Despite the considerable inertia of consumers and businesses, the widespread reliance on the internal combustion engine, and the reluctance to increase energy taxes in a weak global economy, oil companies increasingly forecast that a peak in oil demand is not all that far away.

Admittedly, how quickly that takes place depend on when national government get (more) religion about curbing greenhouse gas emissions. According to the Wall Street Journal, the International Energy Agency has a default of oil demand continuing to rise in the face of collective inaction. However, it’s worth noting that the IEA’s shorter-term forecasts have a bullish bias; will this prove to be true of their long-term scenarios? For instance, young people in the US are not only not keen about car ownership but some are even are ambivalent about having children. They are concerned the combination of environmental decay and escalating conflicts over resources means any children would have a poor quality of life.

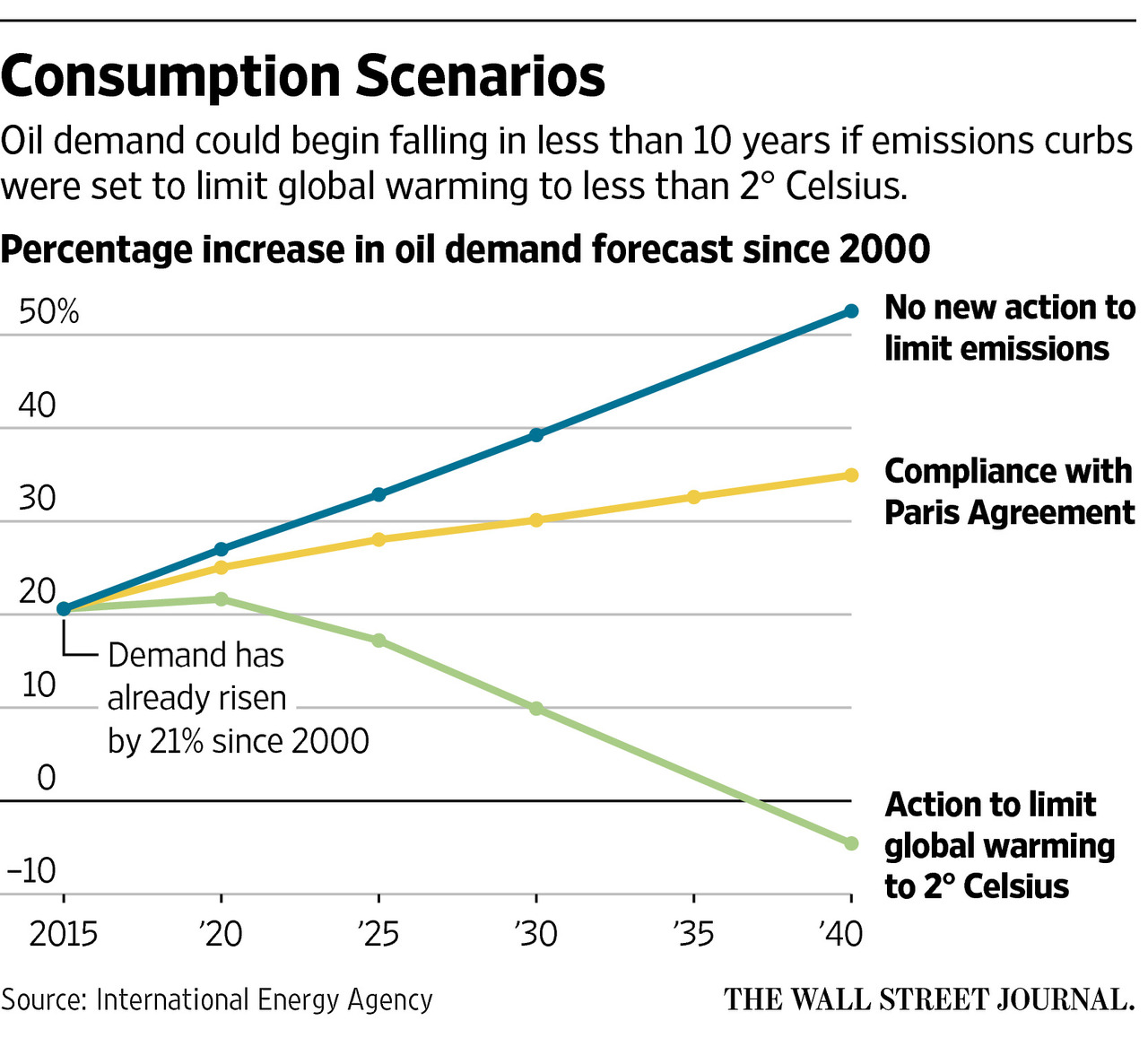

Put it another way: I’m skeptical of simple linear projections over periods of decades, which is what the top line in this chart amounts to:

The Wall Street Journal describes how a number of small and large oil companies are worried about peak demand for oil, starting with Hungary’s MOL Group, which plans to reorient its business over the next decade to focus on petrochemicals, which it sees as having sustained demand, and away from fuel products. From the Journal:

Last month Shell finance chief Simon Henry caused a stir when he said the company sees oil demand peaking in five to 15 years. Shell’s latest published forecasts have consumption flattening toward the end of that period.

State-owned China National Petroleum Corp. quietly issued a report in the summer predicting that China’s oil consumption—a major driver of growth in recent decades—will begin to fall by 2030, if not sooner. Global demand is expected to follow suit…

“The question is more a question of when, rather than if,” Dominic Emery, BP’s vice president for long-term planning and policy, told the Economist Energy Summit in London this month. BP says oil demand could fall by the late 2020s if tougher emissions laws are enacted…

Peak demand “will be later than the common dates that are being thrown around, but if it does happen, because we’re building multiple engines for the economy and we’re planning for an economy beyond oil, we’ll be ready,” Saudi Arabia’s energy minister, Khalid al Falih, told a conference in Istanbul last month.

Needless to say, other big firms, such as Exxon, remain optimistic, and OPEC forecasts that demand will grow beyond 2040. But BP and Total, among others, are hedging by building up alternative energy businesses.

As Wiliam Gibson said, “The future is already here — it’s just not very evenly distributed.” But a question to readers: the underlying assumption in the Journal story, which appears to reflect conventional wisdom in the oil biz, is that more stringent regulations on greenhouse gas emissions is what poses a danger to oil demand. I wonder if that is the only mechanism by which that could occur. What look like economic tail events, like a hard landing in China, or generational changes in attitudes towards energy use, could have a significant dampening effect. Another negative would be a rollback of globalization, since shorter supply chains, generally speaking, should mean less consumption of fuel for transportation. While the plural of anecdote is not data, I wonder what positive and negative development readers see on the ground from your vantages in the US and abroad.

I think its highly likely that oil demand is already at a near peak. For one thing, while cheaper oil has had some impact, its had much less of an impact on demand than historically might be expected, which strongly indicates to me that the slowdown in demand from around 2010 was as much structural as related to price – at least in US/Europe.

Much – of course – depends on future demand in China and India. I suspect neither will grow as much in the medium term as many anticipate. China is hitting hard at the middle income trap – I suspect it will not break through it, which will put a cap on car numbers, and concerns about air pollution (which is horrendous this week in Beijing), will curb construction of highways. India seems incapable of getting its economy right, so while I think individual regions will do well, it will not grow as much as expected – the Nano (the mini car developed for the Indian new middle class) was a flop – I suspect that there just isn’t the infrastructural capacity there for major growth.

In terms of individual cars, I think current oil prices have just delayed the introduction of much more fuel efficient and electric vehicles. From what I can see, most of the European major manufacturers are making a rapid transition from focusing on diesel to hybrids.

A key point I think is that so far as I can see, there has been a reluctance in the industry to invest in new refinery capacity, which is a major constraint on growth – and to me indicates that the oil industry has suspected for years that gasoline/diesel consumption will not grow as much as assumed. Even with the huge growth in tight oil capacity, its notable that nobody in the industry seems interested in building refineries for very light grades – instead its mixed in with heavier grades. That to me indicates a more pessimistic industry than their public pronouncements suggest.

Of course, its not just about transport. Heating oil of course is dependent on people building lots of leaky McMansions. There is a lot of them still being built, but in general worldwide (in Europe and China in particular), there has been a constant tightening of regulations which should reduce demand, and natural gas is also making inroads. And the worldwide trend to urbanisation should reduce per capita need for domestic heating.

Another big use of course is in long distance transport – in particular bunker oil for shipping. As Lamberts links from the shipping industry suggest, there seems to be a very significant structural ceiling now being hit as demand for shipping is just not matching economic growth. I suspect again that this will reduce demand for lower oil grades if it is a real thing – and increasing protectionism along with lower growth in China is likely to result in a significant reduction in bulk transport.

One further issue – the oil producing countries themselves are major users, often in a highly wasteful way. SA, Venezuela, Iran, etc., have hugely wasteful domestic policies. All are finding that this is a major problem, and most, most notably SA, are investing heavily in solar and other technologies in order to stop domestic use eating into exports. And of course some, like Venezuela, simply cant afford the domestic subsidies to cheap fuel that they used to support.

The trouble with the Nano project was poor execution of the idea as well as misleading marketing but for the most part i too see peak oil demand as opposed to hubberts supply peak. Remember how oil fell below $30 when China’s economy was flashing red in the 1st quarter of the year. But then again most consumers of petroleum products in these emerging economies are 2 wheeler commuters as well transport trucks and so on. The average 2 wheeler in india costs less than a $1000 dollars plus public transport is a mess…actually this is a really hard one…Longbets.org anyone :-)

I think it is quite likely oil consumption is peaking because global growth has too, just in time to spare the climate perhaps.

Economists don’t seem to understand this, but debt is future consumption, and most western consumers are tapped out, even younger generations struggling with student debt.

China’s exponential debt growth, is by definition, unsustainable. Even they know it and are trying to manage the transition as best they can.

Where is enough global money anywhere near to China’s levels going to be created over the next decade to keep the financial system ticking over?

Trump’s $1 trillion plan over four years is peanuts in the scheme of things.

Africa is the only region with the demographic potential but the economics and politics there appear impossible to be coordinated quickly enough.

The upside is we might not cook to death in 20 years, but we also won’t be jetting all over the world, having “fun”.

I believe that all the financial fuggery is causing the current slow motion economic collapse–and that the fuggery was a necessary response (in the sense of keeping industrial civilization going a bit longer) to cheap resource depletion and widespead environmental collapse.

Silver lining time: I think we’ll avoid the worst effects of global warming because this whole carbon economy will fall apart long before we hit +2C. Bad thing is that if we keep being delusional trying to build electric cars and biodiesel solar cities as drop in replacements for what we have now, the few of us left will go back to living in caves when this industrial society experiment is over.

I’m 31, about 60% of my friends have no plans to reproduce because the economy will be shit and so will the planet. Most do have a car, but that is because living in a city with good enough public transport to not need one is hard. We do favor good MPG cars though.

A side effect of a crapified economy and increasing inequality might be a lower propensity to consume hydrocarbons out of marginal income among those at the low end of the income distribution. This is not to celebrate inequality; it’s the problem of “who purchases the output?” applied to the hydrocarbon industry.

This always struck me as one of the justifications for continuing policies that exasperate inequality. I long ago came to the determination that the majority of us, by our elite class, were considered excess and highly expendable.

Watching car commercials for Millenials, I’m struck that they spend most of their time boasting about their electronics (phone integration, internet access, auto-braking, etc.) and almost nothing about their performance. If their market research is accurate and younger people aren’t as interested in performance (if they’re even buying cars in the first place), then I think we’ll see large gains in fuel efficiency in the next several years, potentially even more than Obama’s increased CAFE requirements that are kicking in.

Also, I think fossil fuel companies (not necessarily oil, since its share of power generation is small) underestimate the rapidly improving economics of renewables. In some countries, Wind is now cheaper than natural gas (mainly in Europe where natgas is expensive) even without subsidies. For the past several years, globally, renewables are a higher share of new power generation capacity installed than fossil fuel-based plants.

Economies-of-scale have tipping points, and I think renewables have hit that point, or will do so in the next few years. Once peak demand hits, the significant R&D required by the oil industry to continue low-cost production will also become more expensive since it’s amortized over an ever smaller base of sales, while the opposite forces help renewables R&D. These types of self-reinforcing cycles can cause drastic changes in the economic landscape much quicker than anyone expects. Just ask King Coal how he’s doing these days…

We have four millennial kids. Two live in a major urban area, don’t own a car, and have no intention of buying one in the near future. The other two live in suburban-rural areas and have inexpensive compact-intermediate size vehicles. Cost, gas mileage, reliability, and storage space were much higher on the list than “performance”.

The millenials at work have a mix of cars (we have virtually no mass transit, so you have to have a car). Outdoors lovers tend to have pickups, small-mid SUVs, or crossover SUVs. The rest have compacts to intermediate cars. There are probably still a few millenials growing up in car culture but if I am the car companies I would not stake my company on selling many muscle cars in the future.

> muscle cars in the future

Except as toys for the wealthy, of course!

Anxiety about the future is very high where I live in Vermont and we have quite an advanced matrix of transition endeavors in play, including such an emphasis on “local” agriculture and everything else that it’s become so fashionable I’m almost ready to barf whenever I hear the word. That and “gluten free”. I think people are placing their hopes for salvation in these words. Anyway. There’s also a big emphasis on bicycles, weatherization, anything anyone can do to reduce the use of fossil fuels. We have a law against idling any vehicle in a driveway.

Global warming is another variable to consider when projecting demand. odds are that the tipping point has been passed and that there is no way back. The question is how fast temps accellerate and how devastating the impact will be?

Increases and impacts have been dismissable, especially for those whose livelihood depends on dismissing them. But the tundra is releasing methane perhaps in ever greater amounts, the forests are smaller and the ice caps are shrinking and we are burning more not less and eating more not less beef. Could temp increases accellerate to the point that civil unrest and human migration cause enough stress to result in widespread and substantial restrictions on personal and organizational footprints. Say in less than 10 yrs?

I predicted 10 yrs ago that by 2012 Ryan Air would cease to exist in the wake of Peak Oil and global warming. The Frankfurt airport (FRA) recently announced that they have agreed to provide landing capacity at a discount to Ryan Air. The company will be going toe to toe with Lufthansa in Lufthansa’s backyard. Ryan is heading towards dominance in European aviation. So was I wrong?

Obviously, the impact of climate change is potentially immense, and I think its becoming increasingly clear we have hit a major inflection point. I think there have been assumptions that the really severe economic impacts won’t hit until around 2040 or 50, but I think that’s looking very optimistic now. I think much of the world is in for some very nasty surprises within the next decade.

As for Ryanair, I think that sadly the notion of cheap flights has now been ‘baked in’. I’ve been a supporter for years for the idea of very high aviation taxes with a discount per person for one flight a year to discourage regular flying. But cities and countries around the world are now so heavily dependent on tourism that there is little or no political support for appropriate taxes on aviation, and I see taxes as the only way of pegging it back.

Its a frustrating thing that people insist that cheap flights mean lots of tourism jobs – what people seem to forget is that every additional flight to a destination city brings people out as well as in. So for most cities the economic impact is neutral (as far as tourism is concerned). And unfortunately business is wedded to the notion of being able to fly their staff wherever they want at a moments notice. Its as if nobody has heard of skype.

I’m an economic simpleton that tried to think rationally. Then a Japanese Engineer (very rational) told me it didn’t matter what I thought, what mattered was what the market thought.

Watching “The Big Short,” I think I recall the guys that shorted the cheap second tranches incredulity at the rating agencies unbelievably high ratings right up to the day before there was no way to influence what the market thought. To me, “Irrational Exuberance” too often has some help from those who profit from it, producing the people that enable what seems irrational in the long term (while some sellers buy TIPS for themselves.

But then, what do I know?

I think the global warming activists have missed a major message that could convince many more people to reduce oil consumption. Oil revenues are a major funder of many of our enemies, including terrorists. If you are driving a big SUV to commute, then you are funding al Qaeda, ISIL, Iran, and Russia.

China is a major leader in renewable energy. They may be concerned about global warming, but I think their real focus is urban air pollution and energy independence so they don’t have to rely on long supply lines. Much of WW II was fought over long supply lines for oil and gas. I don’t think China wants to do that.

So the US right now has the opportunity to be independent of the Middle East for oil and gas while developing renewable energy to be forever independent. If the US, Europe, China, and India focused on developing renewable energy, the Middle East would fade into being a footnote of history. Russia would need to rely on their other resources, agriculture, and industry, all of which it should be capable of.

None of these arguments require anybody in the “I am not a scientist” block to ever admit to global warming while still supporting a major push for renewable energy.

Half the population of the planet still cooks on three-stone fires and continues to reproduce. This is a distribution issue.

: We need carbon space, please vacate the carbon space which countries have occupied [Prakash Javadekar, India’s environment minister] {thanks Vatch}

: which plans to reorient its business over the next decade to focus on petrochemicals

That’s a good thing. That we are taking billions of years of embodied energy and just burning it has been subject to hindsight for decades.

Peak oil as expressed in this post is a finance issue, not an environmental one. WSJ is simply reframing the speculation to its readers.

Over ten years we have essentially eliminated our personal fossil fuel use with net metered PV panels (which maintain a positive annual energy balance with the local utility where we have specified that they purchase excess energy from a green energy producer), solar thermal and hybrid water heaters, soapstone masonry heaters and an exclusive reliance upon a limited range EV (e golf) and an electric bike for personal transportation (as well as battery and hand powered yard tools to tend three acres), I am retired and my wife drives 35 miles round trip to work. Our son attends a liberal arts college about a 100 miles away. We live about three miles outside of a town where a county loop bus stops. A commuter rail line to a major metropolitan area (where our daughter lives) begins close to where my wife works. Our transition to renewable energy has required substantial upfront investments and numerous lifestyle adjustments, which, when undertaken optimistically, have often lead to small benefits that would otherwise have gone unrecognized, such as being more mindful of the weather forecast or not having to inhale exhaust gases when lawn mowing. More specifically, driving distances greater than 80 miles require that we use secondary roads and stop for a 1 to 1.5 hour charge (and a meal) en route. This produces a travel experience that can be varied each time and seems markedly superior to interstate driving, at least according to our newly acquired tastes. While we are pleased with a number of the changes associated with our reliance upon renewable energy (e.g. every mile driven is quieter, with a more responsive motor), we are also impressed with how difficult it is to make the varied adjustments. Also, whenever the subject is broached with others (interest is rare, including among young, professional adults), it is apparent that they are horrified by some of the required lifestyle changes, which appear greatly limiting at first glance. This speaks to the power of marketing in our culture and the large hurdle of meeting or exceeding current energy use expectations (e.g. most automobile commercials have a slogan such as “find new roads” to emphasize the limitless possibilities of car ownership, and travel to exotic destinations seems to be on everyone’s to do list). It appears that it will be difficult to replace these expectations with the smaller satisfactions of renewable energy reliance. Thus, it appears that oil use may continue to rise until there is a broad panic and WW2 style mobilization.

We reduced our lawn size and bought an electric lawn mower. It has been fabulous. We can go out and mow at 7 am on Sunday and the neighbors don’t even know because it is so quiet (less noise than their air conditioners). Also, most people don’t realize how much smog is created by lawnmowers (including riding mowers) because they do not have to meet the air emissions standards that cars have to meet.

You summarize a good number of rationales for stalling/declining oil demand and all of it is reasonable but difficult to translate in numbers and peak demand year forecasts. A good proxy is to try forecasts by regions and then sume it all. I would like to add a couple of ideas to be considered:

1) Regarding India: is quite a hot country (except the high himalayan regions). When forecasting development and oil consumption you cannot apply the same variables as in China. Less heating oil is necessary there. Also, they have high sun irradiance and this is a good energy source that can be used “passively” (bioclimatic construction) or actively (through solar pannels). Latitude matters in oil consumption. Thus, consumption will almost certainly rise in India, but won’t ever reach the levels seen in China, the US or Europe. The same can be said about Brazil.

2) Regarding general public conscience on energy: I am starting to collaborate through my net of contacts (neighbors & friends) in saving energy projects at the level of households and small companies, here in Spain. What I see is interest in saving… money, rather than energy. Manufacturing companies with high energy consumption, very large corporations, and large public infrastructures can save money very significantly and this incentive is working. Households and SMEs do not foresee such significant improvement and are quite reluctant to invest in energy saving even when you show the investments are amortized in 2-4 years. Yet, the first barrier is still the effort and time required to analyse your energy consumption and then identify your best saving strategies. It is a case by case thing although, when you are experienced, you can adapt energy saving packages for consumers with similar profiles. I always insist that by implementing such measures, you do not only save, but increase the value of your home/office.

Good points. India has great potential for using solar panels effectively, but I don’t think this will be possible during the monsoon period, approximately from July through September.

Edit: this is meant to be a reply to Ignacio’s 10:39 AM comment.

I think the trends in gasoline/diesel use will depend on several factors who’s interplay is highly unpredictable.

1. Cost of oil will determine how fast/slowly more efficient vehicles hit the market. As we’ve seen over the last few years, fuel efficiency standards have gone down due to cheap oil and American’s preference for SUV’s/light trucks over more fuel efficient vehicles.

2. IF and when battery technology for transportation advances to the point where cost and convenience of electrics/hybrids surpasses that of the internal combustion engine (ICE).

3. How strictly will regulations for carbon dioxide emissions be enforced. Will a carbon tax be implemented to help tip the balance towards more efficient engines. Will a carbon tax help or hinder electric engines if most base load electricity is still derived from carbon intensive coal power plants. Will the realization that the pollution from ICE engines and their associated health effects lead to more stringent regulation in heavily polluted/smoggy parts of the world.

4. Where will people live in the next 50 years in this country. Cities (more expensive) where owning a vehicle is a burden, or rural/suburban environments where owning a vehicle is mandatory.

I’d recommend taking this WSJ report with a grain of salt (based on it’s timing). There are still elections in France and Italy coming up. It will be more interesting to see what the oil execs are saying/predicting 6-8 months from now, imo.

Also, low gas prices and falling oil demand have, in past, been one effect of recession. Current low prices and low demand may well indicate that we’re still very much in a recession, on Main St certainly, even though economists claim we’ve recovered.

An update from the supply side: Both Texas and Oklahoma are working large, new oilfields accessible to fracking. The level of activity, and request for drilling permits are amping up. Thanks to eartquakes, Oklahoma’s governor Fallin (AKA “Failin'”) is shutting down some drilling, but the general level of activity continues to rise.

If oil demand peaks, it will come from higher oil prices. While the marginal price to lift oil is cheap throughout OPEC, a number of these countries need much higher prices to meet their social costs – given the government reliance on oil revenues.

In short, the mechanisms for peak oil supply pretty much line up with the mechanisms for peak oil demand. When people can no longer afford oil, they will substitute for other products. If OPEC succeeds in pushing oil prices higher,it will encourage more switching – particularly to CNG vehicles.

Don’t hold your breath that the global climate alarmism many of you believe in will stay in fashion as your global warming models prove to be further irrelevant. Reducing carbon will not be the driver of peak oil demand limits.

That’s a difficult question. I see change in attitude everywhere. But consumption seems the same. Lots of new cars on the road but the city uses (always empty) natgas buses; expensive electric bills even tho 20% comes from renewables. They recently remodeled my grocery store to accommodate changing eating/shopping habits and now sell a very wide variety of imported processed foods, much of it ethnic, most of it more expensive by weight, none of it very good. Peak demand can come from peak prosperity, peak population, peak globalization; or orchestrated at strategic points like factory emissions; commodities mining/heavy mfg and etc. but all of this together is under the radar. There has been a sense of change for several years that you could cut with a knife. Don’t begin to know how it will translate into reality beyond a too-slow progress. Is it true that CO2 has leveled off?

Seen the latest Exxon tv commercial where they sell that they are working hard to “end energy poverty in developing economies” as a virtue? It’s a matter of revenue survival.

Electric cars + distributed solar power + inexpensive battery storage = End of Oil as Transportation Fuel. Crisis happens long before total displacement.

Add in self-driving transport (computerized electric vehicles) and oil goes down the chute even faster.