By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

But don’t blame the oil bust.

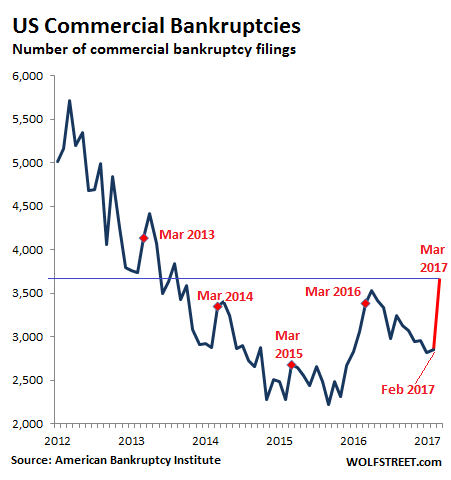

Commercial bankruptcy filings, from corporations to sole proprietorships, spiked 28% in March from February, the largest month-to-month move in the data series of the American Bankruptcy Institute going back to 2012. They’re up 8% year-over-year. Over the past 24 months, they soared 37%! At 3,658, they’re at the highest level for any March since 2013.

Commercial bankruptcy filings skyrocketed during the Financial Crisis and peaked in March 2010 at 9,004. Then they fell sharply until they reached their low point in October 2015. November 2015 was the turning point, when for the first time since March 2010, commercial bankruptcy filings rose year-over-year.

Bankruptcy filings are highly seasonal, reaching their annual lows in December and January. Then they rise into tax season, peak in March or April, and zigzag lower for the remainder of the year. The data is not seasonally or otherwise adjusted – one of the raw and unvarnished measures of how businesses are faring in the economy.

Note that there is no “plateauing” in this chart: since the low-point in September 2015, commercial bankruptcies have soared 65%! That red spike is the mega-increase in March:

At first, they blamed the oil bust. The price of oil began to collapse in mid-2014. By 2015, worried bankers put their hands on the money spigot, and a number of companies in that sector, along with their suppliers and contractors, threw in the towel and started filing for bankruptcy protection. But now the price of oil has somewhat recovered, banks have reopened the spigot, Wall Street has once again the hots for the sector, new money is gushing into it, and oil & gas bankruptcy filings have abated.

So now they blame brick-and-mortar retail which is in terminal decline, given the shift to online sales. I have reported extensively on the distress of the larger chain stores, but brick-and-mortar retailers include countless smaller operations and stores that no ratings agency follows because they’re too small and can’t issue bonds, and many of them are even more distressed.

Businesses file for bankruptcy protection because they have too much debt. Even brick-and-mortar retailers with little debt can get by just fine. Their sales might decline, and they might not make much money, but they can keep going. However, brick-and-mortar retailers with large amounts of debt are toast.

This is happening to other businesses too. Piling on debt in good times puts a business on the edge of a cliff, and it doesn’t take much to knock it over the cliff when adverse winds pick up.

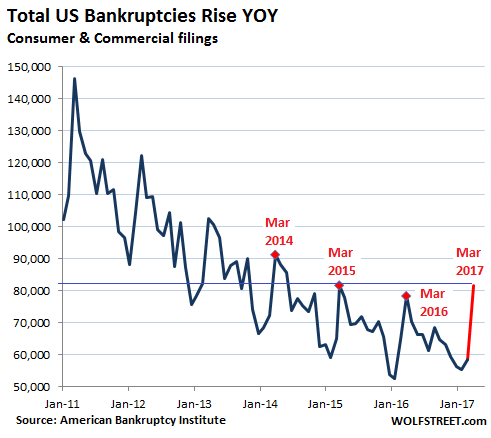

Now come the consumers – not all consumers, but those with mounting piles of debt and stagnating or declining real incomes, of which there are many. They’d been hanging on by their teeth, with bankruptcy filings consistently declining since 2010. But that ended in November 2016.

In December, bankruptcy filings rose 4.5% from a year earlier. In January they rose 5.4%. It was the first time consumer bankruptcies rose back-to-back since 2010. I called it “a red flag that’ll be highlighted only afterwards as a turning point.”

In March, consumer bankruptcy filings rose 4% year-over-year, to 77,900, the highest since March 2015, when 79,000 filings occurred, according to the American Bankruptcy Institute data. The turning point has now been confirmed.

Total US bankruptcy filings by consumers and businesses in March spiked 40% from February and rose 4% year-over-year to 81,590, the highest since March 2015:

The Fed’s monetary policies have purposefully encouraged businesses and consumers to borrow. But debt doesn’t just go away. It accumulates. By now, an increasing number of businesses and consumers are suffocating under this debt overhang in an economy that never developed the “escape velocity” needed – and hyped by Wall Street for years – to outgrow this debt. Rising bankruptcies are a turning point in the “credit cycle.” They’re not exactly a positive mile-marker for the economy.

The irony is thick: In all major sentiment surveys, economic confidence has soared since November: consumers, owners of small businesses, and corporate executives are riding high on their own ebullience. But the economic reality is tough for businesses and consumers struggling under the hangover from eight years of ultra-low interest rates.

I hope the model is wrong. Read… Atlanta Fed GDPNow Forecast Spirals Toward Zero

Some condo bubbles may be bursting as well. The US stock market, OTOH, keeps going up.

Wall Street is always the last to know.

This could indicate a recession is in the making.

No, the D-word.

GFC^2.

“Timber. . . .”

Many of us never “recovered” from the last one. Who gets hurt badly by zero interest rates? Retirees, that’s who. Of interest would be a breakdown of the bankruptcy figures by age group. It’s hard to live off of interest when that interest income is essentially nothing. Capital then is consumed until the wolf is at the door.

It is long past time for some “redistribution” of wealth in our society. The longer “things” are left unreformed, the messier the eventual realignment will be.

I am not so sure retirees get hurt. By the way, I am one. I remember my father reveling in the 13% interest rates he was earning on CDs in the 1970s. I kept telling him that the income was looking great, but inflation was eating up his principle.

Now that I am earning around 3% or so in dividends, the income may be low, but my principle isn’t being eaten up by inflation. I haven’t done a calculation to answer the question exactly, but I think I am doing OK.

Well, if you have $100,000 or more in savings/investments, that will work. But what about the rest of us?

The statistics embedded in the article are not intended to inform but to “scold” those without savings. The asterisk at the bottom is the tell; his savings calulations are based on an APY of 9.36% over 40 years. Most workers today will NEVER see 40 years of stable employment and most who invest will be fleeced by the fees of their “advisors”, or lose out to inflation.

The “ten bagger” days of Peter Lynch are long gone.

The key difference between you may lie in the focus on interest vs. dividends. Less wealthy retirees, or those who tend to be more risk averse, are apt to prefer CDs or treasuries with fixed interest and known principal, regardless of inflation. Investments in which not merely the buying power but the face value of the principal could collapse are not at all what they want, though the interest rates of the past several years may have forced them to consider the relative demerits of spending principal earlier or faster than they wanted and seeing it disappear abruptly in a crash.

Eating the seed corn may take several forms :(

Too true! It comes down to trying to find the least painful, a highly individual decision. And at that, still being thankful there was some, and trying to share because not everyone was that lucky.

Yes, but a severe market correction or recession could reduce your principle by 40% or more within a few days. There are no safe investments that return more than 2%, are there?

Aren’t long-term Treasuries slightly under, but close to, 3%?

Unless you are looking for a loan on a foreclosable, repossessible secured asset (house, car), then 0% interest rates don’t apply. Mortgages and car loans are widely available for less than 5% APR, for short terms sometimes less than 3% APR. Anything else (credit cards, overdraft coverage, consolidation loans, Parents Plus loans, private student loans) are going to start at 7% APR and go north from there up into the mid to high teens even if your credit score is ok. Paying this debt back will consume cash flow at a prodigious rate. With income rising at a much lower rate than the consumer interest rates, many people will not be able to paddle hard enough to prevent themselves going under. That appears to be showing up in the bankruptcy filings.

So ZIRP has been good for the top 10%, but has been largely irrelevant to much of the rest of the population as the gap between their consumer interest rates and the Fed Funds rate is pretty big.

Recession already made.

By now, an increasing number of businesses and consumers are suffocating under this debt overhang in an economy that never developed the “escape velocity” needed – and hyped by Wall Street for years – to outgrow this debt.

A grand delusion foisted on a gullible public. When Wall Street speaks, they are self serving lies.

Bernie Sanders: The business of Wall Street is fraud and greed.

Recession some day. But not now. Take a look at Ed Yardeni’s indicator, with recessions marked in gray:

it’s done a great job of starting to decline in advance of NBER-declared recessions. Since it just hit a fresh peak, a recession is unlikely for the next few months at least.

With the War Party gearing up to vaporize more brown folks, the economy could actually accelerate. Soon our comrades will have good jobs at defense [sic] plants, making armanents.

Buy Death. It’s what America stands for. :-)

As the Revelers proclaim on Twelfth Night: “All Hail the Lord of Misrule!”

There will be a somber and penitential Ash Wednesday after this Mardi Gras ends.

We’re all Nazgul now …..

… or Necromongers. I’m having trouble deciding which fits our MAGA world .

Conversation from the weekend….

“The only difference is that at least Musk does expand the productive capacity of the economy whereas the private bank model of public money creation has one of the worst track records when it comes to supporting and allocating resources to unproductive parasitical behavior”.

Should be re-written as “the bondholders who finance and dump part of their hoard in to the banks and their executive vassals whom they employ to manage their hoards and collect their usury has one of the worst track records when it comes to supporting and allocating resources to unproductive parasitical behavior” – That is better.

“Goes without saying. Is it a coincidence that the neoliberal period corresponds perfectly to the 36 year bull market in bonds? No it isn’t.”

disheveled…. whos your daddy….

Rise in bankruptcies may also be driven by a corresponding rise in mortgage foreclosure cases. In many states foreclosure defenses have a greater chance of winning when they are argued in bankruptcy courts than in the smaller, more local courts that have jurisdiction over “plain” foreclosure actions.

As Wolf says, the small businesses do not tend to show up in the stats except, eventually, as fatalities. SME are usually owner-run, so have lots of reason for “think I can”, even if not warranted, and little or no time/inclination to do hard-nosed number crunching. In my village-within-a-big-city, a dozen or more small businesses have closed this year — hairdressers, healthfood shops, nail salons, restaurants, book sellers, barber shops, the video store, yoga studios, pet food stores, thrift stores, all independent. A bank branch closed, too. They are being replaced by cannabis clinics, martini bars, different restaurants, vintage resale (formerly known as thrift store), a men’s grooming salon (formerly known as a barber shop?), an artisanal jam-maker and several bicycle shops. A chain bakery was replaced by a chain donut shop. Oh, the former bookstore is a new-minted A&W (shoot me now). The big-name payday loan place, here for 10 years already, seems to be doing fine.

We are perhaps seeing simply a roll-over in trendiness? Another driver is (sigh) higher rents, even in buildings that are already a hundred years old and have had the same owner for decades.

I also have seen that the minimum length of time it takes for a small business owner to be cured of their optimism and finally throw in the towel is three years. The recession ‘ended’, people got organized and started up, so March 2017 is right on schedule.

Smaller firms tend go bankrupt any way, even during boom times. I think its like 90% of all new business will go under within the first two years. (I am sure some one will correct me with the proper state there). Policy is geared to rope in potential business owners, get them into lots of debt, and then have the government back the debt when the business fails. Thus making room for the next victims. Its how politicians get to brag about “new jobs” while ignoring the jobs lost when these firms implode.

I would suspect that this is the reason why these small firms do not register in these stats. Because they have to be accounted for differently in the data. And including small firms would inflate the figures.

90% fail in the first three years.

Had a business neighbor tell me the other day that if she had known that the recession was going to take 10 years to get through she would have closed her second generation flower shop and changed careers.

We both agreed that business has improved and we are now doing OK. Not near the sales volumes of 2006 yet, but improving. However in our town a bunch of long time small owner operated businesses have just recently closed. They appeared outwardly successful.

I agree with the “small business owner cured of their optimism” quote above. Maybe that’s what it is.

“So now they blame brick-and-mortar retail which is in terminal decline, given the shift to online sales.”

I don’t think online sales are a major reason. I have only two friends that constantly order online and that’s because they earn enough money and they are too busy to shop. Retail is sinking because at least half the population has no extra money to buy anything.

I believe we are seeing the knock-on effects of health care mismanagement (actually more like legislatively-assisted moral hazard) brought on by the failure to force transparent pricing on health care Providers (as opposed to blaming health care Insurers – not that they’re helping…). People are basically forced to pay whatever the providers want to charge and too few try to claw back later.

fixhc.org

From observation the fastest growing brick and mortar retailer in the Twin Cities area is Goodwill Industries. They are building brand new stores everywhere and the parking lots are full.

I think you might also want to factor in that we’ve been on a decades-long consumption binge. People’s homes are overflowing with stuff to the point where extra storage facilities are popping up everywhere. My own Mother has a TV in every room and a ridiculous number of Tiffany-style lamps that she bought on QVC (with TV in every room, all of them tuned to either QVC or Dr. Oz. Help me…)

Everyone’s got a computer at home, a smartphone, a printer, multiple TV’s. Streaming has taken market share from buying movies and music. We may have reached peak consumption.

The usual chicken little crowd that follows Wolf around everywhere. Goodness, bankruptcies up as high as they were two to four years ago! The end of the world must be nigh.

The whining brigade follows this guy around like the Pied Piper. Haygood, as usual, adds value, which is to show that Wolf is wrong, again.

His columns have had a formula for many years now. The word cloud on them is exactly the same. And they are always wrong. Anyone who reads them is just plain pessi-masochistic. It’s not reality that he is peddling; it is some form of fantasy for the misery-loves-company crowd, who will all be there to say “I told you so” if something bad ever does happen.

Which it always does, of course—just not on Wolf’s schedule.

I guess that means also you believe anthropogenic climate change is a myth, statistics always lie, and the Earth is flat. Dream on.

What killed Lehman Brothers? The subprime debacle. So everything written on that subject in 2004, 2005, 2006, 2007 was just nonsense being written for the “misery loves company” crowd was it?

If we have a system that only provides for a few, and requires all others to endure ever-increasing hardship, perhaps we need quite a different system. Just sayin’.