By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Over the past few days, the Diamond Producers Association launched its first new ad campaign in five years after watching retail sales of diamond jewelry slow down, as Millennials built on the habit pioneered by prior generations of delaying or not even thinking about marriage, and thus not being sufficiently enthusiastic about buying diamond engagement rings.

The campaign, according to Adweek, is designed to motivate Millennials “to commemorate their ‘real,’ honest relationships with diamonds, even if marriage isn’t part of the equation.”

Mother New York, the agency behind the campaign, spent months interviewing millennials, according to Quartz, and learned that they associated diamonds with a “fairytale love story that wasn’t relevant to them.” So the premium jewelry industry, seeing future profits at risk, needs to do something about that.

A year ago, it was Wall Street – specifically Goldman Sachs – that did a lot of hand-wringing about millennials. “They don’t trust the stock market,” Goldman Sachs determined in a survey. Only 18% thought that the stock market was “the best way to save for the future.”

It’s a big deal for Wall Street because millennials are now the largest US generation. There are 75 million of them. They’re supposed to be the future source of big bonuses. Wall Street needs to figure out how to get to their money.

The older ones have seen the market soar, collapse, re-soar, re-collapse, re-soar…. They’ve seen the Fed’s gyrations to re-inflate stocks. They grew up with scandals and manipulations, high-frequency trading, dark pools, and spoofing. They’ve seen hard-working people get wiped out and wealthy people get bailed out. Maybe they’d rather not mess with that infernal machine.

And today, the Los Angeles Times added more fuel. “They’re known for bouncing around jobs, delaying marriage, and holing up in their parents’ basements,” it mused.

Everyone wants to know why millennials don’t follow the script. Brick-and-mortar retailers have been complaining about them for years, with increasing intensity, and a slew of specialty chains have gone bankrupt, a true fiasco for the industry, even as online retailers are laughing all the way to the bank.

“For starters, millennials are not big spenders, at least not in the traditional sense,” the Times said. Yet most of them spend every dime they earn, those that have decent jobs. But much of that spending goes toward their student-loan burden and housing.

Everybody somehow agrees that millennials as a group prefer “experiences” – eating out, traveling, etc. – over buying merchandise, such as jewelry, clothing, furniture, and cars, though they buy gadgets and services galore. But that “experiences” theory too is running into trouble because restaurants are slithering into a recession as sales have hit the skids recently.

So these spending habits of millennials “may not be great for a U.S. economy driven by consumer spending,” the Times points out.

But I wonder: Consumer spending includes a meal from a taco truck along with a craft brew, all made in America, same as a piece of clothing made in Bangladesh. Why would splurging on an “experience” near a taco truck be worse for the economy than buying some imported piece of merchandise? I don’t get it.

And travels? Granted, foreign travel is not good for the US economy. But other generations, too, liked and still like to travel – a lot. Some of us were gone for years. I doubt millennials are more damaging to the US economy in that department than we are.

Domestic travel is good for the economy, thought it may be less good for the environment. Every dime they spend getting there and staying there or having fun – all these “experiences” add to GDP.

But millennials have two problems prior generations didn’t have – at least not to that crazy extent:

- They’re bogged down in student loans, the result of rapacious price increases in higher education. The New York Fed estimates that total student debt from federal and private lenders has reached a record $1.3 trillion. An increasingly large part of that debt sits on top of millennials, turning them into debt slaves.

- They’re facing confiscatory rents and home prices in many cities, thanks to Fed’s effort to inflate the greatest asset bubbles the US has ever seen, though few millennials make that connection.

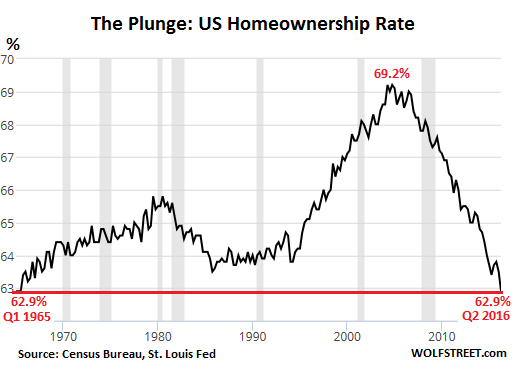

So they rent or stay with their parents or they bunk down together, four or five of them in an apartment in places like San Francisco. Homeownership has plunged to 62.9% in the second quarter, the lowest level since the Census Bureau started tracking it in 1965:

For millennials, the homeownership rate fell to 34%, from around 40% for young adults in prior decades, according to the Times. Given the rents they face, saving up for a down payment has become a herculean task. So forget it. But now the real estate industry is complaining about the millennials. Everyone needs new homebuyers to keep the market propped up and the commissions flowing.

And they’re risk averse and not into starting new businesses, according to the Times, which would corroborate Goldman’s lament about millennials not digging the stock market:

The rate of new start-ups is higher today than 10 or 20 years ago for every major age group — except those between 20 and 34 years old, according to the Kauffman Foundation’s latest annual study of entrepreneurship.

Two decades ago, a little more than 34% of all new entrepreneurs in the U.S. were younger than 34 years old. Today it’s just 25%.

That’s bad news. But it’s logical: burdened by student loans and confronted with confiscatory housing costs, fewer of them have any courage or means left to deal with the extraordinary uncertainties and risks of starting a business in this environment. Given how important small and young businesses are to the economy, to jobs, to invention, to business renewal, and to the middle class, any major reluctance by millennials have in starting businesses will have an impact – or already has an impact.

Over the past three decades, the US averaged nearly 120,000 more business births than deaths per year. But between 2008 and 2011, on average 30,000 more businesses died than were born, according to the Census Bureau. That the core of the US job creation machine has been faltering is not a sign of a healthy or even a “recovering” economy. Read… “Or We’ll Lose the Whole Middle Class”: Gallup CEO

Millennials – mobile labour come to its conclusion w/ a slice of disdain for the past and its baggage…

Total cost of Iraq war (excluding future benefits owed servicemen and women): 2 trillion

Total student loan debt in US: 1.3 trillion

Which use of gvt funds would better serve domestic economy do you think?

Depends, Which domestic economy are we talking about. The answer to that depends on the tribe one belongs to, oligarch or deplorable with less than 1000 USD in savings, one medical bill away from the gutter.

The problem might go a bit beyond just non rose colored glasses from the mill-any-allz…there are more than a hand full of special interest groups who are all taking/skimming one or two percent out of the economy and they either dont see or dont want to see there are 35 to 50 $pecial interest groups all taking their “little” cuts…

lingchi…

Boomer 1: Why don’t the debt slaves buy more at the company store?

Boomer 2: Because they’re lazy entitled hippies who don’t understand that we can’t get richer if they don’t borrow more to buy the stuff we make them make for us to sell? They don’t think we could pay them more, do they?

Boomer 1: They’re stupid, but not that stupid. Clearly that would make us relatively less rich. Besides all we needed was bootstraps, a destroyed Europe, parents willing to retire, cheap education, massive subsidies for our lifestyle (if we were white), world-class infrastructure, and highly progressive taxation.

Boomer 2: I know, right? Bootstraps and hard work was all it took. What in God’s name is wrong with them? Couldn’t have been our parenting. We were clearly the best parents in history. It must be the damned cell phones.

Boomer 1: What should we do?

Boomer 2: Lets try insulting them. I think their problem is not having been insulted enough.

Boomer 1: That’s a great idea!

Excellent. It’s funny cos its true

Sad cause it’s true…

Absolutely true. That’s why we can’t ” make America great again” there no longer exist all of those global advantages.

America still has one option for greatness – one we haven’t tried yet – ethical finance.

“You can always count on Americans to do the right thing – after they’ve tried everything else.” – Winston Churchill

I ran across this article about the Millenials by a young Italian marketing wizard / blogger. Similar sentiments, although young Italians are distinguished by moving to the North and by strong connections to music, which means that culture provides a social life that (maybe) U.S. Millenials lack.

http://www.ninjamarketing.it/2016/09/29/i-millennial-italiani-in-5-punti/

Even if you don’t read Italian, you’ll recognize the themes.

I’ve never made the “Boom!” (as in bomb) connection with Boomers before but how ironic is from “Give peace a chance” to “Give blowing to pieces a chance”?

I’m a boomer myself but made the opposite journey, thank God.

War is never too expensive.

Roads, college, healthcare, housing, jobs? Time for a GRAND BARGAIN…

Damn boomers

+10000

Lol

The author misses the obvious conclusion – millenials where Putin’s idea to defeat Hillary Clinton. It’s Russia’s fault.

I always like to fall back of that classic quote from Marx:

Karl or Groucho?

The plural of SOB is “Sons of Bitches,” just FYI…grammatically correct profanity is important, you know ;-)

This piece also misses that the jobs lots of millennials have had to take aren’t very good ones.

Hard to buy diamonds with the money you make from your 25 hour a week job at Home Depot.

this probably has more to do with it. since most of the entry level jobs that used to be in the US are gone now

yes it is the Toppers (new term for the1% ) .Are doing a great job of dividing us e,g. yes infotainment industry CNN to Disney . Starting with depression babies (My parents) to the Millennials. I knew it was a scam started under Reagan and now both the dems and Reps . being disabled American, us disabled are the worse off ,if African and Hispanic your worse if your disabled too. also we die younger some of us. What crock a future you can believe in %$#@ .

Thanks to all. Writer and commenters.

They’re facing confiscatory (had to look that one up) rents and home prices in many cities, thanks to Fed’s effort (short sighted rigging) to inflate the greatest asset bubbles the US has ever seen, though few millennials make that connection.

Did anyone see the people the study that the DC bureaucrats think we dim witted?

The fact that they haven’t been on the receiving end of torches and pitchforks supports their argument.

Of all the sectors that are a waste of energy and resources, that one takes the cake. Not to mention that it’s the poster child for fake scarcity.

Maybe they don’t buy them because they know that unless they are lab produced, most diamonds are built on other people’s suffering (blood diamonds). What kind of heartless person buys diamonds then? Not that that is the only industry built on human suffering, but it is an ENTIRELY superfluous and unnecessary industry which makes it much easier to avoid than something like electronics that is entirely a part of modern life.

Concentrating all the capital among a few people is good if your society is making big capital investments, like massive dams, but not so good if what you want is consumer spending. Of course these people aren’t doing the big capital investments either.

Beyond the economics, many of us find it icky to flaunt a rock worth enough to feed several children from birth through adulthood, particularly given that it’s only practical purpose is to signal status, and that more than a few human rights were likely violated in the process of acquiring it for us (even if it’s so called “conflict-free”). The boomers still fail to grasp that we hold different values from them in many regards.

History will not be kind to the generation that created the second gilded age.

Sadly, many of them have already died without any comeuppance whatsoever.

I shall not weep for them when the bottom falls out.

The good part of this is (hopefully) lower consumption in general. Consumption consumption consumption is THE evil of our neoliberal capitalist system. The demand for more and more consumption of shit made from dwindling/non-renewing resources. More more more damnit! Buy more! Have more kids so you can buy more for them!

I would hope that what is coming is LESS consumption, LESS desire for shit for shit’s sake (though this doesn’t apply to iPhones, apparently, since everyone ditches their previous year iPhone for the latest version EVERY DAMN YEAR as if their previous version is junk and incapable of performing anymore! Hell, I buy an Android smart phone and hold onto it until I do something stupid like lose it or break it. It works and works well so what’s the point of getting a NEW one every year?!)

Less consumption, a force from below where real change always derives, could be what is needed to end neoliberalism, consumption capitalism, and the destruction of the planet. Let’s move to a steady state economy where people only buy what they need when it’s needed. No more designed obsolescense, no more tickytacky McMansions going up in droves on land needed by deer, antelope, etc. Good enough is good enough. Hell, I’d like to see a tax on houses that built too big for the people buying it. A family of 3 or 4 simply do not need a 3000 sq ft home. I grew up in a family of 8 in a house that was no more than 2000 sq ft and we were fine and comfortable. Don’t BAN people from buying more than x sq ft/person, just make it more and more expensive the higher they go above x sq ft/person. Taxes are ONLY for discouraging damaging/harmful social, environmental, and economic activity so lets dive in and really start using them for their only function. Stop using them to encourage McMansion building and buying. Stop using them to encourage bigger and bigger families (only give the full child tax deduction for the first 2. After that cut it in half for the next one, then half again for the one after that).

My hope, obviously, is that millenials will force a change in our economy from below though it is a weak hope. As soon as they get a buck in their pockets or get off their student debt, I expect they will explode with greed like everyone else and buy buy buy shit for no reason.

As for diamonds and jewelry…what a useless activity and product. I can’t feel sorry for the diamond cartel artificially (literally) jacking up demand and price on rocks that are actually quite common. Jewelry simply doesn’t drive much of the economy or serve any valuable function. Baubles are crap.

What you say is all true but never going to happen in a society that presents Hillary Clinton or Donald Trump as possible POTUS. I believe Why America Failed by Morris Berman should be mandatory reading for everyone who wants to know how we got here and why collapse is inevitable.

But those baubles have a ‘sacraficial’ use … for when a Wall Street priest, welding a goldman’s axe, kicks a Milleinnial off the top of the Pyramid … !!

all may be true. but then who will employ any one? as it is, the US has exported US jobs to LCC, and automated a lot of the others. so unless we are going restrict the number of children that parents can have (even though we are already starting to not have enough births to keep from loosing population, and also heavily reduce the number of immigrants ti the US too) with the goal of reducing our population to say 1/3 to 1/4 of today’s population we wont have jobs for many

The values revolution is clearly underway and has been for decades. It is accelerating today and is evident in the occupy story, the diamonds story but immensely more evident in the recent Bernie Sanders story. This is where the number of people desiring change and willing to come out for it were plain for all to see. Just do it yourself, don’t wait for the controllers of ‘our revolution’ to do it for you.

Our blind consumption lifestyle was and is unsustainable. New value relationships are forming and refining the methods explored centuries ago and better informed by science and global information. Take a look at David Graeber’s thinking and story telling; it points the way toward more serviceable and resilient economic and social relationships that may well be kinder to our planet.

The most immediate need for all people across the world is debt cancellation, that is a global jubilee! for all. The consequences of that one step are revolutionary. Demand global debt cancellation now.

Debt cancellation without a revolutionary lifestyle change to go with it will only bring back the suffering with time. Mindless consumption is what needs to end and maybe the debt burdens we are all facing are a blessing in disguise. We are forced to reevaluate our place in the world and how we do things.

Sustainable living is what is under way and how resources are managed is the key to moving forward. It is a cultural shift- or rebirth if you will.

Somehow, a culture based on individual consumerism as the driving force doesn’t seem likely to survive. When the debt burden can no longer be kicked down the road, it is essential that the tools for living a sustainable life have been mastered by a least a few people and communities.

Debt, investment, and risk management are three interrelated phenomenon that are totally out of balance in our current society. Until there is agreement on the purpose for any effort, no balance can be achieved. Class warfare results.

It is the lifestyle change that is resisted the most, debt is just a powerful tool used to undermine that change.

I don’t think that it is fair to call Millenials risk averse because they are not starting new businesses or investing in the stock market.

I suspect that the former stems from a lack of business access and of credit. Many of the most successful entrepreneurs of a prior age started working in “the business” before taking credit and starting out on their own. Put simply, it is hard to get into a market if you can’t get a job in it in the first place, and it is hard to start anything if you already are burdened by debts.

On one level this is the same reason that the projects and other depressed communities have not been the “innovation hubs” that David Brooks keeps ordering them to be. They have no access and can get no credit. What do you expect?

In the latter case, an unwillingness to invest their meagre savings (if any) in the stock market is hardly a sign of risk aversion. I would say it is a sign of intelligence.

The good old fairy tale of capitalism. Time for money (credit) creation to democratized. Germany set up a state-run bank to lend to industry and SMEs. It’s regarded as the safest bank in the world.

Not starting new businesses? I think the Libertarians are FOS, but this example shows why starting a business is nearly impossible in some places:

http://www.oftwominds.com/blogaug15/destroy-jobs8-15.html

” I signed a lease with the property owner for his 1000 square foot space. I contracted with a general contractor and designed the restaurant floor space on a CAD program I have on my office machine.

…I knew all of the permits needed in order to open a regular business. First, I had to have my attorney file for incorporation in my state. Then, I secured my FEIN (Federal Employer Identification Number) from the IRS, opened a bank account, got my sales and use tax permit (to collect sales taxes) from the State and contacted the person at the state level who is responsible for food establishments at the state level.

The inspector who is responsible for my geographic area.. at the state level told me that since the space had not been a restaurant for a few years, I would need to pay additional fees the first year and my endeavor would be treated as a “new” retail food establishment. The cost was an additional $500, but that’s just the way it is. The property already had a grease interceptor (1500 gallons), floor drains, a mop sink, air exchanger on the roof and was mostly plumbed. I’ll get back to this later.

I submitted plans to the state contact person and was told that my symbology was not standard for the plumbing and electrical. The suggestion was made that I seek the services of an architect. Very well. I did. I found an architect who has done some restaurants in the area and we got to work. I submitted my floor plan to him, which he said was very detailed and seemed to use the space to its maximum potential. However, he did mention that if I were going to serve one single person as a dine-in customer, I would have to have at least one ADA compliant bathroom….” It gets far worse, read it to the end and see what happened.

try opening a business in many countries today, and you will find that the US is so much easier than any place else

worldwide

Your probably joking right? Which countries are your referring to exactly?

Germany, yeah probably worse. Czech Republic, easy as pie (and they are one of the more entrepreneurial countries in Europe). Africa, India, China, super easy to open a business (assuming your a native, obviously).

It might be easy to open a business in America…if you have $2 million to throw at it. So much red tape, legal fees/state/federal fees, restrictions, permits it is an absolute nightmare.

When I was planning to open up a nanotech manufacturing business, I realized it was cheaper to simply buy an older manufacturing firm, sell the old equipment, and get a few additional permits. If I had to start it from scratch it really would have cost me around $500k just for the permits & fees.

no

and try opening one when you cant even find out the rules, because they arent published (some countries might have fewer ‘published’ rules, but make up for that with lots of unpublished ones). the US has lots of rules, and almost all are published. i have little sympathy for those who ignore the rules by just not bother to read them. and lots of those rules come into existence because some company took a short cut and some one was killed or injured. but then some of the rules came into existence because of other oligarchs wanted to slow others from getting into business

You think!?

You can open a business in Denmark in about one hour, online. With none of the US nickel & dime bullshit.

We have none of this ‘code’ business either, our laws are generally goal-oriented, not prescriptive like the US.

If you want a limited liability company, there is fee of about 300 USD. And some paperwork. This will take 5 days max to get processed.

The Deutsche Industriebank will provide finance of up to $25 million to a manufacturing firm. But it does take about a week to set up a company, so yeah, pretty anti-business.

Dude, please don’t complain about the ADA compliant bathroom. Why should some poor soul be trapped in your restaurant’s abysmal bathroom?

“In the latter case, an unwillingness to invest their meagre savings (if any) in the stock market is hardly a sign of risk aversion. I would say it is a sign of intelligence.”

only it’s really NOT at a certain point (though if they have less than $1000 it should be in the bank/credit union/etc.). The only game in town to not be in dire poverty when one is older may be putting at least some of that money in the stock market especially as buying a house is out of most people’s reach at this point and few have pensions etc..

Do I think this is how society should be run? Heck no. And if millenials don’t want this they should invest in: ACTIVISM!!! Full stop.

But it is the way it is now so if they are trying to deal with the problem on an INDIVIDUAL basis then …. well yea.

It’s quite simple: when you have no savings beyond $1 or 2k, you don’t invest in the stock market. You save those couple grand for a rainy day when your car breaks down going to work, or you need some new dress shirts.

I don’t think baby boomers understand: salaries remain virtually unchanged, food is 15x more expensive, college is 50x more expensive, healthcare is 100x more expensive, and only jobs available are low paying, grueling jobs with not even an inkling of future advancement. And of course, the baby boomers are up to their knees in debt, which means that the millennials cant simply borrow/inherit their wealth (like the baby boomers did).

Well why wouldn’t baby boomers understand? Ok not many of them are paying for their own college at this point. But they eat as well. They pay for medicine (and the millenials might not know this, but it costs a HECK of a lot more for medical coverage when you aren’t a 20 or 30 something) at least until they get *some* relief when they finally qualify for Medicare. It’s like the article is arguing noone older than a millenial understands that rent is expensive. But come now, this is ridiculous. While some people bought years ago many people of all ages still rent. The only thing that can be said of generations prior to millenials is they may have less college debt and some of them may have got a better start on a career (but not everyone perfectly planned their career at a very early age either so …) and a head start on savings (same thing).

2006-2016… “The Decade that Velocity Died” (Regarding the relentless decline in the Velocity of money, sung to the song American Pie, by Don McLean)

https://fred.stlouisfed.org/series/M2V

Gee, I wonder why? Seems to me that blaming the victims, while consistent with previous behavior of the control group “insiders”, is counterproductive in terms of improved public policy, including monetary and fiscal policy.

Japan was an early warning, and we didn’t heed it…

The vampire squid needs new blood.

Welcome to Capitalism. It’s baked into the cake.

“You’re born, you take shit…

you get out in the world, you take more shit…

climb a little higher and you take less shit,

until one day you’re on that rarefied atmosphere and you’ve forgotten what shit even looks like.

Welcome to the layer cake son…”

Millennials get to eat shit and go die.

Thank you for running these pieces on “millennials” (insert obligatory hatred of word “millennials” here). Its nice to finally have a conversation about the economic situation of my age group without the words smartphone and social media shoved into every sentence.

After about 6 years of dating I’ve (finally) decided to pop the question. Honestly we’ve been ready for 3 years but as we’ve been living together during that time period there just hasn’t been any rush. We see each other everyday, share almost every expense, and do pretty much the same things married couple do. Dropping several thousand dollars for some jewelry and elaborate ceremony when half your paycheck is immediately taken by rent, student loans, car insurance, etc. just seems absurd. We already live together, why does all of this spending somehow make it more “official”? Why do I need to buy a 24 karat gold band with brand new diamonds guaranteed to appreciate in value over time***? Does the jeweler somehow think we’ll need to sell this thing some time down the line to pay for food or something?

Its not like we’re some sort of financial basket case unable to pay for food and shelter. But the money we bring in is almost immediately taken by some other entity, our job security is weak, and there’s just not enough money saved up to absorb a large unexpected emergency. Why the hell would I want to buy a house and add more stress to our already strained wallet? Why would I put the money I earned into a stock market which in some case is literally designed to swindle small investors?

I mean I get it: most college grads enter the real world struggling to start their lives and remain financially stable. However the future just appears so bleak… The Archdruid made a good analogy in one of his recent posts that I think sums up the feeling. If your at the ocean, its hard to tell immediately if the tide is going in or out as waves are constantly crashing on the beach. However, if you keep track of it over time you can eventually make out the tide. Currently it looks like the tide is going out.

***The ring I’m using was given to me as inheritance from my grandmother, so its priceless and therefore can’t appreciate in value over time ;)

Congrats! I just won’t let myself date anymore because I can’t afford it / too depressed about not being able to afford it. That, and I can’t in good conscience have kids. No need to make them suffer as sea level goes up two feet by the end of the century.

I’m 54. The last year of the boomers. I married my wife of 25 years (3 kids, 3 grandkids now) in my living room. My mother performed the ceremony. We each had one best friend to be witnesses, best man, maid-of-honor. Had a party with the rest of family and friends that night. In our back yard. Strung some Christmas lights, plenty of alcohol. Probably spent a couple of hundred dollars.

She’s a fine woman and its been a great life. Don’t buy into the scam for appearance’s sake, you don’t have to.

Good on you Jon: words of wisdom.

Congratulations Ultra.

I have some friends and acquaintances (all Hillary voters, natch) who are desperately trying to keep up appearances with the big wedding (all parent funded) and the house in the suburbs (falling apart, also completely parent funded). I don’t see it going well for them, and the rest of us all think they’re nuts.

My wedding dress cost $20 at a sample sale, and I proudly wear my grandmother-in-law’s ring. We’re celebrating our 10th anniversary this month.

Congratulations. My son just married. The county didn’t have an officiant, so he called and asked if I could find on. They came to our house, we fixed a nice surprise dinner, they signed the paperwork, we had a toast and that was it. I’m glad we get to help find furniture etc rather than pay for a party.

Congratulations! For the record I agree with you that the whole concept of paying for an elaborate ceremony and all the little things at the margin to make your current arrangement more “official” is not a great use of resources (limited or otherwise).

That said, there are some practical advantages to having .gov recognize you as a married couple:

– you can pass unlimited assets back and forth to each other free of gift tax. This can be very important if one of you passes prematurely – the surviving spouse can inherit the estate completely free of tax even if there’s no will

– you can file taxes jointly

– you get next-of-kin rights in case there’s a medical issue for one of you

– health insurance through an employer can be tricky at many companies if you’re not married

I’m of the opinion that people should be able to pass property at their death or incapacitation to whomever they wish and any tax treatment would be consistently applied regardless of the relation of the receiving individual, but as it stands now the rules are written in such a way as to favor married couples.

Thank you for the kind words and advice everyone!

>Does the jeweler somehow think we’ll need to sell this thing some time down the line to pay for food or something?

They don’t actually appreciate don’t let them fool you. Try to sell one back to the jeweler, you’ll (if lucky) get offered 1/5 of what he sold it to you for – we tried this a long (long long long) time ago since my wife lost her diamond horseback riding. The insurance company bought us a new one, but it wasn’t the same diamond and she sure wasn’t going to give up the horse and horses are expensive and she had a wedding ring then anyway so wtf why keep it. Rather have the cash. That’s how we got reality explained to us (is there another word like mansplain? Oldsplain maybe, the old instructing the young — except in this case it is equally excruciating but sadly actually useful.)

So if you did want a “down the road” security blanket and it didn’t have “sentimental value” I would sell it right now and put the money under the bed, it would do better.

Quote of the day: ” Wall Street needs to figure out how to get to their money.”

Well, it is “God’s Work” don’t ya know.

like ticks on our backs, they produce nothing but misery.

la solution est la guillotine

The Economist wrote an article about this a few weeks back, “Why don’t millennials buy diamonds?” and tweeted a link to the article.

Someone replied, “I work at a grocery store”.

Something like half of the post-1990 ‘inflation’ is due to higher education, health care, and housing.

Millennials are exposed to the housing market – right now starter homes are spendy because rents are high enough to support developers / land lords buying the houses and renting them out. So high rent levels support high housing prices and high housing prices support high rent prices and cities seem reluctant to approve developments (or make it financially viable to develop) sub-300k housing (at least in my metro).

The affordable care act makes it difficult to realize healthcare cost / insurance cost savings if you’re young and healthy.

And to set yourself up for a job that lets you pay to live, you have to get a skill. Whether it’s a white collar skill (programming) or blue collar skill (welding), you’ll probably have to pay tuition to get some sort of certification or signal the skill to employers.

That said, people need to realize the high cost of post-secondary education and pick degrees that maximize their chances of servicing their debt. I know too many people who have an art degree which cost more than a luxury car.

short version: the game is rigged, hope you were high-born otherwise it’s debt slavery, low-wage work, or both.

Getting the right training for the open jobs today neither creates enough open jobs today for the people that want them nor prepares people for whatever jobs will happen to be open tomorrow. Jobs that people can not afford to take because they pay less than it costs to live don’t help either.

Learning how to see, think and actually physically create actual things in the world, what an art degree prepares one for, is how futures get invented. Trade school is how we cling to a dying past.

It seems like consumer spending is the only thing that pokes, prods, panics and debunks the yaysayers running around pointing at their charts and telling us how good things are while they chant “Recovery–roaring ahead!”

The 70% of Americans who can’t come up with $1,000 in an emergency might disagree.

In solidarity with the 70%, and to debunk the political-economic-witch’s cauldron of doubled debt, toil and trouble, my politically motivated friends, all of whom read N.C., and now Wolf, are going to do the following:

Go on a buyer’s strike until after the election, after the hideous Black Friday cultural corruption, after Christmas and until Inauguration Day.

Most middle and upper income households have more than enough liquor, supplies and stuff in them to allow holding off on all discretionary consumer purchases for several months.

Throw a big garage sale and donate the rest to a local thrift shop. Buying a car? Do you know how much cheaper they will be in January?

Just do it! Do I owe a licensing fee to someone for saying that?

Diamonds as an investment? You would be lucky to get 20% of the retail cost if you sell them.

Wall Street especially has nobody to blame but themselves. The same could be said of all of corporate America.

This is the product of decades of a war on employees. Today employees bear all of the risks, from permatemp jobs to no job security to fewer benefits to wages that don’t keep up with the costs of living. Meanwhile, other costs such as rent keep on soaring.

Since the early 1970s, there has been a wage productivity gap. The money has all gone to the very rich. When you don’t pay people their output, then aggregate demand goes down. This should be economics 101, only they are blinded by greed. Eventually the debt filled bubble would bust and with it, consumption.

Wall Street especially has nobody to blame but themselves.

And their enablers. Think deposit insurance is for the sake of depositors? Think again.

The irony is that investment banks (i.e. “Wall Street”) are not inherently unethical being uninsured by government. To find unethical, one need look no further than his commercial bank or credit union where the poorer are forced to lend (a deposit is legally a loan) to lower the borrowing costs of the richer.

The word is “Oligarchy”

La solution est la guillotine

When I saw this I thought… what is the age bracket for millenials? I immediately dumped that, barely skimmed the article because I wanted to see how long it took to blame the boomers. Looks like the ‘uninformed and compliant’ elite propaganda is going swimmingly. Labor and students attacking each other instead of the oligarchs.

Of course, I don’t recognize any of the names doing it.

Gen Xer here. I have been married twice and divorced twice. I think a decent ring is important to a woman but what is not needed is a marriage certificate. It has become a license to rob a guy when the ultimate ‘prince’ (which doesnt exist in the real world) doesnt show up. Woman want a strong guy, one that relates to there feelings but does not cave in and leads.

As men have less opportunity in a depressionary environment this becomes harder but not impossible. A ring says commitment but if it is too small or a marriage license demanded, say goodbye.

As for generations, my Grandmother was Greatest Gen. Lived Great Depression and WW2. She was an RN, my Grandpaps and engineer. Bridge builder. After the massive credit boom and bust she never fully trusted bankers. She bought stock in Exxon in 1962. Think about that. When trust is destroyed it takes decades to rebuild.

Millenials, are broke after general cost of living. When this changes, they will pursue wants over needs but I do not see this changing any time soon. I do not blame them for living at home if they can with parents or consuming less. They like the rulers of the 1920’s deciding on a massive credit boom have zero to do with those decisions. Current business owners lament while those that created the eternal, ultimate scandal have retired to a plush lifestyle free from such mundane worries of rent or education.

My HOA condo is nice. They are wealthy snowbirds. It is full of Boomers admitting they had it good and retired while it was so. I can at least admire there honesty. It is bug biz and .gov blaming them for lack of purchasing power. Lesson probably never learned: Do not let them steal it in the first place.

That chart about home ownership needs context: The run-up starts in 1994/95. I was working a temporary job back then, and a woman cutting my hair told me to get into real estate. I protested that I didn’t have a steady paycheck, had no down payment, and she said it didn’t matter. I finally said that I was a communist and didn’t believe in ownership. I figured that if $15 hair stylists have second gigs as real estate agents, then something funny is going on with the home-buying situation.

It is impossible to explain to an Oligarch (or one of their apologists) that it is better to have a *smaller* part of a *growing* pie as opposed to a *larger* part of a *STAGNANT* or *SHRINKING* pie.

It’s as if we’re playing financial musical chairs and if you just got to the game, tough shit for not being born 40 years earlier.

Yeah. Global warming. One planet. There isn’t going to be a growing pie.

The rate of technological progress isn’t constant. One might argue many of the wonders of our information age are mass produced versions of trinkets which once astounding dedicated crowds.

What an extraordinary piece of whining by the Diamond producers Assoc.

Which bit of “you can’t get blood out of a stone” have they failed to understand ?

Boomers didn’t spend a lot of money on weddings. (We spent $1K on ours in 1980.) Expensive weddings became popular in the ’90s.

Another thing to consider is the impact of the internet and “app” economy on startups. All sorts of services, and the entire Retail sector, are centralized through internet services now, so the possibilities Millennials have open to them re: starting a business are more limited, and more specialized. Not everyone can open a restaurant, for instance, and the possibility of interference from extortionary internet review-services(such as Yelp) makes that even chancier.

So not just less money from an under-employing, boss-favoring economy, not just more debt from school, an over-heated housing market, and the move in service pricing models(credit cards, phones, ect) away from manageable fees and towards lifelong managed debt, but also more restricted entrepreneurial opportunities in a more monopolistic and centralized marketplace.

Blaming The Millenials for “this” is like blaming The Boomers for “that”. It is strategic hate management as Lambert Strether has called it.

And of all the unnecessary things in the world, gem diamonds are uniquely unnecessary . . . right down there with gem sapphires and gem emeralds and gem rubies.

No one ever died of a gemstone defficiency.

Great site – I’ve enjoyed reading it daily the last couple of months. Just wanted to comment as a Early Gen Ex… almost Boomer. I can’t comment on whether the Mils are ‘blaming the boomers’ but I can tell you my peers all spout the same nonsense, or talking points about the Mils. It’s like they are brainwashed. They talk about cell phone costs, bratty behavior, entitlement, “Art Degrees”, and on and on with the same old blame the victim mentality.

I remind them how most of us paid full tuition, books and for apartments with room mates in college, by working part time during the school semester and full time in the summer, for minimum wage at $3.25 an hour. My boom/gen friends all like to brag about how they worked through school and paid for their college without debt. They act clueless why the Mils can’t do that.

My tuition/books in my last year of college in 1989 were $500 for 15 hours. I have the receipts. Last Spring’s tuition for 15 hours at the same non-descript state-owned University is $5000. That’s not counting books. Apparently my peers can’t do math. I put it in terms to them, that to pay for school like we did then – min wage would need to be $32.50/hr. Their only reply to that is that would be too high of min wage.

These are my friends – and I don’t know if they are really that stupid or just jerks. I can’t relate to their opinions or idiotic reasoning. For what it’s worth – I’m 100% behind the Mils- I think they’re getting a very raw deal. They are our future – and the Booms and Gens should be appalled at what’s happening to our younger folks, and if they can’t manage that, they at least need to curtail their baseless ‘judgments’.

It’s really distressing to read this. I sort of hate running articles like this because generations don’t have agency, as in there is no Millennial or GenX party, this is just one way marketers target people, the same way they also target people who have pets or people who have kids. The Boomers get blamed for bad policies when that was a multi-generational affair. And how much does a Boomer blue collar worker who is now unemployed and the best he can probably get is a WalMart job have in common with a Boomer who is in private equity, has five homes, and rides in private jets? The differences within these age groups are greater than the differences between them.

But it is pretty astonishing to see economists and policy makers grouse that young people aren’t buying houses and cars and having kids like they are supposed to….because the job market sucks and many of them have a lot of student debt.

Bravo…. !!!!!!!!!!

Yeah, these lazy hippie slacker Millenials who won’t commit.

They said the same thing about the Gen-Xers and the Boomers (Lasch’s “Me Generation”) and no doubt about the Boomers’ parents’ generation before them.

This pop sociology stuff is all wet.

I chuckled. I am one of those that complains about some of the choices of my millenials. The reality is… we all make what others consider irresponsible financial choices and hope to improve with experience. I don’t think the generations are different. I can look at elderly parents and a young grandkid and it’s all the same and no generation is smarter or works harder than others… housing, food, transportation, health care and hopefully a little something extra so that a person can enjoy their brief time on the planet.

I would expect a younger persons spending to be more erratic. I have always told mine to try new things as ‘no’ is always an answer….. then I slip and think that there might not need to be help with car insurance if a certain person didn’t have cable. mumble, mumble.

Didn’t mean to sound so ‘harsh’… on my peers out there. I see your point about cable and car insurance. :) I remember it was quite awhile before I had cable after graduation. My parents and I sure had that same conversation back in the day. :)

My concern is for this student loan debt hanging over so many of their heads- like some indentured servitude. My peers seem to refuse to see it’s a very large issue that ultimately effects all of us. (or at least diamond sellers, lol) I am disturbed at how many of my peers seem to just except it – and aren’t talking about what we can do to bring costs down (eliminate student loans and cap foreign student attendance (imho)), only justifications and acceptance of the situation, and a lot of scorn and judgment directly to Mils – that amounts to nothing more then “Suck it up”. It’s also an opportunity for them to brag about how they accomplished it (yah, right during the affordable college days…don’t break your hand.)

I don’t know anyone that graduated with a 4 year degree back in the 80’s that left school with any type of significant debt. Most had none at all. Some dropped out – but still no debt, it seemed the majority of us paid as we went, taking out financial aid and paying it back before the next semester.

We were called “Slackers” back then in the early 90’s… a lot of us had “McJobs”. I remember those lean days – wondering if it would always be like that. But my God… to think how that would have felt with massive and growing debt over my head …. I can’t fathom it. What I do imagine is that my life would have turned out completely different, and I certainly would not have had the financial freedoms to take the risks I did after graduation to get to where I am today.

In the affordable college days only 25% of the population graduated college. Really look up the stats for the 1980s. It’s NEVER been the majority. Although it’s probably quite a bit higher now (job market more harsh for one thing). So just how many people is this really talking about, certainly not some whole generation.

You might want to just point out that the cost of college has gone up 300% every 20 years.

http://www.usnews.com/education/best-colleges/paying-for-college/articles/2015/07/29/chart-see-20-years-of-tuition-growth-at-national-universities

I read this crap all the time about generations, and it really getting out of hand. Lots of good comments here, and I have to say many of us know what’s happening to Millenials and other generations through globalisation is in part why we see Millenials not having full time jobs or a sound future as other generations had. Ok, some have good jobs, but it’s not uncommon even in silicon valley for software engs living in trucks or vans as they still can’t afford to rent. There is a lot of anxiety not only with Millenials about the future. So while some can make it’s getting harder to have a good life and future and that is a disgrace on our societies. It’s sick, and action really is needed, but politicians/corporations want it all…there isn’t enough wealth for anyone else. It’s a complex problem, but eventually there will be no GDP when most people have nothing to spend.

I cycle with a lot of Millenials and they are not lazy, and seek that job/future, but try it on if they clearly there is no clear future, and as full time jobs disappear. Ask any university professor how many of the students get jobs now, and you’ll be surprised. Also, don’t forget those over 40 now who are seeing their job prospects also disappear, and strong ageist policies in many companies.

Anyway, it good the issues are being discussed as they were not for a long time, and this has been a problem for quite some time now.