and influence of “connections” and luck. (Real genius level application is rare.)

On construction sites, I re-learned the same lessons. There, I learned that the ‘overseers’ try and fool you by letting you know how great they are, and how ‘grateful’ workers should be, that they give you a job in the first place.

Now the amorphous “they” don’t even try to hide the fact that the “pat on the back” is all too often a stab in the back.

Around here, discounting my personal discontents, the “community vibe” has become anxious. A lot more homeless wandering about as well.

Longer time-axis on Civilian Employment-Population Ratio (EMRATIO).

Civilian Labor Force Participation Rate (CIVPART) is more demographically specific.

Clearest comparison.

It looks to me like you are trying to point to the current situation in a historical context and say that it is not really all that bad. I disagree. When looking at your third graph I am forced to wonder how “Real Median Household Income” was calculated. What inflation figures were used, for instance? After rooting around a little bit, I see that CPI was used, which I think most on this blog would point out produces a number that is not reflective of reality. My bet is that if an inflation figure that included the actual cost to live a life were used in the Real Income calculation, we would see a very different looking graph. Using household income also completely ignores the fact that in today’s world two incomes are generally needed to attain that household income figure vs one income in the past, and this further obscures the fact that wages have been driven downward.

Well, I guess it’s not the clearest comparison. I’ll try to do better, probably the Income curve is to flat at that scale, and doesn’t show the decrease.

I’d say the inaccuracies of the CPI are minimal compared to the Productivity-Pay Gap.

I welcome better statistics and graphics, please feel free to bring them to the party.

Ding ding ding ding ding!

Clear clearly wasn’t clear enough, and my comments are getting vaped.

EMRATIO shows entry of women into the workforce, an emancipation which provides the basis for the two-income households.

I’m working with the data I have, please, bring better graphs to the table. My bet is that CPI error is a lot less important to flat/declining income than the Productivity–Pay Gap.

This makes the not-so-clear graph clearer (sorry for the pdf). It is bad. Peaked in 1999, down nearly 10% since then.

Also: The Rise in Dual Income Households. The number of dual-income households peaked around 1990 and has been very stable, Income has not.

The P-P gap becomes even more frighting if one compares it to the expansion of the monetary base or credit.

Skippy – experience of young adults in the early 1960’s was expansive, so when credit took off in the 1970’s, the assumption was there would be more money to pay it off. False narrative there.

I have an internal pivot date in August 1971, when Nixon unhooked dollar-gold convertibility, and the next week the Powell Memo was released. Monetary base doubled about every 10 years since then until the semi-singularity in 2008. But median income just wouldn’t get on the bus…

Looks like a Depression to me. Don’t forget that the definition of Full Employment is now 36 hours per week. At minimum wage this is $13,572 gross per annum.

A couple more administrations and “trade” deals and the neolibs will have their globalization. The cost of labor will be the same everywhere.

WOW, it really is a “New World Order”.

The argument being Americans would/could never live on those wages, and here we are.

It happened pretty fast really.

Re “The ratio always drops during recessions, but before 2001, it always climbed to higher highs during the recoveries. The 2001 recession and subsequent recovery changed this. For the first time, the ratio never fully recovered, never got even close to fully recovering.”

But the accompanying graph shows the ratio just under 63% in 2001 and over 63% in 2007. How is that “… never got even close to fully recovering?”

Because “fully recovering” means returning to the level at the peak, which was 2000 and 64.7%. So the ratio got about half-way back to full recovery and stalled. I’d say half-way is “… never got even clost to fully recovering.”

The employment population ratio needs to be accompanied by real weekly income changes over time. Flat incomes for decades for most workers adds to the duress of the failure of job growth to match population growth for the last two decades. Also, I think it helps the uninitiated to see why these is such a sense of the economy failing the great majority of people in the country. Add to that the hyperinflation in housing and healthcare, and inflated credentialism in the work force (forcing extra education costs for much more tha before) and you’ve got real problems.

Second, for the uninitiated, it helps to post the employment population level graph for the entire period of measurement, so they can compare the post war period of growth ending in 1997-1998 to our current economic milieu. Although, it’s easy enough to just search the darned graph with your favorite search engine.

It is the combination of these factors which can help people visualize just how different the national economy has become in this new millenium from before, and why the world views of boomer presidential candidates … absent critical updating … just misses the mark.

All 3 of our Boomer presidents have been disastrous for the working class.

So will the 4th, whoever (s)he may be.

I think it’s unrealistic to hope for real weekly income changes. You’re asking for information that just isn’t available that fast, even with computers and electronic communication.

On the Fabius Maximus Website it mentioned that 47% of the new Jobs went to foreign born workers. Most of the gains seemed to be in professional, healthcare and educational and government. I wonder how many of the few private sector unsubsidized Jobs paid more than Minimum wage. I doubt we had a Wave of Indian podiatrists arrive. How many were H1b cases? Were there really so few domestic available? 47% seems awfully high. Everyone I know is under employed or unemployed…….or in School for want of a job.

Tons of Indian H1-B techies around here…….living 4-5 to an apartment, sharing a stripper Toyota or Honda.

One thing they aren’t doing is “assimilating”.

Looks like they are purely extractive to me. But saying so does not conform to the “immigration is an unadulterated good” propaganda.

The millions pouring into Europe thanks to Angela Merkel are surely not expected to ever leave. I’m sure workers, whatever their ethnic background there will now be pressured to work for less. A population that’s an ethnic mishmash faced with social darwinistic political economy is easier to control through divide and conquer. Its the same in the US

The millions pouring into Europe barely represent a fraction won’t even be in the books. I am amazed people still don’t get that.

Huh? I suggest you get a better grip. The number of people that have gone into Sweden (which has admittedly taken the highest % of refugees per capita thus far, but other countries are expected to reach this level) are producing severe strains on housing and social services. But in Sweden it doesn’t hit wage levels because minimum wages are high. It shows up in social welfare payments instead:

http://www.migrationpolicy.org/research/catching-labor-market-outcomes-new-immigrants-sweden

And this report was as of 2014! It’s only gotten worse since then.

There were plenty of Indians — many H1B types as far as I could tell — around where I used to live. I bought one of my used cars from an Indian database programmer who contracted with TATA doing fairly routine database work for a local Pharma.

Agree — I also doubt you were hit by a wave of Indian podiatrists. You wouldn’t see that wave until after a few years. Physicians are licensed by each state and they have strong and relatively effective unions to control their numbers and set the price for their labor. Nursing is in a weaker position and probably absorbs the much greater share of the foreign born workers in healthcare. A few foreign physicians start off here as nurses while working to get credentials as a physician.

I suspect Pharma might be another area which absorbs workers classified as healthcare workers [maybe “professional”?].

I imagine they have a committee studying which is more useless – a wave of Indian podiatrists or a wave of Indian programmers. These studies take time.

That’s why I take good care of my feet.

Nonsense. Absolute nonsense.

And “workforce participation” is maybe the worst indicator of a healthy economy. In fact, I would say the higher the “workforce participation” the worse off the society. Look at historic labor force numbers. If you want to compare to 1990s numbers, suggesting that’s where we need to be, you’re falling into a trap.

I’m seeing tons of “Help Wanted” signs in Aerospace. Genuine “shortages” everywhere. But it sure isn’t translating into higher wages. Especially enough to make you quit your current job, and move 5-600 miles to start from scratch in a new town.

The business plan seems to be (in no particular order)……do without, put the guys you have on 60 hour weeks, hire contractors when possible, lower the training and certification standards. Or a combination of the above.

Anything but raise the hourly wage. God forbid any of the wretched refuse make more money without “earning” it.

“Free Market”? Puuleazzzzz……

Can’t wait to see what the “up to 33% wage increase” of the AA press release actually translates to at the shop level. It’s probably “33% (over 10 years)”

I read both the post and the referenced post about age discrimination in tech. These reminded me of a documentary I watched recently about the Moonshot — not “For All Mankind” but similar. It showed NASA footage of the whole Earth to Moon to Earth journey with fabulous shots of the Earth and Moon from space. [– I like to capitalize some nouns because they look better to me that way]

There was an interview in the film with an engineer who worked in the launch control room. I remember his comment that as they cheered after just completing the successful Moonshot there was a guy going around the room handing out pink slips.

After the space race ended entire neighborhoods within commuting distance of the main contracting firms, firms like General Dynamics, Boeing, Rockwell were emptied. Foreclosures and disintegrating houses were all that was left. Houses dropped in price by roughly 2/3. While in college I had a part-time job working at a filling station owned by a laid-off aerospace engineer who had managed to gather a nest-egg for down payment. [He probably had a relative who gave him a deal — just guessing]. In the middle seventies, two years into my career, I worked for a corporation that had more than 2000 employees at the height of the space race and went down to 400 employees after LEM. I was hired in as #471.

The engineering profession hasn’t really been a true profession for a long time. [True — there are forms of engineering practice that do require a license and remain “true” professions with somewhat greater success than architects have managed — but that represents a very small part of the workforce termed engineers.]

The current Linked-In algo abuses of fair employment described in the tech link are an insidious new form of worker exploitation. Even the process of bringing foreign workers to drive down wages has old precedents. The need for better oversight of our food production wasn’t the main theme of Sinclair Lewis, “The Jungle”.

I came into engineering at the tail end of the space race years. One of the things which impressed me about the people who worked on that project was their amazing levels of dedication and belief they were doing something great and wonderful, something which removed all barriers to what we could accomplish given a remarkable goal and the will to accomplish it. The few guys still around when I started work had families and decent houses and a decent standard of living but it was plain to me they didn’t do what they did just for the money. Thinking on this now reminds me of a Michael Hudson’s description of what motivated the guys who build the pyramids. They weren’t slaves and wanted their thick beer and needed the food they earned but more than that they were working on a great project which transcended their ordinary lives. I suppose similar motivations drove the builders of the great cathedrals.

There are plenty of great projects we could undertake and need to undertake, projects more challenging and more important than the Moon Race. I am haunted by the line from the movie “Interstellar”: “We used to look up at the sky and wonder at our place in the stars. Now we just look down, and worry about our place in the dirt.”

“Sinclair Lewis” should be “Upton Sinclair”–and you’re right about the main theme of “The Jungle:

Ugh! Thanks! [Smacks self in forehead.]

Sinclair Lewis & Main Street works to picture the scene well too. I think he wrote Elmer Gantry as well. Trump Ist that with Huckabee flavoring.

But oh but The Big Money by Dos Passos proving F D R was as good as we got.

Mailer’ s Leut. Hearn told what was what.

The New Deal as a redo In anthtropocene?

Musk is headed for Mars.

(I have to give up before going at recreational vehicles as permanent homes from youth because the Amazon Fire is miserable to write on.)

“… the people who worked on that project … their amazing levels of dedication and belief they were doing something great and wonderful.’

They were.

I believe they were too.

Here’s a thought: We could use the H1B Visa system to bring in technical talent — especially talent paid for with our existing investments in US graduate schools and State Universities [– referring to the new section on H1B Visas for foreign Masters and Doctors students trained in US Universities and noting STEM graduate studies are one of the cost centers for Higher Education because providing a graduate science education ie. running labs is $$$$$ –] NOT to undercut domestic pay and employment BUT to begin some new projects we can all agree amount to “doing something great and wonderful.”

I remember an engineering textbook which made the point that just one of the inventions developed from the technologies created in the Space Race — the heart pacemaker — more than paid for the entire Space Program up to the time we put men on the Moon.

“I’m seeing tons of “Help Wanted” signs in Aerospace” Really? Where? I still look from time to time in the Vancouver/Fraser Valley area and rarely find anything – an when I do they always want someone who has completed their apprenticeship and they usually demand some type endorsements as well. Good thing I spent a few years and thousands of dollars training as an aircraft mechanic – everyone told me how great it was to get into a trade. So far I’ve made $0 working on aircraft after a lot of effort to find jobs. I’ve actually made more money playing music!

It used to be–according to other financial web sites–that we had to come up with 125,000 to 150,000 jobs to keep pace with population. Now you’re telling me the figure is over 200,000? No wonder most of America is going crazy. Perhaps the Republicans ought to rethink their opposition to birth control and their penchant for “forced birth.” Meanwhile, some southern state just passed a ban on aborting deformed fetuses. Maybe this is the Republican plan for creating more jobs for doctors, nurses, caretakers, institution workers, drug companies, and manufacturers of medical equipment? (snark)

He is wrong. Now it is 100-125,000 to keep up with population. It is falling. Richter lied up his ass. Where is America going crazy frankly, I am not seeing it.

That would those who came out on top of the Education Rat Race (You take your exams alone, do not share with anyone – no sharing).

Or those who inherited high IQ (un-taxed) from their parents.

“He’s such a genius. Never studies and always aces his exam. I am so jealous. Never have I ever raised the issue of (inherited and un-taxed) IQ inequality with him. I guess it’s because, instead of IQ genes, I got the Sex Symbol genes – inherited and un-taxed, never have to work for it – from my parents and have been able to score easily and pass on my DNA.”

We humans need them to make ‘progress,’ according to the propaganda ministry.

I would love to see more analysis of the educational attainments of the top 0.1%. Bill Gates is a college dropout. Steve Jobs was a college dropout. Sheldon Adelson is a college dropout. I expect most of the 0.1% have Bachelor’s Degrees, just because college is one of the places they develop their conspiracies … Oops! I mean networks. A few hedge fund managers have Master’s Degrees. Many employers are demanding degrees for jobs that do not actually need them. Janitors, garbage collectors, plumbers, others who are valuable to society, do not need degrees. The obsession with “improving educational outcomes” is bases on an irrelevant statistic, the “education gap” in wages. If everybody gets higher education you’ll need a PhD to get a job as a janitor.

Does anyone know if our country operate on a ‘Last in, First out’ basis?

That’s an option the accountants say is available to, if not all, many.

Last in (to this country), First out of the (unemployment)…i.e.first to get a job.

I don’t know, but I hope that is not how we operate.

While I agree with the overall theme of this so-called recovery being the crappiest ever in terms of jobs (count, quality and wages/benefits), this kind of misuse of statistics does not help make the case:

In April 2010, there were 130.1 million nonfarm payrolls. In today’s July report, there were 144.4 million. Hence, 14.3 million jobs have been added to the economy over the time span, even as the total population has grown by 15.4 million. So that’s not working out very well.

That conclusion rests on the clearly false premise that during a ‘good’ jobs recovery, the number of jobs should increase with or at greater than the rate of population growth. If the E/P ratio in year X was (say) 0.5, then to keep it the same in year Y we need just half as many jobs created as the net gain in population over the same time span.

Much better would have been to compare the jobs situation to pre-great recession, say 2006. Luckily the charts Wolf posted cover that and thus make the case nicely. And as several readers note, broad measures of job quality are at least as important as quantity-stats: I’d wager that most of the decent (full time, inflation-adjusted pay and benefits comparable to pre-GFC) jobs created in the current recovery are directly or indirectly tied to the dual reflated-bubble-sectors of finance and tech. In other words, the recovery has been as hollow as the overall economy has become.

And the “establishment” wonders how you get a Trump for President.

You get it because the Dem party turned into Repubs and the Repub party turned into nut jobs, and nobody get a $hit about the people. People can get rather desperate when they see no future.

I do not expect this to change under Clinton.

I read something that 83% of Americans make less than 125K a year. That really amazed me. I’m in the NYC area and make a bit upwards of that and am still completely freaked out about retirement. I have absolutely no debt. I take no vacations. If I am in the top 15% in terms of income and (it’s just me). And I am flipped out about my future security…what does that tell you?

It tells me that you and all of my brethren in NYC, are even more f***ed than those of us living in the “rust belt” on $40,000 or $50,000, which for a single person with your bona fides (no debt, etc.) is quite ample here, including a nice vacation every year or two. Maybe you’d like to move. We’d love to have you in Cleveland ;-)

And before you respond in horror — we have a lot — A LOT — of very happy NYC transplants here. Of course, most of them have had to learn to drive. Public transit here does leave a great deal to be desired.

Ditto Carla. Hi Carla!!! You can come to SW Arkansas where I live and buy a decent house for about $60,000. If you have any equity at all where you live now you’ll probably have quite a bit of cash left over. After that it shouldn’t be hard to live quietly on your savings-augmented Social Security. Of course, you’re basically relegated to shopping at Walmart and dollar stores, but you get used to it (I’m serious). It is a much cheaper way to live than trying to survive in coastal cities. The reduction in economic survival stress as well as crowding stress offers quite a bit in the way of a feeling of security. There really is nothing in the way of coastal city “culture” to offer, but hey! Attending the high school annual play or local dance recital along with half of the community makes up for its utter lack of subtlety by an extra large helping of small town sweetness. (It really does.)

I recently retired, and made rather less than what you make. Social Security won’t cut it without additional savings of some kind — even in Cleveland — but I suspect you won’t retire without savings.

The really scary part of retiring is that I will probably never be able to earn a living at a job again. What I have now is what I have. Without taking on more risk than I’m comfortable with my money is not growing.

The really scary part is how little control I have over the expenditures I might have to make in the future. I have kids and even though they’re out on their own — I always feel like I have their backs. And future medical costs, medicines, insurance and rents or mortgage costs — even some taxes and fees are rising faster than I can possibly keep up with — even if I take a risk and get lucky investing. I’m the guy who would cut up his $10K tulip bulb thinking it was a boiling onion. And the real amount of social security in the future looks like a real risk.

[Funny thing — there’s a very old children’s book called “Little Bear” and one of the stories is about a time when Little Bear and Papa Bear surprise Mama Bear by making a stew while she is out visiting a sick friend. They cut Mama Bear’s tulip bulbs into the stew thinking they’re boiling onions.]

I’m frightened to try starting a business. I go along main street and see empty storefront after empty storefront.

I talked to fellow students at the school where I studied glass art briefly and most of them have trouble selling their stuff — some of it quite good — for anything close to the time, materials and skill it contains. If they get even moderately successful with a design they start seeing copies offered from sites elsewhere — China and India mostly.

As for Carla’s advice — the Midwest is a very nice place to live. I like Bloomington, Indiana myself — it may cost a little more than Cleveland (?). Learning to drive isn’t hard.

There’s an old joke that there is no “Life” in New Jersey. There is no “Life in NYC” unless you retire with an income of six figures — and even then you’ll be on the edge.

There is one and only one magical way to resurrect the non-inflationary output of goods and services (aka, the U.S. golden era in economics), and that is thru the utilization of existing savings. The only way to match savings with real-investment outlets is to get the CBs out of the savings business altogether (i.e., eliminate the payment of interest on IBDDs, and gradually lower any interest paid on CB savings accounts).

This does not necessarily create a new demand for loan-funds from creditworthy borrowers. It assumes that the largest creditworthy borrower today is the U.S. gov’t.

What will this do? It will route savings to be pooled thru non-bank conduits. And the CB’s assets and liabilities will remain unaffected. The CB’s liabilities will simply change ownership/title, as the NBs are the CB’s customers. I.e., contrary to public enemy #1, the ABA, the non-banks are not in any meaningful way in competition with the CBs for loan-funds (Keynes’ “optical illusion”). Indeed it is an error to presume that the lending capacity of the CBs is based on the savings’ practices of the public. The CBs could continue to lend even if the non-bank public ceased to save altogether.

However, given the increase in money velocity by activating savings (velocity which has been impaired since the saturation of financial innovation in 1981, and the resurgence of financial engineering during the housing boom), the Fed will have to tighten. Since the CB’s largest expense item is paying interest to its depositors, the reduction in interest expense will offset any reduction in their cumulative size or the volume of the CB system’s assets. I.e., size isn’t synonymous with profitability.

This policy will increase both the NB’s and CB’s ROE, and increase their NIMs. It will produce higher and firmer real-rates of interest for savers and lower loss of bad debt for lenders. It will spur Capex and R-gdp.

To continue as we have for the last 57 years will produce an economic depression, i.e., bottling up existing money. Leastwise you are not convinced, remember that CBs from the standpoint of the system, do not loan out deposits, they create new money whenever they lend/invest – whenever their counterparty is the non-bank public. The 1966 S&L credit crunch is the economic paradigm.

– Michel de Nostredame (the best market timer in history)

It’s simple. And surprising. NSA R-gDp rose by 10 percent for the 7 years starting in 1/1/2007. However, the NSA CPI rose 17 percent during the same period. That’s a loss of purchasing power, and a resultant overall lower standard of living (which when considering the massive transfer of wealth to the upper quintiles), is a dangerous trend. It was an afterthought that I predicted higher murder rates this year last summer.

The next spike in the murder rate is December.

There’s just so much country where there is no economy. To add it up on my fingers, you have a little bit of income through social security/disability, you have scattered warehouse retail, police, and a few county/state jobs, if there’s industry it’s light and doesn’t employ many. What does a rosy jobs report look like for that region? The gas station hired another person for the night shift?

The Hillary plan for that huge swathe is, as far as I can see, go to hell. The lack of acknowledgement is damning.