By Martin Watzinger, Assistant Professor, Department of Economics, LMU Munich; Thomas Fackler,PhD candidate, LMU Munich; Markus Nagler, PhD candidate, LMU Munich; and Monika Schnitzer, Chair in Comparative Economics at the University of Munich. Originally published at VoxEU

Innovation is a key driver of economic growth, and the patent system is one of the main instruments governments use to foster innovation. However, there is growing concern that dominant companies might use patents strategically to deny potential entrants – often small, technology-oriented start-ups – access to key technologies in an attempt to keep out competitors.1 As start-ups are thought to generate more radical innovations than established firms, this practice may harm technological progress and economic growth.

The growth of technology companies and their aggressive behaviour in patent disputes has raised concerns that patents in the hands of big business might be harmful to innovation. According to The New York Times, patents are used in the technology industry as “swords” to put pressure on competitors (Duhigg and Lohr 2012), and The Economist (2015) observed that “[p]atents should spur bursts of innovation; instead, they are used to lock in incumbents’ advantages”. Many critics have called for antitrust policies as a remedy to this problem, arguing that it is time that antitrust policy puts innovation front and centre (Wu 2012, Waller and Sag 2014).2

In a recent research project, we explore whether patents held by a dominant firm are harmful for follow-on innovation, and if so, whether antitrust enforcement in the form of compulsory licensing of patents provides an effective remedy (Watzinger et al. 2017).

Watch Monika Schnitzer discuss how patents affect innovation in the video below

The Antitrust Lawsuit Against Bell

To answer these questions, we study one of the most important antitrust rulings in US history, namely, the 1956 consent decree against the Bell System. This decree settled a seven-year old antitrust lawsuit that sought to break up the Bell System, the dominant provider of telecommunications services in the US, because it allegedly monopolised “the manufacture, distribution, and sale of telephones, telephone apparatus and equipment” (Antitrust Subcommittee 1958: 1668). Bell was charged with having foreclosed competitors from the market for telecommunications equipment because its operating companies had exclusive supply contracts with its manufacturing subsidiary Western Electric and because it used exclusionary practices such as the refusal to license its patents.

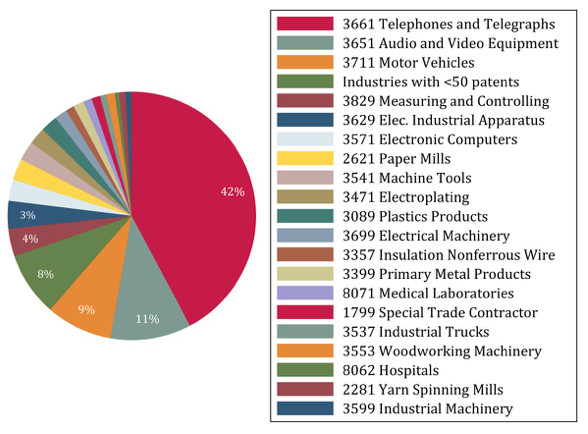

The consent decree contained two main remedies. The Bell System was obligated to license all its patents royalty free, and it was barred from entering any industry other than telecommunications. As a consequence, 7,820 patents, or 1.3% of all unexpired US patents, in a wide range of fields became freely available in 1956. Most of these patents covered technologies from the Bell Laboratories (Bell Labs), the research subsidiary of the Bell System, arguably the most innovative industrial laboratory in the world at the time. The Bell Labs produced path-breaking innovations in telecommunications such as cellular telephone technology or the first transatlantic telephone cable. But as Figure 1 shows, 58% of Bell’s patent portfolio had its main application outside of telecommunications because of Bell’s part in the war effort in WWII and its commitment to basic science. Researchers at Bell Labs are credited for the invention of the transistor, the solar cell, and the laser, among other things.

Figure 1 Bell patents subject to compulsory licensing by industry

The broad patent portfolio of Bell gives us the opportunity to measure how the effect of compulsory licensing depends on the competitive setting. In the telecommunications industry, Bell was a vertically integrated monopolist who allegedly foreclosed rivals. In the industries outside of telecommunications, Bell held patents but was not an active market participant.

Compulsory Licensing Increased Follow-On innovation, in Particular by Start-Ups

Our research shows that compulsory licensing increased follow-on innovation that builds on Bell patents. We measure follow-on innovation by the number of patent citations Bell Labs patents received from other companies that patent in the US. We find that in the first five years, follow-on innovation increased by 17%, or a total of around 1,000 citations. Back-of-the-envelope calculations suggest that the additional patents other companies filed as a direct result of the consent decree had a value of up to $5.7 billion in today’s dollars.3

More than two-thirds of the increase in innovation can be attributed to young and small companies and individual inventors unrelated to Bell. This is in line with the hypothesis that patents can act as a barrier to entry for small and young companies who are less able to strike licensing deals than large firms (Lanjouw and Schankerman 2004, Galasso 2012, Galasso and Schankerman 2015). Compulsory licensing removed this barrier in markets outside the telecommunications industry, arguably unintentionally so. This fostered follow-on innovation by young and small companies and contributed to long run technological progress in the US.

Compulsory Licensing Did Not End Market Foreclosure in the Telecommunications Industry

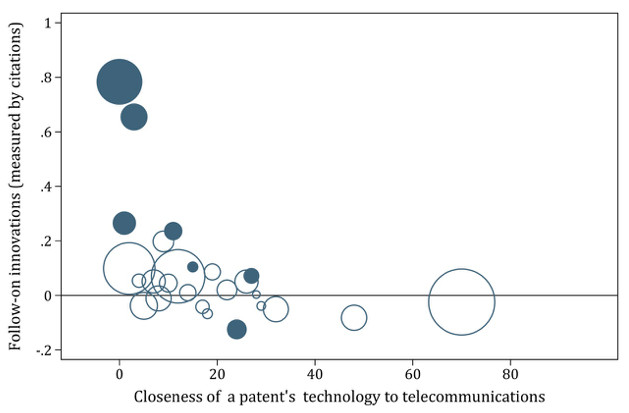

The aim of the antitrust settlement was to increase competition and innovation in the telecommunications industry. We do not find this to be the case. In Figure 2 we compare the increase in innovations for patents sorted by how close the technology of these patents is to the telecommunications industry. The size of the bubbles represents the size of the patent portfolio of Bell in each technology. We find that almost all innovation increases come from patents that have nothing to do with telecommunications. This suggests that compulsory licensing is not an effective remedy to end market foreclosure.

This pattern is consistent with historical records that Bell continued to use exclusionary practices in the telecommunications industry after the consent decree took effect and that these exclusionary practices impeded innovation (Wu 2012). As no structural remedies were imposed Bell continued to control not only the production of telephone equipment but was – in the form of the Bell operating companies – also its own customer. This made competing with Bell in the telecommunications equipment market unattractive even after compulsory licensing facilitated access to Bell’s technology. For example, the Bell operating companies refused to connect any telephone that was not produced by Western Electric, the manufacturing subsidiary of the Bell System (Temin and Galambos 1987: 222). In other industries, compulsory licensing was effective in fostering innovation by young and small companies since Bell as the supplier of technology did not control the product markets through vertical integration or via exclusive contracts.

Figure 2 Follow-on innovations for patents with different levels of closeness to telecommunications

The Consent Decree Increased US Innovation in the Long Run

Although the 1956 consent decree was not effective in ending market foreclosure, it permanently increased the scale of US innovation. In the first five years alone, the number of patents increased by 25% in fields with compulsorily licensed patents compared to technologically similar fields without; and it continued to increase thereafter. This increase is again driven by small and new companies outside the telecommunications industry. We find only a small increase in patents related to the production of telecommunications equipment. This indicates that market foreclosure may slow down technological progress.

Outside the telecommunications industry, however, the consent decree had a long-lasting stimulating effect. By providing free state-of-the-art technology to all US companies, compulsory licensing increased US innovation because it opened up new markets for a large number of entrants. This interpretation is consistent with historical accounts. Gordon Moore, the co-founder of Intel, stated that “[o]ne of the most important developments for the commercial semiconductor industry (…) was the antitrust suit filed against [the Bell System] in 1949 (…) which allowed the merchant semiconductor industry “to really get started” in the United States (…) [T]here is a direct connection between the liberal licensing policies of Bell Labs and people such as Gordon Teal leaving Bell Labs to start Texas Instruments and William Shockley doing the same thing to start, with the support of Beckman Instruments, Shockley Semiconductor in Palo Alto. This (…) started the growth of Silicon Valley” (Wessner et al 2001: 86). Similarly, Peter Grindley and David Teece opined that “[AT&T’s licensing policy shaped by antitrust policy] remains one of the most unheralded contributions to economic development – possibly far exceeding the Marshall plan in terms of wealth generation it established abroad and in the United States“ (Grindley and Teece 1997).

Implications

Our research highlights that patents held by a dominant firm can be harmful for follow-on innovation. Compulsory licensing can help to foster market entry and stimulate innovation in the short and the long run. Yet, if a dominant company can use other exclusionary practices to keep out innovative start-ups, compulsory licensing is ineffective. This suggests that an antitrust policy concerned with innovation should recognise exclusion as a core concern of competition policy and put the protection of market entrants front and centre.

See original post for references

Another way of looking at who benefits from strong long-lasting IP rights is looking at who is lobbying for strong long-lasting IP rights…. Might it be the same people/businesses who lobby and who benefit?

Whether or not the (worshipped?) economy benefits from strong long-lasting IP rights may or may not be our biggest concern or?

Thank you, Yves.

This brings back memories of studying the economics of regulation when studying law, a module chosen by very few fellow law students. It was the same for the sociology of crime module. It was if law exists in a vacuum. One can see the result when dealing with professional lawyers in the City of London.

Do the professional lawyers try to justify the status quo?

According to Chernow’s biography, John D. Rockefeller didn’t really get rich until Standard was busted up: he lost his voting stock but got shares in all the successor companies.

They became an order of magnitude more valuable than the Standard shares over the next decade or so IIRC.

Monopoly isn’t about the money, its about the power and monopolists fight getting richer this way tooth and nail!

It has never been — and I fear may never be — possible to convince the top 1% and especially the top .1% that it is in their better interest to have a smaller portion of a growing pie than a larger portion of a stagnant or shrinking pie.

Greed is truly the greatest disease.

Very good post, thanks for this!

While I find the compulsory licensing idea interesting, I would argue that an equally effective strategy would be to simply weaken intellectual property rights. Some of that has happened in the world of software in light of the Alice decision:

https://www.eff.org/deeplinks/2016/06/happy-birthday-alice-two-years-busting-bad-software-patents

But we need steps much further to limit economic rents. I’m preaching to the choir here at Naked Capitalism, but it is economic rents that truly hold back the progress of technology. Whether that means curtailing the length of patent protection for an innovation or breaking up oligopolies or regulating more industries like utlities (telecos come to mind), limiting rents would unleash broader gains for society as a whole.

You could also change the benefit structure of patent holding, such that there is still economic incentive to patent original ideas, but not in the form of a short or long term monopoly on the use of said ideas.

Might one ask if there’s another set of questions? Like whether Bell/Western Electric products and services were a true reliable regulated entity that provided reliable communications to most people? That the grift of their rentals of phone equipment and charges for local and long distance service were, at the time, a small enough “mordida” that most ordinary people could afford what was then considered state of the art? Whether the suits that ran the corporations involved, and the research part of the structure, for some reason produced stuff and services that were sort of felt by most people to be a public good? So is there some virtue in one form of monopsony/monopoly, where the regulation that is done by people in government, under statutes and regulations and policies that still (as I recall) aimed at “promoting the general welfare” before the seductions of corruption and the means and modes of regulatory capture reached their current state of “refinement?”

Of course, the structure Bell and WE companies created, for billing and funding, lent itself to the seductions of “government fees and taxes” on the interstate-commerce argument, which is a good notion in my estimation and experience, but like any other, the slime that seek domination and insane looting and profiteering and corruption take it to cancerous extremes.

Lots of examples of the cancerous parts of all this, like the wonderful predatory practices of Microsoft with patents and corporate warfare to demolish and/or absorb other actual innovators (often of stuff and code that I would consider inimical in the extreme — fokking spreadsheet, for example. And Apple “owns” the swipe? But my i(diot)Phone requires I press the little round button to “access” that vast mostly useless horribly intrusive load of “apps” and intrusions contained in its “form factor” and cameras and microphones and GPS snitch hard and software. The article shows how the cancer of IP can stifle the body, but does not ask or consider whether “innovation” ain’t an unalloyed good — not that given the forces of “the market,” combined with the stuff that K Street and Koch Street and the other wielders of power and influence is so good at (personal profit from stuff that is killing the planet’s habitability for us naked apes, both those who treasure their neighbors and pick up other people’s trash and care for them and try to build comity, and those who happily gut their neighbors and take their stuff alike…

And how many of us are wedded to the notion that the development of cell technology and the saturation of ever more of our personal environments with high-frequency RF energy (which of course “the regulators” and “the research” say is no big deal, in places that “rely” on “regulation” to set health and safety standards, I think Russia’s reg limits on exposure to gigahertz RF are about 1/100th or less than those of the US — Putin AGAIN?, his predecessors allegedly induced cancers in US ambassadorial personnel by beaming microwave energy through the Embassy walls) and the decimation of face to face discourse and facilitation of what was the Gramsci phrase, “a great variety of morbid symptoms appear”?

Aand what’s with the unexamined “postulate” that “innovation” is even mostly a “good”? Innovators at DARPA are developing and moving into procurement and deployment Avery kind of deadly killing sh!t that fertile mostly young raised-on-first-person-shooting “games” can come up with. CRSP-R is facilitating not just morbid but MORTAL pathogens and fiddling with stuff that’s like letting an apprentice electrician mess with the electronic innards of a nuclear weapon. Maybe no surprise detonation, but on the other hand… And Recall all the sturm und drang without any remedy, occasioned by the math-whiz “innovations” in derivatives and other “financial products”? There was “innovation” for you.

And every day the “spooks” are coming up with “innovations” in manufacturing consensus and consent, and overturning “governments” that don’t go along with what I think of as the main axis that connects all the stuff that’s been discussed here so recently, the movements of that “deep state” thing — markets, and looting, and “just die.”

But by all means, put “protection of market entrants” front and center. Those people hoping for The Next Big Thing and an IPO payday are for sure going to be serving the public interest, the public whose tacit or forced consent to be part of the polity that validates and underlies the “rule of law” as actually applied.

May I ask again: If there is a “we”, a question that might warrant as much discussion as whether there is a “deep state” and what it might be, WHAT OUTCOMES DO “WE” WANT FROM OUR POLITICAL ECONOMY, again? There are and will be outcomes, and it’s hard to believe that the initiation and generation of those outcomes is some kind of random process. Winners and losers — “Of course there’s class warfare, and my class, the rich class, is waging it. And we’re winning.” And the military and security (sic) bits of the whole schmear are certainly nudging the direction and magnitude of “innovation” and the impacts of all those New Things and Ideas that sure look to me to threaten my and my dear ones’ “freedom” and lives…

Awesome, JT. Questions that need to be asked here, when even Naked Capitalism accepts the implicit cancerous ideology of unending “growth” and “innovation”.

Great article!

Wholeheartedly agree with the premise. My wife works as a patent attorney, and she is very much against current policies since they supremely limit innovation and usually do not even benefit the inventor but rather the patent holder. According to my wife, pharmaceutical patents are 99.9% owned by huge mega-corporations/conglomerates and are routinely criticized for being “innovation-less”, since most drugs are:

1). Derivatives of natural forming compounds

2). Pre-existing drugs with random or inert chemical groups attached to disguise liabilities

3). Don’t work as described/trials not compatible with commercial intent

Nowadays, when anyone with a smartphone can find and copy anything, serious attention should be given to the idea of patents, since their entirety is the claim that the innovation was “non-obvious”. Most innovations are built on past innovations, so the idea that something is “non-obvious” is incredibly relative and in many cases, falsified. For example, Parker Hannifin has patents that just ran out of simple bypass valves. Bypass valves have been around for thousands of years. To claim that a spring-loaded bypass valve was invented by Parker Hannifin in the 1980’s is absolute BS of the highest degree. You can find similar examples all over the place.

The massive issue that patents engender is so called prior-art rules. These rules dictate that the patent literature tends to be in the right. This creates a hug mess right off the start since it glosses over patents that have been wrongfully approved. To fight existing patent literature, as an individual, unless you’re a multi-millionaire, you may as well forget about it. Average patent litigation costs $3 million. Just to begin the fight, you need around $50,000. This basically means that patents do not protect the right of the inventor, but the right of the conglomerate, university, law firm, etc. that holds the rights. Innovation doesn’t come from conglomerates or law firms. It also doesn’t come from universities. It comes from individuals that give up their life/time that work at universities. However, patents rarely benefit the inventor. Just look at the case of Lyrica.

Invented at Northwestern, Lyrica was sold to Pfizer for a paltry sum in the tens of millions. It made Pfizer almost a billion in its first year. How much did Silverman, the research doctor, make? 1 million in PRIZE money. That should show everyone that patents are not for the inventor. They are for the companies. They are for legal rights to dominate competition.

In a world where everything is built off of existing work, there should be no patents. In today’s age of information overload, it should be even more apparent how detrimental patents are. Patents are really awarded to the first company that essentially steals or buys work from universities. 3D printing is another example: ‘developed’ by Stratasys in the 80’s and 90’s, many companies were barred from ANY 3D printing technology until 1997 when the initial patents ran out. Stratasys was the first in America to get the funds needed to patent the crap out of it, so now Stratasys is the largest 3D printing company in the world. Did they develop the technology? No. People had been using lasers to cut ‘1D’ layers in paper and assembling them by hand for YEARS. Stratasys merely had the funds to both patent that technology, as well as claim that by inventing resins that solidified under a laser (they didn’t invent them – these resins already existed) and by combining the resins and 3D printing technology, they now had the rights to everything 3D printing.

So, in conclusion, patents don’t work because anything can be considered a new non-obvious patent as long as you pay your legal team enough. Anti-trust enforcement is the least that could be done to rectify the massive problem of allowing corporations to dominate every landscape.

Good post mate.

Yes, ban the corporation, they are truly are an evil conception of those with capital to amass more lucre, abuse the people, and hide their activities.

How do we know this isn’t a one time windfall?(like a corporate tax holiday) Would Bell have invested so much in their labs if they knew that that their patents would be given away for free? (leading to less research investment if a weaker patent protection were adopted in a steady state)

Because of management’s intent and obligations (moral, political and legal). See http://www.nytimes.com/2012/04/08/books/review/the-idea-factory-by-jon-gertner.html

The Bell system had a monopoly on telecommunications, so it invested in anything that may have any remote application to telecommunications. Hence, the long-term investments in basic research, and the very open research environments.

Sadly, the Chicago School dominates patent and antitrust law today in the US. The federal judiciary and the government enforcers at FTC and DOJ pretty much agree that no patent licenses–and no refusal to license a patent–violate antitrust law. It’s nearly impossible for a private party to get relief from antitrust violations by heavyweights in any industry. That’s because it’s nearly impossible for a party to have standing to sue for antitrust violations in the first place. The U.S. Supreme Court is the last bastion of the idea that patents can be damaging to the economy, but lower courts of appeal tend to sidestep Supreme Court precedent.

I’ll never forget moving into my great-grandfathers house in 1991 getting my first phone bill

and seeing the rental charge for the 1935 dial phone. 56 years of monthly rent. Thanks Illinois Bell!!!

When I lived in ZA, there was a two year waiting list for a phone. If you could get on the waiting list. Overseas calls cost 2.5 cents per second.

In the UK at that time all calls were metered. The US concept of teenager talking for hours over the phone was incomprehensible.

The US has the best phone system in the world.

The anti-trust action in the early ’80s had the effect of destroying Bell Labs, but, the 1982 anti-trust settlement did open the way the the internet in the ’90s.

And that opening is an unalloyed Good? Just a rhetorical question, of course. And it looks like the toll gates are being assembled and planted all over that internet thing. What’s going to come after “net neutrality,” and how do “we” get around the plumbing (with valves) that the corps own, so “we” can continue to blog ‘n stuff to our hearts’ content?

Mesh networks

https://www.wired.com/2014/01/its-time-to-take-mesh-networks-seriously-and-not-just-for-the-reasons-you-think/