By Uuriintuya Batsaikhan, an Affiliate Fellow Bruegel and who worked at UNDP in Mongolia and the German Institute for Economic Research in Berlin. Originally published at Bruegel

What’s at stake: The oldest human in known history was a Frenchwoman called Jeanne Calment who celebrated her 122nd birthday in 1997. Thanks to advances in technology and medicine humans living until 100, if not 122, might not be an exception in the near future. Ageing, while described as a looming demographic crisis, also offers a silver lining. Business in rapidly ageing societies is already adapting their strategies to navigate the “silver economy”. This blogs review looks at the implications of the silver economy on growth, productivity and innovation as well as the opportunities offered by the silver industry.

Who is the Silver Consumer?

The population above 65 is the fastest growing demographic. This group is also referred to as the “silver generation”, “baby boomers”, the “grand generation” (GG) in Japan and the “grey wall” in China.

Euromonitor forecasts that the global spending power of the silver generation will reach $12 trillion in 2020, which would be 54% larger than the GDP of Latin America. The global average gross income of the silver consumer is around $14,500 annually, compared to the global average of $12,300. There is a large difference between the spending power of 65+ generation in the developed world vs. the developing the world. In addition consumers in developed markets hold more assets and have accumulated more savings.

However, the trend is spreading to the developing world. In BRICS, for instance, the annual average income of the over 65s is $3,500, compared to $14,000 across the developed world, but their income saw almost 30% growth in real terms between 2007 and 2012. The International Standard Organization’s Active Ageing report writes that the US baby boomer generation outspend other generations by $400bn each year. In the next 20 years 70% of US disposable income will be in the hands of those 60 and older.

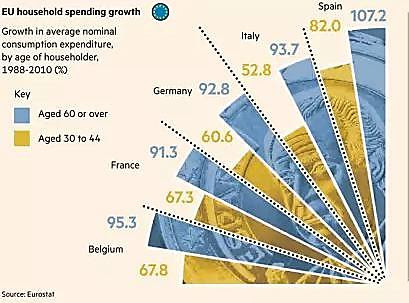

Source: Financial Times (2014) The Silver Economy: Healthier and Wealthier.

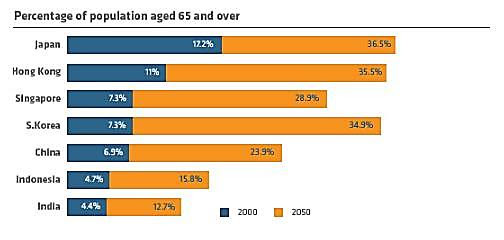

Tapping into the silver market, engaging the over 65s as consumers, offers great opportunities. The Silver Economy in southwest Europe report finds that the market for silver economy is around €450bn in Europe. In France people aged 50+ hold almost half of the country’s purchasing power and the seniors’ market will provide 45% of total demand. Germany’s silver purchasing power is at €316bn. But Europe will soon no longer be the only “Old Continent”. By 2050, one in four people in Asia, a combined 1.2 billion people will be over 60 years old.

Source: The International Silver Economy Portal(2015) The Ageing Asia.

This means that there are great opportunities in the silver economy. Across all markets, according to BNP Paribas Cardif, people over 65 will represent more than 40% of total consumption by 2020. Communication, home and transport sectors will receive the biggest silver boost, while sectors such as e-autonomy, nutrition, health and security will also reap the opportunities offered by the silver economy.

Impact on Growth and Jobs

The silver economy is expected to create a million jobs in Germany until 2030. Schulz and Radvansky write that the silver economy will impact jobs in two ways. One is that the effect of increased demand from the elderly will generate 2.6-4.4 million new jobs across the EU until 2025. The other results from changes in demand in younger households, resulting in approximately 0.5-4.5 million jobs. The change of consumption on employment will either lead to 1.9 million jobs lost in the tough scenario or 3.9 million jobs created in the optimistic scenario. The silver economy has a potential to create jobs especially in the service oriented sectors focusing on wealthy silver consumers in the more advanced countries.

Whereas in countries with comparatively lower incomes the silver goods and services industry will have to meet the needs of the domestic economy and attract foreign interests, for instance through silver tourism, cross-border health and social services. The silver generation themselves can shape the labour market, that is if policies are directed towards considering less rigid rules to retirement, supporting life-long learning and supporting older entrepreneurs.

DIW summarises the common arguments linking ageing to growth and points out that consequently, the shrinking labor supply will decrease potential output, while the decreasing workforce will drag on per capita income. However, in some cases the quality of labour can increase productivity despite the shrinking workforce.

A paper by Aiyar, Ebeke and Shao claims that ageing lowered total factor productivity (TFP) growth by 0.1 percentage point every year in the last two decades in the EU. The future is equally bleak, such that from 2014 to 2045 ageing will intensify in Europe and reduce total factor productivity (TFP) by 0.2 percentage points, even higher in those countries with the fastest ageing populations.

Acemoglu and Restrepo, in what could be a counterintuitive study, find that there is no negative effect of the ageing population on economic growth. They argue that as the population ages, the shrinking workforce will lead to high demand for workforce and therefore higher wages. Higher wages incentivise firms to invest in technology to make labour more productive. This productivity boost will offset the reduction in economic growth. It is possible that a rapid adoption of automation and directed technological change can generate a positive relationship between ageing and economic growth.

Silver Economy and Innovation

There is a large potential for innovation in the silver economy. Opportunities include connected homes that will make mobility easier for the elderly, remote assistance to support autonomy and ensure interaction, and solutions to increase the health and wellbeing of the silver generation. According to Pew Research Center, the baby boomer generation is tech-savvy, contrary to conventional wisdom, and becoming ever more so. Internet use among the over 65s grew by 150% in 2009-2011. 71% of the elderly go online daily and around a third use social media.

According to the Economist, Japan is actively innovating for its “grand generation” since it had a comparatively earlier start. These innovations span from robotic exoskeleton suits to help with mobility to the use of robots in nursing care. Fujitsi has sold 20 million phones with larger buttons and simplified functions, which are coming to Europe.

Toyota is increasingly equipping its cars with lasers, cameras and sensors. Kohlbacher advises that in terms of the marketing strategy for the silver generation, instead of creating products only for the elderly, it is often better to create products that bridge generations. The European Commission writes that the introduction of ICT in telemedicine is estimated to improve the efficiency of health and care by 20%.

Turning the Silver Tsunami into a Silver Lining

Nesta warns that our social institutions, such as social care and labour market, are archaic and inflexible in the face of dramatic advances in medicine and science. Therefore, social institutions needs to be rebuilt taking into account today’s lifespan and changing demands. Instead of focusing on top-down issues such as pension and care, policy needs to focus on the older generation as productive and innovative members of society. The OECD busts three myths around the policy dialogue on the ageing worker:

- Mental and physical health on average begins to decline at 73, long after retirement age. So the myth that ageing worker health is insufficient is untrue

- Ageing workers are on average as productive as young workers. Physical decline in age is compensated with experience, so the myth that productivity decreases with age is untrue

- Higher employment of older workers is positively correlated with higher employment of the young, so the myth that the ageing worker reduces chances for young workers is untrue.

OECD and Global Coalition on Ageing recommend first to correct age related prejudices, support technological solutions, innovate financing models for the silver economy, create flexible career models and pensions, and support older people in social entrepreneurship. Policies and market solutions have the potential to turn the silver tsunami into silver lining.

As Lambert would say, help me. Since 70, I have taken great pleasure in de-accessioning.

This article reads like a sales promotion for new ways to profit…but hey, millennials have been gouged to just about their breaking point, haven’t they? Soooo – if you want growth, you need to find a new market, don’t you? But they forgot one big positive sales point that would have added oomph to their presentation – the Case-Deaton study pretty much says that those that grow oldest (in the US at least) will be the ones that have the most money to grab…….

And ripe for the picking, that pool of assets needs to be stripped and exploited by any means possible. Exclusive retirement homes and assisted living communities are the rage in my area. I’m betting one could correlate the growth and concentration of them to the amount of 401k and investment money in Fidelity by county.

Brilliant post.

Imitating Europe, in the US and Canada … to increase elderly employment, at the expense of young adult employment … will eventually produce the same problems that Europe is facing now. I want to retire, but cannot because of our ill health system in the US, and the caging of pensions/SS.

Also thanks to Medicaid … there is a great sucking sound of non-Elite estate money from the elderly to the medical and nursing home system. The elderly are the only ones with money left, but they are already being maximally fed upon by the vampire bats we already have. Will new vampire bats increase our health?

Are you talking about the Medicaid clawbacks from estates of all costs, to and including monthly insurance tributes, deductibles, out of network fees, non-covered items etc?

In California, people below a certain income level were forced onto Medi-Cal by Obamacare and thus whether they wanted to or not, surrendered all costs incurred to the Moloch upon their death.

See Kareninca’s post below

You are correct … clawback is the way to prevent families from preventing estate exhaustion. Since taxation is unnecessary to raise funds, and since the government could pay for all senior care out of pocket because of unlimited FR accounts … the only reason for this is simply torture of trapped animals.

Even while still working, our corporate health care plan was forced by Obamacare, to reduce benefits, because it was “cadillac care”. I had to up my annual deductible by 2x, my monthly outgo by 2x, and accept a lower standard of care.

I think we should think about the silver tsunami in environmental terms. Now is a good time to do that. I love the way the Japanese have invented really useful things like exoskeletons for us old farts. But the biggest question is pension benefits and health care costs. Just fiddling around the edges, claiming that productivity will match its challenges in a future silver economy is not a convincing argument. We need to hire the incoming generation into socially and environmentally useful industries and give them generous wages. If we really got down to some kinda “silver policy” we’d be smart to use the tsunami to start to fix what’s wrong with the way we live – not just that it is “outdated” because we’ve got stem cell therapies and stair chairs, etc. We need to imagine new industries that solve problems universally. Sustainably.

I think this article is terrible. After reading it I come to two solutions. Older people need to work longer and spend more money then everything will be okay.

That’s pretty hard to swallow, because 1 I don’t think we can make those things happen on large scale, and even if we could I’m not sure it would really make the world a better place.

I think the biggest problem with this aging boom is it will highlight the other extractive mechanism of Health Care, coming up with meager life extension (notice I did say anything about improving health) at insane costs. I believe this will accelerate, the medical community figuring out novel care solutions that the rest of society cannot afford, but can’t say no to, where the profits go in the pockets of the select few. It’s like some twisted form of rent extraction on the under 65 crowd.

I’m hell bent against active euthanasia, but it may come to a point where society has to put a price on extending our numbered days beyond what otherwise God/nature would have intended.

“I’m hell bent against active euthanasia, but it may come to a point where society has to put a price on extending our numbered days beyond what otherwise God/nature would have intended.”

Really? Why? So that the 1% can get richer? Because you DO understand, don’t you, that you won’t see any benefits from killing off old people…….

I also wonder who you think has the right to decide what “God/nature” intends?

Should have done it for Rockefeller perhaps … you know in a fair world …

I think there are lots of rumors about hospitals keeping people on life support long after it’s only causing them pain, but it’s not my experience of how it actually works at all. I’m not saying it never happens, but I’m not sure it’s much more likely than the reverse.

I guarantee people are tortured by being kept on machines too long. Doubt it? Read these books: No Place for Dying: Hospitals and the Ideology of Rescue, by Helen Stanton Chapple, Extreme Measures: Finding a Better Path at the End of LIfe, by Jessica Nutik Zitter, MD, …and a time to die: How American Hospitals Shape the End of Life, by Sharon R. Kaufman, and Ordinary Medicine: Extraordinary Treatments, Longer Lives, and Where to Draw the Line, also by Sharon R. Kaufman (who is incredibly insightful).

It’s not a rumor and if your experience is different, it is quite atypical.

“Older entrepreneurs”…lol. “Stop crying about your Social Security! Start a business!”

These silver wavelets of the Silver Tsunami will have money to extract until suddenly they don’t. I have a friend who is going to be booted out of a rehab facility today after a brief stay. She is 73, and has been living in her car for the last couple of years, since rents around here are at minimum $2,500/month (for a 250 sf rental). She fell down a step and fell forward and badly fractured her shoulder; really badly. She has nowhere to go, and none of her friends can help her with that because we can’t do anything about the housing nightmare; I’ve already crammed my 92 y.o. father-in-law in with us in our 1068 sf condo. She is not destitute; she has a couple hundred thousand (from savings and an inheritance; she is very frugal). But it would go really fast at $2,500/month, and her mom made it to her late 80s, and she wants to save for her real old age. Yes, a social worker is on her case; the role of the social worker seems to be to give her lists of places to try to apply to, but they are costly places.

She won’t move out of the Palo Alto area because she grew up here; it is home; typical stubborn old person, right? Yes, I’ve tried to tell her about other parts of the country, and how much cheaper they are, but they aren’t near all the friends of seven decades. Her dad was a renowned college football coach; she worked as an admin and as a gardener and is living in her car; no more gardening for her (she was still working when she fell). How different is she from a lot of baby boomers? She will have her money until it is extracted from her. Then maybe some poor-person housing if she is very lucky, but there is very little of that around here. What a business opportunity these old folks are.

It was for other boomers that housing costs were kept up, it certainly wasn’t for latter generations with less/no chance to get in. Only in an insane world are high housing prices (and rents) considered a good thing. The rent is too damn high.

Whoever wrote this nonsense doesn’t seem to realize that the silver haired engines of the “silver economy” will have very little silver–except in their hair. The “real owners” as Carlin called them have done everything they could to destroy pensions and convert everyone to “defined contribution” plans that are risky and guaranteed to blow up when the 1%’ers are done looting the economy.

The silver Titanic is on schedule to rendezvous with the pension iceberg. This article almost completely ignored it. Dommage.

You are absolutely correct. Future generations won’t have disposable income because defined pensions have disappeared in the private sector. They are also being eroded in the public sector. I’m 75 years old. I retired at 57 with a defined benefit pension and took my SS at 62. My income is greater than my income when I was working. If I live 5 more years I will have collected more in pensions than I made in my lifetime at working. Since I have been healthy, I visit my doctor 2 time a year and take high blood pressure medication, I have disposable income to spend. Unless policy changes the future of old people will be grim. Most will have to continue working because if they retire they will be living at a poverty level. The economic future for these old people doesn’t look good.

Yves,

Jeanne Calment got her revenge on the “Young Uns.”

She sold her house for very little money to a shark that gave her a life estate in it.

She outlived him and his son that took over the business.

I love walking into a business, looking around and calling the manager over;

“So, you don’t hire anyone over 25 to work here apparently, even though plenty of us need the jobs?”

“So why should I and all my friends spend our money here then?”

This ignores the tendency of some businesses to not only hire youth, but to only hire immigrants, legal or otherwise, all chattering away in Spanish, and screwing things up, when there are plenty of unemployed gringos of all ages in the community.

Somebody has to tell modern economists that “growth for growth’s sake” is the philosophy of a cancer cell.

When did economics lose it’s way? Why is income and growth the only measures of “success?” What happened to wealth, wealth distribution, the commonweal, and all of the rest. Apparently economists, like our politicians, have been bought by corporate interests.