By Felix Roth, Associated Research Fellow, University of Göttingen, Lars Jonung, Senior Professor, Knut Wicksell Centre for Financial Studies, Lund University, and Felicitas Nowak-Lehmann, Senior Researcher at CEGE and IAI, University of Goettingen. Originally published at VoxEU

The euro as a common currency has recently been the subject of harsh criticism by economists from both sides of the Atlantic, including claims that citizens in some Eurozone countries are turning against the it. This column argues that, in fact, the euro currently enjoys comfortable popular support in each of the 12 original member states of the Eurozone and that potential upcoming referenda in any of these countries do not appear to pose a threat to the currency. In contrast, popular support for the euro has declined sharply in non-Eurozone EU member states since the recent crisis, with the UK standing out as the country with the most negative view.

Recently the euro as a common currency has been the subject of strong criticism by economists from both sides of the Atlantic (e.g. Stiglitz 2016, Sinn 2014). This criticism has been inspired by the financial and economic crisis in some Eurozone countries and by the slow recovery in the region after the Global Crisis of 2008. Scholars claim that a majority of citizens have turned against the euro in large member states of the Eurozone, such as Germany (Stiglitz 2016: 314) and Italy (Guiso et al. 2016: 292, Sinn in Kaiser 2016a).

In the wake of the vote for Brexit in the UK referendum in June this year, it is argued that knock-on effects in the form of potential upcoming referenda on the euro in the Eurozone (e.g. in Italy) might lead to its break-up (Feldstein 2016, Stiglitz in Martin 2016, Stiglitz in Kaiser 2016b). In addition, it has been postulated that animosity amongst EU member states is at a high (Alesina 2015: 78). This suggests a rising threat to the European project, including the common currency.

These claims concerning the standing of the euro raise the question: How does the public in EU member states actually look upon the common currency at this stage? We are able to provide an answer based on survey data on the popularity of the single currency, which are available from its creation, as polled by TNS-opinion (European Commission 2016). These data are provided through the Eurobarometer (EB). The euro is a unique currency in the sense that similar time series evidence does not exist for any other currency.

Our answer draws upon our previous contribution to this site (Roth et al. 2012), where we explored Eurobarometer survey data on public support for the common currency from 1990 to 2012. There we concluded that in the first four years of the crisis (2008-2012), public support for the euro declined only marginally. Now the question is: What has happened in the most recent years regarding public support for the euro?

Support for the Common Currency Within the Original Eurozone

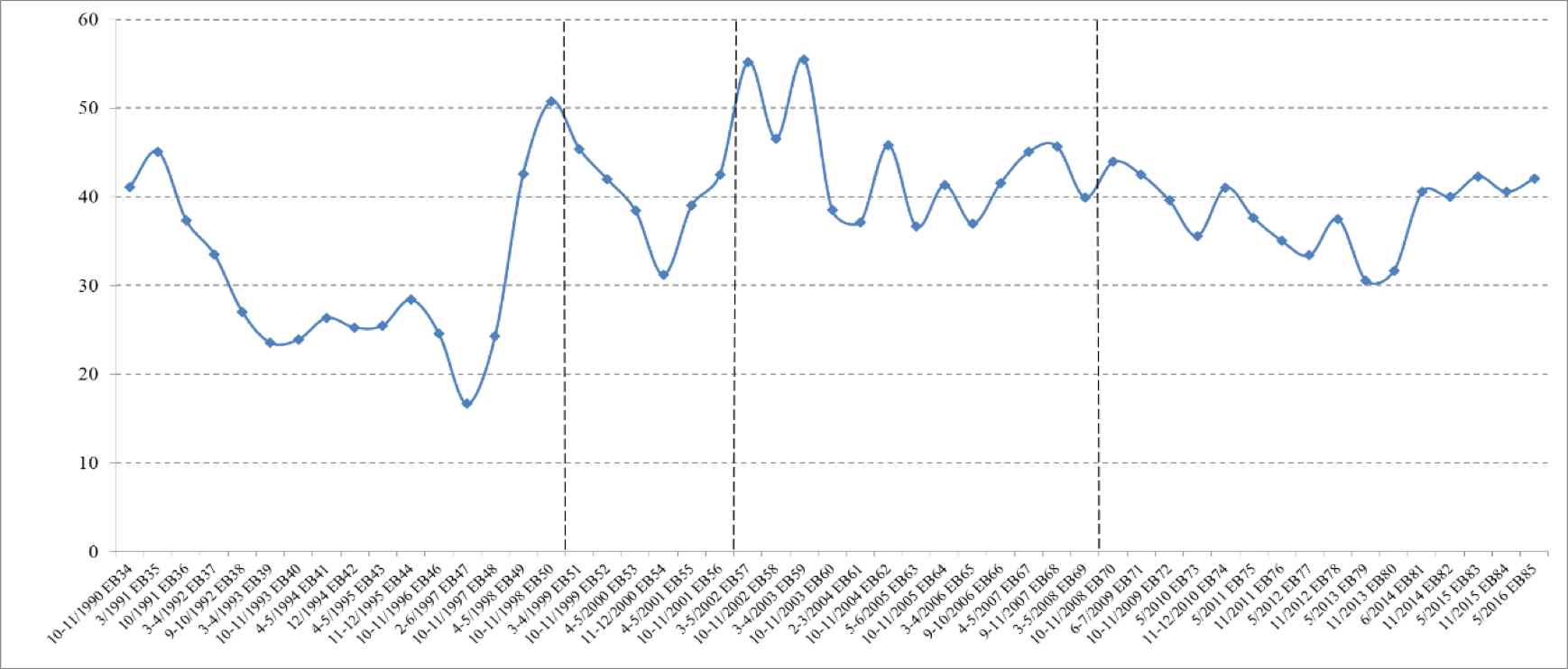

We present an up-to-date picture of the evolution of public support for the euro until May 2016, adopting our approach in Roth et al. (2016). First, we focus on the original 12 Eurozone member states (Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain – the EZ12) that adopted the euro as a physical entity in January 2002. Figure 1 shows average net support (in per cent) for the single currency in the EZ12 countries over a 27-year period from 1990 to 2016.

Figure 1 Average net support (in %) for the single currency in the EZ12 countries, 1990-2016

Note: The y-axis displays net support in percent. Since the figure depicts net-support, all values above 0 indicate that a majority of the respondents support the single currency. The dashed lines distinguish the introduction of the euro as a book keeping entity in January 1999, the actual circulation of the euro in January 2002 and the start of the financial crisis in September 2008. Data for EB45 were not available. Population-weights are applied. Net-support is measured as the number of ‘For’ responses minus ‘Against’ responses and is constructed according to the equation: Net-support = (For – Against)/(For + Against + Don’t Know).

Source: Figure 1 is an updated version of Figure 1 until 5/2016 (by EB’s 82-85) in Roth et al. (2016; 948).

Figure 1 leads us to the following conclusions:

- Over the 27-year time period, a majority of citizens within the EZ12 has supported the single currency (with average net support exceeding 15% at all times).

- Since the introduction of the euro in 1999, a large majority of EZ12 citizens has supported the euro (with average net support exceeding 30%).

- In the 8th year (in May 2016) since the start of the financial crisis, average net support of 42% has surpassed the pre-crisis level of 40% in March-May 2008.

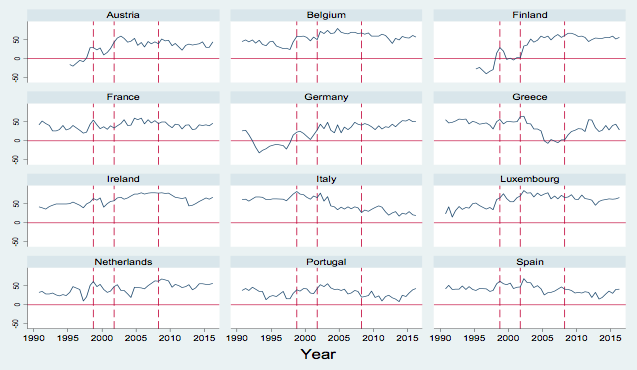

Figure 1 gives the aggregate picture. How has support for the euro evolved in the individual members of the EZ12? Figure 2 provides an answer.

Figure 2 Net support for the single currency in EZ12 countries, 1990-2016 (%)

Source: Figure 2 is an updated version of Figure A1 until 5/2016 (by EB’s 82-85) in Roth et al. (2016: 957).

Figure 2 suggests that:

- Since the introduction of the euro in 1999, aside from short periods in Finland and Greece before the crisis, a majority of citizens in each member state of the EZ12 supported the euro, even in times of crisis.

- From 2008 to 2016, significant increases in support in Greece, Portugal and Germany (26, 23 and 10 percentage points, respectively) have levelled out the fall in net support in other EZ12 countries, ranging from 11 percentage points in Ireland to 5 percentage points in Finland.

- Over the 27-year time period (1990-2016), Italy has always had a pro-euro majority, with the minimum net level of 17% in November 2013, clearly above the majority threshold of 0%.

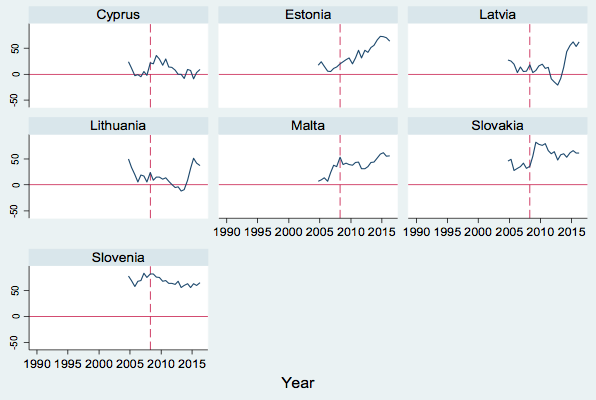

Support for the Euro Among the New Members of the Eurozone

How has support for the euro evolved in the new member states that joined the euro after its physical introduction in January 2002, that is, in Cyprus, Estonia, Latvia, Lithuania, Malta, Slovakia and Slovenia? After adopting the euro, aside from short periods in Cyprus, a majority of citizens in each country has supported the euro.

Figure 3 Net support for the euro across seven EZ countries that joined the euro in the period 2004-16 (%)

Source: Figure 3 is an updated version of Figure A3 until 5/2016 (by EB’s 82-85) in Roth et al. (2016: 958).

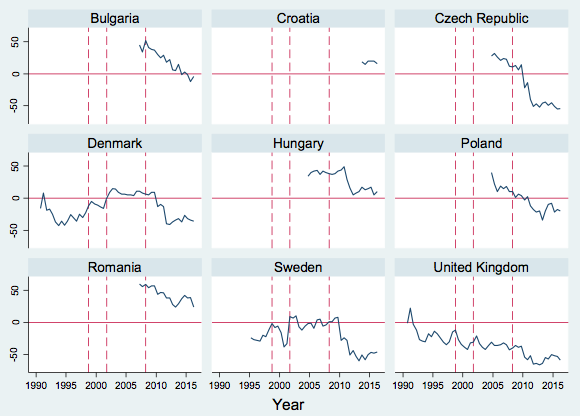

Support for the Euro Outside the Eurozone

In our 2012 column, we highlighted the distinct fall in public support for the euro in EU member states outside the Eurozone (Roth et al. 2012). What has happened since then? Figure 4, displaying the evolution of net support for the euro outside the Eurozone from 1990-2016, gives an answer.

Figure 4 Net support for the single currency in non-EZ countries, 1990-2016 (%)

Source: Figure 4 is an updated version of Figure A2 until 5/2016 (by EB’s 82-85) in Roth et al. (2016: 958).

Figure 4 suggests:

- Outside the Eurozone, net support for the euro has declined in a pronounced manner. Whereas in Bulgaria, Czech Republic and Poland a majority of citizens supported the euro in the years preceding the crisis, a majority in those countries has turned against the euro after the crisis. The decline in support, ranging from 65 to 30 percentage points, is strong. In contrast, in Romania and Hungary, in spite of a fall of 35 and 28 percentage points, respectively, a majority of euro support still exists.

- In Denmark and Sweden, the majority has turned away from euro support after the crisis. Just before the crisis, there was for brief periods a majority for the euro.

- The UK is an exceptional case. For the 26 years from 1991 to 2016, a majority of citizens was always against the single currency. During the crisis, net support for the euro reached levels as low as -66% (in November 2012). Given the persistent rejection of the euro, the Brexit vote should not come as a surprise but rather as reflecting a long-running critical view towards the European project. Therefore, any knock-on effects of the Brexit vote in the form of a break-up of the Eurozone via potential upcoming referenda in the Eurozone are not likely to emerge. On the contrary, recent survey data from July 2016 by the French polling institute, Ifop, suggest an enduring majority support for the euro in the Eurozone (Fourquet et al. 2016: 52).

Conclusions

Our updated analysis of public support for the common currency over a quarter of a century, from 1990-2016, brings out four major conclusions.

First, in contrast to recent claims, a majority of citizens support the euro in each member state of the original Eurozone, including in Germany and Italy. This was the case even during the peak of the recent crisis.

Second, in contrast to some critical euro voices, we do not believe, on basis of Eurobarometer data, that any knock-on effects of the Brexit vote in any potential upcoming referenda on EU issues would pose an imminent threat to the euro.

Third, taking into account our earlier findings, which identify the unemployment rate as a key driver of public support for the euro in times of crisis (Roth et al. 2016), a strong job recovery in the Eurozone is likely to increase public support for the euro.

Fourth, popular support for the common currency has fallen sharply after the recent crisis in EU member states that have not adopted the euro. Here the negative sentiment is strongest in the UK.

We suggest the following bottom line: with the exception of short periods in Finland and Greece before the crisis, the evidence points towards majority support for the euro in each original Eurozone member state (including Italy and Germany) before, during and after the crisis. So far, the euro has clear backing from the public. It has adopted the common currency as its own currency.

See original post for references

This just shows that the people don’t realize that the euro itself, with the economic policies that come with it, is responsible for their economic woes.

The fact that people in countries without the euro seem to understand that the euro is no good vs. those in countries with it that don’t realize it, could have something to do with either the media not doing its job in euro countries, or the media scaring people into thinking that leaving the euro will destroy them. And nothing scares people more than an attack on their bank account!

Agree. Just as most here in us think we are broke and need to balance budget and pay off debt. Could mot be more wrong but we will move towards balanced budget anendment and permanent recession soon.

Very much agree with the first paragraph, not with the second. In this case I believe that the media are just a reflection of what the society in general thinks intuitively: the end of the euro is the end of the world.

Eurobarometer question about the “support for the euro” can be misleading, I believe. It may just well be that people support the concept of a common currency (as I do) BUT this does not, by any means, imply that people in general are happy or support policies embedded within the flawed monetary system.

It’s not just the press, it’s the consensus politicians too, they don’t even want to talk about reforms. They fear a populist backlash over Euro reforms that require risk-sharing, constitutional changes and deeper integration (thus sparking a backlash anyway as the economic malaise grinds on). They are extremely reluctant to openly acknowledge the Euro is not working as hoped, because that inevitable leads to talk about reforms and they just don’t want to open that can of worms. So they rarely engage with the critics, instead trying to dismiss them outright as populists, eurosceptics, cranks or, quelle horreur, Americans wanting to safeguard the dollar’s preeminence (almost 20 years with a sucky Euro and they still think Americans fear for the dollar). And the press accepts these boundaries for acceptable discussion set by “responsible” politicians, so the only politicians that get roasted are the critics.

Politicians in EU countries outside the monetary union don’t feel these constraints, so the debate is open and vigorous. Hardly surprising then that the populace is more well informed and thus largely negative towards the Euro.

The “responsible” politicians have in fact abdicated their responsibilities. It’s deeply irresponsible to just sit there and wait for a miracle, when the unreformed structures of the monetary union work against achieving miracles. Their unwillingness to act is one reason why it took eight years for the Eurozone to reach it’s pre-crisis peak in GDP. And they’re forecasting growth rates of 1-1.5% over the next two years. A lost decade without the robust growth that the author of this paper is praying for. The politicians already wasted eight years yet the author whispers sweet words of reassurances that everything is just fine (because a miracle will surely happen!).

what the data tell me is that we should keep the euro but create a common fiscal and economic policy for the eurozone

First, if the Euro is to survive, then Germany’s export surplus is going to have to go down. This is not sustainable in the long run with the net deficit runners facing mounting trade deficits year after year and an undervalued Germany currency.

Second, the wages for German workers has to go up. The benefits of Germany’s exports have gone to the corporations in Germany, not the people, who are in many cases poorer in terms of real wages than they were 15-20 years ago. Anecdotally, like here in North America, there is a lot of increase in temp jobs that don’t pay very well. Inequality, sadly, is rising in Germany.

Third, austerity must end. It has been deeply damaging and has contributed to the rise of the far right in Europe. Worse, for every dollar cut in government spending, the effects multiple and hurt the wellbeing of the people.

Finally, the European Bank should be democratically accountable to the people. The technocrats who “know best” have thoroughly discredited themselves. They don’t know best and frankly, if they had any decency (they don’t), they’d disappear forever from the public given the extent of their mismanagement.

But leaders do not tell the truth about the real failure of the EMU. They did not foresee what have happened and why it did happen. Even if they were told about the risks they just said what R Prodi did. If a crises comes we will have the opportunity to further integrate the union. And they are trying but people are against it. People in general do not understand that the Euro is a gold-standard. One currency, 19 debts. The founder-states Germany/France will not take the responsibility to adjust, aka pay for the imbalance within the EMU-area. As long as there is not a full fiscal union there will be a break-up sooner or later. The european bank-system is partly running with under-capitalisation. Losses are not taken which is leading to a japanese situation were growth is restrained. The longer the status-quo remains the greater the split between countries. The refugee-situation on top.

The “leaders” had been amply warned that the Euro was an experiment with a very, very high probability of failure.

1. Economists had explained in detail why the EMU, with the straitjacket of the Maastricht criteria, would lead to unbearable internal economic tensions without possibility to dampen them. Example: Wynne Godley.

2. Monetarists had pointed out that the European Community did not fulfill the criteria for an optimal currency area, and therefore the Euro would fail. Example: Milton Friedman.

3. Financial experts had demonstrated that the hodge-podge, non-integrated banking system without safeguards under the Euro would be rife for destabilizing crises. Example: Peter Garber.

4. Historians had analyzed past monetary unions, showing that those not involving a rapid and complete political union all failed. Example: Gerard Lyons.

In the years preceding the introduction of the Euro, the European Commissions published regular “progress reports”, listing for each country its compliance level of the 5 Maastricht criteria required for accession to the EMU.

I remember a major such report a couple of years before the fateful date, as it was published in a major newspaper where I lived. 5 columns, one for each criterion; one row for each country. In blue, criteria met, in red, those unmet.

There was exactly one country fulfilling all criteria: Luxembourg. No other country met the 5 criteria.

There was one country meeting none of the five criteria: Greece.

In other words, there was no possibility, according to the “leaders'” self-imposed criteria, to launch the Euro.

We know what happened then:

a) The “leaders” eliminated two of the criteria. Makes things somewhat easier.

b) They fudged the figures. France could not pass because of the deficit criterion; solution: do not look after the decimal (it was 3.x and was considered to be 3%). Italy and Belgium could not pass because of the debt criterion; solution: a minor reduction of the debt (way above 60%) was deemed equivalent to being below 60%, because “it was moving in the right direction”. Greece would not pass anything; solution: let Goldman-Sachs massage the numbers and reallocate financial flows till everything looks all right. And so on, and so forth.

The Euro was neither an economic, nor a political decision, but an ideological one. The current proof is that the “leaders” are constantly calling for “preserving the Eurozone” and “saving the Euro” — the Euro is the end, not a means towards achieving economic goals.

Thanks for this description of the EU.

Thank you for the list “visitor”. I agree.

I refer to the people. What could be read in the Economist is not read by the people. And even if they did they were lied to by their leaders. It was a referendum and the motive were primarily an economic one. But understanding economics it was as you said ideological and in a political context, a step towards The United States of Europe. As you say, no Euro and the EU would probably fall apart. A dilemma indeed! And more lies and oppressing of the truth. Locally a debate towards a fiscal union is more or less banned. Media is absent, not interested.

But there were/are a lot of political local national leaders who did not understand the “implications” of the Euro. “The Ideologists”, they just spread the message like “useful idiots”. But we the people were the true idiots.

Germany is the biggest beneficient of the euro but they refuse to share the burden. They probably will. Either fiscally or a new massively appreciated D-Mark.

Actually I have assumed only the multinational corporations benefit from the Euro, since presumably they are the only ones that truly benefit from the easier accounting. Germany just gets to look good for the time being, as your endgame predictions imply.

Yes that´s also one point but when I say Germany I mean german (export-)businesses. Not really the people. German Mini-Jobs keep real unemployment(not only “U5-6”) underreported.

Charles is right and I would add that OF COURSE a majority of people in the Eurozone (I am one) support the euro. Once you’ve adapted to an economic system you have no desire to start over. Notice that the support has steadily increased over time. In otherwords, young people who have never known another currency, who feel like integrated “European” citizens and who travel and work freely between member countries are now part of the population being polled. Why (how) would they question the only money they’ve ever known (and which is one of the three major currencies on the planet_?

If we want a clear picture of the future of the Eurozone we should ask them whether or not they believe in capitalism and in the elites who controle their economies.

If the numbers on the cash in your pocket are preceded with the funny-looking E thingy then you’re liable to think one way, while somebody else whose cash is marked with a funny-looking L thingy or a funny-looking S thingy may think differently. Dance with him what brung ya, and all that.

The Euro is popular for the very simple reason that it is very convenient for people. It works in the sense that it provides price transparency across the Eurozone and it has made travel extremely easy (not just within Europe). It is also popular because people remember that many of the original currencies were weak and prone to manipulation by politicians.

The major structural problems which NC readers will all know about are more obscure for most Europeans. I think most are aware that the Euro at least contributed to the deep problems post 2007, but I think most see it as a technical problem that can be fixed, not fundamental to a single currency.

The ‘problem’ with this popularity is that it means politicians are loath to even suggest alternatives, so there are absolutely no fall back preparations for when the next crisis comes – and it will come. There is enormous political momentum behind keeping the Euro at any price, and this may well make any crisis works as there is simply no plan B if a break up becomes inevitable.

You are quite correct.

People in general is completely unable to make a link between the monetary system and economic performance. People do not understand imbalances except in terms of “lazy meds” or “saver fritzs”.

But popularity will not save the euro and should not be a reason for complacency. It can be easily lost. What can save the euro is the end of the centrifugal forces now in place.

The worst enemy of the euro is… itself.

And polls showed that Clinton would win the election and BREXIT would be rejected by the British people………

(YAWN)

I’m done with polls.

The Euro is doomed, it’s just a matter of time until the majority of people in Europe wake up and understand the implications of fixing your currency for the benefit of the German industrial juggenaught.

On the other hand, looking at how completely clueless people are in thinking Clinton was the anti war, anti establishment candidate perhaps the Euro will continue for some time yet. And once they remove cash completely people probably won’t even understand the basics of what money is. (Gold and silver are money and have been for 5 thousand years. It would seem the Chinese and Indians still understand this as they exchange their paper fiat for gold.) The dumbing down of the worlds population hasn’t come cheap, but by golly it’s been profitable for the banking elite. They have turned your books/library into air, and your record/CD collection into air. Now they intend to turn your money into air too. One can only imagine what horror show will take place when paper goes up in flames and your digital currency is switched off

666

coming to place very close to you.

(echoing diabolical laugh)

(Gold and silver are money and have been for 5 thousand years. It would seem the Chinese and Indians still understand this as they exchange their paper fiat for gold.) Sally

You’re silly if you think dumb metals can enforce justice – rather they would enforce injustice for the benefit of the owners of those metals and for the benefit of lazy (cf. The Parable of the Talents, Matt. 25:14-30) money hoarders. But progress requires taking risks, not money hoarding.

Yes, the current system is crooked too but the solution is not to return to a previous form of injustice but to move on to a system where purchasing power is created ethically.

I’m not quite clear on where they get their data. It looks like it’s from the EU itself. Wouldn’t that source be quite suspect? Is there any independent support for these numbers?

During the Greek crisis (still on, really), we heard consistently that the Greek people wanted to stay in the Euro, despite being its victims. At this point, they know how high a price they’d have to pay to escape, so their “support” might reflect resignation.

This would be a lot more illuminating if we knew just how the numbers are obtained, and, even better, some idea of WHY people answer as they do. Is there some push-polling going on?

I have Greek friends who tell me that the supposed widespread ‘support’ for the Euro in Greece was a complete fabrication. One of them was telling me as long ago as 2005 that the Euro had lead to steep prices rises and was widely disliked. Rigging polls is child’s play when you have friends in the right circles.

‘a strong job recovery in the Eurozone is likely to increase public support for the euro’

I don’t see anything concrete in the horizon to that effect! Does any one else see different?

The trend in non EZ countries means no fresh periphery meat to plunder any time soon. Without reform (fiscal union, full LOLR ECB with direct state support) the Euro will implode. Unemployment is on a downward trend it would appear, but I wouldn’t call it a “strong job recovery”, especially with double digits to the south.

Read Em And Weep (Or Not)

I think most people, unless they are in a truly hellish dystopia just want tomorrow to be pretty much like yesterday. The shake up involved in changing something as basic and essential as money is frightening. The Eurozone has some pretty basic structural flaws but unless and until they really cause things to go down the tubes I would guess most people in the would want to stay in it.

On the other hand, how much does the EU actually care about, or even listen to the views of it’s citizens? The technocratic elites of the EU seem to want the Eurozone so it’s going to stay no matter what the people want.