Yves here. I am pairing this post with one by New Deal Democrat of Angry Bear to demonstrate how the ideology of economics masks its fixation with keeping wage rates low. Until the 1970s, economic policies focused on maintaining high employment and rising wages, with the view that stable and strong employment was the foundation of rising consumption and investment. Citizens with good incomes would get married and buy houses and cars and in due course have children. All of those would produce increasing levels of spending.

But the stagflation of the 1970s destroyed the credibility of American Keynesians led by Paul Samuelson. As an aside, they diverge with Keynes in significant ways. As I describe in ECONNED, they treat Keynes’s General Theory as a special case of neoclassical economics. Neoclassical economics has as a fundamental view that economics have a propensity towards equilibrium at full employment (I am not making that up). By contrast, Keynes believed that economies are inherently unstable. Keynes was bastardized by the mainstream because acknowledging instability would have been fatal to the aspirations of economists to depict themselves as scientists, which they do in large measure by using mathematical exposition (often of trivial points) to make their work appear more rigorous than it is and discount the views of laypeople and experts from other disciplines who do not use math as their lingua franca.

The causes of the 1970s stagflation are not hard to understand. The US ran large deficits in the 1960s when the economy was already at full employment. That was due in large measure to President Johnson being unwilling to raise taxes to fund the unpopular Vietnam War (along with lots of other spending programs, but the war provided a flash point). The Nixon shock of going off the gold standard, which led to a fall in the dollar, was in part caused by US military spending. That wound up giving inflation a second kick when the Saudis, using US support of Israel as an excuse, raised the price of oil in dollar terms to compensate for the resulting fall in the price of the greenback.

The final factor that enabled the 1970s inflation to become self-reinforcing was strong labor bargaining power. Union agreements typically had a cost of living adjustment built in; most white collar employers would also increase pay to reflect inflation increases.

Over 40 years of rolling back labor bargaining power means the big bugaboo of economists, self-reinforcing inflation, has no realistic odds of happening absent radical changes in the structure of the workplace. Not only are we seeing a rising precariat, with gigs or part-time work rather than real jobs, job tenures for traditional employment have shortened to under five years. Moreover, none of the economists below even considers that some, and probably a fair bit, of rising prices are not due to inflation but monopoly and oligopoly pricing in important sectors of the economy having an overall price impact. Even Larry Summers called this out last year as an issue:

As the cover story in this week’s Economist highlights, the rate of profitability in the United States is at a near-record high level, as is the share of corporate revenuegoing to capital. The stock market is valued very high by historical standards, as measured by Tobin’s q ratio of the market value of the nonfinancial corporations to the value of their tangible capital. And the ratio of the market value of equities in the corporate sector to its GDP is also unusually high.

All of this might be taken as evidence that this is a time when the return on new capital investment is unusually high. The rate of profit under standard assumptions reflects the marginal productivity of capital. A high market value of corporations implies that “old capital” is highly valued and suggests a high payoff to investment in new capital.

This is an apparent problem for the secular stagnation hypothesis I have been advocating for some time, the idea that the U.S. economy is stuck in a period of lethargic economic growth. Secular stagnation has as a central element a decline in the propensity to invest leading to chronic shortfalls of aggregate demand…,

Third, it could be that higher profits do not reflect increased productivity of capital but instead reflect an increase in monopoly power. If monopoly power increased one would expect to see higher profits, lower investment as firms restricted output, and lower interest rates as the demand for capital was reduced. This is exactly what we have seen in recent years!

Is the increased monopoly power theory plausible? The Economist makes the best case I have seen for it noting that (i) many industries have become more concentrated (ii) we are coming off a major merger wave (iii) there is some evidence of greater profit persistence among major companies (iv) new business formation has declined (v) overlapping ownership of companies that compete has become more common with the rise of institutional investors, (vi) leading technology companies like Google and Apple may be benefiting from increasing returns to scale and network effects.

The combination of the fact that only the monopoly power story can convincingly account for the divergence between the profit rate and the behavior of real interest rates and investment, along with the suggestive evidence of increases in monopoly power makes me think that the issue of growing market power deserves increased attention from economists and especially from macroeconomists.

Yet as you will see from the post below, economists and most of all central bankers are still obsessed with the last war. Even though some see a rise in reported inflation rates as a plus, you’ll notice how little ink they spill on labor market conditions.

By Pia Hüttl, an Affiliate Fellow at Bruegel. Originally published at Bruegel

What at stake: After years of deflationary pressures and anaemic economic performance, inflation seems to be on the rise again, both in the US and the euro area. Does this comeback mark a return to target? Will it be sustained, and what should central banks be thinking? These are among the questions raised in the blogosphere.

Dieter Wermuth is happy that inflation is back in Germany, with the consumer price index hitting 1.7% in December. He states that if prices increase monthly by 0.2% from now onwards, the HICP will increase to 2.2% or 2.3% in February on a seasonally adjusted basis. It will not fall under the 2% line if these monthly price hikes continue.

The real question is whether these increases will prove sustainable. For this, wages – the biggest cost factor, would have to move a bit more. But wages are not increasingly rapidly. This is despite increases in employment numbers – around 0.8% yearly over the last 5 years – and a decrease of the unemployment rate from 8.3% in crisis-year 2009 to 6.0% more recently. Since 2014, yearly wage gains range from 2.5 to 2.8% (on a hourly basis). There is no wage-price spiral in sight, and hence no action required by the ECB, given also the weaker inflationary pressures due to lower economic growth in the rest of the eurozone. But the train seems to have started moving.

Tom Yates adds his thoughts on the political economy of pre and post inflation rates in the euro area. Before the financial crisis, a standard assumption was that the southern peripheral countries were on a path to converge their income per capita to northern levels, and as such, through Balassa-Samuelson effects (describing how increase in traded-goods-sector productivity in the South bids up the price of non-traded goods there, relative to abroad), experiencing faster inflation. The ‘below, but close to’ 2% target of the ECB was fine for the conservative north, since it meant that hitting 2 per cent inflation in the Eurozone as a whole would actually imply <2 per cent for them.

However, after the crisis, the southern story looks rather different. It turns out that the price of non-traded goods was being pushed up not by durable increases in productivity, but by excessive domestic demand, fueled by borrowing against future income that was not going to arrive, and facilitated by spreads that were too low. The south has now been embarking on a protracted and painful internal devaluation. The political economy of the aggregate 2 per cent target is now not so favourable to the north, since it means northern inflation will have to average >2 per cent to hit the target while this devaluation is underway in the south.

On a global level, Gavyn Davies argues that in mid-2016, the global economy embarked on a regime of reflation that has been dominating market behaviour ever since then. One of the most important questions for 2017 is whether this bout of reflation will continue. His answer is that it will continue, at least compared to the sluggish rates of increase in nominal GDP since the Great Financial Crash. Headline inflation rates might keep rising if commodity prices respond further to the strength of global aggregate demand. However, he argues that one of the most important lessons from the recent past is that core inflation is extremely stable at a low level in the face of commodity price shocks in both directions. This limits the probability of a major inflation scare in the advanced economies.

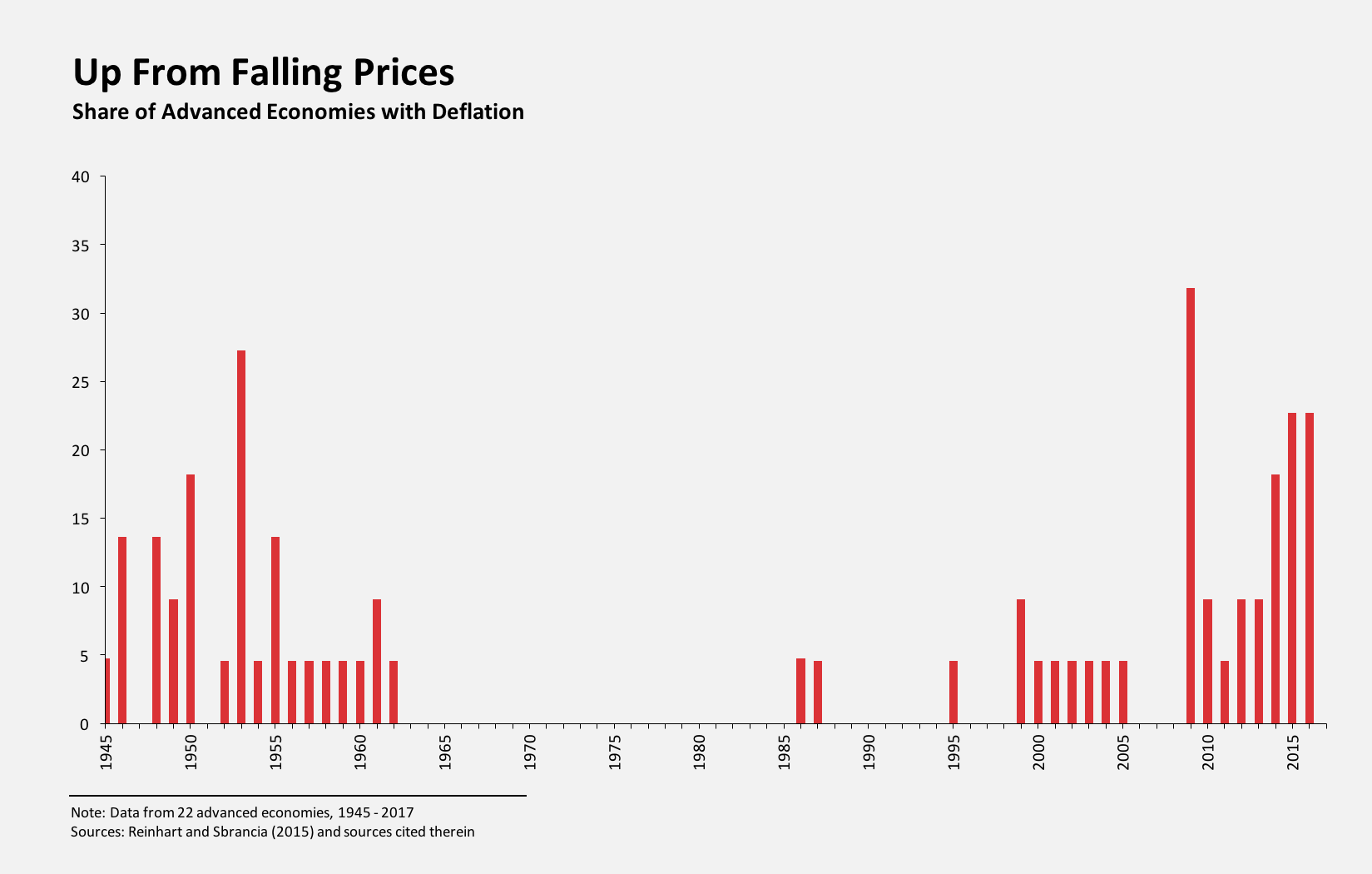

On a similar topic, Carmen Reinhart asks herself if the deflation cycle is really over (see figure below). Since the global crisis that erupted in 2008, private deleveraging became a steady headwind against central bank efforts to reflate. In 2009, about one-third of advanced economies recorded a decline in prices – a post-war high. In the years that followed, the incidence of deflation remained high by post-war standards, and most central banks persistently undershot their modest inflation objectives (around 2%). Also, she argues that because US President Donald Trump’s stimulus plans are procyclical – they are likely to gain traction when the US economy is at or near full-employment – they have reawakened expectations that the US inflation rate is headed higher. Indeed, inflation is widely expected to surpass the Federal Reserve’s 2% objective.

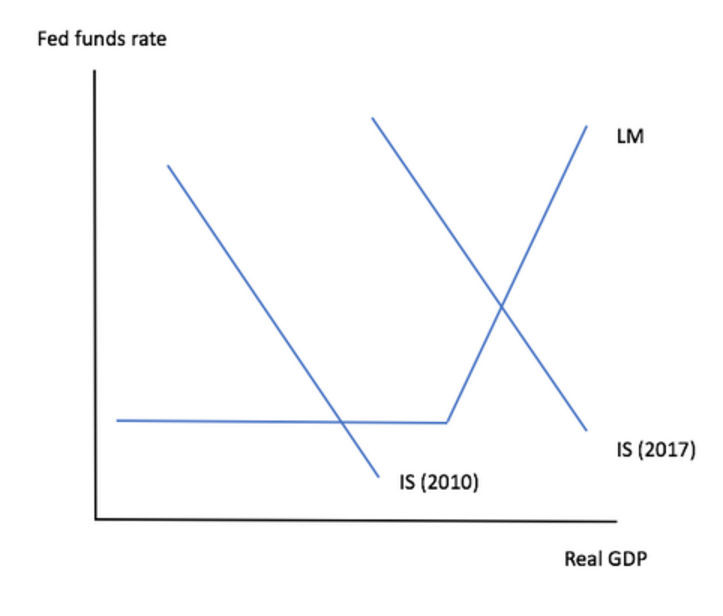

Paul Krugman also has some thoughts about the shock of the normal, and shows it with an updated version of IS-LM. Suppose you’re considering the effects of policies that will, other things equal, raise or lower aggregate demand — that is, shift the IS curve. In normal circumstances, where the IS curve intersects an upward-sloping LM, such shifts have limited effects on output and employment, because they’re offset by changes in interest rates: fiscal expansion leads to crowding out, austerity to crowding in, and multipliers are low.

In the aftermath of the financial crisis, however, we spent an extended period at the ZLB, as shown by the “2010” IS curve. In those conditions, shifts in the IS curve don’t move interest rates, there is no crowding out (actually crowding in because increased sales lead to higher investment), and multipliers are large. Wages are finally rising, quit rates are back to pre-crisis levels, so we seem to be fairly close to full employment, and the Fed is raising rates. So it now looks like the “2017” IS curve in the figure.

Inflation “Overshooting” and Central Bank Action

Paul Krugman adds that the US seems just barely over the border into normality, which is why he thinks the Fed should hold and the US could still use some fiscal stimulus for insurance, and very low rates still make the case for lots of infrastructure spending. But the situation is not the same as it was.

Following Gavin Davis, inflation expectations will continue to rise markedly in the advanced economies only if the credibility of central banks’ inflation targets is called into question. For him, this seems unlikely in the Eurozone and Japan, but it is more conceivable in the US and the UK, where labour markets are very close to full employment. In both of these countries, there are questions about the tolerance of the central banks to “temporarily” higher inflation under the new political regimes that have emerged.

The President of the Federal Reserve Bank of Chicago Charles Evans put forward his thoughts on the topic in a speech back in June 2016. For Simon Wren-Lewis this essentially means that the Fed should depart from the usual policy approach of targeting expected inflation, and wait for inflation to actually rise above target before it raises rates. This would mean that it should ignore any fiscal stimulus (whether it be tax cuts or additional public investment), and focus simply on the actual inflation rate. He states that “if we are in fact below full employment, or if demand creates its own supply, fiscal expansion would raise output and welfare”.

Simon Wren-Lewis adds an important point: you do not need to believe with certainty that an economy is below full employment or that demand will create its own supply. All you have to do is give it some significant probability of being true. You then look at the costs and benefits of pursuing an Evans-type monetary policy weighted by this probability. A key point here is that the costs of a short term overshoot of the 2% target are likely to be a lot smaller than the cost of missing out on a percent or two of national output for potentially some time.

I’ve been repeating myself ad nauseam on this – if you want inflation, give people (and I don’t mean the 0.1%) more disposable income.

QE goosed asset prices, but that means nothing to most as they have very little in assets. Indeed, if QE was successful in raising inflation (which is still dubious, it would be a wealth transfer mechanism – from the poor to the rich (which even BoE admitted a few years back). Well, it was that anyways, but it would be even more so.

Unfortunately, as the article notes, monopolies can cause inflation.

Comcast is an example well known to Americans. I’d argue HMOs are too these days with Obamacare.

Intel’s monopoly in the CPU front is a serious challenge too. Hopefully AMD can challenge with their Zen CPUs soon.

The US doesn’t have an automatic tax system like Norway’s where the government automates the process, largely due the lobbying of H&R Block and Intuit. They of course want to extract their economic rent from you. Grover Norquist, the lobbyist once said he deliberately wanted to make taxes miserable for most people.

Canada is a bit behind, but the CRA here is trying to catch up on that one.

But yeah, basically it amounts to a lot of rent seekers. They are extracting from the economy and driving prices up. It’s not a secret that corporate profits are up and real wages are down, the benefits of which go mostly to the 1% and to a lesser extent the top 10% that control capital.

This war on inflation is basically naked class warfare to keep real wages low.

Early reports on Zen seem to indicate it has comparable (but not noticeably better) performance to the latest Intel processors. It might still be a challenge if AMD sells it for a lot less than Intel, which has always been AMD’s chief strength. But it seems Moore’s Law has just about run out, and we’re now in the era of sharply diminishing returns, before finally hitting a brick-wall around 7 nanometers.

Vlade

Yes! QE in the USA is nothing but a modern version of the old hierarchical temporal social order over the supply of money. Do not let its fancy name and computerization fool you. While in Europe the most significant statement is that the savings-to-investment ratio is the largest since world war 2.

Agreed, but I would reverse your formulation. The goal never is to have inflation or deflation; the goal is for the economy to be distributed equitably. Therefore we should not want inflation per se but we should want people to have more disposable income, which should result in inflation as a side effect.*

QE, on the other hand, has a marginally tangential relation to inflation at most since the increased wealth barely enters the real economy. What it does do, however, is inflate asset prices, creating bubbles all over the planet. When bubbles burst, it is those of us at the bottom of the economy who are ultimately most hurt.Our disposable income goes down: the opposite of the stated goal (not bug; feature).

__________

*At least in the systems in question. Monetarists have as dogma that increasing the money supply always leads to inflation, but as is so often the case with religious dogmas, real life ain’t that simple.

I love vocabulary, so I had to look up the word precariat. Fascinating that there’s a precise term for the state of most people in the US today.

Just hope they don’t turn into the indigniat [derived from Spanish indignados].

Peasants wielding pitchforks can ruin the paint job on your Porsche. :-(

Yes. There’s been a lot of great words added to my vocabulary from reading the articles on this site. Maybe Yves and co. could publish a sort of Devil’s dictionary collecting them all? “The Devil’s Diction: The language of modern economic policy makers and what words to use so that citizens can communicate the resulting effects. With introduction by Bill Black…” :)

Michael Hudson has done this to some extent.

So using price to tangible book value as a measure of asset-light, outsourced American companies? We’re selling a ton of digital information to people today (knowledge economy and whatnot), so Tobin’s q ratio is not such a hot measure of the market’s valuation (unless you want to make a point about overvaluation, I guess). What about Buffett’s methodology — the market’s market cap relative to US GDP? Still pricy, but probably a better measure.

Maybe your insightful comment about “asset-light” companies helps explain why market cap to GDP never exceeded 100% until 1996. Even back in cast-iron, tin-Lizzy 1929, the measure reached only 88%. Chart:

Currently (Feb 2017) we’re at 122.5% market cap to GDP. It’s lower than the Bubble I peak of 151%, but still in the 99th percentile for the past 100 years. Chart:

Bubble III: savor the bold!

Another element of stagflation, at least the British kind, seems to have been deregulation of credit cards etc.

Thus all of a sudden you had a whole new fire hose spewing money into the economy.

But most mainstream economists will stick to the “one mans asset is anothers liability” mantra when talking about lending.

“That was due in large measure to President Johnson being unwilling to raise taxes to fund the unpopular Vietnam War (along with lots of other spending programs, but the war provided a flash point).”

Struggling to understand economics, and communicate these ideas to friends and colleges, I find this statement confusing, especially the “to fund” part. Government spending and taxing powers is the engine that makes everything go- in the broad sense. Spending happens first, then the taxing has to take place to remove that excess money from the system. The tax should fall on the true benefactors of the spending to avoid inflation in that sector. In the case of war spending, arms producers.

Neoliberals have been so successful because common people instinctively relate to the notion that nothing can be done before money is raised, as in a household. The above statement says just that, taxes fund, confirming the prejudice. Getting this wrong turns a democratic government for the people into an authoritarian government exploiting the people.

I only bring it up because to convince people otherwise is next to impossible. Everyday experience overwhelms more complex descriptions on how society actually works and to who’s benefit. People need simplicity.

Pooling resources first, before action, is only necessary when you are building something from scratch. Something new removed from the existing social order. This is where the complexity comes in. Where you fall on the social hierarchy determines what tools are available to you.

The theme moving forward has to be about social engineering and how to achieve desired outcomes. If social spending can easily be subverted by a unscrupulous greedy elite, the time has come to cut the ties and begin anew. Without that, the tax burden, the labor burden, will fall entirely on the poor, while the wealthy use the power of government to enrich and shelter themselves alone.

Everything you say about taxes not funding spending holds true so long as a government has a fiat currency, but the US did not have a fiat currency until 1971 when Nixon took the country off of the gold standard. Before that point the government had a limited amount of dollars it could produce, limited by its gold reserves. After 1971, that restriction was abolished and we are now in the situation you mention, where the only constraints on spending are real resource constraints, not currency constraints.

“Before [1971] the government had a limited amount of dollars it could produce, limited by its gold reserves.”

It was actually a more gradual transition. In the 1920s and 1930s, gold reserves were the largest component of the Fed’s balance sheet. By 1945, deficit financing of WW II brought Treasury securities up to half of the Fed’s balance sheet.

In this chart of the Fed’s balance sheet during the crucial years from 1965 to 1975, gold reserves (by now a small percentage of the total) shrank outright as ol’ Charles DeGaulle cashed in dollars for specie, in a kind of “run on the central bank.” Meanwhile, short and long-term Treasuries (shown in orange and dark blue respectively) ballooned monstrously as the Fed performed its central mission of war finance. Chart:

From the Bretton Woods “dollar exchange standard” agreement in 1946 until it imploded in 1971, the US was cheating like hell. It was pretending to have a gold-backed currency, even as it expanded monetary reserves with irredeemable fiat backing. The only surprise is that it took hapless foreigners (other than DeGaulle) a quarter century to suss out our scam and call us on it.

1. The US was still on the gold standard under Johnson. So it did need to tax to fund spending. Haygood is correct it was cheating but it still hadn’t cut loose.

And the dirty secret is that everyone on the gold standard cheated, as in periodically devalued.

2. From a political perspective, people still believe 1. even though this is no longer true operationally. So the optics and the process (the Treasury issuing Treasury bonds to “fund” spending, when in fact the spending takes place immediately) still dominates how the public views matters.

3. The use of taxes in Modern Monetary Theory is to combat inflation, create incentives and disincentives. So in fact Johnson did need to increase taxes regardless and didn’t. Big fail that we are still paying for now.

Summers’ reference to growing monopoly power is welcome. With the exception of articles in Monthly Review and a couple other left publications that issue has almost entirely disappeared from public discussion. NB how after Yves’ citation of Summers in her preface the economists the article assembles don’t mention the problem.

What also disappeared from the media is any discussion about the continued price inflation since the 2008 meltdown when many prices rose 50 to 100%. Every one of my bills continues to go up; my school and property taxes continue to go up; supermarket prices continue to go up. (I do not consider supermarket sales “deflation.”) And the increases are all well beyond the 1.7% touted by economists and the media. Some of the increases I’ve seen lately amount to 20%.

On a separate, but related note to yves’s comments, is there a more ridiculous idea in the econ world than the concept of NAIRU?!!??? Is there ANY empirical evidence for proof of that concept, or is the whole idea just a big excuse for central bankers to come down hard on rate hikes at the first sign of wage increases??!?!?

If you look at the history of the cpi in the late 60s-early 70s, it took years of loose policy, a broken monetary system, and a pair of oil shocks to get price pressures building.

A longer view of inflationary episodes in history shows that major inflationary periods are mostly associated with war spending. So, if inflation was the real concern of central bankers, they’d yell at governments to lay off the wars of opportunity!!!

But, of course, we know it’s more about pounding the average wage earner, more than anything else.

Diptherio totally agrees with you.

And I would add, your point about wars is kinda shaky. None of the US wars since Vietnam has had any real effect on inflation– at least in the US. The countries destroyed by US military action, however, (all?) have inflation problems as they run into resource shortages. From the evidence I see, inflation is caused by supply shocks and supply shocks are an inevitable consequence of having your economy disrupted by invasion.

I’m trying to find a quick chart showing major inflation spikes around wars. I know there was a big one around the civil war, and around WWI and WWII, Korea was a smaller bump, Vietnam was a biggish one, but historically it’s been true. I’ll concede that the correlation has probably decreased in recent decades, but that might be because…

1) the wars aren’t big enough as a % of GDP. Defense (Offense?) spending is still well off its Cold War peak.

2) Maybe also there’s an argument that US wars that since wars have gotten less inflationary as they’ve gotten less labor intensive and more capital intensive (this probably holds as long as there aren’t tremendous resource constraints, which there aren’t since US has the lion’s share of the world’s natural resources as it’s beck and call).

Keep in mind at peak, US had about 166K troops in Iraq….vs 500K in Vietnam.

Or (3) spending commodity-backed money on wars necessarily causes inflation at home, whereas spending fiat currency does not.

The inflation spike after WW2 was a result of the end of rationing and wage and price controls during the war. In particular, there was lots of labor push for high wage increases to make up for lost purchasing power during the war. (Price controls were not 100% effective but wage controls were.) Possibly (others might know) if this was the case for WW1. Whereas this is not at all the case for Viet Nam and later wars.

Is there a more ridiculous idea in the econ world than the concept of NAIRU?!!???

As a kid, I had a nice gold NAIRU shirt. Looked like these:

Weren’t various NC writers (including Yves) predicting EU deflation within 1-2 years, around 2 years ago?

I viewed that as credible myself, around that time, but here we are seeing inflation climbing again.

We do not make market or economic predictions as a matter of policy. We were describing current conditions.

The EU was in borderline deflation until May of last year:

http://www.tradingeconomics.com/euro-area/inflation-cpi

Note that Carmen Reinhart above isn’t sure whether the EU is really out of deflation. The Euro has dropped some since the Brexit vote and oil prices have gone up in dollars, so more in Euro terms. That has had an impact, but not clear how much.

“Indeed, inflation is widely expected to surpass the Federal Reserve’s 2% objective.”

In fact, it’s probably gonna happen tomorrow morning at 8:30 am, when the CPI release comes out. I project a 2.2 percent year-on-year rise, possibly 2.3%.

The interaction between fiscal stimulus and monetary reserve expansion is not well understood, but under the right circumstances (such as the 1960s period that Rabbi Gandhi and I were discussing above) they can be synergistic.

Whether it’s the procyclical infrastructure spending mentioned by Carmen Reinhart, or simply the automatic stabilizers in a coming recession, heavy fiscal stimulus could finally ignite the dry tinder of QE1-4 and give us a flashover of stagflation.

J-Yel plans to waltz out of her post before it gets too bad. She don’t want to end up tarred as the “21st century Arthur Burns.” :-0

Wild! So stagnant growth combined with the slightest scintilla of inflation above 0% is “ZOMG Stagflation!!!”? The Craazyman Fund should start shorting Wiemar barrels.

Historically, the level at which inflation starts to erode equity valuations is around 5 percent. Below that level, nobody’s going to get too excited. Initially, it might even be welcomed.

But I really doubt that GDP is going to grow any more under Trump than the feeble rate achieved under Obama. Roughly, sub-two percent GDP growth coupled with inflation of 5 percent or more can be called stagflation.

This is a real dilemma for Craazyman Fund as it approaches its first year anniversary on March 2nd. What to do, what to do?

OK so if you’re projecting Obama style stagnant growth (I agree– stagnation may be even optimistic given “events”) plus inflation under 5%, why even bring up stagflation (other than the fact that the word is constantly used by monetarists to scare the population into accepting austerity?

How are you not guilty of the sin (remember I am a rabbi after all) outlined in today’s posts: obsessing over inflation while the 99% suffers from issues (no jobs, declining real wages) that are only exacerbated by economists’ inflation fixation?

Shoulda said “incipient stagflation.” It could become actual in 2 to 3 years.

One idea under consideration for Craazyman Fund is a modest position in a commodity fund. Otherwise, holding bonds during an incipient stagflation is not going to be any fun at all.

“Incipient stagflation”

From now on I’m gonna call the benign freckle on my ankle “Incipient Stage IV melanoma”.

I read it thusly, the economy is so far removed from reality at this point for a large percentage of working people,that the fear this inspires will either ignite scarcity in purchase power for non essentials, or the animals at the top will jack commodities so far into their ratios about true employment that the working class will collapse on itself. Encourage those on the way down to bankruptcy to increase purchases in essentials like something to sleep in and a way to stay connected for the big hustlers atg the top that create the stupid apps for menial tasks and they might find that the scarcity principal will starve the middle class wage earners in retail that the wealthy will not be able to fill the gap. H1b1 visas will be a n interesting concern as Trump balances his hit list of career economists across his concern for immigration. This will increase the odds that his deportation policys will create even more backlash to operations that somehow, all those dollars that are spent here by illegals will continue while the trueist of the blue begin to actually reflect there values that they will harbor the illegals and either house and employ them to decrease riotous activity. The cops will blush as they are spared the need tp police anxious citizens. If everyone balances this appropriately we can charade along as usual and prey gist intended for an actual healthcare policy free fror all citizens and better for the rich.

“Even though some see a rise in reported inflation rates as a plus, you’ll notice how little ink they spill on labor market conditions.”

It’s a feature, not a bug …

The causes of the 1970s stagflation are not hard to understand.

I know this is generally perceived to be the case but I’m not so sure it’s true. As Yves has pointed out in previous posts, it turns out growth during the 1970s wasn’t all that bad. In fact, it was higher than any decade since. So I’m not sure the “stag” part of stagnation even exists. I was around (in my teens) then and the general sense of stagflation at the time – and I would argue it was a zeitgeist term, not a technical term for economists – was that life was more than just buying more stuff, and the stuff itself was increasingly crap (see 1970s cars and clothes – although lots of other things in retrospect were still pretty well made).

As far as inflation, clearly the primary cause(s) of 1970s inflation were the two oil shocks. I can’t find a good chard that shows inflation net of oil effect (perhaps one of you chart wizards knows where to find one) but the oil shocks were clearly exogenous in economic sense.

The final factor that enabled the 1970s inflation to become self-reinforcing was strong labor bargaining power. Union agreements typically had a cost of living adjustment built in; most white collar employers would also increase pay to reflect inflation increases.

I have started pushing back hard against the notion that there even is anything called “wage-push” inflation. Yes, many union contracts had automatic cost-of-living clauses in those days but BY DEFINITION those clauses only responded to inflation, they didn’t “push” it. In digging through the history of that period, I can’t find any (private sector) union contracts that that negotiated wage increases higher than long-run productivity plus immediate past inflation. One could point to increasing benefit costs as an inflation driver. But this is all driven by health care pricing power. The unions were not (for the most part) negotiating new benefits (i.e lower employee co-pays and deductibles, since these were at the time already very low). They were simply maintaining a constant benefit that was increasingly costly for employers to provide. (The UAW at the time always threw out a joint employer-union push for national health care as a bargaining proposal though it is not clear that it was ever serious. The union was well aware that capitalist class solidarity would keep the Big Three from supporting it even as it become obvious that US health care costs were killing them.) One might also point to high public sector union settlements, but I’m not sure how big a driver they would have been at the time.

There is only one proximate cause of inflation, which is producer pricing power. (Even for housing, for which I will admit interest rates play a key role.) Regardless of any cost push (and I have argued that there has never been evidence of wage-push inflation, which means even “cost-push” inflation is ultimately caused by pricing power of commodity and intermediate goods suppliers), producers can only raise prices if consumers will pay.

So yes, it’s high time we investigate the true causes of inflation. Given continued weak labor power and global competition in many industries, it seems obvious that any current inflation ought to be easily traceable back to those firms that have pricing power

I’d add that the oil inflation came beginning in 1973. In 1971, U.S. domestic petroleum production peaked, exactly as M. King Hubbert predicted, roughly 40 years after the peak in discoveries of reserves. In 1973 the Arabs began to use the “oil weapon” to protest the Yom Kippur war. For the first time in its history, the U.S. couldn’t produce its way out of a shortfall.

Price of oil in…

1971 – > $1.75 / barrel

1982 – > $42.00 / barrel (the peak, at that time).

According to Daniel Yergin, the Arabs never denied the world more than 3% of global production, but when you can’t get the petroleum you absolutely must have, cost push inflation ensues. The housing bubble that followed was based on leveraged returns in an inflationary environment (and some crooked S&Ls).

Incidentally, Reagan lucked out because Alaska’s North Slope came online soon after that price peak, and prices moderated to in the $10 / barrel range, producing much of the vaunted “Morning in America” recovery, although the trillion or so dollars in deficit spending didn’t hurt either. (Krugman’s Peddling Prosperity does a nice job of documenting how that “Morning” was really an average business cycle recovery.)

Why the hell do we want inflation anyway? I’ve never understood that. Inflation reduces the purchasing power of our dollars. If we don’t get raises that exceed the inflation rate, we actually become poorer.

IMO, this is as stupid as US Government and Federal Reserve propping up housing prices after they fell from the artificial highs of the housing bubble. Higher housing prices make housing less affordable. And sure enough, home-ownership rates have fallen from 68% to less than 64% over the past 8 years. [And the affordable housing advocate inside me is furious.]

If the economy is growing strongly (and wages are likewise growing strongly), rising housing prices and general inflation are common side effects. People have more purchasing power, which means that they can bid up prices on houses and afford higher prices on goods & services than they did before. But they’re unwanted side effects. It’d be even better if wages grew sharply without any housing price rises or general inflation at all. But when wages are growing sharply, “times are good”, and people are generally pretty tolerant of inflation that is slower than their growing wages.

To impose the unwanted side effects without the happy cause (i.e., growing wages), though, just makes everybody miserable and unhappy. Shooting for 2% inflation when wages are flat just makes everybody 2% poorer. Why are we doing this, again? Have we mistaken the unwanted side effect for the cure?

Seriously, could somebody explain to me why economists consider a 2% inflation target to be a good idea? It seems to be the accepted “conventional wisdom”, but for the life of me, I cannot figure out how it actually improves things over a 0% rate.

Dunno if they have an explicit theory on this but I can think of three reasons:

1) They dislike inflation but they hate deflation. They know they can’t control ‘flation very well so they try to keep a margin of safety.

2) Inflation reduces real debt repayments so (they think) the government gets off the hook easier.

3) They realise (perhaps subconsciously) that a little inflation actually promotes growth, just as deflation promotes contraction. Perhaps I should say the same forces that can create inflation also promote growth, rather than the inflation itself.

You said, “a little inflation actually promotes growth, just as deflation promotes contraction“.

I don’t understand. How does a little inflation actually promote growth? And how does a little deflation promote contraction?

I understand the hazards of steep inflation: People hoard physical goods as a way of preserving wealth, even to the point of hoarding stuff they don’t need. [See Venezuela as an example.] And the hazard of steep deflation would be similar: People would hoard currency as a way of preserving wealth, and the money supply would eventually disappear entirely, pushing everybody onto the barter system.

But I still don’t get how 2% inflation is helpful. You said it promotes growth, but didn’t explain how. And why is 2% a better target than 4% inflation at promoting growth?

And how would 2% deflation cause contraction? After all, we’ve seen shocking levels of deflation in the consumer electronics world over the years, and everybody’s response has been to buy more. How is that a contraction?

I still think economists are confusing symptoms and root causes here.

Yes it is a confusion of symptoms and causes.

A growing economy, with a growing population and decreasing poverty will naturally have inflation as demand increases (as people are given the chance to buy things they never had before– eg, China). An economy that is contracting in spite of a growing population, that has decreasing aggregate demand and has an increasing gap between the richest and the poorest, will have no inflation or even deflation (eg, Europe and the US).

Thus whilst inflation is not a goal in and of itself, it is a good indicator that something is going wrong. No inflation generally means enterprises have less income –> less income –> fewer staff –> fewer jobs –> less demand for products=deflationary spiral.

A healthy economy should have an inflation level in accord with its growth level, and cost of living adjustments for workers and fixed income recipients like retirees– essentially the US economy in the 1950s/60s. But this is not what the Central Banks want with their inflation target, because they do not treat it as a target but rather as a ceiling: don’t let the CPI get over 2% or we’ll use monetary policy to squelch growth. And that’s just hunky dory for the oligarchs, because who wants to lose value on debts and to have to negotiate with ornery workers for COLA raises?

You said, “A growing economy, with a growing population and decreasing poverty will naturally have inflation as demand increases.”

I’m not sure I buy the first part of that. If the money supply in active circulation remains proportional to the size of the population, then price and wage pressures would remain unchanged on a per-capita basis. [Except for land prices, of course, because the land supply is fixed.] Decreasing poverty, on the other hand, implies rising wages, which can indeed drive inflation. But I maintain that the inflation is an unwanted side-effect. Not something to be sought even in the absence of rising wages or falling poverty rates.

You also said, “No inflation generally means enterprises have less income –> fewer staff –> fewer jobs –> less demand for products = deflationary spiral.” I don’t think I buy that either. Flat prices would mean flat income, not less. There’s no spiral there at all. And when companies use productivity gains to lower their prices (eeek, deflation!!), they often come out ahead because of increased volume. Lots of things in our economy have gotten cheaper over the years but still remain viable products for companies to make.

And a final note: If inflation were zero, COLA raises wouldn’t be necessary for anybody.

You’re both overlooking a fact Michael Hudson cites repeatedly: debts (payable with interest) grow faster than the ability of the real economy to repay them. The tendency is for indebtedness to produce debt peons, hence such things as debt jubilees. Inflation offers a mini-jubilee, and convinces consumers that money can “spoil” and shouldn’t be hoarded, overcoming their reluctance to spend.

Before the ’70s the U.S. economy was reliably producing increases in real incomes accompanied by productivity increases. That expectation disappointed may factor into the horror about inflation, but the inevitability of debt outrunning the real economy’s ability to pay is simply mathematical. Even Einstein, when asked what was the most powerful force in the universe, replied “compound interest.”

I have a much simpler explanation. Producers always want to raise prices and will whenever they are able. Deflation, net of productivity gains, is a structural condition where producers are not able to raise prices, which makes them very unhappy. When capitalists are unhappy, economists (lackeys to capital) are unhappy.

I am not of the view that economists are generally right or know what they are doing. My reasons above are what I think they may be thinking, not necessarily what I think is true.

However, inflation is generally thought to be caused by an excess of demand (or money) over available wealth in the economy. High demand encourages wealth production. Sustained high demand will encourage investment in extra production capacity.

Conversely deflation means reduced demand, unsold inventory, less production, no investment.

Ha-Joon Chang cites empirical data showing that 10% or even higher inflation does not in fact harm growth. I don’t think an inflation target is desirable. The target should be full employment. Inflation is an indication that it has been reached.

If inflation is 10% (or even higher) and wages are rising slower than that, I can assure you that it hurts growth. Why? Because the real wages of workers would effectively be falling, and this would reduce their purchasing power and their ability to provide demand. Is this not essentially what’s happened over the past 8 years? “Mild” inflation has gobbled up the purchasing power of our equally mild raises, and overall demand has pretty much stayed flat. Economic growth has barely kept up with population growth.

Looking at inflation independently of wages is a fool’s errand. Vlade’s very first comment said it all: “If you want inflation, give people (and I don’t mean the 0.1%) more disposable income.” The Federal Reserve has failed entirely in this regard. All we’ve really gotten is lots of asset inflation, which pretty much only benefits the people who hold the assets, i.e., the 0.1%.

Yup. Wages must keep up with inflation, either by union action or enlightened government, or there will be ructions.

The trend you refer to has actually been going for about 40 years. Unions have been squashed at the same time. The gap has been filled with easy debt and unemployment. But the first ruction has finally arrived in the form of Trump.

Consumer electronics have not deflated, their prices have gone down. This is due to competition, economies of scale, improvements in technology etc.

Phones are cheaper but other things are more expensive.

Economies deflate, not individual commodities. ‘flation is a general, sustained trend of changing prices. One-off price hikes or reductions in one class of good don’t count.

Myth: Inflation lets government off the debt hook easier.

Correction: Unanticipated inflation lets government off it’s long-term debt easier.

Anticipated inflation is wired into interest rates. And when most of the debt is very short term, inflation won’t for long stay unanticipated at the times interest rates are locked in.

Another characteristic of inflation is that it’s good for debtors and bad for creditors, since it reduces the value of outstanding debts in inflation-adjusted terms. Lenders (banks) don’t like that for obvious reasons, so they prefer inflation to remain low. In general inflation acts to level the playing field by making both past savings and past debts less relevant in comparison to current borrowing/lending/earning activity. Yes, it diminishes the real value of wages, but I think most people (and certainly all unions) are aware of that and expect employers to make annual adjustments to allow for it. It does make it a little easier for employers to impose stealth pay cuts in real terms without appearing to do so, but that can be mitigated.

At a macro level, very low or zero inflation is considered undesirable because it makes hoarding currency a more attractive option relative to investing it. This reduces overall demand, which leads to overcapacity, business losses, unemployment, and recessions/depressions. In extreme cases (zero inflation or deflation) you can also end up with large hoards of money that aren’t spent for a long time and therefore aren’t participating in the economy. It can be difficult to track where (and how large) these hoards actually are, and if conditions change and they all reenter the economy at the same time it can have a destabilizing effect and you get boom/bust cycles. It also reduces the level of control the government has over the money supply, which limits the influence of fiscal and monetary policy decisions.

Having a low but non-zero inflation rate largely preserves the function of money as a store of value over short periods of time, but imposes a significant cost on anyone using it for that purpose over long periods. Rather than accept that cost, people will look for ways to spend or invest it. This results in money changing hands more often, which increases economic activity and keeps businesses healthy, workers employed etc. (provided it doesn’t go too far, but that’s another story).

I don’t think the banks care very much about the inflation rate, as long as it’s predictable. They made money when inflation was high in the 1970s and 80s, and they’re making money now when inflation is low. The tactic is always the same: Charge a higher interest rate than the current inflation rate. Inflation only helps when it rises and people have their old debt locked in at lower rates. It doesn’t do anything for people looking to take out new debt.

And is there any evidence that a low or zero inflation rate make hoarding money really attractive? I don’t think there is. If you hold money in a zero inflation rate environment, you get a zero percent rate of return. Sounds like a crappy return to me. Have you seen a study that suggests otherwise?

Now if the inflation rate were negative 10% or so, then hoarding money would indeed be super-attractive. But at zero? There’s no gain there at all.

I agree that a positive inflation rate imposes costs on anybody holding money, and that it encourages people to spend or invest it. But is that really what we want? To force people to buy crap they don’t need? Or (even worse) start hoarding real estate as means of preserving their wealth over time? I’d argue that we have enough of a housing affordability crisis already.

I don’t think the banks care very much about the inflation rate, as long as it’s predictable. They made money when inflation was high in the 1970s and 80s, and they’re making money now when inflation is low. The tactic is always the same: Charge a higher interest rate than the current inflation rate. Inflation only helps when it rises and people have their old debt locked in at lower rates. It doesn’t do anything for people looking to take out new debt.

True, but at any given time there are lots of creditors holding debt that is locked in at earlier rates, sometimes for quite long durations – the most obvious example being that uniquely American construct, the 30 year fixed-rate mortgage. Any entity that does more fixed-rate lending than fixed-rate borrowing is going to be hurt financially by inflation, and that describes most banks. In the long term yes, it will even out, but in the short term higher inflation means lower profits and therefore lower bonuses for senior execs.

And is there any evidence that a low or zero inflation rate make hoarding money really attractive? I don’t think there is.

…

I agree that a positive inflation rate imposes costs on anybody holding money, and that it encourages people to spend or invest it.

‘Hoarding’ might not have been the best term to use. Let’s say that a low or zero inflation rate encourages people to spend/invest less money than they might choose to do if the inflation rate was higher. It sounds like you agree with that statement.

But is that really what we want? To force people to buy crap they don’t need? Or (even worse) start hoarding real estate as means of preserving their wealth over time?

Now you are asking whether economic growth is desirable as an end goal. That is a fine question to ask, but it’s not one that economists will ever accept as valid, since their entire discipline is predicated on the assumption that economic growth is the source of all that is good and holy.

The pragmatic answer is that we don’t really have a good alternative, since economic contraction typically means bankruptcies and job losses, and (because the rich have more options for protecting their wealth) the impact tends to fall disproportionately on the poor. Now if you extrapolate our current growth rates out for say 500 to 1000 years, you will pretty quickly reach the conclusion that they can’t continue indefinitely, and we will eventually need to either start thinking about how to live in a world of no growth or face collapse. But very few people or governments have shown any inclination to engage seriously with that problem.

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” Milton Friedman said that and he was correct.

I have always been an inflationista because I have observed it firsthand since the 1970s in the U.S. The most stable period of prices was in the 1990s. Inflation was in the 5-7% range in the mid 2000s, which was the first time since the 1970s that we had significant inflation. I would argue the inflation was caused by increased deficit spending to finance the Afghanistan and Iraq wars as well as increased mortgage lending and home equity loans.

It was only after the financial crisis in 2008 that we saw a reversal in the general price level. Even then, it was a brief period of deflation not at all comparable to the deflation following the Great Depression.

Inflation has been in the 3-5% range since 2009 and I think a lot of people are in denial about it, even though they have experienced it first hand. In 2008 a bag of potato chips was 13 ounces. It is now 9.5 ounces. As we observed in the 1970s, inflation can happen in a stagnant economy with high unemployment.

How could this happen? Well, money is making its way into the economy faster than the economy is growing. Deficit spending, student loans, mortgage lending, etc. are all contributing to inflation.

I think it’s a good rule of thumb to add 2 percentage points to the officially reported inflation rate to arrive at the actual inflation rate that the typical American is experiencing. If they are reporting inflation is 1.7%, then it is more like 3.7%.

If your experience with inflation covers the period of time since the 70’s, then you only have half the story. Prior to the 70’s wages increased faster than inflation, and this was the “norm” in an environment that targeted full employment.

From the 70’s onward, your friend Milton Friedman’s NAIRU has been a weapon of mass destruction on the battlefield of class warfare. Instead of targeting full employment, the central banks of the world were perverted to instead target *unemployment* in a campaign of wage suppression. From that time nominal wages ceased to grow faster than employment, and real wage growth was stopped in its tracks (even as profits continued to grow at the same pace).